Current Report Filing (8-k)

December 14 2022 - 6:46AM

Edgar (US Regulatory)

0001360214

false

0001360214

2022-12-13

2022-12-13

0001360214

HROW:CommonStock0.001ParValuePerShareMember

2022-12-13

2022-12-13

0001360214

HROW:Sec8.625SeniorNotesDue2026Member

2022-12-13

2022-12-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 13, 2022

HARROW

HEALTH, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35814 |

|

45-0567010 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 102

Woodmont Blvd., Suite 610 |

|

|

| Nashville,

Tennessee |

|

37205 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (615) 733-4730

| |

Not Applicable |

|

| |

(Former Name or Former Address, if Changed Since Last Report) |

|

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

on exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

HROW |

|

The

NASDAQ Global Market |

| 8.625%

Senior Notes due 2026 |

|

HROWL |

|

The

NASDAQ Global Market |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Act of 1934: Emerging growth company ☐

If

any emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry Into a Material Definitive Agreement.

On

December 13, 2022, Harrow Health, Inc. along with its wholly-owned subsidiaries, Harrow IP, LLC and Harrow Eye, LLC (individually and

together the “Company”) entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Novartis Technology,

LLC and Novartis Innovative Therapies AG (together, “Novartis”), pursuant to which the Company agreed to purchase from Novartis

the exclusive commercial rights to assets associated with the following ophthalmic products (collectively the “Products”)

in the U.S. (the “Acquisition”): ILEVRO® (nepafenac ophthalmic suspension) 0.3%; NEVANAC® (nepafenac ophthalmic suspension)

0.1%; VIGAMOX® (moxifloxacin hydrochloride ophthalmic solution) 0.5%; MAXIDEX® (dexamethasone ophthalmic suspension) 0.1%; and

TRIESENCE® (triamcinolone acetonide injectable suspension) 40 mg/ml.

Under

the terms of the Purchase Agreement, the Company will make a one-time payment of $130,000,000 at closing, with up to another $45,000,000

due in a milestone payment related to the commercial availability of Triesence. The Acquisition is expected to close in the first quarter

of 2023, subject to the satisfaction of customary closing conditions, including clearance under the Hart-Scott Rodino Antitrust Improvements

Act. Pursuant to the Purchase Agreement and various ancillary agreements, immediately following the closing and subject to certain conditions,

for a period that the Company expects to last approximately six months, and prior to the transfer of the Products new drug applications

(the “NDAs”) to the Company, Novartis will continue to sell the Products on the Company’s behalf and transfer the net

profit from the sale of the Products to the Company. Novartis has agreed to supply certain Products to the Company for a period of time

after the NDAs are transferred to the Company and to assist with technology transfer of the Products manufacturing to other third-party

manufacturers, if needed.

The

foregoing is a summary description of certain terms of the Agreement, is not complete and is qualified in its entirety by reference to

the text of the Agreement, which the Company has filed as an exhibit to this Current Report on Form 8-K.

Item

8.01 Other Events.

On

December 14, 2022, the Company issued a press release announcing the Transaction. A copy of the press release is attached as Exhibit

99.1 to this Current Report on Form 8-K.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HARROW

HEALTH, INC. |

| |

|

|

| Dated:

December 14, 2022 |

By: |

/s/

Andrew R. Boll |

| |

Name:

|

Andrew

R. Boll |

| |

Title:

|

Chief

Financial Officer |

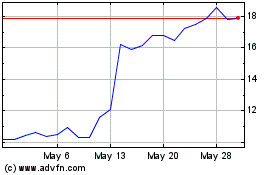

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

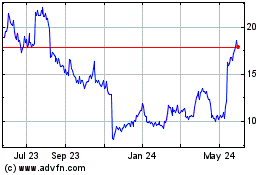

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Apr 2023 to Apr 2024