Filed by Comtech Telecommunications Corp.

Pursuant to Rule 425 under the Securities

Act of 1933

Form S-4 File No.: 333-236840

Subject Company: Gilat Satellite Networks

Ltd.

Commission File No.: 000-21218

Date: March 5, 2020

The following is a partial transcript of

Comtech Telecommunications Corp.’s (“Comtech”) fiscal 2020 second quarter earnings conference call held on March

4, 2020:

Michael D. Porcelain

As announced in January 29, 2020, we are

also excited about our pending acquisition of Gilat, a worldwide leader in satellite networking technology solutions and services,

with a strong presence in the satellite ground station and in-flight connectivity markets and deep expertise in operating large

network infrastructures.

The acquisition of Gilat offers many strategic

benefits. First, the acquisition will drive Comtech’s global market access by creating the world leader with combined annual

pro forma sales approaching nearly $1 billion. Second, it will strengthen our position as a leading supplier of advanced communication

solutions. We believe we’ll be uniquely capable of servicing the expanding need for ground infrastructure to support both

existing and emerging satellite networks. Third, the acquisition will greatly expand our product portfolio with highly complementary

technologies, including Gilat’s high-performance TDMA based satellite modems and Gilat’s next-generation solid-state

amplifiers. But also considering our current products and UHP’s product line, we believe we will have a broad range of products

to meet our customers’ more complicated needs in the future. Fourth, the acquisition will broaden our leadership position

in the rapidly growing in-flight connectivity and cellular backhaul markets, which are expected to expand, given the availability

of lower cost bandwidth and the adoption of satellite technologies into the 5G cellular backhaul ecosystem. Fifth, the acquisition

will bolster our world-class research and development capabilities, enabling Comtech to offer customers more complete end-to-end

technology solutions. Sixth, we believe the acquisition will allow us to accelerate shareholder value creation by contributing

to our ongoing strategy to move towards higher-margin solutions and by increasing customer diversification geographically and by

market. We are very excited about the growth that we expect from these pending acquisitions. And overall, we believe that this

product line will grow from current levels over the next several years.

* * *

Operator

We will take our next question from Chris

Sakai with Singular Research. Please go ahead. Your line is open.

Chris Sakai

Hi, everyone. Just had a question, I guess,

on the acquisition of Gilat. Wanted to sort of get your idea, when will you start to see some revenue additions from Gilat?

Michael D. Porcelain

Sure. Our thinking at the moment, if all

goes well, is that we’ll likely close the transaction sometime in late June, maybe early July of fiscal 2020. It’s

possible it gets into August of our 2020, which would be the start of our fiscal year 21. So that’s kind of the time frame.

It’s very late in Q4 of this year or certainly in our Q1 of next year, assuming everything works according to plan. At that

point, then you just really taking a snap if we close at the beginning of August, it will be a full year impact next year.

Chris Sakai

Okay, great. And then to follow-up on that,

are you seeing any sort of delays because of the coronavirus with the integration there?

Michael D. Porcelain

With the integration, no. I think it’s

fair to assume that Gilat’s no different than any other company in the world and is being impacted by the coronavirus as

well. But from an integration perspective, the lull in travel has actually been very helpful towards facilitating our planning.

And it’s allowing people to actually be around to actually plan integration efforts, and there’s lots of conversation.

We’ve done some internal site visits of their facilities, they’ve done some internal visits of ours. And so I would

actually say it’s allowed us to accelerate our planning process over the acquisition. And as we continue to learn each company,

they learn us, we learn them. The culture match between the companies is extremely similar and exciting and employees literally

around the world are truly excited about it and we’re all becoming friends and it’s a good thing. And we think that

once the acquisition closes, we’ve got plenty years of growth ahead as a combined company.

Chris Sakai

Okay, great. I mean, when you say plenty

of years of growth, I mean, what are you sort of referring to? How long?

Michael D. Porcelain

It’s many years. I mean, we

think that the cellular backhaul growth, as things get rolled out on 5G and satellite becomes part of that ecosystem,

that’s certainly four, five, 10 years’ worth of growth. Certainly, IFEC – you can’t – as I

said, you can’t run a piece of fiber to the plane. So IFEC is going to be on every single large jet and business jet in

the future. So, we’re in what we would say is in the early stages of multi-year growth. Putting timing aside, our view

is, it’s going to happen and it’s one of the reasons why we did the acquisition.

Chris Sakai

Okay. Thanks.

Additional Information and Where to

Find It

This filing is being made in respect of

a proposed business combination involving Comtech and Gilat Satellite Networks Ltd. (“Gilat”). This document does not

constitute an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote

or approval nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The proposed

transaction will be submitted to the shareholders of Gilat for their consideration. Comtech has filed with the U.S. Securities

and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that includes a preliminary prospectus with

respect to Comtech’s common stock to be issued in the proposed transaction and a proxy statement of Gilat in connection with

the proposed merger of an indirect subsidiary of Comtech with and into Gilat, with Gilat surviving. The registration statement

has not yet become effective. The information in the preliminary proxy statement/prospectus is not complete and may be changed.

Comtech may not sell the common stock referenced in the proxy statement/prospectus until the Registration Statement on Form S-4

becomes effective. The proxy statement/prospectus will be provided to Gilat shareholders. Comtech and Gilat also plan to file other

documents with the SEC regarding the proposed transaction.

This document is not a substitute for

any prospectus, proxy statement or any other document that Comtech or Gilat may file with the SEC in connection with the proposed

transaction. Investors and security holders of Comtech and Gilat are urged to read the definitive proxy statement/final prospectus

and any other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because

they will contain important information about the proposed transaction.

You may obtain copies of all documents

filed with the SEC regarding the proposed transaction, free of charge, at the SEC’s website (www.sec.gov). In

addition, investors and security holders will be able to obtain a free copy of the

proxy statement/prospectus (when they become available) and other documents filed with the SEC by Comtech on Comtech’s Investor

Relations page on Comtech’s web site at www.comtechtel.com or by writing

to Comtech, Investor Relations, (for documents filed with the SEC by Comtech), or by Gilat on Gilat’s Investor Relations

page on Gilat’s web site at www.Gilat.com or by writing to Gilat, Investor Relations, (for documents filed with the

SEC by Gilat).

Cautionary Statement Regarding Forward-Looking

Statements

Certain information in this document contains

forward-looking statements, including, but not limited to, information relating to Comtech’s and Gilat’s future performance

and financial condition, plans and objectives of Comtech's management and Gilat’s management and Comtech's and Gilat’s

assumptions regarding such future performance, financial condition and plans and objectives that involve certain significant known

and unknown risks and uncertainties and other factors not under Comtech's or Gilat’s control which may cause their actual

results, future performance and financial condition, and achievement of plans and objectives of Comtech's management and Gilat’s

management to be materially different from the results, performance or other expectations implied by these forward-looking statements.

Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking

statements, which generally are not historical in nature. Forward-looking statements could be affected by factors including, without

limitation: risks associated with the ability to consummate the proposed transaction and the timing of the closing of the proposed

transaction or the occurrence of any event, change or circumstance that could give rise to the termination of the merger agreement;

the risk that requisite regulatory approvals will not be obtained; the possibility that the expected synergies from the proposed

transaction or other recent acquisitions will not be fully realized, or will not be realized within the anticipated time periods;

the risk that Comtech’s and Gilat’s businesses will not be integrated successfully; the possibility of disruption from

the proposed transaction or other recent acquisitions making it more difficult to maintain business and operational relationships

or retain key personnel; the risk that Comtech will be unsuccessful in implementing a tactical shift in its Government Solutions

segment away from bidding on large commodity service contracts and toward pursuing contracts for its niche products with higher

margins; the risks associated with Comtech’s ongoing evaluation and repositioning of its location technologies solutions

offering in its Commercial Solutions segment; the nature and timing of receipt of, and Comtech’s performance on, new or existing

orders that can cause significant fluctuations in net sales and operating results; the timing and funding of government contracts;

adjustments to gross profits on long-term contracts; risks associated with international sales; rapid technological change; evolving

industry standards; new product announcements and enhancements, including the risks associated with Comtech's launch of its HeightsTM

Networking Platform; changing customer demands and or procurement strategies; changes in prevailing economic and political conditions;

changes in the price of oil in global markets; changes in foreign currency exchange rates; risks associated with legal proceedings,

customer claims for indemnification and other similar matters; risks associated with Comtech's obligations under its Credit Facility;

risks associated with large contracts; the impact of H.R.1, also known as the Tax Cuts and Jobs Act, which was enacted in December

2017 in the U.S.; and other factors described in this and Comtech's and Gilat’s other filings with the SEC. Neither Comtech

nor Gilat undertakes any duty to update any forward-looking statements contained herein.

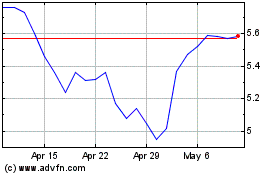

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Mar 2024 to Apr 2024

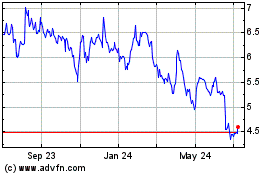

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Apr 2023 to Apr 2024