0001089872false00010898722024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 5, 2024 |

GAIA, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Colorado |

000-27517 |

84-1113527 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

833 West South Boulder Road |

|

Louisville, Colorado |

|

80027 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (303) 222-3600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock |

|

GAIA |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 5, 2024, Gaia, Inc. issued a press release announcing results for its quarter ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report.

In accordance with General Instruction B.2 of Form 8-K, the information contained in this Item 2.02 and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference into any of the Registrant’s filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

GAIA, INC. |

|

|

|

|

Date: |

May 6, 2024 |

By: |

/s/ Ned Preston |

|

|

|

Name: Ned Preston

Title: Chief Financial Officer |

Gaia Reports Second Quarter 2024 Results

BOULDER, CO – August 5, 2024 - Gaia, Inc. (NASDAQ: GAIA), a conscious media and community company, reported financial results for the second quarter ended June 30, 2024.

Highlights:

•Revenue growth of 11% and member growth of 10% from the year-ago quarter.

•Operating cash flows for the first half of 2024 improved by $2.6 million and free cash flow improved by $2.0 million from the same period in 2023.

•Gaia subsidiary completed transactions raising $12 million.

“During the second quarter, which is our seasonally slowest, we grew revenue 11% and members 10% year over year, while delivering positive free cash flow. We expect the positive cash flow generation to continue with revenue growth increasing to about 15% in the fourth quarter,” said Jirka Rysavy, Gaia’s Executive Chairman. “In 2016 we invested $10 million and recently raised $12 million for our subsidiary Igniton from outside investors, a portion of which was used to acquire an exclusive worldwide license for the Igniton health technology. This technology uses concentrated quasi-particles transmitted by the sun to improve cognition, memory and longevity.”

Gaia CEO James Colquhoun commented: "We continued our trend of executing on cash flow positive growth with notable improvements in marketing efficiency. Today, we are also excited to officially announce the launch of the Gaia Marketplace to our entire member base. This initiative not only strengthens our community engagement but also introduces an alternative revenue stream to the Gaia business. Additionally, we have also implemented a price increase for new members, starting in July, which we expect to positively impact our revenue by the end of the year. The timing was moved from Q2 to Q3 to strategically align with our third-party partners, ensuring minimal disruption to our members, which resulted in a slight impact on our second quarter revenue."

Gaia CFO Ned Preston commented: “Operating cash flows for the first six months finished at $3.9 million, representing a $2.6 million improvement from the first six months of 2023 and continues the momentum we've delivered in the prior four quarters. During the second quarter, we incurred meaningful amounts of non-recurring expenses related to Igniton and corporate administrative expenses. We expect our ARPU to grow more rapidly with our price increases and the launch of Gaia Marketplace during the second half of 2024.”

Second Quarter 2024 Financial Results

Revenues for the second quarter grew $2.24 million or 11% to $22.08 million from $19.84 million in the year-ago quarter. Member count increased to 850,000 as of June 30, 2024, up from 774,500 or 10% from June 30, 2023.

Gross profit in the second quarter increased 10% to $18.7 million from $17.0 million in the year-ago quarter.

Including the non-recurring expenses, net loss was $(2.2) million, or $(0.09) per share, unchanged from the year-ago quarter, and free cash flow was $0.7 million, representing a fifth consecutive quarter of positive cash flow.

In the last six months both revenue and member growth were stable at over 10%, with an improvement in free cash flow of $2.0 million on top of the $8.4 million improvement delivered during 2023.

Conference Call

Date: Monday, August 5, 2024

Time: 4:30 p.m. Eastern time (2:30 p.m. Mountain time)

Toll-free dial-in number: 1-877-269-7751

International dial-in number: 1-201-389-0908

Conference ID: 13747669

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at (949) 574-3860.

The conference call will be broadcast live and available for replay here and via ir.gaia.com.

A telephonic replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through August 19, 2024.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13747669

About Gaia

Gaia is a member-supported global video streaming service and community that produces and curates conscious media through four primary channels—Seeking Truth, Transformation, Alternative Healing and Yoga—in four languages (English, Spanish, French and German) to its members in 185 countries. Gaia’s library includes over 10,000 titles, over 88% of which is exclusive to Gaia, and approximately 75% of viewership is generated by content produced or owned by Gaia. Gaia is available on Apple TV, iOS, Android, Roku, Chromecast, and sold through Amazon Prime Video and Comcast Xfinity. For more information about Gaia, visit www.gaia.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact are forward looking statements that involve risks and uncertainties. When used in this discussion, we intend the words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “future,” “hope,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “strive,” “target,” “will,” “would” and similar expressions as they relate to us to identify such forward-looking statements. Our actual results could differ materially from the results anticipated in these forward-looking statements as a result of certain factors set forth under “Risk Factors” and elsewhere in our filings with the U.S. Securities and Exchange Commission, including in our Annual Report on Form 10-K for the year ended December 31, 2023. Risks and uncertainties that could cause actual results to differ include, without limitation: our ability to attract new members and retain existing members; our ability to compete effectively, including for customer engagement with different modes of entertainment; maintenance and expansion of device platforms for streaming; fluctuation in customer usage of our service; fluctuations in quarterly operating results; service disruptions; production risks; general economic conditions;

future losses; loss of key personnel; price changes; brand reputation; acquisitions; new initiatives we undertake; security and information systems; legal liability for website content; failure of third parties to provide adequate service; future internet-related taxes; our founder’s control of us; litigation; consumer trends; the effect of government regulation and programs; the impact of public health threats; our ability to remediate the material weaknesses in our internal control over financial reporting and technical accounting; and other risks and uncertainties included in our filings with the Securities and Exchange Commission. We caution you that no forward-looking statement is a guarantee of future performance, and you should not place undue reliance on these forward-looking statements which reflect our views only as of the date of this press release. We undertake no obligation to update any forward-looking information.

Non-GAAP Measures

In addition to disclosing financial results calculated in accordance with generally accepted accounting principles in the United States of America (GAAP), the financial information included in this release contains non-GAAP financial measures, including Free Cash Flow. These non-GAAP measures should not be considered a substitute for, or superior to, financial measures and results calculated in accordance with GAAP, including net income, and reconciliations to GAAP financial statements should be carefully evaluated. Free Cash Flow represents net cash provided by operating activities, adjusted for interest payments, and less capital expenditures. We believe Free Cash Flow is also useful as one of the bases for comparing the Gaia’s performance with its competitors. Although Free Cash Flow and similar measures are frequently used as measures of cash flows generated from operations by other companies, Gaia’s calculation of Free Cash Flow might not necessarily be comparable to such other similarly titled captions of other companies. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting and analyzing future periods.

Company Contact:

Ned Preston

Chief Financial Officer

Gaia, Inc.

Investors@gaia.com

Investor Relations:

Gateway Group, Inc.

Cody Slach

(949) 574-3860

GAIA@gateway-grp.com

GAIA, INC.

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

(in thousands, except share and per share data) |

|

2024 |

|

|

2023 |

|

|

|

(unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,459 |

|

|

$ |

7,766 |

|

Accounts receivable |

|

|

4,806 |

|

|

|

4,111 |

|

Other receivables |

|

|

2,903 |

|

|

|

2,191 |

|

Prepaid expenses and other current assets |

|

|

2,468 |

|

|

|

2,015 |

|

Total current assets |

|

|

15,636 |

|

|

|

16,083 |

|

Media library, net |

|

|

39,125 |

|

|

|

40,125 |

|

Operating right-of-use asset, net |

|

|

5,875 |

|

|

|

6,288 |

|

Property and equipment, net |

|

|

25,282 |

|

|

|

26,303 |

|

Equity method investment |

|

|

— |

|

|

|

6,374 |

|

Technology license, net |

|

|

15,954 |

|

|

|

— |

|

Investments and other assets, net |

|

|

8,301 |

|

|

|

3,157 |

|

Goodwill |

|

|

31,943 |

|

|

|

31,943 |

|

Total assets |

|

$ |

142,116 |

|

|

$ |

130,273 |

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

14,132 |

|

|

$ |

12,038 |

|

Accrued and other liabilities |

|

|

1,957 |

|

|

|

2,599 |

|

Long-term debt, current portion |

|

|

158 |

|

|

|

155 |

|

Operating lease liability, current portion |

|

|

809 |

|

|

|

780 |

|

Deferred revenue |

|

|

17,737 |

|

|

|

15,861 |

|

Total current liabilities |

|

|

34,793 |

|

|

|

31,433 |

|

Long-term debt, net of current portion |

|

|

5,721 |

|

|

|

5,801 |

|

Operating lease liability, net of current portion |

|

|

5,296 |

|

|

|

5,708 |

|

Deferred taxes, net |

|

|

551 |

|

|

|

551 |

|

Total liabilities |

|

|

46,361 |

|

|

|

43,493 |

|

Commitments and Contingencies |

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Class A common stock, $0.0001 par value, 150,000,000 shares

authorized, 18,046,018 and 17,813,179 shares

issued, 17,981,031 and 17,748,374 shares outstanding at June 30, 2024 and December 31, 2023, respectively |

|

|

2 |

|

|

|

2 |

|

Class B common stock, $0.0001 par value, 50,000,000 shares

authorized, 5,400,000 shares issued and outstanding

at June 30, 2024 and December 31, 2023, respectively |

|

|

1 |

|

|

|

1 |

|

Additional paid-in capital |

|

|

170,562 |

|

|

|

170,695 |

|

Accumulated deficit |

|

|

(88,433 |

) |

|

|

(85,195 |

) |

Total Gaia, Inc. shareholders’ equity |

|

|

82,132 |

|

|

|

85,503 |

|

Noncontrolling interests |

|

|

13,623 |

|

|

|

1,277 |

|

Total equity |

|

|

95,755 |

|

|

|

86,780 |

|

Total liabilities and equity |

|

$ |

142,116 |

|

|

$ |

130,273 |

|

GAIA, INC.

Condensed Consolidated Statements of Operations (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

(in thousands, except per share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

Revenues, net |

|

$ |

22,081 |

|

|

$ |

19,839 |

|

|

$ |

43,774 |

|

|

$ |

39,486 |

|

Cost of revenues |

|

|

3,415 |

|

|

|

2,839 |

|

|

|

6,583 |

|

|

|

5,612 |

|

Gross profit |

|

|

18,666 |

|

|

|

17,000 |

|

|

|

37,191 |

|

|

|

33,874 |

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling and operating |

|

|

18,697 |

|

|

|

17,085 |

|

|

|

36,456 |

|

|

|

33,208 |

|

Corporate, general and administration |

|

|

1,988 |

|

|

|

1,520 |

|

|

|

3,617 |

|

|

|

3,293 |

|

Total operating expenses |

|

|

20,685 |

|

|

|

18,605 |

|

|

|

40,073 |

|

|

|

36,501 |

|

Loss from operations |

|

|

(2,019 |

) |

|

|

(1,605 |

) |

|

|

(2,882 |

) |

|

|

(2,627 |

) |

Equity method investment loss |

|

|

— |

|

|

|

(125 |

) |

|

|

— |

|

|

|

(250 |

) |

Interest and other expense, net |

|

|

(144 |

) |

|

|

(113 |

) |

|

|

(252 |

) |

|

|

(234 |

) |

Loss before income taxes |

|

|

(2,163 |

) |

|

|

(1,843 |

) |

|

|

(3,134 |

) |

|

|

(3,111 |

) |

Provision for income taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss |

|

|

(2,163 |

) |

|

|

(1,843 |

) |

|

|

(3,134 |

) |

|

|

(3,111 |

) |

Net income attributable to noncontrolling interests |

|

|

30 |

|

|

|

45 |

|

|

|

104 |

|

|

|

83 |

|

Net loss attributable to common shareholders |

|

$ |

(2,193 |

) |

|

$ |

(1,888 |

) |

|

$ |

(3,238 |

) |

|

$ |

(3,194 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations (attributable to common shareholders) |

|

$ |

(0.09 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.15 |

) |

Basic and Diluted loss per share |

|

$ |

(0.09 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.15 |

) |

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

23,372 |

|

|

|

20,874 |

|

|

|

23,267 |

|

|

|

20,850 |

|

Diluted |

|

|

23,372 |

|

|

|

20,874 |

|

|

|

23,267 |

|

|

|

20,850 |

|

GAIA, INC.

Condensed Consolidated Statement of Cash Flows (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

Net cash provided by (used in): |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash (used in) provided by operating activities |

|

|

(2,081 |

) |

|

|

584 |

|

|

|

3,855 |

|

|

|

1,270 |

|

Net cash used in investing activities |

|

|

(11,447 |

) |

|

|

(491 |

) |

|

|

(12,520 |

) |

|

|

(1,909 |

) |

Net cash provided by (used in) financing activities |

|

|

6,388 |

|

|

|

(62 |

) |

|

|

6,358 |

|

|

|

(44 |

) |

Net change in cash, cash equivalents, and restricted cash |

|

$ |

(7,140 |

) |

|

$ |

31 |

|

|

$ |

(2,307 |

) |

|

$ |

(683 |

) |

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

Net cash (used in) provided by operating activities |

|

$ |

(2,081 |

) |

|

$ |

584 |

|

|

$ |

3,855 |

|

|

$ |

1,270 |

|

Cash paid for interest |

|

|

154 |

|

|

|

128 |

|

|

|

262 |

|

|

|

253 |

|

Net cash used in investing activities |

|

|

(11,447 |

) |

|

|

(491 |

) |

|

|

(12,520 |

) |

|

|

(1,909 |

) |

Purchase of technology license |

|

|

10,000 |

|

|

|

— |

|

|

|

10,000 |

|

|

|

— |

|

Adjustment from investment held in restricted cash |

|

|

4,035 |

|

|

|

|

|

|

4,035 |

|

|

|

|

Restricted cash |

|

|

— |

|

|

|

— |

|

|

|

(4,000 |

) |

|

|

— |

|

Free cash flow |

|

$ |

661 |

|

|

$ |

221 |

|

|

$ |

1,632 |

|

|

$ |

(386 |

) |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

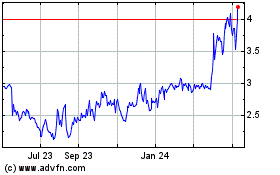

Gaia (NASDAQ:GAIA)

Historical Stock Chart

From Oct 2024 to Nov 2024

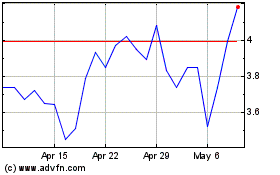

Gaia (NASDAQ:GAIA)

Historical Stock Chart

From Nov 2023 to Nov 2024