UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2024

COMMISSION FILE NUMBER 001-34041

Evotec

SE

(Translation of registrant’s name into English)

Essener Bogen 7

22419 Hamburg

Germany

Tel:

+49 40 560810

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F: Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

On August 06, 2024, Evotec SE (the “Company”) issued an

ad-hoc release announcing the Company’s guidance update for the fiscal year 2024 attached hereto as Exhibit 99.1.

SIGNATURE

Pursuant to the requirements

of s the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Evotec

SE |

| |

|

|

| |

By: |

/s/ Laetitia

Rouxel |

| |

|

Name:

Laetitia Rouxel |

| |

|

Title:

Chief Financial Officer |

Date: August 06, 2024

EXHIBIT INDEX

Exhibit 99.1

Disclosure of an inside information acc. to Article 17 MAR of

the Regulation (EU) No 596/2014

Ad hoc: Evotec SE provides guidance update

Hamburg, Germany, – Evotec SE (Frankfurt

Stock Exchange: EVT, MDAX/TecDAX, Prime Standard, ISIN: DE 000 566480 9, WKN 566480; NASDAQ: EVO) announces that it has refined

its guidance for the fiscal year 2024.

The Company expects Group revenues in

the range of € 790 – 820 m (low to mid-single-digit percentage growth vs previously low double-digit percentage

growth; 2023: € 781.4 m);

R&D expenditures are expected in

a range of € 50 – 60 m (low double-digit percentage reduction vs previously mid-single to low double-digit percentage

reduction; 2023: € 64.8 m);

Adjusted EBITDA is expected to reach

€ 15 – 35 m (mid double-digit percentage reduction vs previously mid double-digit percentage growth; 2023:

€ 66.4 m).

The primary drivers of lower revenue and adjusted EBITDA guidance are

related to the slower than anticipated conversion of sales orders into revenues and continued pressure on margins due to a still high

fixed cost base. However, the priority reset is fully on track and actions are underway to transform the business towards sustainable

profitable growth.

– End of the ad hoc release –

Contact: Volker Braun, EVP Head of Global Investor Relations &

ESG, Evotec SE, Manfred Eigen Campus, Essener Bogen 7, 22419 Hamburg, Germany, Phone: +49 (0) 151 1940 5058 (m), volker.braun@evotec.com

Exhibit 99.2

EVOTEC PROVIDES GUIDANCE UPDATE

| • | Navigating through a challenging H1 2024: Unsatisfying revenue

dynamics in Shared R&D; Just – Evotec Biologics with mid double-digit revenue growth versus strong comparable basis |

| • | Adjusted EBITDA impacted by high fixed cost base in Shared

R&D and ramp-up costs for J.POD Toulouse, France |

| • | Further strengthened sales order book in Discovery is basis

for a moderate growth acceleration in H2 2024; conversion of orders into revenues taking longer than anticipated |

| • | Reset towards sustainable profitable growth starts getting

traction and will be enhanced to make Evotec more agile in a still challenging market environment |

Hamburg, Germany, 06 August 2024:

Evotec SE (Frankfurt

Stock Exchange: EVT, MDAX/TecDAX, ISIN: DE0005664809; NASDAQ: EVO) today announced that it has refined its guidance for the fiscal

year 2024.

For the current fiscal year, the Company expects Revenues1

in the range of € 790 – 820 m (low to mid-single-digit percentage growth vs previously low double-digit

percentage growth; 2023: € 781.4 m);

R&D expenditures are expected in a range of € 50 –

60 m (low double-digit percentage reduction vs previously mid-single to low double-digit percentage reduction; 2023: € 64.8 m);

Adjusted EBITDA1 is expected to reach € 15 –

35 m (mid-double-digit percentage reduction vs previously mid double-digit percentage growth; 2023: € 66.4 m).

The Shared R&D segment faced the anticipated challenging environment

in the first half with a year-over-year revenue decline at a high single digit rate. Gross margin showed modest improvements in Q2 versus

Q1, but adjusted EBITDA was influenced by a still high fixed cost base.

Just – Evotec Biologics revenues grew at mid double-digit rates

versus a strong comparable basis due to signing of the Tech alliance with Sandoz in May 2023. Costs were driven by the capacity ramp-up

with the J.POD in Toulouse, France, which progressed according to plan to meet requirements related to the significant expansion of sales

orders from various partners, of which the contract extension and expansion with Sandoz in early July is by far the largest contributor.

1 Guidance including future non-core activities

Sales orders for Shared R&D in the Discovery business grew strongly

in the first half. However, due to the long-term nature of recently signed contracts, revenue conversion in 2024 is anticipated to be

slower than initially expected. Given that Evotec’s cost base is laid out for benefiting from future growth, short-term effects

on adj. EBITDA are more pronounced than initially anticipated.

In parallel, Evotec progressed with implementing measures to reset

its operational and corporate priorities with a focus on sustainable profitable growth and right-sizing of its business. Footprint, capacity &

portfolio optimisation measures should result in first positive financial effects to become visible as of the third quarter 2024. Annualised

recurring benefits on adjusted EBITDA are still expected to exceed € 40 m. Over and beyond the reset, Evotec’s management decided

to evaluate additional strategic steps to sharpen its profile further. The development of a new mid-range plan gives reason to reschedule

the Capital Markets Day, originally planned for 10 October. Details will be shared in due course.

Dr Christian Wojczewski, Chief Executive Officer of Evotec, commented:

“Evotec’s main success drivers are its differentiated drug discovery and development platforms and the quality and expertise

of its dedicated people. However, we have challenges that urgently must be addressed. I am convinced that the priority reset with the

refined guidance is the starting point to restoring trust, sharpening the focus of our organisation, and getting Evotec back on track

for better performance and sustainable growth. We will evaluate and refine our strategy further, reduce complexity and pursue new approaches

with the aim to strengthen our leading position and financial performance.”

Evotec will release its detailed results for the first half year 2024

on 14 August.

About Evotec SE

Evotec is a life science company with a unique business model that delivers on its mission to discover and develop highly effective therapeutics

and make them available to the patients. The Company’s multimodality platform comprises a unique combination of innovative technologies,

data and science for the discovery, development, and production of first-in-class and best-in-class pharmaceutical products. Evotec provides

high value pipeline co-creating partnerships and solutions to all Top 20 Pharma and over 800 biotechnology companies, academic institutions,

as well as other healthcare stakeholders. Evotec has strategic activities in a broad range of currently underserved therapeutic areas,

including e.g. neurology, oncology, as well as metabolic and infectious diseases. Within these areas of expertise, Evotec aims to create

the world-leading co-owned pipeline for innovative therapeutics and has to-date established a portfolio of more than 200 proprietary

and co-owned R&D projects from early discovery to clinical development. Evotec operates globally with more than 5,000 highly qualified

people. The Company’s sites in Europe and the USA offer highly synergistic technologies and services and operate as complementary

clusters of excellence. For additional information please go to www.evotec.com and follow us on X/Twitter @Evotec and LinkedIn.

Forward-looking statements

This announcement contains forward-looking statements concerning future events, including the proposed offering and listing of Evotec’s

securities. Words such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“intend,” “may,” “might,” “plan,” “potential,” “should,” “target,”

“would” and variations of such words and similar expressions are intended to identify forward-looking statements. Such statements

include comments regarding Evotec’s expectations for revenues, Group EBITDA and unpartnered R&D expenses. These forward-looking

statements are based on the information available to, and the expectations and assumptions deemed reasonable by Evotec at the time these

statements were made. No assurance can be given that such expectations will prove to have been correct. These statements involve known

and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties

and contingencies, many of which are beyond the control of Evotec. Evotec expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Evotec’s expectations

with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For further information, please contact:

Media

Gabriele Hansen

SVP Head of Global Corporate Communications

Gabriele.Hansen@evotec.com

Hinnerk Rohwedder

Director of Global Corporate Communications

Hinnerk.Rohwedder@evotec.com

Investor Relations

Volker Braun

EVP Head of Global Investor Relations & ESG

Volker.Braun@evotec.com

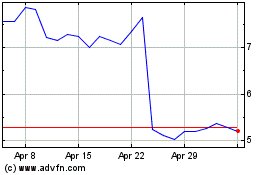

Evotec (NASDAQ:EVO)

Historical Stock Chart

From Jul 2024 to Aug 2024

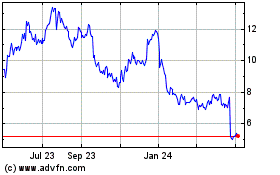

Evotec (NASDAQ:EVO)

Historical Stock Chart

From Aug 2023 to Aug 2024