Filed Pursuant to Rule 424(b)(5)

Registration No. 333-237213

(To the Prospectus dated May 22, 2020)

|

|

|

|

1,325,000 Shares of Common Stock

Duos Technologies Group, Inc.

|

duostech

|

|

|

|

We are offering 1,325,000 shares

of our common stock pursuant to this prospectus supplement and the accompanying prospectus.

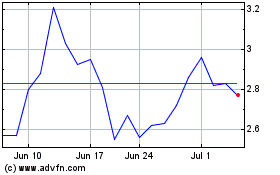

Our common stock is listed

on the NASDAQ Capital Market under the symbol “DUOT.” On February 3, 2022, the last reported sale price of our common

stock on the NASDAQ Capital Market was $5.62 per share.

Our business and an investment

in our securities involve a high degree of risk. Before deciding whether to invest in our securities, you should carefully review the

information described under the heading “Risk Factors” beginning on page S-5 of this prospectus supplement and on page 8

of the accompanying prospectus, and under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31,

2020 and our Form 10-Q for the quarter ended September 30, 2021, each of which is incorporated by reference in this prospectus supplement.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy

or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

4.00

|

|

|

$

|

5,300,000

|

|

|

Underwriting discount(1)

|

|

$

|

0.28

|

|

|

$

|

371,000

|

|

|

Proceeds, before expenses, to us

|

|

$

|

3.72

|

|

|

$

|

4,929,000

|

|

(1) The underwriter will receive compensation in addition

to the underwriting discount. See “Underwriting” of this prospectus supplement for a description of the compensation payable

to the underwriter.

We have granted a 30-day option

to the underwriter to purchase up to 198,750 additional shares of common stock from us at the public offering price, less the underwriting

discount, solely to cover over-allotments, if any. See “Underwriting” of this prospectus supplement for more information.

The underwriter expects to

deliver our shares to purchasers in the offering on or about February 8, 2022, subject to customary closing conditions.

Northland Capital Markets

The date of this prospectus supplement is February

3, 2022.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus of Duos Technologies Group, Inc., a Florida corporation (the “Company,” “we,”

“us,” or “our”), form part of a “shelf” registration statement on Form S-3 (File No. 333-237213)

that we filed with the Securities and Exchange Commission (the “SEC”) on March 16, 2020, as amended on May 12, 2020,

and that was declared effective on May 22, 2020.

This document is in two parts.

The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information

contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying

prospectus. The second part, the accompanying prospectus, gives more general information about securities we may offer from time to time,

some of which does not apply to this offering. Generally, when we refer to the “prospectus,” we are referring to both parts

of this document combined together with all documents incorporated by reference. If the description of the offering varies between this

prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement. However,

if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example,

a document incorporated by reference into this prospectus supplement or the accompanying prospectus — the statement in the document

having the later date modifies or supersedes the earlier statement. You should rely only on the information contained in or incorporated

by reference into this prospectus supplement or contained in or incorporated by reference into the accompanying prospectus to which we

have referred you. We have not authorized anyone to provide you with information that is different. If anyone provides you with different

or inconsistent information, you should not rely on it. The information contained in, or incorporated by reference into, this prospectus

supplement and contained in, or incorporated by reference into, the accompanying prospectus is accurate only as of the respective dates

thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of securities.

It is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus,

including the documents incorporated by reference herein and therein, in making your investment decision. You should also read and consider

the information in the documents to which we have referred you under the captions “Where You Can Find More Information” and

“Incorporation by Reference” in this prospectus supplement and in the accompanying prospectus.

This prospectus supplement

and the accompanying prospectus do not contain all of the information included in the registration statement, as permitted by the rules

and regulations of the SEC. For further information, we refer you to our registration statement on Form S-3, including its exhibits, of

which this prospectus supplement and the accompanying prospectus form a part. We are subject to the informational requirements of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), and therefore file reports and other information with the

SEC. Statements contained in this prospectus supplement and the accompanying prospectus about the provisions or contents of any agreement

or other document are only summaries. If SEC rules require that any agreement or document be filed as an exhibit to the registration statement,

you should refer to that agreement or document for its complete contents.

We are offering to sell, and

are seeking offers to buy, securities only in jurisdictions where such offers and sales are permitted. The distribution of this prospectus

supplement and the accompanying prospectus and the offering of securities in certain jurisdictions or to certain persons within such jurisdictions

may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying

prospectus must inform themselves about and observe any restrictions relating to the offering of securities and the distribution of this

prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus

do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered

by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement

and any accompanying prospectus, including the documents that we incorporate by reference, contain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act.

These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private

Securities Litigation Reform Act of 1995. Forward-looking statements give our current expectations or forecasts of future events. You

can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements

involve risks and uncertainties and include statements regarding, among other things, our projected revenue growth and profitability,

our growth strategies and opportunity, anticipated trends in our market and our anticipated needs for working capital. They are generally

identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,”

“plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,”

“management believes,” “we believe,” “we intend” or the negative of these words or other variations

on these words or comparable terminology. In particular, these include statements relating to future actions, prospective products, market

acceptance, future performance or results of current and anticipated products, sales efforts, expenses, and the outcome of contingencies

such as legal proceedings and financial results. Any forward-looking statements are qualified in their entirety by reference to the factors

discussed throughout this prospectus supplement.

Examples of forward-looking

statements in this prospectus include, but are not limited to, our expectations regarding our business strategy, business prospects, operating

results, operating expenses, working capital, liquidity and capital expenditure requirements. Important assumptions relating to the forward-looking

statements include, among others, assumptions regarding demand for our products, the cost, terms and availability of components, pricing

levels, the timing and cost of capital expenditures, competitive conditions and general economic conditions. These statements are based

on our management’s current expectations, beliefs and assumptions concerning future events affecting us, which in turn are based

on currently available information. These assumptions could prove inaccurate. They are subject to risks and uncertainties known and unknown

that could cause actual results and developments to differ materially from those expressed or implied in such statements. Although we

believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations may prove to be

incorrect.

You should read this prospectus

supplement, the accompanying prospectus and the documents that we incorporate by reference herein and therein and have filed as exhibits

to the registration statement, of which this prospectus supplement is part, completely and with the understanding that our actual future

results may be materially different from what we expect. You should assume that the information appearing in this prospectus supplement

and any accompanying prospectus is accurate as of the date on the front cover of this prospectus supplement. Because the risk factors

referred to above, as well as the risk factors included in this prospectus supplement, the accompanying prospectus and those incorporated

herein by reference, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements

made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement

speaks only as of the date on which it is made, and except as may be required under applicable securities laws, we undertake no obligation

to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect

the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will

arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors,

may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information

presented in this prospectus supplement and the accompanying prospectus and the documents that we incorporate by reference herein and

therein, and particularly our forward-looking statements, by these cautionary statements.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

information contained elsewhere or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary

does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire

prospectus supplement and the accompanying prospectus carefully, including the “Risk Factors” section contained in this prospectus

supplement and our consolidated financial statements and the related notes and the other documents incorporated by reference into this

prospectus supplement and the accompanying prospectus.

Overview

Duos Technologies Group, Inc.

(the “Company”), based in Jacksonville, Florida, through its wholly owned subsidiary, Duos Technologies, Inc., designs, develops,

deploys and operates intelligent vision-based technology solutions supporting rail, logistics, intermodal and Government customers that

streamline operations, improve safety and reduce costs. The Company provides cutting edge solutions that automate the mechanical and security

inspection of fast-moving trains, trucks and automobiles through a broad range of proprietary hardware, software, information technology

and artificial intelligence.

The Company was incorporated

in Florida on May 31, 1994 under the original name of Information Systems Associates, Inc. (“ISA”). Initially, our business

operations consisted of consulting services for asset management of large corporate data centers and the development and licensing of

information technology (“IT”) asset management software. In late 2014, ISA entered negotiations with Duos Technologies, Inc.

(“Duos”), for the purposes of executing a reverse triangular merger. This transaction was completed on April 1, 2015, whereby

Duos became a wholly owned subsidiary of the Company. Duos was incorporated under the laws of Florida on November 30, 1990 for design,

development and deployment of proprietary technology applications and turn-key engineered systems. The Company has a current staff of

65 people of which 57 are full time and is a technology and software applications company with a strong portfolio of intellectual property.

The Company’s core competencies, including advanced intelligent technologies, are delivered through its proprietary integrated enterprise

command and control platform, Centraco®.

The Company has developed

the Railcar Inspection Portal (RIP) that provides both freight and transit railroad customers and select government agencies the ability

to conduct fully remote railcar inspections of trains while they are in transit. The system, which incorporates a variety of sophisticated

optical technologies, illumination and other sensors, scans each passing railcar to create an extremely high-resolution image set from

a variety of angles including the undercarriage. These images are then processed through various methods of artificial intelligence algorithms

to identify specific defects and/or areas of interest on each railcar. This is all accomplished within seconds of a railcar passing through

our portal. This solution has the potential to transform the railroad industry immediately increasing safety, improving efficiency and

reducing costs. The Company has successfully deployed this system with several Class 1 railroad customers and anticipates an increased

demand in the future. Government agencies can conduct digital inspections combined with the incorporated artificial intelligence (AI)

to improve rail traffic flow across borders which also directly benefits the Class 1 railroads through increasing their velocity.

The Company has also developed

the Automated Logistics Information System (ALIS) or Truck Inspection (Portal) which automates and reduces/removes personnel from gatehouses

where trucks enter and exit large logistics and intermodal facilities. This solution also incorporates sensors and data points as necessary

for each operation and directly interconnects with backend logistics databases and processes to streamline operations, and significantly

improve operations and security and importantly dramatically improves the vehicle throughput on each lane on which the technology is deployed.

The Company is also researching using its inspection portal technology for other applications where examination of moving vehicles is

required. Examples of possible future applications include trucks, cars and aircraft, and the Company plans to expand into these applications

based upon market requirements and demand within certain industries such as aviation.

The Company has built a portfolio

of IP and patented solutions that creates “actionable intelligence” using two core native platforms called Centraco® and

Praesidium™. All solutions provided include a variant of both applications. Centraco is designed primarily as the user interface

to all our systems as well as the backend connection to third-party applications and databases through both Application Programming Interfaces

(APIs) and Software Development Kits (SDKs). This interface is browser based and hosted within each one of our systems and solutions.

It is typically also customized for each unique customer and application. Praesidium typically resides as middleware in our systems and

manages the various image capture devices and some sensors for input into the Centraco software.

The Company also developed

a proprietary Artificial Intelligence (AI) software platform, Truevue360™ with the objective of focusing the Company’s advanced

intelligent technologies in the areas of AI, deep machine learning and advanced multi-layered algorithms to further support our solutions.

The Company is now delivering advanced algorithms to the rail industry using expert driven Artificial Intelligence with an experienced

team of railroad mechanical car inspectors, imagery experts and data scientists.

Through September 30, 2021,

the Company also provided professional and consulting services for large data centers and had developed a system for the automation of

asset information marketed as DcVue™. The Company had deployed its DcVue software at one beta site. This software was used by Duos’

consulting auditing teams. DcVue was based upon the Company’s OSPI patent which was awarded in 2010. The Company offered DcVue available

for license to our customers as a licensed software product. As of October 1, 2021, the Company sold its assets related to DcVue to the

general manager of that business line and no longer operates in that space.

The Company’s strategy

is to deliver operational and technical excellence to our customers; expand our RIP and ALIS solutions into current and new customers

focused in the Transportation, Logistics and U.S. Government Sectors; offer both CAPEX and OPEX pricing models to customers that increases

recurring revenue, grows backlog and improves profitability; responsibly grow the business both organically and through selective acquisitions;

and promote a performance-based work force where employees enjoy their work and are incentivized to excel and remain with the Company.

Our principal executive office

is located at 7660 Centurion Parkway, Suite 100, Jacksonville, Florida 32256, and our telephone number is (904) 287-5409. Our website

address is www.duostechnologies.com. The information available on or accessible through our website does not constitute a part of this

prospectus supplement or the accompanying prospectus and should not be relied upon.

For a further description

of our business, financial condition, results of operations and other important information regarding us, we refer you to our filings

with the SEC incorporated by reference in this prospectus supplement and the accompanying prospectus. For information on how to find copies

of these documents, see “Where You Can Find More Information” and “Incorporation of Documents by Reference.”

Recent Developments

Our financial statements for

the fiscal year ended December 31, 2021 will not be available until after this offering is completed and consequently will not be available

to you prior to investing in this offering. This is not a comprehensive statement of our financial results and is subject to change. These

estimates should not be viewed as a substitute for our full year financial statements prepared in accordance with generally accepted accounting

principles in the United States (“GAAP”).

Based on our preliminary unaudited

estimates and information available to us as of the date of this prospectus supplement, we expect total revenue for the fourth quarter

of 2021 to be $3.75 million, in line with the same period one year ago. Management also estimates that the Company’s fourth quarter

net loss will be in the range of $250,000 to $295,000 compared with a net loss of $426,000 for the fourth quarter in fiscal year 2020,

an improvement of at least 31%. This improvement in operating results is expected to continue in 2022 for the full year. Based on preliminary

fourth quarter results, the Company expects total revenue for the fiscal year ended December 31, 2021 to be approximately $8.29 million.

Duos is entering 2022 with

a strong backlog of business. During the last quarter, the Company was successful in closing several high-value contracts in the rail

segment and is now developing offerings to inspect other types of moving vehicles, such as trucks.

These preliminary estimates

are not necessarily indicative of any future period and should be read together with the sections titled “Cautionary Note Regarding

Forward-Looking Statements” and “Risk Factors” and under similar headings in the documents incorporated by reference

into this prospectus supplement and the accompanying prospectus as well as our financial statements, related notes and other financial

information incorporated by reference into this prospectus supplement.

The Offering

The following summary is provided solely for your

convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus

supplement and the accompanying prospectus. For a more detailed description of the common stock, see “Description of Capital Stock”

in the accompanying prospectus.

|

|

Issuer

|

Duos Technologies Group, Inc.

|

|

|

|

|

|

|

|

|

Common stock offered by us

|

1,325,000 shares of common stock (or 1,523,750 shares if the underwriter exercises its option to purchase additional shares in full).

|

|

|

|

|

|

|

|

|

Over-allotment option

|

We have granted the underwriter a 30-day option from the date of this prospectus supplement to purchase up to 198,750 additional shares from us at the public offering price less the underwriting discount to cover over-allotments, if any.

|

|

|

|

|

|

|

|

|

Common stock to be outstanding

immediately after this offering

|

5,881,033 shares of common stock (or 6,079,783 shares if the underwriter exercises its option to purchase additional shares in full).

|

|

|

|

|

|

|

|

|

Use of Proceeds

|

We intend to use the net proceeds of this offering for general corporate purposes and working capital. See “Use of Proceeds” for further information.

|

|

|

|

|

|

|

|

|

Risk Factors

|

See “Risk Factors” of this prospectus supplement and other information included or incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before investing in our securities.

|

|

|

|

|

|

|

|

|

NASDAQ Capital Market trading symbol

|

DUOT

|

|

Unless we indicate otherwise,

all information in this prospectus supplement (i) assumes no exercise by the underwriter of its option to purchase up to an additional

198,750 shares of common stock to cover over-allotments, if any, and (ii) is based on 4,556,033 shares of common stock outstanding

as of February 1, 2022 and excludes as of such date:

|

|

●

|

121,572 shares of our common stock issuable upon conversion of all outstanding shares of our preferred stock;

|

|

|

|

|

|

|

●

|

944,838 shares of our common stock issuable upon exercise of outstanding stock options under our equity incentive plans at a weighted-average exercise price of $6.13 per share, with 335,000 additional shares reserved for future issuance under such plans;

|

|

|

|

|

|

|

●

|

160,000 shares of our common stock issuable upon exercise of outstanding stock options issued outside of our equity incentive plans at a weighted average exercise price of $4.22 per share; and

|

|

|

|

|

|

|

●

|

1,376,466 shares of our common stock issuable upon exercise of warrants with a weighted average exercise price of $8.18 per share.

|

RISK FACTORS

You should carefully consider

the risks described below before making an investment decision. The risks described below are not the only ones we face. Additional risks

we are not presently aware of or that we currently believe are immaterial may also impair our business operations. Our business could

be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or

part of your investment. In assessing these risks, you should also refer to the risk factors and other information contained or incorporated

by reference into this prospectus supplement and the accompanying prospectus, specifically including the risk factors contained in our

Quarterly Report on Form 10-Q for the period ended September 30, 2021 filed with the SEC on November 15, 2021 and our Annual

Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 30, 2021 and the financial statements and

related notes filed therewith.

Risks Relating to this Offering

Management will have broad

discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad

discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that you do not agree with or

that do not improve our results of operations or enhance the value of our common stock – see the section entitled “Use of

Proceeds” in this prospectus supplement. Our failure to apply these funds effectively could have a material adverse effect on our

business and cause the price of our common stock to decline.

You will experience immediate

and substantial dilution in the net tangible book value per share of the common stock you purchase.

Since the price per share

of our common stock being offered is higher than the net tangible book value per share of our common stock, you will suffer substantial

dilution in the net tangible book value of the common stock you purchase in this offering. Based on the public offering price of $4.00

per share, and after deducting the underwriting discount and estimated offering expenses payable by us, if you purchase shares of common

stock in this offering, you will suffer immediate and substantial dilution of $2.88 per share in the net tangible book value of the common

stock or $2.78 per share if the underwriter exercises in full its option to purchase additional shares to cover over-allotments, if any.

See the section entitled “Dilution” in this prospectus supplement for a more detailed discussion of the dilution you will

incur if you purchase common stock in this offering.

Our outstanding options,

warrants and preferred stock and the availability for resale of the underlying shares may adversely affect the trading price of our common

stock.

As of February 1, 2022,

there were outstanding stock options to purchase 1,104,838 shares of our common stock at a weighted-average exercise price of $5.85 per

share, warrants to purchase 1,376,466 shares of our common stock at a weighted-average exercise price of $8.18 per share and shares of

preferred stock convertible into 121,572 shares of our common stock at a weighted-average conversion price of $7.00 per share. Our outstanding

options, warrants and preferred stock could adversely affect our ability to obtain future financing or engage in certain mergers or other

transactions, since the holders of options, warrants and preferred stock can be expected to exercise or convert them at a time when we

may be able to obtain additional capital through a new offering of securities on terms more favorable to us than the terms of outstanding

options, warrants or preferred stock. The issuance of shares upon the exercise or conversion of outstanding options, warrants or preferred

stock will also dilute the ownership interests of our existing stockholders.

The rights of the holders

of common stock may be impaired by the potential issuance of preferred stock.

Our board of directors has

the right, without stockholder approval, to issue preferred stock with voting, dividend, conversion, liquidation or other rights which

could adversely affect the voting power and equity interest of the holders of common stock, which could be issued with the right to more

than one vote per share, and could be utilized as a method of discouraging, delaying or preventing a change of control. The possible negative

impact on takeover attempts could adversely affect the price of our common stock. Although we have no present intention to issue any shares

of preferred stock or to create any new series of preferred stock, we may issue such shares in the future.

Because we do not intend

to pay dividends on our common stock, stockholders will benefit from an investment in our stock only if it appreciates in value.

We have never declared or

paid any cash dividends on our shares of common stock. We currently intend to retain all future earnings, if any, for use in the operations

and expansion of the business. As a result, we do not anticipate paying cash dividends in the foreseeable future. Any future determination

as to the declaration and payment of cash dividends will be at the discretion of our Board of Directors and will depend on factors the

Board of Directors deems relevant, including, among others, our results of operations, financial condition and cash requirements, business

prospects, and the terms of our financing arrangements, if any. Accordingly, realization of a gain on stockholders’ investments

will depend on the appreciation of the price of our common stock. There is no guarantee that our common stock will appreciate in value.

Our common stock may be

delisted from the Nasdaq Capital Market.

On November 23, 2021, the

Company received from The Nasdaq Stock Market LLC (“Nasdaq”) a letter indicating that we are not in compliance with Nasdaq

Marketplace Rule 5550(b)(1), which requires companies listed on the Nasdaq Capital Market to maintain a minimum of $2,500,000 in

stockholders’ equity for continued listing. On our Form 10-Q for the quarter ended September 30, 2021, the Company reported

stockholders’ equity of $865,221, and, as a result, does not currently satisfy Nasdaq Marketplace Rule 5550(b)(1).

Nasdaq’s letter has

no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on Nasdaq, subject

to the Company’s compliance with the other continued listing requirements. Nasdaq’s letter provides the Company 45 calendar

days, or until January 17, 2022, to submit a plan to regain compliance, which the Company has done. If the plan is accepted, the

Company can be granted up to 180 calendar days from November 23, 2021 to evidence compliance. There can be no guarantee that the

plan will be accepted by Nasdaq.

The Company intends to take

all reasonable measures available to regain compliance under the Nasdaq Listing Rules and remain listed on the Nasdaq. The Company is

currently evaluating its available options to resolve the deficiency and regain compliance with the Nasdaq minimum stockholders’

equity requirement. The Company expects that if all of the shares of common stock offered by this prospectus supplement are sold we will

regain compliance with the Nasdaq Listing Rules but there can be no guarantee that we will do so.

USE OF PROCEEDS

We estimate that our net proceeds

from the sale of the common stock offered pursuant to this prospectus supplement will be approximately $4.7 million or approximately

$5.4 million if the underwriter exercises in full its option to purchase additional shares to cover over-allotments, if any, in

each case after deducting the underwriting discount and the estimated offering expenses that are payable by us.

We currently intend to use

the net proceeds from this offering for potential acquisitions, general corporate purposes and working capital.

The timing and amount of our

actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business. As

of the date of this prospectus supplement, we have not yet determined the amount of net proceeds to be used specifically for any specific

purpose. Accordingly, our management will have significant discretion and flexibility in applying the net proceeds from this offering.

DIVIDEND POLICY

We have never declared or

paid cash dividends on our common stock. We currently intend to retain our future earnings, if any, for use in our business and therefore

do not anticipate paying cash dividends in the foreseeable future. Payment of future dividends, if any, will be at the discretion of our

Board of Directors after taking into account various factors, including our financial condition, operating results, current and anticipated

cash needs and plans for expansion.

CAPITALIZATION

The following table sets forth

our capitalization as of September 30, 2021:

|

|

●

|

on an actual basis; and

|

|

|

|

|

|

|

●

|

on an as adjusted basis to give effect to the receipt of the estimated

net proceeds of approximately $4.7 million from the sale of the common stock in this offering, after deducting the underwriting

discount and estimated offering expenses payable by us.

|

This table should be read

with “Use of Proceeds” in this prospectus supplement as well as (a) “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our financial statements and notes thereto included in our Annual Report on Form 10-K for

the year ended December 31, 2020 and (b) “Management’s Discussion and Analysis of Financial Condition and Results of

Operation” and our condensed financial statements and notes thereto included in our Quarterly Report on Form 10-Q for the quarter

ended September 30, 2021, which are incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

|

September 30, 2021

|

|

|

|

|

Actual

|

|

|

As adjusted

|

|

|

|

|

(Unaudited)

|

|

|

Cash

|

|

$

|

2,257,971

|

|

|

$

|

6,953,171

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term liabilities

|

|

|

33,860

|

|

|

|

33,860

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock: $0.001 par value, 10,000,000 authorized, 9,480,000 shares available to be designated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A redeemable convertible preferred stock, $10 stated value per share; 500,000 shares designated; 0 issued and outstanding at September 30, 2021, convertible into common stock at $6.30 per share

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Series B convertible preferred stock, $1,000 stated value per share; 15,000 shares designated; 1,705 shares issued and outstanding at September 30, 2021, convertible into common stock at $7.00 per share

|

|

|

1,705,000

|

|

|

|

1,705,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Series C convertible preferred stock, $1,000 stated value per share; 5,000 shares designated; 4,500 shares issued and outstanding at September 30, 2021, convertible into common stock at $5.50 per share

|

|

|

4,500,000

|

|

|

|

4,500,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock: $0.001 par value; 500,000,000 shares authorized, 3,612,125 shares issued, 3,610,801 shares outstanding at September 30, 2021 (actual); 4,935,801 shares outstanding (as adjusted)

|

|

|

3,612

|

|

|

|

4,937

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional paid-in-capital

|

|

|

39,954,099

|

|

|

|

44,805,426

|

|

|

Accumulated deficit

|

|

|

(45,297,490

|

)

|

|

|

(45,297,490

|

)

|

|

Treasury stock

|

|

|

(157,452

|

)

|

|

|

(157,452

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

865,221

|

|

|

|

5,560,421

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

899,081

|

|

|

$

|

5,594,281

|

|

All information above (i) assumes

no exercise by the underwriter of its option to purchase up to an additional 198,750 shares of common stock to cover over-allotments,

if any, and (ii) the number of shares of common stock outstanding as of September 30, 2021 is 3,610,801 and excludes as of such

date:

|

|

●

|

1,061,753 shares of our common stock issuable upon conversion of all outstanding shares of our preferred stock (between October 1, 2021 and February 1, 2022, 940,181 shares of common stock were issued upon conversion of shares of our preferred stock);

|

|

|

|

|

|

|

|

|

●

|

431,266 shares of our common stock issuable upon exercise of outstanding stock options under our equity incentive plans at a weighted-average exercise price of $5.32 per share, with 1,000,000 additional shares reserved for future issuance under such plans;

|

|

|

|

|

|

|

|

|

●

|

160,000 shares of our common stock issuable upon exercise of outstanding stock options issued outside of our equity incentive plans at a weighted-average exercise price of $4.22 per share; and

|

|

|

|

|

|

|

|

|

●

|

1,376,466 shares of our common stock issuable upon exercise of warrants with a weighted-average exercise price of $8.18 per share.

|

|

DILUTION

If you purchase our securities

in this offering, your interest will be diluted to the extent of the difference between the public offering price per share of our common

stock and the net tangible book value per share of our common stock after this offering. We calculate net tangible book value per share

by dividing our net tangible assets (tangible assets less total liabilities) by the number of shares of our common stock issued and outstanding

as of September 30, 2021.

Our net tangible book value

at September 30, 2021 was $854,590, or $0.24 per share, based on 3,610,801 shares of our common stock outstanding. After giving

effect to the issuance and sale of all the shares in this offering at the public offering price of $4.00 per share less the estimated

offering expenses, our pro forma as adjusted pro forma net tangible book value at September 30, 2021 would have been $5,494,140 or

$1.12 per share. This represents an immediate increase in pro forma net tangible book value of $0.88 per share to existing stockholders

and an immediate dilution of $(2.88) per share to investors in this offering. The following table illustrates this per share dilution:

|

Public offering price per share of common stock

|

|

$

|

4.00

|

|

|

Net tangible book value per share as of September 30, 2021

|

|

$

|

0.24

|

|

|

Increase per share attributable to this offering

|

|

$

|

0.88

|

|

|

As adjusted net tangible book value per share as of September 30, 2021 after this offering

|

|

$

|

1.12

|

|

|

Dilution per share to new investors participating in this offering

|

|

$

|

(2.88

|

)

|

If the underwriter exercises

in full its option to purchase additional shares of common stock at the public offering price of $4.00 per share, the as adjusted net

tangible book value after this offering would be $1.22 per share, representing an increase in net tangible book value of $0.98 per

share to existing stockholders and immediate dilution in net tangible book value of $(2.78) per share to purchasers in this

offering at the public offering price.

To the extent that outstanding

options or warrants are exercised or shares of preferred stock are converted, or any additional options, warrants or other equity awards

are granted and exercised or become vested or other issuances of shares of our common stock are made, you will experience further dilution.

In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have

sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of common

stock or securities exercisable, convertible or exchangeable into common stock, such issuance could result in further dilution to our

stockholders.

The above information is based

on 3,610,801 shares of common stock outstanding as of September 30, 2021, and excludes as of such date:

|

|

●

|

1,061,753 shares of our common stock issuable upon conversion of all outstanding shares of our preferred stock (between October 1, 2021 and February 1, 2022, 940,181 shares of common stock were issued upon conversion of shares of our preferred stock);

|

|

|

|

|

|

|

●

|

431,266 shares of our common stock issuable upon exercise of outstanding stock options under our equity incentive plans at a weighted-average exercise price of $5.32 per share, with 1,000,000 additional shares reserved for future issuance under such plans;

|

|

|

|

|

|

|

●

|

160,000 shares of our common stock issuable upon exercise of outstanding stock options issued outside of our equity incentive plans at a weighted average exercise price of $4.22; and

|

|

|

|

|

|

|

●

|

1,376,466 shares of our common stock issuable upon exercise of warrants with a weighted-average exercise price of $8.18 per share.

|

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

In this offering, we are offering

1,325,000 shares of our common stock at the public offering price of $4.00 per share. The material terms and provisions of our common

stock are described under the captions “Description of Capital Stock” and “Common Stock” of the accompanying prospectus.

UNDERWRITING

We are offering the shares

of common stock described in this prospectus supplement through Northland Securities, Inc. (“Northland”) as the sole book-running

manager. We have entered into a firm commitment underwriting agreement with Northland.

The underwriting agreement

provides that the obligations of Northland are subject to certain conditions precedent, including approval of legal matters by its counsel.

Northland has the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part. Subject to the terms

and conditions set forth in the underwriting agreement, we have agreed to sell to Northland, and Northland has agreed to purchase from

us, the number of shares of our common stock listed opposite its name below.

|

Underwriter

|

|

Number

of Shares

|

|

|

Northland Securities, Inc.

|

|

|

1,325,000

|

|

|

|

|

|

|

|

|

Total

|

|

|

1,325,000

|

|

The shares sold in this offering

are expected to be ready for delivery on or about February 8, 2022, against payment in immediately available funds.

Option to Purchase

Additional Shares

We have granted Northland

an option to buy up to an additional 198,750 shares of common stock from us. Northland may exercise this option at any time and from time

to time during the 30-day period from the date of this prospectus supplement. If any additional shares of common stock are purchased,

Northland will offer the additional shares on the same terms as those on which the shares are being offered.

Discounts and Commissions

Northland has advised us that

it proposes to offer the common stock directly to the public at the offering price set forth on the cover page of this prospectus supplement.

Northland proposes to offer the shares to certain dealers at the same price less a concession of not more than $0.1680 per share. After

the offering, these figures may be changed by Northland.

The underwriting fee is equal

to the public offering price per share of common stock less the amount paid by Northland to us per share of common stock. The following

table shows the per share and total underwriting discount to be paid by Northland in connection with this offering, assuming either no

exercise and full exercise of the option to purchase additional shares:

|

|

|

|

|

|

Total

|

|

|

|

|

Per Share

|

|

|

Without Option

|

|

|

With Option

|

|

|

Public offering price

|

|

$

|

4.00

|

|

|

$

|

5,300,000

|

|

|

$

|

6,100,000

|

|

|

Underwriting discounts

|

|

$

|

0.28

|

|

|

$

|

371,000

|

|

|

$

|

426,650

|

|

|

Proceeds, before expenses, to us

|

|

$

|

3.72

|

|

|

$

|

4,929,000

|

|

|

$

|

5,668,350

|

|

We estimate that the total

fees and expenses payable by us, excluding the underwriting discount, will be approximately $235,000,

which includes $150,000 that we have agreed to reimburse Northland for the fees incurred by it in connection with the offering. The fees

and expenses of the underwriter that we have agreed to reimburse are not included in the underwriting discounts in the table above.

Except as disclosed in this

prospectus supplement, Northland has not received and will not receive from us any other item of compensation or expense in connection

with this offering considered by FINRA to be underwriting compensation under FINRA Rule 5110. The underwriting discount and reimbursable

expenses Northland will receive were determined through arms’ length negotiations between us and Northland.

Indemnification

of Underwriter

We have agreed to indemnify

Northland against certain liabilities, including liabilities under the Securities Act or to contribute to payments that Northland may

be required to make in respect of those liabilities.

No Sales of Similar

Securities

We and each of our directors

and executive officers and certain of our stockholders are subject to lock-up agreements that prohibit us and them from offering, selling,

contracting to sell, granting any option or contract to purchase, purchasing any option or contract to sell, granting any option, right

or warrant to purchase, lending or otherwise transferring or disposing of any shares of our common stock or any securities convertible

into or exercisable or exchangeable for shares of our common stock or other capital stock for a period of 90 days following the date of

this prospectus supplement without the prior written consent of Northland.

The lock-up agreements do

not prohibit our directors and executive officers and those stockholders party to such agreements from transferring shares of our common

stock for bona fide gifts or by will, or for estate or tax planning purposes, subject to certain requirements, including that the transferee

be subject to the same lock-up terms. The lock-up provisions do not prohibit us from issuing shares upon the exercise or conversion of

securities outstanding on the date of this prospectus supplement. The lock-up provisions do not prevent us from selling shares to Northland

pursuant to the underwriting agreement, or from granting options to acquire securities under our existing stock option plans or issuing

shares upon the exercise or conversion of securities outstanding on the date of this prospectus supplement.

Listing

Our common stock is listed

on the Nasdaq Capital Market under the symbol “DUOT.”

Price Stabilization,

Short Positions and Penalty Bids

To facilitate the offering,

Northland may engage in transactions that stabilize, maintain or otherwise affect the price of our common stock during and after the offering.

Specifically, Northland may over-allot or otherwise create a short position in the common stock for its own account by selling more shares

of common stock than we have sold to it. Short sales involve the sale by Northland of a greater number of shares than Northland is required

to purchase in the offering. Northland may close out any short position by either exercising its option to purchase additional shares

or purchasing shares in the open market.

In addition, Northland may

stabilize or maintain the price of the common stock by bidding for or purchasing shares of common stock in the open market and may impose

penalty bids. If penalty bids are imposed, selling concessions allowed to syndicate members or other broker-dealers participating in the

offering are reclaimed if shares of common stock previously distributed in the offering are repurchased, whether in connection with stabilization

transactions or otherwise. The effect of these transactions may be to stabilize or maintain the market price of the common stock at a

level above that which might otherwise prevail in the open market. The imposition of a penalty bid may also affect the price of the common

stock to the extent that it discourages resales of the common stock. The magnitude or effect of any stabilization or other transactions

is uncertain. These transactions may be effected on the Nasdaq Capital Market or otherwise and, if commenced, may be discontinued at any

time. Northland may also engage in passive market making transactions in our common stock. Passive market making consists of displaying

bids on the Nasdaq Capital Market limited by the prices of independent market makers and effecting purchases limited by those prices in

response to order flow. Rule 103 of Regulation M promulgated by the SEC limits the amount of net purchases that each passive market maker

may make and the displayed size of each bid. Passive market making may stabilize the market price of the common stock at a level above

that which might otherwise prevail in the open market and, if commenced, may be discontinued at any time.

Neither we nor the underwriter

makes any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on

the price of our common stock. In addition, neither we nor the underwrites makes any representation that the underwriter will engage in

these transactions or that any transaction, if commenced, will not be discontinued without notice.

Electronic Distribution

This prospectus supplement

and the accompanying base prospectus in electronic format may be made available on the website maintained by Northland and Northland may

distribute prospectuses and prospectus supplements electronically. In addition, Northland may facilitate Internet distribution for this

offering to certain of its Internet subscription customers. Northland may allocate a limited number of securities for sale to its online

brokerage customers. An electronic prospectus supplement and accompanying prospectus is available on the Internet on the website maintained

by Northland. Other than the prospectus supplement and accompanying prospectus in electronic format, the information on Northland’s

website is not part of this prospectus supplement or the accompanying prospectus.

Affiliations

Northland and its affiliates

are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment

banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities.

Northland may in the future engage in investment banking and other commercial dealings in the ordinary course of business with us or our

affiliates. Northland may in the future receive customary fees and commissions for these transactions.

In the ordinary course of

their various business activities, Northland and its affiliates may make or hold a broad array of investments and actively trade debt

and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own accounts and for

the accounts of their customers and such investment and securities activities may involve our securities and/or instruments. Northland

and its affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities

or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and

instruments.

Northland may facilitate the

marketing of this offering online directly or through one of its affiliates. In those cases, prospective investors may view offering terms

and the prospectus supplement and accompanying prospectus online and place orders online or through their financial advisors.

Transfer Agent and

Registrar

The transfer agent and registrar

for our common stock is Continental Stock Transfer & Trust Company, One State Street, 30th Floor, New York, New York 10004.

Selling Restrictions

European Economic

Area

In relation to each Member

State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”) an offer

to the public of any shares of our common stock may not be made in that Relevant Member State, except that an offer to the public in that

Relevant Member State of any shares of our common stock may be made at any time under the following exemptions under the Prospectus Directive,

if they have been implemented in that Relevant Member State:

|

|

(a)

|

to any legal entity that is a qualified investor as defined in the Prospectus Directive;

|

|

|

|

|

|

|

(b)

|

to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the representatives for any such offer; or

|

|

|

|

|

|

|

(c)

|

in any other circumstances falling within Article 3(2) of the Prospectus Directive, provided that no such offer of shares of our common stock shall result in a requirement for the publication by us or any underwriter of a prospectus pursuant to Article 3 of the Prospectus Directive.

|

For the purposes of this provision,

the expression an “offer to the public” in relation to any shares of our common stock in any Relevant Member State means the

communication in any form and by any means of sufficient information on the terms of the offer and any shares of our common stock to be

offered so as to enable an investor to decide to purchase any shares of our common stock, as the same may be varied in that Member State

by any measure implementing the Prospectus Directive in that Member State, the expression “Prospectus Directive” means Directive

2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State),

and includes any relevant implementing measure in the Relevant Member State, and the expression “2010 PD Amending Directive”

means Directive 2010/73/EU.

United Kingdom

Northland has represented

and agreed that:

|

|

(a)

|

it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000 (the “FSMA”)) received by it in connection with the issue or sale of the shares of our common stock in circumstances in which Section 21(1) of the FSMA does not apply to us; and

|

|

|

|

|

|

|

(b)

|

it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the shares of our common stock in, from or otherwise involving the United Kingdom.

|

Canada

The securities may be sold

in Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National

Instrument 45 106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in

National Instrument 31 103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the securities must

be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities

laws.

Securities legislation in

certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus supplement

or the accompanying prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission

or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province

or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province

or territory for particulars of these rights or consult with a legal advisor.

Pursuant to section 3A.3 of

the National Instrument 33 105 Underwriting Conflicts (NI 33 105), the underwriters are not required to comply with the disclosure requirements

of NI 33 105 regarding underwriter conflicts of interest in connection with this offering.

Germany

Each person who is in possession

of this prospectus is aware of the fact that no German securities prospectus (wertpapierprospekt) within the meaning of the German Securities

Prospectus Act (Wertpapier-prospektgesetz, or the “German Act”) of the Federal Republic of Germany has been or will be published

with respect to the shares of our common stock. In particular, each underwriter has represented that it has not engaged and has agreed

that it will not engage in a public offering in the Federal Republic of Germany within the meaning of the German Act with respect to any

of the shares of our common stock otherwise than in accordance with the German Act and all other applicable legal and regulatory requirements.

Hong Kong

The common shares may not

be offered or sold in Hong Kong by means of any document other than (i) in circumstances which do not constitute an offer to the public

within the meaning of the Companies Ordinance (Cap. 32, Laws of Hong Kong), or (ii) to “professional investors” within the

meaning of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder, or (iii) in other circumstances

which do not result in the document being a “prospectus” within the meaning of the Companies Ordinance (Cap. 32, Laws of Hong

Kong) and no advertisement, invitation or document relating to the shares may be issued or may be in the possession of any person for

the purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be

accessed or read by, the public in Hong Kong (except if permitted to do so under the laws of Hong Kong) other than with respect to common

shares which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” within

the meaning of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder.

Singapore

This prospectus has not been

registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus and any other document or material in

connection with the offer or sale, or invitation for subscription or purchase, of the common shares may not be circulated or distributed,

nor may the common shares be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or

indirectly, to persons in Singapore other than (i) to an institutional investor under Section 274 of the Securities and Futures Act, Chapter

289 of Singapore (the “SFA”), (ii) to a relevant person pursuant to Section 275(1), or any person pursuant to Section 275(1A),

and in accordance with the conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions

of, any other applicable provision of the SFA, in each case subject to compliance with conditions set forth in the SFA.

Where the common shares are

subscribed or purchased under Section 275 of the SFA by a relevant person which is:

|

|

(a)

|

a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

|

|

|

|

|

|

|

(b)

|

a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor,

|

shares, debentures and units of shares and debentures

of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within

six months after that corporation or that trust has acquired the common shares pursuant to an offer made under Section 275 of the SFA

except:

|

|

(a)

|

to an institutional investor (for corporations, under Section 274 of the SFA) or to a relevant person defined in Section 275(2) of the SFA, or to any person pursuant to an offer that is made on terms that such shares, debentures and units of shares and debentures of that corporation or such rights and interest in that trust are acquired at a consideration of not less than $200,000 (or its equivalent in a foreign currency) for each transaction, whether such amount is to be paid for in cash or by exchange of securities or other assets, and further for corporations, in accordance with the conditions specified in Section 275 of the SFA;

|

|

|

|

|

|

|

(b)

|

where no consideration is or will be given for the transfer; or

|

|

|

|

|

|

|

(c)

|

where the transfer is by operation of law.

|

Switzerland

The shares may not be publicly

offered in Switzerland and will not be listed on the SIX Swiss Exchange (the “SIX”) or on any other stock exchange or regulated

trading facility in Switzerland. This document has been prepared without regard to the disclosure standards for issuance prospectuses

under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of

the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this document

nor any other offering or marketing material relating to the shares or the offering may be publicly distributed or otherwise made publicly

available in Switzerland.

Neither this document nor

any other offering or marketing material relating to the offering, or the shares have been or will be filed with or approved by any Swiss

regulatory authority. In particular, this document will not be filed with, and the offer of shares will not be supervised by, the Swiss

Financial Market Supervisory Authority FINMA, and the offer of shares has not been and will not be authorized under the Swiss Federal

Act on Collective Investment Schemes (“CISA”). Accordingly, no public distribution, offering or advertising, as defined in

CISA, and its implementing ordinances and notices, and no distribution to any non-qualified investor, as defined in CISA, and its implementing

ordinances and notices, shall be undertaken in or from Switzerland, and the investor protection afforded to acquirers of interests in

collective investment schemes under CISA does not extend to acquirers of shares.

United Arab Emirates

This offering has not been

approved or licensed by the Central Bank of the United Arab Emirates (the “UAE”), Securities and Commodities Authority of

the UAE and/or any other relevant licensing authority in the UAE including any licensing authority incorporated under the laws and regulations

of any of the free zones established and operating in the territory of the UAE, in particular the Dubai Financial Services Authority (“DFSA”),

a regulatory authority of the Dubai International Financial Centre (“DIFC”). The offering does not constitute a public offer

of securities in the UAE, DIFC and/or any other free zone in accordance with the Commercial Companies Law, Federal Law No 8 of 1984 (as

amended), DFSA Offered Securities Rules and NASDAQ Dubai Listing Rules, accordingly, or otherwise. The common shares may not be offered

to the public in the UAE and/or any of the free zones.

The common shares may be offered

and issued only to a limited number of investors in the UAE or any of its free zones who qualify as sophisticated investors under the

relevant laws and regulations of the UAE or the free zone concerned.

France

This prospectus (including

any amendment, supplement or replacement thereto) is not being distributed in the context of a public offering in France within the meaning

of Article L. 411-1 of the French Monetary and Financial Code (Code monétaire et financier).

This prospectus has not been

and will not be submitted to the French Autorité des marchés financiers (the “AMF”) for approval in France and

accordingly may not and will not be distributed to the public in France.

Pursuant to Article 211-3

of the AMF General Regulation, French residents are hereby informed that:

1. the

transaction does not require a prospectus to be submitted for approval to the AMF;

2. persons

or entities referred to in Point 2°, Section II of Article L.411-2 of the Monetary and Financial Code may take part in the transaction

solely for their own account, as provided in Articles D. 411-1, D. 734-1, D. 744-1, D. 754-1 and D. 764-1 of the Monetary and Financial

Code; and

3. the

financial instruments thus acquired cannot be distributed directly or indirectly to the public otherwise than in accordance with Articles

L. 411-1, L. 411-2, L. 412-1 and L. 621-8 to L. 621-8-3 of the Monetary and Financial Code.

This prospectus is not to

be further distributed or reproduced (in whole or in part) in France by the recipients of this prospectus. This prospectus has been distributed

on the understanding that such recipients will only participate in the issue or sale of our common stock for their own account and undertake

not to transfer, directly or indirectly, our common stock to the public in France, other than in compliance with all applicable laws and

regulations and in particular with Articles L. 411-1 and L. 411-2 of the French Monetary and Financial Code.

Australia

No placement document, prospectus,

product disclosure statement, or other disclosure document has been lodged with the Australian Securities and Investments Commission (“ASIC”),

in relation to the offering.

Neither this prospectus supplement

nor the accompanying prospectus constitutes a prospectus, product disclosure statement, or other disclosure document under the Corporations

Act 2001 (the “Corporations Act”), nor do they purport to include the information required for a prospectus, product disclosure

statement, or other disclosure document under the Corporations Act.

Any offer in Australia of

the shares may only be made to persons (the “Exempt Investors”) who are “sophisticated investors” (within the

meaning of section 708(8) of the Corporations Act), “professional investors” (within the meaning of section 708(11) of the

Corporations Act), or otherwise pursuant to one or more exemptions contained in section 708 of the Corporations Act so that it is lawful

to offer the shares without disclosure to investors under Chapter 6D of the Corporations Act.

The shares applied for by

Exempt Investors in Australia must not be offered for sale in Australia in the period of 12 months after the date of allotment under the

offering, except in circumstances where disclosure to investors under Chapter 6D of the Corporations Act would not be required pursuant

to an exemption under section 708 of the Corporations Act or otherwise or where the offer is pursuant to a disclosure document that complies

with Chapter 6D of the Corporations Act. Any person acquiring shares must observe such Australian on-sale restrictions.

This prospectus supplement

and the accompanying prospectus contain general information only and do not take account of the investment objectives, financial situation

or particular needs of any particular person. It does not contain any securities recommendations or financial product advice. Before making

an investment decision, investors need to consider whether the information in this prospectus supplement and the accompanying prospectus

is appropriate to their needs, objectives, and circumstances, and, if necessary, seek expert advice on those matters.

LEGAL MATTERS

The validity of the issuance

of the securities offered hereby will be passed upon for us by Shutts & Bowen LLP, Miami, Florida. The underwriter is represented

in this offering by Faegre Drinker Biddle & Reath LLP.

EXPERTS

The consolidated balance sheets

of Duos Technologies Group, Inc. as of December 31, 2020 and 2019, and the related consolidated statements of operations, stockholders’

equity, and cash flows for each of the years then ended have been audited by Salberg & Company, P.A., independent registered public

accounting firm, as stated in their report which is incorporated herein by reference. Such financial statements have been incorporated

herein (by reference) in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement

and the accompanying prospectus are part of the registration statement on Form S-3 we filed with the SEC under the Securities Act, and

do not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus supplement

or the accompanying prospectus to any of our contracts, agreements or other documents, the reference may not be complete, and you should

refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by

reference into this prospectus supplement and the accompanying prospectus for a copy of such contract, agreement or other document. You

may inspect a copy of the registration statement, including the exhibits and schedules, without charge, at the SEC’s public reference

room mentioned below, or obtain a copy from the SEC upon payment of the fees prescribed by the SEC.

Because we are subject to

the information and reporting requirements of the Exchange Act, we file annual, quarterly and special reports, proxy statements and other

information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov. You

may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C.

20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

We also maintain a web site

at www.duostechnologies.com, through which you can access our SEC filings. The information set forth on our web site is not part of this

prospectus supplement.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate

by reference” certain information from other documents that we file with it, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement

and the accompanying prospectus. Information contained in this prospectus supplement and the accompanying prospectus and information that

we file with the SEC in the future and incorporate by reference in this prospectus supplement and the accompanying prospectus will automatically