Kroll Bond Rating Agency Maintains Dime’s Outlook at “Stable” and Affirms Ratings

June 17 2024 - 6:26PM

Dime Community Bancshares, Inc. (the “Company” or “Dime”) (NASDAQ:

DCOM), the parent company of Dime Community Bank (the “Bank”),

announced that Kroll Bond Rating Agency (“KBRA”) has affirmed all

ratings of Dime Community Bancshares, Inc. and Dime Community Bank.

KBRA affirmed the Bank’s senior unsecured debt rating of “BBB+” and

the Company’s senior unsecured debt rating of “BBB”.

The Outlook for all long-term ratings is “Stable”.

According to the KBRA report:

- The ratings are

supported by Dime’s outperformance with regard to credit quality

over a long period of time, including multiple economic cycles,

with a cumulative NCO ratio of below 15 bps since 2007. KBRA noted

Dime’s conservative underwriting and management’s knowledge of

local markets and borrowers.

- KBRA also recognized

Dime’s solid funding base, with a higher level of core deposits,

which have grown steadily in recent quarters and should continue to

expand considerably over the next few years due to the recent

hiring of deposit-focused teams. Given the anticipated core deposit

growth, Dime is expected to reflect an enhanced funding and

liquidity profile that will position it well to execute its

strategic shift in the loan portfolio.

- Over the

longer-term, Dime should reflect a stronger earnings profile, in

part, due to the effective integration with Bridge Bancorp, Inc.,

which significantly reduced operating expenses. As such, in a more

normalized interest rate environment and from the build out of its

C&I business, the company has the ability to produce stronger

than peer returns.

- Risk based capital

ratios have been growing over the past year, with the CET1 ratio

increasing 80 bps since Year End 2022 (10.0% at 1Q24). Moreover,

ratios are expected to continue to build prospectively. KBRA also

recognized that regulatory capital measures are not materially

impacted when adjusting for negative AOCI due to the smaller sized,

and shorter duration, securities portfolio.

Stuart H. Lubow, President and Chief Executive Officer, stated,

“We are pleased to receive an affirmation of our investment grade

rating and a Stable outlook from KBRA.”

ABOUT DIME COMMUNITY BANCSHARES, INC.

Dime Community Bancshares, Inc. is the holding company for Dime

Community Bank, a New York State-chartered trust company with over

$13.5 billion in assets and the number one deposit market share

among community banks on Greater Long Island (1).

Dime Community Bancshares, Inc.Investor Relations

Contact:Avinash ReddySenior Executive Vice President – Chief

Financial OfficerPhone: 718-782-6200; Ext.

5909Email: avinash.reddy@dime.com

____________________¹ Aggregate deposit market share for Kings,

Queens, Nassau & Suffolk counties for community banks with less

than $20 billion in assets.

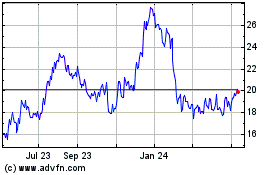

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From May 2024 to Jun 2024

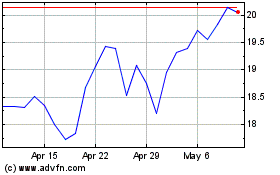

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Jun 2023 to Jun 2024