China Recycling Energy Corporation Reports Results for the Third Quarter of 2020

November 16 2020 - 3:08PM

China Recycling Energy Corporation (NASDAQ: CREG) ("CREG" or "the

Company"), an industrial waste-to-energy solution provider in

China, today reported certain highlights of its operating results

for the quarter ended September 30, 2020.

“As of September 30, 2020, we maintained a

healthy cash and cash equivalents balance of approximately $73.8

million,” stated Mr. Guohua Ku, Chairman and CEO of the Company. In

addition, we have accomplished significant cost cutting throughout

our entire organization, evidenced by net loss narrowed by

approximately 83.6% to approximately $(671,280) in the third

quarter ended September 30, 2020, as compared to approximately

$(4.1) million in the same period of 2019. We are executing what we

believe is a clear plan to manage our business efficiently and

effectively through the coronavirus pandemic, prioritizing the

health and safety of our customers and teams. We expect the company

to return to profitability for fiscal year 2020 driven by

anticipated sales growth in the four quarter. Longer term, we

believe our financial position and contingency plans will allow us

to retain the financial flexibility to pursue opportunities in the

fast-growing smart power sector. We feel we are back on track to

continue evaluating several exciting strategic opportunities to

reinvest in innovative growth initiatives. We expect to reposition

our energy sustainability business in direct relation to smart

power integrated solutions to vastly improve climate change

efficiency in China in order to better serve our clients, employees

and shareholders. As such, we will maintain our focus on expense

and working capital discipline, so that we can move forward with a

strengthened platform to attempt to capitalize on the significant

opportunities we see for growth.”

Financial Summary for the Quarter Ended September 30,

2020

-

Cash and cash equivalents were approximately $73.8 million as of

September 30, 2020, an increase of approximately $57.6 million as

compared to approximately $16.2 million as of December 31,

2019.

-

Net sales were nil and remained the same for the same period of

2019.

-

Loss from operations was approximately $77,015, due to our cost

saving initiatives compared to approximately loss from operations

of approximately $2.8 million. The decrease was mainly due to

decreased bad debts expense of $2,692,953 during the three months

ended September 30, 2020.

-

Net loss for three months ended September 30, 2020 was $671,280 or

$(0.25) per fully diluted share compared to a net loss of

approximately $4.1 million or $(2.54) per fully diluted share for

the three months ended September 30, 2019. This decrease in net

loss was mainly due to the decrease operating expenses resulting

from decrease in bad debts expense, and decrease in interest

expense.

About China Recycling Energy Corp.

China Recycling Energy Corporation (Nasdaq:

CREG) ("CREG" or "the Company") is based in Xi'an, China and

provides environmentally friendly waste-to-energy technologies to

recycle industrial byproducts for steel mills, cement factories and

coke plants in China. Byproducts include heat, steam, pressure, and

exhaust to generate large amounts of lower-cost electricity and

reduce the need for outside electrical sources. The Chinese

government has adopted policies to encourage the use of recycling

technologies to optimize resource allocation and reduce pollution.

Currently, recycled energy represents only an estimated 1% of total

energy consumption and this renewable energy resource is viewed as

a growth market due to intensified environmental concerns and

rising energy costs as the Chinese economy continues to expand. The

Company’s management and engineering teams have over 20 years of

experience in industrial energy recovery in China. For more

information about CREG, please

visit http://creg-cn.investorroom.com.

Safe Harbor Statement

This press release may contain certain

"forward-looking statements" relating to the business of CREG and

its subsidiary companies. All statements, other than statements of

historical fact included herein are "forward-looking statements."

These forward-looking statements are often identified by the use of

forward-looking terminology such as "believes," "expects" or

similar expressions, involve known and unknown risks and

uncertainties. Although the Company believes that the expectations

reflected in these forward-looking statements are reasonable, they

do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. Investors should not place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. The Company's actual

results could differ materially from those anticipated in these

forward-looking statements as a result of a variety of factors,

including, but not limited to, the risks and uncertainties

associated with market conditions and the satisfaction of customary

closing conditions relating to the registered direct offering and

those discussed in the Company's annual and periodic reports that

are filed with the Securities and Exchange Commission and available

on its website at http://www.sec.gov. All forward-looking

statements attributable to the Company or persons acting on its

behalf are expressly qualified in their entirety by these factors.

Other than as required under the securities laws, the Company does

not assume a duty to update these forward-looking statements.

|

|

|

CHINA RECYCLING ENERGY CORPORATION AND

SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

|

| |

SEPTEMBER 30, 2020(UNAUDITED) |

|

|

DECEMBER 31, 2019 |

|

| |

|

|

|

|

|

| ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash |

$ |

73,787,158 |

|

|

$ |

16,221,297 |

|

|

Accounts receivable, net |

|

24,827,842 |

|

|

|

42,068,760 |

|

|

Interest receivable on sales type leases |

|

- |

|

|

|

5,245,244 |

|

|

Prepaid expenses |

|

62,609 |

|

|

|

52,760 |

|

|

Operating lease right-of-use assets, net |

|

5,891 |

|

|

|

- |

|

|

Other receivables |

|

45,641 |

|

|

|

1,031,143 |

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

98,729,141 |

|

|

|

64,619,204 |

|

|

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

|

|

Investment in sales-type leases, net |

|

- |

|

|

|

8,287,560 |

|

|

Long term deposit |

|

- |

|

|

|

15,712 |

|

|

Operating lease right-of-use assets, net |

|

- |

|

|

|

54,078 |

|

|

Property and equipment, net |

|

27,704,004 |

|

|

|

27,044,385 |

|

|

Construction in progress |

|

- |

|

|

|

23,824,202 |

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

27,704,004 |

|

|

|

59,225,937 |

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

$ |

126,433,145 |

|

|

$ |

123,845,141 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

2,253,884 |

|

|

$ |

2,200,220 |

|

|

Taxes payable |

|

2,509,792 |

|

|

|

4,087,642 |

|

|

Accrued interest on notes |

|

7,599 |

|

|

|

- |

|

|

Notes payable, net of unamortized OID |

|

591,974 |

|

|

|

- |

|

|

Accrued liabilities and other payables |

|

1,182,642 |

|

|

|

1,184,751 |

|

|

Operating lease liability |

|

- |

|

|

|

56,755 |

|

|

Due to related parties |

|

28,590 |

|

|

|

41,174 |

|

|

Interest payable on entrusted loans |

|

9,387,757 |

|

|

|

8,200,044 |

|

|

Entrusted loan payable |

|

20,979,731 |

|

|

|

20,480,214 |

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

36,941,969 |

|

|

|

36,250,800 |

|

|

|

|

|

|

|

|

|

|

|

NONCURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Accrued interest on notes |

|

- |

|

|

|

368,362 |

|

|

Income tax payable |

|

5,782,625 |

|

|

|

5,782,625 |

|

|

Notes payable, net of unamortized OID |

|

- |

|

|

|

1,552,376 |

|

|

Long term payable |

|

440,522 |

|

|

|

430,034 |

|

|

Entrusted loan payable |

|

293,681 |

|

|

|

286,689 |

|

|

Refundable deposit from customers for systems leasing |

|

- |

|

|

|

544,709 |

|

|

|

|

|

|

|

|

|

|

|

Total noncurrent liabilities |

|

6,516,828 |

|

|

|

8,964,795 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

43,458,797 |

|

|

|

45,215,595 |

|

|

|

|

|

|

|

|

|

|

|

CONTINGENCIES AND COMMITMENTS (NOTE 17 & 18) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 10,000,000 shares

authorized,3,001,146 shares and 2,032,721 shares issued and

outstanding as ofSeptember 30, 2020 and December 31, 2019,

respectively |

|

3,001 |

|

|

|

2,033 |

|

|

Additional paid in capital |

|

119,128,530 |

|

|

|

116,682,374 |

|

|

Statutory reserve |

|

14,667,404 |

|

|

|

14,525,712 |

|

|

Accumulated other comprehensive loss |

|

(3,959,045 |

) |

|

|

(6,132,614 |

) |

|

Accumulated deficit |

|

(46,865,542 |

) |

|

|

(46,447,959 |

) |

|

|

|

|

|

|

|

|

|

|

Total Company stockholders’ equity |

|

82,974,348 |

|

|

|

78,629,546 |

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

$ |

126,433,145 |

|

|

$ |

123,845,141 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of

these consolidated financial statements.

|

|

|

CHINA RECYCLING ENERGY CORPORATION |

|

AND SUBSIDIARIES |

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS |

|

(UNAUDITED) |

|

|

| |

NINE MONTHS ENDED SEPTEMBER 30, |

|

|

THREE MONTHS ENDED SEPTEMBER 30, |

|

| |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Contingent rental income |

$ |

- |

|

|

$ |

702,973 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income on sales-type leases |

|

- |

|

|

|

173,360 |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating income |

|

- |

|

|

|

876,333 |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bad debts (reversal) |

|

(1,659,101 |

) |

|

|

5,508,377 |

|

|

|

(9,479 |

) |

|

|

2,683,474 |

|

|

Loss on disposal of systems |

|

- |

|

|

|

1,250,731 |

|

|

|

- |

|

|

|

- |

|

|

General and administrative |

|

477,358 |

|

|

|

2,160,017 |

|

|

|

86,494 |

|

|

|

142,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating (income) expenses |

|

(1,181,743 |

) |

|

|

8,919,125 |

|

|

|

77,015 |

|

|

|

2,826,155 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

1,181,743 |

|

|

|

(8,042,792 |

) |

|

|

(77,015 |

) |

|

|

(2,826,155 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain (loss) on note conversion |

|

(496,853 |

) |

|

|

24,240 |

|

|

|

(298,523 |

) |

|

|

24,240 |

|

|

Interest expense-inducement on note conversion |

|

- |

|

|

|

(893,958 |

) |

|

|

- |

|

|

|

- |

|

|

Interest income |

|

124,305 |

|

|

|

120,903 |

|

|

|

51,688 |

|

|

|

38,293 |

|

|

Interest expense |

|

(1,037,183 |

) |

|

|

(5,888,819 |

) |

|

|

(340,155 |

) |

|

|

(2,094,899 |

) |

|

Other income (expenses), net |

|

(47,903 |

) |

|

|

332,397 |

|

|

|

(7,275 |

) |

|

|

1,919 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-operating expenses, net |

|

(1,457,634 |

) |

|

|

(6,305,237 |

) |

|

|

(594,265 |

) |

|

|

(2,030,447 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income tax |

|

(275,891 |

) |

|

|

(14,348,029 |

) |

|

|

(671,280 |

) |

|

|

(4,856,602 |

) |

|

Income tax benefit |

|

- |

|

|

|

(3,041,884 |

) |

|

|

- |

|

|

|

(755,840 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to China Recycling Energy Corporation |

|

(275,891 |

) |

|

|

(11,306,145 |

) |

|

|

(671,280 |

) |

|

|

(4,100,762 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss) |

|

2,173,569 |

|

|

|

(2,582,759 |

) |

|

|

3,456,157 |

|

|

|

(2,486,200 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) attributable to China Recycling Energy

Corporation |

$ |

1,897,678 |

|

|

$ |

(13,888,904 |

) |

|

$ |

2,784,877 |

|

|

$ |

(6,586,962 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average shares outstanding |

|

2,381,180 |

|

|

|

1,467,114 |

|

|

|

2,687,609 |

|

|

|

1,615,919 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share |

$ |

(0.12 |

) |

|

$ |

(7.71 |

) |

|

$ |

(0.25 |

) |

|

$ |

(2.54 |

) |

|

|

|

* The basic and diluted loss per share are the same due to

antidilutive options and warrants resulting from the Company’s net

loss. |

The accompanying notes are an integral part of

these consolidated financial statements.

|

|

|

CHINA RECYCLING ENERGY CORPORATION AND

SUBSIDIARIES |

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(UNAUDITED) |

|

|

| |

NINE MONTHS ENDED SEPTEMBER 30, |

|

| |

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss |

$ |

(275,891 |

) |

|

$ |

(11,306,145 |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: |

|

|

|

|

|

|

|

|

Amortization of OID and debt issuing costs of notes |

|

45,833 |

|

|

|

84,661 |

|

|

Stock compensation expense |

|

10,999 |

|

|

|

- |

|

|

Operating lease expenses |

|

49,034 |

|

|

|

- |

|

|

Bad debts expense (reversal) |

|

(1,659,101 |

) |

|

|

5,508,377 |

|

|

Loss on disposal of 40% ownership of Fund Management Co |

|

- |

|

|

|

46,761 |

|

|

Loss on transfer of Chengli Boxing system |

|

- |

|

|

|

628,170 |

|

|

Loss on transfer of Xuzhou Huayu system |

|

- |

|

|

|

399,601 |

|

|

Loss on transfer of Shenqiu Phase I & II systems |

|

- |

|

|

|

209,707 |

|

|

Loss on disposal of fixed assets |

|

- |

|

|

|

289 |

|

|

Loss (gain) on note conversion |

|

496,853 |

|

|

|

(24,240 |

) |

|

Interest expense-inducement on note conversion |

|

- |

|

|

|

893,958 |

|

|

Changes in deferred tax |

|

- |

|

|

|

(3,044,371 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

Interest receivable on sales type leases |

|

- |

|

|

|

(171,506 |

) |

|

Collection of principal on sales type leases |

|

13,959,334 |

|

|

|

- |

|

|

Accounts receivable |

|

43,765,943 |

|

|

|

64,306 |

|

|

Prepaid expenses |

|

(8,339 |

) |

|

|

(20,320 |

) |

|

Other receivables |

|

(3,141 |

) |

|

|

(132,920 |

) |

|

Accounts payable |

|

- |

|

|

|

(2,857,402 |

) |

|

Taxes payable |

|

(2,133,778 |

) |

|

|

(1,323,919 |

) |

|

Payment of lease liability |

|

(57,442 |

) |

|

|

- |

|

|

Interest payable on entrusted loan |

|

962,052 |

|

|

|

5,551,651 |

|

|

Accrued liabilities and other payables |

|

46,968 |

|

|

|

(109,867 |

) |

|

Refundable deposit for systems leasing |

|

- |

|

|

|

(481,462 |

) |

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities |

|

55,199,324 |

|

|

|

(6,084,671 |

) |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from disposal of property & equipment |

|

- |

|

|

|

5,106 |

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by investing activities |

|

- |

|

|

|

5,106 |

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Issuance of notes payable |

|

- |

|

|

|

2,000,000 |

|

|

Issuance of common stock |

|

497,187 |

|

|

|

3,309,475 |

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

497,187 |

|

|

|

5,309,475 |

|

|

|

|

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE CHANGE ON CASH |

|

1,869,350 |

|

|

|

(1,607,514 |

) |

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH |

|

57,565,861 |

|

|

|

(2,377,604 |

) |

|

CASH, BEGINNING OF PERIOD |

|

16,221,297 |

|

|

|

53,223,142 |

|

|

|

|

|

|

|

|

|

|

|

CASH, END OF PERIOD |

$ |

73,787,158 |

|

|

$ |

50,845,538 |

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow data: |

|

|

|

|

|

|

|

|

Income tax paid |

$ |

- |

|

|

$ |

223,369 |

|

|

Interest paid |

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of non-cash operating activities |

|

|

|

|

|

|

|

|

Transfer of Tian’an project from construction in progress to

accounts receivable |

$ |

23,771,386 |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of non-cash operating and financing

activities |

|

|

|

|

|

|

|

|

Transfer of Xuzhou Huayu Project and Shenqiu Phase I & II

projects to Mr. Bai |

$ |

- |

|

|

$ |

34,931,358 |

|

|

Conversion of convertible debt into common shares |

$ |

- |

|

|

$ |

1,272,000 |

|

|

Conversion of long-term notes into common shares |

$ |

1,442,086 |

|

|

$ |

- |

|

The accompanying notes are an integral part of

these consolidated financial statements.

Investor Relations Inquiries: Vivian Chen

vivianchen@irimpact.com

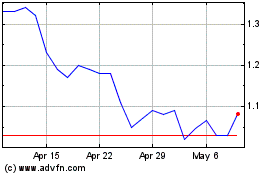

Smart Power (NASDAQ:CREG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smart Power (NASDAQ:CREG)

Historical Stock Chart

From Apr 2023 to Apr 2024