Bank of Marin Bancorp, "Bancorp" (Nasdaq: BMRC), parent company

of Bank of Marin, "Bank," announced record annual earnings of $34.2

million in 2019 compared to $32.6 million in 2018 as a result of

consistent loan growth and lower expenses. Diluted earnings per

share were $2.48 for the year ended December 31, 2019, compared to

$2.33 per share for the year ended December 31, 2018.

Earnings were $9.1 million in the fourth quarter of 2019,

compared to $9.4 million in the third quarter of 2019 and $9.7

million in the fourth quarter of 2018. Earnings were slightly down

in the fourth quarter of 2019 due to a benefit on bank-owned-life

insurance ("BOLI") policies and deferred tax liability true up in

the prior quarter. Diluted earnings per share were $0.66 in the

fourth quarter of 2019, compared to $0.69 in the prior quarter and

same quarter a year ago. Share and per share data has been adjusted

throughout this document to reflect the two-for-one stock split

effective November 27, 2018.

“The robust financial performance we delivered in 2019 is a

testament to the Bank's commitment to relationship banking,” said

Russell A. Colombo, President and Chief Executive Officer. “We

believe the future looks bright as we move into 2020 with

consistently growing loan volume, a low cost and stable deposit

base, and exceptional credit quality.”

Bancorp also provided the following highlights for the fourth

quarter and year ended December 31, 2019:

- The Bank achieved loan growth of $79.4 million in 2019, or

4.5%, to $1,843.3 million at December 31, 2019, from $1,763.9

million at December 31, 2018. Loans increased $44.6 million in the

fourth quarter from $1,798.7 million at September 30, 2019.

- Strong credit quality remains a cornerstone of the Bank’s

consistent performance. Non-accrual loans represented 0.01% of the

Bank's loan portfolio as of December 31, 2019. There was a $500

thousand provision for loan losses recorded in the fourth quarter

of 2019, reflecting loan growth.

- Deposits grew $161.7 million, or 7.4%, to $2,336.5 million at

December 31, 2019, compared to $2,174.8 million at December 31,

2018. Non-interest bearing deposits grew by $62.8 million in 2019

and made up 48.3% of total deposits at year end. Cost of deposits

remained low at 0.20% for the full year of 2019, up only 0.10% from

2018.

- For the full year 2019, return on assets ("ROA") and return on

equity ("ROE") were 1.34% and 10.49%, respectively, compared to

1.31% and 10.73% in the prior year. For the quarter ended December

31, 2019, ROA was 1.37% and ROE was 10.75%, compared to 1.49% and

11.34%, respectively, in the prior quarter.

- All capital ratios were above regulatory requirements for a

well-capitalized institution. The total risk-based capital ratio

for Bancorp was 15.1% at December 31, 2019 and 14.9% at December

31, 2018. Tangible common equity to tangible assets was 11.3% at

both December 31, 2019 and December 31, 2018 (refer to footnote 3

on page 6 for definition of this non-GAAP financial measure).

- The Board of Directors declared a cash dividend of $0.23 per

share on January 24, 2020, a $0.02 increase from the prior quarter.

This is the 59th consecutive quarterly dividend paid by Bank of

Marin Bancorp. The cash dividend is payable on February 14, 2020 to

shareholders of record at the close of business on February 7,

2020.

- With the current Share Repurchase Plan nearing expiration, on

January 24, 2020, the Bancorp Board of Directors approved a new

Share Repurchase Program under which Bancorp may repurchase up to

$25.0 million of its outstanding common stock through February 28,

2022.

Loans and Credit Quality

Loans grew $44.6 million in the fourth quarter of 2019 and

totaled $1,843.3 million at December 31, 2019. For the quarter and

year ended December 31, 2019, new loan originations of $103.4

million and $259.6 million, respectively, exceeded 2018 loan

originations of $73.6 million and $239.4 million for the same

periods. New loan originations were partially offset by payoffs of

$37.9 million in the fourth quarter and $145.7 million for the full

year ended December 31, 2019.

Non-accrual loans totaled $226 thousand, or 0.01% of the Bank's

loan portfolio at December 31, 2019, a decrease from $422 thousand,

or 0.02%, at September 30, 2019 and $697 thousand, or 0.04%, a year

ago. Loans classified substandard totaled $9.9 million at both

December 31, 2019 and September 30, 2019, down $2.7 million from

$12.6 million at December 31, 2018. There were no loans classified

doubtful at December 31, 2019 or December 31, 2018. Accruing loans

past due 30 to 89 days totaled $1.5 million at December 31, 2019,

compared to $574 thousand at September 30, 2019 and $1.1 million a

year ago.

The Bank recorded a $500 thousand provision for loan losses in

the fourth quarter and $400 thousand in the third quarter of 2019.

No provision for loan losses was recorded in the fourth quarter a

year ago. Net charge-offs for the fourth quarter of 2019 totaled

$63 thousand compared to net recoveries of $6 thousand last quarter

and $4 thousand in the fourth quarter of 2018. Net charge-offs

totaled $44 thousand for the year ended December 31, 2019, compared

to net recoveries of $54 thousand in 2018. The ratio of loan loss

reserve to loans, including acquired loans, was 0.90% at December

31, 2019, September 30, 2019 and December 31, 2018.

The new current expected credit loss ("CECL") accounting

standard became effective on January 1, 2020 and had no impact on

our 2019 results. Under CECL, our primary credit loss methodology

will utilize a discounted cash flow approach that considers the

probability of default and loss given default. Parallel testing

occurred throughout 2019 and we estimate that our implementation of

CECL will result in an increase to our allowance for credit losses

between 5% and 15%, which will be recorded as an adjustment to

retained earnings net of tax.

Investments

The investment portfolio totaled $569.7 million at December 31,

2019, an increase of $68.7 million from September 30, 2019 and a

decrease of $50.0 million from December 31, 2018. The increase in

the fourth quarter of 2019 was primarily attributed to purchases of

securities totaling $95.6 million, partially offset by principal

paydowns and maturities. The year-over-year decrease was a

combination of sales of $66.0 million, principal paydowns of $62.9

million, and maturities and calls of $46.1 million, partially

offset by purchases of $114.5 million, and an increase in the fair

value of available-for-sale securities.

Deposits

Deposits totaled $2,336.5 million at December 31, 2019, compared

to $2,224.5 million at September 30, 2019 and $2,174.8 million at

December 31, 2018. The $112.0 million increase in deposits from the

prior quarter primarily resulted from cash fluctuations in some of

our large clients' business accounts. The average cost of deposits

increased 2 basis points in the fourth quarter to 0.23%. The

average cost of deposits for the full year of 2019 was 0.20%, up 10

basis points from 2018.

Earnings

“Our record 2019 results are a product of a well-executed

strategy to invest in people focused on performing at a high

level,” said Tani Girton, EVP and Chief Financial Officer. “With a

fourth quarter tax equivalent net interest margin of 3.82%, and a

50.84% efficiency ratio that demonstrates a commitment to making

every expense dollar count, we feel that our team is poised to

deliver another good year in 2020.”

Net interest income totaled $23.9 million in the fourth quarter

of 2019, compared to $24.2 million in the prior quarter and $23.3

million in the same quarter a year ago. The $257 thousand decrease

from the prior quarter primarily related to a $388 thousand

interest recovery on a land development loan in the third quarter

and lower earning asset yields in the fourth quarter, partially

offset by higher average balances in the fourth quarter. Increases

in interest-bearing deposit balances and rates also contributed to

the decrease.

The $622 thousand net interest income increase from the same

quarter last year was primarily due to a decrease in interest

expense from the early redemption of a subordinated debenture ($916

thousand in accelerated discount accretion) in the fourth quarter

of 2018, and higher average loan balances in the fourth quarter of

2019. Positive variances were partially offset by lower investment

securities balances and higher interest-bearing deposit balances

and rates.

The tax-equivalent net interest margin was 3.82% for the fourth

quarter of 2019, compared to 4.04% in the prior quarter and 3.85%

in the fourth quarter of 2018. The 22 basis point decrease from the

prior quarter was primarily attributed to interest recovered from

the land development loan in the third quarter, lower loan rates

and higher interest-bearing deposit rates and balances. The 3 basis

point decrease from the same quarter a year ago was primarily

attributed to lower yields on loans and cash and higher

interest-bearing deposit balances and rates, largely offset by

higher loan balances and the accelerated accretion from the early

redemption of the high-rate subordinated debenture in the fourth

quarter of 2018.

Net interest income totaled $95.7 million and $91.5 million in

2019 and 2018, respectively. The increase of $4.2 million in 2019

was primarily due to higher average loan balances and asset yields

and the early redemption of subordinated debt mentioned above.

Positive variances were partially offset by higher balances and

rates on money market accounts. The tax-equivalent net interest

margin increased 8 basis points to 3.98% in 2019, from 3.90% in

2018 for the same reasons.

Non-interest income in the fourth quarter of 2019 totaled $2.3

million, compared to $2.7 million in the prior quarter and $3.4

million in the same quarter a year ago. The $403 thousand decrease

compared to the prior quarter was primarily related to a $562

thousand benefit collected on BOLI policies in the third quarter,

partially offset by higher fee income from one-way deposit sales to

third-party deposit networks. The $1.1 million decrease from the

same quarter a year ago primarily related to a $956 thousand

pre-tax gain on sale of 6,500 shares of Visa Inc. Class B

restricted common stock to a member bank of Visa U.S.A and a $180

thousand Federal Home Loan Bank ("FHLB") special dividend in the

fourth quarter of 2018. The Bank sold less than half of its Visa

Inc. position in 2018 to realize appreciation in market prices and

hedge against market volatility. Non-interest income of $9.1

million in 2019 decreased from $10.1 million in 2018 primarily due

to the Visa Inc. Class B stock sale and FHLB special dividend in

2018, as well as lower fee income from one-way deposit sales in

2019. The negative variance was partially offset by the benefit

collected on BOLI in 2019.

Non-interest expense totaled $13.3 million in the fourth quarter

of 2019, compared to $14.2 million in the prior quarter and $13.7

million in the same quarter a year ago. The $874 thousand decrease

in the fourth quarter of 2019 compared to the prior quarter was

mainly due to lower incentive bonus expense and higher deferred

loan origination costs due to a higher volume of loan originations.

The same items contributed to the $379 thousand decrease from the

same quarter last year in addition to lower data processing costs

and the reversal of Federal Deposit Insurance Corporation ("FDIC")

deposit insurance expense when the FDIC Deposit Insurance Fund

reserve exceeded its billing threshold.

Non-interest expense of $58.0 million in 2019 decreased from

$58.3 million in 2018, primarily due to consulting expenses related

to core processing contract negotiations and Bank of Napa

acquisition-related expenses in 2018, lower employee health

insurance expenses due to change in carrier in 2019, and cost

reductions mentioned above. Reductions were partially offset by

staffing and annual merit increases.

Share Repurchase Program

Bancorp's existing $25.0 million Share Repurchase Program

expires February 28, 2020. Bancorp repurchased 42,349 shares

totaling $1.9 million in the fourth quarter of 2019 for a

cumulative total of 527,217 shares and $22.0 million as of December

31, 2019.

With the current Share Repurchase Program nearing expiration,

Bancorp’s Board of Directors approved a new repurchase program on

January 24, 2020 of up to $25.0 million of Bancorp’s common stock.

Repurchases will not begin under this new program until Bancorp is

no longer in a trading blackout or otherwise in possession of

material non-public information and the program will continue

through February 28, 2022.

Under the new Share Repurchase Program, Bancorp may purchase

shares of its common stock through various means such as open

market transactions, including block purchases, and privately

negotiated transactions. The number of shares repurchased and the

timing, manner, price and amount of any repurchases will be

determined at Bancorp’s discretion. Factors include, but are not

limited to, stock price, trading volume and general market

conditions, along with Bancorp’s general business conditions. The

program may be suspended or discontinued at any time and does not

obligate Bancorp to acquire any specific number of shares of its

common stock.

As part of the new Share Repurchase Program, Bancorp intends to

enter into a trading plan adopted in accordance with Rule 10b5-1 of

the Securities Exchange Act of 1934, as amended. The 10b5-1 trading

plan would permit common stock to be repurchased at a time that

Bancorp might otherwise be precluded from doing so under insider

trading laws or self-imposed trading restrictions. The 10b5-1

trading plan will be administered by an independent broker and will

be subject to price, market volume and timing restrictions.

Earnings Call and Webcast Information

Bank of Marin Bancorp will webcast its fourth quarter and year

end 2019 earnings call on Monday, January 27, 2020 at 8:30 a.m.

PT/11:30 a.m. ET. Investors will have the opportunity to listen to

the conference call online through Bank of Marin’s website at

https://www.bankofmarin.com under “Investor Relations.” To listen

to the live call, please go to the website at least 15 minutes

early to register, download and install any necessary audio

software. For those who cannot listen to the live broadcast, a

replay will be available at the same website location shortly after

the call.

About Bank of Marin Bancorp

Founded in 1990 and headquartered in Novato, Bank of Marin is

the wholly owned subsidiary of Bank of Marin Bancorp (Nasdaq:

BMRC). A leading business and community bank in the San Francisco

Bay Area, with assets of $2.7 billion, Bank of Marin has 22

branches, 5 commercial banking offices and 1 loan production office

located across the North Bay, San Francisco and East Bay regions.

Bank of Marin provides commercial banking, personal banking, and

wealth management and trust services. Specializing in providing

legendary service to its customers and investing in its local

communities, Bank of Marin has consistently been ranked one of the

“Top Corporate Philanthropists" by the San Francisco Business Times

and one of the “Best Places to Work” by the North Bay Business

Journal. Bank of Marin Bancorp is included in the Russell 2000

Small-Cap Index and Nasdaq ABA Community Bank Index. For more

information, go to www.bankofmarin.com.

Forward-Looking Statements

This release may contain certain forward-looking statements that

are based on management's current expectations regarding economic,

legislative, and regulatory issues that may impact Bancorp's

earnings in future periods. Forward-looking statements can be

identified by the fact that they do not relate strictly to

historical or current facts. They often include the words

“believe,” “expect,” “intend,” “estimate” or words of similar

meaning, or future or conditional verbs such as “will,” “would,”

“should,” “could” or “may.” Factors that could cause future results

to vary materially from current management expectations include,

but are not limited to, general economic conditions, economic

uncertainty in the United States and abroad, changes in interest

rates, deposit flows, real estate values, costs or effects of

acquisitions, competition, changes in accounting principles,

policies or guidelines, legislation or regulation (including the

Tax Cuts & Jobs Act of 2017), natural disasters (such as

wildfires and earthquakes), interruptions of utility service in our

markets for sustained periods, and other economic, competitive,

governmental, regulatory and technological factors (including

external fraud and cyber-security threats) affecting Bancorp's

operations, pricing, products and services. These and other

important factors are detailed in various securities law filings

made periodically by Bancorp, copies of which are available from

Bancorp without charge. Bancorp undertakes no obligation to release

publicly the result of any revisions to these forward-looking

statements that may be made to reflect events or circumstances

after the date of this press release or to reflect the occurrence

of unanticipated events.

BANK OF MARIN BANCORP

FINANCIAL HIGHLIGHTS

December 31, 2019

(dollars in thousands, except per share

data; unaudited)

December 31, 2019

September 30, 2019

December 31, 2018

Quarter-to-Date

Net income

$

9,079

$

9,448

$

9,662

Diluted earnings per common share 4

$

0.66

$

0.69

$

0.69

Return on average assets

1.37

%

1.49

%

1.52

%

Return on average equity

10.75

%

11.34

%

12.37

%

Efficiency ratio

50.84

%

52.84

%

51.34

%

Tax-equivalent net interest margin 1

3.82

%

4.04

%

3.85

%

Cost of deposits

0.23

%

0.21

%

0.14

%

Net charge-offs (recoveries)

$

63

$

(6

)

$

(4

)

Net charge-offs (recoveries) to average

loans

—

%

—

%

—

%

Year-to-Date

Net income

$

34,241

$

32,622

Diluted earnings per common share 4

$

2.48

$

2.33

Return on average assets

1.34

%

1.31

%

Return on average equity

10.49

%

10.73

%

Efficiency ratio

55.33

%

57.30

%

Tax-equivalent net interest margin 1

3.98

%

3.90

%

Cost of deposits

0.20

%

0.10

%

Net charge-offs (recoveries)

$

44

$

(54

)

Net (recoveries) charge-offs to average

loans

—

%

—

%

At Period

End

Total assets

$

2,707,280

$

2,592,071

$

2,520,892

Loans:

Commercial and industrial

$

246,687

$

260,828

$

230,739

Real estate:

Commercial owner-occupied

$

308,824

$

310,486

$

313,277

Commercial investor-owned

$

946,317

$

896,066

$

873,410

Construction

$

61,095

$

50,254

$

76,423

Home Equity

$

116,024

$

121,814

$

124,696

Other residential

$

136,657

$

130,781

$

117,847

Installment and other consumer loans

$

27,682

$

28,461

$

27,472

Total loans

$

1,843,286

$

1,798,690

$

1,763,864

Non-performing loans2:

Commercial and industrial

$

—

$

195

$

319

Home equity

$

168

$

167

$

313

Installment and other consumer loans

$

58

$

60

$

65

Total non-accrual loans

$

226

$

422

$

697

Classified loans (graded substandard and

doubtful)

$

9,934

$

9,935

$

12,608

Total accruing loans 30-89 days past

due

$

1,481

$

574

$

1,121

Allowance for loan losses to total

loans

0.90

%

0.90

%

0.90

%

Allowance for loan losses to

non-performing loans

73.86x

38.45x

22.71x

Non-accrual loans to total loans

0.01

%

0.02

%

0.04

%

Total deposits

$

2,336,489

$

2,224,524

$

2,174,840

Loan-to-deposit ratio

78.9

%

80.9

%

81.1

%

Stockholders' equity

$

336,788

$

333,065

$

316,407

Book value per share 4

$

24.81

$

24.47

$

22.85

Tangible common equity to tangible assets

3

11.3

%

11.7

%

11.3

%

Total risk-based capital ratio - Bank

14.6

%

14.6

%

14.0

%

Total risk-based capital ratio -

Bancorp

15.1

%

15.3

%

14.9

%

Full-time equivalent employees

290

291

290

1 Net interest income is annualized by

dividing actual number of days in the period times 360 days.

2 Excludes accruing troubled-debt

restructured loans of $11.3 million, $11.9 million and $14.3

million at December 31, 2019, September 30, 2019 and December 31,

2018, respectively. Excludes purchased credit-impaired (PCI) loans

with carrying values that were accreting interest of $2.0 million

at December 31, 2019, and $2.1 million at September 30, 2019 and

December 31, 2018, respectively. These amounts are excluded as PCI

loan accretable yield interest recognition is independent from the

underlying contractual loan delinquency status.

3 Tangible common equity to tangible

assets is considered to be a meaningful non-GAAP financial measure

of capital adequacy and is useful for investors to assess Bancorp's

ability to absorb potential losses. Tangible common equity includes

common stock, retained earnings and unrealized gains on available

for sale securities, net of tax, less goodwill and intangible

assets of $34.8 million, $35.0 million and $35.7 million at

December 31, 2019, September 30, 2019 and December 31, 2018,

respectively. Tangible assets excludes goodwill and intangible

assets.

4 Per share data has been adjusted to

reflect the two-for-one stock split effective November 27,

2018.

BANK OF MARIN BANCORP

CONSOLIDATED STATEMENTS OF

CONDITION

at December 31, 2019,

September 30, 2019 and December 31, 2018

(in thousands, except share data; unaudited)

December 31, 2019

September 30, 2019

December 31, 2018

Assets

Cash, cash equivalents and restricted

cash

$

183,388

$

182,486

$

34,221

Investment securities

Held-to-maturity, at amortized cost

137,413

142,213

157,206

Available-for-sale (at fair value;

amortized cost of $423,923, $348,369 and $465,910 at December 31,

2019, September 30, 2019 and December 31, 2018, respectively)

432,260

358,724

462,464

Total investment securities

569,673

500,937

619,670

Loans, net of allowance for loan losses of

$16,677, $16,240 and $15,821 at December 31, 2019, September 30,

2019 and December 31, 2018, respectively

1,826,609

1,782,450

1,748,043

Bank premises and equipment, net

6,070

6,474

7,376

Goodwill

30,140

30,140

30,140

Core deposit intangible

4,684

4,906

5,571

Operating lease right-of-use assets

11,002

11,934

—

Interest receivable and other assets

75,714

72,744

75,871

Total assets

$

2,707,280

$

2,592,071

$

2,520,892

Liabilities and Stockholders'

Equity

Liabilities

Deposits

Non-interest bearing

$

1,128,823

$

1,101,288

$

1,066,051

Interest bearing

Transaction accounts

142,329

162,015

133,403

Savings accounts

162,817

170,007

178,429

Money market accounts

804,710

693,137

679,775

Time accounts

97,810

98,077

117,182

Total deposits

2,336,489

2,224,524

2,174,840

Borrowings and other obligations

212

255

7,000

Subordinated debentures

2,708

2,691

2,640

Operating lease liabilities

12,615

13,665

—

Interest payable and other liabilities

18,468

17,871

20,005

Total liabilities

2,370,492

2,259,006

2,204,485

Stockholders' Equity

Preferred stock, no par value, Authorized

- 5,000,000 shares, none issued

—

—

—

Common stock, no par value, Authorized -

30,000,000 shares; Issued and outstanding- 13,577,008, 13,608,525

and 13,844,353 at December 31, 2019, September 30, 2019 and

December 31, 2018, respectively

129,058

130,220

140,565

Retained earnings

203,227

196,999

179,944

Accumulated other comprehensive income

(loss), net of taxes

4,503

5,846

(4,102

)

Total stockholders' equity

336,788

333,065

316,407

Total liabilities and stockholders'

equity

$

2,707,280

$

2,592,071

$

2,520,892

BANK OF MARIN BANCORP

CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE INCOME

Three months ended

Years ended

(in thousands, except per share amounts;

unaudited)

December 31, 2019

September 30, 2019

December 31, 2018

December 31, 2019

December 31, 2018

Interest income

Interest and fees on loans

$

21,123

$

21,525

$

20,732

$

84,331

$

79,527

Interest on investment securities

3,543

3,382

3,912

14,785

14,092

Interest on federal funds sold and due

from banks

567

425

373

1,321

1,461

Total interest income

25,233

25,332

25,017

100,437

95,080

Interest expense

Interest on interest-bearing transaction

accounts

78

101

68

347

226

Interest on savings accounts

18

17

18

70

72

Interest on money market accounts

1,033

855

566

3,439

1,355

Interest on time accounts

154

147

116

595

542

Interest on borrowings and other

obligations

2

4

—

77

2

Interest on subordinated debentures

54

57

977

229

1,339

Total interest expense

1,339

1,181

1,745

4,757

3,536

Net interest income

23,894

24,151

23,272

95,680

91,544

Provision for loan losses

500

400

—

900

—

Net interest income after provision for

loan losses

23,394

23,751

23,272

94,780

91,544

Non-interest income

Service charges on deposit accounts

462

439

484

1,865

1,891

Wealth Management and Trust Services

501

495

426

1,907

1,919

Debit card interchange fees, net

386

406

403

1,586

1,561

Merchant interchange fees, net

78

79

81

331

378

Earnings on bank-owned life Insurance,

net

226

795

227

1,196

913

Dividends on FHLB stock

208

202

377

799

959

Gains on investment securities, net

—

—

956

55

876

Other income

457

305

469

1,345

1,642

Total non-interest income

2,318

2,721

3,423

9,084

10,139

Non-interest expense

Salaries and related benefits

7,827

8,412

7,933

34,253

33,335

Occupancy and equipment

1,527

1,507

1,514

6,143

5,976

Depreciation and amortization

527

573

518

2,228

2,143

Federal Deposit Insurance Corporation

insurance

7

1

188

361

756

Data processing

775

923

1,004

3,717

4,358

Professional services

431

580

481

2,132

3,317

Directors' expense

180

189

170

735

700

Information technology

243

279

228

1,065

1,023

Amortization of core deposit

intangible

222

222

230

887

921

Provision for losses on off-balance sheet

commitments

—

—

—

129

—

Other expense

1,587

1,514

1,439

6,320

5,737

Total non-interest expense

13,326

14,200

13,705

57,970

58,266

Income before provision for income

taxes

12,386

12,272

12,990

45,894

43,417

Provision for income taxes

3,307

2,824

3,328

11,653

10,795

Net income

$

9,079

$

9,448

$

9,662

$

34,241

$

32,622

Net income per common share:1

Basic

$

0.67

$

0.70

$

0.70

$

2.51

$

2.35

Diluted

$

0.66

$

0.69

$

0.69

$

2.48

$

2.33

Weighted average shares:1

Basic

13,521

13,571

13,841

13,620

13,864

Diluted

13,703

13,735

14,033

13,794

14,029

Comprehensive income:

Net income

$

9,079

$

9,448

$

9,662

$

34,241

$

32,622

Other comprehensive (loss) income:

Change in net unrealized gains or losses

on available-for-sale securities

(2,018

)

936

7,714

11,839

(1,707

)

Reclassification adjustment for gains or

losses on available-for-sale securities in net income

—

—

—

(55

)

79

Net unrealized losses on securities

transferred from available-for-sale to held-to-maturity

—

—

—

—

(278

)

Amortization of net unrealized losses on

securities transferred from available-for-sale to

held-to-maturity

117

123

120

445

516

Subtotal

(1,901

)

1,059

7,834

12,229

(1,390

)

Deferred tax (benefit) expense

(558

)

313

2,318

3,624

(412

)

Other comprehensive (loss) income, net of

tax

(1,343

)

746

5,516

8,605

(978

)

Comprehensive income

$

7,736

$

10,194

$

15,178

$

42,846

$

31,644

1 Share and per share data has been

adjusted to reflect the two-for-one stock split effective November

27, 2018.

BANK OF MARIN BANCORP

AVERAGE STATEMENTS OF

CONDITION AND ANALYSIS OF NET INTEREST INCOME

Three months ended

Three months ended

Three months ended

December 31, 2019

September 30, 2019

December 31, 2018

Interest

Interest

Interest

Average

Income/

Yield/

Average

Income/

Yield/

Average Income/ Yield/

(dollars in thousands; unaudited)

Balance

Expense

Rate

Balance

Expense

Rate

Balance Expense Rate

Assets

Interest-bearing due from banks 1

$

136,320

$

566

1.63

%

$

77,467

$

425

2.15

%

$

65,961

$

373

2.21

%

Investment securities 2, 3

530,596

3,625

2.73

%

506,023

3,443

2.72

%

600,914

4,000

2.66

%

Loans 1, 3, 4

1,804,667

21,276

4.61

%

1,780,325

21,719

4.77

%

1,726,045

20,933

4.75

%

Total interest-earning assets 1

2,471,583

25,467

4.03

%

2,363,815

25,587

4.24

%

2,392,920

25,306

4.14

%

Cash and non-interest-bearing due from

banks

39,882

38,434

38,943

Bank premises and equipment, net

6,326

6,713

7,529

Interest receivable and other assets,

net

112,895

114,537

84,651

Total assets

$

2,630,686

$

2,523,499

$

2,524,043

Liabilities and Stockholders' Equity

Interest-bearing transaction accounts

$

145,237

$

79

0.22

%

$

137,861

$

101

0.29

%

$

130,546

$

68

0.21

%

Savings accounts

164,664

17

0.04

%

170,166

17

0.04

%

177,018

18

0.04

%

Money market accounts

725,192

1,033

0.57

%

661,131

855

0.51

%

643,459

566

0.35

%

Time accounts, including CDARS

97,302

154

0.63

%

101,404

147

0.57

%

121,838

116

0.38

%

Borrowings and other obligations 1

226

2

2.80

%

599

4

2.69

%

76

—

2.52

%

Subordinate debentures 1

2,698

54

7.79

%

2,682

57

8.27

%

2,770

977

138.09

%

Total interest-bearing liabilities

1,135,319

1,339

0.47

%

1,073,843

1,181

0.44

%

1,075,707

1,745

0.64

%

Demand accounts

1,129,068

1,088,903

1,118,785

Interest payable and other liabilities

31,270

30,268

19,662

Stockholders' equity

335,029

330,485

309,889

Total liabilities & stockholders'

equity

$

2,630,686

$

2,523,499

$

2,524,043

Tax-equivalent net interest income/margin

1

$

24,128

3.82

%

$

24,406

4.04

%

$

23,561

3.85

%

Reported net interest income/margin 1

$

23,894

3.78

%

$

24,151

4.00

%

$

23,272

3.81

%

Tax-equivalent net interest rate

spread

3.56

%

3.80

%

3.49

%

Year ended

Year ended

December 31, 2019

December 31, 2018

Interest

Interest

Average

Income/

Yield/

Average

Income/

Yield/

(dollars in thousands; unaudited)

Balance

Expense

Rate

Balance

Expense

Rate

Assets

Interest-bearing due from banks 1

$

67,192

$

1,321

1.94

%

$

78,185

$

1,461

1.84

%

Investment securities 2, 3

555,618

15,102

2.72

%

566,883

14,512

2.56

%

Loans 1, 3, 4

1,775,193

85,062

4.73

%

1,704,390

80,406

4.65

%

Total interest-earning assets 1

2,398,003

101,485

4.17

%

2,349,458

96,379

4.05

%

Cash and non-interest-bearing due from

banks

35,956

41,595

Bank premises and equipment, net

6,911

8,021

Interest receivable and other assets,

net

109,837

86,709

Total assets

$

2,550,707

$

2,485,783

Liabilities and Stockholders' Equity

Interest-bearing transaction accounts

$

133,922

$

347

0.26

%

$

143,706

$

226

0.16

%

Savings accounts

172,273

70

0.04

%

178,907

72

0.04

%

Money market accounts

680,296

3,439

0.51

%

612,372

1,355

0.22

%

Time accounts, including CDARS

106,783

595

0.56

%

137,339

542

0.39

%

Borrowings and other obligations 1

2,935

77

2.57

%

105

2

2.03

%

Subordinated debentures 1

2,673

229

8.44

%

5,025

1,339

26.29

%

Total interest-bearing liabilities

1,098,882

4,757

0.43

%

1,077,454

3,536

0.33

%

Demand accounts

1,094,806

1,085,870

Interest payable and other liabilities

30,578

18,514

Stockholders' equity

326,441

303,945

Total liabilities & stockholders'

equity

$

2,550,707

$

2,485,783

Tax-equivalent net interest income/margin

1

$

96,728

3.98

%

$

92,843

3.90

%

Reported net interest income/margin 1

$

95,680

3.94

%

$

91,544

3.84

%

Tax-equivalent net interest rate

spread

3.74

%

3.72

%

1 Interest income/expense is divided by

actual number of days in the period times 360 days to correspond to

stated interest rate terms, where applicable.

2 Yields on available-for-sale securities

are calculated based on amortized cost balances rather than fair

value, as changes in fair value are reflected as a component of

stockholders' equity. Investment security interest is earned on

30/360 day basis monthly.

3 Yields and interest income on tax-exempt

securities and loans are presented on a taxable-equivalent basis

using the Federal statutory rate of 21 percent in 2019 and

2018.

4 Average balances on loans outstanding

include non-performing loans. The amortized portion of net loan

origination fees is included in interest income on loans,

representing an adjustment to the yield.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200127005150/en/

Beth Drummey Marketing and Corporate Communications Manager

415-763-4529 | bethdrummey@bankofmarin.com

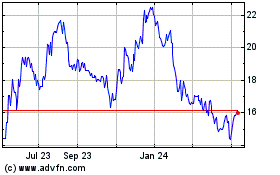

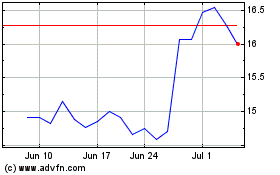

Bank of Marin Bancorp (NASDAQ:BMRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of Marin Bancorp (NASDAQ:BMRC)

Historical Stock Chart

From Apr 2023 to Apr 2024