0000009326--12-31false2024Q2P3Y0.66660.6666http://fasb.org/us-gaap/2024#OtherComprehensiveIncomeLossCashFlowHedgeGainLossAfterReclassificationAndTaxParenthttp://fasb.org/us-gaap/2024#OtherComprehensiveIncomeLossCashFlowHedgeGainLossAfterReclassificationAndTaxParenthttp://fasb.org/us-gaap/2024#OtherComprehensiveIncomeDefinedBenefitPlansNetUnamortizedGainLossArisingDuringPeriodNetOfTaxhttp://fasb.org/us-gaap/2024#OtherComprehensiveIncomeDefinedBenefitPlansNetUnamortizedGainLossArisingDuringPeriodNetOfTaxxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purebcpc:votebcpc:segmentbcpc:planbcpc:financial_instrumentbcpc:tranche00000093262024-01-012024-06-3000000093262024-07-1800000093262024-06-3000000093262023-12-3100000093262024-04-012024-06-3000000093262023-04-012023-06-3000000093262023-01-012023-06-300000009326us-gaap:RetainedEarningsMember2023-12-310000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000009326us-gaap:CommonStockMember2023-12-310000009326us-gaap:AdditionalPaidInCapitalMember2023-12-3100000093262024-01-012024-03-310000009326us-gaap:RetainedEarningsMember2024-01-012024-03-310000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000009326us-gaap:CommonStockMember2024-01-012024-03-310000009326us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100000093262024-03-310000009326us-gaap:RetainedEarningsMember2024-03-310000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000009326us-gaap:CommonStockMember2024-03-310000009326us-gaap:AdditionalPaidInCapitalMember2024-03-310000009326us-gaap:RetainedEarningsMember2024-04-012024-06-300000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000009326us-gaap:CommonStockMember2024-04-012024-06-300000009326us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000009326us-gaap:RetainedEarningsMember2024-06-300000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000009326us-gaap:CommonStockMember2024-06-300000009326us-gaap:AdditionalPaidInCapitalMember2024-06-3000000093262022-12-310000009326us-gaap:RetainedEarningsMember2022-12-310000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000009326us-gaap:CommonStockMember2022-12-310000009326us-gaap:AdditionalPaidInCapitalMember2022-12-3100000093262023-01-012023-03-310000009326us-gaap:RetainedEarningsMember2023-01-012023-03-310000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000009326us-gaap:CommonStockMember2023-01-012023-03-310000009326us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100000093262023-03-310000009326us-gaap:RetainedEarningsMember2023-03-310000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000009326us-gaap:CommonStockMember2023-03-310000009326us-gaap:AdditionalPaidInCapitalMember2023-03-310000009326us-gaap:RetainedEarningsMember2023-04-012023-06-300000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000009326us-gaap:CommonStockMember2023-04-012023-06-300000009326us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-3000000093262023-06-300000009326us-gaap:RetainedEarningsMember2023-06-300000009326us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000009326us-gaap:CommonStockMember2023-06-300000009326us-gaap:AdditionalPaidInCapitalMember2023-06-300000009326us-gaap:CostOfSalesMember2024-04-012024-06-300000009326us-gaap:CostOfSalesMember2023-04-012023-06-300000009326us-gaap:CostOfSalesMember2024-01-012024-06-300000009326us-gaap:CostOfSalesMember2023-01-012023-06-300000009326us-gaap:OperatingExpenseMember2024-04-012024-06-300000009326us-gaap:OperatingExpenseMember2023-04-012023-06-300000009326us-gaap:OperatingExpenseMember2024-01-012024-06-300000009326us-gaap:OperatingExpenseMember2023-01-012023-06-3000000093262023-06-222023-06-220000009326srt:MinimumMemberus-gaap:EmployeeStockOptionMember2024-01-012024-06-300000009326us-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-01-012024-06-300000009326us-gaap:RestrictedStockMember2024-01-012024-06-300000009326us-gaap:PerformanceSharesMember2024-01-012024-06-300000009326srt:DirectorMemberus-gaap:RestrictedStockMember2024-01-012024-06-300000009326us-gaap:EmployeeStockOptionMember2024-01-012024-06-300000009326us-gaap:EmployeeStockOptionMember2023-01-012023-06-300000009326us-gaap:RestrictedStockMember2023-12-310000009326us-gaap:RestrictedStockMember2022-12-310000009326us-gaap:RestrictedStockMember2023-01-012023-06-300000009326us-gaap:RestrictedStockMember2024-06-300000009326us-gaap:RestrictedStockMember2023-06-300000009326us-gaap:PerformanceSharesMember2023-12-310000009326us-gaap:PerformanceSharesMember2022-12-310000009326us-gaap:PerformanceSharesMember2023-01-012023-06-300000009326us-gaap:PerformanceSharesMember2024-06-300000009326us-gaap:PerformanceSharesMember2023-06-300000009326us-gaap:LandMember2024-06-300000009326us-gaap:LandMember2023-12-310000009326us-gaap:BuildingMember2024-06-300000009326us-gaap:BuildingMember2023-12-310000009326us-gaap:EquipmentMember2024-06-300000009326us-gaap:EquipmentMember2023-12-310000009326us-gaap:ConstructionInProgressMember2024-06-300000009326us-gaap:ConstructionInProgressMember2023-12-310000009326srt:MinimumMemberus-gaap:CustomerListsMember2024-06-300000009326srt:MaximumMemberus-gaap:CustomerListsMember2024-06-300000009326us-gaap:CustomerListsMember2024-06-300000009326us-gaap:CustomerListsMember2023-12-310000009326srt:MinimumMemberus-gaap:TrademarksAndTradeNamesMember2024-06-300000009326us-gaap:TrademarksAndTradeNamesMembersrt:MaximumMember2024-06-300000009326us-gaap:TrademarksAndTradeNamesMember2024-06-300000009326us-gaap:TrademarksAndTradeNamesMember2023-12-310000009326srt:MinimumMemberus-gaap:DevelopedTechnologyRightsMember2024-06-300000009326us-gaap:DevelopedTechnologyRightsMembersrt:MaximumMember2024-06-300000009326us-gaap:DevelopedTechnologyRightsMember2024-06-300000009326us-gaap:DevelopedTechnologyRightsMember2023-12-310000009326srt:MinimumMemberus-gaap:OtherIntangibleAssetsMember2024-06-300000009326us-gaap:OtherIntangibleAssetsMembersrt:MaximumMember2024-06-300000009326us-gaap:OtherIntangibleAssetsMember2024-06-300000009326us-gaap:OtherIntangibleAssetsMember2023-12-310000009326bcpc:StGabrielCCCompanyLLCMember2013-12-310000009326bcpc:EastmanChemicalCompanyMemberbcpc:StGabrielCCCompanyLLCMember2013-12-310000009326bcpc:StGabrielCCCompanyLLCMember2024-04-012024-06-300000009326bcpc:StGabrielCCCompanyLLCMember2024-01-012024-06-300000009326bcpc:StGabrielCCCompanyLLCMember2023-04-012023-06-300000009326bcpc:StGabrielCCCompanyLLCMember2023-01-012023-06-300000009326bcpc:StGabrielCCCompanyLLCMember2024-06-300000009326bcpc:StGabrielCCCompanyLLCMember2023-12-310000009326us-gaap:RevolvingCreditFacilityMemberbcpc:A2018CreditAgreementMember2022-07-270000009326us-gaap:RevolvingCreditFacilityMemberbcpc:A2018CreditAgreementMember2024-06-300000009326us-gaap:RevolvingCreditFacilityMemberbcpc:A2018CreditAgreementMember2023-12-310000009326us-gaap:RevolvingCreditFacilityMemberbcpc:A2018CreditAgreementMember2024-01-012024-06-300000009326bcpc:RevolvingCreditAgreementMember2024-06-300000009326srt:MinimumMemberbcpc:RevolvingCreditAgreementMember2024-01-012024-06-300000009326bcpc:RevolvingCreditAgreementMembersrt:MaximumMember2024-01-012024-06-300000009326bcpc:RevolvingCreditAgreementMember2024-01-012024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:HumanNutritionAndHealthMember2024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:HumanNutritionAndHealthMember2023-12-310000009326us-gaap:OperatingSegmentsMemberbcpc:AnimalNutritionAndHealthMember2024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:AnimalNutritionAndHealthMember2023-12-310000009326us-gaap:OperatingSegmentsMemberbcpc:SpecialtyProductsMember2024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:SpecialtyProductsMember2023-12-310000009326us-gaap:CorporateNonSegmentMember2024-06-300000009326us-gaap:CorporateNonSegmentMember2023-12-310000009326us-gaap:OperatingSegmentsMemberbcpc:HumanNutritionAndHealthMember2024-04-012024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:HumanNutritionAndHealthMember2023-04-012023-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:HumanNutritionAndHealthMember2024-01-012024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:HumanNutritionAndHealthMember2023-01-012023-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:AnimalNutritionAndHealthMember2024-04-012024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:AnimalNutritionAndHealthMember2023-04-012023-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:AnimalNutritionAndHealthMember2024-01-012024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:AnimalNutritionAndHealthMember2023-01-012023-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:SpecialtyProductsMember2024-04-012024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:SpecialtyProductsMember2023-04-012023-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:SpecialtyProductsMember2024-01-012024-06-300000009326us-gaap:OperatingSegmentsMemberbcpc:SpecialtyProductsMember2023-01-012023-06-300000009326us-gaap:CorporateNonSegmentMember2024-04-012024-06-300000009326us-gaap:CorporateNonSegmentMember2023-04-012023-06-300000009326us-gaap:CorporateNonSegmentMember2024-01-012024-06-300000009326us-gaap:CorporateNonSegmentMember2023-01-012023-06-300000009326us-gaap:MaterialReconcilingItemsMember2024-04-012024-06-300000009326us-gaap:MaterialReconcilingItemsMember2023-04-012023-06-300000009326us-gaap:MaterialReconcilingItemsMember2024-01-012024-06-300000009326us-gaap:MaterialReconcilingItemsMember2023-01-012023-06-300000009326bcpc:ProductSalesMember2024-04-012024-06-300000009326bcpc:ProductSalesMember2023-04-012023-06-300000009326bcpc:ProductSalesMember2024-01-012024-06-300000009326bcpc:ProductSalesMember2023-01-012023-06-300000009326us-gaap:RoyaltyMember2024-04-012024-06-300000009326us-gaap:RoyaltyMember2023-04-012023-06-300000009326us-gaap:RoyaltyMember2024-01-012024-06-300000009326us-gaap:RoyaltyMember2023-01-012023-06-300000009326country:US2024-04-012024-06-300000009326country:US2023-04-012023-06-300000009326country:US2024-01-012024-06-300000009326country:US2023-01-012023-06-300000009326us-gaap:NonUsMember2024-04-012024-06-300000009326us-gaap:NonUsMember2023-04-012023-06-300000009326us-gaap:NonUsMember2024-01-012024-06-300000009326us-gaap:NonUsMember2023-01-012023-06-300000009326us-gaap:CurrencySwapMember2023-04-012023-06-300000009326us-gaap:CurrencySwapMember2023-01-012023-06-300000009326us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000009326us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310000009326us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000009326us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-06-300000009326us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-06-300000009326us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-06-300000009326us-gaap:AccumulatedTranslationAdjustmentMember2024-06-300000009326us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-06-300000009326us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-06-300000009326us-gaap:PostemploymentRetirementBenefitsMember2024-01-012024-06-300000009326us-gaap:PostemploymentRetirementBenefitsMember2023-01-012023-06-300000009326us-gaap:PostemploymentRetirementBenefitsMember2024-06-300000009326us-gaap:PostemploymentRetirementBenefitsMember2023-12-310000009326us-gaap:PensionPlansDefinedBenefitMemberbcpc:ChemogasDefinedPensionPlanMember2024-06-300000009326us-gaap:PensionPlansDefinedBenefitMemberbcpc:ChemogasDefinedPensionPlanMember2023-12-310000009326us-gaap:PensionPlansDefinedBenefitMemberbcpc:ChemogasDefinedPensionPlanMember2024-01-012024-06-300000009326us-gaap:PensionPlansDefinedBenefitMemberbcpc:ChemogasDefinedPensionPlanMember2023-01-012023-06-300000009326us-gaap:FairValueInputsLevel1Member2024-06-300000009326us-gaap:FairValueInputsLevel1Member2023-12-310000009326us-gaap:MoneyMarketFundsMember2024-06-300000009326us-gaap:MoneyMarketFundsMember2023-12-310000009326us-gaap:FairValueInputsLevel3Member2024-06-300000009326us-gaap:FairValueInputsLevel3Member2023-12-310000009326bcpc:ServicesProvidedMemberus-gaap:CorporateJointVentureMember2024-04-012024-06-300000009326bcpc:ServicesProvidedMemberus-gaap:CorporateJointVentureMember2024-01-012024-06-300000009326bcpc:ServicesProvidedMemberus-gaap:CorporateJointVentureMember2023-04-012023-06-300000009326bcpc:ServicesProvidedMemberus-gaap:CorporateJointVentureMember2023-01-012023-06-300000009326us-gaap:CorporateJointVentureMemberbcpc:RawMaterialsSoldMember2024-04-012024-06-300000009326us-gaap:CorporateJointVentureMemberbcpc:RawMaterialsSoldMember2024-01-012024-06-300000009326us-gaap:CorporateJointVentureMemberbcpc:RawMaterialsSoldMember2023-04-012023-06-300000009326us-gaap:CorporateJointVentureMemberbcpc:RawMaterialsSoldMember2023-01-012023-06-300000009326us-gaap:CorporateJointVentureMember2024-04-012024-06-300000009326us-gaap:CorporateJointVentureMember2024-01-012024-06-300000009326us-gaap:CorporateJointVentureMember2023-04-012023-06-300000009326us-gaap:CorporateJointVentureMember2023-01-012023-06-300000009326us-gaap:CorporateJointVentureMember2024-06-300000009326us-gaap:CorporateJointVentureMember2023-12-310000009326us-gaap:CorporateJointVentureMemberbcpc:NonContractualMoniesOwedMember2024-06-300000009326us-gaap:CorporateJointVentureMemberbcpc:NonContractualMoniesOwedMember2023-12-310000009326srt:MinimumMemberbcpc:LesseeOperatingLeaseTrancheOneMember2024-06-300000009326bcpc:LesseeOperatingLeaseTrancheOneMembersrt:MaximumMember2024-06-300000009326bcpc:LesseeOperatingLeaseTrancheOneMember2024-06-300000009326srt:MinimumMemberbcpc:LesseeOperatingLeaseTrancheTwoMember2024-06-300000009326srt:MaximumMemberbcpc:LesseeOperatingLeaseTrancheTwoMember2024-06-300000009326bcpc:LesseeOperatingLeaseTrancheTwoMember2024-06-300000009326bcpc:LesseeOperatingLeaseTrancheThreeMembersrt:MinimumMember2024-06-300000009326bcpc:LesseeOperatingLeaseTrancheThreeMembersrt:MaximumMember2024-06-300000009326bcpc:LesseeOperatingLeaseTrancheThreeMember2024-06-300000009326bcpc:LesseeOperatingLeaseTrancheFourMember2024-06-300000009326bcpc:PayFixedInterestRateMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2019-05-280000009326us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2019-05-280000009326us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2023-04-012023-06-300000009326us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2023-01-012023-06-300000009326us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2024-04-012024-06-300000009326us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2024-01-012024-06-300000009326bcpc:PayFixedInterestRateMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2019-05-280000009326us-gaap:DesignatedAsHedgingInstrumentMemberbcpc:ReceiveFixedInterestRateMemberus-gaap:CurrencySwapMember2019-05-280000009326us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2019-05-280000009326us-gaap:InterestExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2023-04-012023-06-300000009326us-gaap:InterestExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2023-01-012023-06-300000009326us-gaap:InterestExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-01-012024-06-300000009326us-gaap:InterestExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-04-012024-06-300000009326us-gaap:InterestRateSwapMember2023-01-012023-06-300000009326us-gaap:InterestRateSwapMember2023-04-012023-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number: 1-13648

_______________________________________________________________________________________________________________

Balchem Corporation

(Exact name of Registrant as specified in its charter) | | | | | | | | |

| Maryland | | 13-2578432 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

5 Paragon Drive, Montvale, NJ 07645

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (845) 326-5600

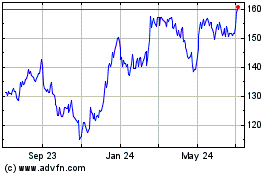

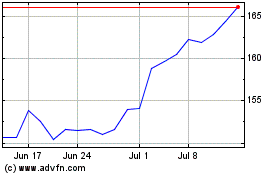

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, par value $.06-2/3 per share | BCPC | The Nasdaq Stock Market LLC |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| (Check one): | Large accelerated filer | ☑ | Accelerated filer | ☐ | | |

| | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of July 18, 2024, the registrant had 32,443,731 shares of its Common Stock, $.06 2/3 par value, outstanding.

BALCHEM CORPORATION

QUARTERLY REPORT ON FORM 10-Q

Part I. Financial Information

Item 1. Financial Statements

BALCHEM CORPORATION

Condensed Consolidated Balance Sheets

(Dollars in thousands, except share and per share data) | | | | | | | | | | | | | | |

| Assets | | June 30, 2024 (unaudited) | | December 31, 2023 |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 63,738 | | | $ | 64,447 | |

Accounts receivable, net of allowances of $1,066 and $908 at June 30, 2024 and December 31, 2023 respectively | | 123,400 | | | 125,284 | |

| Inventories, net | | 117,099 | | | 109,521 | |

| Prepaid expenses | | 9,963 | | | 7,798 | |

| Other current assets | | 5,956 | | | 7,192 | |

| Total current assets | | 320,156 | | | 314,242 | |

| Property, plant and equipment, net | | 272,539 | | | 276,039 | |

| Goodwill | | 770,026 | | | 778,907 | |

| Intangible assets with finite lives, net | | 176,102 | | | 191,212 | |

| Right of use assets - operating leases | | 16,469 | | | 17,763 | |

| Right of use assets - finance lease | | 1,976 | | | 2,101 | |

| Other non-current assets | | 17,698 | | | 16,947 | |

| Total assets | | $ | 1,574,966 | | | $ | 1,597,211 | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

| Trade accounts payable | | $ | 54,501 | | | $ | 55,503 | |

| Accrued expenses | | 36,993 | | | 40,855 | |

| Accrued compensation and other benefits | | 14,500 | | | 17,228 | |

| Dividends payable | | 53 | | | 25,717 | |

| Income taxes payable | | 3,437 | | | 4,967 | |

| Operating lease liabilities - current | | 3,589 | | | 3,949 | |

| Finance lease liabilities - current | | 249 | | | 272 | |

| Total current liabilities | | 113,322 | | | 148,491 | |

| Revolving loan | | 266,569 | | | 309,569 | |

| Deferred income taxes | | 49,956 | | | 52,046 | |

| Operating lease liabilities - non-current | | 13,666 | | | 14,601 | |

| Finance lease liabilities - non-current | | 1,847 | | | 1,943 | |

| Other long-term obligations | | 17,242 | | | 16,577 | |

| Total liabilities | | 462,602 | | | 543,227 | |

| Commitments and contingencies (Note 15) | | | | |

| Stockholders' equity: | | | | |

Preferred stock, $25 par value. Authorized 2,000,000 shares; none issued and outstanding | | — | | | — | |

Common stock, $0.0667 par value. Authorized 120,000,000 shares; 32,434,858 and 32,254,728 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | | 2,164 | | | 2,152 | |

| Additional paid-in capital | | 158,791 | | | 145,653 | |

| Retained earnings | | 958,543 | | | 897,488 | |

| Accumulated other comprehensive (loss) income | | (7,134) | | | 8,691 | |

| Total stockholders' equity | | 1,112,364 | | | 1,053,984 | |

| Total liabilities and stockholders' equity | | $ | 1,574,966 | | | $ | 1,597,211 | |

See accompanying notes to condensed consolidated financial statements.

BALCHEM CORPORATION

Condensed Consolidated Statements of Earnings

(Dollars in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Net sales | | $ | 234,081 | | | $ | 231,252 | | | $ | 473,740 | | | $ | 463,792 | |

| | | | | | | | |

| Cost of sales | | 151,087 | | | 153,903 | | | 309,232 | | | 313,273 | |

| | | | | | | | |

| Gross margin | | 82,994 | | | 77,349 | | | 164,508 | | | 150,519 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Selling expenses | | 18,014 | | | 18,684 | | | 36,241 | | | 36,867 | |

| Research and development expenses | | 3,854 | | | 3,795 | | | 7,954 | | | 7,245 | |

| General and administrative expenses | | 15,329 | | | 12,034 | | | 32,840 | | | 29,163 | |

| | | 37,197 | | | 34,513 | | | 77,035 | | | 73,275 | |

| | | | | | | | |

| Earnings from operations | | 45,797 | | | 42,836 | | | 87,473 | | | 77,244 | |

| | | | | | | | |

| Other expenses, net: | | | | | | | | |

| Interest expense, net | | 4,240 | | | 5,163 | | | 9,638 | | | 10,728 | |

| Other expense (income), net | | 331 | | | (727) | | | (241) | | | (1,003) | |

| | 4,571 | | | 4,436 | | | 9,397 | | | 9,725 | |

| | | | | | | | |

| Earnings before income tax expense | | 41,226 | | | 38,400 | | | 78,076 | | | 67,519 | |

| | | | | | | | |

| Income tax expense | | 9,157 | | | 8,290 | | | 17,021 | | | 14,699 | |

| | | | | | | | |

| Net earnings | | $ | 32,069 | | | $ | 30,110 | | | $ | 61,055 | | | $ | 52,820 | |

| | | | | | | | |

| Net earnings per common share - basic | | $ | 0.99 | | | $ | 0.94 | | | $ | 1.89 | | | $ | 1.65 | |

| | | | | | | | |

| Net earnings per common share - diluted | | $ | 0.98 | | | $ | 0.93 | | | $ | 1.87 | | | $ | 1.63 | |

See accompanying notes to condensed consolidated financial statements.

BALCHEM CORPORATION

Condensed Consolidated Statements of Comprehensive Income

(Dollars in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Net earnings | | $ | 32,069 | | | $ | 30,110 | | | $ | 61,055 | | | $ | 52,820 | |

| | | | | | | | |

| Other comprehensive (loss) income, net of tax: | | | | | | | | |

| Foreign currency translation adjustment | | (3,260) | | | (1,116) | | | (15,977) | | | 8,308 | |

| Unrealized loss on cash flow hedge | | — | | | (554) | | | — | | | (1,065) | |

| Change in postretirement benefit plans | | (2) | | | 2 | | | 152 | | | 102 | |

| Other comprehensive (loss) income | | (3,262) | | | (1,668) | | | (15,825) | | | 7,345 | |

| | | | | | | | |

| Comprehensive income | | $ | 28,807 | | | $ | 28,442 | | | $ | 45,230 | | | $ | 60,165 | |

See accompanying notes to condensed consolidated financial statements.

BALCHEM CORPORATION

Condensed Consolidated Statements of Changes in Stockholders’ Equity

For the Three and Six Months Ended June 30, 2024 and 2023

(Dollars in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total

Stockholders'

Equity | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income (Loss) | | Common Stock | | Additional

Paid-in

Capital |

| Shares | | Amount |

| Balance - December 31, 2023 | | $ | 1,053,984 | | | $ | 897,488 | | | $ | 8,691 | | | 32,254,728 | | $ | 2,152 | | | $ | 145,653 | |

| Net earnings | | 28,986 | | | 28,986 | | | — | | | — | | — | | | — | |

| Other comprehensive loss | | (12,563) | | | — | | | (12,563) | | | — | | — | | | — | |

Repurchases of common stock, including

excise tax | | (5,254) | | | — | | | — | | | (36,122) | | (2) | | | (5,252) | |

| Shares and options issued under stock plans | | 13,638 | | | — | | | — | | | 204,794 | | 13 | | | 13,625 | |

| Balance - March 31, 2024 | | 1,078,791 | | | 926,474 | | | (3,872) | | | 32,423,400 | | 2,163 | | | 154,026 | |

| Net earnings | | 32,069 | | | 32,069 | | | — | | | — | | — | | | — | |

| Other comprehensive loss | | (3,262) | | | — | | | (3,262) | | | — | | — | | | — | |

Repurchases of common stock, including

excise tax | | (11) | | | — | | | — | | | (72) | | — | | | (11) | |

| Shares and options issued under stock plans | | 4,777 | | | — | | | — | | | 11,530 | | 1 | | | 4,776 | |

| Balance - June 30, 2024 | | $ | 1,112,364 | | | $ | 958,543 | | | $ | (7,134) | | | 32,434,858 | | $ | 2,164 | | | $ | 158,791 | |

| | | | | | | | | | | | |

| Balance - December 31, 2022 | | $ | 938,284 | | | $ | 814,487 | | | $ | (7,154) | | | 32,152,787 | | $ | 2,145 | | | $ | 128,806 | |

| Net earnings | | 22,710 | | | 22,710 | | | — | | | — | | — | | | — | |

| Other comprehensive income | | 9,013 | | | — | | | 9,013 | | | — | | — | | | — | |

Repurchases of common stock, including

excise tax | | (3,887) | | | — | | | — | | | (28,109) | | (2) | | | (3,885) | |

| Shares and options issued under stock plans | | 7,296 | | | — | | | — | | | 100,949 | | 7 | | | 7,289 | |

| Balance - March 31, 2023 | | 973,416 | | | 837,197 | | | 1,859 | | | 32,225,627 | | 2,150 | | | 132,210 | |

| Net earnings | | 30,110 | | | 30,110 | | | — | | | — | | — | | | — | |

| Other comprehensive loss | | (1,668) | | | — | | | (1,668) | | | — | | — | | | — | |

Repurchases of common stock, including

excise tax | | (76) | | | — | | | — | | | (567) | | — | | | (76) | |

| Shares and options issued under stock plans | | 5,121 | | | — | | | — | | | 14,142 | | 1 | | | 5,120 | |

| Balance - June 30, 2023 | | $ | 1,006,903 | | | $ | 867,307 | | | $ | 191 | | | 32,239,202 | | $ | 2,151 | | | $ | 137,254 | |

See accompanying notes to condensed consolidated financial statements.

BALCHEM CORPORATION

Condensed Consolidated Statements of Cash Flows

(Dollars in thousands)

(unaudited) | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, |

| | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | |

| Net earnings | | $ | 61,055 | | | $ | 52,820 | |

| | | | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 26,174 | | | 27,074 | |

| Stock compensation expense | | 8,636 | | | 8,518 | |

| Deferred income taxes | | (1,116) | | | (573) | |

| Provision for doubtful accounts | | 295 | | | 133 | |

| Unrealized gain on foreign currency transactions and deferred compensation | | (507) | | | (1,010) | |

| Asset impairment and loss on disposal of assets | | 313 | | | 5,203 | |

| Change in fair value of contingent consideration liability | | (91) | | | (6,400) | |

| Changes in assets and liabilities | | | | |

| Accounts receivable | | 1,208 | | | 6,621 | |

| Inventories | | (8,345) | | | (5,332) | |

| Prepaid expenses and other current assets | | (1,160) | | | (5,389) | |

| Accounts payable and accrued expenses | | (6,875) | | | (5,451) | |

| Income taxes | | (1,441) | | | (6,293) | |

| Other | | 234 | | | (92) | |

| Net cash provided by operating activities | | 78,380 | | | 69,829 | |

| | | | |

| Cash flows from investing activities: | | | | |

| Capital expenditures and intangible assets acquired | | (13,788) | | | (17,880) | |

| Cash paid for acquisitions, net of cash acquired | | — | | | (341) | |

| Proceeds from sale of assets | | 272 | | | 1,881 | |

| Proceeds from settlement of net investment hedge | | — | | | 2,740 | |

| Investment in affiliates | | (80) | | | (72) | |

| Net cash used in investing activities | | (13,596) | | | (13,672) | |

| | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from revolving loan | | 26,000 | | | 13,000 | |

| Principal payments on revolving loan | | (69,000) | | | (48,000) | |

| Principal payments on finance lease | | (111) | | | (110) | |

| Proceeds from stock options exercised | | 9,682 | | | 3,826 | |

| Dividends paid | | (25,568) | | | (22,869) | |

| Repurchases of common stock | | (5,213) | | | (3,924) | |

| Net cash used in financing activities | | (64,210) | | | (58,077) | |

| | | | |

| Effect of exchange rate changes on cash | | (1,283) | | | 2,216 | |

| | | | |

| (Decrease) increase in cash and cash equivalents | | (709) | | | 296 | |

| | | | |

| Cash and cash equivalents beginning of period | | 64,447 | | | 66,560 | |

| Cash and cash equivalents end of period | | $ | 63,738 | | | $ | 66,856 | |

See accompanying notes to condensed consolidated financial statements.

BALCHEM CORPORATION

Notes to Condensed Consolidated Financial Statements (Unaudited)

(All dollar amounts in thousands, except share and per share data)

NOTE 1 – CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The condensed consolidated financial statements presented herein have been prepared in accordance with the accounting policies described in the December 31, 2023 consolidated financial statements, and should be read in conjunction with the consolidated financial statements and notes, which appear in the Annual Report on Form 10-K for the year ended December 31, 2023. The condensed consolidated financial statements reflect the operations of Balchem Corporation and its subsidiaries (the "Company" or "Balchem"). All intercompany balances and transactions have been eliminated in consolidation.

In the opinion of management, the unaudited condensed consolidated financial statements furnished in this Form 10-Q include all adjustments necessary for a fair presentation of the financial position, results of operations and cash flows for the interim periods presented. All such adjustments are of a normal, recurring nature. The condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP” or “GAAP”) governing interim financial statements and the instructions to Form 10-Q and Article 10 of Regulation S-X under the Securities Exchange Act of 1934 (the "Exchange Act") and therefore do not include some information and notes necessary to conform to annual reporting requirements. The results of operations for the three and six months ended June 30, 2024 are not necessarily indicative of the operating results expected for the full year or any interim period.

Recent Accounting Pronouncements

Recently Issued Accounting Standards

In December 2023, the FASB issued Accounting Standards Update ("ASU") 2023-09, "Income Taxes (Topic 740) - Improvements to Income Tax Disclosures." The new guidance is intended to enhance the transparency and decision usefulness of income tax disclosures by requiring disaggregated information about a reporting entity's effective tax rate reconciliation and information on income taxes paid. The amendment is effective for fiscal years beginning after December 15, 2024, with early adoption permitted. The amendment in this update should be applied on a prospective basis, with retrospective application permitted. The Company is in the process of evaluating the impact that the adoption of ASU 2023-09 will have to the financial statements and related disclosures.

In November 2023, the FASB issued ASU 2023-07, "Segment Reporting (Topic 280) - Improvements to Reportable Segment Disclosures." The ASU expands reportable segment disclosure requirements by requiring disclosures of significant reportable segment expenses that are regularly provided to the Chief Operating Decision Maker (“CODM”) and included within each reported measure of a segment's profit or loss. The ASU also requires disclosure of the title and position of the individual identified as the CODM and an explanation of how the CODM uses the reported measures of a segment's profit or loss in assessing segment performance and deciding how to allocate resources. Additionally, ASU 2023-07 requires all segment profit or loss and assets disclosures to be provided on an annual and interim basis. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning December 15, 2024. Early adoption is permitted and the amendments must be applied retrospectively to all prior periods presented. The adoption of this guidance will not affect the Company's consolidated results of operations, financial position or cash flows. The Company is currently evaluating the effect the guidance will have on its disclosures.

Recently Adopted Accounting Standards

In August 2023, the FASB issued ASU 2023-05, "Business Combinations - Joint Venture Formations (Subtopic 805-60): Recognition and Initial Measurement." The new guidance applies to the formation of a joint venture and requires a joint venture to initially measure all contributions received upon its formation at fair value. The guidance is intended to reduce diversity in practice and is applicable to joint venture entities with a formation date on or after January 1, 2025 on a prospective basis. While ASU 2023-05 is not currently applicable to Balchem, the Company will apply this guidance in future reporting periods after the guidance is effective to any future arrangements meeting the definition of a joint venture.

NOTE 2 - STOCKHOLDERS' EQUITY

Stock-Based Compensation

The Company’s results for the three and six months ended June 30, 2024 and 2023 reflected the following stock-based compensation cost, and such compensation cost had the following effects on net earnings:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Increase/(Decrease) for the | | Increase/(Decrease) for the |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of sales | | $ | 425 | | | $ | 545 | | | $ | 825 | | | $ | 959 | |

| Operating expenses | | 3,461 | | | 3,203 | | | 7,811 | | | 7,559 | |

| Net earnings | | (2,974) | | | (2,881) | | | (6,627) | | | (6,563) | |

As allowed by ASC 718, the Company has made an estimate of expected forfeitures based on its historical experience and is recognizing compensation cost only for those stock-based compensation awards expected to vest.

The Company's omnibus incentive plan allows for the granting of stock awards and options to purchase common stock. Both incentive stock options and nonqualified stock options can be awarded under the plan. No option will be exercisable for longer than ten years after the date of grant. The Company has approved and reserved a number of shares to be issued upon exercise of the outstanding options that is adequate to cover all exercises. As of June 30, 2024, the plan had 841,101 shares available for future awards, which included an additional 800,000 shares approved by the Company's shareholders during its annual meeting of shareholders held on June 22, 2023. Compensation expense for stock options and stock awards is recognized on a straight-line basis over the vesting period, generally three to five years for stock options, three years for employee restricted stock awards, three years for employee performance share awards, and three years for non-employee director restricted stock awards. Certain awards provide for accelerated vesting if there is a change in control (as defined in the plans) or other qualifying events.

Option activity for the six months ended June 30, 2024 and 2023 is summarized below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Six Months Ended June 30, 2024 | | Shares (000s) | | Weighted

Average

Exercise

Price | | Aggregate

Intrinsic

Value | | Weighted

Average

Remaining

Contractual

Term |

| Outstanding as of December 31, 2023 | | 1,078 | | | $ | 104.38 | | | $ | 47,889 | | | |

| Granted | | 113 | | | 143.43 | | | | | |

| Exercised | | (137) | | | 70.75 | | | | | |

| Forfeited | | (2) | | | 137.06 | | | | | |

| Canceled | | — | | | — | | | | | |

| Outstanding as of June 30, 2024 | | 1,052 | | | $ | 112.90 | | | $ | 43,199 | | | 6.0 |

| | | | | | | | |

| Exercisable as of June 30, 2024 | | 687 | | | $ | 98.31 | | | $ | 38,241 | | | 4.7 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Six Months Ended June 30, 2023 | | Shares (000s) | | Weighted

Average

Exercise

Price | | Aggregate

Intrinsic

Value | | Weighted

Average

Remaining

Contractual

Term |

| Outstanding as of December 31, 2022 | | 1,045 | | | $ | 99.82 | | | $ | 27,221 | | | |

| Granted | | 109 | | | 138.09 | | | | | |

| Exercised | | (46) | | | 83.43 | | | | | |

| Forfeited | | (11) | | | 131.79 | | | | | |

| Canceled | | (1) | | | 138.07 | | | | | |

| Outstanding as of June 30, 2023 | | 1,096 | | | $ | 103.96 | | | $ | 35,430 | | | 6.2 |

| | | | | | | | |

| Exercisable as of June 30, 2023 | | 728 | | | $ | 87.95 | | | $ | 34,170 | | | 4.8 |

ASC 718 requires companies to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award. The weighted average fair values of the stock options granted under the Plans were calculated using either the Black-Scholes model or the Binomial model, whichever was deemed to be most appropriate. For the six months ended June 30, 2024, the fair value of each option grant was estimated on the date of the grant using the following weighted average assumptions: dividend yields of 0.6%; expected volatilities of 28%; risk-free interest rates of 4.1%; and expected lives of 5.0 years. For the six months ended June 30, 2023, the fair value of each option grant was estimated on the date of the grant using the following weighted average assumptions: dividend yields of 0.5%; expected volatilities of 28%; risk-free interest rates of 3.9%; and expected lives of 4.8 years.

The Company used a projected expected life for each award granted based on historical experience of employees’ exercise behavior. Expected volatility is based on the Company’s historical volatility levels. Dividend yields are based on the Company’s historical dividend yields. Risk-free interest rates are based on the implied yields currently available on U.S. Treasury zero-coupon issues with a remaining term equal to the expected life.

Other information pertaining to option activity during the three and six months ended June 30, 2024 and 2023 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Weighted-average fair value of options granted | | $ | — | | | $ | — | | | $ | 44.52 | | | $ | 40.91 | |

| Total intrinsic value of stock options exercised ($000s) | | $ | 944 | | | $ | 597 | | | $ | 11,321 | | | $ | 2,181 | |

Non-vested restricted stock activity for the six months ended June 30, 2024 and 2023 is summarized below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2024 | | 2023 |

| | Shares (000s) | | Weighted

Average Grant

Date Fair

Value | | Shares (000s) | | Weighted

Average Grant

Date Fair

Value |

| Non-vested balance as of December 31 | | 116 | | | $ | 133.06 | | | 122 | | | $ | 124.42 | |

| Granted | | 37 | | | 143.78 | | | 39 | | | 137.48 | |

| Vested | | (32) | | | 119.11 | | | (32) | | | 110.95 | |

| Forfeited | | (2) | | | 132.81 | | | (4) | | | 128.06 | |

| Non-vested balance as of June 30 | | 119 | | | $ | 140.14 | | | 125 | | | $ | 131.76 | |

Non-vested performance share activity for the six months ended June 30, 2024 and 2023 is summarized below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2024 | | 2023 |

| | Shares (000s) | | Weighted

Average Grant

Date Fair

Value | | Shares (000s) | | Weighted

Average Grant

Date Fair

Value |

| Non-vested balance as of December 31 | | 76 | | | $ | 135.25 | | | 70 | | | $ | 127.69 | |

| Granted | | 47 | | | 152.28 | | | 42 | | | 139.66 |

| Vested | | (44) | | | 106.57 | | | (36) | | | 98.84 |

| Forfeited | | — | | | — | | | — | | | — |

| Non-vested balance as of June 30 | | 79 | | | $ | 150.73 | | | 76 | | | $ | 135.25 | |

The performance share (“PS”) awards provide the recipients the right to receive a certain number of shares of the Company’s common stock in the future, subject to an EBITDA performance hurdle, where vesting is dependent upon the Company achieving a certain EBITDA percentage growth over the performance period, and relative total shareholder return (TSR) where vesting is dependent upon the Company’s TSR performance over the performance period relative to a comparator group consisting of the Russell 2000 index constituents. Expense is measured based on the fair value of the grant at the date of grant. A Monte-Carlo simulation has been used to estimate the fair value. The assumptions used in the fair value determination were risk free interest rates of 4.2% and 4.2%; dividend yields of 0.0% and 0.5%; volatilities of 25% and 32%; and initial TSR’s of 10.3% and 4.2%, in each case for the six months ended June 30, 2024 and 2023, respectively. Expense is estimated based on the number of shares expected to vest, assuming the requisite service period is rendered and the probable outcome of the performance condition is achieved. The estimate is revised if subsequent information indicates that the actual number of shares likely to vest differs from previous estimates. Expense is ultimately adjusted based on the actual achievement of service and performance targets. The PS will cliff vest 100% at the end of the third year following the grant in accordance with the performance metrics set forth. Grants may be subject to a mandatory holding period of one year from the vesting date. For PS grants made for the 2024-2026 performance period, grants are subject to such holding period.

As of June 30, 2024 and 2023, there were $26,557 and $26,244, respectively, of total unrecognized compensation costs related to non-vested share-based compensation arrangements granted under the plans. As of June 30, 2024, the unrecognized compensation cost is expected to be recognized over a weighted-average period of approximately 1.9 years. The Company estimates that share-based compensation expense for the year ended December 31, 2024 will be approximately $16,700.

Repurchase of Common Stock

The Company's Board of Directors has approved a stock repurchase program. The total authorization under this program is 3,763,038 shares. Since the inception of the program in June 1999, a total of 3,139,300 shares have been repurchased. The Company intends to acquire shares from time to time at prevailing market prices if and to the extent it deems it is advisable to do so based on its assessment of corporate cash flow, market conditions and other factors. Open market repurchases of common stock could be made pursuant to a trading plan established pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, which would permit common stock to be repurchased at a time that the Company might otherwise be precluded from doing so under insider trading laws or self-imposed trading restrictions. The Company also repurchases (withholds) shares from employees in connection with the tax settlement of vested shares and/or exercised stock options under the Company's omnibus incentive plan. Such repurchases of shares from employees are funded with existing cash on hand. During the six months ended June 30, 2024 and 2023, the Company purchased 36,194 and 28,676 shares, respectively, from employees in connection with the tax settlement of vested shares and/or exercised stock options under the Company's omnibus incentive plan at an average cost of $144.04 and $136.85, respectively.

NOTE 3 – INVENTORIES

Inventories, net of reserves at June 30, 2024 and December 31, 2023 consisted of the following:

| | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| Raw materials | | $ | 36,069 | | | $ | 39,517 | |

| Work in progress | | 6,175 | | | 3,960 | |

| Finished goods | | 74,855 | | | 66,044 | |

| Total inventories | | $ | 117,099 | | | $ | 109,521 | |

NOTE 4 – PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment at June 30, 2024 and December 31, 2023 are summarized as follows:

| | | | | | | | | | | | | | |

| | | June 30, 2024 | | December 31, 2023 |

| Land | | $ | 11,612 | | | $ | 11,787 | |

| Building | | 103,940 | | | 104,363 | |

| Equipment | | 311,096 | | | 312,704 | |

| Construction in progress | | 65,639 | | | 59,981 | |

| | | 492,287 | | | 488,835 | |

| Less: accumulated depreciation | | 219,748 | | | 212,796 | |

| Property, plant and equipment, net | | $ | 272,539 | | | $ | 276,039 | |

In accordance with Topic 360, the Company reviews long-lived assets for impairment whenever events indicate that the carrying amount of the assets may not be fully recoverable. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the asset, which is generally based on discounted cash flows. Included in "General and administrative expenses" were $6,146 of restructuring-related impairment and asset disposal charges for the three and six months ended June 30, 2023. There were no such charges related to restructuring for the three and six months ended June 30, 2024.

NOTE 5 - INTANGIBLE ASSETS

The Company had goodwill in the amount of $770,026 and $778,907 as of June 30, 2024 and December 31, 2023, respectively, subject to the provisions of ASC 350, “Intangibles-Goodwill and Other.” The decrease in goodwill is due to changes in foreign currency translation.

Identifiable intangible assets with finite lives at June 30, 2024 and December 31, 2023 are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Amortization

Period

(in years) | | Gross Carrying Amount at June 30, 2024 | | Accumulated Amortization at June 30, 2024 | | Gross Carrying Amount at December 31, 2023 | | Accumulated Amortization at December 31, 2023 |

| Customer relationships & lists | | 10-20 | | $ | 358,082 | | | $ | 216,998 | | | $ | 362,032 | | | $ | 209,651 | |

| Trademarks & trade names | | 2-17 | | 50,112 | | | 39,754 | | | 50,286 | | | 37,773 | |

| Developed technology | | 5-12 | | 40,638 | | | 18,308 | | | 41,184 | | | 17,516 | |

| Other | | 2-18 | | 26,004 | | | 23,674 | | | 25,733 | | | 23,083 | |

| | | | | $ | 474,836 | | | $ | 298,734 | | | $ | 479,235 | | | $ | 288,023 | |

Amortization of identifiable intangible assets was approximately $5,243 and $11,585 for the three and six months ended June 30, 2024, respectively, and $6,892 and $14,185 for the three and six months ended June 30, 2023, respectively. Assuming no change in the gross carrying value of identifiable intangible assets, estimated amortization expense is $7,530 for the remainder of 2024, $15,645 for 2025, $15,434 for 2026, $14,907 for 2027, $14,509 for 2028 and $14,086 for 2029. At June 30, 2024 and December 31, 2023, there were no identifiable intangible assets with indefinite useful lives as defined by ASC 350. Identifiable intangible assets are reflected in “Intangible assets with finite lives, net” on the Company’s condensed consolidated balance sheets. There were no changes to the useful lives of intangible assets subject to amortization during the six months ended June 30, 2024 and 2023.

NOTE 6 - EQUITY METHOD INVESTMENT

In 2013, the Company and Eastman Chemical Company formed a joint venture (66.66% / 33.34% ownership), St. Gabriel CC Company, LLC, to design, develop, and construct an expansion of the Company’s St. Gabriel aqueous choline chloride plant. The Company contributed the St. Gabriel plant, at cost, and all continued expansion and improvements are funded by the owners. The joint venture became operational as of July 1, 2016. St. Gabriel CC Company, LLC is a Variable Interest Entity (VIE) because the total equity at risk is not sufficient to permit the joint venture to finance its own activities without additional subordinated financial support. Additionally, voting rights (2 votes each) are not proportionate to the owners’ obligation to absorb expected losses or receive the expected residual returns of the joint venture. The Company receives up to 2/3 of the production offtake capacity and absorbs operating expenses approximately proportional to the actual percentage of offtake. The joint venture is accounted for under the equity method of accounting since the Company is not the primary beneficiary as the Company does not have the power to direct the activities of the joint venture that most significantly impact its economic performance. The Company recognized a loss of $122 and $243 for the three and six months ended June 30, 2024, respectively, and $139 and $278 for the three and six months ended June 30, 2023, respectively, relating to its portion of the joint venture's expenses in other expense. The Company made capital contributions to the investment totaling $38 and $80 for the three and six months ended June 30, 2024, respectively, and $16 and $72 for the three and six months ended June 30, 2023, respectively. The carrying value of the joint venture at June 30, 2024 and December 31, 2023 was $3,912 and $4,076, respectively, and is recorded in "Other non-current assets" on the condensed consolidated balance sheets.

NOTE 7 – REVOLVING LOAN

On July 27, 2022, the Company entered into an Amended and Restated Credit Agreement (the "2022 Credit Agreement") with certain lenders in the form of a senior secured revolving credit facility, due on July 27, 2027. The 2022 Credit Agreement allows for up to $550,000 of borrowing. The loans may be used for working capital, letters of credit, and other corporate purposes and may be drawn upon at the Company’s discretion. As of June 30, 2024 and December 31, 2023, the total balance outstanding on the 2022 Credit Agreement amounted to $266,569 and $309,569, respectively. There are no installment payments required on the revolving loans; they may be voluntarily prepaid in whole or in part without premium or penalty, and all outstanding amounts are due on the maturity date.

Amounts outstanding under the 2022 Credit Agreement are subject to an interest rate equal to a fluctuating rate as defined by the 2022 Credit Agreement plus an applicable rate. The applicable rate is based upon the Company’s consolidated net leverage ratio, as defined in the 2022 Credit Agreement, and the interest rate was 6.569% at June 30, 2024. The Company is also required to pay a commitment fee on the unused portion of the revolving loan, which is based on the Company’s consolidated net leverage ratio as defined in the 2022 Credit Agreement and ranges from 0.150% to 0.225% (0.175% at June 30, 2024). The unused portion of the revolving loan amounted to $283,431 at June 30, 2024. The Company is also required to pay, as applicable, letter of credit fees, administrative agent fees, and other fees to the arrangers and lenders.

Costs associated with the issuance of the revolving loans are capitalized and amortized on a straight-line basis over the term of the 2022 Credit Agreement, which is not materially different than the effective interest method. Capitalized costs net of accumulated amortization were $886 and $1,030 at June 30, 2024 and December 31, 2023, respectively, and are included in "Other non-current assets" on the condensed consolidated balance sheets. Amortization expense pertaining to these costs totaled $73 and $144 for both the three and six months ended June 30, 2024 and 2023 and are included in "Interest expense, net" in the accompanying condensed consolidated statements of earnings.

The 2022 Credit Agreement contains quarterly covenants requiring the consolidated leverage ratio to be less than a certain maximum ratio and the consolidated interest coverage ratio to exceed a certain minimum ratio. At June 30, 2024, the Company was in compliance with these covenants. Indebtedness under the Company’s loan agreements is secured by assets of the Company.

NOTE 8– NET EARNINGS PER SHARE

The following presents a reconciliation of the net earnings and shares used in calculating basic and diluted net earnings per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net Earnings - Basic and Diluted | | $ | 32,069 | | | $ | 30,110 | | | $ | 61,055 | | | $ | 52,820 | |

| | | | | | | | |

| Shares (000s) | | | | | | | | |

| Weighted Average Common Shares - Basic | | 32,310 | | | 32,110 | | | 32,280 | | | 32,094 | |

| Effect of Dilutive Securities – Stock Options, Restricted Stock, and Performance Shares | | 339 | | | 324 | | | 358 | | | 330 | |

| Weighted Average Common Shares - Diluted | | 32,649 | | | 32,434 | | | 32,638 | | | 32,424 | |

| | | | | | | | |

| Net Earnings Per Share - Basic | | $ | 0.99 | | | $ | 0.94 | | | $ | 1.89 | | | $ | 1.65 | |

| Net Earnings Per Share - Diluted | | $ | 0.98 | | | $ | 0.93 | | | $ | 1.87 | | | $ | 1.63 | |

The number of anti-dilutive shares were 339,366 and 357,534 for the three and six months ended June 30, 2024, respectively, and 352,759 and 391,269 for the three and six months ended June 30, 2023, respectively. Anti-dilutive shares could potentially dilute basic earnings per share in future periods and therefore, were not included in diluted earnings per share.

NOTE 9 – INCOME TAXES

The Company’s effective tax rate for the three months ended June 30, 2024 and 2023, was 22.2% and 21.6%, respectively. The higher effective tax rate for the quarter was primarily due to lower tax benefits from stock-based compensation and certain higher state taxes, partially offset by certain lower foreign taxes. The effective tax rate was 21.8% for each of the six months ended June 30, 2024 and 2023. Certain lower foreign taxes for the six months ended June 30, 2024 were offset by certain higher state taxes.

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company regularly reviews its deferred tax assets for recoverability and would establish a valuation allowance if it believed that such assets may not be recovered, taking into consideration historical operating results, expectations of future earnings, changes in its operations and the expected timing of the reversals of existing temporary differences.

The Company accounts for uncertainty in income taxes utilizing ASC 740-10, "Income Taxes". ASC 740-10 clarifies whether or not to recognize assets or liabilities for tax positions taken that may be challenged by a tax authority. It prescribes a recognition threshold and measurement attribute for financial statement disclosure of tax positions taken or expected to be taken. This interpretation also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, and disclosures. The application of ASC 740-10 requires judgment related to the uncertainty in income taxes and could impact our effective tax rate.

The Company files income tax returns in the U.S. and in various states and foreign countries. As of June 30, 2024, in the major jurisdictions where the Company operates, it is generally no longer subject to income tax examinations by tax authorities for years before 2019. The Company had approximately $4,766 and $4,650 of unrecognized tax benefits, which are included in "Other long-term obligations" on the Company’s condensed consolidated balance sheets, as of June 30, 2024 and December 31, 2023, respectively. The Company includes interest expense or income as well as potential penalties on uncertain tax positions as a component of "Income tax expense" in the condensed consolidated statements of earnings. Total accrued interest and penalties related to uncertain tax positions at June 30, 2024 and December 31, 2023 were approximately $1,530 and $1,413, respectively, and are included in "Other long-term obligations" on the Company’s condensed consolidated balance sheets.

The European Union ("EU") member states formally adopted the EU's Pillar Two Directive on December 15, 2022, which was established by the Organization for Economic Co-operation and Development. Pillar Two generally provides for a 15 percent minimum effective tax rate for the jurisdictions where multinational enterprises operate. While the Company does not anticipate that this will have a material impact on its tax provision or effective tax rate, the Company continues to monitor evolving tax legislation in the jurisdictions in which it operates.

NOTE 10 – SEGMENT INFORMATION

Balchem Corporation reports three reportable segments: Human Nutrition and Health, Animal Nutrition and Health, and Specialty Products. Sales and production of products outside of our reportable segments and other minor business activities are included in "Other and Unallocated".

The segment information is summarized as follows:

| | | | | | | | | | | | | | |

| Business Segment Assets | | June 30,

2024 | | December 31,

2023 |

| Human Nutrition and Health | | $ | 1,171,962 | | | $ | 1,180,527 | |

| Animal Nutrition and Health | | 155,919 | | | 166,994 | |

| Specialty Products | | 166,306 | | | 168,307 | |

Other and Unallocated (1) | | 80,779 | | | 81,383 | |

| Total | | $ | 1,574,966 | | | $ | 1,597,211 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business Segment Net Sales | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Human Nutrition and Health | | $ | 147,928 | | | $ | 135,669 | | | $ | 300,672 | | | $ | 268,322 | |

| Animal Nutrition and Health | | 49,557 | | | 61,329 | | | 103,478 | | | 126,218 | |

| Specialty Products | | 35,094 | | | 32,726 | | | 66,707 | | | 64,957 | |

Other and Unallocated (2) | | 1,502 | | | 1,528 | | | 2,883 | | | 4,295 | |

| Total | | $ | 234,081 | | | $ | 231,252 | | | $ | 473,740 | | | $ | 463,792 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business Segment Earnings Before Income Taxes | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Human Nutrition and Health | | $ | 33,367 | | | $ | 27,499 | | | $ | 66,624 | | | $ | 45,934 | |

| Animal Nutrition and Health | | 2,693 | | | 7,662 | | | 4,753 | | | 17,160 | |

| Specialty Products | | 11,228 | | | 9,298 | | | 19,427 | | | 17,244 | |

Other and Unallocated (2) | | (1,491) | | | (1,623) | | | (3,331) | | | (3,094) | |

| Interest and other expenses | | (4,571) | | | (4,436) | | | (9,397) | | | (9,725) | |

| Total | | $ | 41,226 | | | $ | 38,400 | | | $ | 78,076 | | | $ | 67,519 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Depreciation/Amortization | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Human Nutrition and Health | | $ | 8,386 | | | $ | 9,265 | | | $ | 17,926 | | | $ | 18,927 | |

| Animal Nutrition and Health | | 2,096 | | | 2,123 | | | 4,198 | | | 3,768 | |

| Specialty Products | | 1,765 | | | 1,811 | | | 3,544 | | | 3,609 | |

Other and Unallocated (2) | | 259 | | | 229 | | | 506 | | | 770 | |

| Total | | $ | 12,506 | | | $ | 13,428 | | | $ | 26,174 | | | $ | 27,074 | |

| | | | | | | | | | | | | | |

Capital Expenditures | | Six Months Ended June 30, |

| | | 2024 | | 2023 |

| Human Nutrition and Health | | $ | 7,697 | | | $ | 13,785 | |

| Animal Nutrition and Health | | 4,332 | | | 2,130 | |

| Specialty Products | | 1,245 | | | 1,447 | |

Other and Unallocated (2) | | 173 | | | 151 | |

| Total | | $ | 13,447 | | | $ | 17,513 | |

| | |

(1) Other and Unallocated assets consist of certain cash, capitalized loan issuance costs, other assets, investments, and income taxes, which the Company does not allocate to its individual business segments. It also includes assets associated with a few minor businesses which individually do not meet the quantitative thresholds for separate presentation. |

|

(2) Other and Unallocated consists of a few minor businesses which individually do not meet the quantitative thresholds for separate presentation and corporate expenses that have not been allocated to a segment. Unallocated corporate expenses consist of: (i) Transaction and integration costs of $132 and $572 for the three and six months ended June 30, 2024, respectively, and $651 and $1,216 for the three and six months ended June 30, 2023, respectively, and (ii) Unallocated amortization expense of $0 and $0 for the three and six months ended June 30, 2024, respectively, and $0 and $312 for the three and six months ended June 30, 2023, respectively, related to an intangible asset in connection with a company-wide ERP system implementation. |

NOTE 11 – REVENUE

Revenue Recognition

Revenues are recognized when control of the promised goods is transferred to customers, in an amount that reflects the consideration the Company expects to realize in exchange for those goods.

The following table presents revenues disaggregated by revenue source. Sales and usage-based taxes are excluded from revenues.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Product Sales Revenue | | $ | 233,726 | | | $ | 230,473 | | | $ | 472,852 | | | $ | 462,233 | |

| Royalty Revenue | | 355 | | | 779 | | | 888 | | | 1,559 | |

| Total Revenue | | $ | 234,081 | | | $ | 231,252 | | | $ | 473,740 | | | $ | 463,792 | |

The following table presents revenues disaggregated by geography, based on the shipping addresses of customers:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| United States | | $ | 177,692 | | | $ | 171,450 | | | $ | 359,778 | | | $ | 338,334 | |

| Foreign Countries | | 56,389 | | | 59,802 | | | 113,962 | | | 125,458 | |

| Total Revenue | | $ | 234,081 | | | $ | 231,252 | | | $ | 473,740 | | | $ | 463,792 | |

Product Sales Revenues

The Company’s primary operation is the manufacturing and sale of health and nutrition ingredient products, in which the Company receives an order from a customer and fulfills that order. The Company’s product sales are considered point-in-time revenue.

Royalty Revenues

Royalty revenue consists of agreements with customers to use the Company’s intellectual property in exchange for a sales-based royalty. Royalties are considered over time revenue and are recorded in the Human Nutrition and Health segment.

Contract Liabilities

The Company records contract liabilities when cash payments are received or due in advance of performance, including amounts which are refundable.

The Company’s payment terms vary by the type and location of customers and the products offered. The term between invoicing and when payment is due is not significant. For certain products or services and customer types, the Company requires payment before the products are delivered to the customer.

Practical Expedients and Exemptions

The Company generally expenses sales commissions when incurred because the amortization period would have been one year or less. These costs are recorded within selling and marketing expenses.

The Company does not disclose the value of unsatisfied performance obligations for (i) contracts with an original expected length of one year or less and (ii) contracts for which the Company recognizes revenue at the amount to which it has the right to invoice for products shipped.

NOTE 12 – SUPPLEMENTAL CASH FLOW INFORMATION

Cash paid during the six months ended June 30, 2024 and 2023 for income taxes and interest is as follows:

| | | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2024 | | 2023 |

| Income taxes | | $ | 19,140 | | | $ | 20,471 | |

| Interest | | $ | 10,155 | | | $ | 13,454 | |

NOTE 13 – ACCUMULATED OTHER COMPREHENSIVE (LOSS) INCOME

The changes in accumulated other comprehensive (loss) income were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Net foreign currency translation adjustment | | $ | (3,260) | | | $ | (1,116) | | | $ | (15,977) | | | $ | 8,308 | |

| | | | | | | | |

Net change of cash flow hedge (see Note 19 for further

information) | | | | | | | | |

| Unrealized loss on cash flow hedge | | — | | | (730) | | | — | | | (1,406) | |

| Tax | | — | | | 176 | | | — | | | 341 | |

| Net of tax | | — | | | (554) | | | — | | | (1,065) | |

| | | | | | | | |

Net change in postretirement benefit plan (see Note 14 for

further information) | | | | | | | | |

| Amortization of (gain) loss | | (2) | | | 2 | | | (5) | | | 4 | |

| Prior service loss arising during the period | | — | | | — | | | 206 | | | 132 | |

| Total before tax | | (2) | | | 2 | | | 201 | | | 136 | |

| Tax | | — | | | — | | | (49) | | | (34) | |

| Net of tax | | (2) | | | 2 | | | 152 | | | 102 | |

| | | | | | | | |

| Total other comprehensive (loss) income | | $ | (3,262) | | | $ | (1,668) | | | $ | (15,825) | | | $ | 7,345 | |

Included in "Net foreign currency translation adjustment" were losses of $434 and $1,455 related to a net investment hedge, which were net of tax benefits of $782 and $1,114 for the three and six months ended June 30, 2023, respectively. The Company settled its derivative instruments on their maturity date of June 27, 2023. See Note 19, Derivative Instruments and Hedging Activities.

Accumulated other comprehensive (loss) income at June 30, 2024 and December 31, 2023 consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Foreign currency

translation

adjustment | | Cash flow hedge | | Postretirement

benefit plan | | Total |

| Balance December 31, 2023 | | $ | 8,408 | | | $ | — | | | $ | 283 | | | $ | 8,691 | |

| Other comprehensive (loss) income | | (15,977) | | | — | | | 152 | | | (15,825) | |

| Balance June 30, 2024 | | $ | (7,569) | | | $ | — | | | $ | 435 | | | $ | (7,134) | |

NOTE 14 – EMPLOYEE BENEFIT PLANS

Defined Contribution Plans

The Company sponsors one 401(k) savings plan for eligible employees, which allows participants to make pretax or after tax contributions and the Company matches certain percentages of those contributions. The plan also has a discretionary profit sharing portion and matches 401(k) contributions with shares of the Company’s Common Stock. All amounts contributed to the plan are deposited into a trust fund administered by independent trustees.

Postretirement Medical Plans

The Company provides postretirement benefits in the form of two unfunded postretirement medical plans; one that is under a collective bargaining agreement and covers eligible retired employees of the Verona facility and one for officers of the Company pursuant to the Balchem Corporation Officer Retiree Program.

Net periodic benefit costs for such retirement medical plans were as follows:

| | | | | | | | | | | | | | |

| | | Six Months Ended June 30, |

| | | 2024 | | 2023 |

| Service cost | | $ | 56 | | | $ | 54 | |

| Interest cost | | 28 | | | 31 | |

| Amortization of (gain) loss | | (5) | | | 4 | |

| Net periodic benefit cost | | $ | 79 | | | $ | 89 | |

The amounts recorded for these obligations on the Company’s condensed consolidated balance sheets as of June 30, 2024 and December 31, 2023 are $1,336 and $1,395, respectively, and are included in "Other long-term obligations" on the Company's condensed consolidated balance sheets. These plans are unfunded and approved claims are paid from Company funds. Historical cash payments made under such plans have typically been less than $200 per year.

Defined Benefit Pension Plans

On May 27, 2019, the Company acquired Chemogas Holding NV, a privately held specialty gases company headquartered in Grimbergen, Belgium ("Chemogas"), which has an unfunded defined benefit pension plan. The plan provides for the payment of a lump sum at retirement or payments in case of death of the covered employees. The amounts recorded for these obligations on the Company's condensed consolidated balance sheets as of June 30, 2024 and December 31, 2023 were $393 and $420, respectively, and were included in "Other long-term obligations" on the Company's condensed consolidated balance sheets.

Net periodic benefit costs for such benefit pension plans were as follows:

| | | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | | 2024 | | 2023 |

| Service cost with interest to end of year | | $ | 37 | | | $ | 32 | |

| Interest cost | | 28 | | | 32 | |

| Expected return on plan assets | | (21) | | | (21) | |

| Total net periodic benefit cost | | $ | 44 | | | $ | 43 | |

Deferred Compensation Plan

The Company provides an unfunded, nonqualified deferred compensation plan maintained for the benefit of a select group of management or highly compensated employees. Assets of the plan are held in a rabbi trust, and are subject to additional risk of loss in the event of bankruptcy or insolvency of the Company. The deferred compensation liability was $10,965 as of June 30, 2024, of which $10,946 was included in "Other long-term obligations" and $19 was included in "Accrued compensation and other benefits" on the Company's condensed consolidated balance sheets. The deferred compensation liability was $10,188 as of December 31, 2023 and was included in "Other long-term obligations" on the Company’s condensed consolidated balance sheets. The related assets of the irrevocable trust funds (also known as "rabbi trust funds") were $10,962 and $10,188 as of June 30, 2024 and December 31, 2023, respectively, and were included in "Other non-current assets" on the Company's condensed consolidated balance sheets.

NOTE 15 – COMMITMENTS AND CONTINGENCIES

The Company is obligated to make rental payments under non-cancelable operating and finance leases. Aggregate future minimum rental payments required under these leases at June 30, 2024 are disclosed in Note 18, Leases.

The Company’s Verona, Missouri facility, while held by a prior owner, Syntex Agribusiness, Inc. (“Syntex”), was designated by the U.S. Environmental Protection Agency (the "EPA") as a Superfund site and placed on the National Priorities List in 1983 because of dioxin contamination on portions of the site. Remediation was conducted by Syntex under the oversight of the EPA and the Missouri Department of Natural Resources. The Company is indemnified by the sellers under its May 2001 asset purchase agreement covering its acquisition of the Verona, Missouri facility for potential liabilities associated with the Superfund site. One of the sellers, in turn, has the benefit of certain contractual indemnification by Syntex in relation to the implementation of the above-described Superfund remedy. In June 2023, in response to a Special Notice Letter received from the EPA in 2022, BCP Ingredients, Inc. ("BCP"), the Company's subsidiary that operates the site, Syntex, EPA, and the State of Missouri entered into an Administrative Settlement Agreement and Order on Consent (“ASAOC”) for a focused remedial investigation/feasibility study ("RI/FS") under which (a) BCP will conduct a source investigation of potential source(s) of releases of 1,4-dioxane and chlorobenzene at a portion of the site and (b) BCP and Syntex will complete a RI/FS to determine a potential remedy, if any is required. Activities under the ASAOC are underway and are expected to continue for some period of time.

Separately, in June 2022, the EPA conducted an inspection of BCP’s Verona, Missouri facility (“2022 EPA Inspection”) which was followed by BCP entering into an Administrative Order for Compliance on Consent (“AOC”) with the EPA in relation to its risk management program at the Verona facility. Further, in January 2023, BCP entered into an Amended AOC with the EPA whereby the parties agreed to the extension of certain timelines. BCP timely completed all requirements under the Amended AOC. In November 2023, BCP received a notice from the Environment and Natural Resources Division of the U.S Department of Justice (“DOJ”) primarily related to the 2022 EPA Inspection, which extended the opportunity to discuss alleged violations of Sections 112(r)(7) of the Clean Air Act and regulations in 40 C.F.R. Part 68, commonly known as the Risk Management Plan Rule (“RMP Rule”). BCP has engaged in, and intends to continue to participate in, such discussions in 2024. In connection with the 2022 EPA Inspection, the Company believes that a loss contingency in this matter is probable and reasonably estimable and has recorded a loss contingency in an amount that is not material to its financial performance or operations.

In addition to the above, from time to time, the Company is a party to various legal proceedings, litigation, claims and assessments. While it is not possible to predict the ultimate disposition of each of these matters, management believes that the ultimate outcome of such matters will not have a material effect on the Company's consolidated financial position, results of operations, liquidity or cash flows.

NOTE 16 – FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company has a number of financial instruments, none of which are held for trading purposes. The Company estimates that the fair value of all financial instruments at June 30, 2024 and December 31, 2023 does not differ materially from the aggregate carrying values of its financial instruments recorded in the accompanying condensed consolidated balance sheets. The estimated fair value amounts have been determined by the Company using available market information and appropriate valuation methodologies. Considerable judgment is necessarily required in interpreting market data to develop the estimates of fair value, and, accordingly, the estimates are not necessarily indicative of the amounts that the Company could realize in a current market exchange. The carrying value of debt approximates fair value as the interest rate is based on market and the Company’s consolidated leverage ratio. The Company’s financial instruments also include cash equivalents, accounts receivable, accounts payable, and accrued liabilities, which are carried at cost and approximate fair value due to the short-term maturity of these instruments. Cash and cash equivalents at June 30, 2024 and December 31, 2023 includes $5,472 and $959 in money market funds and other interest-bearing deposit accounts, respectively.

Non-current assets at June 30, 2024 and December 31, 2023 included $10,962 and $10,188, respectively, of rabbi trust funds related to the Company's deferred compensation plan. The money market and rabbi trust funds are valued using level one inputs, as defined by ASC 820, “Fair Value Measurement.”