Filed Pursuant to Rule 424(b)(3)

Registration No. 333-261679

PROSPECTUS

20,143,404 Shares of Common Stock

This prospectus relates to the

offer and resale of up to 20,143,404 shares (the “Shares”) of our common stock, $0.0001 per share (the “Common

Stock”), by B. Riley Principal Capital, LLC (the “Selling Stockholder”). The shares included in this prospectus

consist of shares of Common Stock that we have issued or that we may, in our discretion, elect to issue and sell to the Selling Stockholder,

from time to time after the date of this prospectus, pursuant to a common stock purchase agreement we entered into with the Selling Stockholder

on December 15, 2021 (the “Purchase Agreement”), in which the Selling Stockholder has committed to purchase from us,

at our direction, up to $100,000,000 of our Common Stock, subject to terms and conditions specified in the Purchase Agreement. Concurrently

with our execution of the Purchase Agreement on December 15, 2021, we issued 197,628 shares of Common Stock (the “Commitment

Shares”) to the Selling Stockholder as consideration for its irrevocable commitment to purchase shares of our Common Stock at

our election in our sole discretion, from time to time after the date of this prospectus, upon the terms and subject to the satisfaction

of the conditions set forth in the Purchase Agreement. See the section titled “Committed Equity Financing” for a description

of the Purchase Agreement and the section titled “Selling Stockholder” for additional information regarding the Selling

Stockholder.

We are not selling any shares of

Common Stock being offered by this prospectus and will not receive any of the proceeds from the sale of such shares by the Selling Stockholder.

However, we may receive up to $100,000,000 in aggregate gross proceeds from sales of our Common Stock to the Selling Stockholder that

we may, in our discretion, elect to make, from time to time after the date of this prospectus, pursuant to the Purchase Agreement.

The

Selling Stockholder may sell or otherwise dispose of the shares of Common Stock included in this prospectus in a number of different ways

and at varying prices. See the section titled “Plan of Distribution” for more information about how the Selling Stockholder

may sell or otherwise dispose of the Common Stock being offered in this prospectus. The Selling Stockholder is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”).

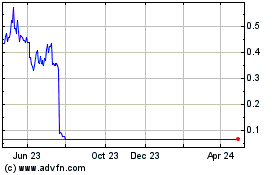

The Common Stock is listed on the

Nasdaq Global Select Market (“Nasdaq”) under the symbol “APPH”. On March 10, 2022, the last reported sales

price of the Common Stock as reported on Nasdaq was $5.38 per share.

We are incorporated in Delaware

as a public benefit corporation. See the section titled “Prospectus Summary — Public Benefit Corporation.”

Investing

in our securities involves a high degree of risks. You should review carefully the risks and uncertainties described in the section

titled “Risk Factors” beginning on page 5 of this prospectus, and under similar headings in any amendments or

supplements to this prospectus and the documents incorporated herein by reference.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon

the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus

dated March 11, 2022

TABLE OF CONTENTS

Page

You

should rely only on the information contained in this prospectus, information incorporated by reference into this prospectus or any applicable

prospectus supplement filed with the Securities and Exchange Commission (the “SEC”). Neither we nor the Selling

Stockholder have authorized anyone to provide you with additional information or information different from that contained in this prospectus

filed with the SEC. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others

may give you. The Selling Stockholder is offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers

and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of

the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects

may have changed since that date.

For investors outside of the United States: Neither

we nor the Selling Stockholder have done anything that would permit this offering or possession or distribution of this prospectus in

any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come

into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities

and the distribution of this prospectus outside the United States.

To

the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in

any document incorporated by reference filed with the SEC before the date of this prospectus, on the other hand, you should rely on the

information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document

incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier

statement.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the SEC using the “shelf” registration process. Under this shelf registration process, the Selling Stockholder

may, from time to time, sell the securities described in this prospectus. We will not receive any proceeds from the sale by such Selling

Stockholder of the securities described in this prospectus.

Neither we nor the Selling Stockholder have authorized

anyone to provide you with any information or to make any representations other than those contained in or incorporated by reference into

this prospectus or any applicable prospectus supplement. Neither we nor the Selling Stockholder take responsibility for, and can provide

no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Stockholder will make

an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or

post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus.

You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement

together with the additional information to which we refer you in the sections of this prospectus titled “Where You Can Find

More Information” and “Incorporation of Certain Information by Reference.”

Unless the context indicates otherwise, references

in this prospectus to the “Company,” “AppHarvest,” “we,” “us,” “our” and similar

terms refer to AppHarvest, Inc. and its consolidated subsidiaries.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements that may constitute

“forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. All statements contained

in this prospectus other than statements of historical fact, including statements regarding our future results of operations and financial

position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believes,”

“expects,” “intends,” “estimates,” “projects,” “anticipates,” “will,”

“plan,” “design,” “may,” “should,” or similar language are intended to identify forward-looking

statements. These statements speak only as of the date of this prospectus and involve known and unknown risks, uncertainties and other

important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements. We have based these forward-looking statements largely on our

current expectations and projections about future events and financial trends that we believe may affect our business, financial condition

and results of operations. These forward-looking statements include, without limitation, statements about:

| · | our financial and business performance, including financial

projections and business metrics and any underlying assumptions thereunder; |

| · | our ability to obtain funding for our future operations; |

| · | changes in our strategy, future operations, financial position,

estimated revenues and losses, projected costs, prospects and plans; |

| · | our ability to successfully construct controlled environment

agriculture facilities, which may be subject to unexpected costs and delays; |

| · | our business, expansion plans and opportunities; |

| · | the outcome of any known and unknown litigation and regulatory

proceedings; |

| · | the implementation, market acceptance and success of our business

model; |

| · | our ability to scale in a cost-effective manner; |

| · | developments and projections relating to our competitors and

industry; |

| · | the impact of health epidemics, including the COVID-19 pandemic,

on our business and the actions we may take in response thereto; |

| · | our expectations regarding our ability to obtain and maintain

intellectual property protection and not infringe on the rights of others; |

| · | our ability to maintain our status as a Certified B Corporation; |

| · | our future capital requirements and sources and uses of cash; |

| · | changes in applicable laws or regulations; and |

| · | other risks and uncertainties described under the heading “Risk

Factors” in our Annual Report on Form 10-K and under similar headings in the other documents we file with the SEC that are

incorporated by reference into this prospectus. |

The foregoing list of forward-looking statements

is not exhaustive. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted

or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future

events. Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus or any documents

incorporated by reference herein and any prospectus supplement, the events and circumstances reflected in our forward-looking statements

may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements.

Moreover, we operate in an evolving environment.

New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and

uncertainties. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus or any documents

incorporated by reference herein and any prospectus supplement will prove to be accurate. Except as required by applicable law, we do

not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future

events, changed circumstances or otherwise, except as required by law.

You should read this prospectus, any documents

incorporated by reference herein and the documents that we reference in this prospectus and have filed as exhibits to the registration

statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially

different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

In addition, statements that “we believe”

and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available

to us as of the date of the statement is made, and while we believe such information forms a reasonable basis for such statements, such

information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry

into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned

not to unduly rely upon these statements.

PROSPECTUS SUMMARY

This summary highlights selected information contained

elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you should

consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including

the risks of investing in our securities discussed under the heading “Risk Factors” contained in this prospectus and any applicable

prospectus supplement, and under similar headings in the other documents that are incorporated by reference in this prospectus. You should

also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits

to the registration statement of which this prospectus is a part.

Overview

We were founded on January 19, 2018. Together with

our subsidiaries, we are an applied agricultural technology company in Appalachia developing and operating some of the world’s largest

high-tech indoor farms, which are designed to grow non-GMO produce, free of or with minimal chemical pesticide residues, use primarily

rainwater, and produce significantly higher yields than those yields achieved by traditional agriculture on the same amount of land. We

combine conventional agricultural techniques with cutting-edge technology, including artificial intelligence and robotics, to improve

access to nutritious food, farming more sustainably, building a domestic food supply, and increasing investment in Appalachia.

Public Benefit Corporation

Under Delaware law, a public benefit

corporation is required to identify in its certificate of incorporation the public benefit or benefits it will promote and its directors

have a duty to manage the affairs of the corporation in a manner that balances the pecuniary interests of the corporation’s stockholders,

the best interests of those materially affected by the corporation’s conduct, and the specific public benefit or public benefits

identified in the public benefit corporation’s certificate of incorporation. Public benefit corporations organized in Delaware are

also required to assess their benefit performance internally and to disclose to stockholders at least biennially a report detailing their

success in meeting their benefit objectives.

As provided in our amended and restated certificate

of incorporation, the public benefits that we promote, and pursuant to which we manage our company, are empowering individuals in Appalachia,

driving positive environmental change in the agriculture industry, and improving the lives of our employees and the community at large.

Being a public benefit corporation underscores our commitment to our purpose and our stakeholders, including farmers and suppliers, consumers

and customers, communities and the environment and stockholders.

Certified B Corporation

While not required by Delaware

law or the terms of our amended and restated certificate of incorporation, we have elected to have our social and environmental performance,

accountability and transparency assessed against the proprietary criteria established by an independent non-profit organization. As a

result of this assessment, in December 2019, we were designated as a Certified B Corporation.

Committed Equity Financing

On

December 15, 2021, we entered into a purchase agreement (the “Purchase Agreement”) and a registration rights agreement

(the “Registration Rights Agreement”), with B. Riley Principal Capital, LLC (the “Selling Stockholder”

or “B. Riley Principal Capital”). Pursuant to the Purchase Agreement, from and after our initial satisfaction of all

of the conditions set forth in the Purchase Agreement (the “Commencement”), which occurred on December 29, 2021 (the

“Commencement Date”), we have the right to sell to B. Riley Principal Capital up to $100 million of shares of our

Common Stock (the “Total Commitment”), subject to certain limitations and conditions set forth in the Purchase Agreement,

from time to time during the 24-month period beginning on the Commencement Date. Sales of Common Stock to B. Riley Principal Capital

under the Purchase Agreement, and the timing of any such sales, are solely at our option, and we

are under no obligation to sell any securities to B. Riley Principal Capital under the Purchase Agreement. In accordance with our obligations

under the Registration Rights Agreement, on December 16, 2021, we filed a registration statement on Form S-1 (the "Registration Statement")

with the SEC to register under the Securities Act the resale by B. Riley Principal Capital of up to 20,143,404 shares of Common Stock,

consisting of 197,628 shares of Common Stock that we issued to B. Riley Principal Capital in consideration of its commitment to purchase

shares of Common Stock at our election under to the Purchase Agreement (the “Commitment Shares”), and up to 19,945,776

shares of Common Stock that we may elect, in our sole discretion, to issue and sell to B. Riley Principal

Capital, from time to time from and after the Commencement Date. The Registration Statement was declared effective by the SEC on December 23, 2021. We have not sold any shares of

our common stock to B. Riley Principal Capital since the Commencement Date. On March 8, 2022, we filed a post-effective amendment to

the Registration Statement to convert the Registration Statement into a registration statement on Form S-3, which the SEC declared effective on March 11, 2022. Please see the section titled

“Committed Equity Financing” for more information.

There are substantial risks to

our stockholders as a result of the sale and issuance of Common Stock to B. Riley Principal Capital under the Purchase Agreement. These

risks include substantial dilution, significant declines in our stock price and our inability to draw sufficient funds when needed. See

the section titled “Risk Factors.” Issuances of our Common Stock in this offering will not affect the rights or privileges

of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted as a

result of any such issuance. Although the number of shares of Common Stock that our existing stockholders own will not decrease, the shares

owned by our existing stockholders will represent a smaller percentage of our total outstanding shares after any such issuance to B. Riley

Principal Capital.

Corporate Information

On January 29, 2021, AppHarvest Operations,

Inc. (f/k/a AppHarvest, Inc., “Legacy AppHarvest”), a Delaware public benefit corporation, Novus Capital

Corporation, a Delaware corporation (“Novus”), ORGA, Inc., a Delaware corporation and wholly-owned subsidiary of

Novus (“Merger Sub”), consummated the closing of the transactions contemplated by a Business Combination

Agreement, dated September 28, 2020 (the “Business Combination Agreement”), following the approval at a special

meeting of the stockholders of Novus held on January 29, 2021. Pursuant to the terms of the Business Combination Agreement, a

business combination of Legacy AppHarvest and Novus was effected through the merger of Legacy AppHarvest with and into Merger Sub,

with Legacy AppHarvest surviving as a wholly owned subsidiary of Novus (the “Business Combination”). On the

closing of the Business Combination, Legacy AppHarvest changed its name to AppHarvest Operations, Inc. and Novus changed its

name from Novus Capital Corporation to AppHarvest, Inc.

Our

principal executive offices are located at 500 Appalachian Way, Morehead, Kentucky and our telephone number is (606) 653-6100. Our corporate

website address is www.appharvest.com. Information contained on or accessible through our website is not a part of this

prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

“AppHarvest”

and our other registered and common law trade names, trademarks and service marks are property of AppHarvest, Inc. This prospectus contains

additional trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for

convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols.

THE OFFERING

| Shares of Common Stock offered by the Selling Stockholder . . . |

|

Up to 20,143,404 shares of Common Stock, consisting of: |

| |

|

|

| |

|

• 197,628 Commitment Shares that we issued to the Selling Stockholder upon execution of the Purchase Agreement in consideration of its commitment to purchase shares of Common Stock at our election under the Purchase Agreement; and |

| |

|

|

| |

|

• Up to 19,945,776 shares (the “Purchase Shares”) we may elect, in our sole discretion, to issue and sell to the Selling Stockholder under the Purchase Agreement. |

| |

|

|

| Shares of Common Stock outstanding . . . . . . . . . . . . . |

|

101,135,849 shares of Common Stock |

| |

|

|

| Shares of Common Stock outstanding after giving effect to the issuance of the shares registered hereunder . . . . . . . |

|

121,081,625 shares of Common Stock |

| |

|

|

| Use of proceeds . . . . . . . . . . . . |

|

We will not receive any proceeds from the resale of shares of Common Stock included in this prospectus by the Selling Stockholder. However, we may receive up to $100 million in aggregate gross proceeds under the Purchase Agreement from sales of Common Stock that we may elect to make to the Selling Stockholder pursuant to the Purchase Agreement, if any, from time to time in our sole discretion. |

| |

|

|

| |

|

We expect to use the net proceeds that we receive from sales of our Common Stock to the Selling Stockholder, if any, under the Purchase Agreement for working capital and general corporate purposes. |

| |

|

|

| |

|

See the section titled “Use of Proceeds.” |

| |

|

|

| Risk factors . . . . . . . . . . . . . . |

|

See the section titled “Risk Factors” and the other information included in this prospectus and in the documents incorporated by reference for a discussion of factors you should consider carefully before deciding to invest in our Common Stock. |

| |

|

|

| The Nasdaq Global Select Market trading symbol . . . . . |

|

“APPH” |

The number of shares of Common Stock to be outstanding

is based on 101,135,849 shares of Common Stock outstanding as of December 31, 2021, and excludes:

| · | 6,324,944 shares of Common Stock issuable upon the settlement of restricted stock units granted under the 2021 Equity Incentive Plan

and 2018 Equity Incentive Plan; |

| · | 2,808,482 shares of Common Stock issuable upon the exercise of outstanding options with a weighted average exercise price of $0.3288

per share granted under the 2021 Equity Incentive Plan and 2018 Equity Incentive Plan; |

| · | 9,916,820 shares of Common Stock reserved for future issuance under the 2021 Equity Incentive Plan; |

| · | 1,966,656 shares of Common Stock reserved for future issuance under our 2021 Employee Stock Purchase Plan; and |

| · | 13,241,717 shares of Common Stock issuable upon the exercise of outstanding warrants with an exercise

price of $11.50 per share. |

RISK

FACTORS

Investing in our Common Stock involves a high

degree of risk. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Special

Note Regarding Forward-Looking Statements,” you should carefully consider the risks and uncertainties described below together with

the risk factors incorporated by reference to our most recent Annual Report on Form 10-K, any subsequent Quarterly Reports on Form 10-Q

or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated

by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement

before acquiring our Common Stock. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial

may become material and adversely affect our business. The occurrence of any of these risks might cause you to lose all or part of your

investment in the Common Stock.

Risks Related to the Offering

It is not possible to predict

the actual number of shares we will sell under the Purchase Agreement to the Selling Stockholder, or the actual gross proceeds resulting

from those sales. Further, we may not have access to the full amount available under the Purchase Agreement with the Selling Stockholder.

On December 15, 2021, we entered into the Purchase

Agreement with the Selling Stockholder, pursuant to which the Selling Stockholder has committed to purchase up to $100 million of our

Common Stock, subject to certain limitations and conditions set forth in the Purchase Agreement. The shares of our Common Stock that may

be issued under the Purchase Agreement may be sold by us to the Selling Stockholder at our discretion from time to time over an approximately

24-month period commencing on the Commencement Date.

We generally have the right to control the timing

and amount of any sales of our shares of Common Stock to the Selling Stockholder under the Purchase Agreement. Sales of our Common Stock,

if any, to the Selling Stockholder under the Purchase Agreement will depend upon market conditions and other factors to be determined

by us. We may ultimately decide to sell to the Selling Stockholder all, some or none of the shares of our Common Stock that may be available

for us to sell to the Selling Stockholder pursuant to the Purchase Agreement.

Because the purchase price per share to be paid

by the Selling Stockholder for the shares of Common Stock that we may elect to sell to the Selling Stockholder under the Purchase Agreement,

if any, will fluctuate based on the market prices of our Common Stock during the applicable Purchase Valuation Period for each

Purchase made pursuant to the Purchase Agreement, if any, it is not possible for us to predict, as of the date of this prospectus and

prior to any such sales, the number of shares of Common Stock that we will sell to the Selling Stockholder under the Purchase Agreement,

the purchase price per share that the Selling Stockholder will pay for shares purchased from us under the Purchase Agreement, or the aggregate

gross proceeds that we will receive from those purchases by the Selling Stockholder under the Purchase Agreement, if any.

Moreover, although the Purchase Agreement provides

that we may sell up to an aggregate of $100 million of our Common Stock to the Selling Stockholder, only 20,143,404 shares of our Common

Stock (197,628 of which represent the Commitment Shares we issued to the Selling Stockholder upon signing the Purchase Agreement as payment

of a commitment fee for the Selling Stockholder’s obligation to purchase shares of our Common Stock under the Purchase Agreement)

are being registered for resale under the registration statement that includes this prospectus. If after the Commencement Date we elect

to sell to the Selling Stockholder all of the 19,945,776 shares of Common Stock being registered for resale under this prospectus that

are available for sale by us to the Selling Stockholder in Purchases and Additional Purchases under the Purchase

Agreement, depending on the market prices of our Common Stock during the applicable Purchase Valuation Period and Additional Purchase

Valuation Period for each Purchase and each Additional Purchase, respectively, made pursuant to the Purchase Agreement, the actual gross

proceeds from the sale of all such shares may be substantially less than the $100 million Total Commitment available to us under the Purchase

Agreement, which could materially adversely affect our liquidity.

If it becomes necessary for us to issue and sell

to the Selling Stockholder under the Purchase Agreement more than the 20,143,404 shares being registered for resale under the registration

statement that includes this prospectus in order to receive aggregate gross proceeds equal to the Total Commitment of $100 million under

the Purchase Agreement, we must file with the SEC one or more additional registration statements to register under the Securities Act

the resale by the Selling Stockholder of any such additional shares of our Common Stock we wish to sell from time to time under the Purchase

Agreement, which the SEC must declare effective and we will need to obtain stockholder approval to issue shares of Common Stock in excess

of 20,143,404 shares of Common Stock (the “Exchange Cap”) under the Purchase Agreement in accordance with applicable

Nasdaq rules, unless the average per share purchase price paid by the Selling Stockholder for all shares of Common Stock sold under the

Purchase Agreement equals or exceeds $5.11, in which case, under applicable Nasdaq rules, the Exchange Cap limitation will not apply to

issuances and sales of Common Stock under the Purchase Agreement, in each case, before we may elect to sell any additional shares of our

Common Stock to the Selling Stockholder under the Purchase Agreement. Any issuance and sale by us under the Purchase Agreement of a substantial

amount of shares of Common Stock in addition to the 20,143,404 shares of Common Stock being registered for resale by the Selling Stockholder

under this prospectus could cause additional substantial dilution to our stockholders.

In addition, we are not required or permitted to

issue any shares of Common Stock under the Purchase Agreement if such issuance would breach our obligations under the rules or regulations

of Nasdaq. In addition, the Selling Stockholder will not be required to purchase any shares of our Common Stock if such sale would result

in the Selling Stockholder’s beneficial ownership exceeding 4.99% of the then issued and outstanding Common Stock (the “Beneficial

Ownership Cap”). Our inability to access a portion or the full amount available under the Purchase Agreement, in the absence

of any other financing sources, could have a material adverse effect on our business.

The sale and issuance of our

Common Stock to the Selling Stockholder will cause dilution to our existing stockholders, and the sale of the shares of Common Stock acquired

by the Selling Stockholder, or the perception that such sales may occur, could cause the price of our Common Stock to fall.

The purchase price for the shares that we may sell

to the Selling Stockholder under the Purchase Agreement will fluctuate based on the price of our Common Stock. Depending on market liquidity

at the time, sales of such shares may cause the trading price of our Common Stock to fall.

If and when we do sell shares to the Selling Stockholder,

after the Selling Stockholder has acquired the shares, the Selling Stockholder may resell all, some, or none of those shares at any time

or from time to time in its discretion. Therefore, sales to the Selling Stockholder by us could result in substantial dilution to the

interests of other holders of our Common Stock. Additionally, the sale of a substantial number of shares of our Common Stock to the Selling

Stockholder, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the

future at a time and at a price that we might otherwise wish to effect sales.

Investors who buy shares at

different times will likely pay different prices.

Pursuant to the Purchase Agreement, we will have

discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold to the Selling Stockholder. If and when we

do elect to sell shares of our Common Stock to the Selling Stockholder pursuant to the Purchase Agreement, after the Selling Stockholder

has acquired such shares, the Selling Stockholder may resell all, some or none of such shares at any time or from time to time in its

discretion and at different prices. As a result, investors who purchase shares from the Selling Stockholder in this offering at different

times will likely pay different prices for those shares, and so may experience different levels of dilution and in some cases substantial

dilution and different outcomes in their investment results. Investors may experience a decline in the value of the shares they purchase

from the Selling Stockholder in this offering as a result of future sales made by us to the Selling Stockholder at prices lower than the

prices such investors paid for their shares in this offering. In addition, if we sell a substantial number of shares to the Selling Stockholder

under the Purchase Agreement, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement

with the Selling Stockholder may make it more difficult for us to sell equity or equity-related securities

in the future at a time and at a price that we might otherwise wish to effect such sales.

Our management team will have

broad discretion over the use of the net proceeds from our sale of shares of Common Stock to the Selling Stockholder, if any, and you

may not agree with how we use the proceeds and the proceeds may not be invested successfully.

Our management team will have broad

discretion as to the use of the net proceeds from our sale of shares of Common Stock to the Selling Stockholder, if any, and we

could use such proceeds for purposes other than those contemplated at the time of Commencement.

Accordingly, you will be relying on the judgment of our management team with regard to the use of those net proceeds, and you will

not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is

possible that, pending their use, we may invest those net proceeds in a way that does not yield a favorable, or any, return for us.

The failure of our management team to use such funds effectively could have a material adverse effect on our business, financial

condition, operating results and cash flows.

COMMITTED

EQUITY FINANCING

On December 15, 2021, we entered into the

Purchase Agreement and the Registration Rights Agreement with the Selling Stockholder. Pursuant to the Purchase Agreement, from and

after the Commencement, we have the right to sell to the Selling Stockholder up to $100 million of shares of our Common Stock,

subject to certain limitations and conditions set forth in the Purchase Agreement, from time to time during the 24-month period

beginning on the Commencement Date. Sales of Common Stock pursuant to the Purchase Agreement, and the timing of any sales, are

solely at our option, and we are under no obligation to sell any securities to the Selling Stockholder under the Purchase Agreement.

In accordance with our obligations under the Registration Rights Agreement, on December 16, 2021, we filed the Registration Statement with the SEC to register under the Securities Act the resale by the Selling Stockholder of

up to 20,143,404 shares of Common Stock, consisting of 197,628 Commitment Shares that we issued to the Selling Stockholder as

payment of a commitment fee for its commitment to purchase shares of Common Stock at our election under to the Purchase Agreement,

and up to 19,945,776 shares of Common Stock that we may elect, in our sole discretion, to issue and sell to the Selling Stockholder,

from time to time from and after the Commencement Date. The Registration Statement was declared effective by the SEC on December 23, 2021. We have not sold any shares of our common stock to B. Riley Principal Capital since the Commencement Date. On March 8, 2022, we filed

a post-effective amendment to the Registration Statement to convert the Registration Statement into a registration statement on Form

S-3, which the SEC declared effective on March 11, 2022.

Following the satisfaction of the conditions to

the Selling Stockholder’s purchase obligation set forth in the Purchase Agreement and subject to the continued satisfaction of these

conditions, including the effectiveness of the registration statement that includes this prospectus, we have the right, but not the obligation,

from time to time at our sole discretion over the 24-month period commencing on the Commencement Date, to direct the Selling Stockholder

to purchase a specified amount of shares of Common Stock, not to exceed 20% of the Purchase Volume Reference Amount (as defined below)

applicable to such purchase, by delivering written notice to the Selling Stockholder between 6:00 a.m. and 9:00 a.m., New York City time,

on any trading day, so long as (i) the closing sale price of our Common Stock on the trading day immediately prior to such trading day

is not less than $1.00 and (ii) all shares of Common Stock subject to all prior purchases by the Selling Stockholder under the Purchase

Agreement have theretofore been received by the Selling Stockholder electronically as set forth in the Purchase Agreement.

We generally control the timing and amount of any

sales of Common Stock to the Selling Stockholder. Actual sales of shares of our Common Stock to the Selling Stockholder under the Purchase

Agreement will depend on a variety of factors to be determined by us from time to time, including, among other things, market conditions,

the trading price of our Common Stock and determinations by us as to the appropriate sources of funding for our company and its operations.

Under the applicable Nasdaq rules, in no event

may we issue to the Selling Stockholder under the Purchase Agreement more than the Exchange Cap of 20,143,404 shares of Common Stock,

which number of shares is equal to 19.99% of the shares of the Common Stock outstanding immediately prior to the execution of the Purchase

Agreement, unless (i) we obtain stockholder approval to issue shares of Common Stock in excess of the Exchange Cap in accordance with

applicable Nasdaq rules or (ii) the average price per share paid by the Selling Stockholder for all of the shares of Common Stock that

we direct the Selling Stockholder to purchase from us pursuant to the Purchase Agreement, if any, equals or exceeds $5.11 per share (representing

the lower of the official closing price of our common stock on Nasdaq on the trading day immediately preceding the date of the Purchase

Agreement and the average official closing price of our common stock on Nasdaq for the five consecutive trading days ending on the trading

day immediately preceding the date of the Purchase Agreement, as adjusted pursuant to applicable Nasdaq rules). Moreover, we may not issue

or sell any shares of Common Stock to the Selling Stockholder under the Purchase Agreement which, when aggregated with all other shares

of Common Stock then beneficially owned by the Selling Stockholder and its affiliates (as calculated pursuant to Section 13(d) of the

Exchange Act and Rule 13d-3 promulgated thereunder), would result in the Selling Stockholder beneficially

owning shares of Common Stock in excess of the 4.99%.

Neither we nor the Selling Stockholder

may assign or transfer any of our respective rights and obligations under the Purchase Agreement or the Registration Rights Agreement,

and no provision of the Purchase Agreement or the Registration Rights Agreement may be modified or waived by the parties.

The net proceeds from sales, if any, under the

Purchase Agreement, will depend on the frequency and prices at which we sell shares of Common Stock to the Selling Stockholder. To the

extent we sell shares under the Purchase Agreement, we currently plan to use any proceeds therefrom for working capital and general corporate

purposes.

As consideration for the Selling Stockholder’s

commitment to purchase shares of Common Stock at our direction upon the terms and subject to the conditions set forth in the Purchase

Agreement, upon execution of the Purchase Agreement, we issued 197,628 Commitment Shares to the Selling Stockholder.

The Purchase Agreement and the Registration Rights

Agreement contain customary representations, warranties, conditions and indemnification obligations of the parties. The representations,

warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely

for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting

parties.

Purchase of Common Stock Under the Purchase

Agreement

Purchases

We have the right, but not the obligation, from

time to time at our sole discretion over the 24-month period commencing on the Commencement Date, to direct the Selling Stockholder to

purchase up to a specified maximum amount of shares of Common Stock as set forth in the Purchase Agreement (each such purchase, a “Purchase”)

by delivering written notice to the Selling Stockholder between 6:00 a.m. and 9:00 a.m., New York City time (each, a “Purchase

Notice”) on any trading day (each, a “Purchase Date”), so long as:

| · | the closing sale price of our Common Stock on the trading day immediately prior to the applicable Purchase Date is not less than $1.00

(subject to adjustment as set forth in the Purchase Agreement); and |

| · | all shares of Common Stock subject to all prior Purchases and Additional Purchases (as defined below) by the Selling Stockholder under

the Purchase Agreement theretofore required to have been received by the Selling Stockholder electronically on the applicable settlement

date therefor have been so received by the Selling Stockholder in accordance with the Purchase Agreement. |

The maximum number of shares of Common Stock that

the Selling Stockholder is required to purchase in any single Purchase under the Purchase Agreement is equal to 20% of the Purchase Volume

Reference Amount, which is defined as the lowest of:

| · | the total number of shares of Common Stock traded on Nasdaq during the trading day immediately preceding the applicable Purchase Date; |

| · | the average daily number of shares of Common Stock traded on Nasdaq during the five consecutive trading day-period ending on (and

including) the trading day immediately preceding the applicable Purchase Date; and |

| · | the average daily number of shares of Common Stock traded on Nasdaq during the 21 consecutive trading day-period ending on (and including)

the trading day immediately preceding the applicable Purchase Date. |

The per share purchase price of the shares of Common

Stock that we may elect to sell to the Selling Stockholder in a Purchase pursuant to the Purchase Agreement, if any, will be determined

by reference to the volume weighted average price of the Common Stock (“VWAP”),

during the full regular trading hour period on Nasdaq on the applicable Purchase Date, calculated in accordance with the Purchase Agreement,

or, if the trading volume threshold calculated in accordance with the Purchase Agreement is reached during such regular trading hour period,

then only during the portion of the regular trading hour period on the applicable Purchase Date prior to the time such volume threshold

is reached, the precise commencement and ending times of such period in accordance with the Purchase Agreement (the “Purchase

Valuation Period”), less a variable discount ranging from 3% to 5%. The applicable discount for a Purchase will depend on the

aggregate number of shares of Common Stock purchased by the Selling Stockholder on the applicable Purchase Date for the Purchase and all

Additional Purchases effected on the same Purchase Date as such Purchase (as applicable) (such amount, the

“Aggregate Daily Purchase Share Amount”) relative to the Purchase Volume Reference Amount.

The resulting per share purchase price of each

such Purchase will be equal to:

| · | 97% of the VWAP for the applicable Purchase Valuation Period on the applicable Purchase Date, if the Aggregate Daily Purchase Share

Amount for such Purchase is equal to or less than 6.67% of the Purchase Volume Reference Amount applicable to such Purchase; |

| · | 96% of the VWAP for the applicable Purchase Valuation Period on the applicable Purchase Date, if the Aggregate Daily Purchase Share

Amount for such Purchase is greater than 6.67%, but less than 15%, of the Purchase Volume Reference Amount applicable to such Purchase;

or |

| · | 95% of the VWAP for the applicable Purchase Valuation Period on the applicable Purchase Date, if the Aggregate Daily Purchase Share

Amount for such Purchase is equal to or greater than 15% of the Purchase Volume Reference Amount applicable to such Purchase. |

Additional Purchases

We may also direct the Selling Stockholder, on

the same Purchase Date on which we have properly submitted a Purchase Notice for a Purchase, with respect to which the Purchase Valuation

Period has ended prior to 1:30 p.m., New York City time, on such Purchase Date (provided all shares of Common Stock subject to all prior

Purchases and Additional Purchases effected by us under the Purchase Agreement theretofore required to have been received by the Selling

Stockholder electronically on the applicable settlement date therefor have been so received by the Selling Stockholder in accordance with

the Purchase Agreement), to purchase an additional amount of our common stock (each such additional purchase, an “Additional

Purchase”) by delivering written notice to the Selling Stockholder (each, an “Additional Purchase Notice”)

by no later than 1:30 p.m., New York City time, on such Purchase Date, not to exceed 20% of the Purchase Volume Reference Amount applicable

to such Additional Purchase.

The per share purchase price for the shares of

Common Stock that we elect to sell to the Selling Stockholder in an Additional Purchase pursuant to the Purchase Agreement, if any, will

be calculated in the same manner as in the case of a Purchase, provided that the VWAP will be measured during the portion of the normal

trading hours on the applicable Purchase Date determined in accordance with the Purchase Agreement (such period, the “Additional

Purchase Valuation Period”).

The resulting per share purchase price of each

such Additional Purchase will be equal to:

| · | 97% of the VWAP for the applicable Additional Purchase Valuation Period on the applicable Purchase Date, if the Aggregate Daily Purchase

Share Amount for such Additional Purchase is equal to or less than 6.67% of the Purchase Volume Reference Amount applicable to such Additional

Purchase; |

| · | 96% of the VWAP for the applicable Additional Purchase Valuation Period on the applicable Purchase Date, if the Aggregate Daily Purchase

Share Amount for such Additional Purchase is greater than 6.67%, but less than 15%, of the Purchase Volume Reference Amount applicable

to such Additional Purchase; or |

| · | 95% of the VWAP for the applicable Additional Purchase Valuation Period on the applicable Purchase Date, if the Aggregate Daily Purchase

Share Amount for such Additional Purchase is equal to or greater than 15% of the Purchase Volume Reference Amount applicable to such Additional

Purchase. |

We may, in our sole discretion, submit multiple

Additional Purchase Notices on the same Purchase Date on which we have properly submitted a Purchase Notice for a Purchase and one or

more Additional Purchase Notices for an Additional Purchase, with respect to which the Purchase Valuation Period and the Additional Purchase

Valuation Period(s), respectively, have each ended prior to 1:30 p.m., New York City time, on such Purchase Date (again, provided all

shares of Common Stock subject to all prior Purchases and Additional Purchases effected by us under the Purchase Agreement theretofore

required to have been received by the Selling Stockholder electronically on the applicable settlement date therefor have been so received

by the Selling Stockholder in accordance with the Purchase Agreement).

The terms and limitations of such multiple Additional

Purchases effected on the same Purchase Date will be the same as those for a prior Additional Purchase on the same Purchase Date, and

the per share purchase price for the shares of Common Stock that we elect to sell to the Selling Stockholder in such multiple Additional

Purchases pursuant to the Purchase Agreement, if any, will be calculated in the same manner as in the case

of a prior Additional Purchase on the same Purchase Date, with the exception that the Additional Purchase Valuation Period(s) for each

will begin and end at different times and may vary in length of time during normal trading hours on the applicable Purchase Date, as determined

in accordance with the Purchase Agreement.

In the case of the Purchases and Additional Purchases,

the purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse

stock split or other similar transaction occurring during the business days used to compute the purchase price.

At or prior to 5:30 p.m., New York City time, on

the applicable Purchase Date for a Purchase, the Selling Stockholder will provide us with a written confirmation for such Purchase and

Additional Purchase, if applicable, setting forth the applicable purchase price (both on a per share basis and the total aggregate purchase

price) to be paid by the Selling Stockholder for the shares of Common Stock purchased by the Selling Stockholder in such Purchase and

Additional Purchase, if applicable.

The payment for, against delivery of, shares of

Common Stock purchased by the Selling Stockholder in a Purchase and any Additional Purchase under the Purchase Agreement will be fully

settled within two trading days immediately following the applicable Purchase Date for such Purchase and Additional Purchase, as set forth

in the Purchase Agreement.

Conditions to Each Purchase

The Selling Stockholder’s obligation to accept

Purchase Notices and Additional Purchase Notices that are timely delivered by us under the Purchase Agreement and to purchase shares of

our Common Stock in Purchases and Additional Purchases under the Purchase Agreement, are subject to the satisfaction at the applicable

“VWAP Purchase Commencement Time” or “Additional VWAP Purchase Commencement Time” (as such terms

are defined in the Purchase Agreement) on the applicable Purchase Date or Additional Purchase Date for each Purchase or Additional Purchase,

respectively, of the conditions precedent thereto set forth in the Purchase Agreement, all of which are entirely outside of the Selling

Stockholder’s control, which conditions include the following:

| · | the accuracy in all material respects of the representations and warranties of the Company included in the Purchase Agreement; |

| · | the Company having performed, satisfied and complied in all material respects with all covenants, agreements and conditions required

by the Purchase Agreement to be performed, satisfied or complied with by the Company; |

| · | the SEC shall not have issued any stop order suspending the effectiveness of the registration statement that includes this prospectus

(or any one or more additional registration statements filed with the SEC that include shares of Common Stock that may be issued and sold

by the Company to the Selling Stockholder under the Purchase Agreement) or prohibiting or suspending the use of this prospectus (or the

prospectus included in any one or more additional registration statements filed with the SEC under the Registration Rights Agreement),

and the absence of any suspension of qualification or exemption from qualification of the Common Stock for offering or sale in any jurisdiction; |

| · | there shall not have occurred any event and there shall not exist any condition or state of facts, which makes any statement of a

material fact made in the registration statement that includes this prospectus (or in any one or more additional registration statements

filed with the SEC that include shares of Common Stock that may be issued and sold by the Company to the Selling Stockholder under the

Purchase Agreement) untrue or which requires the making of any additions to or changes to the statements contained therein in order to

state a material fact required by the Securities Act to be stated therein or necessary in order to make the statements then made therein

(in the case of this prospectus or the prospectus included in any one or more additional registration statements filed with the SEC under

the Registration Rights Agreement, in the light of the circumstances under which they were made) not misleading; |

| · | all reports, schedules, registrations, forms, statements, information and other documents required to have been filed by the Company

with the SEC pursuant to the reporting requirements of the Exchange Act shall have been filed with the SEC; |

| · | trading in the Common Stock shall not have been suspended by the SEC or the Nasdaq, the Company shall not have received any final

and non-appealable notice that the listing or quotation of the Common Stock on the Nasdaq shall be terminated on a date certain (unless,

prior to such date, the Common Stock is listed or quoted on any other Eligible Market, as such term is defined in the Purchase Agreement),

and there shall be no suspension of, or restriction on, accepting additional deposits of the Common Stock, electronic trading or book-entry

services by DTC with respect to the Common Stock; |

| · | the Company shall have complied with all applicable federal, state and local governmental laws, rules, regulations and ordinances

in connection with the execution, delivery and performance of the Purchase Agreement and the Registration Rights Agreement; |

| · | the absence of any statute, regulation, order, decree, writ, ruling or injunction by any court or governmental authority of competent

jurisdiction which prohibits the consummation of or that would materially modify or delay any of the transactions contemplated by the

Purchase Agreement or the Registration Rights Agreement; |

| · | the absence of any action, suit or proceeding before any arbitrator or any court or governmental authority seeking to restrain, prevent

or change the transactions contemplated by the Purchase Agreement or the Registration Rights Agreement, or seeking material damages in

connection with such transactions; |

| · | all of the shares of Common Stock that may be issued pursuant to the Purchase Agreement shall have been approved for listing or quotation

on Nasdaq (or if the Common Stock is not then listed on Nasdaq, on any Eligible Market), subject only to notice of issuance; |

| · | no condition, occurrence, state of facts or event constituting a Material Adverse Effect (as such term is defined in the Purchase

Agreement) shall have occurred and be continuing; |

| · | the absence of any bankruptcy proceeding against the Company commenced by a third party, and the Company shall not have commenced

a voluntary bankruptcy proceeding, consented to the entry of an order for relief against it in an involuntary bankruptcy case, consented

to the appointment |

| · | of a custodian of the Company or for all or substantially all of its property in any bankruptcy proceeding, or made a general assignment

for the benefit of its creditors; and |

| · | the receipt by the Selling Stockholder of the bring-down legal opinions and negative assurances as required under the Purchase Agreement. |

Termination of the Purchase Agreement

Unless earlier terminated as provided in the Purchase

Agreement, the Purchase Agreement will terminate automatically on the earliest to occur of:

| · | the first day of the month next following the 24-month anniversary of the effective date of the registration statement of which this

prospectus forms a part; |

| · | the date on which the Selling Stockholder shall have purchased shares of Common Stock under the Purchase Agreement for an aggregate

gross purchase price equal to $100 million; |

| · | the date on which the Common Stock shall have failed to be listed or quoted on Nasdaq or any other Eligible Market; |

| · | the 30th trading day after the date on which a voluntary or involuntary bankruptcy proceeding involving our company has been commenced

that is not discharged or dismissed prior to such trading day; and |

| · | the date on which the Company commences a voluntary bankruptcy case or any third party commences a bankruptcy proceeding against the

Company, a custodian is appointed for the Company in a bankruptcy proceeding for all or substantially all of its property, or the Company

makes a general assignment for the benefit of its creditors |

We have the right to terminate the Purchase Agreement

at any time after Commencement, at no cost or penalty, upon five trading days’ prior written notice to the Selling Stockholder.

We and the Selling Stockholder may also terminate the Purchase Agreement at any time by mutual written consent.

The Selling Stockholder also has the right to terminate

the Purchase Agreement upon five trading days’ prior written notice to us, but only upon the occurrence of certain events, including:

| · | the occurrence of a Material Adverse Effect (as such term is defined in the Purchase Agreement); |

| · | the occurrence of a Fundamental Transaction (as such term defined in the Purchase Agreement) involving our company; |

| · | if we are in breach or default in any material respect of any of our covenants and agreements in the Purchase Agreement or in the

Registration Rights Agreement, and, if such breach or default is capable of being cured, such breach or default is not cured within ten

(10) trading days after notice of such breach or default is delivered to us; |

| · | the effectiveness of the registration statement that includes this prospectus or any additional registration statement we file with

the SEC pursuant to the Registration Rights Agreement lapses for any reason (including the issuance of a stop order by the SEC), or this

prospectus or the prospectus included in any additional registration statement we file with the SEC pursuant to the Registration Rights

Agreement otherwise becomes unavailable to the Selling Stockholder for the resale of all of the shares of Common Stock included therein,

and such lapse or unavailability continues for a period of 20 consecutive trading days or for more than an aggregate of 60 trading days

in any 365-day period, other than due to acts of the Selling Stockholder; or |

| · | trading in the Common Stock on The Nasdaq Global Select Market (or if the Common Stock is then listed on an Eligible Market, trading

in the Common Stock on such Eligible Market) has been suspended for a period of three consecutive trading days. |

No termination of the Purchase Agreement by us

or by the Selling Stockholder will become effective prior to the second trading day immediately following the date on which any pending

Purchase has been fully settled in accordance with the terms and conditions of the Purchase Agreement, and will not affect any of our

respective rights and obligations under the Purchase Agreement with respect to any pending Purchase, and both we and the Selling Stockholder

have agreed to complete our respective obligations with respect to any such pending Purchase under the Purchase Agreement. Furthermore,

no termination of the Purchase Agreement will affect the Registration Rights Agreement, which will survive any termination of the Purchase

Agreement.

No Short-Selling or Hedging by the Selling

Stockholder

The Selling Stockholder has agreed that none of

the Selling Stockholder, its officers, its sole member or any entity managed or controlled by the Selling Stockholder or its sole member

will engage in or effect, directly or indirectly, for its own account or for the account of any other of such persons or entities, any

(i) “short sale” (as such term is defined in Rule 200 of Regulation SHO of the Exchange Act) of the Common Stock or (ii) hedging

transaction, which establishes a net short position with respect to the Common Stock, during the term of the Purchase Agreement.

Prohibition of Other Similar Continuous

Equity Offerings

Subject to specified exceptions included in the

Purchase Agreement, we are limited in our ability to enter into an agreement to effect an “equity line of credit,” “at-the-market

offering,” or “equity distribution program” whereby we may issue or sell Common Stock or securities convertible into

or exercisable for Common Stock at a future determined price.

Effect of Sales of our Common Stock under

the Purchase Agreement on our Stockholders

All shares of Common Stock that may be issued or

sold by us to the Selling Stockholder under the Purchase Agreement that are being registered under the Securities Act for resale by the

Selling Stockholder in this offering are expected to be freely tradable. The shares of Common Stock being registered for resale in this

offering may be issued and sold by us to the Selling Stockholder from time to time at our discretion over a period of up to 24 months

commencing on the Commencement Date. The resale by the Selling Stockholder of a significant amount of shares registered for resale in

this offering at any given time, or the perception that these sales may occur, could cause the market price of our Common Stock to decline

and to be highly volatile. Sales of our Common Stock, if any, to the Selling Stockholder under the Purchase Agreement will depend upon

market conditions and other factors to be determined by us. We may ultimately decide to sell to the Selling Stockholder all, some or none

of the shares of our Common Stock that may be available for us to sell to the Selling Stockholder pursuant to the Purchase Agreement.

If and when we do elect to sell shares of our Common

Stock to the Selling Stockholder pursuant to the Purchase Agreement, after the Selling Stockholder has acquired such shares, the Selling

Stockholder may resell all, some or none of such shares at any time or from time to time in its discretion and at different prices. As

a result, investors who purchase shares from the Selling Stockholder in this offering at different times will likely pay different prices

for those shares, and so may experience different levels of dilution and in some cases substantial dilution and different outcomes in

their investment results. Investors may experience a decline in the value of the shares they purchase from the Selling Stockholder in

this offering as a result of future sales made by us to the Selling Stockholder at prices lower than the prices such investors paid for

their shares in this offering. In addition, if we sell a substantial number of shares to the Selling Stockholder under the Purchase Agreement,

or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with the Selling Stockholder

may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise

wish to effect such sales.

Because

the purchase price per share to be paid by the Selling Stockholder for the shares of Common Stock that we may elect to sell to the Selling

Stockholder under the Purchase Agreement, if any, will fluctuate based on the market prices of our Common Stock during the applicable

Purchase Valuation Period for each Purchase made pursuant to the Purchase Agreement, if any, as of the date

of this prospectus it is not possible for us to predict the number of shares of Common Stock that we will sell to the Selling Stockholder

under the Purchase Agreement, the actual purchase price per share to be paid by the Selling Stockholder for those shares, or the actual

gross proceeds to be raised by us from those sales, if any. As of December 31, 2021, there were 101,135,849 shares

of our Common Stock outstanding. If all of the 20,143,404 shares offered for resale by the Selling Stockholder under this prospectus were

issued and outstanding as of December 31, 2021, such shares would represent approximately 16.6% of

the total number of shares of our Common Stock outstanding and approximately 23.2% of the total number of outstanding shares held

by non-affiliates.

Although the Purchase Agreement provides that we

may, in our discretion, from time to time after the date of this prospectus and during the term of the Purchase Agreement, direct the

Selling Stockholder to purchase shares of our Common Stock from us in one or more Purchases under the Purchase Agreement, for a maximum

aggregate purchase price of up to $100,000,000, only 20,143,404 shares of Common Stock (197,628 of which represent the Commitment Shares

we issued to the Selling Stockholder upon signing the Purchase Agreement as payment of a commitment fee for the Selling Stockholder’s

obligation to purchase shares of our Common Stock under the Purchase Agreement) are being registered for resale under the registration

statement that includes this prospectus. Assuming all of such 20,143,404 shares were sold to the Selling Stockholder at the maximum 5%

discount to the per share price of $5.06 (which represents the lower of the official closing price of our

common stock on Nasdaq on December 14, 2021, the trading day immediately preceding the date of the Purchase Agreement, and the average

official closing price of our common stock on Nasdaq for the five consecutive trading days ending on December 14, 2021, the trading day

immediately preceding the date of the Purchase Agreement, such number of shares would be insufficient to enable us to receive aggregate

gross proceeds from the sale of such shares to the Selling Stockholder equal to the Selling Stockholder’s $100,000,000 total aggregate

purchase commitment under the Purchase Agreement. However, because the market prices of our Common Stock may fluctuate from time to time

after the date of this prospectus and, as a result, the actual purchase prices to be paid by the Selling Stockholder for shares of our

Common Stock that we direct it to purchase under the Purchase Agreement, if any, also may fluctuate because they will be based on such

fluctuating market prices of our Common Stock, it is possible that we may need to issue and sell more than the number of shares being

registered for resale under this prospectus to the Selling Stockholder under the Purchase Agreement in order to receive aggregate gross

proceeds equal to the Selling Stockholder’s $100,000,000 total aggregate purchase commitment under the Purchase Agreement.

If it becomes necessary for us to issue and sell

to the Selling Stockholder under the Purchase Agreement more shares than are being registered for resale under this prospectus in order

to receive aggregate gross proceeds equal to $100 million under the Purchase Agreement, we must first (i) obtain stockholder approval

to issue shares of Common Stock in excess of the Exchange Cap under the Purchase Agreement in accordance with applicable Nasdaq rules

and (ii) file with the SEC one or more additional registration statements to register under the Securities Act the resale by the Selling

Stockholder of any such additional shares of our Common Stock we wish to sell from time to time under the Purchase Agreement, which the

SEC must declare effective, in each case before we may elect to sell any additional shares of our Common Stock to the Selling Stockholder

under the Purchase Agreement. The number of shares of our Common Stock ultimately offered for sale by the Selling Stockholder is dependent

upon the number of shares of Common Stock, if any, we ultimately sell to the Selling Stockholder under the Purchase Agreement.

The issuance of our Common Stock to the Selling

Stockholder pursuant to the Purchase Agreement will not affect the rights or privileges of our existing stockholders, except that the

economic and voting interests of each of our existing stockholders will be diluted. Although the number of shares of our Common Stock

that our existing stockholders own will not decrease, the shares of our Common Stock owned by our existing

stockholders will represent a smaller percentage of our total outstanding shares of our Common Stock after any such issuance.

The following table sets forth the amount of gross

proceeds we would receive from the Selling Stockholder from our sale of shares of Common Stock to the Selling Stockholder under the Purchase

Agreement at varying purchase prices:

Assumed Average

Purchase Price Per

Share | | |

Number of

Registered

Shares to be

Issued if Full

Purchase(1) | | |

Percentage of

Outstanding

Shares After

Giving Effect to

the Issuance to

the Selling

Stockholder(2) | | |

Gross Proceeds

from the Sale of

Shares to the

Selling

Stockholder

Under the

Purchase

Agreement | |

| $ | 4.00 | | |

| 19,945,776 | | |

| 16.5 | % | |

$ | 79,783,104 | |

| $ | 5.00 | | |

| 19,945,776 | | |

| 16.5 | % | |

$ | 99,728,880 | |

| $ | 5.06 | (3) | |

| 19,762,846 | | |

| 16.3 | % | |

$ | 100,000,000 | |

| $ | 5.11 | (4) | |

| 19,569,472 | | |

| 16.2 | % | |

$ | 100,000,000 | |

| $ | 6.00 | | |

| 16,666,667 | | |

| 14.1 | % | |

$ | 100,000,000 | |

| $ | 7.00 | | |

| 14,285,715 | | |

| 12.4 | % | |

$ | 100,000,000 | |

| (1) | Does not include the 197,628 Commitment Shares that we issued to the Selling Stockholder as consideration

for its commitment to purchase shares of Common Stock under the Agreement. The number of shares of Common Stock offered by this prospectus

may not cover all the shares we ultimately sell to the Selling Stockholder under the Purchase Agreement, depending on the purchase price

per share. We have included in this column only those shares being offered for resale by the Selling Stockholder under this prospectus

(excluding the 197,628 Commitment Shares), without regard for the Beneficial Ownership Cap. The assumed average

purchase prices are solely for illustration and are not intended to be estimates or predictions of future stock performance. |

| (2) | The denominator is based on 101,135,849 shares outstanding as of December 31, 2021 (which includes the

197,628 Commitment Shares we issued to the Selling Stockholder on December 15, 2021), adjusted to include the issuance of the number of

shares set forth in the second column that we would have sold to the Selling Stockholder, assuming the average purchase price in the first

column. The numerator is based on the number of shares of Common Stock set forth in the second column. |

| (3) | The closing sale price of our Common Stock on Nasdaq on December 14, 2021. |

USE

OF PROCEEDS

This prospectus relates to shares of our Common

Stock that may be offered and sold from time to time by the Selling Stockholder. All of the Common Stock offered by the Selling Stockholder

pursuant to this prospectus will be sold by the Selling Stockholder for its own account. We will not receive any of the proceeds from

these sales. We may receive up to $100 million aggregate gross proceeds under the Purchase Agreement from any sales we make to B. Riley

Principal Capital pursuant to the Purchase Agreement. The net proceeds from sales, if any, under the Purchase Agreement, will depend on

the frequency and prices at which we sell shares of Common Stock to the Selling Stockholder after the date of this prospectus. See the

section titled “Plan of Distribution” in this prospectus for more information.

We expect to use any proceeds that we receive under

the Purchase Agreement for working capital and general corporate purposes, including to fund potential future investments and acquisitions

of companies that we believe are complementary to our business and consistent with our growth strategy. As of the date of this prospectus,

we cannot specify with certainty all of the particular uses, and the respective amounts we may allocate to those uses, for any net proceeds

we receive. Accordingly, we will retain broad discretion over the use of these proceeds. Pending our use of the net proceeds as described

above, we intend to invest the net proceeds pursuant to the Purchase Agreement in interest-bearing, investment-grade instruments.

SELLING

STOCKHOLDER

This prospectus relates to the offer and sale by

B. Riley Principal Capital of up to 20,143,404 shares of Common Stock that have been and may be issued by us to B. Riley Principal Capital

under the Purchase Agreement. For additional information regarding the shares of Common Stock included in this prospectus, see the section

titled “Committed Equity Financing”. We are registering the shares of Common Stock included

in this prospectus pursuant to the provisions of the Registration Rights Agreement we entered into with B. Riley Principal Capital on

December 15, 2021, in order to permit the Selling Stockholder to offer the shares included in this prospectus for resale from time to

time. Except for the transactions contemplated by the Purchase Agreement and the Registration Rights Agreement and as set forth in the

section titled “Plan of Distribution” in this prospectus, B. Riley Principal Capital has not had any material relationship

with us within the past three years. As used in this prospectus, the term “Selling Stockholder” means B. Riley Principal Capital,

LLC.

The

table below presents information regarding the Selling Stockholder and the shares of Common Stock that may be resold by the Selling Stockholder

from time to time under this prospectus. This table is prepared based on information supplied to us by the Selling Stockholder, and reflects

holdings as of December 31, 2021 . The number of shares in the column “Maximum

Number of Shares of Common Stock to be Offered Pursuant to this Prospectus” represents all of the shares of Common Stock being offered

for resale by the Selling Stockholder under this prospectus. The Selling Stockholder may sell some, all or none of the shares being offered

for resale in this offering. We do not know how long the Selling Stockholder will hold the shares before selling them, and we are not

aware of any existing arrangements between the Selling Stockholder and any other stockholder, broker, dealer,

underwriter or agent relating to the sale or distribution of the shares of our Common Stock being offered for resale by this prospectus.

Beneficial ownership is determined in accordance

with Rule 13d-3(d) promulgated by the SEC under the Exchange Act, and includes shares of Common Stock with respect to which the Selling

Stockholder has sole or shared voting and investment power. The percentage of shares of Common Stock beneficially owned by the Selling

Stockholder prior to the offering shown in the table below is based on an aggregate of 101,135,849 shares of our Common Stock outstanding