UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☒

|

|

Soliciting Material under § 240.14a-12

|

Agios Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

The following is a transcript of an investor webcast held by Agios Pharmaceuticals, Inc. (the

“Company”) on December 21, 2020 discussing the Company’s sale of its oncology business to Servier Pharmaceuticals, LLC.

Holly

Manning: If you would like to ask a question, either submit it through the Q&A, or you can send it through the chat, but send it to all panellists so that I can see them. And I’ll read your question and identify you if you just make

sure to identify yourself in the question. And with that, Jackie, I will turn it over to you.

Jackie Fouse: Thank you, Holly. Good morning,

everybody. Thank you for joining us this morning, as we’re very excited to talk to you about how we’re taking Agios into a future full of potential, with a lot of opportunities ahead of us as we reimagine our future. We’ve also this

morning announced a transaction that will enable that future, and I’ll talk a little bit more about that transaction as well.

Delivering excellence

is something that has always been at the core of what we do at Agios, and we’ve done that over the course of our 12 years of existence, and we intend to continue to do that for a very, very long time as we try to bring the full potential of our

science to the patients that we want to serve. Part of delivering excellence also includes being willing to evolve your strategy and your approach as the landscape around you changes. And so the – one of the things that we’re going to talk

about today is the evolution of our strategy at Agios as we move forward into what we think is a very bright future.

Having trouble advancing the slides.

Is there a trick to advancing the slides? Sorry.

Holly Manning: Just make sure you’re clicked into PowerPoint and not accidentally in the

WebEx.

Jackie Fouse: There we go.

So the –

sorry about that. The first slide has some information for investors related to our transaction that we announced with Servier this morning. The next slide has our forward-looking statements. Now, what has not changed with Agios – what’s

not ever going to change at Agios – as always, we are driven by a sense of urgency to bring truly transformative therapies to helping patients. We have done that by bringing the biology of IDH inhibition to cancer patients over the course of

our 12 years of existence. Along the way, that same scientific platform in cellular metabolism has also brought forward the elucidation of the biology around PK activation, and PKR activation within that. We’ve been studying that mechanism in

our company for – in humans for around six years. And our intent on a go-forward basis is to reach as many patients as we can with our differentiated science, with focus in genetically defined diseases as

we take things forward to benefit patients like Tamara, who you see on the screen here, who has pyruvate kinase deficiency.

We are at an inflection

point

We’re at an inflection point as a company. We have delivered differentiated therapies in the past to IDH mutant cancer patients, and

we’ve continued to develop our science and see the evolution of our pipeline – both our clinical development, as well as our research pipeline. And today we are making the decision to move forward with our strategy with a singular focus

2

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

on genetically defined diseases, because we think that we see tremendous potential in that area and an opportunity to reach even more patients on a

go-forward basis than we have in the past, with a relatively greater differentiated profile for the therapies that we’re going to bring forward for those patients. In order to enable this strategy we also

have announced that we are engaging in a transaction to divest our oncology assets to Servier, a global French pharmaceutical company. And, in their hands, we believe that they will be able to take those assets forward and continue to maximise the

value for patients from those assets, while today we are able to capture terrific value for those assets and then reinvest that in our company, as well as return some funds to shareholders and thoughtfully pursue capital markets independence as we

rightsize both the capital structure and the cost structure for Agios in line with where we’re going in the future.

We’ve had a lot of

developments over the course of the last year that give us great confidence in our genetically defined disease research capabilities and our pipeline and, as we evaluated the promise of our portfolio for both delivering great therapies for patients

as welling – as well as allowing us to create relatively more value for shareholders over time, we came to the conclusion that the right thing to do is to focus singularly on these genetically defined diseases, including rare genetic diseases

under that umbrella, and we’ll talk a little bit more about that pipeline in some of the untapped potential that we think that we have, both in our PK activation platform as well as other mechanisms that we have coming out of our research team.

Don’t get us wrong; we love our oncology assets. We think that we have terrific assets. The landscape in oncology has evolved over the last 12 years since we were founded as a company, and we think the best solution for the ongoing support of

those assets, taking those assets to benefit the most patients possible, is for us to place those assets in the hand of a company who is going to take them forward, and we’ll be able to singularly focus on genetically defined diseases, where we

think we can make a relatively greater impact.

The deal that we announced with Servier today is allowing us to today capture the full value of our

oncology portfolio and enable our future strategic focus and shift for Agios. It includes cash consideration of up to $2 billion, of which 1.8 billion is upfront cash. Then we have a $200 million milestone payment – potential

regulatory approval of vorasidenib. We also have rights to two sets of royalty strings, one on TIBSOVO and one on vorasidenib, so we continue to participate in the success of our oncology assets as they go forward. Importantly, we are planning to

return at least 1.2 of that $1.8 billion of upfront cash to our shareholders, most likely in the form of share repurchases. And, with cash that we have on our balance sheet and the remaining proceeds, we can achieve capital markets independence

to fund our company through the next wave of our major catalyst – allows us potentially to expand our genetically defined disease portfolio efforts and takes us to cash profitability – cash flow positivity in 2025.

This has been a very deliberate process for us. We’ve done this from a position of strength. I think all companies are constantly evaluating their

strategy and their portfolio of assets. We have been [inaudible] over the course of 2020 as we saw a positive evolution in terms of the clinical data supporting our lead product, mitapivat, in the genetically defined disease area, as well as the

evolution of our research efforts and where we think we can take our portfolio in genetically defined diseases. We became even more confident in the value creation potential

3

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

of those assets on a go-forward basis and the need to focus so that we can bring our best efforts to those – be first, move fast and be the best

across the indications that we want to bring forward in this area. To enable that strategy, we ran a broad process to evaluate the options for our oncology assets, and that culminated in the announcement of the deal that we have with Servier that we

have brought forward today.

We believe that the reimagined Agios of the future represents a very compelling story for our patients, for our employees,

for the opportunity to bring our science forward in truly differentiated fashion in genetically defined diseases, and we think it represents a compelling investment opportunity for all the reasons that I’ve talked about up to this point in the

presentation. We’re very excited about our near-term catalysts and all of the things that we’ve seen in terms of developments with mitapivat and its potential to play across a variety of haemolytic anaemias. And that has evolved over the

course of 2020, and many of you have followed the evolution of our data over time, including the recent announcement of the positive results from the ACTIVATE non-transfusion-dependent pyruvate kinase

deficiency phase III trial that will enable filing for that indication in 2021. And we expect to include in that filing the results from our ACTIVATE-T transfusion-dependent patient population in pyruvate

kinase deficiency that we expect to have in the first quarter of 2021 as well. We’re also initiating pivotal development in mitapivat in thalassaemia, in sickle cell disease. You’ve heard about the thalassaemia pivotal programme. You will

hear more about the sickle cell disease programme. So all the things that are listed on this slide in the yellow/orange colour are near-term catalysts for us as we’re moving these programmes forward, including our next generation PKR activator

946 that’s being studied in healthy volunteers.

When we look at 2025 and beyond now, with the shift in strategic focus and the enabling transaction

that we’re undertaking with our oncology assets, in 2025 – and you’ll remember that we talked about our vision at the beginning of this year for 2025. And that was before we had this evolving clinical dataset for mitapivat and before

seeing how our genetically defined disease research efforts have been evolving. Now, when we look forward to 2025 and beyond with this shift, what we can tell you today is we expect mitapivat to be approved in three indications across haemolytic

anaemias. We also expect to have a broad pipeline with at least five compounds and at least the potential for treating ten indications. The prior vision, as you may remember, included six compounds in clinical development with – and at least

eight indications. You can now see the potential that we see in genetically defined diseases only and why so we’re excited – why we’re so excited about the future and the focus on this. We continue to expect robust productivity out of

our research team and, as we had said before, we to see ourselves as being cash flow positive in 2025. And now, with the transaction we’ve announced this morning, we’re capital markets independent to that point in time.

Affirming our legacy

I did want to take just a couple of

minutes to talk a little bit about our legacy as a company and what we’ve built over the last 12 years. The first thing I want to do is thank every Agios employee who is with us today, every person who’s been with us over the course of the

12-year journey for Agios, because that – all of you have contributed to building the company that we are in the fortunate position of being able to look at today and decide where we think the greatest

potential for our science and patients is on a go-forward basis in a company that

4

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

also is moving toward a sustainable business model to deliver long-term value for our shareholders. Every one of our employees has contributed to that. This is a big announcement today for our

company and our people. It’s emotional for our teams, and so I want to congratulate them and recognise the legacy of everybody who’s contributed to Agios. On this slide we have highlighted some of our past achievements. I don’t need

to spend too much time on those, other than to – just to remind all of you that the things that have made Agios great are attributes that we retain within the company is we take it forward into the next wave of success in the coming decade, and

that includes our core expertise in cancer metabolism and what we’ve learned about the treatment of genetically defined diseases over the course of our history in elucidating the biology of cancer metabolism and the potential for therapies

coming from those roots in cancer metabolism to deliver great therapies for patients.

These are some of the accomplishments that our team has produced

over 12 years. We’re very proud of having brought [inaudible] TIBSOVO to the treatment of IDH mutant cancers, and that’s always going to be something that’s part of our legacy and something that we can be very proud of.

Accelerating our impact

We think that where we’re

going today, with the strategic focus and the enabling of that stray – strategy with the transaction that we’ve announced with Servier is going to allow us to accelerate the impact that we can have for patients and the value that we can

create also for our shareholders. When I think about how things are coming together to make me and all of us at Agios very excited about our future, as excited as we are – have ever been – the intersection now of the potential of the

science of cellular metabolism that’s such a central part of our heritage and our scientific competency – we’re clear leaders in this area. The intersection of that and how it has evolved over time with the insights that we now have

in genetically defined diseases combines to make for a very powerful position for Agios – a position that we think is unique and is going to allow us to bring a differentiated proposition to the treatment of these diseases as we take the

company forward. We have been the pioneers in PKR activation for quite some time now. We have a differentiating leadership role in this area. We have been in the clinic studying PKR activation for approximately six years. We’ve already

generated a lot of productivity across the different areas that you see on the slide here, and we’ve contributed to a number of firsts related to patient advocacy, related to interactions with the physicians who treat haemolytic anaemias, and

we’ve produced the first positive phase III trial readout for pyruvate kinase deficiency and expect to have an approval of the first approved product for the treatment of that rare genetic disease. We see a lot of potential in PKR activation on

a go-forward basis and PK activation and other things coming out of our research, so we’re already differentiating leaders in this area, and we’re going to continue to lead and be the best and the

fastest in this area.

What you see now is how we’ve evolved our clinical development strategy as well to run broader clinical programs, to support

molecules that we believe in. This is the pipeline overview for mitapivat, our lead pyruvate kinase R activator. This is a drug that we believe easily has blockbuster potential across a range of haemolytic anaemias. You’re familiar with some of

these. When you put it all together on one page, it’s a very exciting story and an anchor product for our genetically defined disease platform that gives us a potential to have a

5

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

peak revenue blockbuster product with our first drug that we’re going to bring to market for the first approval for pyruvate kinase deficiency, starting in 2022, and then the opportunity

with label expansions over time to significantly increase the impact that we have on a greater number of patients with this mechanism. But we’re not only a mitapivat story. We love mitapivat. Mitapivat’s going to be great. It’s going

to be an anchor in our platform, and we like what we see for that drug across pyruvate kinase deficiency, thalassaemia, where we’re the first company to generate clinical data for alpha thalassemia patients, and we like what we see for sickle

cell disease, a complex disease that needs more treatment options.

But we have a lot more going on. I mentioned earlier we have 946 in healthy

volunteers. On the right side of this slide – at least, it’s on my right – you can see a variety of indications that we think the drugs and the PK activation mechanism can play in. We have our PKR activators. We have even more of

those in the works behind 946, and we have others in the PK activation arena that go from PKR activation to PKM2. Again, you see the indications on the sides, and we’ve included patient – estimated patient numbers for some of those. As we

take things forward, we’re going to be looking at those and thinking through the opportunities and prioritising how we take some – take these programmes forward, but we have an opportunity to move very quickly with two PKR activators that

are already in humans to do proof-of-concept work to see where we might be able to move fast in some of these other indications. And over time we’ll be sharing more

data with you – both preclinical data that supports the profile of these drugs, as well as the ongoing evolution of our clinical data.

We also have

other mechanisms moving through our research platform and a very productive team pushing these forward with what we think can be best-in-class and first-in-class mechanisms to treat the indications that you see down there in green. The two mechanisms we’ve highlighted here include PAH, where we soon have a

development candidate coming along for phenylketonuria (PKU), and we’re also moving forward novel mechanism called BCAT-II, and over time Bruce Woods[?] is going to be more than happy to talk with you

about how he sees the potential here. So, terrific anchor product in mitapivat, great pipeline coming along behind it.

Achieving our potential

So we’ve seen the evolution of our portfolio. We’re taking deliberate steps in order to be able to realise the full potential that we think

we have here and deliver that for patients first, our employees and our shareholders. So the announcement that we’re making today regarding the focus and our new strategy on a go-forward basis on

genetically defined diseases we think is absolutely the best way for us to reach more patients and be truly differentiated in the therapeutic areas that we are going to serve. The transaction with Servier’s a transaction that enables that while

placing our oncology assets in the hands of a company that I think will absolutely do them justice and continue to do great things for patients with those assets. The Agios of tomorrow is going to continue to leverage the core values and

capabilities that have made us successful to this point. Some of those are listed on this slide. By bringing those, singularly focused on delivering terrific treatments for patients with genetically defined diseases, we think that we’re going

to create differentiated therapies for patients and do great things for our shareholders and all of our constituents. And some of those aspirations are listed on the right side of the slide here. So we’re extremely excited about where

we’re going today. The two things come together; three key messages for you. We’ve made a strategic

6

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

decision to accelerate and expand the difference that we can make for patients with genetically defined diseases by singularly focusing on that area. We believe we capture full value and monetise

that value today for our shareholders and in support of our business model, through the transaction that we’re undertaking with Servier. And we’re going to use this opportunity to realign both our capital structure and our company

footprint so that we’re set up extremely well to deliver on the promise of tomorrow that our science holds for patients with genetically defined diseases.

So, again, I want to thank all of our employees at Agios and everybody who’s been supporting us over the last 12 years for making us successful and

putting us where we are today, and we’re extremely excited about where we’re going in the future. We hope that you get excited about it as well and join us on that journey. So thank you very much, and I am going to stop and let Holly start

emceeing the Q&A. Thank you.

Q&A

Holly Manning: Great. Thanks, Jackie. So, just a reminder to anyone who wants to submit a question: submit it through the Q&A box, or you can

submit it through the chat. Just send it to all panellists. So I will start with a question from Alethia Young at Cantor. The value of this deal is almost the entire market cap, so do you think this indicates that the oncology platform was being

undervalued or that mitapivat was being undervalued? And then, as a follow-up, why is now the right time for this transaction?

Jackie Fouse: So let me take a stab at that. I think that it is – I think all of it may have been undervalued it, from my perspective. It seems

like there’s been some challenges maybe with respect to trying to figure out where to best place the value, in terms of the intrinsic value of the company today, in line with the future opportunities associated with any of our assets. And that

ties into the second part of the question, which is why do this now. We remain in a position of strength. We could have continued to do what we’re doing. We think we have terrific assets. At the same time, it – we see incrementally –

significantly incremental relative value creation potential in the future coming out of our genetically defined disease efforts as compared to our oncology efforts. The landscape has changed over time in oncology. And so we – when we think

about how to focus our efforts on a go-forward basis, we think we’re going to create relatively more value for both patients and for our shareholders with genetically defined diseases. And we feel like

we’ve captured – to the point about our intrinsic value as according to the stock market today, we think we’ve captured the full value on a risk-adjusted basis today and have in our hands a transaction that gives us a significant

amount of cash up front so we can strike the right balance between supporting our future strategy and returning some funds to shareholders. So I think the focus on GDD is going to allow investors and analysts to really dig into those assets and try

to assess what their views are on the full potential of those, where we think they’re underappreciated today.

Holly Manning: Great. Next

question comes from Anna Pamrama[?] of JP Morgan. When should we expect to hear more about the internal GDD pipeline? What are your thoughts on expanding beyond PKR?

7

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

Jackie Fouse: So I think we’ve got a few things in the works, and I hope, over the course of

2021, that we’re going to be able to build out with substance. So we don’t want to talk about things too early and make promises that we can’t deliver on, but we’ve been doing a lot of work here. We’re seeing a lot of

evolution of the science, and I’m more than happy to let Bruce comment as he wishes, but we’re going to be gradually unveiling and talking about our programmes coming forward in that pipeline as we – as we have substantive data to

support that. You’re also, over the course of 2021, going to see data updates for the thalassaemia phase II trial for mitapivat. You’ll see the ACTIVATE-T

top-line results in Q1. We’ll be filing for mitapivat in PK deficiency. You’ll likely see updates on our sickle cell disease programme. You’ll hear something about 946 as we continue to run that

healthy volunteer study. And then, as we have data to support our research efforts, we’re going to bring that forward as well. So I intend for our team to create a nice flow of information over the course of 2021 to continue to build that out.

We have a lot going on. The transaction today is going to enable us to move even faster on some of these things – potentially go even broader. As I said, we’ve got two compounds in humans now where we can take those and look at other

opportunities for those compounds, potentially in other haemolytic anaemias, some of which were listed, or other indications that were listed on the slide that was included in the feck.

Bruce Car: But Jackie, just to add to that, you’ve already mentioned that we’ve been studying the PKR mechanism for six years in patients

now. Well – so everybody should be aware we’ve been studying PK activation in detail in our labs for over 12 years now and supporting the study of this in other labs as well. And this has given us a tremendous scope of knowledge for

understanding how that we can impact diseases in which PKR activation is important, but also PKM2 and potentially PKL. And a common theme that’s underpinning this is a strength that we’ve built in computational, synthetic, structural

chemistry and biochemistry around allosteric activators and how that parlays then into cellular metabolism. And Jackie did mention an approach that we’re working on in phenylketonuria. That’s also an allosteric activator, and this is

really a unique strength that we’ve built in this space that we – we realise – we can really extend into multiple therapy – genetically defined disease therapeutic areas.

Jackie Fouse: I’ll just quickly remind – take the opportunity to remind everybody that when the come – when the company was founded in

2008, it was founded on the basis of a scientific platform in cellular metabolism and fully exploiting the science of cellular metabolism to bring it forward to the treatment of serious diseases. The – one of the first insights that came out of

it was related to these IDH mutations and these driver mutations in cancer, and then the company focused appropriately on that, very quickly brought those forward, got them into humans pretty fast in 2013, and then the first product approval in

2017. It’s a terrific, terrific outcome for patients and a very, by industry standards, rapid movement, but the founding of the company was not predicated only on serving cancer patients. It came back to the roots in cellular metabolism and

some of the things that Bruce has been talking about. So we’ve been studying this for 12 years, and we moved fast without IDH mutant cancers first and appropriately, but along the way we’ve been continuing this other work. And now we see

terrific opportunity associated with that in the midst of a change – changing cancer landscape, which over the last decade has evolved with checkpoint inhibitors and IO and cell-based therapies – combinatorial strategies. And this is one

of the reasons why we see relatively greater differentiation for what we can bring to patients in genetically defined diseases on a go-forward basis. And that’s a long comment and I’ll stop now,

Holly, so…

8

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

Holly Manning: No worries. Next question comes from Kennen McKay of RBC. How does this divestiture

change the aspirations outlined at the beginning of the year for $1 billion of revenue by 2025? And can you help us with the SGNA and R&D expense run rate moving forward after this?

Jackie Fouse: So at some point I’m going to stop talking and maybe let Jonathan talk, but I’ll just say you saw one of the slides where we

have updated the 2025 vision elements that we are able to update today and give you, so you saw that. Clearly – and we’ve said it before – part of the $1 billion revenue target in 2025 included TIBSOVO revenues. We’re also

seeing an evolution of the mix, and we talked about that, I think. Over the last a few weeks or couple of months, we’re seeing – as we have more visibility to the potential approval timelines for mitapivat in thalassemia and sickle cell

disease, we do have – we are refining how we think about the mix of what our revenues could look like in 2025, but we’re not ready to give you a number yet. We have seen that mix shifting over time, but TIBSOVO was still in there, so

unlikely that we hit a billion dollars of revenue in 2025, but we’re going to come back at some point with you when we have more visibility to what the mix of indications could look like in 2025 and where we would be in the revenue ramp

trajectories. I think the most exciting – one of the very exciting things about this is you’re going to have mitapivat moving into indications with a greater and greater number of patients [inaudible] will be early in the ramp trajectory

for indications like thalassaemia and sickle cell disease. And we could see those coming in late in that time frame, and then very strong growth post 2025 as those start to ramp up. And we’ll see how the product profile evolves based on the

totality of the clinical data that we have at that point in time. SGNA is – Jonathan, do you want to talk about that?

Jonathan Biller: Sure.

Thanks. Thanks, Jackie. So, as Jackie mentioned when she walked through the strategy that we’re executing here – and this transaction being a part of it – an important part is making sure that we’re rightsizing both the capital

structure of the company and also our cost base. So, you know, we’re in that process, we’ll be sharpening pencils, but 2021 will be a year that will be kind of a hybrid year for us because, you know, this transaction is likely not to close

until sometime in Q2. We’ll have some transition service obligations that we’ll be providing to Servier so they can make sure that the oncology business, you know, runs smoothly as it transitions over to them. But I think as you’re

thinking and as we move into the end of next year and into – and into 2022, you’ll see a very rightsized, focused genetically defined disease business with, you know, meaningful [inaudible] in overall OPEX. And so it will certainly be, you

know, smaller than our – where we’re ending up on 2020. And I think what’s important, and what I will guide you to, is our – you know, our belief that this transaction, after the 1.2 billion of return to shareholders, will

allow us to still be capital markets independent so we can get and fund these programmes, accelerate the excitement that we’re seeing with PK activation and what Bruce was talking about, and do that, you know, without the need to go back to the

equity markets to raise funds and get ourselves to cash flow profitability in 2025.

Holly Manning: Great. So the next question comes from Tyler

Van Buren of Piper. He says so – for how long have you considered selling your oncology assets and when did the talks with Servier begin, and how long did it take to consummate this transaction? And, sort of as a

follow-up, why is Servier the best owner or the most qualified to maximise the value?

9

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

Jackie Fouse: Why don’t I start with Servier and then maybe let Jonathan also come in on the

process that we ran? So the first thing that I would say is this is driven by the strategic pivot to focus on genetically defined diseases. And that decision was supported over the course of time in 2020 as we saw data evolve in – across the

three indications for mitapivat, as well as the productivity of our research team and the potential for the long-term additional compounds to come out of that platform. So strategy first, then the oncology asset sale process second. But, with

respect to Servier, I think we ended up with a very unique alignment of strategic interests that are complementary across the two companies. In Europe, Servier’s a pretty well-known company. They’re now establishing their presence and

growing it in the US. They have, as from two or three years ago, begun to prioritise oncology as a therapeutic area that they want to build out, and they also want to build out their presence in the US. They have deep respect for what we’ve

built at Agios on the oncology side of things, from both our assets and our people. And so that alignment of our desire to refocus our strategy on genetically defined diseases, their desire to prioritise oncology as well as increase their presence

in the US, and they are also a company who put forth a very compelling value proposition for us with a significant amount of upfront cash for our assets. And Jonathan, do you want to…?

Jonathan Biller: Sure. Sure, Jackie. So, as – you know, as Jackie mentioned, as we saw the emergence of the promise of mitapivat across these

first few indications, and then the PK activation platform more generally, you know, we already started, and we knew we were going to want to allocate more of our capital to that investment opportunity. So we began exploring, you know, different

options to create the most value from our oncology assets. And that was a process that included – as we started, we were very open-minded as to the form of the transaction or transactions that might ultimately evolve from that process. And so,

as we did that, working with our financial advisors and our internal team, you know, it was a broad process, you know, that, that included, ultimately, I think, you know, 17, 18 companies that we had conversations with along the way, exploring how

we could best extract the value both for patients going forward and for our company and our shareholders, and the deal that evolved ultimately was this one with Servier. And I think, as Jackie noted, in addition to the financial consideration,

which, you know, we viewed as capturing the full value and the importance of these assets to Servier and the importance of our people to Servier I think was really critical for us because, you know, it was pretty clear in a deal like this,

there’s going to be some element of contingent consideration. And so having it, you know, be determined by a company that’s fully committed and able to really advance it is really – and with our people, giving us more confidence that

we’ll – you know, we’ll get there and we’ll actually see that potential value from, for example, the vorasidenib milestone payment and royalties, which can be a very nice complementary source of cash flow for us going forward.

You’ll see more information. We’re filing a proxy statement, so there’ll be a very detailed description narrative of the – of the process as well.

Holly Manning: Great. So the next question comes from Mark Fromm[?] at Cowen[?]. He says, press release says Agios will return at least

1.2 billion to shareholders. What would cause this to increase, and would a similar ratio of the vorasidenib milestone be returned to shareholders if it is earned?

10

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

Jackie Fouse: So I think again Jonathan’s probably going to want to come in and make my answer

better, because he always does. But the – so what we’re signalling to you today is what we think that we need, between the cash that we have in our hand, the cash that we will retain after returning funds to shareholders, to fund our base

case plan out to 2025 and allow us to focus, move fast with high quality, even continue to expand that research pipeline. And we’ve said at least 1.2 billion because we think that we have tremendous value creation potential with these

assets. We also want to reset our capital base and we want to have – we have some flexibility to toggle that. So it’s going to be partly related to the evolution of our stock price and partly related to some of the other things that is

– that’s included in your question around receipt of the milestone, how the royalties go, other things we may do with our portfolio if we see opportunities to partner either for geographically for delivering the most value to patients

globally and for our shareholders, with the potential that our drugs have across the different indications, which have very different mixes in terms of the geographic distribution of the patient population. And some of the indications that you saw

on the research pipeline slide might be indications that we would not necessarily lead on ourselves, that we might partner on. So I think this gives us a lot of flexibility, and it’s why we’re comfortable with saying at least

$1.2 billion return to shareholders.

Holly Manning: Okay. Next question comes from Peter Lawson of Barclays. When can we expect the second-gen PKR activator, AG-946, to enter the clinic? And when can we expect to see the next data from the phase III INDIGO trial for vorasidenib in glioma and the timeline

around commercialisation?

Jackie Fouse: I think Chris could – could maybe address that?

Chris Bowden: Yeah, so AG-946 is in the clinic now. We’re under way with our study in healthy volunteers,

with single ascending dose and a multi-ascending does cohorts under way and planned – further planned, depending on how does escalation and safety [inaudible] sickle cell cohort with that. For the INDIGO trial, we haven’t guided yet to

when we think we’ll have data. The study is in its early operational phases, and so we can’t provide that information yet, although we can tell you that the – even in the phase of the [inaudible] that have been encountered with

getting studies up and running, and clearly we’ve seen really good initial [inaudible] of the study. We’re very encouraged, and thanks to our team who’ve been – and the investigators and patients [inaudible] moving along there.

So hopefully, as that trial continues to accrue and we’ll get a better sense of what the accrual kinetic – stable accrual kinetics look like, we’ll be able to guide further there.

Holly Manning: Okay. So the next question comes from – well, we have two questions that are similar from George Farmer at BMO and – sorry, my

computer [inaudible] – and Andy Berens at Leerink. So they ask, can you provide guidance on how this deal affects burn rate going forward? And how should we think about ongoing R&D expense?

Jackie Fouse: I’m looking at Jonathan to see who wants to start. So we had already included in our base case plan, where we talk about having cash

runway to the end of 2022, the initiation of the pivotal plans for mitapivat in both thalassaemia and sickle cell disease. So the – this transaction is one of the reasons why we can then go forward with capital markets independence, because

we’ll be able to continue to fund all of those programmes in 2023, 2024 and into 2025, the year that we expect to be cash flow positive. And we’ve also made some assumptions in our plan about the ongoing productivity coming out of our

11

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

research group and funding the successful movement of molecules into IND[?] and then through the early stages of clinical development, so that is included in our plan. As Jonathan mentioned, and

then maybe I’ll stop, we are going to undergo a transition year in 2021, and then a bit of a reset. And I think he said that we expect our expense base, at least on the SGNA side, to be lower in 2022 than it is in 2020. And that creates some

opportunity to move resources more into research and development, but at the stages that we are with some of these programmes, and it’s – including the PKR activators that are already in the clinic, we’ll be able to very rapidly move

into proof-of-concept trials in humans with those two PKR activator molecules for some of these other haemolytic anaemias. And there are potentially accelerated paths to

approval for some of those rare indications and things like that, and we just need a little bit more time to flesh out the prioritisation of those so that we can move the fastest in the areas that hold the greatest opportunity. And I don’t know

if Bruce wants to comment about some of the things coming out of research, or, Jonathan, you want to talk about the expense side of things, but we think everything’s kind of lining up to take us in a very clear direction with respect to how

we’re allocating the resources across the different activities. And maybe Darrin could talk a little bit at some point about the commercial model for the PKD launch as compared to some of the commercial organisation that we have today with the

PKD approval coming in 2022.

Bruce Car: Just very briefly adding onto that, Jackie, you know, identifying really considerable scope for expansion

of the number of indications that we can hit with PKR alone, and then with PKR and PKM2, either combined or separately, in our preclinical labs, we’ve instituted a variety of studies that are currently ongoing that are – that are really

starting to generate some very interesting results. So that – that will flow into the potential indications that we could have in haematologic and other indications in this coming year and subsequent years. And of course, you know, if there is

additional investment, I’d be very welcome to, you know, what we could do then to accelerate our broader portfolio of other inborn errors of metabolism and genetically defined disease approaches, of course.

Jackie Fouse: And the transaction enables us moving quickly on those opportunities as we see them in accommodating that investment. Darrin, you want to

talk about the commercial model just a little bit, or…?

Darrin Miles: Sure, sure. As – so I think, as we’ve shared previously, the

– we intend to have a small field team on the ground by the middle of this year, about a little more than half the size of the – of the oncology sales team. If you – if you recall, we’re – we were spending a fair amount of

time prior to the approval focused on conventional market development activities, but specifically on physician profiling, identification, and patient identification where possible, so that we can further understand the true prevalence of the –

of the disease across the major markets. So – and also remind you that these physicians that we’re – that we’re going to be calling on for PKD are also going to be the same physicians who will treat thalassaemia and will also

treat sickle cell disease. So it’ll give – it’ll give the community several years of familiarity with mitapivat before they begin to expand the use of mitapivat into new indications.

Holly Manning: So next question comes from Michael Schmidt at Guggenheim. What will this transaction mean for your cost structure going forward? I

think we kind of covered some of that, but…

12

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

Jackie Fouse: Yeah, I mean, just to summarise it, as Darren [inaudible] as Jonathan said, when we make

our way through 2021, which will be a transition year and a hybrid year, and we get to 2022, we expect to have the SGNA part of the cost structure in 2020 be lower than it was in 2020, and by a meaningful amount. It’s hard to give you an exact

figure, but we’re very focused on rightsizing the SGNA infrastructure for the opportunities ahead of us, and then evolving that over time as we take the products into additional indications, as we move mitapivat from PKD to sickle cell to

thalassaemia, and we can gate that spend according to the opportunity. So that’s one thing. Our base case plan assumes funding of the – all the pivotal programmes that we see ahead of us today, as well as our ongoing research efforts and

funding an assumption – assumed number of successful candidates making it to IND and beyond, and that’s where we want to be able to spend the money. But this is – the transaction and the pivot in the strategy with the focus on

genetically defined diseases is giving us a pretty significant opportunity to re-account – reallocate our spending to the highest-opportunity activities that we can pursue, and the mix of percentage of

spend to R&D is going to go up versus percentage of spend in SGNA.

Holly Manning: So maybe a quick

follow-up from Michael. When will you file the next IND, and in which disease/area?

Jackie Fouse: So I

– without overstepping my bounds here, I think the next likely candidate will be our PAH mechanism candidate for PKU. We’ve talked about that some. I’m not sure that we’re quite yet ready to declare on the timing for that one,

but we’re moving it as quickly as we can, and I think we’ll give you some insight into that early next year, when we can be a little bit more accurate about the timeline but suffice it to say that hopefully you see excitement in my eyes. I

think we’re making some great progress in terms of moving that along, and we hope to have some – a little bit more concrete visibility on that to be able to tell you about it relatively soon.

Holly Manning: Great. And I’ve gotten this question from multiple people in multiple different ways, but how did you come up with the

1.2 billion as the appropriate amount to return to shareholders? And how will you return that to shareholders – in what form?

Jackie

Fouse: Do you want to start, Jonathan, or…?

Jonathan Biller: Sure, sure. So it’s really – you know, we came at this in –

from many different angles and ultimately, as Jackie suggested, I think, a little bit earlier, it was a balancing act, right? And so it was both – you know, we want to realign our capital structure, have, you know, an outstanding number of

shares that are more reflective of the stage of company that we will be now as a focused GGD company. You know, when we close this transaction, we’ll be, you know, a year or so-ish away from our first

launch. We’ll have three launches, you know, in the course of the four years that we’re expecting. We wanted to make sure our capital structure and outstanding shares reflected that. And, you know, when we think about that historic equity

capital that we’ve – that we’ve raised since our IPO, including that IPO, the public raise has been – this is about 70%, I think, a return of that – you know, that amount. And so that was – that was certainly something

that we thought about.

13

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

And then the other side of the ledger was, you know, wanting to retain capital to get us to cash flow

positivity in 2025. And, as Jackie noted, I think it’s important to emphasise this includes what we see to deliver that 2025 vision that Jackie talked about earlier. So, you know, it’s the five molecules in the clinic for ten – ten-plus indications. That’s included, that’s assumed, in what we’re saying we need to get to cash flow profitability. So it’s really a balance of those things. That’s how we triangulated

it. And, you know, we feel it’s a very meaningful amount. It’s two thirds of the upfront consideration. And so we think that that’s quite appropriate. And in terms of how we’re going to do it, you know, we certainly feel that

share repurchases are the most efficient way to accomplish that capital return, particularly in a case like ours when we’re very confident in the long-term shareholder value creation that we can generate from this focused GGD business. So

that’s our – that’s our plan for the manner in which we’ll return the capital. Over to you, Jackie, if you want to add anything else.

Jackie Fouse: That was perfect.

Holly Manning:

Great. question from Mark Breitenbach[?], Oppenheimer. As you expand your rare disease pipeline, will the new programmes exclusively come from in-house discovery, or are you looking to bolster the pipeline

with in-licensing agreements?

Jackie Fouse: I mean, I think – and I’m happy to let Bruce jump in

as well. I think, in the – in the initial wave of things, what you see in terms of what we have going on internally today with wholly owned molecules for which we have the global rights – we’ve got a tremendous amount of opportunity.

So our – we’re going to be prioritising moving those programmes as fast as we can, and in the areas that hold the greatest potential for unique differentiation. At the same time – I mean, we’ve always done this – we do want

to stay open to what’s going on in scientific innovation and ideas that are out there. And we will be constantly canvassing that landscape to potentially complement our own efforts on the research side, but everything that we’re outlining

for you today, and the vision and the potential that we see on a go-forward basis, is coming out of the productivity that we already see with programmes that we have

in-house. And so I think that gives you a nice kind of risk/reward profile on a go-forward basis.

Bruce Car: Yeah, not much to add to that, Jackie, but, you know, you saw the pipeline that’s ahead of us today. We’ve got plenty to keep us

busy. We also have a very rich and sustainable early validated target pipeline with very early chemistry, but being open to, you know – and just – and open to understanding of the pathogenesis of the complexity of the diseases we’re

going after – that many will take combinatorial approaches and, if there are opportunities that help us build the franchise out that we have, we’ll certainly take them. You know, we’re – so we’re keeping our on the pulse of

that area, for sure.

Holly Manning: And another question that may be punted to you, Bruce – a

follow-up from Tyler. I’d be interested to hear more about the promise of PKM2 mechanism versus PKR, and broadly how the indications are separated.

Bruce Car: Thanks very much, Tyler. So the mechanisms are related in terms of them both being tetramers where we would act – where we would

stabilise the active tetrameric form of the molecule with the – with drug candidates that we have. We have – we have solid material in this space of things that we believe have the potential to be drugs and go all the way. The disease

indications for PKM2 relate to tissues that have high levels of expression of PKM2, and, you know, examples of those might be the retina of the eye, where it’s extremely

14

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

high in regenerating muscle. It’s extremely high in the astrocytes of the brain. It’s in a number of other places – the kidney and so on – as well. And we’re studying, in

disease models, very specific to understanding the contribution of the expression of PKM2. It’s quite possible that there will be diseases that profit from a combination of both PKR and PKM2, or either alone as well.

Holly Manning: Great. maybe a follow-up from Michael Schmidt. What percent of current R&D is not oncology?

Jackie Fouse: I’m waiting for Jonathan to [inaudible] both of us are hesitating is the mix has been shifting over time, as we’ve had

some of the oncology programs mature and drift and come down a little bit while we’ve been ramping up the spend for thalassaemia and sickle cell, and as we put those in the plan for the pivotal programmes on a

go-forward basis. So I don’t know how you want to answer that question, Jonathan, exactly. We were going to see some shift anyway towards genetically defined diseases, but…

Jonathan Biller: Yeah, that’s exactly right. I mean, you know, as we – we’ll be starting up – if we hadn’t – even if we

hadn’t done this transaction, has been starting up, you know, two phase III registration-enabling trials next year for thalassaemia and sickle cell disease. You know, we’re definitely seeing that – you know, that shift. I mean, the

way that we’ve kind of thought about it, to give you a little bit more direction, is if you think about where we are this year and then we’ve talked about this kind of hybrid bridge year next year as we go into 2022, you know, we will have

been, or we’ll be a rightsized GGD-focused company, but it will reflect over the course of ’21, you know, a company that’s in growth mode, right, driving these two phase III

registration-enabling trials, getting ready for a launch in PKD. And so I think, like, you know, at a – at a higher level, without getting into too much detail prematurely, we’d probably be looking at, you know, an R&D spend in 2022

for our GDD company that’s, you know, in the, you know, two thirds of the range of where we’re spending across both companies today for 2020, and that’s reflecting the growth of the portfolio that Bruce and Chris will be managing and

driving forward.

Holly Manning: Okay. Maybe a – one more follow-up from Alethia. So how are you

thinking about developing earlier-stage assets like AG-946 now that the pipeline has narrowed?

Chris

Bowden: Want me to take that, Jackie?

Jackie Fouse: Sure. I’m happy to have someone else talk

Chris Bowden: Hey, Alethia, it’s Chris here. I think that 946, if you – if you think about where we are in the early stages of development of

that molecule as we enter into healthy volunteers, and then it [inaudible] the presentation that Jackie walked you through and sort of what Bruce just presented is that we’ll first understand the initial pharmacokinetics, PD, early safety data

of that molecule. We have a reference frame with mitapivat that we can think about it [inaudible] properties, dependent on that initial data. And then what we do in terms of taking it forward, if there would be next steps – if it were to have

[inaudible] clear those early hurdles – would then be to start considering some of those other indications and applications that Bruce and Jackie have talked about. One thing that we get lots of questions about: is this a replacement for

mitapivat in the three diseases that mitapivat is far advanced, and that is [inaudible] thalassaemia and sickle cell disease, and we’ve consistently said it’s unlikely. The reason why is that mitapivat has three-plus years of safety data

now in adults

15

|

|

|

|

|

Embracing Our Past, Reimagining Our Future

|

|

Monday, 21st December 2020

|

in pyruvate kinase deficiency, stretching out for four-plus years and beyond, so we really know a lot about the safety profile of that drug. We’re getting ready to bring it into kids. And so

if – we have a lot of confidence in it. Now 946 may have a – so that’s where mitapivat is, as we’ve said multiple times over the – in the – in the past and emphasizing today [inaudible] pyruvate kinase activation and

where 9 – what the next steps could be for 946. It gives us a lot of different ways to go, but, as always, we’ve really got to see it clear those initial hurdles of safety, pharmacodynamic activation – and that’s having the

expertise of six years in the clinic with mitapivat, with PK activators and with an extensive research and preclinical understanding of the – of the target and the diseases that are involved with it and the expansion possibilities that you

heard today, we can really think about what the next steps could be for 946, if it passes its initial hurdles in healthy volunteers and potentially a sickle cell [inaudible].

Jackie Fouse: Great. Holly, are you canvassing the landscape?

Holly Manning: I think we’ve answered pretty much all of the questions in here, so I’ll turn it over to you to close this out.

Jackie Fouse: All right. So thank you very much for hopping on the call with us today at short notice. We’re really excited about where we’re

going. I hope you both hear that in our voices, see it in our eyes, and hopefully the slide deck, which, for anybody who hasn’t had time to fully digest it yet, has a lot of information in it. We designed it to serve as a presentation deck for

today, but also as a reference document that people can go back to and digest a little bit. So we’re excited. We’re very grateful for everything that all of our people have done to put us in a position of strength to be able to do this

today, to take this step with our strategy and execute on the transaction with Servier that’s going to enable it. So thank you very much to all of you, thanks to the team here, and we wish you all a great upcoming holiday break and a terrific

start to 2021, and we look forward to following up with any of you who want to follow up. So, thank you, team. Thank you very much.

[END OF TRANSCRIPT]

Additional Information and Where to Find It

This

communication relates to the proposed transaction involving the sale by Agios Pharmaceuticals, Inc. (“Agios”) of its oncology business to Servier Pharmaceuticals, LLC. In connection with the proposed transaction, Agios will file

relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including Agios’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement

or any other document that Agios may file with the SEC or send to its stockholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, STOCKHOLDERS OF AGIOS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE

SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents (when available) free of charge

at the SEC’s website, at http://www.sec.gov, and Agios’s website, at www.agios.com. In addition, the documents (when available) may be obtained free of charge by accessing Agios’s website at www.agios.com under the heading

“Investors” or, alternatively, directing a request to Holly Manning by email at holly.manning@agios.com or by calling 617-649-8600.

Participants in the Solicitation

Agios and its

directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Agios common stock in respect of the proposed transaction. Information about the directors and executive officers of Agios is

set forth in the proxy statement for Agios’s 2020 annual meeting of stockholders, which was filed with the SEC on April 16, 2020, and in other documents filed by Agios with the SEC. Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they

become available.

16

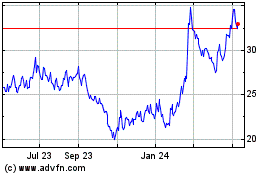

Agios Pharmaceuticals (NASDAQ:AGIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

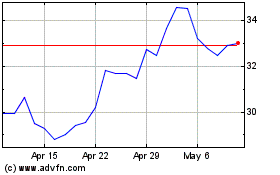

Agios Pharmaceuticals (NASDAQ:AGIO)

Historical Stock Chart

From Apr 2023 to Apr 2024