Revised Proxy Soliciting Materials (definitive) (defr14a)

July 29 2021 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed

by the Registrant ( X )

Filed

by a Party other than the Registrant ( )

Check

the appropriate box:

( )

Preliminary Proxy

Statement

(

)

Confidential, for

Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

(

)

Definitive Proxy

Statement

(X)

Definitive

Additional Materials

(

)

Soliciting Material

Pursuant to Section 240.14a-11(c) or Section

240.14a-12

AEMETIS, INC.

-----------------------------------------------

(Name

of Registrant as Specified In Its Charter)

------------------------------------------------

(Name

of Person(s) Filing Proxy Statement if other than the

Registrant)

Payment

of Filing Fee (Check the appropriate box):

(

)

Fee computed on

table below per Exchange Act Rules 14a-6(i) and O-11.

1)

Title of each class

of securities to which transaction applies:

2)

Aggregate number of

securities to which transaction applies:

3)

Per unit price or

other underlying value of transaction computed pursuant to Exchange

Act Rule O-11

(set

forth the amount on which the filing fee is calculated and state

how it was determined):

4) Proposed

maximum aggregate value of transaction:

(

) Fee

paid previously with preliminary materials.

(

) Check

box if any part of the fee is offset as provided by Exchange Act

Rule O-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing.

1)

Amount Previously

Paid:

2) Form,

Schedule or Registration State No.:

AMENDED NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

TO BE HELD ON AUGUST 26, 2021

July

29, 2021

To the

Stockholders of

AEMETIS,

INC.:

THIS

AMENDED NOTICE IS HEREBY given that the 2021 Annual Meeting of

Stockholders (the “Annual Meeting”) of Aemetis, Inc.

(the “Company” or “Aemetis”) will be held

at the offices of Shearman & Sterling LLP, 1460 El Camino Real,

Floor 2, Menlo Park, California 94025 on Thursday, August 26, 2021

at 1:00 p.m. (Pacific Time) for the following

purposes:

1)

To elect Naomi L.

Boness, as a Class II Director, to hold office for a three-year

term, until her successor is duly elected and

qualified;

2)

To ratify the

appointment of RSM US LLP as our independent registered public

accounting firm for the fiscal year ending December 31,

2021;

3)

To consider and

vote on a proposal to reincorporate the Company from the State of

Nevada to the State of Delaware and adopt certain other corporate

changes;

4)

To ratify the

proposed amendment to the Aemetis, Inc. 2019 Stock

Plan;

5)

To authorize the

adjournment of the Annual Meeting, if necessary or appropriate, to

solicit additional proxies if there are insufficient votes at the

Annual Meeting in favor of Proposal No. 3;

6)

To hold a

non-binding advisory vote on the frequency of holding an advisory

vote to approve our executive compensation; and

7)

To transact such

other business as may properly come before the meeting and any

adjournment or postponement thereof.

The

Board of Directors of the Company (the “Board of

Directors”) has fixed the close of business on the record

date for determining the stockholders entitled to receive notice

of, and to vote at, the Annual Meeting and any adjournment thereof.

A complete list of such stockholders will be available at the

Company’s executive offices at 20400 Stevens Creek Blvd.,

Suite 700, Cupertino, CA 95014, for ten days before the Annual

Meeting.

Our

Board of Directors recommends that you vote:

●

“FOR”

the individual nominated for election to the Board of

Directors;

●

“FOR”

ratification of RSM US LLP as our independent registered public

accounting firm for the fiscal year ending December 31,

2021.

●

“FOR”

the reincorporation of Aemetis, Inc. from the State of Nevada to

the State of Delaware and the adoption of certain other corporate

changes;

●

“FOR”

the ratification of the proposed amendment to the Aemetis, Inc.

2019 Stock Plan;

●

“FOR”

the adjournment of the Annual Meeting, if necessary or appropriate,

to solicit additional proxies if there are insufficient votes at

the Annual Meeting in favor of Proposal No. 3; and

●

“FOR”

the approval, on an advisory basis, of an advisory vote on

executive compensation every three years.

We are

pleased to take advantage of the SEC rules that allow companies to

furnish their proxy materials over the Internet. As a result, we

are mailing to our stockholders a Notice of Internet Availability

of Proxy Materials (the “Internet Availability Notice”)

instead of a paper copy of this proxy statement and our Annual

Report on Form 10-K for the fiscal year ended December 31, 2020

(the “2020 Annual Report”). The Internet Availability

Notice contains instructions on how to access those documents over

the Internet. The Internet Availability Notice also contains

instructions on how to request a paper copy of our proxy materials,

including this proxy statement, our 2020 Annual Report and a form

of proxy card or voting instruction card, as applicable. We believe

that this process will reduce the costs of printing and

distributing our proxy materials and provide other

benefits.

You are

encouraged to vote by following the instructions included in this

proxy statement or by following the instructions detailed in the

Internet Availability Notice, as applicable. If you are able to

attend the Annual Meeting and wish to vote in person, you may do so

whether or not you have returned your proxy or voted by telephone

or the Internet.

|

|

BY

ORDER OF THE BOARD OF DIRECTORS

/s/ Todd Waltz

Todd

Waltz

Corporate

Secretary

|

YOUR VOTE IS IMPORTANT, WHETHER YOU OWN A FEW SHARES OR

MANY

AEMETIS, INC.

20400

Stevens Creek Blvd., Suite 700, Cupertino, CA 95014

Tel.:

(408) 213-0940 Fax: (408) 252-8044

www.aemetis.com

Explanatory Note

On July

23, 2021, Aemetis, Inc. (the “Company”) filed with the

Securities and Exchange Commission (the “SEC”) its

definitive proxy statement on Schedule 14A (the “Proxy

Statement”) and the related proxy card (the “Proxy

Card”) for the Company’s 2021 Annual Meeting of

Stockholders (the “Annual Meeting”), to be held

virtually on August 26, 2021. This supplement to the Proxy

Statement and Proxy Card is being filed to add a new Proposal No. 6

that is soliciting a non-binding, advisory vote from

Company’s stockholders as of July 6, 2021 (the “Record

Date”) on the frequency of holding an advisory vote to

approve our executive compensation. Proposal No. 6 was

inadvertently omitted from the Proxy Statement and Proxy Card when

originally filed with the SEC and this filing corrects that

omission. Other than the addition of Proposal No. 6 to the Proxy

Statement, the Proxy Card and the Notice of the Annual Meeting, no

other changes have been made to the Proxy Statement or the Proxy

Card and they continue to be in full force and effect as originally

filed and continue to seek the vote of Company’s stockholders

for the proposals to be voted on at the Annual

Meeting.

This

supplement should be read together with the Proxy Statement, which

should be read in its entirety. Capitalized terms used but not

otherwise defined in this supplement have the meanings ascribed to

them in the Proxy Statement.

2021 PROXY STATEMENT SUPPLEMENT

This

Proxy Statement Supplement (the “Supplement”)

supplements and amends the Proxy Statement of the Company for the

Company’s Annual Meeting to (i) add a new Proposal No. 6 to

the Proxy Statement that provides for a non-binding, advisory vote

of Company’s stockholders on the frequency of holding an

advisory vote to approve our executive compensation

(“Proposal No. 6”), and (ii) update the Notice of the

Annual Meeting to add the new Proposal No. 6. This Supplement and a

revised proxy card (the “Revised Proxy Card”) attached

here as Appendix A are being distributed or made available to the

Company’s stockholders as of the Record Date. This Supplement

does not provide all of the information that you should read and

consider before voting on all of the proposals that are being

presented to stockholders for their vote at the Annual Meeting.

Additional information is contained in the Proxy Statement. To the

extent that the information in this Supplement differs from,

updates or conflicts with the information contained in the Proxy

Statement, the information in this Supplement shall amend and

supersede the information in the Proxy Statement. Except as so

amended or superseded, all information set forth in the Proxy

Statement remains unchanged and important for your consideration

before voting. Accordingly, we encourage you to read this

Supplement carefully and in its entirety together with the Proxy

Statement.

If you

sign and return the Revised Proxy Card, it will revoke and replace

any previous proxy you have submitted.

Proposal

No. 6 is a “non-routine” matter. Accordingly, if you

hold shares beneficially in street name and do not provide your

broker with voting instructions as to Proposal No. 6, your shares

may constitute “broker non-votes” as to Proposal No. 6.

Broker non-votes occur on a matter when a broker is not permitted

to vote on that matter without instructions from the beneficial

owner and instructions are not given.

With

respect to Proposal No. 6, your vote may be cast for “1

YEAR,” “2 YEAR” “3 YEAR” frequency or

“ABSTAIN.” A vote to “ABSTAIN” will have no

effect on the vote. The choice receiving the most votes cast by

stockholders present virtually or represented by proxy and entitled

to vote on the matter will be deemed to be the frequency preferred

by the stockholders.

PROPOSAL SIX:

ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE

COMPENSATION

The

Dodd-Frank Wall Street Reform and Consumer Protection Act of

2010 (the “Dodd-Frank Act”) and the rules

promulgated thereunder by the SEC enable stockholders of certain

public companies to vote to indicate, on an advisory

(nonbinding) basis, how frequently we should seek an advisory

vote on the compensation of our named executive officers, as

disclosed pursuant to the SEC’s compensation disclosure

rules. By voting on this Proposal No. 6,

stockholders may indicate whether they would prefer an advisory

vote on named executive officer compensation once every one, two,

or three years.

After

careful consideration of this Proposal, our Board has determined

that an advisory vote on executive compensation that occurs every

three years is the most appropriate alternative for the

Company, and therefore our Board recommends that you vote for a

three-year interval for the advisory vote on executive

compensation.

In

formulating its recommendation, our Board considered that an

advisory vote occurring once every three years will provide

stockholders with a sufficient amount of time to evaluate the

effectiveness of our compensation

policies. Specifically, the three year interval

will allow stockholders to gauge our compensation policies in the

context of our long-term business results and will minimize the

impact of short-term variations in our compensation and business

results. Holding an advisory vote every three years

will also give us more time to evaluate and implement appropriate

changes to our compensation policies between votes, to the extent

that changes are appropriate. We understand that our

stockholders may have different views as to what is the best

approach for the Company, and we look forward to hearing from our

stockholders on this Proposal.

You

may cast your vote on your preferred voting frequency by choosing

the option of one year, two years, three years or

abstain from voting when you vote in response to the resolution set

forth below.

“RESOLVED,

that, with respect to the resolution on the frequency of holding an

advisory vote on executive compensation, the option of once every

one year, two years, or three years that receives

the highest number of votes cast for this resolution will be

determined to be the preferred frequency with which the

Company is to hold a stockholder vote to approve the

compensation of the named executive officers, as disclosed pursuant

to the Securities and Exchange Commission’s compensation

disclosure rules (which disclosure shall include the Summary

Compensation Table and the other related tables and

disclosure).”

VOTE REQUIRED

The

option of one year, two years or three years that

receives the highest number of votes cast by stockholders will be

the frequency for the advisory vote on executive compensation that

has been selected by stockholders. However, because this

vote is advisory and not binding on the Board or the

Company in any way, the Board or the Governance, Compensation

and Nominating Committee may decide that it is in the best

interests of our stockholders and the Company to hold an

advisory vote on executive compensation more or less frequently

than the option approved by our stockholders.

BOARD RECOMMENDATION

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE OPTION OF ONCE EVERY

THREE YEARS AS THE FREQUENCY WITH WHICH STOCKHOLDERS ARE PROVIDED

AN ADVISORY VOTE ON EXECUTIVE COMPENSATION, AS DISCLOSED PURSUANT

TO THE COMPENSATION DISCLOSURE RULES OF THE SEC.

APPENDIX A

Revised Proxy Card

|

AEMETIS, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF

DIRECTORS

ANNUAL

MEETING OF STOCKHOLDERS – AUGUST 26, 2021 AT 1:00 PM PACIFIC

TIME

|

|

|

|

|

|

|

CONTROL ID:

|

|

|

|

|

|

|

|

|

REQUEST ID:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The undersigned hereby appoints

Eric A. McAfee, Francis Barton, Lydia Beebe, John Block, and Naomi

Boness (collectively, the “Proxies”), or any of them,

each with the power of substitution, to represent and vote the

shares of the undersigned, with all the powers which the

undersigned would possess if personally present, at the Annual

Meeting of Stockholders (the “Annual Meeting”) of

Aemetis, Inc., a Nevada corporation (the “Company”), to

be held on Thursday, August 26, 2021, at 1:00 p.m. (Pacific Time),

at the offices of Shearman & Sterling LLP, 1460 El Camino Real,

Floor 2, Menlo Park, California 94025, and at any adjournments or

postponements thereof. SHARES REPRESENTED BY THIS

PROXY CARD WILL BE VOTED AS DIRECTED BY THE STOCKHOLDER. IF NO SUCH

DIRECTIONS ARE INDICATED, THE PROXIES WILL HAVE AUTHORITY TO VOTE

FOR THE ELECTION OF THE DIRECTOR NOMINEES LISTED ON THE REVERSE

SIDE, FOR PROPOSALS 2, 3, 4 AND 5 AND FOR THREE YEARS WITH RESPECT

TO PROPOSAL 6. IN THEIR DISCRETION, THE

PROXIES ARE AUTHORIZED TO VOTE UPON SUCH OTHER BUSINESS AS MAY

PROPERLY COME BEFORE THE ANNUAL

MEETING.

|

|

|

|

|

(CONTINUED AND TO BE SIGNED ON REVERSE SIDE.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VOTING

INSTRUCTIONS

|

|

|

|

|

|

|

|

If you vote by phone, fax or internet, please DO NOT mail your

proxy card.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIL:

|

Please

mark, sign, date, and return this Proxy Card promptly using the

enclosed envelope.

|

|

|

|

|

|

|

|

FAX:

|

Complete the reverse portion of this Proxy Card

and Fax to 202-521-3464.

|

|

|

|

|

|

|

|

INTERNET:

|

https://www.iproxydirect.com/AMTX

|

|

|

|

|

|

|

|

PHONE:

|

1-866-752-VOTE(8683)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL MEETING OF THE STOCKHOLDERS OFAEMETIS, INC.

|

PLEASE COMPLETE, DATE, SIGN AND RETURN PROMPTLY IN THE ENCLOSED

ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN

HERE: ☒

|

|

|

|

|

PROXY

SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

|

|

|

|

|

|

|

|

Proposal

1

|

|

FOR

|

|

WITHHOLD

|

|

|

|

|

|

|

|

Election

of Class II Director:

|

|

|

|

|

|

|

|

CONTROL ID:

|

|

|

|

Naomi

L. Boness

|

|

☐

|

|

☐

|

|

|

|

REQUEST ID:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal

2

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

|

|

|

|

To

ratify the appointment of RSM US LLP as our independent registered

public accounting firm for the fiscal year ending December 31,

2021.

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal

3

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

|

|

|

|

To

consider and vote on a proposal to reincorporate the Company from

the State of Nevada to the State of Delaware and adopt certain

other corporate changes.

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal

4

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

|

|

|

|

To ratify the

proposed amendment to the Aemetis, Inc. 2019 Stock

Plan.

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

Proposal

5

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

|

|

|

|

To

authorize the adjournment of the Annual Meeting, if necessary or

appropriate, to solicit additional proxies if there are

insufficient votes at the Annual Meeting in favor of Proposal No.

3.

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal

6

|

|

ONE

YEAR

|

|

TWO YEARS

|

|

THREE

YEARS

|

|

ABSTAIN

|

|

|

|

To hold a

non-binding advisory vote on the frequency of holding an advisory

vote to approve our executive compensation.

|

|

☐

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

|

|

MARK

“X” HERE IF YOU PLAN TO ATTEND THE MEETING:

☐

|

|

|

|

|

|

MARK HERE FOR ADDRESS CHANGE ☐ New Address (if applicable):

__________________________

__________________________

__________________________

IMPORTANT: Please sign exactly as your name or names appear

on this Proxy. When shares are held jointly, each holder should

sign. When signing as executor, administrator, attorney, trustee or

guardian, please give full title as such. If the signer is a

corporation, please sign full corporate name by duly authorized

officer, giving full title as such. If signer is a partnership,

please sign in partnership name by authorized

person.

Dated:

________________________, 2021.

|

|

|

|

|

(Print Name of

Stockholder and/or Joint Tenant)

|

|

|

|

(Signature of

Stockholder)

|

|

|

|

(Second Signature

if held jointly)

|

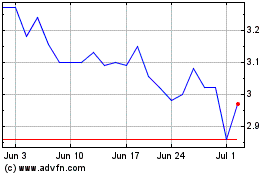

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

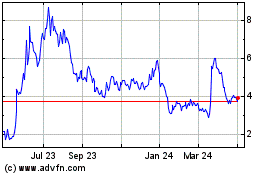

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From Apr 2023 to Apr 2024