Adamis Pharmaceuticals Corporation (NASDAQ: ADMP), a specialty

biopharmaceutical company focused on developing and commercializing

products in various therapeutic areas, including opioid overdose,

allergy, respiratory and inflammatory disease, and DMK

Pharmaceuticals, Corp., a private, clinical-stage biotechnology

company at the forefront of endorphin-inspired drug design focused

on developing novel treatments for opioid use disorder (OUD) and

other neuro-based diseases, today announced that the companies have

entered into an Agreement and Plan of Merger and Reorganization

(the “Agreement”). Pursuant to the Agreement, Adamis will acquire

DMK, including its library of approximately 750 small molecule

neuropeptide analogues and on-going government funding for its

development programs.

“Last fall, we initiated a process to explore strategic

alternatives for the company with the goal of maximizing

stockholder value,” stated David J. Marguglio, CEO of Adamis.

“After engaging in a thorough process of exploring potential

alternatives and transactions, we believe a merger with DMK is the

best path forward for Adamis and the strategy that has the

potential to deliver significant value to Adamis’ shareholders. I

believe by combining Adamis’ commercial products and development

infrastructure with DMK’s clinical-stage programs and library of

small molecules, under Dr. Versi’s leadership, the new company will

have the potential to develop multiple groundbreaking treatments

and ultimately grow shareholder value.”

At the close of the merger, Eboo Versi, the current CEO of DMK,

will assume the role of CEO and chairman of the combined company.

Dr. Versi explained, “There are substantial synergies between

Adamis and DMK. The combined company will have both the expertise

and infrastructure to further the development of DMK’s potentially

life-changing products to address large unmet medical needs. I

believe that each of our clinical-stage product candidates has

blockbuster potential, and we only need one to succeed to

significantly increase shareholder value. I believe the combined

companies present a risk diversified portfolio which is especially

important in a time of market uncertainty.”

Please find a short video discussion with both CEOs on Adamis’

website.

Transaction Details

On February 24, 2023, Adamis entered into the Agreement with DMK

and Aardvark Merger Sub (“Merger Sub”), a newly created

wholly-owned subsidiary of Adamis, pursuant to which DMK will merge

with and into Merger Sub (the “Merger”), with Merger Sub as the

surviving corporation of the Merger and a wholly owned subsidiary

of Adamis.

Subject to approval by the Adamis stockholders of proposals

relating to the transaction and the satisfaction of other closing

conditions, in connection with and before the effective time of the

Merger (the “Effective Time”), a reverse stock split of Adamis

Common Stock will be consummated, pursuant to which a number of

outstanding shares of Adamis Common Stock (determined by the

Reverse Stock Split Ratio) will be converted into one share of

Adamis Common Stock at a ratio to be determined by the Adamis board

of directors.

Please see Adamis Report on Form 8-K which will be filed with

the Securities and Exchange Commission for additional detail on the

proposed transaction.

About DMK Pharmaceuticals

DMK Pharmaceuticals, Corp. is a privately held, clinical stage

neuro-biotechnology company focused on developing novel therapies

for opioid use disorder (OUD) and other important neuro-based

conditions where patients are currently underserved. The company’s

technology is at the forefront of endorphin-inspired drug design.

DMK is developing mono, bi- and tri-functional small molecules that

simultaneously modulate critical networks in the nervous system

with the goal of creating treatments that are efficacious, safe,

and tolerable. DMK has a library of high value, first-in-class

compounds and a differentiated pipeline that could address several

unmet medical needs by taking the novel approach to integrate with

the body’s own efforts to regain balance of disrupted physiology.

By designing small molecule analogs of neuropeptides, one or

multiple receptors can be targeted by a single molecule to support

a transition back to a balanced neurophysiological state.

Since the company’s inception, DMK’s development programs have

been largely financed by non-dilutive funding from the government.

DMK’s lead clinical stage product candidate, DPI-125, is being

studied as a potential novel treatment for OUD. The company also

plans to develop the compound for the treatment of moderate to

severe pain, where it could potentially offer a superior safety

profile with lower addiction risk than currently marketed opioids

(pain killers) and hence help prevent opioid addiction. DMK’s other

product candidates include DPI-221 being developed for treating

bladder control problems and DPI-289 being developed for treating

severe end stage Parkinson’s disease. For additional information

about DMK Pharmaceuticals, please visit the company website.

About Dr. Versi

Eboo Versi received a BA, MA and DPhil (PhD) from Oxford

University before obtaining his MB BChir (MD) degree from Cambridge

University in the United Kingdom. Following medical school, Dr.

Versi completed a residency and fellowship at Kings College

Hospital and served as a Senior Registrar at the Royal London

Hospital. He was then a Senior Lecturer and Consultant (Attending)

at St. Thomas’ & Guys Hospitals before moving to the U.S. to

accept a senior academic position at Harvard Medical School. There,

he set up the first urogynecology program at the Brigham &

Women’s Hospital and served as Chief of Urogynecology. Since

Harvard, Dr. Versi has spent the last 20+ years in the

pharmaceutical and medical device industry, holding positions at

large companies such as Pfizer, Lilly and Astellas, as well as

smaller companies including Odyssey, Plethora, Auxilium and Mt.

Cook. During his career in the industry, Dr. Versi has been the

inventor of several patents and the recipient of several NIH

grants, and has helped develop drugs and devices for a variety of

indications. Dr. Versi is an internationally recognized opinion

leader with more than 100 scientific publications.

About Adamis Pharmaceuticals

Adamis Pharmaceuticals Corporation is a specialty

biopharmaceutical company focused on developing and commercializing

products in various therapeutic areas, including opioid overdose,

allergy, respiratory and inflammatory disease. Company products

approved by the FDA include ZIMHI® (naloxone) Injection for the

treatment of opioid overdose and SYMJEPI® (epinephrine) Injection

for use in the emergency treatment of acute allergic reactions,

including anaphylaxis. For additional information about Adamis

Pharmaceuticals, please visit our website and follow us on Twitter

and LinkedIn.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements are identified by terminology such

as “may,” “should,” “expects,” “plans,” “anticipates,” “could,”

“intends,” “target,” “projects,” “contemplates,” “believes,”

“estimates,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar words. Such forward-looking

statements include those that express plans, anticipation, intent,

contingencies, goals, targets or future development and/or

otherwise are not statements of historical fact. These statements

relate to future events or future results of operations, including,

but not limited to statements concerning the following matters:

(i) risks associated with Adamis’ and DMK’s ability to obtain

the stockholder approvals required to consummate the proposed

Merger and the timing of the closing of the proposed Merger; risks

that one or more conditions to closing of the Merger may not be

satisfied within the expected timeframe or at all or that the

closing of the proposed Merger will not occur; (ii) the

outcome of any current legal proceedings or future legal

proceedings that may be instituted against the parties or others,

including proceedings related to the Merger Agreement;

(iii) the occurrence of any event, change or other

circumstance or condition that could give rise to the termination

of the Merger Agreement; (iv) unanticipated difficulties or

expenditures relating to the proposed Merger; (v) potential

difficulties in employee retention as a result of the announcement

and pendency of the proposed Merger; (vi) whether the combined

business of DMK and Adamis will be successful; (vii) whether any

DMK product candidates will be successfully developed or

commercialized; (viii) the Company’s review and evaluation of

potential strategic alternatives and their impact on stockholder

value; (ix) the Company’s ability to raise capital to continue as a

going concern; and (x) those risks detailed in Adamis’ most

recent Annual Report on Form 10-K and subsequent reports

filed with the Securities and Exchange Commission (“SEC”), as well

as other documents that may be filed by Adamis from time to time

with the SEC. These statements are only predictions and involve

known and unknown risks, uncertainties, and other factors, which

may cause Adamis’ actual results to be materially different from

the results anticipated by such forward-looking statements.

Accordingly, you should not rely upon forward-looking statements as

predictions of future events. Neither Adamis nor DMK can assure you

that the events and circumstances reflected in the forward-looking

statements will be achieved or occur, and actual results could

differ materially from those projected in the forward-looking

statements. Factors that could cause actual results to differ

materially from management’s current expectations include those

risks and uncertainties relating to: our ability to raise capital;

the results of our strategic review process; the risk of not

obtaining stockholder approval for the proposals required to

consummate the Merger; risks associated with development of DMK’s

drug product candidates; our cash flow, cash burn, expenses,

obligations and liabilities; the outcomes of any litigation,

regulatory proceedings, inquiries or investigations that we are or

may become subject to; and other important factors discussed in the

Company’s filings with the Securities and Exchange Commission

(“SEC”). If we do not obtain required additional equity or debt

funding, our cash resources will be depleted and we could be

required to materially reduce or suspend operations, which would

likely have a material adverse effect on our business, stock price

and our relationships with third parties with whom we have business

relationships, at least until additional funding is obtained. If we

do not have sufficient funds to continue operations or satisfy out

liabilities, we could be required to seek bankruptcy protection or

other alternatives to attempt to resolve our obligations and

liabilities that could result in our stockholders losing some or

all of their investment in us. You should not place undue reliance

on any forward-looking statements. Further, any forward-looking

statement speaks only as of the date on which it is made, and

except as may be required by applicable law, we undertake no

obligation to update or release publicly the results of any

revisions to these forward-looking statements or to reflect events

or circumstances arising after the date of this press release.

Certain of these risks and additional risks, uncertainties, and

other factors are described in greater detail in Adamis’ filings

from time to time with the SEC, including its annual report on Form

10-K for the year ended December 31, 2021, and subsequent

filings with the SEC, which Adamis strongly urges you to read and

consider, all of which are available free of charge on the SEC’s

website at http://www.sec.gov.

Additional Information about the Merger and Where to

Find It

Adamis intends to file a proxy statement in connection with the

proposed transaction. Investors and stockholders are urged to read

this filing when it becomes available because it will contain

important information about the transaction. This press release

does not constitute an offer of any securities for sale or the

solicitation of any proxy. BEFORE MAKING ANY VOTING OR INVESTMENT

DECISION, ADAMIS’ STOCKHOLDERS ARE URGED TO READ THE PROXY

STATEMENT REGARDING THE PROPOSED TRANSACTION CAREFULLY AND IN ITS

ENTIRETY WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED

MATTERS. Investors and stockholders may obtain free copies of the

proxy statement and other relevant documents (when they become

available) and other documents filed with the Securities and

Exchange Commission at the Securities and Exchange Commission's web

site at: www.sec.gov. In addition, investors and stockholders may

obtain free copies of the documents filed with the Securities and

Exchange Commission by Adamis by contacting David C. Benedicto,

Adamis’ chief financial officer, at (858) 997-2400.

Participants in the Solicitation

Adamis and DMK, and their respective directors and executive

officers, may be deemed to be participants in the solicitation of

proxies from the companies’ stockholders in connection with the

proposed transaction. Information regarding the interests of

directors and executive officers in the transaction will be

included in the proxy statement to be filed by Adamis. Investors

and security holders are urged to read the Company’s proxy

statement and the other relevant materials when they become

available before making any voting or investment decision with

respect to the proposed transaction. Additional information

regarding directors and executive officers of Adamis is also

included in the Company’s annual report on Form 10-K for the year

ended December 31, 2021, and, when it becomes available, its annual

report on Form 10-K for the year ended December 31, 2022, filed

with the Securities and Exchange Commission, which is available as

described above.

No Offer or Solicitation

This press release is not intended to and shall not constitute

an offer to sell or the solicitation of an offer to buy any

securities or the solicitation of any vote in any jurisdiction

pursuant to the proposed transaction or otherwise, nor shall there

be any sale of securities in any jurisdiction in contravention of

applicable law.

ContactsAdamis Investor RelationsRobert

UhlManaging DirectorICR

Westwicke619.228.5886robert.uhl@westwicke.com

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

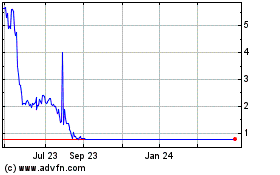

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024