Current Report Filing (8-k)

May 22 2020 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 18, 2020

ACELRX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35068

|

|

41-2193603

|

|

(State of incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

351 Galveston Drive

Redwood City, CA 94063

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (650) 216-3500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

ACRX

|

The Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement

On May 18, 2020, AcelRx Pharmaceuticals, Inc. (the “Company”) received a notice (the “Notice”) from Grünenthal GmbH (“Grünenthal”) that it is exercising its right to terminate the amended Collaboration and License Agreement (the “License Agreement”) and the amended Manufacture and Supply Agreement (the “Supply Agreement”) (together, the “Agreements”) between the Company and Grünenthal, effective on or about November 14, 2020. Upon termination, the rights to market and sell Zalviso® in the European Union, Switzerland, Liechtenstein, Iceland, Norway and Australia (the “Territory”) will revert immediately back to the Company.

On May 20, 2020, the Company agreed to provide a right of first negotiation (“ROFN”) for a license agreement to replace the Grünenthal License Agreement to a third party with which the Company is currently negotiating a license agreement for DZUVEO for the European market.

For the years ended December 31, 2018 and 2019, the Company’s cost of goods sold under the Supply Agreement exceeded net sales due to the manufacturing cost of Zalviso components being higher than the contractual sales price to Grünenthal. The Company intends to negotiate revised supply terms for Zalviso under any new agreement.

As previously disclosed, under the License Agreement the Company received, among other things, $50.0 million in upfront and milestone payments and is eligible to receive approximately $194.5 million in additional regulatory and sales-based milestone payments, plus tiered royalty and supply and trademark fee payments in the mid-teens up to the mid-twenties percent range, depending on the level of sales achieved, on net sales of Zalviso.

Also as previously disclosed, in September 2015, the Company sold the majority of the royalty rights and certain commercial sales milestones it was entitled to receive under the License Agreement to PDL BioPharma, Inc. (“PDL”) in a transaction for which the Company received gross proceeds of $65.0 million (the “Royalty Monetization”). Under the Royalty Monetization, PDL receives 75% of the Territory royalties under the License Agreement, as well as 80% of the first four commercial milestones worth $35.6 million (or 80% of $44.5 million), up to a capped amount of $195.0 million over the life of the arrangement. In consideration of the expected termination of the License Agreement, under the Royalty Monetization, the Company must use commercially reasonable efforts to negotiate a replacement license agreement with a third party.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: May 22, 2020

|

ACELRX PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Raffi Asadorian

|

|

|

|

|

Raffi Asadorian

|

|

|

|

|

Chief Financial Officer

|

|

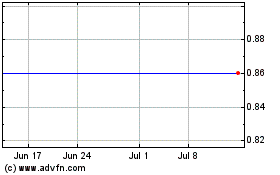

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

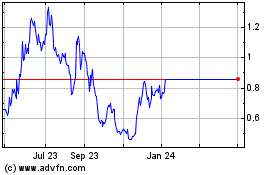

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Apr 2023 to Apr 2024