Lido DAO (LDO) Surges Nearly 20% In The Past 7 Days, Here’s Why

May 16 2023 - 4:30PM

NEWSBTC

In the fast-paced world of cryptocurrencies, Lido DAO (LDO) has

made significant waves in the past week, experiencing an impressive

surge of nearly 20%. Though the surge comes at a time the global

crypto market is not deep in a downtrend, Lido’s current rally can

be attributed to two notable factors. Over the past seven days, LDO

has recorded a significant spike, up by 16%. The asset has picked

up from trading at a low of below $2 as of May 9 to trading at a

high of $2.25, at the time of writing. Meanwhile, over the past 24

hours, the rally continues as the asset is currently up 6.3% with

an increasing trading volume. Whale Accumulation Fuels Lido’s Surge

One possible catalyst for Lido’s remarkable performance over the

past 7 days is the increased buying activity by cryptocurrency

whales. According to a recent report by Onchain analyst

Lookonchain, three whale accounts have been observed accumulating

LDO tokens. Related Reading: Lido (LDO) Surges 16% In Single Day,

Maintains Dominance In Liquid Staking Market Notably, these whales

have been seen transferring their LDO assets from centralized

cryptocurrency exchange Binance to personal wallets, indicating a

deliberate accumulation strategy. The magnitude of these whale

transactions is noteworthy. For instance, one address withdrew a

substantial amount of 724,822 LDO tokens, valued at approximately

$1.52 million, from Binance for $2.01 per token. Another whale

withdrew 655,641 LDO tokens, equivalent to $1.38 million, from

Binance at $1.83 per token. Additionally, a third whale

purchased 570,883 LDO tokens using 974,000 USDC for $1.71 on May

12. This influx of capital from these significant players in the

market has undoubtedly contributed to the surge in Lido’s value.

Lido V2 Launch Amplifies Momentum Another driving force behind

Lido’s recent upward trend is the launch of Lido V2. This highly

anticipated upgrade brings several notable features to the Lido DAO

ecosystem, enhancing its appeal to investors and participants. A

key highlight of the V2 release is the ability for users to

withdraw their staked Ethereum (ETH). With the new Withdrawals

page, Lido users can easily deposit their staked Ethereum tokens,

such as stETH or wstETH, and receive ETH in return. Lido has

streamlined the withdrawal process, reducing the withdrawal period

to as short as 1-5 days. This improvement not only enhances the

liquidity and accessibility of staked Ethereum but also provides

users with greater flexibility and control over their assets.

Additionally, the V2 upgrade introduces a modular staking router,

which promotes staking diversity among several cohorts. Related

Reading: Lido DAO (LDO) Holds 10% Gains On Weekly Chart While

Majority Of Coins Shrink Solo stakers, decentralized autonomous

organizations (DAOs), and Distributed Validator Technology (DVT)

clusters can now participate in staking activities through Lido,

further expanding the network’s staking capabilities. LDO’s price

has already risen nearly 20% since the upgrade, with a market

currently above $2 at the time of writing. Alongside the price

surge, Lido DAO’s market capitalization has also experienced a

notable rise. The market cap moved from $1.4 billion last Friday to

$1.9 billion today. Moreover, the trading volume of LDO has also

witnessed a significant uptick over the same period indicating the

increasing accumulation of the asset. Lido’s trading volume has

surged from $47.4 million last Friday to more than $104 million in

the past 24 hours. Featured image from iStock, Chart from

TradingView

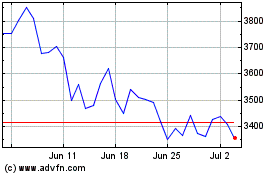

stETH (COIN:STETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

stETH (COIN:STETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024