- Diluted EPS of $0.16, adjusted EPS1 of $0.74

- EBITDA of $148.3 million, adjusted EBITDA1 of $250.1

million

- Operating cash flow of $145.6 million, free cash flow1 of

$155.1 million

- Total assets of $391.1 billion, up 4.1% over Q4

- Paid quarterly dividend of $33.5 million or $0.18 a

share

- Today announced sale of a 20% stake in U.S. wealth

management business, raising $1.34 billion

- Investment values U.S. business equity value at $6.7

billion, or ~3x CI’s current market cap

- In May, acquired Avalon Advisors, a leading Texas RIA,

adding approximately $11.1 billion in assets to CI’s U.S.

business

All financial amounts in Canadian dollars at March 31, 2023,

unless stated otherwise.

CI Financial Corp. (“CI”) (TSX: CIX) today released financial

results for the quarter ended March 31, 2023.

CI also announced this morning that it has agreed to sell a 20%

minority stake in its U.S. wealth management business (“CI US”) to

a group of prominent institutional investors. Please see the press

release “CI Financial Announces pre-IPO Minority Investment in its

U.S. Wealth Management Business from Leading Global Institutional

Investors” for more information about this transaction.

“The CI US transaction is a significant step in CI’s ongoing

strategic transformation and builds on the important progress we

have made for the year-to-date,” said Kurt MacAlpine, Chief

Executive Officer of CI. “Our U.S. wealth management business now

manages more than $198 billion in assets2 with the addition this

month of Avalon Advisors, a high-quality Houston-based firm focused

on the ultra-high-net-worth segment and one of the largest

registered investment advisors in Texas with $11.1 billion under

management.

“We have numerous projects underway to both realize synergies

from the integration of the U.S. business and to drive its

continued strong growth and development,” Mr. MacAlpine said. “The

impact is clear – our adjusted U.S. EBITDA1 increased 15% quarter

over quarter.

“In Canadian wealth management, our initiative to expand CI

Investment Services into the foundation of an integrated platform

serving the entire business is proceeding well, and we expect to

complete the transfer of client assets at Aligned Capital to the

CIIS custody platform by the third quarter.

“In asset management, the Canadian retail business had its third

consecutive quarter of net sales with inflows of $0.8 billion in

the first quarter,” Mr. MacAlpine said. “We continued to modernize

the business with an impressive series of product launches across

our mutual fund and ETF lineups, including a unique fund-of-funds

private markets solution designed to provide simple one-ticket

access to this increasingly important asset class.”

Operating and financial data highlights

[millions of dollars, except share

amounts]

As of and for the quarters

ended

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Total AUM and Client Assets:

Asset Management AUM

121,987

117,753

114,196

116,065

136,271

Canada Wealth Management assets

81,592

77,421

73,976

74,128

78,957

U.S. Wealth Management assets

187,481

180,579

149,841

143,520

145,768

Total assets

391,060

375,753

338,014

333,712

360,996

Asset Management Net Inflows:

Retail

841

1,621

640

(381)

(861)

Institutional

(177)

(195)

(21)

(3,203)

(264)

Australia

(81)

12

(377)

(122)

(305)

Closed Business

(195)

(169)

(129)

(160)

(203)

U.S. Asset Management

(67)

595

(38)

(195)

402

Total

321

1,864

75

(4,060)

(1,231)

IFRS

Results

Net income attributable to

shareholders

30.0

(9.5)

14.9

156.2

138.1

Diluted earnings per share

0.16

(0.05)

0.08

0.81

0.70

Pretax income

54.8

33.6

37.8

219.0

185.8

Pretax margin

8.6%

5.4 %

7.4 %

38.6 %

29.3 %

Operating cash flow before the change in

operating assets and liabilities

145.6

150.9

64.8

141.2

207.7

Adjusted

Results

Adjusted net income

136.8

135.9

135.9

149.1

166.8

Adjusted diluted earnings per share

0.74

0.74

0.73

0.78

0.85

Adjusted EBITDA

250.1

242.7

237.5

251.0

272.9

Adjusted EBITDA margin

41.5%

42.4 %

43.0 %

44.5 %

46.5 %

Free cash flow

155.1

157.9

151.5

176.4

201.6

Average shares outstanding

184,517,832

183,666,579

185,601,752

191,151,896

196,111,771

Ending shares outstanding

184,517,832

184,517,832

183,526,499

189,037,762

192,987,082

Total debt

4,190

4,216

3,949

3,688

3,530

Net debt

4,052

4,059

3,730

3,538

3,352

Net debt to adjusted EBITDA

4.0

4.2

4.0

3.5

3.0

1. Free cash flow, net debt, adjusted net income, adjusted earnings

per share and adjusted EBITDA are not standardized earningsmeasures

prescribed by IFRS. For further information, see “Non-IFRS

Measures” note below. 2.Based on U.S. wealth management assets of

$187.5 billion as at March 31, 2023.

Financial highlights

The first quarter net income of $30.2 million compared to a net

loss of ($8.3) million in the fourth quarter of 2022. The

improvement reflected stronger revenues, lower transaction,

integration, restructuring and settlement costs, and a more

normalized tax rate partially offset by higher interest expenses.

Excluding non-operating items, adjusted net income of $136.8

million in the quarter was little changed from the fourth

quarter.

First quarter total net revenues increased 2.8% to $637.8

million in the quarter from $620.3 million in the fourth quarter of

2022. Excluding non-operating items, adjusted total net revenues

grew 4.1% to $640.0 million, driven by growth in our Canadian and

U.S. Wealth Management segments. Asset Management segment revenues

were essentially unchanged as higher average AUM was offset by two

fewer days in the quarter and effective fee rate pressure due to

asset mix shift.

First quarter total expenses decreased 0.1% to $583.0 million in

the quarter from $586.7 million in the fourth quarter of 2022.

Excluding non-operating items, adjusted total expenses were up 4.8%

to $431.5 million, reflecting seasonally higher compensation and

benefits, higher advisor and dealer fees due to revenue growth, and

higher interest expense.

Capital allocation

The Board of Directors declared a quarterly dividend of $0.18

per share, payable on October 13, 2023 to shareholders of record on

September 29, 2023. The annual dividend rate of $0.72 per share

represented a yield of 5.8% on CI’s closing share price of $12.50

on May 10, 2023.

First quarter business highlights

- CI’s common shares ceased trading on the New York Stock

Exchange as of January 19, 2023, following CI’s decision to

voluntarily delist its shares from the exchange, as announced in

November 2022.

- In support of CI’s strategic priority of modernizing asset

management, CI Global Asset Management (“CI GAM”) launched a series

of investment funds that enhance the firm’s comprehensive product

lineup. These included an innovative private markets fund-of-funds

solution, a pair of ETFs that seek to minimize downside volatility

for equity investors, and a suite of new covered call funds.

- CI GAM was the recipient of 39 FundGrade A+® Awards, which are

presented annually by Fundata Canada Inc. to acknowledge Canadian

investment funds that have demonstrated consistent, outstanding

risk-adjusted performance.

Following quarter-end:

- CI acquired Avalon Advisors, LLC of Houston, one of the leading

registered investment advisor firms in Texas with US$8.2 billion in

client assets under management. Avalon serves ultra-high-net-worth

individuals and families, offering a broad range of investment

management and wealth planning services characterized by a

client-centered approach, service excellence and a robust

investment platform that includes access to alternative mandates.

The acquisition closed on May 1, 2023.

- CI reached an agreement to sell its minority stake in

Boston-based Congress Wealth Management, LLC (“Congress”) to Audax

Private Equity. CI, which first invested in Congress in the third

quarter of 2020, agreed to sell its interest because Congress’s

ownership structure precluded its full integration into CI Private

Wealth, LLC (“CIPW”), CI’s U.S. wealth management subsidiary.

- CIPW launched CIPW Trust, LLC, a South Dakota chartered trust

company, allowing CIPW advisors across the U.S. to offer a wide

array of corporate trustee services through the firm. The ability

to integrate trust solutions into a client’s overall wealth plan is

an important enhancement to CIPW’s ability to provide a superior

client experience.

Analysts’ conference call

CI will hold a conference call with analysts today at 9:00 a.m.

EDT, led by Chief Executive Officer Kurt MacAlpine and Chief

Financial Officer Amit Muni. A live webcast of the call and slide

presentation can be accessed here, or through the Investor

Relations section of CI’s website.

Alternatively, investors may listen to the discussion through

the following numbers (access code: 175331):

- Canada toll-free: 1-833-950-0062

- United States toll-free: 1-833-470-1428

- All other locations: 1-929-526-1599.

A recording of the webcast will be archived on CI’s Investor

Relations site.

About CI Financial

CI Financial Corp. is a diversified global asset and wealth

management company operating primarily in Canada, the United States

and Australia. Founded in 1965, CI has developed world-class

portfolio management talent, extensive capabilities in all aspects

of wealth planning, and a comprehensive product suite.

CI operates in three segments:

- Asset Management, which includes CI Global Asset Management,

which operates in Canada, and GSFM Pty Ltd., which operates in

Australia.

- Canadian Wealth Management, which includes the operations of CI

Assante Wealth Management, Aligned Capital Partners, CI Private

Wealth (Canada), Northwood Family Office, CI Direct Investing and

CI Investment Services.

- U.S. Wealth Management, which includes CI Private Wealth

(U.S.), an integrated wealth management firm providing

comprehensive solutions to ultra-high-net-worth and high-net-worth

clients across the United States.

CI is headquartered in Toronto and listed on the Toronto Stock

Exchange (TSX: CIX). To learn more, visit CI’s website or LinkedIn

page.

Commissions, trailing commissions, management fees and expenses

all may be associated with an investment in mutual funds and

exchange-traded funds (ETFs). Please read the prospectus before

investing. Important information about mutual funds and ETFs is

contained in their respective prospectus. Mutual funds and ETFs are

not guaranteed; their values change frequently, and past

performance may not be repeated. You will usually pay brokerage

fees to your dealer if you purchase or sell units of an ETF on

recognized Canadian exchanges. If the units are purchased or sold

on these Canadian exchanges, investors may pay more than the

current net asset value when buying units of the ETF and may

receive less than the current net asset value when selling

them.

FundGrade A+® is used with permission from Fundata Canada Inc.,

all rights reserved. The annual FundGrade A+® Awards are presented

by Fundata Canada Inc. to recognize the “best of the best” among

Canadian investment funds. The FundGrade A+® calculation is

supplemental to the monthly FundGrade ratings and is calculated at

the end of each calendar year. The FundGrade rating system

evaluates funds based on their risk-adjusted performance, measured

by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score

for each ratio is calculated individually, covering all time

periods from 2 to 10 years. The scores are then weighted equally in

calculating a monthly FundGrade. The top 10% of funds earn an A

Grade; the next 20% of funds earn a B Grade; the next 40% of funds

earn a C Grade; the next 20% of funds receive a D Grade; and the

lowest 10% of funds receive an E Grade. To be eligible, a fund must

have received a FundGrade rating every month in the previous year.

The FundGrade A+® uses a GPA-style calculation, where each monthly

FundGrade from “A” to “E” receives a score from 4 to 0,

respectively. A fund’s average score for the year determines its

GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade

A+® Award. For more information, see www.FundGradeAwards.com.

Although Fundata makes every effort to ensure the accuracy and

reliability of the data contained herein, the accuracy is not

guaranteed by Fundata.

This press release contains forward-looking statements

concerning anticipated future events, results, circumstances,

performance or expectations with respect to CI Financial Corp.

(“CI”) and its products and services, including its business

operations, strategy and financial performance and condition.

Forward-looking statements are typically identified by words such

as “believe”, “expect”, “foresee”, “forecast”, “anticipate”,

“intend”, “estimate”, “goal”, “plan” and “project” and similar

references to future periods, or conditional verbs such as “will”,

“may”, “should”, “could” or “would”. These statements are not

historical facts but instead represent management beliefs regarding

future events, many of which by their nature are inherently

uncertain and beyond management’s control. Although management

believes that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, such statements

involve risks and uncertainties. The foregoing list is not

exhaustive and the reader is cautioned to consider these and other

factors carefully and not to place undue reliance on

forward-looking statements. Other than as specifically required by

applicable law, CI undertakes no obligation to update or alter any

forward-looking statement after the date on which it is made,

whether to reflect new information, future events or otherwise.

This communication is provided as a general source of

information and should not be considered personal, legal,

accounting, tax or investment advice, or construed as an

endorsement or recommendation of any entity or security discussed.

Individuals should seek the advice of professionals, as

appropriate, regarding any particular investment. Investors should

consult their professional advisors prior to implementing any

changes to their investment strategies.

CI Global Asset Management is a registered business name of CI

Investments Inc.

CONSOLIDATED STATEMENT OF

INCOME

For the three-month period ended March

31

2023

2022

[in thousands of Canadian dollars, except

per share amounts]

$

$

REVENUE

Canada asset management fees

377,665

437,623

Trailer fees and deferred sales

commissions

(115,896)

(135,289)

Net asset management fees

261,769

302,334

Canada wealth management fees

141,533

138,246

U.S. wealth management fees

201,337

164,479

Other revenues

32,320

21,646

Foreign exchange gain

1,754

11,469

Other losses

(889)

(4,424)

Total net revenues

637,824

633,750

EXPENSES

Selling, general and administrative

304,598

259,260

Advisor and dealer fees

107,822

106,908

Interest and lease finance

47,179

35,876

Amortization and depreciation

12,897

11,376

Amortization of intangible assets from

acquisitions

31,345

24,083

Transaction, integration, restructuring

and legal

14,175

3,800

Change in fair value of contingent

consideration

53,506

3,088

Other

11,507

3,599

Total expenses

583,029

447,990

Income before income taxes

54,795

185,760

Provision for (recovery of) income

taxes

Current

39,069

47,741

Deferred

(14,427)

511

24,642

48,252

Net income for the period

30,153

137,508

Net income (loss) attributable to

non-controlling interests

185

(639)

Net income attributable to

shareholders

29,968

138,147

Basic earnings per share attributable

to shareholders

$0.16

$0.70

Diluted earnings per share attributable

to shareholders

$0.16

$0.70

Other comprehensive loss, net of

tax

Exchange differences on translation of

foreign operations

(2,868)

(6,721)

Total other comprehensive loss, net of

tax

(2,868)

(6,721)

Comprehensive income for the

period

27,285

130,787

Comprehensive income (loss)

attributable to non-controlling interests

153

(1,052)

Comprehensive income attributable to

shareholders

27,132

131,839

CONSOLIDATED BALANCE SHEET

As at

As at

March 31, 2023

December 31, 2022

[in thousands of Canadian dollars]

$

$

ASSETS

Current

Cash and cash equivalents

136,969

153,620

Client and trust funds on deposit

1,246,237

1,306,595

Investments

37,374

40,448

Accounts receivable and prepaid

expenses

337,246

298,778

Assets held for sale

67,662

—

Income taxes receivable

39,001

33,989

Total current assets

1,864,489

1,833,430

Capital assets, net

60,754

55,587

Right-of-use assets

130,898

139,422

Intangibles

7,192,758

7,227,700

Deferred income taxes

66,183

54,415

Other assets

330,756

397,804

Total assets

9,645,838

9,708,358

LIABILITIES AND EQUITY

Current

Accounts payable and accrued

liabilities

319,562

293,246

Current portion of provisions and other

financial liabilities

556,266

502,746

CIPW unit liabilities

794,073

765,959

Dividends payable

66,426

66,426

Client and trust funds payable

1,260,097

1,312,640

Income taxes payable

2,233

3,044

Current portion of long-term debt

298,000

320,000

Current portion of lease liabilities

23,386

23,994

Total current liabilities

3,320,043

3,288,055

Long-term debt

3,892,165

3,896,214

Provisions and other financial

liabilities

191,351

270,567

Deferred income taxes

479,490

480,500

Lease liabilities

143,287

149,360

Total liabilities

8,026,336

8,084,696

Equity

Share capital

1,706,880

1,706,880

Contributed surplus

32,848

30,239

Deficit

(164,135)

(160,572)

Accumulated other comprehensive income

30,388

33,224

Total equity attributable to the

shareholders of the Company

1,605,981

1,609,771

Non-controlling interests

13,521

13,891

Total equity

1,619,502

1,623,662

Total liabilities and equity

9,645,838

9,708,358

CONSOLIDATED STATEMENT OF CASH

FLOWS

For the three-month period ended March

31

2023

2022

[in thousands of Canadian dollars]

$

$

OPERATING ACTIVITIES (*)

Net income for the period

30,153

137,508

Add (deduct) items not involving cash

Other losses

889

4,424

Change in fair value of contingent

consideration

53,506

3,088

Contingent consideration recorded as

compensation

1,703

18,210

Amortization of loan guarantees

(255)

—

Recognition of vesting of CIPW unit

liabilities

28,968

3,926

Equity-based compensation

3,554

4,536

Equity accounted income

(4,786)

—

Amortization of equity accounted

investments

2,056

—

Amortization and depreciation

12,897

11,376

Amortization of intangible assets from

acquisitions

31,345

24,083

Deferred income taxes

(14,427)

511

Cash provided by operating activities

before net change in operating assets and liabilities

145,603

207,662

Net change in operating assets and

liabilities

(2,214)

(52,856)

Cash provided by operating

activities

143,389

154,806

INVESTING ACTIVITIES

Purchase of investments

(642)

(30)

Proceeds on sale of investments

4

94,659

Additions to capital assets

(9,121)

(3,311)

Decrease (increase) in other assets

(3,211)

2,148

Additions to intangibles

(3,104)

(1,564)

Cash paid to settle acquisition

liabilities

(74,976)

(18,288)

Acquisitions, net of cash acquired

(7,108)

(5,729)

Cash provided by (used in) investing

activities

(98,158)

67,885

FINANCING ACTIVITIES

Repayment of long-term debt

(320,000)

(297,500)

Issuance of long-term debt

298,000

80,000

Repurchase of share capital

—

(91,038)

Payment of lease liabilities

(6,350)

(5,210)

Net issuance of CIPW unit liabilities

523

83,330

Net distributions to non-controlling

interest

(523)

(1,489)

Dividends paid to shareholders

(33,531)

(35,511)

Cash used in financing

activities

(61,881)

(267,418)

Net decrease in cash and cash

equivalents during the period

(16,650)

(44,727)

Cash and cash equivalents, beginning of

period

153,619

230,778

Cash and cash equivalents, end of

period

136,969

186,051

SUPPLEMENTAL CASH FLOW

INFORMATION

(*) Included in operating activities are

the following:

Interest paid

20,285

9,665

Income taxes paid

40,126

52,277

ASSETS UNDER MANAGEMENT AND NET

FLOWS

[billions of dollars]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Beginning AUM

117.8

114.2

116.1

136.3

144.2

Gross inflows

6.9

7.3

4.9

4.8

4.9

Gross outflows

(6.5)

(6.0)

(4.8)

(8.7)

(6.6)

Net inflows/(outflows)

0.4

1.3

0.1

(3.9)

(1.6)

Acquisitions

—

—

—

—

—

Market move and FX

3.8

2.3

(2.0)

(16.3)

(6.3)

Ending AUM

122.0

117.8

114.2

116.1

136.3

Proprietary AUM

33.0

31.9

30.4

30.8

34.5

Non-proprietary AUM

89.0

85.9

83.7

85.2

101.7

Average assets under management

121.9

117.7

119.1

125.4

138.2

Annualized organic growth

1.3 %

4.4 %

0.4 %

(11.4) %

(4.6) %

Gross management fee/average AUM

1.27 %

1.29 %

1.30 %

1.31 %

1.30 %

Net management fee/average AUM

0.86 %

0.87 %

0.88 %

0.89 %

0.88 %

Net

Inflows/(Outflows)

Retail

0.8

1.6

0.6

(0.4)

(0.9)

Institutional

(0.2)

(0.2)

—

(3.2)

(0.3)

Closed business

(0.2)

(0.2)

(0.1)

(0.2)

(0.2)

Total Canada net inflows/(outflows)

0.5

1.3

0.5

(3.7)

(1.3)

Australia

(0.1)

—

(0.4)

(0.1)

(0.3)

Total net inflows/(outflows)

0.4

1.3

0.1

(3.9)

(1.6)

RETAIL (ex Closed Business)

[billions of dollars]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Beginning AUM

97.1

94.0

95.1

108.4

114.6

Net Flows

0.8

1.6

0.6

(0.4)

(0.9)

Market Move / FX

3.3

1.5

(1.7)

(12.9)

(5.3)

Acquisitions

___

___

___

___

___

Ending AUM

101.2

97.1

94.0

95.1

108.4

Average AUM

100.9

97.0

97.9

101.4

109.6

INSTITUTIONAL

[billions of dollars]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Beginning AUM

8.3

8.3

8.4

12.7

13.3

Net Flows

(0.2)

(0.2)

0.0

(3.2)

(0.3)

Market Move / FX

0.4

0.2

(0.1)

(1.1)

(0.3)

Acquisitions

___

___

___

___

___

Ending AUM

8.5

8.3

8.3

8.4

12.7

Average AUM

8.5

8.4

8.6

10.2

12.9

AUSTRALIA

[billions of dollars]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Beginning AUM

5.0

4.7

5.1

6.6

7.3

Net Flows

(0.1)

0.0

(0.4)

(0.1)

(0.3)

Market Move / FX

0.0

0.3

0.0

(1.4)

(0.4)

Acquisitions

___

___

___

___

___

Ending AUM

4.9

5.0

4.7

5.1

6.6

Average AUM

5.0

4.8

4.9

5.8

7.0

CLOSED BUSINESS

[billions of dollars]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Beginning AUM

7.3

7.3

7.5

8.6

9.1

Net Flows

(0.2)

(0.2)

(0.1)

(0.2)

(0.2)

Market Move / FX

0..3

0.2

(0.1)

(0.9)

(0.3)

Acquisitions

___

___

___

___

___

Ending AUM

7.4

7.3

7.3

7.5

8.6

Average AUM

7.5

7.4

7.6

8.0

8.7

AUM BY ASSET CLASS

[billions of dollars]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Balanced

50.8

50.3

49.8

50.9

59.4

Equity

43.3

41.6

40.2

41.4

49.3

Fixed income

11.3

11.0

11.2

11.7

13.1

Alternatives

4.0

3.6

3.8

3.6

4.9

Cash/Other

7.7

6.2

4.5

3.4

3.0

Total Canada asset management

117.1

112.8

109.5

111.0

129.7

Australia

4.9

5.0

4.7

5.1

6.6

Total asset management segment

122.0

117.8

114.2

116.1

136.3

CANADA WEALTH MANAGEMENT CLIENT

ASSETS

[billions of dollars]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Beginning client assets

77.4

74.0

74.1

79.0

80.6

Acquisitions

—

—

—

2.4

—

Net flows and market move

4.2

3.4

(0.2)

(7.2)

(1.7)

Ending client assets

81.6

77.4

74.0

74.1

79.0

Average client assets

80.7

77.3

76.0

77.7

79.0

Wealth management fees/average client

assets

0.93 %

0.91 %

0.90 %

0.91 %

0.95 %

U.S. WEALTH MANAGEMENT CLIENT

ASSETS

[billions of dollars]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Beginning billable client assets

174.3

144.9

138.8

141.2

146.4

Acquisitions

—

24.9

—

7.1

1.1

Net flows and market move

5.6

4.4

6.2

(9.5)

(6.3)

Ending billable client assets

179.9

174.3

144.9

138.8

141.2

Non-billable client assets

7.6

6.3

4.9

4.8

4.6

Total client assets

187.5

180.6

149.8

143.5

145.8

Fees/beginning billable client assets

0.47 %

0.52 %

0.47 %

0.48 %

0.46 %

NON-IFRS MEASURES

In an effort to provide additional information regarding our

results as determined by IFRS, we also disclose certain non-IFRS

information which we believe provides useful and meaningful

information. Our management reviews these non-IFRS financial

measurements when evaluating our financial performance and results

of operations; therefore, we believe it is useful to provide

information with respect to these non-IFRS measurements so as to

share this perspective of management. Non-IFRS measurements do not

have any standardized meaning, do not replace nor are superior to

IFRS financial measurements and may not be comparable to similar

measures presented by other companies. The non-IFRS financial

measurements include:

- Adjusted net income and adjusted basic and diluted earnings per

share

- Adjusted EBITDA and adjusted EBITDA margin

- Free cash flow

- Net debt.

These non-IFRS measurements exclude the following revenues and

expenses which we believe allows investors a consistent way to

analyze our financial performance, allows for better analysis of

core operating income and business trends and permits comparisons

of companies within the industry, normalizing for different

financing methods and levels of taxation:

- gains or losses related to foreign currency fluctuations on our

cash balances

- costs related to our acquisitions including:

- amortization of intangible assets

- change in fair value of contingent consideration

- related advisory fees

- contingent consideration classified as compensation per

IFRS

- restructuring charges including organizational expenses for the

establishment of CIPW

- legal provisions for a class action related to market

timing

- certain gains or losses in assets and investments

- costs related to issuing or retiring debt obligations

- expenses associated with CIPW redeemable units.

Further explanations of these Non-IFRS measures can be found in

the “Non-IFRS Measures” section of Management’s Discussion and

Analysis dated May 11, 2023 available on SEDAR at www.sedar.com or

at www.cifinancial.com.

ADJUSTED NET INCOME AND ADJUSTED

EARNINGS PER SHARE

[millions of dollars, except per share

amounts]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Mar. 31, 2022

Net Income

30.2

(8.3)

137.5

Amortization of intangible assets from

acquisitions

31.3

26.5

24.1

Amortization of equity accounted

investments

2.1

2.6

—

Change in fair value of contingent

consideration

53.5

76.8

3.1

Contingent consideration recorded as

compensation

1.7

1.5

18.2

Non-controlling interest

reclassification

2.5

1.2

0.9

CIPW adjustments

43.1

27.7

13.2

Severance

5.5

—

—

Amortization of loan guarantees

(0.3)

—

—

FX (gains)/losses

(1.8)

(15.2)

(11.5)

Transaction, integration, restructuring

and legal

14.2

41.3

3.8

Other (gains)/losses

1.9

7.1

—

Total adjustments

153.7

169.6

51.7

Tax effect of adjustments

(28.5)

(9.9)

(11.5)

Less: Non-controlling interest

18.5

15.5

10.9

Adjusted net income

136.8

135.9

166.8

Adjusted earnings per share

0.74

0.74

0.85

Adjusted diluted earnings per

share

0.74

0.74

0.85

EBITDA, ADJUSTED EBITDA AND ADJUSTED

EBITDA MARGIN

[millions of dollars, except per share

amounts]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Mar. 31, 2022

Pretax income

54.8

33.6

185.8

Amortization of intangible assets from

acquisitions

31.3

26.5

24.1

Amortization of equity accounted

investments

2.1

2.6

—

Depreciation and other amortization

12.9

13.1

11.4

Interest and lease finance expense

47.2

41.4

35.9

EBITDA

148.3

117.2

257.1

Change in fair value of contingent

consideration

53.5

76.8

3.1

Contingent consideration recorded as

compensation

1.7

1.5

18.2

Non-controlling interest

reclassification

2.5

1.2

0.9

CIPW adjustments

43.1

27.7

13.2

Severance

5.5

—

—

Amortization of loan guarantees

(0.3)

—

—

FX (gains)/losses

(1.8)

(15.2)

(11.5)

Transaction, integration, restructuring

and legal

14.2

41.3

3.8

Other (gains)/losses

1.9

7.1

—

Total adjustments

120.3

140.5

27.7

Less: Non-controlling interest

18.5

15.0

11.9

Adjusted EBITDA

250.1

242.7

272.9

Reported net revenue

637.8

620.3

633.8

Less: FX gains/(losses)

1.8

15.2

11.5

Less: Non-Operating Other

gains/(losses)

(1.9)

(7.1)

—

Less: Amortization of equity accounted

investments

(2.1)

—

—

Less: Non-controlling interest

revenues

37.3

40.6

35.5

Adjusted net revenue

602.7

571.7

586.8

Adjusted EBITDA margin

41.5%

42.4 %

46.5 %

FREE CASH FLOW

[millions of dollars]

Quarters ended

Mar. 31, 2023

Dec. 31, 2022

Mar. 31, 2022

Cash provided by operating activities

143.4

56.7

154.8

Less: Net change in operating assets and

liabilities

(2.2)

(94.1)

(52.9)

Operating cash flow before the change

in operating assets and liabilities

145.6

150.9

207.7

FX (gains)/losses

(1.8)

(15.2)

(11.5)

Transaction, integration, restructuring

and legal

14.2

41.3

3.8

Total adjustments

12.4

26.1

(7.7)

Tax effect (recovery) of adjustments

(1.8)

(18.8)

1.2

Less: Non-controlling interest

1.1

0.3

(0.4)

Free cash flow

155.1

157.9

201.6

NET DEBT

Quarters ended

[millions of dollars]

Mar. 31, 2023

Dec. 31, 2022

Sep. 30, 2022

Jun. 30, 2022

Mar. 31, 2022

Current portion of long-term debt

298.0

320.0

400.5

314.6

225.3

Long-term debt

3,892.2

3,896.2

3,548.2

3,373.5

3,304.7

4,190.2

4,216.2

3,948.7

3,688.1

3,530.0

Less:

Cash and short-term investments

137.0

153.6

220.4

154.8

186.1

Marketable securities

22.6

20.6

17.8

18.1

20.3

Add:

Regulatory capital and non-controlling

interests

21.7

16.8

19.9

22.4

28.8

Net Debt

4,052.2

4,058.8

3,730.3

3,537.5

3,352.4

Adjusted EBITDA

250.1

242.7

237.5

251.0

272.9

Adjusted EBITDA, annualized

1,014.2

962.8

942.1

1,006.9

1,106.6

Gross leverage (Gross debt/Annualized

adjusted EBITDA)

4.1

4.4

4.2

3.7

3.2

Net leverage (Net debt/Annualized adjusted

EBITDA)

4.0

4.2

4.0

3.5

3.0

SUMMARY OF QUARTERLY RESULTS

[millions of dollars, except per share

amounts]

IFRS Results

Adjusted Results

For the quarters ended

For the quarters ended

Mar.

31,

2023

Dec.

31,

2022

Sep.

30,

2022

Jun.

30,

2022

Mar.

31,

2022

Mar.

31,

2023

Dec.

31,

2022

Sep.

30,

2022

Jun.

30,

2022

Mar.

31,

2022

Revenues

Asset management fees

377.7

378.2

386.7

404.3

437.6

377.7

378.2

386.7

404.3

437.6

Trailer fees and deferred sales

commissions

(115.9)

(116.0)

(119.2)

(124.0)

(135.3)

(115.9)

(116.0)

(119.2)

(124.0)

(135.3)

Net asset management fees

261.8

262.2

267.5

280.3

302.3

261.8

262.2

267.5

280.3

302.3

Canada wealth management fees

141.5

133.1

129.2

130.1

138.2

141.5

133.1

129.2

130.1

138.2

U.S. wealth management fees

201.3

190.1

164.1

168.9

164.5

201.3

190.1

164.1

168.9

164.5

Other revenues

32.3

26.2

26.6

21.2

21.6

34.4

28.8

26.6

21.2

21.6

FX gains/(losses)

1.8

15.2

(73.9)

(32.9)

11.5

—

—

—

—

—

Other gains/(losses)

(0.9)

(6.5)

0.1

(1.1)

(4.4)

1.0

0.6

0.1

(2.3)

(4.4)

Total net revenues

637.8

620.3

513.6

566.7

633.8

640.0

614.9

587.5

598.3

622.3

Expenses

Selling, general & administrative

304.6

277.2

245.6

238.0

259.3

254.6

248.0

230.3

234.2

227.9

Advisor and dealer fees

107.8

101.1

98.3

99.7

106.9

107.8

101.1

98.3

99.7

106.9

Other

11.5

9.2

17.1

4.7

3.6

9.0

8.1

8.1

3.8

2.7

Interest and lease finance expense

47.2

41.4

38.6

36.2

35.9

47.2

41.4

38.6

36.2

35.9

Depreciation and other amortization

12.9

13.1

13.0

11.9

11.4

12.9

13.1

13.0

11.9

11.4

Amortization of intangible assets from

acquisitions

31.3

26.5

27.7

27.4

24.1

—

—

—

—

—

Transaction, integration, restructuring

and legal

14.2

41.3

13.1

4.6

3.8

—

—

—

—

—

Change in fair value of contingent

consideration

53.5

76.8

22.5

(75.0)

3.1

—

—

—

—

—

Total expenses

583.0

586.7

475.8

347.7

448.0

431.5

411.7

388.2

386.0

384.8

Pretax income

54.8

33.6

37.8

219.0

185.8

208.5

203.2

199.3

212.3

237.5

Income tax expense

24.6

41.9

23.5

60.7

48.3

53.2

51.8

51.3

55.1

59.7

Net income

30.2

(8.3)

14.4

158.3

137.5

155.3

151.4

148.1

157.2

177.8

Less: Non-controlling interest

0.2

1.2

(0.5)

2.1

(0.6)

18.5

15.5

12.1

8.1

10.9

Net income attributable to

shareholders

30.0

(9.5)

14.9

156.2

138.1

136.8

135.9

135.9

149.1

166.8

Basic earnings per share

0.16

(0.05)

0.08

0.82

0.70

0.74

0.74

0.73

0.78

0.85

Diluted earnings per share

0.16

(0.05)

0.08

0.81

0.70

0.74

0.74

0.73

0.78

0.85

RESULTS OF OPERATIONS – ASSET

MANAGEMENT SEGMENT

[millions of dollars, except per share

amounts]

IFRS Results

Adjusted Results

For the quarters ended

For the quarters ended

Mar.

31,

2023

Dec.

31,

2022

Sep.

30,

2022

Jun.

30,

2022

Mar.

31,

2022

Mar.

31,

2023

Dec.

31,

2022

Sep.

30,

2022

Jun.

30,

2022

Mar.

31,

2022

Revenues

Asset management fees

382.0

382.3

390.9

408.9

442.5

382.0

382.3

390.9

408.9

442.5

Trailer fees and deferred sales

commissions

(123.4)

(123.8)

(126.8)

(131.9)

(143.9)

(123.4)

(123.8)

(126.8)

(131.9)

(143.9)

Net asset management fees

258.6

258.5

264.1

277.0

298.6

258.6

258.5

264.1

277.0

298.6

Other revenues

4.0

3.6

6.6

5.6

10.2

4.0

3.6

6.6

5.6

10.2

FX gains/(losses)

2.0

15.5

(74.4)

(32.8)

11.4

—

—

—

—

—

Other gains/(losses)

(0.9)

(6.5)

0.1

(1.1)

(4.4)

1.0

0.6

0.1

(2.3)

(4.4)

Total net revenues

263.6

271.2

196.4

248.7

315.8

263.5

262.8

270.7

280.2

304.4

Expenses

Selling, general & administrative

98.9

94.3

98.7

97.3

96.8

98.6

94.3

98.7

97.3

96.8

Other

—

—

7.2

—

—

—

—

—

—

—

Interest and lease finance expense

0.6

0.9

1.0

1.0

1.0

0.6

0.9

1.0

1.0

1.0

Depreciation and other amortization

3.8

4.7

5.0

5.0

5.0

3.8

4.7

5.0

5.0

5.0

Amortization of intangible assets from

acquisitions

0.6

0.6

0.6

0.6

0.6

—

—

—

—

—

Transaction, integration, restructuring

and legal

1.7

11.0

2.6

2.3

(0.9)

—

—

—

—

—

Change in fair value of contingent

consideration

(2.2)

1.6

3.2

(3.9)

4.0

—

—

—

—

—

Total expenses

103.5

113.1

118.2

102.3

106.5

103.0

99.9

104.6

103.3

102.8

Pretax income

160.1

158.0

78.2

146.4

209.3

160.5

162.8

166.1

176.9

201.6

Non-IFRS adjustments

Pretax income

160.1

158.0

78.2

146.4

209.3

160.5

162.8

166.1

176.9

201.6

Amortization of intangible assets from

acquisitions

0.6

0.6

0.6

0.6

0.6

—

—

—

—

—

Depreciation and other amortization

3.8

4.7

5.0

5.0

5.0

3.8

4.7

5.0

5.0

5.0

Interest and lease finance expense

0.6

0.9

1.0

1.0

1.0

0.6

0.9

1.0

1.0

1.0

EBITDA

165.1

164.2

84.7

153.0

215.9

164.9

168.4

172.1

183.0

207.6

Change in fair value of contingent

consideration

(2.2)

1.6

3.2

(3.9)

4.0

—

—

—

—

—

FX (gains)/losses

(2.0)

(15.5)

74.4

32.8

(11.4)

—

—

—

—

—

Severance

0.5

—

—

—

—

—

—

—

—

—

Amortization of loan guarantees

(0.3)

—

—

—

—

—

—

—

—

—

Transaction, integration, restructuring

and legal

1.7

11.0

2.6

2.3

(0.9)

—

—

—

—

—

Other (gains)/losses

1.9

7.1

—

(1.2)

—

—

—

—

—

—

Trading and bad debt

—

—

7.1

—

—

—

—

—

—

—

Total adjustments

(0.2)

4.2

87.3

30.0

(8.3)

—

—

—

—

—

Less: Non-controlling interest

0.2

0.1

0.1

0.3

0.4

0.2

0.1

0.1

0.3

0.4

Adjusted EBITDA

164.7

168.3

172.0

182.7

207.2

164.7

168.3

172.0

182.7

207.2

RESULTS OF OPERATIONS - CANADA WEALTH

MANAGEMENT SEGMENT

[millions of dollars, except per share

amounts]

IFRS Results

Adjusted Results

For the quarters ended

For the quarters ended

Mar.

31,

2023

Dec.

31,

2022

Sep.

30,

2022

Jun.

30,

2022

Mar.

31,

2022

Mar.

31,

2023

Dec.

31,

2022

Sep.

30,

2022

Jun.

30,

2022

Mar.

31,

2022

Revenues

Canada wealth management fees

184.3

176.8

171.7

175.6

185.7

184.3

176.8

171.7

175.6

185.7

Other revenues

31.8

29.1

25.5

21.3

17.1

31.8

29.2

25.5

21.3

17.1

FX gains/(losses)

(0.2)

(0.4)

0.5

—

0.1

—

—

—

—

—

Other gains/(losses)

—

—

—

—

—

—

—

—

—

—

Total net revenues

215.9

205.5

197.7

196.9

202.9

216.2

206.0

197.2

196.9

202.8

Expenses

Selling, general & administrative

48.2

46.2

43.8

44.0

41.1

47.7

45.9

43.6

43.9

41.1

Advisor and dealer fees

141.7

136.2

132.4

135.9

145.6

141.7

136.2

132.4

135.9

145.6

Other

9.8

9.3

8.2

4.0

3.2

8.8

8.1

6.3

3.2

2.4

Interest and lease finance expense

0.3

—

—

(0.1)

0.2

0.3

—

—

(0.1)

0.2

Depreciation and other amortization

4.1

3.2

3.2

2.8

2.5

4.1

3.2

3.2

2.8

2.5

Amortization of intangible assets from

acquisitions

2.1

2.1

2.1

2.1

1.6

—

—

—

—

—

Transaction, integration, restructuring

and legal

0.3

0.2

0.3

0.4

0.8

—

—

—

—

—

Change in fair value of contingent

consideration

5.3

1.9

(0.7)

(0.6)

—

—

—

—

—

—

Total expenses

211.8

199.1

189.3

188.5

195.0

202.5

193.4

185.6

185.6

191.7

Pretax income

4.1

6.4

8.4

8.4

7.9

13.7

12.5

11.6

11.4

11.1

Non-IFRS adjustments

Pretax income

4.1

6.4

8.4

8.4

7.9

13.7

12.5

11.6

11.4

11.1

Amortization of intangible assets from

acquisitions

2.1

2.1

2.1

2.1

1.6

—

—

—

—

Amortization of equity accounted

investments

0.1

0.1

—

—

—

—

—

—

—

—

Depreciation and other amortization

4.1

3.2

3.2

2.8

2.5

4.1

3.2

3.2

2.8

2.5

Interest and lease finance expense

0.3

—

—

(0.1)

0.2

0.3

—

—

(0.1)

0.2

EBITDA

10.7

11.8

13.7

13.1

12.1

18.0

15.8

14.9

14.0

13.8

Change in fair value of contingent

consideration

5.3

1.9

(0.7)

(0.6)

—

—

—

—

—

—

Contingent consideration recorded as

compensation (included in SG&A)

0.2

0.2

0.1

0.1

—

—

—

—

—

—

CIPW adjustments (included in

SG&A)

0.2

0.1

0.1

0.1

—

—

—

—

—

—

FX (gains)/losses

0.2

0.4

(0.5)

—

(0.1)

—

—

—

—

—

Severance

0.1

—

—

—

—

—

—

—

—

—

Transaction, integration, restructuring

and legal

0.3

0.2

0.3

0.4

0.8

—

—

—

—

—

Non-controlling interest reclassification

(included in Other)

1.1

1.2

1.0

0.9

0.9

—

—

—

—

—

Trading and bad debt

—

—

0.8

—

—

—

—

—

—

—

Total adjustments

7.3

4.0

1.2

0.8

1.6

—

—

—

—

—

Less: Non-controlling interest

1.9

1.3

1.2

1.0

0.9

1.9

1.3

1.2

1.0

0.9

Adjusted EBITDA

16.2

14.5

13.7

13.0

12.9

16.2

14.5

13.7

13.0

12.9

RESULTS OF OPERATIONS - U.S. WEALTH

MANAGEMENT SEGMENT

[millions of dollars, except per share

amounts]

IFRS Results

Adjusted Results

For the quarters ended

For the quarters ended

Mar.

31,

2023

Dec.

31,

2022

Sep.

30,

2022

Jun.

30,

2022

Mar.

31,

2022

Mar.

31,

2023

Dec.

31,

2022

Sep.

30,

2022

Jun.

30,

2022

Mar.

31,

2022

Revenues

U.S. wealth management fees

201.3

190.1

164.1

168.9

164.5

201.3

190.1

164.1

168.9

164.5

Other revenues

6.3

2.9

4.2

4.5

4.8

8.3

5.5

4.2

4.5

4.8

FX gains/(losses)

—

—

—

—

—

—

—

—

—

—

Total net revenues

207.7

193.1

168.2

173.4

169.2

209.6

195.6

168.3

173.5

169.2

Expenses

Selling, general & administrative

173.0

151.1

117.7

112.8

136.9

123.8

122.2

102.6

109.2

105.5

Other

1.7

(0.1)

1.8

0.7

0.4

0.2

(0.1)

1.8

0.7

0.4

Interest and lease finance expense

0.8

0.8

0.7

0.6

0.5

0.8

0.8

0.7

0.6

0.5

Depreciation and other amortization

5.1

5.2

4.8

4.1

3.9

5.1

5.2

4.8

4.1

3.9

Amortization of intangible assets from

acquisitions

28.6

23.8

25.0

24.7

21.9

—

—

—

—

—

Transaction, integration, restructuring

and legal

12.2

30.0

10.2

2.0

3.9

—

—

—

—

—

Change in fair value of contingent

consideration

50.4

73.3

20.0

(70.5)

(0.9)

—

—

—

—

—

Total expenses

271.7

284.2

180.1

74.4

166.5

129.9

128.1

109.8

114.6

110.3

Pretax income

(64.0)

(91.1)

(11.9)

99.0

2.7

79.7

67.4

58.4

58.9

59.0

Non-IFRS adjustments

Pretax income

(64.0)

(91.1)

(11.9)

99.0

2.7

79.7

67.4

58.4

58.9

59.0

Amortization of intangible assets from

acquisitions

28.6

23.8

25.0

24.7

21.9

—

—

—

Amortization of equity accounted

investments

2.0

2.5

—

—

—

—

—

—

—

—

Depreciation and other amortization

5.1

5.2

4.8

4.1

3.9

5.1

5.2

4.8

4.1

3.9

Interest and lease finance expense

0.8

0.8

0.7

0.6

0.5

0.8

0.8

0.7

0.6

0.5

EBITDA

(27.5)

(58.8)

18.6

128.4

29.1

85.6

73.5

63.9

63.5

63.4

Change in fair value of contingent

consideration

50.4

73.3

20.0

(70.5)

(0.9)

—

—

—

—

—

Contingent consideration recorded as

compensation (included in SG&A)

1.5

1.3

3.7

0.6

18.2

—

—

—

—

—

NCI reclassification (included in

SG&A)

1.4

—

—

—

—

—

—

—

—

—

CIPW adjustments (included in

SG&A)

42.9

27.6

11.4

3.0

13.2

—

—

—

—

—

FX (gains)/losses

—

—

—

—

—

—

—

—

—

—

Severance

4.8

—

—

—

—

—

—

—

—

—

Transaction, integration, restructuring

and legal

12.2

30.0

10.2

2.0

3.9

—

—

—

—

—

Total adjustments

113.1

132.2

45.3

(64.9)

34.3

—

—

—

—

—

Less: Non-controlling interest

16.5

13.6

12.1

8.2

10.9

16.5

13.6

12.1

8.2

10.9

Adjusted EBITDA

69.1

59.9

51.8

55.4

52.5

69.1

59.9

51.8

55.4

52.5

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230511005369/en/

Investor Relations Jason Weyeneth, CFA Vice-President,

Investor Relations & Strategy 416-681-8779 jweyeneth@ci.com

Media Canada Murray Oxby Vice-President, Communications

416-681-3254 moxby@ci.com

United States Jimmy Moock Managing Partner, StreetCred

610-304-4570 jimmy@streetcredpr.com ci@streetcredpr.com

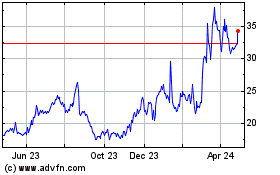

CompX (AMEX:CIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

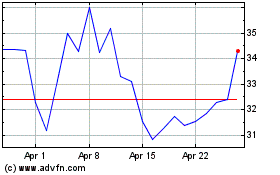

CompX (AMEX:CIX)

Historical Stock Chart

From Apr 2023 to Apr 2024