UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

|

CKX Lands, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

CKX LANDS, INC.

One Lakeside Plaza, 4th Floor

127 W. Broad Street

Lake Charles, LA 70601

Tel. 337-493-2399

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD THURSDAY MAY 7, 2020

The Annual Meeting of the Shareholders of CKX Lands, Inc., will be held at One Lakeside Plaza, 4th Floor, 127 W. Broad Street, Lake Charles, Louisiana 70601, on Thursday, May 7, 2020, at 10:00 a.m., central time, for the following purposes:

|

|

2.

|

To vote on a proposal to ratify the appointment of MaloneBailey LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2020;

|

|

|

3.

|

To approve, in a non-binding, advisory vote, the compensation of our named executive officers;

|

|

|

4.

|

To determine, in a non-binding, advisory vote, the frequency with which we should hold future non-binding, advisory votes on executive compensation like Item 3 above; and

|

|

|

5.

|

To transact such other business as may properly come before the meeting.

|

Only shareholders of record at the close of business on April 3, 2020, are entitled to notice of and to vote at the meeting.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. THEREFORE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SIGN AND DATE YOUR PROXY AND RETURN IT THROUGH ONE OF THE PERMISSIBLE MEANS OF VOTING LISTED ON THE CARD. IF YOU VOTE BY MAIL, RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

SPECIAL NOTICE CONCERNING THE COVID-19 PANDEMIC

The number of persons admitted entry to the Annual Meeting may be limited under any local, state or federal government restrictions related to the COVID-19 pandemic that are in effect on the meeting date. So that your vote will be counted, we urge you to complete, sign, date and return your proxy rather than depending on attending the meeting and voting in person.

|

|

|

|

|

/s/ Lee W. Boyer

|

|

|

Lee W. Boyer

President and Treasurer

|

April 9, 2020

IMPORTANT NOTICE REGARDING THE

AVAILABILITY OF PROXY MATERIALS FOR THE

2020 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 7, 2020

This Proxy Statement, the form of Proxy and the Company’s Annual Report on Form 10-K for the year

ended December 31, 2019 are available at www.envisionreports.com/ckx.

CKX Lands, Inc.

One Lakeside Plaza, 4th Floor

127 W. Broad Street

Lake Charles, LA 70601

PROXY STATEMENT

This proxy statement and the CXK Lands, Inc. annual report to shareholders on Form 10-K are first being made available to shareholders on or about April 9, 2020.

The Board of Directors of CKX Lands, Inc. (CKX Lands or the Company) is soliciting your proxy to vote your shares of the Company’s common stock in connection with the Company’s 2020 Annual Meeting of Shareholders. The meeting will be held on Thursday, May 7, 2020, at 10:00 a.m., central time, at One Lakeside Plaza, 4th Floor, 127 W. Broad Street, Lake Charles, Louisiana 70601 or any adjournments or postponements of the meeting. You may revoke your proxy at any time prior to it being voted by:

|

|

●

|

giving written notice to the Secretary of the Company,

|

|

|

●

|

submitting a later dated proxy through any of the permissible means of voting listed on the enclosed proxy card, or

|

|

|

●

|

by voting in person at the meeting.

|

The Company is paying all expenses of preparing, printing and mailing the proxy statement and all materials used in this solicitation. Proxies may also be solicited in person or by telephone or fax by directors, officers and other employees of the Company, none of whom will receive additional compensation for such services. The Company will also request brokerage houses, custodians and nominees who are record owners of the Company’s common stock and who hold the stock on behalf of beneficial owners to forward these materials to the beneficial owners and will pay the reasonable expenses of such persons for forwarding the material.

On April 3, 2020, CKX Lands had outstanding 1,942,495 shares of common stock, its only class of stock, which was held by 443 shareholders of record. Only shareholders of record at the close of business on April 3, 2020, will be entitled to receive notice of and to vote at the meeting. With respect to all matters that will come before the meeting, each shareholder may cast one vote for each share registered in his or her name on the record date. The presence, in person or by proxy, of holders of a majority of the outstanding shares of common stock entitled to vote at the meeting is necessary to constitute a quorum at the meeting. Shareholders voting, or abstaining from voting, by proxy on any issue will be counted as present for purposes of constituting a quorum. If a quorum is present, the election of directors will be decided by a plurality vote and the approval of the independent auditor and the non-binding advisory vote on our executive compensation will be decided by a majority of the votes cast at the meeting in person or by proxy. Abstentions will have no effect on the calculation of the vote on any matter at the meeting.

If you are the record holder of your shares, then the shares represented by your properly executed proxy card will be voted at the meeting in accordance with your directions set forth on the proxy, unless you revoke it. If you do not specify a choice on the proxy, the shares will be voted FOR the election of all director nominees, FOR the ratification of the engagement of MaloneBailey LLP as auditors and FOR the approval of the compensation of the Company’s named executive officers. The proxy also gives authority to the proxy holders to vote your shares in their discretion on any other matter that properly comes before the meeting.

If you hold your shares in an account at a brokerage firm, bank, or other nominee, then you are the beneficial owner of shares held in “street name,” and the proxy materials were forwarded to you by that firm, bank or nominee. The organization holding your account is considered the shareholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. You will receive instructions from your broker, bank or other nominee that you must follow in order for your broker, bank or other nominee to vote your shares according to your instructions. Many brokerage firms and banks have a process for their beneficial holders to provide instructions via the Internet or over the telephone. If you are a beneficial owner of shares held in street name and you wish to vote in person at the annual meeting, you must obtain a legal proxy from the organization that holds your shares.

If the organization that holds your shares does not receive instructions from you on how to vote your shares, then under the rules of various national and regional securities exchanges, the organization may generally vote your shares in its discretion on routine matters, but it cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will not have the authority to vote, and therefore cannot vote, on that matter with respect to your shares. This is generally referred to as a “broker non-vote.” The election of directors (Item 1) and matters relating to executive compensation (Item 3 and Item 4) are non-routine matters, so brokers may not vote your shares on Items 1, 3 or 4 if you do not give specific instructions on how to vote. We encourage you to provide instructions to your broker or nominee regarding these proposals so your shares will be voted.

The ratification of the engagement of the Company’s independent auditors (Item No. 2) is a matter that we believe will be considered routine. Therefore, no broker non-votes are expected to occur in connection with Item No. 2.

Broker non-votes will be counted as present at the shareholders’ meeting for the purposes of calculating a quorum but will not be counted as present for any other purpose or as a vote cast for or against a matter. Thus, we believe broker non-votes will have no effect on any matter at the meeting.

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table provides information as of April 3, 2020, concerning the beneficial ownership of the Company’s common stock by each director, each director nominee, each executive officer, all directors and executive officers as a group, and each person known by CKX Lands to own beneficially more than 5% of the outstanding shares of Common Stock. Unless otherwise noted, the listed persons have sole voting and dispositive powers with respect to shares listed below. The address of each person listed below is c/o CKX Lands, Inc., One Lakeside Plaza, 4th Floor, 127 W. Broad Street, Lake Charles, LA 70601.

|

Name of Beneficial Owner

|

|

Number

Beneficially Owned

|

|

|

Percent

of Class

|

|

|

Lee W. Boyer

|

|

|

2,962

|

|

|

|

*

|

|

|

Keith Duplechin

|

|

|

1,200

|

|

|

|

*

|

|

|

Edward M. Ellington, II

|

|

|

—

|

|

|

|

—

|

|

|

Daniel J. Englander (2)

|

|

|

52,180

|

|

|

|

2.69

|

%

|

|

Max H. Hart (1)

|

|

|

9,805

|

|

|

|

*

|

|

|

Eugene T. Minvielle, IV

|

|

|

1,000

|

|

|

|

*

|

|

|

William Gray Stream (4)

|

|

|

88,219

|

|

|

|

4.54

|

%

|

|

Mary Leach Werner (3)

|

|

|

21,276

|

|

|

|

1.10

|

%

|

|

Michael B. White (5)

|

|

|

369,610

|

|

|

|

19.03

|

%

|

|

All directors and executive officers as a group

|

|

|

546,252

|

|

|

|

28.12

|

%

|

|

(1)

|

Includes 3,500 shares owned by a trust of which Mr. Hart is a co-trustee; 2,200 shares owned by a trust of which Mr. Hart is a co-trustee; and 1,000 shares owned by a limited liability company of which Mr. Hart is a manager. Mr. Hart does not have sole voting and/or investment power over these 6,700 shares. Mr. Hart does have sole voting and/or investment powers over the remaining 3,105 shares.

|

|

(2)

|

Consists of 52,180 shares owned by a partnership of which Mr. Englander is the sole general partner.

|

|

(3)

|

Includes 8,250 shares owned by a partnership of which Mrs. Werner is a partner and 11,250 shares owned by a corporation of which Mrs. Werner is a director. Mrs. Werner does not have sole voting and/or investment power over these 19,500 shares. Mrs. Werner does have sole voting and/or investment power over the remaining 1,776 shares.

|

|

(4)

|

Consists of 9,626 shares owned by Mr. Stream directly over which he has sole voting and/or investment power; 33,055 shares owned by a limited partnership of which the general partner is a corporation that Mr. Stream is president of; 7,844 shares owned by a limited liability company of which Mr. Stream is sole manager; 2,050 shares owned by Mr. Stream’s grandmother over which Mr. Stream has proxy authority; and 35,644 shares owned by a trust of which Mr. Stream is a trustee.

|

|

(5)

|

All shares owned are by a limited liability company of which Mr. White is sole manager and sole member. Mr. White has sole voting and/or investment power over these shares.

|

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended (the Exchange Act), requires the Company’s executive officers, directors and more than 10% shareholders to file with the Securities and Exchange Commission (SEC) reports on prescribed forms of their ownership and changes in ownership of Company stock and furnish copies of such forms to the Company. Based solely upon a review of the Form 3, 4 and 5 filings received from or filed by CKX Lands, Inc. on behalf of reporting persons during the most recent fiscal year, CKX Lands, Inc. is not aware of any failure to file on a timely basis any Form 3, 4 or 5 specifically during the most recent fiscal year, other than the following: Mr. Stream filed on August 29, 2019 a Form 4 reporting his purchase of 5,300 shares, which was due on August 28, 2019.

ITEM 1: ELECTION OF DIRECTORS

The By-Laws of the Company specify that the Board fixes the number of directors from time to time, but the number may not be less than five nor more than fifteen. The Board has fixed the number of directors at nine. Each director will hold office for one year and until either his or her successor is elected and qualified or there is a decrease in the number of directors. On the recommendation of the Nominating Committee, the Board of Directors has nominated the persons listed below for election as director. If a nominee should become unavailable for election, the persons voting the accompanying proxy may in their discretion vote for a substitute. All nominees have been with the same organization and in the same position as listed below for the past five years unless noted. The table below also includes the specific qualifications and experience of each nominee that led to the conclusion that the nominee should serve as a director.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE NOMINEES NAMED BELOW.

|

Name

|

Age

|

Experience and Qualifications

|

Director

Since

|

|

Lee W. Boyer

|

62

|

President and Treasurer of CKX Lands, Inc.; Attorney with Stockwell, Sievert, Viccellio, Clements & Shaddock, L.L.P. law firm. Former President, Second University Homesites, Inc.; Manager, Jones-Boyer, LLC; Manager, Boyer Properties, LLC, which are residential and commercial property management companies. Director, Mallard Bay, LLC, a land management company. Mr. Boyer’s experience in land management and real estate makes him qualified to serve as a director.

|

2016

|

|

Keith Duplechin

|

58

|

Principal, First Capital Group, LLC and AdSource, LLC. Mr. Duplechin’s experience in land management, real estate, banking, and financial matters make him qualified to serve as a director.

|

2018

|

|

Edward M. Ellington, II

|

66

|

Retired Senior Vice President and financial adviser, Morgan Stanley Private Wealth (2012 to 2017); Manager, EME Holdings, LLC, a private investment holding company with investments concentrated in real estate; financial adviser, Merrill Lynch Private Wealth, from 1972 to 2012. Mr. Ellington’s long career in investment management and experience in financial matters, real estate and banking make him qualified to serve as a director.

|

2019

|

|

Daniel J. Englander

|

51

|

Founder and managing partner of Ursula Capital Partners, an investment management firm. Director, America’s Car-Mart, Inc. (NASDAQ), an automotive retailer, since 2007 and Copart, Inc. (NASDAQ), a provider of online auctions and vehicle remarketing services, since 2006. From 1994 to 2004, investment banker with Allen & Company, a New York-based merchant bank. Mr. Englander’s qualifications to serve on the board include his financial and investment experience and his experience as a director of other public companies. He also brings operational and strategic expertise, as well as business development expertise, to the board.

|

2018

|

|

Max H. Hart

|

61

|

Principal, Haas-Hirsch Interests, a land management company. Mr. Hart’s experience in land management, oil and gas leasing activities, forestry, farming and rights of way makes him qualified to serve as a director.

|

2016

|

|

Eugene T. Minvielle, IV

|

46

|

Financial Professional, MSE Partners, LLC. Mr. Minvielle’s experience in oil and gas and financial reporting, including past experience as chief financial officer of an upstream oil and gas company, make him qualified to serve as a director.

|

2017

|

|

William Gray Stream

|

40

|

President, Matilda Stream Management, Inc., an investment holding company that, among other things, indirectly owns and operates approximately 100,000 acres of land in Louisiana and provides wetland habitat restoration services. Director, Waitr Holdings Inc. (NASDAQ), an on-demand food ordering and delivery company, since 2014. Mr. Stream’s experience in oil and gas, timber, agriculture, wetlands, ranching and commercial and residential real estate makes him qualified to serve as a director. Also, he previously served as a director of CKX Lands from 2006 to 2017 and was Chair of the Audit Committee from 2011 to 2017.

|

2018

|

|

Mary Leach Werner

|

52

|

Secretary of CKX Lands, Inc. Vice President and Director of North American Land Co., LLC and Vice President and Director of The Sweet Lake Land & Oil Co., LLC, both land management companies. Mrs. Werner’s experience in land management and oil and gas activities makes her qualified to serve as a director.

|

2004

|

|

Michael B. White

|

63

|

Oil and gas ventures, farmland and timberland investments, sole manager of Ottley Properties, LLC, an investment holding company. Mr. White’s experience in oil and gas, farmland and timberland make him qualified to serve as a director.

|

2013

|

Mary W. Savoy retired from the Board of Directors on December 3, 2019.

The Board of Directors determined that Mrs. Savoy was and director nominees Ellington, Englander, Duplechin, Hart, Minvielle, Stream, and White are “independent directors” as defined under the rules of the NYSE American. In connection with this assessment, the Board of Directors also determined that Messrs. Ellington, Minvielle, and Stream are independent within the meaning of the NYSE American standards currently in effect and Rule 10A-3 of the Exchange Act applicable to members of the Audit Committee, and that Messrs. Englander, Hart and Minvielle are independent under the standards applicable to members of the Compensation Committee.

Each of the Company’s directors is requested to attend the Annual Meeting in person. Six of the Company’s nine directors then serving attended the Company’s 2019 Annual Meeting of Shareholders in person.

BOARD OF DIRECTORS LEADERSHIP STRUCTURE AND RISK OVERSIGHT

Michael B. White serves as the Independent Chairman of the Board of Directors. Mr. White is also the Company’s largest shareholder. The Board believes that leadership of the Board by a director who is not part of Company management provides a layer of independent oversight that benefits the Company’s shareholders and is therefore appropriate.

Independent Directors meet at least annually in executive session without non-independent or management Directors in attendance. During 2019, independent Directors met twice in executive session.

CKX Lands’ Board of Directors administers its risk oversight responsibilities by requiring specific Board authorization of all non-routine activities of the Company and through its Audit Committee’s quarterly review of the Company’s financial statements, discussions of management activities and communication with external auditors.

During 2019, the Board of Directors held a total of five meetings. No director attended fewer than 75% of the aggregate of board meetings held while he or she was a director and meetings of committees of which he or she was a member during 2019.

HEDGING POLICY

The Company’s insider trading policy prohibits hedging transactions. The policy applies to all directors; employees; other persons, including service providers, who have access to the Company’s confidential information; and any other person designated by the Company’s Board of Directors as subject to the policy. The hedging prohibition in the policy is excerpted below:

Hedging transactions permit an individual to hedge against a decline in stock price. Because hedging may have the appearance of a bet against the Company, hedging transactions, whether direct or indirect, involving the Company’s securities are prohibited, regardless of whether the Insider knows Material, Non-Public Information.

Derivative securities transactions, whether or not entered into for hedging purposes, may also appear improper if there is any unusual activity in the underlying equity security. Accordingly, transactions involving CKX-based derivative securities are prohibited, whether or not you know Material, Non-Public Information. Derivative securities include options, warrants, stock appreciation rights, convertible notes or similar rights whose value is derived from the value of CKX common stock. Transactions in derivative securities include trading in CKX-based option contracts, transactions in straddles or collars, and writing puts or calls.

BOARD OF DIRECTORS COMMITTEES

The Board of Directors has an Audit Committee, Compensation Committee and Nominating Committee. The membership of each committee during 2019 consisted solely of non-employee directors who met the independence standards established by the NYSE American, and is set forth below:

|

Committee

|

Chair

|

Other Members

|

|

Audit

|

Minvielle

|

Hart, Stream

|

|

Compensation

|

Hart

|

Englander, Minvielle

|

|

Nominating

|

Savoy

|

Stream, White

|

Effective November 7, 2019, Mr. Englander became the Chair of the Compensation Committee. Mr. Hart remained a member of the committee. Also on that date, Mr. Duplechin replaced Mrs. Savoy on the Nominating Committee and became its Chair. Effective March 12, 2020, Mr. Ellington replaced Mr. Hart on the Audit Committee.

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities with respect to financial reports and other financial information, and selects and appoints the independent registered public accountants. The Company has determined that Mr. Minvielle qualifies as “audit committee financial expert” under Item 407(d)(5) of Regulation S-K. Each member of the Audit Committee meets the financial literacy requirements of the NYSE American. During 2019, the Audit Committee held four meetings. A copy of the Audit Committee’s charter is available on the company’s website, www.ckxlands.com. All committee members attended all Audit Committee meetings during 2019.

The Compensation Committee approves all executive compensation. The Compensation Committee does not have a charter. During 2019, the Compensation Committee held one meeting. All members attended the Compensation Committee meeting, except for Mr. Englander. Executive officers do not participate in the design of, deliberations about, or voting on their compensation or the compensation of directors. In light of the simplicity and relatively modest levels of the Company’s executive and director compensation, the Company does not believe that there is any risk that could arise from its pay practices that would have a material adverse effect on it.

The Nominating Committee selects nominees for the Board of Directors. The Nominating Committee identifies individuals qualified to become directors and recommends them to the Board for directorships. The Nominating Committee will consider persons recommended by shareholders to become nominees for election as directors. Recommendations for consideration by the Nominating Committee should be sent to the Secretary of the Company in writing together with appropriate biographical information. Please see “Shareholder Proposals.”

The Committee identifies and evaluates nominees on the basis of their education, business experience, integrity, and knowledge of Southwest Louisiana, particularly as it relates to land management. Nominees recommended by security holders will be evaluated by the same criteria. When identifying nominees for directorships, the Committee considers diversity of skills, experience and business background, and no specific minimum qualifications are required.

The Nominating Committee has in the past considered potential director candidates suggested by its members, other directors and management. Members on the committee and management have in the past interviewed potential candidates who were not incumbent directors, and the committee has then voted to recommend a slate of nominees to the Board.

The Nominating Committee does not have a charter and operates under a board resolution addressing the nominating process. During 2019, the Nominating Committee held one meeting. All members attended the meeting.

DIRECTOR COMPENSATION

The table below sets forth the compensation paid to our directors during 2019. Fees are paid only for each regular Board of Directors meeting.

|

|

|

|

|

|

|

Member

|

|

|

Meeting

|

|

Chairperson

|

|

|

Attending

|

|

|

Non-Attending

|

|

|

Board of Directors

|

|

$

|

1,000

|

|

|

$

|

600

|

|

|

$

|

200

|

|

|

Audit Committee

|

|

|

1,000

|

|

|

|

—

|

|

|

|

—

|

|

|

Compensation Committee

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Nominating Committee

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

Actual compensation paid to Directors during 2019 is presented below:

|

Director

|

|

Fees Paid

|

|

|

Lee W. Boyer

|

|

$

|

2,400

|

|

|

Keith Duplechin

|

|

|

2,400

|

|

|

Edward M. Ellington, II

|

|

|

—

|

|

|

Daniel J. Englander

|

|

|

1,600

|

|

|

Max H. Hart

|

|

|

2,400

|

|

|

Eugene T. Minvielle, IV

|

|

|

8,000

|

|

|

Mary Watkins Savoy

|

|

|

2,300

|

|

|

William Gray Stream

|

|

|

2,000

|

|

|

Mary Leach Werner2

|

|

|

3,200

|

|

|

Michael B. White

|

|

|

3,600

|

|

|

(1)

|

Ms. Werner’s compensation includes $300 per regular meeting attended as the Company’s secretary.

|

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

BY SHAREHOLDERS AND OTHER INTERESTED PARTIES

The Company’s Annual Meeting of Shareholders provides an opportunity for shareholders and others to ask questions directly of Directors on matters relevant to the Company. In addition, shareholders and other interested parties may, at any time, communicate with the full Board of Directors, any individual director or any group of directors, by sending a written communication to the full Board of Directors, individual director or group of directors at the following address: CKX Lands, Inc., P.O. Box 1864, Lake Charles, LA 70602.

SUMMARY COMPENSATION TABLE

|

Name and Position

|

|

Year

|

|

Salary

|

|

|

Non-Equity

Incentive Plan

|

|

|

All Other

Compensation(2)

|

|

|

Total

|

|

|

Lee W. Boyer, President and Treasurer(1)

|

|

2019

|

|

$

|

80,000

|

|

|

$

|

—

|

|

|

$

|

2,400

|

|

|

$

|

82,400

|

|

|

|

|

2018

|

|

|

33,333

|

|

|

|

—

|

|

|

|

2,800

|

|

|

|

36,133

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brian R. Jones, President and Treasurer(3)

|

|

2019

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

2018

|

|

|

53,125

|

|

|

|

25,864

|

|

|

|

2,200

|

|

|

|

81,189

|

|

|

(1)

|

Mr. Boyer became President and Treasurer effective August 1, 2018. The Board set his annual salary at $80,000. He receives no other compensation besides directors’ meeting attendance fees.

|

|

(2)

|

Consists solely of Board of Director meeting attendance fees.

|

|

(3)

|

Mr. Jones resigned as President and Treasurer effective July 31, 2018.

|

The Company has no long-term compensation programs, stock option program or stock grants program.

The Company has no employment agreements, pension plan or profit-sharing plan.

During 2018, Mr. Jones’s compensation plan included a cash incentive bonus for directing the Company’s strategic goal of acquiring and selling real property. The incentive bonus was equal to 2.5% of the value of each property purchased or sold, as approved by the Board, with a minimum bonus per transaction of $2,000 and a maximum per transaction of $15,000.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Company and Stream Wetlands Services, LLC (Stream Wetlands) are parties to an option to lease agreement dated April 17, 2017 (the OTL). The OTL provides Stream Wetlands an option to lease certain lands from the Company, subject to the negotiation and execution of a mutually acceptable lease form. Stream Wetlands paid the Company $38,333 upon execution of the OTL, and an additional $38,333 during each of the quarters ended March 31, 2018 and March 31, 2019 to extend the option for two periods of 12 months. In 2020, Stream Wetlands exercised its right to extend the term of the OTL for another 12 months through February 28, 2021 by paying the Company an additional $38,333. Mr. Stream, a director of the Company, is the president of Stream Wetlands.

Mr. Boyer, the Company’s President, is a partner in Stockwell, Sievert, Viccellio, Clements, L.LP. (Stockwell). Beginning in August 2018, the Company began renting office space from Stockwell. The Company pays Stockwell $750 per month as rent for office space and associated services, $2,000 per month to reimburse the firm for an administrative assistant and reimburses Stockwell for miscellaneous office supplies. For the year ended December 31, 2019, the Company recorded $33,914 in total of such expense, of which $9,000 was rent expense. For the year ended December 31, 2018, the Company recorded $14,920 in total of such expense, of which $2,800 was rent expense.

Stockwell also received $661 for legal services performed for the Company in 2018.

During the year ended December 31, 2018, the Company incurred rental expense for office space of $2,800 payable to the prior president’s accounting firm.

ITEM 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

MaloneBailey LLP, acted as our independent registered public accounting firm and audited our financial statements for the year ended December 31, 2019. The Audit Committee of the Board has selected MaloneBailey LLP as independent registered public accounting firm to audit our financial statements for 2020. Representatives of MaloneBailey LLP will attend the annual meeting, have an opportunity to make a statement if they so desire and, respond to appropriate questions.

REPORT OF THE AUDIT COMMITTEE

The following Report of the Audit Committee does not constitute proxy soliciting materials and should not be deemed filed or incorporated by reference into any other filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent specifically incorporated into such a filing.

The Audit Committee of the Board of Directors has furnished the following report on the Company’s audit procedures and its relationship with its independent accountants for the twelve-month period ending December 31, 2019.

The Audit Committee has reviewed and discussed with the Company’s management and MaloneBailey LLP the audited financial statements of the Company contained in the Company’s Annual Report on Form 10-K for the Company’s 2019 fiscal year. The Audit Committee has also discussed with MaloneBailey LLP the matters that are required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) and the SEC.

The Audit Committee also has received from MaloneBailey LLP the written disclosures and the letter required by the PCAOB rules regarding auditors’ communications with audit committees about independence, and has discussed with MaloneBailey LLP their independence from the Company.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended December 31, 2019 be included in the Company’s Annual Report on Form 10-K for its 2019 fiscal year for filing with the SEC.

The Board of Directors adopted a Charter governing the Audit Committee in January 2003. The Audit Committee is composed of independent directors as required by and in compliance with the listing standards of the NYSE American.

|

|

AUDIT COMMITTEE

|

|

|

Eugene T. Minvielle, IV (Chair)

Edward M. Ellington, II

William Gray Stream

|

RELATIONSHIP WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

For each of 2018 and 2019, MaloneBailey LLP was paid $50,000 solely for audit services. Audit service fees include fees for services performed for the recurring audit of the Company’s financial statements.

MaloneBailey, LLC was paid no audit-related fees, non-audit fees or tax fees during 2018 or 2019. Audit-related fees include fees associated with assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements. Tax fees are for the preparation of the Company’s federal and state income tax returns and the state franchise tax return.

The Audit Committee has adopted policies and procedures which require the pre-approval of all audit and non-audit services to be performed by the independent auditor of the Company.

The Audit Committee may delegate, to one or more designated members of the Committee, the authority to grant pre-approvals of audit and permitted non-audit services. Any decision by such member or members to grant pre-approval shall be presented to the Committee at its next scheduled meeting. During 2019, there was no audit or non-audit work performed by the independent auditor which was not pre-approved by the Audit Committee prior to the engagement.

The Audit Committee has selected the firm of MaloneBailey LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2020. Shareholder approval and ratification of this selection is not required by law or by the By-Laws of the Company. Nevertheless, the Board of Directors has chosen to submit it to the shareholders for their ratification as a matter of good corporate practice. A majority of the votes cast on the proposal to ratify the appointment of MaloneBailey LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2020 must be voted in favor of the proposal for the proposal to be adopted. If the proposal is not adopted, the Audit Committee will take the vote into consideration in selecting independent auditors for the Company.

The Board of Directors recommends a vote FOR the appointment of MaloneBailey LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2020.

ITEM 3: ADVISORY VOTE ON THE COMPANY’S EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act amended the Exchange Act to require that the Company’s shareholders be provided an opportunity to vote whether to approve the compensation of the Company’s Named Executive Officers as disclosed in this Proxy Statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission. As this “Say-on-Pay” vote is an advisory vote, it is not binding upon the Company, the Board of Directors, or Compensation Committee of the Board of Directors. However, the Board of Directors will take the results of this advisory vote under advisement. Also, this vote is not intended to address any specific element of compensation, but rather relates to the overall compensation of the Company’s Named Executive Officers as disclosed in this Proxy Statement.

In 2014, the Company’s shareholders voted to hold an advisory vote on executive compensation every year.

We are asking shareholders to vote on the following proposal, which gives you the opportunity to endorse or not endorse our pay program for our Named Executive Officers by voting for or against the following resolution. This resolution is required pursuant to Section 14A of the Exchange Act.

“RESOLVED, that the shareholders of CKX Lands, Inc. (the Company) approve, on an advisory basis, the compensation of the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Securities and Exchange Commission Regulation S-K, including the compensation tables and narrative disclosures.”

The Board of Directors recommends that the shareholders vote FOR the proposal to approve the compensation of CKX Lands’ Named Executive Officers as disclosed in its proxy statement relating to its 2020 Annual Meeting of Shareholders pursuant to the SEC’s compensation disclosure rules.

ITEM 4: ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

Applicable law also requires that our shareholders vote at least once every six years on whether we should hold an advisory “Say-on-Pay” vote every year, every two years or every three years. Therefore, we are presenting the following resolution, which gives you the opportunity to inform us as to how often you wish us to include an advisory Say-on-Pay vote, like Item 3, in our Proxy Statement. You may also abstain from voting on this item.

“RESOLVED, that a non-binding advisory vote of the stockholders on the compensation of CKX Lands, Inc.’s Named Executive Officers pursuant to Section 14A of the Securities Exchange Act should be held:

When we last held this advisory vote at our annual meeting of shareholders in 2014, a majority of the votes cast were in favor of holding a Say-on-Pay vote every year. Following the meeting, our Board of Directors determined to hold the vote annually, and since then we have held a Say-on-Pay vote every year.

Therefore, the Board recommends that the shareholders vote to hold the advisory Say-on-Pay vote every year. Note, however, that you are not voting on whether to approve or disapprove the Board’s recommendation, rather you are being asked to affirmatively select the option of every one, two or three years.

We will treat the option selected by the plurality of the votes cast at the meeting as the option approved by the shareholders. Abstentions and broker non-votes will not be counted as votes cast with respect to this proposal. While this vote is non-binding and advisory in nature, our Board of Directors intends to hold future Say-on-Pay votes in accordance with the selection receiving the highest number of votes at the annual meeting.

OTHER MATTERS

At the time of the preparation of this Proxy Statement, the Company had not been informed of any matters to be presented by, or on behalf of, the Company or its management, for action at the meeting other than those listed in the notice of meeting and referred to herein. If any other matters come before the meeting or any adjournment thereof, the persons named in the enclosed proxy will vote on such matters according to their best judgment.

A copy of the Company’s Annual Report on Form 10-K as filed with the SEC for 2019 accompanies this Proxy Statement.

Shareholders are urged to sign the enclosed proxy, which is solicited on behalf of the Board of Directors and return it at once in the enclosed envelope. Shareholders can also access the proxy material at www.envisionreports.com/ckx.

SHAREHOLDER PROPOSALS

A shareholder who intends to present a proposal relating to a proper subject for shareholder action at the 2021 annual meeting of shareholders and who wishes the proposal to be included in the Company’s proxy materials for that meeting must cause the proposal to be received, in proper form and in compliance with SEC Rule 14a-8 at the Company’s corporate office no later than December 10, 2020. If a proposal is not submitted timely, it will not be considered for inclusion in the proxy statement for the 2021 annual meeting.

Our By-Laws govern the submission of nominations for director and other business proposals that a shareholder wishes to have considered at a shareholders’ meeting, but that are not included in our proxy materials for the meeting. Shareholder nominations or proposals may be made by eligible shareholders only if timely written notice has been given pursuant to the By-Laws. To be timely for the 2021 annual meeting of stockholders, the notice must be received at our corporate office at the address set forth on page 1 no earlier than the close of business on January 7, 2021 and not later than the close of business on February 6, 2021. The By-Laws specify what such notices must include.

|

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

|

|

|

|

/s/ Lee W. Boyer

|

|

|

Lee W. Boyer

|

|

|

President and Treasurer

|

Lake Charles, Louisiana

April 9, 2020

12

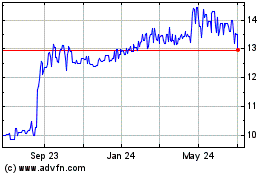

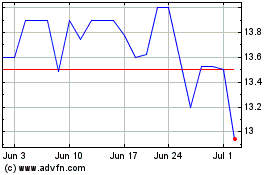

CKX Lands (AMEX:CKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CKX Lands (AMEX:CKX)

Historical Stock Chart

From Apr 2023 to Apr 2024