Current Report Filing (8-k)

August 10 2021 - 6:04AM

Edgar (US Regulatory)

0001604738false00016047382021-08-092021-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): August 9, 2021

ASHFORD INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada

|

|

001-36400

|

|

84-2331507

|

(State or other jurisdiction of incorporation

or organization)

|

|

(Commission

File Number)

|

|

(IRS employer

identification number)

|

|

14185 Dallas Parkway

|

|

|

|

|

|

Suite 1200

|

|

|

|

|

|

Dallas

|

|

|

|

|

|

Texas

|

|

|

|

75254

|

|

(Address of principal executive offices)

|

|

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

AINC

|

|

NYSE American LLC

|

Item 8.01 Other Events.

On August 10, 2021, Ashford Inc. (the “Company”) issued a press release announcing that on August 9, 2021 it had received a notification letter from the NYSE American LLC (the “Exchange”) that the Company has regained compliance with all of the NYSE American LLC continued listing standards set forth in Part 10, Section 1003 of the NYSE American Company Guide (the “Company Guide”). The Company previously received a notification letter (the “Letter”) from the Exchange on August 26, 2020, which indicated that the Company was not in compliance with the standards of Sections 1003(a)(i) and 1003(a)(ii) of the Company Guide. Pursuant to these Sections, the Exchange will normally consider suspending dealings in, or removing from the list, securities of a listed company whose stockholders’ equity is less than (i) $2.0 million if it has reported losses from continuing operations or net losses in two of its three most recent fiscal years and (ii) $4.0 million if it has reported losses from continuing operations or net losses in three of its four most recent fiscal years (together, the “Stockholders’ Equity Standards”). However, Section 1003(a) of the Company Guide also states that the Exchange will not normally consider suspending dealings in, or removing from the list, the securities of a listed company that falls below the Stockholders’ Equity Standards if the listed company is in compliance with the following two standards: (1) total value of market capitalization of at least $50 million or total assets and revenue of $50 million each in its last fiscal year, or in two of its last three fiscal years (the “First Standard”), and (2) the listed company has at least 1.1 million shares publicly held, a market value of publicly held shares of at least $15.0 million and 400 round lot shareholders (the “Second Standard”).

When the Company received the Letter, it was not in compliance with the Stockholders’ Equity Standards, but it was in compliance with the First Standard because it had total assets and total revenue of at least $50 million in its last fiscal year and was in compliance with the Second Standard, except that the current market value of publicly held shares was below $15.0 million. On September 24, 2020, the Company submitted to the Exchange a compliance plan which detailed how it intended to regain compliance with Section 1003(a) by increasing the current market value of the publicly held shares above $15.0 million while maintaining compliance with all other requirements of the First and Second Standards. As of June 30, 2021, the Company did not meet the requisite Stockholders’ Equity Standards. However, as a result of management’s efforts, the Company has come into compliance with the First and Second Standards, and the Exchange has informed the Company that it has cured the previously cited deficiencies and is in full compliance with the continued listing standards set forth in Part 10, Section 1003 of the Company Guide. Effective at the start of trading on August 10, 2021, the “.BC” designation, signifying noncompliance with the Exchange’s listing standards, will be removed from the “AINC” trading symbol.

A copy of the above-referenced press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

ASHFORD INC.

By: /s/ Alex Rose

Alex Rose

Executive Vice President, General Counsel & Secretary

Date: August 10, 2021

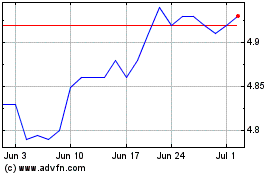

Ashford (AMEX:AINC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ashford (AMEX:AINC)

Historical Stock Chart

From Apr 2023 to Apr 2024