Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-217094

PROSPECTUS SUPPLEMENT

(to Prospectus dated April 20, 2017)

Up to $50,000,000

Common Stock

Ampio Pharmaceuticals, Inc.

We have entered into a sales agreement (the “Sales Agreement”) with ThinkEquity, a division of Fordham Financial Management, Inc. (“ThinkEquity”) and Roth Capital Partners, LLC (“Roth” and ThinkEquity collectively the “Sales Agents”) relating to shares of our common stock, $0.0001 par value per share, offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell shares of our common stock from time to time up to an aggregate offering price of $50,000,000 through or to the Sales Agents, acting as sales agents or principals.

Upon our delivery of a placement notice and subject to the terms and conditions of the Sales Agreement, each Sales Agent may sell the common stock by methods deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). The Sales Agents will use their commercially reasonable efforts consistent with their normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of the New York Stock Exchange American market. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

We will pay the Sales Agents a total commission for their services in acting as agents in the sale of common stock equal to 4.0% of the gross sales price per share of all shares sold through them as agents under the Sales Agreement. See “Plan of Distribution” for information relating to certain expenses of the Sales Agents to be reimbursed by us.

In connection with the sale of common stock on our behalf, the Sales Agents will be deemed to be “underwriters” within the meaning of the Securities Act and the compensation to the Sales Agents will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to the Sales Agents with respect to certain liabilities, including liabilities under the Securities Act.

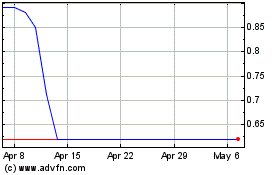

Our common stock is listed on the New York Stock Exchange American market under the symbol “AMPE.” The last sale price of our common stock on February 14, 2020, as reported by the New York Stock Exchange American market, was $0.69 per share.

We are a smaller reporting company under Rule 405 of the Securities Act and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus supplement, the documents incorporated by reference herein and future filings.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus supplement and page 5 of the accompanying base prospectus, as well as the information under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, and in the other documents incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of the factors you should carefully consider before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

ThinkEquity

|

|

Roth Capital Partners

|

|

a division of Fordham Financial Management, Inc.

|

|

|

Prospectus Supplement dated February 21, 2020.

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus relate to the offering of shares of our common stock. Before buying any shares of our common stock offered hereby, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated herein and therein by reference as described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” These documents contain important information that you should consider when making your investment decision.

On March 31, 2017, we filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-3 (File No. 333-217094) utilizing a shelf registration process relating to the securities described in this prospectus supplement, which registration statement became effective on April 20, 2017. Under this shelf registration process, we may, from time to time, sell common stock and other securities, including this offering.

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into the prospectus and this prospectus supplement. The second part, the accompanying prospectus dated April 20, 2017, including the documents incorporated by reference therein, gives more general information, some of which does not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined.

You should rely only on the information contained or incorporated herein by reference in this prospectus supplement and contained or incorporated therein by reference in the accompanying prospectus. We have not authorized any other person to provide you with any information that is different. If anyone provides you with different, additional or inconsistent information, you should not rely on it.

If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference — the statement in the document having the later date modifies or supersedes the earlier statement.

We are offering to sell our securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the securities in certain jurisdictions may be restricted by law. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in the prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We obtained statistical data, market data and other industry data, and forecasts used in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into the prospectus and this prospectus supplement from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly, while we believe that the statistical data, market data and other industry data and forecasts used herein are reliable, we have not independently verified the data, and we do not make any representation as to the accuracy of the information.

S-2

Table of Contents

All references in this prospectus supplement and the accompanying base prospectus to “Ampio,” “Ampio Pharmaceuticals Inc.,” the “Company,” “we,” “us,” “our” or similar references refer to Ampio Pharmaceuticals, Inc., except where the context otherwise requires or as otherwise indicated.

AMPIO (and design), our logo design and AMPION are our registered trademarks. This prospectus also contains trademarks, registered marks and trade names of other companies. Any other trademarks, registered marks and trade names appearing in this prospectus are the property of their respective holders.

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying base prospectus and the documents incorporated by reference in these documents contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. All statements other than statements of historical facts contained in this prospectus supplement, including statements regarding our anticipated future clinical and regulatory events, future financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. Forward looking statements are generally written in the future tense and/or are preceded by words such as “may,” “will,” “should,” “forecast,” “could,” “expect,” “suggest,” “believe,” “estimate,” “continue,” “anticipate,” “intend,” “plan” or similar words, or the negatives of such terms or other variations on such terms or comparable terminology. Such forward-looking statements include, without limitation, statements regarding the anticipated start dates, durations and completion dates, as well as the potential future results, of our current and future clinical trials, the designs of our current and future clinical trials, anticipated future regulatory submissions and events, regulatory responses or other actions in relation to our submissions, applications and proposals, the potential future commercialization of our product candidate, Ampion, our anticipated future cash position and future events under our current and potential future collaborations. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including without limitation the risks described in the “Risk Factors” section in this prospectus supplement.

These risks are not exhaustive. Other sections of this prospectus supplement include additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. We assume no obligation to update or supplement forward-looking statements.

All written and verbal forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We caution investors not to rely too heavily on the forward-looking statements we make or that are made on our behalf. We undertake no obligation, and specifically decline any obligation, to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

S-3

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

The following summary is qualified in its entirety by, and should be read together with, the more detailed information and financial statements and related notes thereto appearing elsewhere or incorporated by reference in this prospectus supplement and the accompanying base prospectus. Before you decide to invest in our common stock, you should read the entire prospectus supplement and the accompanying base prospectus carefully, including the risk factors and the financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying base prospectus.

About Ampio Pharmaceuticals, Inc.

Overview

We are a pre-revenue development stage biopharmaceutical company focused on the development of Ampion, our lead product candidate, to treat prevalent inflammatory conditions for which there are limited treatment options.

Ampion has advanced through late-stage clinical trials in the United States. The U.S. Food and Drug Administration (“FDA”) provided guidance that we should complete a trial of severe osteoarthritis of the knee (“OAK”) patients with concurrent controls that would be carried out under a Special Protocol Assessment (“SPA”).

In June 2019, we received an SPA agreement from the FDA for our Phase III clinical trial titled, “A Randomized, Controlled, Double-Blind Study to Evaluate the Efficacy and Safety of an Intra-Articular Injection of Ampion in Adults with Pain Due to Severe Osteoarthritis of the Knee” (the “AP-013 study”). An SPA is a process in which sponsors may ask to meet with the FDA to reach agreement with the FDA on the design and size of certain clinical trials to determine if they adequately address scientific and regulatory requirements for a study that could support regulatory submission. An SPA agreement indicates concurrence by the FDA with the adequacy and acceptability of specific critical elements of overall protocol design (e.g. entry criteria, dose selection, endpoints and planned analyses) for a study intended to support a future marketing application. These elements are critical to ensuring that the trial conducted under the protocol can be considered an adequate and well-controlled study that can support marketing approval. Feedback on these issues provides the greatest benefit to sponsors in planning late-phase development strategy. The existence of our SPA agreement does not guarantee that the FDA will accept our biologics license application (“BLA”) for Ampion when submitted, or that the results of the trials we have conducted on Ampion will be adequate to support approval. Those issues are addressed during the review of a submitted application and are determined based on the adequacy of the overall submission.

AMPION

Ampion for Osteoarthritis and Other Inflammatory Conditions

We have developed a novel biologic drug, Ampion, containing blood-derived cyclized peptide and small molecules that target multiple pathways in the innate immune response and other pathways that are characteristic of OAK disease. Ampion targets the cellular pathways in the innate immune response correlated with pain, inflammation, and joint damage in osteoarthritis. In vitro studies have shown that Ampion represses the transcription of proteins responsible for inflammation, while activating anti-inflammatory proteins. Ampion has also been shown in vitro to regulate the cellular pathways responsible for tissue growth and healing. We believe that this mechanism of action interrupts the disease process responsible for the pain and disability associated with OAK and provides market expansion potential as a disease modifying biologic and may provide a treatment option for other inflammatory and degenerative indications.

We are currently developing Ampion as an intra-articular injection to treat the signs and symptoms of severe OAK, which is a growing epidemic in the United States. OAK is a progressive disease characterized by gradual degradation and loss of cartilage due to inflammation of the soft tissue and bony structures of the knee joint. Progression of the most severe form of OAK leaves patients with little to no treatment options other than a total knee arthroplasty. The FDA has stated that severe OAK is an “unmet medical need” with no licensed therapies for this indication. While we believe that Ampion could treat this “unmet medical need”, our ability to market this product is subject to FDA approval.

S-4

Table of Contents

Market Opportunity

Osteoarthritis, or OA, is the most common form of arthritis, affecting over 30 million people in the United States. It is a progressive and incurable disease of the joints involving degradation of the intra-articular cartilage, joint lining, ligaments, and bone. Certain risk factors in conjunction with natural wear and tear lead to the breakdown of cartilage. Osteoarthritis is caused by inflammation of the soft tissue and bony structures of the joint, which worsens over time and leads to progressive thinning of intra-articular cartilage. Other progressive effects include narrowing of the joint space, synovial membrane thickening, osteophyte formation and increased density of the subchondral bone. The global market size for treatments that currently address moderate to moderately severe OAK was valued at approximately $3.6 billion in 2018 and is expected to grow with a compound annual growth rate of 9.11% through 2026. The global demand for OAK treatment is expected to be fueled by aging demographics and increased awareness of treatment options. Despite the size and growth of the OAK market, only a few treatment options currently exist, with none labeled specifically for the severely diseased patient population.

Ampion Development

Since our inception, we have conducted multiple clinical trials and have advanced through late-stage clinical trials in the United States, initially under the guidance of the FDA’s Office of Blood Research and Review, or OBRR, and most recently under the guidance of the FDA’s Office of Tissues and Advanced Therapies, or OTAT.

Study AP-003-A was a multicenter, randomized, double-blind trial of 329 patients who were randomized 1:1 to receive Ampion or saline control via intra-articular injection. The study showed a statistically significant reduction in pain compared to the control, with an average of greater than 40% reduction in pain from baseline at 12 weeks with Ampion treatment. Patients who received Ampion also showed a significant improvement in function and quality of life compared to patients who received the saline control at 12 weeks. Quality of life was assessed using Patient Global Assessment. Furthermore, the trial included severely diseased patients, defined radiographically as Kellgren Lawrence Grade 4 (“KL 4”). From this patient population, those patients who received Ampion had a significantly greater reduction in pain than those who received the saline control. Ampion was well tolerated with minimal adverse events reported across the Ampion and saline groups in the study. There were no drug-related serious adverse events.

In 2018, the FDA reiterated and confirmed that our successful pivotal Phase III clinical trial, AP-003-A, was adequate and well-controlled, provided evidence of the effectiveness of Ampion and can contribute to the substantial evidence of effectiveness necessary for the approval of a BLA. The FDA provided guidance that we should complete an additional trial of “KL 4” severe OAK patients with concurrent controls that would be carried out under an SPA to obtain FDA concurrence on the trial design.

As noted above, we received an SPA agreement in June 2019 from the FDA for a clinical protocol for the AP-013 study. The SPA agreement for the AP-013 study finalized patient enrollment at 1,034 patients, with a sample size assessment at an interim analysis of 724 patients to allow an adjustment up to 1,551 patients if deemed necessary. In the SPA agreement, the FDA agreed that the design and planned analysis of the AP-013 study adequately addressed the objectives necessary to support a regulatory submission. According to the FDA’s guidance for industry regarding SPAs (published in April 2018), an SPA documents the FDA’s agreement that the design and planned analysis of a study can address objectives in support of a regulatory submission, however final determinations for marketing application approval are made after a complete review of the marketing application and are based on the entire data in the application. Following the receipt of the SPA agreement, we initiated the AP-013 study, identified and engaged clinical sites for the trial, and initiated dosing of patients at those sites. As of December 31, 2019, we completed the enrollment and dosing of 724 patients required from the interim analysis sample size assessment. As of February 14, 2020, we had dosed 875 patients.

S-5

Table of Contents

Ampion Manufacturing Facility

In May 2014, we commenced a 125-month lease of a multi-purpose facility containing approximately 19,000 square feet. This facility includes quality control and research laboratories, our corporate offices and approximately 3,000 square feet of modular clean rooms to manufacture Ampion.

Since the manufacturing site has been operational, we have implemented a quality system for both U.S. and E.U. (“European Union”) regulatory compliance, validated the facility for human-use products, produced Ampion and placebo for use in the inception-to-date clinical trials, and produced approximately 200,000 vials of Ampion without a sterility failure.

The manufacturing facility utilizes automated equipment with single use line sets and modular clean rooms designed to maximize flexibility and scalability while meeting international quality standards to fulfill potential future global demand. We believe that the Ampion manufacturing process delivers a competitive cost of goods that is significantly lower than the industry benchmark. Additionally, we estimate that the maximum capacity for this turnkey facility is approximately 8.0 million vials per year. During fiscal 2019, we engaged an independent third-party to conduct a quality audit of the Ampion manufacturing facility, which confirmed that our facility is expected to meet the requirements of an FDA inspection for the CMC section of a BLA filing.

Corporate Information

We are a Delaware corporation. Our principal offices are located at 373 Inverness Parkway, Suite 200, Englewood, Colorado 80112, and our telephone number is (720) 437-6500. Our website address is www.ampiopharma.com. Our website and the information contained on, or that can be accessed through, our website shall not be deemed to be incorporated by reference in, and are not considered part of, this prospectus and our reference to the URL for our website is intended to be an inactive textual reference only. You should not rely on any such information in making your decision whether to purchase our common stock.

S-6

Table of Contents

THE OFFERING

The following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus supplement and the accompanying base prospectus.

|

Common stock offered by us

|

|

Shares of our common stock having an aggregate offering price of up to $50,000,000.

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

Up to 72,463,768 shares, assuming sales at a price of $0.69 per share, which was the closing price of our common stock on the New York Stock Exchange American market on February 14, 2020. The actual number of shares issued, if any, will vary depending on the sales price under this offering.

|

|

|

|

|

|

Plan of Distribution

|

|

“At the market offering” that may be made from time to time through or to the Sales Agents, as sales agents or principals. See the section titled “Plan of Distribution.”

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering for working capital and other general corporate purposes. See the section titled “Use of Proceeds.”

|

|

|

|

|

|

Risk Factors

|

|

You should read the “Risk Factors” section of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to purchase shares of our common stock.

|

|

|

|

|

|

The New York Stock Exchange American symbol

|

|

AMPE

|

|

|

|

|

|

The number of shares of common stock that will be outstanding immediately after this offering as shown above is based on 158,780,993 shares of common stock outstanding as of February 14, 2020, and excludes, in each case as of February 14, 2020:

· 7,116,524 shares of our common stock issuable upon the exercise of outstanding warrants;

· 6,239,832 shares of our common stock issuable upon the exercise of outstanding options under the 2010 Stock and Incentive Plan (the “2010 Plan”) and the 2019 Stock and Incentive Plan (the “2019 Plan”), collectively; and

· 9,516,500 shares of our common stock reserved for issuance under the 2019 Plan.

Unless otherwise indicated, all information in this prospectus assumes no conversion of preferred stock, exercise of the outstanding options or warrants or settlement of outstanding restricted stock units, described above.

S-7

Table of Contents

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” in our most recent Annual Report on Form 10-K and all of the other information contained in this prospectus supplement and the accompanying base prospectus, and incorporated by reference into this prospectus supplement and the accompanying base prospectus, including our financial statements and related notes, before investing in our common stock. If any of the possible adverse events described below or in those sections actually occur, our business, business prospects, cash flow, results of operations or financial condition could be harmed, the trading price of our common stock could decline, and you might lose all or part of your investment in our common stock. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our operations and results.

Risks Related to This Offering and Our Common Stock

An active trading market for our common stock may not develop or be sustained and investors may not be able to resell their shares at or above the price at which they purchased them.

An active trading market for our shares may never develop or be sustained. In the absence of an active trading market for our common stock, investors may not be able to sell their common stock at or above the price they paid or at the time that they would like to sell. In addition, an inactive market may impair our ability to raise capital by selling shares and may impair our ability to acquire other companies or technologies by using our shares as consideration, which, in turn, could harm our business.

The trading price of the shares of our common stock has been and is likely to continue to be highly volatile, and purchasers of our common stock could incur substantial losses.

Our stock price has been and will likely continue to be volatile for the foreseeable future. The stock market in general and the market for biotechnology companies in particular have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, investors may not be able to sell their common stock at or above the price they paid.

In addition, in the past, stockholders have initiated class action lawsuits against biotechnology and pharmaceutical companies including us following periods of volatility in the market prices of these companies’ and our stock. Such litigation, including the litigation that is currently instituted against us and certain of our officers and directors and any litigation that may be instituted against us, our officers and/or our directors in the future, could cause us to incur substantial costs and divert management’s attention and resources, which could have a material adverse effect on our business, financial condition and results of operations.

Our quarterly operating results may fluctuate significantly.

We expect that our operating results may be subject to substantial quarterly fluctuations. If our quarterly operating results fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially. We believe that quarterly comparisons of our financial results are not necessarily meaningful and should not be relied upon as an indication of our future performance.

You will experience immediate and substantial dilution.

The offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this offering. Assuming that an aggregate of $50,000,000 of shares of our common stock are sold at the assumed offering price of $0.69 per share (the last reported sale price of our common stock on the New York Stock Exchange American market on February 14, 2020), and after deducting commissions and estimated aggregate offering expenses payable by us, you will experience immediate dilution of $0.46 per share, representing the difference between our as adjusted net tangible book value per share as of December 31, 2019 after giving effect to this offering and the assumed offering price. In addition, we are not restricted from issuing additional securities in the future, including shares of common stock, securities that are convertible into or exchangeable for, or that represent the right to receive, common stock or substantially similar securities. The issuance of these securities may cause further dilution to our stockholders. The exercise of outstanding warrants, stock options and the vesting of outstanding restricted stock units may also result in further dilution of your investment. See the section entitled “Dilution” on page S-14 below for a more detailed illustration of the dilution you may incur if you participate in this offering.

S-8

Table of Contents

We may allocate our cash and cash equivalents, including the proceeds from this offering, in ways that you and other stockholders may not approve.

Our management has broad discretion in the application of our cash, cash equivalents and marketable securities, including the proceeds from this offering. Because of the number and variability of factors that will determine our use of our cash and cash equivalents, their ultimate use may vary substantially from their currently intended use. Our management might not apply our cash and cash equivalents in ways that ultimately increase the value of your investment. We expect to use our cash and cash equivalents to fund Ampion clinical trials, working capital and other general corporate purposes. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may invest our cash and cash equivalents in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders. If we do not invest or apply our cash and cash equivalents, including the proceeds from this offering, in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

A substantial number of shares of our common stock could be sold into the public market in the near future, which could depress our stock price.

Sales of substantial amounts of our common stock in the public market could reduce the prevailing market prices for our common stock. Substantially all of our outstanding common stock are eligible for sale as are common stock issuable under vested and exercisable stock options or warrants. If our existing stockholders sell a large number of shares of our common stock, or the public market perceives that existing stockholders might sell shares of common stock, the market price of our common stock could decline significantly. These sales might also make it more difficult for us to sell equity securities at a time and price that we deem appropriate.

If securities or industry analysts do not publish research or reports or publish unfavorable research or reports about our business, our stock price and trading volume could decline.

The trading market for our common stock will depend in part on the research and reports that securities or industry analysts publish about us, our business, our market or our competitors. We currently have limited research coverage by securities and industry analysts. If other securities or industry analysts do not commence coverage of our company, the trading price for our stock could be negatively impacted. If one or more of the analysts who covers us downgrades our stock, our stock price would likely decline. If one or more of these analysts ceases to cover us or fails to regularly publish reports on us, interest in our stock could decrease, which could cause our stock price or trading volume to decline.

We are defendants in securities and shareholder litigations and could be subject to additional litigations.

The company and certain of its officers and directors are currently defendants in pending shareholder derivative actions and/or putative class actions for violations of the federal securities laws.

On August 25, 2018, a purported stockholder of the Company commenced a putative class action lawsuit in the United States District Court for the Central District of California, captioned Shi v. Ampio Pharmaceuticals, Inc., et al., Case No. 18-cv-07476 (the “Securities Class Action”). Plaintiff in the Securities Class Action alleges that the Company and certain of its current and former officers violated the federal securities laws by misrepresenting and/or omitting material information regarding the AP-003 Phase III clinical trial of Ampion. The plaintiff asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Securities and Exchange Commission Rule 10b-5, on behalf of a putative class of purchasers of the Company’s common stock from December 14, 2017 through August 7, 2018. Plaintiff in the Securities Class Action seeks unspecified damages, pre-judgment and post-judgment interest, and attorneys’ fees and costs. On September 27, 2019, the Court presiding over the Securities Class Action issued an order appointing a Lead Plaintiff and Lead Counsel, pursuant to the Private Securities Litigation Reform Act. Lead Plaintiff filed an amended complaint in late 2019. The Company filed a motion to dismiss the amended complaint on February 10, 2020. Plaintiffs’ opposition is due in March and the Company then has the right to file a reply.

S-9

Table of Contents

On September 10, 2018, a purported stockholder of the Company brought a derivative action in the United States District Court for the Central District of California, captioned Cetrone v. Macaluso, et al., Case No. 18-cv-07855 (the “Cetrone Action”), alleging primarily that the directors and officers of Ampio breached their fiduciary duties in connection with alleged misstatements and omissions regarding the AP-003 Phase III clinical trial of Ampion. On October 5, 2018, a purported stockholder of the Company brought a derivative action in the United States District Court for the District of Colorado, Theise v. Macaluso, et al., Case No. 18-cv-02558 (the “Theise Action”), which closely parallels the allegations in the Cetrone Action. A second derivative action was filed in the United States District Court for the District of Colorado and was consolidated with the Theise Action under the caption In re: Ampio Pharmaceuticals Inc. Stockholder Derivative Actions, Case No. 18-cv-02558. This consolidated action, and the Certrone Action in California, are stayed pending further developments in the Securities Class Action.

While we believe that all claims asserted above are without merit and we intend to defend these lawsuits vigorously. However, it is possible that additional actions will be filed in the future. The Company currently believes the likelihood of a loss contingency related to these matters is remote and given the fact of where the claims exist in the litigation process, the Company is not in the position to provide an estimate and/or range of potential loss.

It is not possible to predict the aggregate proceeds resulting from sales made under the Sales Agreement.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to each Sales Agent at any time throughout the term of the Sales Agreement. The number of shares that are sold through the Sales Agent, if any, after delivering a placement notice will fluctuate based on a number of factors, including the market price of our common stock during the sales period, the limits we set with the Sales Agent in any applicable placement notice, and the demand for our common stock during the sales period. Because the price per share of each share sold will fluctuate during the sales period, it is not currently possible to predict the aggregate proceeds to be raised in connection with those sales.

The common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and number of shares sold in this offering. In addition, subject to the final determination by our board of directors, there is no minimum or maximum sales price for shares to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

The proceeds from this offering, if any, and funds from other potential sources, along with our cash and cash equivalents, may not be sufficient to fund our operations for the near future and we may not be able to obtain additional financing.

As of December 31, 2019, we had $6.5 million of cash and cash equivalents, which we expect can fund our operation into the second quarter of 2020.

Our future capital requirements will depend on and could increase significantly as a result of many factors including:

· progress in and the costs of our clinical trials and research and development;

· incremental costs of increasing patient sample size beyond 1,034 patients;

· progress in and the costs of applying for regulatory approval for Ampion;

S-10

Table of Contents

· the costs of sustaining our corporate overhead requirements and hiring and retaining necessary personnel;

· the scope, prioritization, and number of our research and development programs;

· the achievement of milestones or occurrence of other developments that trigger payments under any collaboration agreements we obtain;

· the extent to which we are obligated to reimburse, or entitled to reimbursement of, clinical trial costs under future collaboration agreements, if any;

· the costs involved in filing, prosecuting, enforcing, and defending patent claims and other intellectual property rights;

· the costs of securing manufacturing arrangements for commercial production;

· the costs of defending lawsuits and other claims by third parties or responding to various government agencies that we are required to report to or respond to inquiries from;

· the costs associated with obtaining Directors and Officers (“D&O”) insurance, which may be higher due to our industry and due to our current shareholder litigation and government investigation concerning trading in our publicly listed securities; and

· the likely increase in the future level of D&O policy retention amounts given the industry trend and our current experience with increased legal costs associated with our current litigation and government investigation.

Until we can generate ongoing operating profit on an ongoing and reliable basis, we expect to satisfy our future ongoing cash and liquidity needs through one or more of the following: (i) third-party collaboration arrangements, (ii) private or public sales of our securities, which we expect will include this “at-the-market offering”, or (iii) debt financings. We cannot be certain the amount of proceeds that will be generated from this offering or that additional funding and incremental working capital will be available to us on acceptable terms, if at all, or that it will exist in a timely and/or adequate manner to allow for the proper execution of our near and long-term business strategy. If sufficient funds are not available on terms and conditions acceptable to management and stockholders of the Company, we may be required to delay, reduce the scope of, or eliminate further development of Ampion and the planned filing of the BLA and/or substantially curtail or close our operations altogether.

Even if we obtain requisite financing, it may be on terms not favorable to us, it may be costly and it may require us to agree to covenants or other provisions that will favor new investors over existing stockholders or other restrictions that may adversely affect our business. Additional funding, if obtained, may also result in significant dilution to our stockholders.

S-11

Table of Contents

USE OF PROCEEDS

We will retain broad discretion over the use of the net proceeds from the sale of our securities offered hereby. Except as described in any free writing prospectus that we may authorize to be provided to you, we currently anticipate using the net proceeds, if any, from the sale of our securities offered hereby primarily for working capital, including the conduct of clinical trials, and other general corporate purposes. Further, from time to time we may evaluate acquisition opportunities and engage in related discussions with other companies. We do not currently have any intentions with respect to the acquisition of or investment in complementary businesses, products or technologies. As of the date hereof, the Company does not have any debt to service.

The amounts and timing of our use of the net proceeds from this offering, if any, will depend on a number of factors, such as the timing and progress of our research and development efforts, the timing and progress of any partnering and collaboration efforts and technological advances. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. Accordingly, our management will have broad discretion in the timing and application of these proceeds. Pending use of the proceeds as described above, we intend to invest the proceeds in a variety of capital preservation investments, including short term, interest bearing, investment grade instruments and U.S. government securities.

S-12

Table of Contents

DIVIDEND POLICY

We have never declared or paid cash dividends on our common stock. We currently intend to retain all available funds and any future earnings for use in the operation of our business and do not anticipate paying any cash dividends in the foreseeable future. Any future determination to declare cash dividends will be made at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, general business conditions and other factors that our board of directors may deem relevant.

S-13

Table of Contents

DILUTION

If you invest in this offering, your ownership interest will be immediately diluted to the extent of the difference between the public offering price per share and the as adjusted net tangible book value per share after giving effect to this offering. We calculate net tangible book value per share by dividing the net tangible book value, which is the total tangible assets less total liabilities, by the number of outstanding shares of our common stock. Dilution represents the difference between the portion of the amount per share paid by purchasers of shares in this offering and the as adjusted net tangible book value per share of our common stock immediately after giving effect to this offering. Our net tangible book value as of December 31, 2019 was approximately $6.4 million, or $0.04 per share.

After giving effect to the sale of our common stock during the term of the Sales Agreement with the Sales Agents in the aggregate amount of $50,000,000 at an assumed offering price of $0.69 per share, the last reported sale price of our common stock on the New York Stock Exchange American market on February 14, 2020, and after deducting commissions and estimated aggregate offering expenses payable by us, on an as-adjusted pro forma basis assuming 158,644,757 outstanding common shares, consisting of shares outstanding as of December 31, 2019, our net tangible book value as of December 31, 2019 would have been approximately $54.3 million, or approximately $0.23 per share of common stock. This represents an immediate increase in the net tangible book value of approximately $0.19 per share to our existing stockholders and an immediate dilution in net tangible book value of approximately $0.46 per share to new investors.

The following table illustrates this per share dilution based on shares outstanding as of December 31, 2019:

|

Assumed public offering price per share

|

|

|

|

$

|

0.69

|

|

|

Historical net tangible book value per share as of December 31, 2019

|

|

$

|

0.04

|

|

|

|

|

Increase in net tangible book value per share after this offering

|

|

$

|

0.19

|

|

|

|

|

As-Adjusted Net tangible book value per share as of December 31, 2019 after this offering

|

|

|

|

$

|

0.23

|

|

|

Dilution per share to investors participating in this offering

|

|

|

|

$

|

0.46

|

|

The above discussion and tables excludes:

· 7,116,524 shares of our common stock issuable upon the exercise of outstanding warrants as of December 31, 2019;

· 6,000,332 shares of our common stock issuable upon the exercise of outstanding options under the 2010 Plan and 2019 Plan, collectively, as of December 31, 2019;

· 9,856,000 shares of our common stock reserved for issuance under the 2019 Plan as of December 31, 2019; and

· 136,236 shares of our common stock issued under the 2019 Plan after December 31, 2019.

To the extent that any of these options or warrants are exercised, new options are issued under our 2019 Plan and subsequently exercised or we issue additional shares of common stock or securities convertible and exercisable into shares of common stock in the future, there will be further dilution to investors participating in this offering.

S-14

Table of Contents

PLAN OF DISTRIBUTION

We have entered into a Sales Agreement with the Sales Agents under which we may issue and sell from time to time up to $50,000,000 of our common stock through or to the Sales Agents as sales agents or principals. The Sales Agreement was filed as an exhibit to a Current Report on Form 8-K filed with the SEC on February 20, 2020. Sales of the common stock, if any, will be made at market prices by methods deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act.

Upon delivery of a placement notice, the Sales Agent receiving the notice may offer the common stock subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by us and the Sales Agent. We will designate the maximum amount of common stock to be sold through the Sales Agent on a daily basis or otherwise determine such maximum amount together with the Sales Agent. Subject to the terms and conditions of the Sales Agreement, each Sales Agent will use its commercially reasonable efforts to sell on our behalf all of the shares of common stock requested to be sold by us. We may instruct a Sales Agent not to sell common stock if the sales cannot be effected at or above the price designated by us in any such instruction. We or a Sales Agent may suspend the offering of the common stock being made through the Sales Agent under the Sales Agreement upon proper notice to the other party and subject to other conditions.

We will pay the Sales Agents commissions, in cash, for their services in acting as agents in the sale of our common stock. The aggregate compensation payable to the Sales Agents shall be equal to 4% of the gross sales price per share of all shares sold through both Sales Agents under the Sales Agreement. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We estimate that the total expenses of the offering payable by us, excluding commissions payable to the Sales Agents under the Sales Agreement, will be approximately $140,000.

Settlement for sales of common stock will occur on the second business day following the date on which any sales are made, or on some other date that is agreed upon by us and the Sales Agent in connection with a particular transaction, in return for payment of the net proceeds to us. Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the Sales Agent may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

Each Sales Agent is not required to sell any specific amount of securities, but will act as our sales agent using its commercially reasonable efforts, consistent with its sales and trading practices under the terms and subject to the conditions set forth in the Sales Agreement. In connection with the sales of the common stock on our behalf, each Sales Agent will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation to them will be deemed to be underwriting commissions or discounts. We have also agreed in the Sales Agreement to provide indemnification and contribution to the Sales Agents with respect to certain liabilities, including liabilities under the Securities Act.

The offering of our common stock pursuant to Sales Agreement will terminate automatically upon the sale of all shares of our common stock subject to the Sales Agreement or as otherwise permitted therein. We and the Sales Agents may each terminate the Sales Agreement at any time upon five days’ prior written notice.

Any portion of the $50,000,000 included in this prospectus supplement not previously sold or included in an active placement notice pursuant to the Sales Agreement, may be later made available for sale in other offerings pursuant to the accompanying base prospectus, and if no shares have been sold under the Sales Agreement, the full $50,000,000 of securities may be later made available for sale in other offerings pursuant to the accompanying base prospectus.

Our common stock is listed on the New York Stock Exchange American market under the trading symbol “AMPE.” The transfer agent for our common stock is Corporate Stock Transfer, Inc.

S-15

Table of Contents

The Sales Agents and their affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation M, the Sales Agents will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus supplement.

This prospectus supplement and the accompanying prospectus in electronic format may be made available on a website maintained by the Sales Agents, who may distribute this prospectus supplement and the accompanying prospectus electronically.

S-16

Table of Contents

DESCRIPTION OF CAPITAL STOCK

General

Our authorized capital stock consists of 300,000,000 shares of common stock, par value $0.0001 per share, and 10,000,000 shares of undesignated preferred stock, $0.0001 par value, of which no preferred shares are issued or outstanding.

The summary description of our capital stock contained in this prospectus supplement and the accompanying base prospectus is based on the provisions of our certificate of incorporation and bylaws and the applicable provisions of the Delaware General Corporation Law. This information is qualified entirely by reference to the applicable provisions of our certificate of incorporation, bylaws and the Delaware General Corporation Law. For information on how to obtain copies of our certificate of incorporation and bylaws, please see “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

S-17

Table of Contents

LEGAL MATTERS

The validity of the securities offered by this prospectus supplement will be passed on for us by Squire Patton Boggs (US) LLP. Certain legal matters in connection with this offering will be passed on for ThinkEquity by Loeb & Loeb LLP and for Roth by Duane Morris LLP.

EXPERTS

The audited financial statements for the fiscal year ended December 31, 2018 incorporated by reference in this prospectus supplement and elsewhere in the registration statement have been so incorporated by reference in reliance upon the report of Plante & Moran PLLC, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

The 2019 financial statements appearing in the Annual Report on Form 10-K of Ampio Pharmaceuticals, Inc. for the year ended December 31, 2019, and the effectiveness of internal control over financial reporting as of December 31, 2019, of Ampio Pharmaceuticals, Inc. have been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in its report, which are incorporated herein by reference. Such consolidated statements have been so incorporated in reliance upon the report of such firm and upon the authority of such firm as experts in accounting and auditing.

S-18

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 (File No. 333-217094), of which this prospectus supplement and the accompanying base prospectus are a part, under the Securities Act, to register the shares of common stock offered by this prospectus supplement. However, this prospectus supplement and the accompanying base prospectus do not contain all of the information contained in the registration statement and the exhibits and schedules to the registration statement. We encourage you to carefully read the registration statement and the exhibits and schedules to the registration statement.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, including us.

Our common stock is listed on the New York Stock Exchange American market under the symbol “AMPE.” General information about our company, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments and exhibits to those reports, are available free of charge through our website at www.ampiopharma.com as soon as reasonably practicable after we file them with, or furnish them to, the SEC. Information on, or that can be accessed through, our website is not incorporated into this prospectus supplement or other securities filings and is not a part of these filings.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We “incorporate by reference” into this prospectus supplement the information we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus supplement and information that we file subsequently with the SEC will automatically update this prospectus supplement. We incorporate by reference the documents listed below and any filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended, after initial filing of the registration statement that contains the prospectus and prior to the time that we sell all the securities offered by this prospectus supplement (in each case, except for the information furnished under Item 2.02 or Item 7.01 in any current report on Form 8-K and Form 8-K/A):

· Our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on February 21, 2020;

· Our Quarterly Report on Form 10-Q/A for the fiscal period ended September 30, 2019 filed with the SEC on January 14, 2020;

· Our Current Report on Form 8-K filed with the SEC on February 20, 2020; and

· the description of our common stock contained or incorporated by reference in our Registration Statement on Form 8-A, filed on May 17, 2011, including any amendment or reports filed for the purpose of updating this description.

S-19

Table of Contents

You may request a copy of these filings (other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing) at no cost, by writing to or telephoning us at the following address:

Ampio Pharmaceuticals, Inc.

373 Inverness Parkway, Suite 200

Englewood, Colorado 80112

(720) 437-6500

Attn: Investor Relations

S-20

Table of Contents

PROSPECTUS

$100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

5,000,000 Shares of Common Stock Offered by

the Selling Stockholder

Issuable Upon Exercise of Warrants

We may, from time to time, offer and sell up to $100,000,000 of any combination of our common stock, preferred stock, debt securities or warrants described in this prospectus, either individually or in combination with other securities, at prices and on terms described in one or more supplements to this prospectus. We may also offer common stock or preferred stock upon conversion of debt securities, common stock upon conversion of preferred stock, or common stock, preferred stock or debt securities upon the exercise of warrants. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings.

In addition, the selling stockholder may from time to time, offer and sell up to 5,000,000 shares our common stock issuable upon the exercise of warrants held by such selling stockholder. We will not receive any of the proceeds from the sales of common stock from the selling stockholder, however, the selling stockholder would pay us the exercise price of $0.40 per, for an aggregate amount of $2,000,000 if the warrants are exercised for cash, in full, subject to any adjustments. See “Use of Proceeds.” The selling stockholder may sell the shares of common stock described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” below for additional information on how the selling stockholder may conduct sales of our common stock. We have agreed to bear the expenses of the registration of the common stock under the federal and state securities laws on behalf of the selling stockholder.

Each time we offer securities, we will provide the specific terms of the securities offered in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference, before buying any of the securities being offered.

The securities offered by this prospectus may be sold directly by us to investors, through agents designated from time to time or to or through underwriters or dealers. We will set forth the names of any underwriters or agents and any applicable fees, commissions, discounts and over-allotments in an accompanying prospectus supplement. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus and in the applicable prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Our common stock is traded on the NYSE MKT LLC under the symbol “AMPE.” On March 29, 2017, the last reported sale price of our common stock on the NYSE MKT LLC was $0.80. The applicable prospectus supplement will contain information, where applicable, as to any other listing, if any, on the NYSE MKT LLC or any securities market or other exchange of the securities covered by the applicable prospectus supplement.

This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading “risk factors” on page 5 of this prospectus as well as those contained in the applicable prospectus supplement and any related free writing prospectus, and in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 20, 2017.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. Under this shelf registration process, we may offer shares of our common stock preferred stock, debt securities, and/or warrants to purchase our common stock, either individually or in units, in one or more offerings, up to a total dollar amount of $100,000,000. In addition, the selling stockholder may sell up to an aggregate of 5,000,000 shares of our common stock issuable upon the exercise of warrants held by such selling stockholder. This prospectus provides you with a general description of the securities we and the selling stockholder may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will contain more specific information about the specific terms of the offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. Each such prospectus supplement (and any related free writing prospectus that we may authorize to be provided to you) may also add, update or change information contained in this prospectus or in documents incorporated by reference into this prospectus. We urge you to carefully read this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated herein by reference as described under the headings “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference” before buying any of the securities being offered. This prospectus may not be used to offer or sell securities unless it is accompanied by a prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus, any applicable prospectus supplement and any related free writing prospectus. We have not authorized anyone to provide you with different information in addition to or different from that contained in this prospectus, any applicable prospectus supplement and any related free writing prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus that we may authorize to be provided to you. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

SUMMARY

This summary highlights selected information from this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement and any related free writing prospectus, including the risks of investing in our securities contained in the applicable prospectus supplement and any related free writing prospectus, and in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Unless otherwise indicated or unless the context otherwise requires, references in this prospectus to the “Company,” “Ampio,” “we,” “us,” or “our” are to Ampio Pharmaceuticals, Inc. and its subsidiaries.

1

Table of Contents

Overview

We are a biopharmaceutical company focused primarily on the development of therapies to treat prevalent inflammatory conditions for which there are limited treatment options.

Our product portfolio is primarily based on the work of Dr. David Bar-Or, the Director of Trauma Research LLC for the Swedish Medical Center located in Englewood, CO, St. Anthony Hospital located in Lakewood, CO and the medical center of Plano located in Plano, Texas. For over two decades, while directing these trauma research laboratories, Dr. Bar-Or and his staff have built a robust portfolio of product candidates focusing on inflammatory conditions. Our initial clinical programs were selected from Dr. Bar-Or’s research based on certain criteria, particularly the ability to advance the candidates rapidly into late-stage clinical trials. The benchmarks used to build our pipeline were products with: (i) potential indications to address large underserved markets; (ii) strong intellectual property protection and the potential for market and data exclusivity; and (iii) a well-defined regulatory path to marketing approval.

We are primarily developing compounds that decrease inflammation by (i) inhibiting specific pro-inflammatory compounds by affecting specific pathways at the protein expression and at the transcription level; (ii) activating specific phosphatase or depleting available phosphate needed for the inflammation process; and (iii) decreasing vascular permeability.

Our predecessor, DMI Life Sciences, Inc., or Life Sciences, was incorporated in Delaware in December 2008. In March 2010, Life Sciences was merged with a subsidiary of Chay Enterprises, Inc. As a result of this merger, Life Sciences stockholders became the controlling stockholders of Chay Enterprises. Following the merger, we reincorporated in Delaware as Ampio Pharmaceuticals, Inc. in March 2010.

Corporate Information

Our principal executive offices are located at 373 Inverness Parkway, Suite 200, Englewood, Colorado 80112, and our telephone number is (720) 437-6500. Additional information about us is available on our website at www.ampiopharma.com. The information contained on or that may be obtained from our website is not, and shall not be deemed to be, a part of this prospectus. You can review filings we make with the SEC at its website (www.sec.gov), including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports electronically filed or furnished pursuant to Section 15(d) of the Exchange Act.

The Securities We May Offer

We may offer shares of our common stock, various series of preferred stock, debt securities and/or warrants to purchase our common stock, either individually or in units, with a total value of up to $100,000,000 from time to time under this prospectus at prices and on terms to be determined at the time of any offering. In addition, the selling stockholder may sell up to an aggregate of 5,000,000 shares of our common stock issuable upon the exercise of warrants held by such selling stockholder. This prospectus provides you with a general description of the securities we and the selling stockholder may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities, including, to the extent applicable:

· designation or classification;

· aggregate principal amount or offering price;

· maturity, if applicable;

· original issue discount, if any;

· rates and times of payment of interest or dividends, if any;

· redemption, conversion, exchange or sinking fund terms, if any;

2

Table of Contents

· conversion or exchange prices or rates, if any, and, if applicable, any provisions for changes to or adjustments in the conversion or exchange prices or rates and in the securities or other property receivable upon conversion or exchange;

· restrictive covenants, if any; and

· voting or other rights, if any.

The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement or free writing prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of the registration statement of which this prospectus is a part.

This prospectus may not be used to offer or sell securities unless it is accompanied by a prospectus supplement.

We and the selling stockholder may sell the securities directly to investors or to or through agents, underwriters or dealers. We and the selling stockholder, and our agents or underwriters, reserve the right to accept or reject all or part of any proposed purchase of securities. If we or the selling stockholder does offer securities to or through agents or underwriters, we will include in the applicable prospectus supplement:

· the names of those agents or underwriters;

· applicable fees, discounts and commissions to be paid to them;

· details regarding over-allotment options, if any; and

· the net proceeds to us.

Common Stock. We may issue shares of our common stock from time to time and the selling stockholder may offer up to 5,000,000 shares of common stock issuable upon exercise of warrants held by such selling stockholder. Holders of shares of our common stock are entitled to one vote for each share held of record on all matters to be voted on by stockholders and do not have cumulative voting rights. Subject to the preferences that may be applicable to any then outstanding preferred stock, the holders of our outstanding shares of common stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of legally available funds. In the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities, subject to the satisfaction of any liquidation preference granted to the holders of any outstanding shares of preferred stock.

Preferred Stock. We may issue shares of our preferred stock from time to time, in one or more series. Under our certificate of incorporation, our board of directors has the authority, without further action by the stockholders (unless such stockholder action is required by applicable law or the rules of any stock exchange or market on which our securities are then traded), to designate up to 10,000,000 shares of preferred stock in one or more series and to determine the designations, voting powers, preferences and rights of each series of the preferred stock, as well as the qualifications, limitations or restrictions thereof, including dividend rights, conversion rights, preemptive rights, terms of redemption or repurchase, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of any series, any or all of which may be greater than the rights of the common stock. Any convertible preferred stock we may issue will be convertible into our common stock or exchangeable for our other securities. Conversion may be mandatory or at the holder’s option and would be at prescribed conversion rates.

If we sell any series of preferred stock under this prospectus, we will fix the designations, voting powers, preferences and rights of such series of preferred stock, as well as the qualifications, limitations or restrictions thereof, in the certificate of designation relating to that series. We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of any certificate of designation that describes the terms of the series of preferred stock that we are offering before the issuance of the related series of preferred stock. We urge you to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the series of preferred stock being offered, as well as the complete certificate of designation that contains the terms of the applicable series of preferred stock.

3

Table of Contents

Debt Securities. We may issue debt securities from time to time, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. The senior debt securities will rank equally with any other unsecured and unsubordinated debt. The subordinated debt securities will be subordinate and junior in right of payment, to the extent and in the manner described in the instrument governing the debt, to all of our senior indebtedness. Convertible debt securities will be convertible into or exchangeable for our common stock or preferred stock. Conversion may be mandatory or at the holder’s option and would be at prescribed conversion rates.

The debt securities will be issued under one or more documents called indentures, which are contracts between us and a national banking association or other eligible party, as trustee. In this prospectus, we have summarized certain general features of the debt securities. We urge you, however, to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the series of debt securities being offered, as well as the complete indentures that contain the terms of the debt securities. Forms of indentures have been filed as exhibits to the registration statement of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of the debt securities being offered, will be filed as exhibits to the registration statement of which this prospectus is a part or will be incorporated by reference from reports that we file with the SEC.