Altisource Asset Management Corporation Reports First Quarter 2021 Results

May 18 2021 - 8:17AM

Altisource Asset Management Corporation (“AAMC” or the “Company”)

(NYSE American: AAMC) today announced financial and operating

results for the first quarter of 2021.

First Quarter 2021 Highlights and Recent

Developments

- Fueled by cash resources emanating from the sales and

termination of discontinued operations late last year, the Company

invested in equity securities concentrated in Real Estate

Investment Trusts (“REITs”). The purpose was to secure investment

income while the Company reviews new business opportunities.

- Net income of $5.9 million for the first quarter was fueled in

part by (i) the market value appreciation of those REIT equity

securities as well as the associated dividend income, and (ii) the

gain on the sale of subsidiaries to Front Yard Residential

Corporation.

- Settled ongoing litigation with Putnam Investments, LLC and its

affiliates (collectively “Putnam”), one of the plaintiffs in the

litigation related to the Company’s Series A Convertible Preferred

Stock.

“The Company’s attention and focus,” stated Thomas K. McCarthy,

Interim Chief Executive Officer, “is to identify, evaluate and

where applicable, pursue new business opportunities. In the

meantime, the Company is keeping its options open and no final

decision has been made.”

First Quarter 2021 Financial Results

AAMC’s net income for the first quarter of 2021 was $5.9 million

compared to a net loss of $3.8 million for the same period in 2020.

Due to a $71.9 million gain on the settlement of preferred shares,

which was recorded directly to equity, but is included in the

numerator for our earnings per share calculations, diluted earnings

per share was $37.41 for the quarter, compared with a diluted net

loss per share of $2.35 for the same period in 2020.

About AAMC

AAMC has historically been an asset management company that

provides portfolio management and corporate governance services to

investment vehicles but given the sale and discontinuance of

certain operations the Company is in the process of repositioning

itself. Additional information is available at

www.altisourceamc.com.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding management’s beliefs, estimates, projections,

anticipations and assumptions with respect to, among other things,

the Company’s financial results, future operations, business plans

and investment strategies as well as industry and market

conditions. These statements may be identified by words such as

“anticipate,” “intend,” “expect,” “may,” “could,” “should,”

“would,” “plan,” “estimate,” “target,” “seek,” “believe” and other

expressions or words of similar meaning. We caution that

forward-looking statements are qualified by the existence of

certain risks and uncertainties that could cause actual results and

events to differ materially from what is contemplated by the

forward-looking statements. Factors that could cause our actual

results to differ materially from these forward-looking statements

may include, without limitation, our ability to implement new

businesses or, to the extent such businesses are developed, our

ability to make them successful or sustain the performance of any

such businesses; developments in the litigation regarding our

redemption obligations under the Certificate of Designations of our

Series A Convertible Preferred Stock; and other risks and

uncertainties detailed in the “Risk Factors” and other sections

described from time to time in the Company’s current and future

filings with the Securities and Exchange Commission. The foregoing

list of factors should not be construed as exhaustive.

The statements made in this press release are current as of the

date of this press release only. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements or any other information contained herein, whether as a

result of new information, future events or otherwise.

Altisource Asset Management

Corporation Condensed Consolidated Statements of

Operations (In thousands, except share and per

share amounts)(Unaudited)

| |

Three months ended March 31, |

| |

2021 |

|

2020 |

|

Expenses: |

|

|

|

|

Salaries and employee benefits |

$ |

3,545 |

|

|

$ |

3,094 |

|

| Legal and professional

fees |

1,885 |

|

|

1,480 |

|

| General and

administrative |

753 |

|

|

586 |

|

|

Total expenses |

6,183 |

|

|

5,160 |

|

| |

|

|

|

| Other income

(loss): |

|

|

|

| Change in fair value of Front

Yard common stock |

146 |

|

|

(634 |

) |

| Dividend income on Front Yard

common stock |

— |

|

|

244 |

|

| Change in fair value of equity

securities |

5,721 |

|

|

— |

|

| Dividend income |

2,154 |

|

|

— |

|

| Interest expense |

(36 |

) |

|

— |

|

| Other income |

135 |

|

|

18 |

|

|

Total other income (loss) |

8,120 |

|

|

(372 |

) |

| |

|

|

|

| Net income (loss) from

continuing operations before income taxes |

1,937 |

|

|

(5,532 |

) |

| Income tax expense |

2,294 |

|

|

122 |

|

|

Net loss from continuing operations |

(357 |

) |

|

(5,654 |

) |

| |

|

|

|

| Discontinued

operations: |

|

|

|

| Income from operations related

to Front Yard, net of tax |

— |

|

|

1,897 |

|

| Gain on disposal of operations

related to Front Yard |

7,485 |

|

|

— |

|

| Income tax expense related to

disposal |

1,272 |

|

|

— |

|

|

Net gain on discontinued operations |

6,213 |

|

|

1,897 |

|

| |

|

|

|

| Net income (loss) |

5,856 |

|

|

(3,757 |

) |

| Amortization of preferred

stock issuance costs |

— |

|

|

(42 |

) |

|

Net income (loss) attributable to common stockholders |

$ |

5,856 |

|

|

$ |

(3,799 |

) |

| |

|

|

|

| Continuing operations earnings

per share |

|

|

|

| Net loss from continuing

operations |

$ |

(357 |

) |

|

(5,654 |

) |

|

Reverse amortization of preferred stock issuance costs |

— |

|

|

42 |

|

|

Gain on preferred stock transaction |

71,883 |

|

|

— |

|

| Numerator for earnings

per share from continuing operations |

$ |

71,526 |

|

|

$ |

(5,612 |

) |

| |

|

|

|

| Discontinued operations

earnings per share |

|

|

|

| Net income from

discontinued operations |

$ |

6,213 |

|

|

$ |

1,897 |

|

| |

|

|

|

| Earnings (loss) per

share of common stock – basic: |

|

|

|

| Continuing operations –

basic |

$ |

38.78 |

|

|

$ |

(3.52 |

) |

| Discontinued operations –

basic |

3.37 |

|

|

1.17 |

|

| Earnings (loss) per basic

common share |

$ |

42.15 |

|

|

$ |

(2.35 |

) |

| Weighted average common stock

outstanding – basic |

1,844,212 |

|

|

1,615,710 |

|

| |

|

|

|

| Earnings (loss) per

share of common stock – diluted: |

|

|

|

| Continuing operations –

diluted |

$ |

34.42 |

|

|

$ |

(3.52 |

) |

| Discontinued operations –

diluted |

2.99 |

|

|

1.17 |

|

| Earnings (loss) per diluted

common share |

$ |

37.41 |

|

|

$ |

(2.35 |

) |

| Weighted average common stock

outstanding – diluted |

2,078,077 |

|

|

1,615,710 |

|

Altisource Asset Management

Corporation Condensed Consolidated Balance

Sheets (In thousands, except share and per share

amounts)

|

|

March 31, 2021 |

|

December 31, 2020 |

| |

(unaudited) |

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

14,902 |

|

|

$ |

41,623 |

|

| Equity securities, at fair

value |

102,672 |

|

|

— |

|

| Front Yard common stock, at

fair value |

— |

|

|

47,355 |

|

| Receivable from Front

Yard |

— |

|

|

3,414 |

|

| Dividends receivable |

2,012 |

|

|

— |

|

| Prepaid expenses and other

assets |

2,882 |

|

|

3,328 |

|

| Current assets held for

sale |

— |

|

|

894 |

|

|

Total current assets |

122,468 |

|

|

96,614 |

|

| |

|

|

|

| Non-current

assets: |

|

|

|

| Right-of-use lease assets |

932 |

|

|

656 |

|

| Other non-current assets |

587 |

|

|

503 |

|

| Non-current assets held for

sale |

— |

|

|

1,979 |

|

|

Total non-current assets |

1,519 |

|

|

3,138 |

|

|

Total assets |

$ |

123,987 |

|

|

$ |

99,752 |

|

| |

|

|

|

| Current

liabilities: |

|

|

|

| Accrued salaries and employee

benefits |

$ |

404 |

|

|

$ |

2,539 |

|

| Accounts payable and accrued

liabilities |

1,668 |

|

|

9,152 |

|

| Interest payable |

36 |

|

|

— |

|

| Borrowed funds |

28,407 |

|

|

— |

|

| Short-term lease

liabilities |

126 |

|

|

75 |

|

| Current liabilities held for

sale |

— |

|

|

1,338 |

|

|

Total current liabilities |

30,641 |

|

|

13,104 |

|

| |

|

|

|

| Non-current

liabilities: |

|

|

|

| Long-term lease

liabilities |

830 |

|

|

600 |

|

| Other non-current

liabilities |

4,523 |

|

|

1,027 |

|

| Non-current liabilities held

for sale |

— |

|

|

1,599 |

|

|

Total non-current liabilities |

5,353 |

|

|

3,226 |

|

|

Total liabilities |

35,994 |

|

|

16,330 |

|

| |

|

|

|

| Commitments and

contingencies (Note 6) |

— |

|

|

— |

|

| |

|

|

|

| Redeemable preferred

stock: |

|

|

|

| Preferred stock, $0.01 par

value, 250,000 and 250,000 shares issued as March 31, 2021

andDecember 31, 2020, respectively. 168,200 shares outstanding

and $168,200 redemption value as ofMarch 31, 2021 and 250,000

shares outstanding and $250,000 redemption value as of

December 31,2020 |

168,200 |

|

|

250,000 |

|

| |

|

|

|

| Stockholders'

deficit: |

|

|

|

| Common stock, $0.01 par value,

5,000,000 authorized shares; 3,407,919 and 2,048,319 shares

issuedand outstanding, respectively, as of March 31, 2021 and

2,966,207 and 1,650,212 shares issued andoutstanding, respectively,

as of December 31, 2020 |

34 |

|

|

30 |

|

| Additional paid-in

capital |

127,953 |

|

|

46,574 |

|

| Retained earnings |

69,310 |

|

|

63,426 |

|

| Accumulated other

comprehensive loss |

58 |

|

|

(65 |

) |

| Treasury stock, at cost,

1,359,600 shares as of March 31, 2021 and 1,315,995 shares as

ofDecember 31, 2020 |

(277,562 |

) |

|

(276,543 |

) |

|

Total stockholders' deficit |

(80,207 |

) |

|

(166,578 |

) |

|

Total liabilities and equity |

$ |

123,987 |

|

|

$ |

99,752 |

|

| |

FOR FURTHER

INFORMATION CONTACT: |

| |

Investor Relations |

| |

T: +1-704-275-9113 |

| |

E: IR@AltisourceAMC.com |

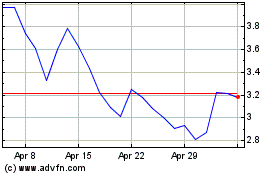

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

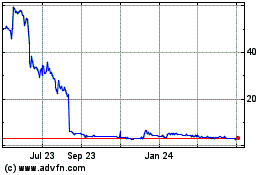

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Apr 2023 to Apr 2024