Form 8-K/A - Current report: [Amend]

February 07 2024 - 6:01AM

Edgar (US Regulatory)

true

2024-02-06

0001424864

Rise Gold Corp.

0001424864

2024-02-06

2024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 6, 2024

RISE GOLD CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-53848

|

30-0692325

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

650-669 Howe Street

Vancouver, British Columbia, Canada

V6C 0B4

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (604) 260-4577

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| — |

|

— |

|

— |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Securities

As described in Item 8.01 below, Rise Gold Corp. (the "Company") has issued to a lender 1,000,000 non‐transferable share purchase warrants (each, a "Bonus Warrant") having the terms described in Item 8.01. The Company issued the Bonus Warrants and offered the underlying shares of common stock to the lender in a private transaction in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933.

Item 8.01 Other Events

On February 6, 2024, the Company announced that it has entered into a credit facility arrangement (the "Arrangement") with an arm's length lender (the "Lender") that also provides services to the Company. Pursuant to the Arrangement, each month the Lender will advance to the Company an amount equal to half of the fees billed by the Lender up to US$1,000,000. Amounts advanced will bear interest at a rate of 12% compounding annually and will be due four years from the date of the Arrangement. The Company may repay any amounts owing under the facility at any time without penalty.

As consideration for making the credit facility available, the Company agreed to issue 1,000,000 non‐transferable Bonus Warrants to the Lender. Each Bonus Warrant will be exercisable into one share of common stock of the Company at a price of US$0.16 for a period of four years from the date of issuance. In addition, for each US$100,000 advanced under the Arrangement, the Company has agreed to issue to the Lender 200,000 additional non-transferable warrants (each, an "Additional Warrant"). Each Additional Warrant will be exercisable into one share of common stock of the Company at any time within a four-year period from the date of issuance at a price equal to the market price of the shares of the Company as determined in accordance with the terms of the Arrangement.

Additional information is provided in the news release, a copy of which is included as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 6, 2024

RISE GOLD CORP.

/s/ Joseph Mullin

Joseph Mullin

President and CEO

Rise Gold Announces a Credit Facility Arrangement

February 6, 2024 - Grass Valley, California - Rise Gold Corp. (CSE: RISE, OTCQX: RYES) (the "Company" or "Rise") The Company announces it has entered into a credit facility arrangement (the "Arrangement") with an arm's length lender (the "Lender") that also provides services to the Company. Pursuant to the Arrangement, each month the Lender will advance to the Company an amount equal to half of the fees billed by the Lender up to US$1,000,000. Amounts advanced will bear interest at a rate of 12% compounding annually and will be due four years from the date of the Arrangement. The Company may repay any amounts owing under the facility at any time without penalty.

In connection with making the credit facility available, the Company has agreed to issue 1,000,000 non‐transferable share purchase warrants (each, a "Bonus Warrant") to the Lender. Each Bonus Warrant will be exercisable into one share of common stock of the Company at a price of US$0.16 for a period of four years from the date of issuance. In addition, for each US$100,000 advanced under the Arrangement, the Company has agreed to issue to the Lender 200,000 additional non-transferable warrants (each, an "Additional Warrant"). Each Additional Warrant will be exercisable into one share of common stock of the Company at any time within a four-year period from the date of issuance at a price equal to the market price of the shares of the Company as determined in accordance with the terms of the Arrangement.

The securities offered under the Arrangement have not been registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws and may not be offered or sold absent registration or compliance with an applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. All securities issued pursuant to the Arrangement will be subject to statutory hold periods in accordance with applicable United States and Canadian securities laws.

About Rise Gold Corp.

Rise Gold is an exploration-stage mining company incorporated in Nevada, USA. The Company's principal asset is the historic past-producing Idaho-Maryland Gold Mine located in Nevada County, California, USA.

On behalf of the Board of Directors:

Joseph Mullin

President and CEO

Rise Gold Corp.

For further information, please contact:

RISE GOLD CORP.

Suite 215, 333 Crown Point Circle

Grass Valley, CA 95945

T: 530.433.0188

info@risegoldcorp.com

www.risegoldcorp.com

The CSE has not reviewed, approved or disapproved the contents of this news release.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words or statements that certain events or conditions "may" or "will" occur.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks, uncertainties and assumptions related to certain factors including, without limitation, obtaining all necessary approvals, meeting expenditure and financing requirements, compliance with environmental regulations, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, and one-time events that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements and information contained in this release. Rise undertakes no obligation to update forward-looking statements or information except as required by law.

v3.24.0.1

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

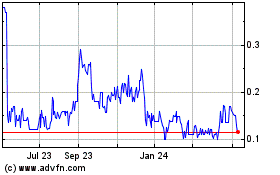

Rise Gold (QX) (USOTC:RYES)

Historical Stock Chart

From Mar 2024 to Apr 2024

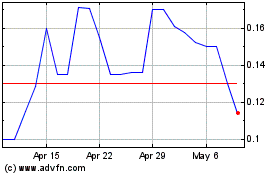

Rise Gold (QX) (USOTC:RYES)

Historical Stock Chart

From Apr 2023 to Apr 2024