UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

Santo Mining Corp

|

(Exact name of registrant as specified in its charter)

|

Wyoming

|

| 65-0945967

|

(State of incorporation

or organization)

|

| (IRS Employer

Identification No.)

|

848 Biscayne Blvd, PH5

Miami, FL

33133

(Address of Principal Executive Offices) (Zip Code)

1-954-787-1770

(Registrant’s telephone number, including area code)

Email: info@groovy.click

Communication Copies to

Jeff Turner

JDT Legal

897 W Baxter Dr.

South Jordan, Utah 84095

Phone: 801.810.4465

Fax: 888.920.1297

jeff@jdt-legal.com

Securities to be Registered Under Section 12(g) of the Act:

Common Stock, Par Value $0.00001

(Title of Class)

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large, accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large, accelerated filer

| ☐

| Accelerated filer

| ☐

|

Non-accelerated filer

| ☒

| Smaller reporting company

| ☒

|

|

| Emerging growth company

| ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

i

Table of Contents

INDEX TO FORM 10

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Registration Statement contains certain forward-looking statements. When used in this Registration Statement, statements which are not historical in nature, including words such as “believe,” “expect,” “may,” “will,” “should,” “expect,” “project,” “intend”, “plan”, “estimate”, “anticipate” or similar expressions are intended to identify forward-looking statements. They also include statements containing a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms. All statements we make relating to estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments.

The forward-looking statements in this Registration Statement are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, considering the information currently available to them.

These statements are not statements of historical fact, and are subject to risks and uncertainties, some of which are not currently known to us, which may change over time, and which may cause our actual results, performance, or financial condition to differ materially from the expectations of future results, performance, or financial condition we express or imply in any forward-looking statements. We derive most of our forward-looking statements from our current plans, expectations, and forecasts, which are based upon certain assumptions and are subject to a number of risks and uncertainties that could significantly affect our future financial condition and results. While we believe that our assumptions are reasonable, we caution that it is difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. There may be other factors not presently known to us or which we currently consider to be immaterial that may cause our actual results to differ materially from the expectations expressed or implied in our forward-looking statements.

All forward-looking statements and projections attributable to us or persons acting on our behalf apply only as of the date of this Registration Statement and are expressly qualified in their entirety by the cautionary statements included in this Registration Statement. We undertake No obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You are cautioned not to unduly rely on such forward-looking statements when evaluating information presented herein.

ii

Table of Contents

ITEM 1.BUSINESS.

Corporate History

The Company was incorporated in the State of Nevada on July 8, 2009 as Santa Pita Corp to operate an internet portal for dentists and patients to access dental information, as well as a teeth-whitening business.

On July 30, 2012, the Company redirected its focus toward precious metal exploration and mining. Mineral exploration began with a mineral claim acquisition agreement (the “Acquisition Agreement”), with GEXPLO, SRL (the “Vendor”) and the Company, whereby the Company agreed to acquire from the Vendor a one hundred percent (100%) interest in a claim (“the Claim”) located in the Dominican Republic.

The owner of the Vendor, Alain French, became President, Chief Executive Officer, Secretary, Treasurer and Director on the acquisition closing date. The Company was renamed Santo Mining Corp.

The Company also has three subsidiaries: (1) Cathay International LLC, a Florida corporation specializing in administration, logistics, and an Asian to USA interoperability; (2) Santo Blockchain Labs Corp. a Wyoming corporation leveraging the blockchain and crypto-asset states laws of the State of Wyoming; and (3) Santo Blockchain Labs of Colombia S.A.S., El Poblado, Medellin, Antioquia, Republic of Colombia.

Santo Mining Corp. was re-domiciled to Florida in July 2015. In July 2021, the Company re-redomiciled to Wyoming where we maintain an active business registration in good standing.

Our Current Business

Santo Mining Corp, is a forward-thinking and innovative software development company that specializes in the creation of cutting-edge solutions for the global cannabis industry. Our primary focus revolves around the development of advanced software applications harnessing technologies such as Blockchain as a Service (BaaS), Non-Fungible Tokens (NFTs), Decentralized Autonomous Organizations (DAOs), Internet of Things (IoT), and Artificial Intelligence (AI). SANTO is dedicated to revolutionizing and enhancing the operational efficiency, compliance, and sustainability of businesses within the rapidly expanding global cannabis sector.

Core Competencies

Our core competencies serve as the bedrock of our distinctive value proposition:

Blockchain as a Service (BaaS):

·SANTO boasts deep expertise in BaaS, allowing us to create and deploy customized blockchain solutions. These solutions enhance trust, transparency, and traceability within the global cannabis supply chain while ensuring robust security measures are in place.

·NFT Development: We excel in designing and developing NFT solutions specifically tailored for cannabis applications. These solutions encompass product authentication, digital collectibles, and intellectual property protection. Our NFT platforms are engineered to elevate engagement and bolster brand recognition for cannabis enterprises on a global scale.

·Decentralized Autonomous Organizations (DAOs): SANTO specializes in the conception and implementation of DAOs that empower cannabis communities and stakeholders to collectively participate in governance and decision-making. Our DAOs are engineered to foster transparency, inclusivity, and decentralized management across borders.

·Internet of Things (IoT): We provide advanced IoT solutions that enable real-time monitoring and control of environmental conditions within cannabis cultivation facilities. These solutions contribute to optimized growing conditions, increased crop yields, and the responsible utilization of resources.

·Artificial Intelligence (AI): Leveraging AI capabilities, SANTO offers data-driven insights and analytics to empower cannabis businesses in optimizing operations, facilitating informed decision-making, and

1

Table of Contents

enhancing overall operational efficiency.

Product and Service Offering

Our extensive portfolio of software solutions and services encompasses:

·Blockchain-Based Solutions: We specialize in developing bespoke blockchain applications that enhance transparency, traceability, and security within the global cannabis supply chain. Our blockchain solutions facilitate compliance with evolving regulatory standards and mitigate fraudulent activities.

·NFT Platforms: SANTO provides NFT platforms that empower global cannabis businesses to create, manage, and trade digital assets. Whether utilized for unique product labeling, digital collectibles, or intellectual property protection, our NFT solutions drive engagement and enhance brand recognition on a global scale.

·DAO Development: We are at the forefront of designing and implementing DAOs that facilitate community-driven governance and decision-making within the international cannabis ecosystem. Our DAOs are meticulously crafted to promote transparency, inclusivity, and decentralized governance across borders.

·IoT Applications: Our IoT solutions enable real-time monitoring and control of environmental conditions within cannabis cultivation facilities on a global scale. This results in optimized growing conditions, increased crop yields, and responsible resource management.

·AI-Powered Analytics: SANTO’s AI-driven analytics tools empower global cannabis companies to extract actionable insights from their data. These insights facilitate informed decision-making, streamline operations, and drive sustainable growth across international boundaries.

Competition

The Company faces competition from companies of varying sizes, some of which have greater access to financial resources, research and development, and other resources.

In many cases, the Company’s competitors have longer operating histories, established ties to the market and consumers, greater brand awareness, and greater financial, technical, and marketing resources. The Company’s ability to compete depends, in part, upon a number of factors outside the Company’s control, including the ability of the Company’s competitors to develop alternatives that are superior. If the Company fails to successfully compete in its markets, or if the Company incurs significant expenses in order to compete, it will have a material adverse effect on the Company’s results of operations.

Compliance with Government Regulation

If regulatory changes or interpretations of our activities require our registration as a money services business (“MSB”) under the regulations promulgated by FinCEN under the authority of the U.S. Bank Secrecy Act, or otherwise under state laws, we may incur significant compliance costs, which could be substantial or cost prohibitive. If we become subject to these regulations our costs in complying with them may have a material negative effect on our business and the results of our operations.

To the extent that the activities of the Company cause it to be deemed an MSB under the regulations promulgated by FinCEN under the authority of the U.S. Bank Secrecy Act, we may be required to comply with FinCEN regulations, including those that would mandate us to implement anti-money laundering programs, make certain reports to FinCEN and maintain certain records.

To the extent that the activities of the Company cause it to be deemed a “money transmitter” (“MT”) or equivalent designation, under state law in any state in which the Company operates, we may be required to seek a license or otherwise register with a state regulator and comply with state regulations that may include the implementation of anti-money laundering programs, maintenance of certain records and other operational requirements. Currently, the NYSDFS has finalized its “BitLicense” framework for businesses that conduct “virtual currency business. The Company will continue to monitor developments in such legislation, guidance or regulations.

2

Table of Contents

Such additional federal or state regulatory obligations may cause us to incur extraordinary expenses, possibly affecting an investment in the Shares in a material and adverse manner. Furthermore, the Company and its service providers may not be capable of complying with certain federal or state regulatory obligations applicable to MSBs and MTs. If the Company is deemed to be subject to and determines not to comply with such additional regulatory and registration requirements, we may act to dissolve and liquidate the Company. Any such action may adversely affect an investment in the Company.

Industry

Our success will depend on our ability to obtain and maintain meaningful intellectual property protection for any such intellectual property. The names and/or logos of Company brands (whether owned by the Company or licensed to us) may be challenged by holders of trademarks who file opposition notices, or otherwise contest trademark applications by the Company for its brands. Similarly, domains owned and used by the Company may be challenged by others who contest the ability of the Company to use the domain name or URL. Such challenges could have a material adverse effect on the Company’s financial results as well as your investment.

Subsidiaries

Cathay International, LLC

| Santo Blockchain Labs Corporation

| Santo Blockchain Labs of Colombia S.A.S.

|

8000 Avalon Blvd., Suite 100

| 1309 Coffeen Avenue Suite 2902

| Cl. 7#37-50, Torre1 Unit 1016

|

Alpharetta, Georgia 30009

| Sheridan, Wyoming 82801

| El Poblado, Medellin, Antioquia

|

|

| Republic of Colombia

|

Employees

As of the date of this Form-10, the Company has 6 full-time, 3 full-time directors & part-time employees. There is no collective agreement between the Company and its employees. The employment relationship between employees and the Company is standard for the industry.

Corporate Information

Our corporate offices are located at Cl. 7 #37-50, El Poblado, Torre 1 Unit 1016, Medellín 050021, Republic of Colombia. Our telephone number is +57-304-312-0273.

ITEM 1A.RISK FACTORS.

You should carefully consider the risks described below together with all of the other information included in this registration statement before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment. In addition to other information in this registration statement and in other filings we make with the Securities and Exchange Commission, the following risk factors should be carefully considered in evaluating our business as they may have a significant impact on our business, operating results and financial condition. If any of the following risks occurs, our business, financial condition, results of operations and future prospects could be materially and adversely affected. Because of the following factors, as well as other variables affecting our operating results, past financial performance should not be considered as a reliable indicator of future performance and investors should not use historical trends to anticipate results or trends in future periods.

Risks Related to the Company and Its Business

The Company has a limited operating history.

The Company has a limited operating history. There can be no assurance that the Company’s proposed plan of business can be realized in the manner contemplated and, if it cannot be, shareholders may lose all or a substantial part of their investment. There is no guarantee that it will ever realize any significant operating revenues or that its operations will ever be profitable.

3

Table of Contents

We are dependent upon management, key personnel, and consultants to execute our business plan.

Our success is heavily dependent upon the continued active participation of our current management team, especially our current executive officer. Loss of this individual could have a material adverse effect upon our business, financial condition, or results of operations. Further, our success and the achievement of our growth plans depends on our ability to recruit, hire, train, and retain other highly qualified technical and managerial personnel. Competition for qualified employees among companies in our industry, and the loss of any of such persons, or an inability to attract, retain, and motivate any additional highly skilled employees required for the expansion of our activities, could have a materially adverse effect on our business. If we are unable to attract and retain the necessary personnel, consultants, and advisors, it could have a material adverse effect on our business, financial condition, or operations.

Although we are dependent upon certain key personnel, we do not have any key man life insurance policies on any such people.

We are dependent upon management in order to conduct our operations and execute our business plan; however, we have not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, should any of those key personnel, management, or founders die or become disabled, we will not receive any compensation that would assist with any such person’s absence. The loss of any such person could negatively affect our business and operations.

Changes in employment laws or regulations could harm our performance.

Various federal and state labor laws govern the Company’s relationship with our employees and affect operating costs, including labor laws of non-USA jurisdictions. These laws may include minimum wage requirements, overtime pay, healthcare reform and the implementation of various federal and state healthcare laws, unemployment tax rates, workers’ compensation rates, citizenship requirements, union membership and sales taxes. A number of factors could adversely affect our operating results, including additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, changing regulations from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

The Company is subject to income taxes as well as non-income-based taxes such as payroll, sales, use, value-added, net worth, property, and goods and services taxes.

Significant judgment is required in determining our provision for income taxes and other tax liabilities. In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although the Company believes that our tax estimates will be reasonable: (i) there is no assurance that the final determination of tax audits or tax disputes will not be different from what is reflected in our income tax provisions, expense amounts for non-income-based taxes and accruals and (ii) any material differences could have an adverse effect on our financial position and results of operations in the period or periods for which a determination is made.

Our ability to adopt technology in response to changing security needs or trends poses a challenge to the safekeeping of our digital assets.

The history of digital asset exchanges has shown that exchanges and large holders of digital assets must adapt to technological change in order to secure and safeguard their digital assets. We rely on third party storage solutions and “cold storage” of our digital wallets to safeguard our digital assets from theft, loss, destruction, or other issues relating to hackers and technological attack; however, malicious actors may be able to intercept our digital assets in the process of selling them. Further, we may move our digital assets to various exchanges to exchange them for fiat currency, which will require us to rely on the security protocols of these exchanges to safeguard our digital assets. While these exchanges purport to be secure, and while we believe them to be so, no security system is perfect and malicious actors may be able to intercept our digital assets while we are in the process of selling them via such exchanges. Given the growth in their size and their relatively unregulated nature, we believe these exchanges will become a more appealing target for malicious actors. To the extent we are unable to identify and mitigate or stop new security threats, our digital assets may be subject to theft, loss, destruction, or other attack, which could adversely affect an investment in us.

4

Table of Contents

The limited rights of legal recourse against us, and our lack of insurance protection expose us and our shareholders to the risk of loss of our digital assets for which no person is liable.

The digital assets held by us are not insured. Further, banking institutions will not accept our digital assets; they are therefore not insured by the Federal Deposit Insurance Corporation (“FDIC”) or the Securities Investor Protection Corporation (“SIPC”). Therefore, a loss may be suffered with respect to our digital assets which is not covered by insurance, and we may not be able to recover any of our carried value in these digital assets if they are lost or stolen or suffer significant and sustained reduction in conversion spot price. If we are not otherwise able to recover damages from a malicious actor in connection with these losses, our business and results of operations may suffer, which may have a material negative impact on our stock price.

We are not subject to Sarbanes-Oxley regulations and lack the financial controls and safeguards required of public companies.

We have not been subject to Sarbanes-Oxley throughout our operating history and therefore have not previously developed the internal infrastructure necessary to complete an attestation of our financial controls pursuant to Section 404 of the Sarbanes-Oxley Act of 2002. We expect to incur substantial expenses and diversion of management’s time if and when it becomes necessary to perform the system and process evaluation, testing and remediation required in order to comply with the management certification and auditor attestation requirements.

There is no guarantee that we will have sufficient cash flow from our business to pay our indebtedness or that we will not incur additional debt.

Holders of convertible notes issued by us may convert such notes at their option prior to the scheduled maturities of the respective convertible notes under certain circumstances pursuant to the terms of such notes. Upon conversion of the applicable convertible notes, we will be obligated to deliver cash and/or shares pursuant to the terms of such notes. Moreover, holders of such convertible notes may have the right to require us to repurchase their notes upon the occurrence of a fundamental change pursuant to the terms of such notes.

Our ability to make scheduled payments of the principal and interest on our indebtedness when due, to make payments upon conversion or repurchase demands with respect to our convertible notes, or to refinance our indebtedness as we may need or desire, depends on our future performance, which is subject to economic, financial, competitive, and other factors beyond our control. Our business may not generate cash flow from future operations sufficient to satisfy our obligations under our existing indebtedness and any future indebtedness we may incur, and to make necessary capital expenditures. If we are unable to generate such cash flow, we may be required to adopt one or more alternatives, such as reducing or delaying investments or capital expenditures, selling assets, refinancing, or obtaining additional equity capital on terms that may be onerous or highly dilutive. Our ability to refinance existing or future indebtedness will depend on the capital markets and our financial condition at such time. In addition, our ability to make payments may be limited by law, by regulatory authority, or by agreements governing our future indebtedness. We may not be able to engage in these activities on desirable terms or at all, which may result in a default on our existing or future indebtedness and harm our business, financial condition, and operating results.

Our operating plan relies in large part on assumptions and analysis developed by the Company. If these assumptions prove to be incorrect, the Company’s actual operating results may be materially different from our forecasted results.

Whether actual operating results and business developments will be consistent with the Company’s expectations and assumptions as reflected in its forecast depends on a number of factors, many of which are outside the Company’s control, including, but not limited to:

·whether the Company can obtain sufficient capital to sustain and grow its business

·our ability to manage the Company’s growth

·demand for the Company’s products and services

·the timing and costs of new and existing marketing and promotional efforts

·competition

·the Company’s ability to retain existing key management, to integrate recent hires and to attract, retain and motivate qualified personnel

·the overall strength and stability of domestic and international economies

5

Table of Contents

·consumer spending habits

Unfavorable changes in any of these or other factors, most of which are beyond the Company’s control, could materially and adversely affect its business, results of operations and financial condition.

Our indebtedness could adversely affect our financial condition or operations, and our ability to raise additional capital financing on favorable terms.

As of September 30, 2023, we had total outstanding liabilities of $5,199,374. Our indebtedness and the terms of the instruments governing such indebtedness could have significant consequences such as:

·Increasing our vulnerability to general adverse economic and industry conditions;

·Limiting our ability to fund future working capital, capital expenditures costs and other general corporate requirements;

·Requiring us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes;

·Limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

·Placing us at a competitive disadvantage compared to our competitors that have less debt; and

·Limiting, along with the financial and other restrictive covenants in our indebtedness, among other things, our ability to borrow additional funds or engage in various transactions that might otherwise be beneficial to us.

We will likely need to raise additional capital through debt and/or equity financing. There can be no assurance that adequate debt and equity financing will be available on satisfactory terms. Any such failure to service our debt or an inability to obtain further financing could have a negative effect on our business and operations.

Additional financing may not be available to us when we need or want it, nor may it be available on satisfactory terms.

We have limited capital and there is no assurance that our current capital is sufficient to implement our business plan. We will likely require additional debt and/or equity financing to pursue our growth and business strategy, including enhancements to our operations infrastructure and improving our ability to respond to competitive pressures. There can be no assurance that adequate debt and/or equity financing will be available or offered on satisfactory terms. Any failure to obtain further financing could have a materially adverse effect on our business, financial condition, and operating results.

Other Risks

We may not realize the anticipated benefits of past or future acquisitions, and integration of these acquisitions may disrupt our business and management.

In the future, we may acquire additional companies, project pipelines, products, or technologies or enter into join ventures or other strategic initiatives. We may not realize the anticipated benefits of an acquisition and each acquisition has numerous risks. These risks include the following:

·high volatility in the value of cryptocurrencies generally and in the value of Bitcoin and Ethereum particularly, and the effect of such volatility on our ability to operate profitably;

·changes in the regulatory and legal environments in Latin America and the Caribbean Region in which we operate may lead to future challenges to operating our business or may subject our business to added costs with the result that some or all of our operating facilities become less profitable or unprofitable altogether;

·changes in United States tax laws may impose burdensome reporting or regulation on our operations;

·risks related to our failure to continue to obtain financing on a timely basis and on acceptable terms;

·our ability to keep pace with technology changes and competitive conditions;

·other risks and uncertainties related to our business plan and business strategy; and

·the impact on the world economy of coronavirus (“COVID-19”).

6

Table of Contents

Risks Related to the Ownership of Our Common Stock

If we are subject to Securities and Exchange Commission regulations relating to low-priced stocks, the market for our common stock could be adversely affected.

The SEC has adopted regulations concerning low-priced or “penny” stocks. The regulations generally define “penny stock” to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. If our shares are offered at a market price less than $5.00 per share, and do not qualify for any exemption from the penny stock regulations, our shares may become subject to these additional regulations relating to low-priced stocks.

The penny stock regulations require that broker-dealer who recommend penny stocks to persons other than institutional accredited investors make a special suitability determination for the purchase, receive the purchaser’s written agreement to the transaction prior to the sale and provide the purchaser with risk disclosure documents that identify risks associated with investing in penny stocks. Furthermore, the broker-dealer must obtain a signed and dated acknowledgment form the purchaser demonstrating that the purchaser has actually received the required risk disclosure document before effecting a transaction in penny stock. These requirements have historically resulted in reducing the level of trading activity in securities that become subject to the penny stock rules.

The additional burdens imposed upon broker-dealers by these penny stock requirements may discourage broker-dealers from effecting transactions in the common stock, which could severely limit the market liquidity of our common stock and our shareholders’ ability to sell our common stock in the secondary market.

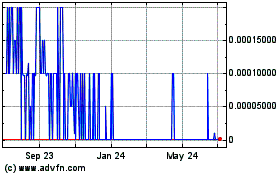

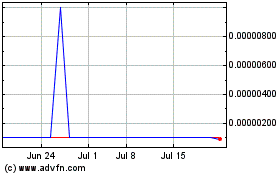

The trading price of our common stock is likely to continue to be volatile.

The trading price of our common stock has been highly volatile and could continue to be subject to wide fluctuations in response to various factors, some of which are beyond our control. The stock market in general has experienced, and likely will continue to experience, substantial price and volume fluctuations that are often unrelated or disproportionate to the operating performances of companies. Our common stock may be traded by short sellers which may put pressure on the supply and demand for our company stock, further influencing volatility in its market price. Public perception and other factors outside of our control may additionally impact our stock price and volatility. The market price of our common stock will likely fluctuate significantly in response to the following or other factors, again some of which are beyond are control:

·Significant delays in our supply channel;

·Inability to raise additional capital or do so on favorable terms, if necessary, to maintain or grow our operations;

·Additions or departures of key personnel;

·Future sales of our common stock;

·Stock market price and volume fluctuations attributable to inconsistent trading volume levels of our stock;

·Commencement of or involvement in litigation; and

·Our inability to effectively manage our current and future operations.

Our largest stockholders have significant control over us, and their interests may conflict with or differ from interests of other stockholders.

Our largest stockholders are Franjose Yglesias, Marc Williams, and Kevin Jodrey (collectively, the “Significant Stockholders”). The Significant Stockholders have substantial influence over all matters requiring stockholder approval, including the election of our directors and the approval of significant corporate transactions such as mergers, tender offers, and the sale of all or substantially all of our assets. The interests of the Significant Stockholders could conflict with or differ from interests of other stockholders. For example, the concentration of ownership held by the Significant Stockholders could delay, defer, or prevent a change of control of our company or impede a merger, takeover, or other business combination which a majority of stockholders may view favorably.

7

Table of Contents

We may fail to meet our publicly announced guidance or other expectations about our business, which could cause our stock price to decline.

From time-to-time we may provide guidance regarding our expected financial and business performance. Correctly identifying key factors affecting business conditions and predicting future events is inherently an uncertain process, and our guidance may not ultimately be accurate. Our guidance is based on certain assumptions such as those relating to sales volumes (which generally are not linear throughout a given period), average sales prices, supplier and commodity costs, and planned cost reductions. If our guidance varies from actual results due to our assumptions not being met or the impact on our financial performance that could occur as a result of various risks and uncertainties, the market value of our common stock could decline significantly.

Transactions relating to our convertible notes may dilute the ownership interest of existing stockholders or may otherwise depress the price of our common stock.

The conversion of some or all of the convertible notes issued by us, or our subsidiaries would dilute the ownership interests of existing stockholders to the extent we deliver shares upon conversion of any of such notes by their holders, and we may be required to deliver a significant number of shares. Any sales in the public market of the common stock issuable upon such conversion could adversely affect their prevailing market prices. In addition, the existence of the convertible senior notes may encourage short selling by market participants because the conversion of such notes could be used to satisfy short positions, or the anticipated conversion of such notes into shares of our common stock could depress the price of our common stock.

We do not anticipate paying any dividends on our common stock.

We do not anticipate paying any dividends on our common stock for the foreseeable future. Rather, we intend to retain any future earnings for use in the operation and expansion of our business.

General Risk Factors

Unanticipated changes in our tax provisions, the adoption of a new U.S. tax legislation, or exposure to additional income tax liabilities could affect our profitability.

We are subject to income taxes, and are therefore subject to potential tax examinations, in the United States. Tax authorities may disagree with our tax positions and assess additional taxes. We regularly assess the likely outcome of these examinations in order to determine the appropriateness of our tax provision. However, there can be no assurance that we will accurately predict the outcomes of these potential examinations, and the amounts ultimately paid upon resolution of examinations could be materially different from the amount previously included in our income tax expense and therefore, could have a material impact on our tax provision, net income, and cash flows. In addition, our future effective tax rate could be adversely affected by changes to our operating structure, changes in the valuation of deferred tax assets and liabilities, changes in tax laws, and the discovery of new information in the course of our tax return preparation process. In addition, recently announced proposals for new U.S. tax legislation could have a material effect on the results of our operations, if enacted.

We are susceptible to changes in employment laws and regulations or to changes in employment classifications by government agencies.

As we expand our operations, we may become subject to additional federal and state employment laws. Therefore, we may be required to allocate resources, including management’s time, to establishing a policy pursuant to which we evaluate any changes in federal and state laws to ensure our compliance with these requirements. In addition, other factors beyond our control, including increases in minimum wage requirements, overtime pay, healthcare reform, and other laws and regulations affecting employees, independent contractors, and other third-party service providers, could have a material adverse effect on our business, financial condition, and results of operation.

We depend on third-party providers for internet, other communication infrastructures and data management systems upon which our operations critically rely.

We rely on third-party service providers for substantially all of our communication and information technology systems, including for product data management, procurement, inventory management, operations planning and

8

Table of Contents

execution, sales, service, and logistics, financial, tax and regulatory compliance systems. We rely on our third-party service providers to protect our systems and databases against intellectual property theft, data breaches, sabotage and other external or internal cyber-attacks or misappropriation. No assurances can be made that third-party service providers will protect against those and other risks. Any disruption, either temporary or permanent, to our communication and technology systems would likely have a significant adverse material effect on our business, financial condition, and operating results.

Our operations could be adversely affected by events outside of our control, such as natural disasters, wars, or health epidemics.

We may be impacted by natural disasters, wars, health epidemics, or other events outside of our control. If major disasters such as earthquakes, floods, fires, or other events occur, or our information system or communications breaks down or operates improperly, our headquarters and/or exploration operations on our various mining properties may be seriously damaged, or we may have to stop or delay our operations. In addition, the global COVID-19 pandemic has impacted economic markets, manufacturing operations, supply chains, employment and consumer behavior in nearly every geographic region and industry across the world, and we have been, and may in the future be, adversely affected as a result. We may incur expenses or delays relating to such events outside of our control, which could have a material adverse impact on our business, operating results, and financial condition.

ITEM 2.FINANCIAL INFORMATION.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Fiscal Year End

We have included with this offering circular audited financial statements for the fiscal years ended December 31, 2022, and December 31, 2021, and unaudited financial statements for the nine months ended September 30, 2023.

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are forward-looking statements. These forward-looking statements generally are identified by the words believes, project, expects, anticipates, estimates, intends, strategy, plan, may, will, would, will be, will continue, will likely result, and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on our operations and future prospects on a consolidated basis include but are not limited to changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Business Development Plan

Santo Mining Corp, operating under the trade name “SANTO,” is uniquely positioned to capitalize on a myriad of opportunities within the global cannabis industry. As a specialized software development company, our core competencies in Blockchain as a Service (BaaS), Non-Fungible Tokens (NFTs), Decentralized Autonomous Organizations (DAOs), Internet of Things (IoT), and Artificial Intelligence (AI) open the doors to a wealth of prospects in this dynamic sector. Here are key opportunities that stand before us:

Cannabis Industry Growth:

The global cannabis industry is experiencing exponential growth, driven by increasing legalization efforts, changing consumer preferences, and a growing acceptance of the plant’s medicinal and recreational uses. SANTO can continue to ride this wave by providing essential technological infrastructure.

·Compliance and Regulatory Solutions: Evolving regulations are a constant challenge for the cannabis industry. SANTO’s expertise in BaaS and blockchain technology positions us to provide robust compliance

9

Table of Contents

solutions, ensuring cannabis businesses meet the ever-changing regulatory landscape on a global scale.

·Supply Chain Optimization: Our BaaS and blockchain solutions enable end-to-end supply chain traceability. This capability offers cannabis companies the opportunity to enhance transparency, reduce fraud, and ensure product integrity from cultivation to point of sale.

·NFT Applications: NFTs offer numerous opportunities, from verifying product authenticity to creating digital collectibles for cannabis brands. SANTO can lead the way in leveraging NFTs to enhance engagement and brand recognition within the cannabis industry.

·Decentralized Governance: DAOs are gaining traction as a means of decentralized decision-making. SANTO’s proficiency in DAO development positions us to empower cannabis communities and businesses to govern themselves in a transparent and inclusive manner.

·IoT for Sustainable Cultivation: As sustainability becomes a focal point in agriculture, SANTO’s IoT solutions can help cannabis cultivators optimize resource usage, reduce waste, and increase crop yields in environmentally responsible ways.

·Data-Driven Insights: Our AI-driven analytics tools provide a significant opportunity for cannabis businesses to extract valuable insights from their data. This can lead to informed decision-making, process optimization, and enhanced profitability on a global scale.

·International Expansion: The cannabis industry is rapidly expanding beyond borders. SANTO can seize opportunities in emerging cannabis markets by tailoring our solutions to meet region-specific needs and compliance requirements.

·Strategic Partnerships: Collaborations with key players in the cannabis industry can amplify our reach and impact. Partnering with growers, dispensaries, and regulatory bodies can lead to mutually beneficial opportunities for growth and innovation.

·Research and Development: Continued investment in research and development allows SANTO to stay at the forefront of technology in the cannabis sector. New technologies and innovations can open doors to novel opportunities.

In summary, Santo Mining Corp, DBA SANTO, is a pioneering software development company specializing in BaaS, NFTs, DAOs, IoT, and AI solutions for the global cannabis industry. Our unyielding dedication to innovation, industry expertise, and ethical practices underscores our commitment to driving positive change within the international cannabis sector through the transformative power of technology. We are poised to lead the digital transformation of the global cannabis industry, fostering operational efficiency, compliance, and sustainability on a global scale.

Summary of Our Opportunity

Blockchain technology is renowned for its security, transparency, and decentralization, making it an attractive solution for various industries. BaaS solutions would allow organizations to take advantage of these benefits without having to invest time and resources into developing a blockchain solution from scratch.

Utilizing BaaS, organizations can leverage the blockchain technology to improve their existing business processes, such as supply chain management, asset tracking, identity verification, and more. The technology can also be used to develop decentralized applications that can be customized to meet specific business requirements.

One of the key benefits of BaaS is that it enables organizations to reduce the costs associated with developing and maintaining a blockchain solution. BaaS providers handle the infrastructure and technical support, so companies can focus on developing and deploying their solutions quickly.

BaaS solutions are also highly scalable, allowing organizations to expand their blockchain solutions as their needs change. This is particularly useful for companies that are looking to implement blockchain solutions but are unsure of their future growth.

10

Table of Contents

Santo Blockchain Labs can provide Blockchain as a Service (BaaS) for your organizations with a secure, flexible, and scalable solution for utilizing blockchain technology. With BaaS, companies can take advantage of the benefits of blockchain technology without the need for extensive in-house expertise or infrastructure, allowing them to focus on their core business processes.

Staking pools allow coin holders to combine their computational resources as a way to earn rewards. Each pool operator charges a fee for the coin holders to stake in the selected pool. The staking pool model idea is quite similar to the traditional mining pool.

Real Estate Tokenization offers investors access to fractional ownership and a frictionless form of investment. Real Estate Tokenization is the process of converting the value of a real estate property into digital tokens that you can sell to investors to raise funds. NFT unlocks the doors of Real-Estate by enabling it to digitize your lands and the infrastructures virtually.

Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and related notes included elsewhere in this prospectus. Material changes in our Statement of Operations for the nine months ended September 30, 2023, and 2022, and the years ended December 31, 2022 and 2021 are discussed below.

Three Months Ended September 30, 2023, compared to Three Months Ended September 30, 2022

The Company did not generate any revenues for the three months ended September 30, 2023 and 2022.

Total operating expenses for the three months ended September 30, 2023 and September 30, 2022 were $118,630 and $70,350, respectively. Total operating expenses consisted of professional fees of $5,140 and $0, respectively, selling, general and administrative expenses of $58,001 and $62,326, respectively; rent expense of $44,005 and $8,024, respectively and depreciation and amortization of $11,484 and $0, respectively.

Professional fees increased by approximately 100% due to preparing the Company to be full reporting with the Securities and Exchange Commission.

General and administrative expenses decreased by approximately 7% due to the Company implementing cost savings in its general operations.

Rent expenses increased by approximately 448% due to the Company executing new leases.

Depreciation and amortization expenses increased by approximately 100% due to the addition of new depreciable property, plant and equipment.

Other income (expense) for the three months ended September 30, 2023 and 2022 was ($258,549) and ($44,291), respectively. The change in other income (expense) can be attributed to the Company’s increase in interest expense and the ratable changes in derivative liabilities. Other income (expense) consisted of interest expense of ($52,022) and ($44,291), respectively; interest expense related to derivatives of ($71,585) and $0, respectively and change in derivatives of ($134,989) and $0, respectively.

Net loss from operations for the three months ended September 30, 2023 was $377,179 compared to $114,641 for the three months ended September 30, 2022, a change of $262,538 or approximately 229%. The increase in the net loss can primarily be attributed to the Company’s ratable changes in derivatives.

Othe comprehensive income (loss) for the three months ended September 30, 2023 and 2022 was $424 and $0, respectively. The change in other comprehensive income (loss) can be attributed to the Company’s unrealized foreign currency translation income.

Nine Months Ended September 30, 2023, compared to Nine Months Ended September 30, 2022

The Company did not generate any revenues for the nine months ended September 30, 2023 and 2022.

11

Table of Contents

Total operating expenses for the nine months ended September 30, 2023 and September 30, 2022 were $321,904 and $435,836, respectively. Total operating expenses consisted of professional fees of $8,352 and $3,739, respectively, selling, general and administrative expenses of $217,588 and $411,878, respectively; rent expense of $61,512 and $20,219, respectively and depreciation and amortization of $34,452 and $0, respectively.

Professional fees increased by approximately 123% due to preparing the Company to be full reporting with the Securities and Exchange Commission.

General and administrative expenses decreased by approximately 47% due to the Company implementing cost savings in its general operations.

Rent expenses increased by approximately 204% due to the Company executing new leases.

Depreciation and amortization expenses increased by approximately 100% due to the addition of new depreciable property, plant and equipment.

Other income (expense) for the nine months ended September 30, 2023 and 2022 was ($643,521) and $644,710, respectively. The change in other income (expense) can be attributed to the Company’s increase in interest expense, extinguishment of debt, disposal of assets and the ratable changes in derivative liabilities. Other income (expense) consisted of interest expense of ($147,982) and ($128,012), respectively; interest expense related to derivatives of ($226,896) and ($281,194), respectively; loss on disposal of assets of $0 and $(70,000), respectively; gain on extinguishment of debt of $0 and $76,547, respectively and change in derivatives of ($268,716) and $1,047,369, respectively.

Net income (loss) from operations for the nine months ended September 30, 2023 was ($965,425) compared to $208,874 for the nine months ended September 30, 2022, a change of $1,174,299 or approximately 562%. The increase in the net loss can primarily be attributed to the Company’s ratable changes in derivatives.

Othe comprehensive income (loss) for the nine months ended September 30, 2023 and 2022 was $2,341 and $0, respectively. The change in other comprehensive income (loss) can be attributed to the Company’s unrealized foreign currency translation income.

Liquidity and Capital Resources

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern which contemplates, among other things, the realization of assets and satisfaction of liabilities in the ordinary course of business.

As of September 30, 2023, the Company had $44,004 in cash and cash equivalents. The Company did not generate revenues for the nine months ended September 30, 2023 and has relied primarily upon capital generated from public and private offerings of its securities.

The Company sustained a loss of $965,425 for the nine months ended September 30, 2023 and net income of $208,874 for the nine months ended September 30, 2022. The Company has accumulated losses totaling $7,297,254 at September 30, 2023. Because of the absence of positive cash flows from operations, the Company will require additional funding for continuing the development and marketing of products. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We are presently able to meet our obligations as they come due through our borrowing and the support of our shareholders. At September 30, 2023, we had a working capital deficit of $5,155,370. Our working capital deficit is due to the results of operations.

Cash flows

The following table sets forth the primary sources and uses of cash and cash equivalents for the nine months ended September 30, 2023 and 2022 as presented below:

12

Table of Contents

SANTO MINING CORP.

d/b/a SANTO BLOCKCHAIN LABS CORP.

Consolidated Condensed Statements of Cash Flows

|

(Unaudited)

|

|

|

| For the Nine Months Ended

|

|

|

| September 30,

|

|

|

| 2023

|

| 2022

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

| Net income (loss)

| $

| (965,425)

| $

| 208,874

|

| Adjustment to reconcile net loss to net cash provided in operations:

|

|

|

|

|

| Inventory

|

| ----

|

| (49,422)

|

| Change in fair market value of derivatives

|

| 268,716

|

| (1,047,369)

|

| Amortization of debt discount

|

| 226,896

|

| 302,241

|

| Depreciation and amortization

|

| 34,452

|

| ----

|

| Gain on extinguishment of debt

|

| ----

|

| (76,547)

|

| Change in assets and liabilities:

|

|

|

|

|

| Accounts payable and accrued expenses

|

| ----

|

| 75,000

|

| Accrued compensation

|

| 92,355

|

| 57,661

|

| Accrued interest

|

| 147,982

|

| 99,278

|

| Net Cash (used in) provided by operating activities

|

| (195,024)

|

| (430,284)

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

| Loss on extinguishment of intangible asset

|

| ----

|

| 70,000

|

| Sale (purchase) of digital assets

|

| ----

|

| 229,766

|

| Net Cash Used in investing activates

|

| ----

|

| 299,766

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

| Proceeds (payments) notes payable, related party

|

| 4,845

|

| (30,340)

|

| Proceeds (payments) convertible notes payable

|

| 205,000

|

| 150,000

|

| Stock issued to reduce debt

|

| ----

|

| 7,687

|

| Net Cash provided by financing activates

|

| 209,845

|

| 127,347

|

|

|

|

|

|

|

Foreign currency translation

|

| 2,341

|

| ----

|

|

|

|

|

|

|

Net change in cash and cash equivalents

|

| 17,162

|

| (3,171)

|

| Cash and cash equivalents Beginning of period

|

| 26,842

|

| 10,150

|

| Cash and cash equivalents End of period

| $

| 44,004

| $

| 6,979

|

Supplemental cash flow information

|

|

|

|

|

| Cash paid for interest

| $

| ----

| $

| ----

|

| Cash paid for taxes

| $

| ----

| $

| ----

|

Non-cash transactions

|

|

|

|

|

| Original discount recorded on the recognition of notes with derivative liability

| $

| 205,000

| $

| ----

|

Net cash used in operating activities for the nine months ended September 30, 2023 and 2022 were ($195,024) and ($430,284), respectively. The primary difference was due to the derivatives associated with convertible notes payable.

Net cash used in investing activities for the nine months ended September 30, 2023, and September 30, 2022, were $0 and $299,766, respectively.

Net cash provided by financing activities for the nine months ended September 30, 2023, and September 30, 2022, were $209,845 and $127,347, respectively.

We anticipate that our future liquidity requirements will arise from the need to fund our growth from operations, pay current obligations and future capital expenditures. The primary sources of funding for such requirements are expected to be cash generated from operations and raising additional funds from the private sources and/or debt financing. However, we can provide no assurances that we will be able to generate sufficient cash flow from operations and/or obtain additional financing on terms satisfactory to us, if at all, to remain a going concern. Our continuation as a going concern is dependent upon our ability to generate sufficient cash flow to meet our obligations on a timely basis and ultimately to attain profitability. Our Plan of Operation for the next twelve months is to raise capital to implement our strategy. We do not have the necessary cash and revenue to satisfy our cash requirements for the next twelve months. We cannot guarantee that additional funding will be available on favorable terms, if at all. If adequate funds are not available, then we may not be able to expand our operations. If adequate funds are not available, we believe that our

13

Table of Contents

officers and directors will contribute funds to pay for some of our expenses. However, we have not made any arrangements or agreements with our officers and directors regarding such advancement of funds. We do not know whether we will issue stock for the loans or whether we will merely prepare and sign promissory notes. If we are forced to seek funds from our officers or directors, we will negotiate the specific terms and conditions of such loan when made, if ever. Although we are not presently engaged in any capital raising activities, we anticipate that we may engage in one or more private offering of our company’s securities. We would most likely rely upon the transaction exemptions from registration provided by Regulation A, or conduct another private offering under Section 4(2) of the Securities Act of 1933. See “Note 2 - Going Concern” in our financial statements for additional information as to the possibility that we may not be able to continue as a “going concern.”

We are not aware of any trends or known demands, commitments, events or uncertainties that will result in or that are reasonably likely to result in material increases or decreases in liquidity.

Capital Resources

We had no material commitments for capital expenditures as of September 30, 2023.

Off Balance Sheet Arrangements

We have made no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Critical Accounting Policies & Use of Estimates

Management’s Discussion and Analysis of Financial Condition and Results of Operations is based upon our financial statements, which have been prepared in accordance with GAAP. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. In consultation with the Company’s Board of Directors, management has identified in the accompanying financial statements the accounting policies that it believes are key to an understanding of its financial statements. These are important accounting policies that require management’s most difficult, subjective judgments. See “Note 2 - Summary of Significant Accounting Policies” in our financial statements for additional information.

Year Ended December 31, 2022, compared to Year Ended December 31, 2021

Total revenues for the years ended December 31, 2022 and 2021 were $0 and $127,725, respectively. Revenues decreased by approximately 100% due to the Company change in operations.

Total operating expenses for the years ended December 31, 2022 and December 31, 2021 were $569,496 and $908,212, respectively. Total operating expenses consisted of professional fees of $4,664 and $195,032, respectively, selling, general and administrative expenses of $496,347 and $557,556, respectively; rent expense of $28,292 and $34,500, respectively and depreciation and amortization of $40,193 and $121,124.

Professional fees decreased by approximately 98% due to the process and the reduced cost associated with reporting on the OTC Markets.

General and administrative expenses decreased by approximately 11% due to the Company implementing cost savings in its general operations.

Rent expense decreased by approximately 18% due to the Company negotiating more favorable terms.

Depreciation and amortization expenses decreased by approximately 67% due to the Company fully depreciating and disposing of certain assets during the year ending December 31, 2021.

Other income (expense) for the years ended December 31, 2022 and 2021 was $550,002 and $336,068, respectively. The change in other income (expense) can be attributed to the Company’s increase in interest expense and the ratable changes in derivative liabilities. Other income (expense) consisted of interest expense of ($173,575) and ($189,271), respectively; interest expense related to derivatives of ($385,799) and ($969,028), respectively; loss on disposal of

14

Table of Contents

assets of $0 and ($14,063), respectively; realized gain on sale of crypto of $3,936 and $130,777, respectively; gain on extinguishment of debt of $76,547 and $911,660, respectively; loss on disposal of intangible asset of ($70,000) and $0, respectively and change in derivatives of $1,098,893 and $465,993, respectively.

Net loss from operations for the year ended December 31, 2022 was $19,494 compared to $444,419 for the year ended December 31, 2021, a change of $424,925 or approximately 96%. The decrease in the net loss can primarily be attributed to the Company’s ratable changes in derivatives.

Liquidity and Capital Resources

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern which contemplates, among other things, the realization of assets and satisfaction of liabilities in the ordinary course of business.

As of December 31, 2022, the Company had $26,842 in cash and cash equivalents. The Company did not generate revenues for the year ended December 31, 2022 and has relied primarily upon capital generated from public and private offerings of its securities.

The Company sustained a loss of $19,494 for the year ended December 31, 2022 and $444,419 for the year ended December 31, 2021. The Company has accumulated losses totaling $6,331,829 at December 31, 2022. Because of the absence of positive cash flows from operations, the Company will require additional funding for continuing the development and marketing of products. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We are presently able to meet our obligations as they come due through our borrowing and the support of our shareholders. At December 31, 2022, we had a working capital deficit of $4,155,861. Our working capital deficit is due to the results of operations.

Cash flows

The following table sets forth the primary sources and uses of cash and cash equivalents for the years ended December 31, 2022 and 2021 as presented below:

SANTO MINING CORP.

d/b/a SANTO BLOCKCHAIN LABS CORP.

Consolidated Statements of Cash Flows

|

|

|

|

| For the Years Ended

|

|

|

| December 31,

|

|

|

| 2022

|

| 2021

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

| Net income (loss)

| $

| (19,494)

| $

| (444,419)

|

| Adjustment to reconcile net loss to net cash provided in operations:

|

|

|

|

|

| Change in fair market value of derivatives

|

| (1,098,893)

|

| (465,993)

|

| Amortization of debt discount

|

| 385,799

|

| 969,028

|

| Depreciation and amortization

|

| 40,193

|

| 32,923

|

| Gain on extinguishment of debt

|

| (76,547)

|

| (911,660)

|

| Digital asset impairment losses

|

| 70,000

|

| 88,201

|

| Stock issued for services

|

| ----

|

| 350,000

|

| Change in assets and liabilities:

|

|

|

|

|

| Accounts payable and accrued expenses

|

| 75,002

|

| ----

|

| Accrued compensation

|

| 90,281

|

| (585,236)

|

| Accrued interest

|

| 118,908

|

| (160,404)

|

| Deposits

|

| ----

|

| 4,200

|

| Net Cash (used in) provided by operating activities

|

| (414,751)

|

| (1,123,360)

|

15

Table of Contents

SANTO MINING CORP.

d/b/a SANTO BLOCKCHAIN LABS CORP.

Consolidated Statements of Cash Flows

(continued)

|

|

|

|

| For the Years Ended

|

|

|

| December 31,

|

|

|

| 2022

|

| 2021

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

| Sale (purchase) of digital assets

|

| 242,576

|

| (330,777)

|

| Property, plant and equipment, net

|

| (46,163)

|

| (119,342)

|

| Net Cash Used in investing activates

|

| 196,413

|

| (450,119)

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

| Proceeds (payments) notes payable, related party

|

| (21,687)

|

| 64,600

|

| Proceeds (payments) convertible notes payable

|

| 283,299

|

| 696,370

|

| Stock issued to reduce debt

|

| (66,496)

|

| 293,503

|

| Paid-in capital adjusted for derivative liability

|

| 39,914

|

| 528,801

|

| Net Cash provided by financing activates

|

| 235,030

|

| 1,583,274

|

Net change in cash and cash equivalents

|

| 16,692

|

| 9,795

|

| Cash and cash equivalents Beginning of period

|

| 10,150

|

| 355

|

| Cash and cash equivalents End of period

| $

| 26,842

| $

| 10,150

|

Net cash used in operating activities for the years ended December 31, 2022 and 2021 were ($414,751) and ($1,123,360), respectively. The primary difference was due to the derivatives associated with convertible notes payable.

Net cash used in investing activities for the years ended December 31, 2022, and December 31, 2021, were $196,413 and ($450,119), respectively.

Net cash provided by financing activities for the years ended December 31, 2022, and December 31, 2021, were $235,030 and $1,583,274, respectively.

We anticipate that our future liquidity requirements will arise from the need to fund our growth from operations, pay current obligations and future capital expenditures. The primary sources of funding for such requirements are expected to be cash generated from operations and raising additional funds from the private sources and/or debt financing. However, we can provide no assurances that we will be able to generate sufficient cash flow from operations and/or obtain additional financing on terms satisfactory to us, if at all, to remain a going concern. Our continuation as a going concern is dependent upon our ability to generate sufficient cash flow to meet our obligations on a timely basis and ultimately to attain profitability. Our Plan of Operation for the next twelve months is to raise capital to implement our strategy. We do not have the necessary cash and revenue to satisfy our cash requirements for the next twelve months. We cannot guarantee that additional funding will be available on favorable terms, if at all. If adequate funds are not available, then we may not be able to expand our operations. If adequate funds are not available, we believe that our officers and directors will contribute funds to pay for some of our expenses. However, we have not made any arrangements or agreements with our officers and directors regarding such advancement of funds. We do not know whether we will issue stock for the loans or whether we will merely prepare and sign promissory notes. If we are forced to seek funds from our officers or directors, we will negotiate the specific terms and conditions of such loan when made, if ever. Although we are not presently engaged in any capital raising activities, we anticipate that we may engage in one or more private offering of our company’s securities. We would most likely rely upon the transaction exemptions from registration provided by Regulation A, or conduct another private offering under Section 4(2) of the Securities Act of 1933. See “Note 2 - Going Concern” in our financial statements for additional information as to the possibility that we may not be able to continue as a “going concern.”

We are not aware of any trends or known demands, commitments, events or uncertainties that will result in or that are reasonably likely to result in material increases or decreases in liquidity.

Capital Resources

We had no material commitments for capital expenditures as of December 31, 2022.

16

Table of Contents

Off Balance Sheet Arrangements

We have made no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Critical Accounting Policies & Use of Estimates

Management’s Discussion and Analysis of Financial Condition and Results of Operations is based upon our financial statements, which have been prepared in accordance with GAAP. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. In consultation with the Company’s Board of Directors, management has identified in the accompanying financial statements the accounting policies that it believes are key to an understanding of its financial statements. These are important accounting policies that require management’s most difficult, subjective judgments. See “Note 2 - Summary of Significant Accounting Policies” in our financial statements for additional information.

Additional Company Matters

The Company has not filed for bankruptcy protection.

We may from time to time be involved in various claims and legal proceedings of a nature we believe are normal and incidental to our business. Should such litigation ever ensue, it may have an adverse impact on the Company because of defense and settlement costs, diversion of management resources, and other factors.

We are not presently a party to any legal proceedings.

Subsequent Material Events

The Company evaluated subsequent events that have occurred after the balance sheet date of September 30, 2023, and up through the date of this Registration Statement. There are two types of subsequent events: (i) recognized, or those that provide additional evidence with respect to conditions that existed at the date of the balance sheet, including the estimates inherent in the process of preparing financial statements, and (ii) non-recognized, or those that provide evidence with respect to conditions that did not exist at the date of the balance sheet but arose subsequent to that date. The Company has determined that there are no additional events that would require adjustment to or disclosure in the attached financial statements.

ITEM 3.PROPERTIES.

Principal Executive Office

Our principal executive office is located at Cl. 7 #37-50, El Poblado Torre1 Unit 1016 Medellin 050021 Colombia. This property is leased by management and to the Company. We believe these facilities are adequate for our current needs, and that alternate facilities on similar terms would be readily available, if needed. The principal executive offices lease is due on March 31, 2024.

Operating Subsidiary Properties

NONE

ITEM 4.SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The following table sets forth information regarding beneficial ownership of our Stock as of the date of this filing.

Beneficial ownership and percentage ownership are determined in accordance with the rules of the Securities and Exchange Commission and include voting or investment power with respect to Shares of stock. This information does not necessarily indicate beneficial ownership for any other purpose.

17

Table of Contents

Unless otherwise indicated and subject to applicable community property laws, to our knowledge, each Shareholder named in the following table possesses sole voting and investment power over their Shares of Stock. Percentage of beneficial ownership before the offering is based on 18,436,585,961 Shares of Common Stock outstanding and 500,000,000 shares of Series A Preferred Stock as of the date of this filing.

Name & Address

| Position

| Number of

Shares

| Share

Type

| Percent

| Name of

Control Person

|

Franjose Yglesias CEO/Secretary

| Controlling Shareholder

| 150,000,000

| Preferred A

| 30%

| Frank Yglesias

|

Marc Williams

COO/Chairman

| Controlling Shareholder

| 150,000,000

| Preferred A

| 30%

| Marc Williams

|

Kevin Jodrey

CCO/Board Member

| Controlling Shareholder

| 50,000,000

| Preferred A

| 10%

| Kevin Jodrey

|

* The mailing address for these individuals/entities is: c/o Cl. 7 #37-50, El Poblado, Torre 1 Unit 1016, Medellín 050021, Colombia.

ITEM 5.DIRECTORS AND EXECUTIVE OFFICERS.

The following table sets forth information regarding our executive officers, directors and significant employees, including their ages as of the date of this Offering Circular:

Name

|

| Position

|

| Age

|

| Director or Officer Since

|

Frank Yglesias

|

| CEO, Secretary

|

| 60

|

| April 10, 2015

|

Marc Williams

|

| COO/Chairman

|

| 55

|

| Oct 1, 2023

|

Kevin Jodrey

|

| CCO/Board Member

|

| 58

|

| Oct 1, 2023

|

Franjose “Frank” Yglesias, CEO, Secretary.

Mr. Yglesias (60) has been the CEO and director of three publicly traded companies in the OTC Markets in America over the last 18 years. Mr. Yglesias currently lives in Medellin Colombia spending the last 5 years in Saigon, Vietnam and has lived in China for over ten years.