Groupama AM Expands Use of Virtu’s Triton Valor EMS to Trade Fixed Income

October 02 2023 - 1:00AM

Virtu Financial, Inc. (NASDAQ: VIRT), a leading provider of global,

multi-asset financial services that delivers liquidity and

innovative, transparent products across the complete investment

cycle to the global markets, is pleased to announce that Groupama

Asset Management, the asset manager arm of the large French

insurance and financial services firm, has expanded its use of

Virtu’s award-winning Triton Valor EMS to trade fixed income.

“The increased electronification of fixed income

trading over the last few years has changed our workflow–away from

chat and telephone–and we needed a more centralised approach to our

execution management across this asset class,” says Eric Heleine,

Head of Trading at Groupama AM. “Virtu’s Triton Valor EMS provides

us with a single view that brings together all our workflows

including electronic RFQs, automated execution, and negotiated

trading and provides us with tools to aggregate real-time feeds,

liquidity sources and valuable pre-trade analytics to make trading

decisions faster and with confidence. It’s the key to success if we

want to enhance the FICC market structure which has largely stayed

the same for the last 50 years.”

“Based on client feedback, we designed Triton

Valor’s fixed income capabilities to empower traders with pre-trade

transparency, operational efficiency, and control in navigating the

market. These capabilities enable clients to assess individual and

aggregate trade difficulty and find liquidity in a simpler and more

cohesive manner–that’s where we see a key added value for a fixed

income EMS. Our fixed income solution is differentiated by the

close integration of Triton Valor’s EMS capabilities with Virtu’s

advanced trading analytics–both pre-trade, post-trade, and

real-time data handling. Data and analytics are key in electronic

trading and especially in fixed income given the fragmented market

structure and complexity of OTC data collection,” said Melissa

Ellis, Head of Workflow Technology in Europe. “The addition of

fixed income trading and analytics to Triton Valor is a major

milestone for our clients and underlines our commitment to

providing a full multi-asset class trading and analytics

solution.”

About Triton Valor EMSTriton is a

sophisticated multi-asset class execution management system used by

approximately 300 global asset managers, supporting trading in

fixed income securities, equities, listed derivatives, and foreign

exchange. Triton Valor enables fixed income traders to enhance

their trading workflow with tools such as routing and execution

automation, market data integration and normalisation, pre-trade

and post-trade analytics, real-time data handling, and seamless

connectivity to venues, that are well established in other asset

classes and are becoming critical components of fixed income

trading.

Triton Valor supports trading in a variety of FI

instruments–global corporate and sovereign bonds, EM debt, Munis,

MBSs, CMOs, FI ETFs and futures–enabling traders to decide how,

when, and where to trade. Closely integrated with Virtu’s advanced

fixed income analytics, it provides clients with a single dashboard

to interrogate data and make trading decisions in a consistent way

across all their asset classes. Virtu does all the heavy lifting,

giving the client a flexible, scalable system with the latest

technology to ensure they can take advantage of opportunities in

the market.

About Virtu Financial, Inc.Virtu

is a leading financial services firm that leverages cutting-edge

technology to provide execution services and data, analytics and

connectivity products to its clients and deliver liquidity to the

global markets. Leveraging its global market making expertise and

infrastructure, Virtu provides a robust product suite including

offerings in execution, liquidity sourcing, analytics and

broker-neutral, multi-dealer platforms in workflow technology.

Virtu’s product offerings allow clients to trade on hundreds of

venues across 50+ countries and in multiple asset classes,

including global equities, ETFs, foreign exchange, futures, fixed

income and myriad other commodities. In addition, Virtu’s

integrated, multi-asset analytics platform provides a range of pre-

and post-trade services, data products and compliance tools that

clients rely upon to invest, trade and manage risk across global

markets.

Media & Investor

RelationsAndrew

Smithmedia@virtu.cominvestor_relations@virtu.com

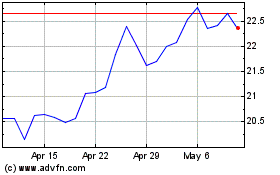

Virtu Financial (NASDAQ:VIRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

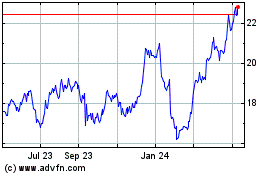

Virtu Financial (NASDAQ:VIRT)

Historical Stock Chart

From Apr 2023 to Apr 2024