Whole Earth Brands, Inc. (the “Company” or “we” or “our”) (Nasdaq:

FREE), a global food company enabling healthier lifestyles through

premium plant-based sweeteners, flavor enhancers and other foods,

today announced its financial results for its second quarter ended

June 30, 2023.

Second Quarter 2023

Highlights

-

Reported consolidated revenue of $132.9 million, a decrease of 0.5%

on a reported basis and essentially flat compared to the prior year

period on a constant currency basis.

-

Branded CPG revenue declined 1.7% on a reported basis and 1.2% on a

constant currency basis as compared to 2022 as strong pricing

growth was more than offset by volume declines; excluding the

planned strategic decrease in Wholesome bulk sugar sales, which

accounted for a 4.0% revenue decline, segment constant currency

revenue increased 2.8%.

-

Flavors & Ingredients revenue grew 4.0% compared to the prior

year period, to a record $30.6 million, driven by strong pricing

contributing to increased profitability of this segment.

-

Operating income of $3.0 million and Adjusted EBITDA of $18.2

million.

| |

|

Second Quarter Net Product Revenue Growth

Overview |

|

|

|

Reported |

|

Foreign Currency Exchange |

|

Constant Currency |

|

Branded CPG |

|

(1.7)% |

|

(0.5)% |

|

(1.2)% |

| Flavors &

Ingredients |

4.0% |

|

(0.1)% |

|

4.0% |

| Total |

|

(0.5)% |

|

(0.4)% |

|

(0.1)% |

| |

|

|

|

|

|

|

“We continued to demonstrate meaningful progress

with our margin improvement initiatives in the second quarter along

with a top-line performance that was consistent with the prior year

on a constant currency basis and ahead of the prior year when

taking into account our strategic decision to decrease Wholesome

bulk sugar sales,” stated Irwin D. Simon, Executive Chairman. “The

entire global team remains laser focused on stabilizing,

streamlining, and evolving our operations to drive enhanced

productivity and sustainable margin improvement. Our

supply chain reinvention is on track and will play a critical role

in rightsizing our cost base, freeing up additional dollars for

growth investments in support of our diverse portfolio of global

brands.”

Mr. Simon continued, “We are pleased with the

recent organizational changes implemented in April within our

Branded CPG business. Both Rajnish and Nigel have already made an

impact and have carried forward our efforts to streamline our

operations as a means to reinvigorate global growth and enhance our

margin profile. We are fortunate to have an excellent group of

leaders across both our operating segments and I look forward to

working alongside Rajnish Ohri and Jeff Robinson, who were

appointed Interim co-CEOs in mid-July. Both are highly capable

executives and will be invaluable to ensuring continuity in the

near-term as the Special Committee of the Board evaluates the

non-binding proposal from Sababa Holdings FREE, LLC and other

potential strategic alternatives that are focused on delivering

value to shareholders.”

Jeff Robinson, Interim Co-CEO, commented, “Our

Flavors & Ingredients business is a strong free cash flow

generator with high barriers to entry and a global leadership

position. The business continues to perform well and in the second

quarter we achieved our highest quarterly sales since becoming a

public company. Our commercial initiatives are generating strong

growth and coupled with our improved cost structure, we are

delivering consistently high operating margins and resultant cash

flow.”

Rajnish Ohri, Interim Co-CEO, stated, “Our

Branded CPG portfolio is well-positioned in the current environment

with a diverse assortment of strong brands and complementary

private label offerings. Additionally, our brands are performing

well internationally, gaining market share across all key

international regions. In North America, we have made important

progress on streamlining our organization and manufacturing

footprint. We are working relentlessly towards developing new

opportunities to support the momentum of our brands and drive

long-term profitable growth.”

SECOND QUARTER 2023 RESULTS

-

Consolidated product revenues were $132.9 million, a decrease of

0.5% on a reported basis and essentially flat on a constant

currency basis, as compared to the prior year second quarter. A

stronger US dollar reduced reported consolidated product revenues

by approximately $0.5 million, or 0.4%, versus the prior year

quarter.

-

Reported gross profit was $33.4 million, compared to $37.3 million

in the prior year second quarter. The decrease was largely driven

by cost inflation, partially offset by pricing actions.

Additionally, the prior year period included $0.9 million of

favorable non-cash purchase accounting adjustments related to

inventory revaluations that did not re-occur. Adjusted gross profit

was $40.4 million, compared to $42.6 million in the prior year

second quarter.

-

Reported gross profit margin was 25.1% in the second quarter of

2023, compared to 27.9% in the prior year period. Adjusted gross

profit margin was 30.4%, compared to 31.9% in the prior year second

quarter. Adjusted gross profit margin has improved approximately

150 basis points as compared to the fourth quarter of 2022.

-

Consolidated operating income was $3.0 million compared to

operating income of $7.7 million in the prior year second quarter

primarily due to cost inflation and increased severance costs.

-

Consolidated net loss was $5.5 million in the second quarter of

2023 compared to net income of $1.3 million in the prior year

period due to the decline in operating income as well as increased

interest expense.

-

Consolidated Adjusted EBITDA was $18.2 million compared to $19.7

million in the prior year quarter, declining 7.6% driven by cost

inflation exceeding pricing gains.

SEGMENT RESULTS

Branded CPG SegmentBranded CPG

segment product revenues were $102.3 million for the second quarter

of 2023, compared to $104.1 million for the same period in the

prior year, a decrease of $1.8 million, or 1.7%. On a

constant currency basis, segment product revenues were down 1.2%

compared to the prior year as 4.8% growth from pricing actions was

more than offset by a 6% decline due to lower volumes. The decline

from volumes was largely driven by the planned strategic decision

to manage Wholesome bulk sugar sales to avoid incremental tariffs.

Excluding the decrease in Wholesome bulk sugar sales, segment

constant currency revenue increased 2.8%.

Operating income was $1.5 million in the second

quarter of 2023 compared to operating income of $5.6 million for

the same period in the prior year. The decrease in operating income

was primarily due to cost inflation, as well as other discrete

costs such as higher severance expense and an impairment of fixed

assets of $0.8 million related to idled production lines at our

Decatur, Alabama facility.

Flavors & Ingredients

SegmentFlavors & Ingredients segment product revenues

increased 4.0% to $30.6 million for the second quarter of 2023,

compared to $29.4 million for the same period in the prior year.

The impact of foreign currency exchange was insignificant.

Operating income of $9.0 million in the second

quarter of 2023 was essentially flat with that of the prior year

period.

CorporateCorporate expenses for

the second quarter of 2023 were $7.4 million, compared to $6.9

million of expenses in the prior year period. The increase is

primarily attributed to severance related costs.

YEAR-TO-DATE 2023

HIGHLIGHTS

-

Consolidated product revenues were $265.3 million, an increase of

0.5% on a reported basis, as compared to the six months ended June

30, 2022. On a constant currency basis, product revenues increased

1.4% compared to the prior year period.

-

Consolidated operating income was $6.1 million compared to $14.8

million in the prior year period.

-

Consolidated Adjusted EBITDA decreased $2.7 million, or 7.2%, to

$34.8 million.

BALANCE SHEET

As of June 30, 2023, the Company had cash and

cash equivalents of $24.1 million and $427.0 million of long-term

debt, net of unamortized debt issuance costs. At June 30, 2023,

there was $72 million drawn on its $125 million revolving credit

facility.

Cash provided by operating activities was $4.9

million for the six months ended June 30, 2023. Free cash flow,

defined as operating cash flow minus capital expenditures, was $2.2

million for the first half of 2023.

During the second quarter of 2023, the Company

entered into an interest rate swap agreement to manage exposure to

interest rate risk related to the variable portion of its term loan

facility. The agreement converts the variable interest rate on

$183.3 million of the term loan (approximately 50% of the notional

amount of the facility) to a rate of 4.265% through February 2026.

The Company expects to realize approximately $1 million of interest

savings in the second half of 2023.

OUTLOOK

The Company is reaffirming its outlook for the

full year 2023. The Company’s 2023 outlook is as follows:

-

Net Product Revenues: $550 million to $565 million representing

reported growth of 2% to 5%

-

Adjusted EBITDA: $76 million to $78 million

-

Capital Expenditures: Approximately $9 million

The outlook is provided in the context of

greater than usual volatility as a result of current geo-political

events, the current inflationary environment and foreign currency

exchange rate fluctuations.

CONFERENCE CALL DETAILS

The Company will host a conference call and

webcast to review its second quarter results today, August 9, 2023,

at 8:30 am ET. The conference call can be accessed live over the

phone by dialing (877) 704-4453 or for international callers by

dialing (201) 389-0920. A replay of the call will be available

until August 23, 2023, by dialing (844) 512-2921 or for

international callers by dialing (412) 317-6671; the passcode is

13740110.

The live audio webcast of the conference call

will be accessible in the News & Events section on the

Company's Investor Relations website at

investor.wholeearthbrands.com. An archived replay of the webcast

will also be available shortly after the live event has

concluded.

About Whole Earth Brands

Whole Earth Brands is a global food company

enabling healthier lifestyles and providing access to high quality

plant-based sweeteners, flavor enhancers and other foods through

our diverse portfolio of trusted brands and delicious products,

including Whole Earth®, Pure Via®, Wholesome®, Swerve®, Canderel®

and Equal®. With food playing a central role in people’s health and

wellness, Whole Earth Brands’ innovative product pipeline addresses

the growing consumer demand for more dietary options, baking

ingredients and taste profiles. Our world-class global distribution

network is the largest provider of plant-based sweeteners in more

than 100 countries with a vision to expand our portfolio to

responsibly meet local preferences. We are committed to helping

people enjoy life’s everyday moments and the celebrations that

bring us together. For more information on how we “Open a World of

Goodness®,” please visit www.WholeEarthBrands.com.

Forward-Looking Statements

This press release contains forward-looking

statements (including within the meaning of the Private Securities

Litigation Reform Act of 1995) concerning Whole Earth Brands, Inc.

and other matters. These statements may discuss goals, intentions

and expectations as to future plans, trends, events, results of

operations or financial condition, or otherwise, based on current

beliefs of management, as well as assumptions made by, and

information currently available to, management.

Forward-looking statements may be accompanied by

words such as “achieve,” “aim,” “anticipate,” “believe,” “can,”

“continue,” “could,” “drive,” “estimate,” “expect,” “forecast,”

“future,” “guidance,” “grow,” “improve,” “increase,” “intend,”

“may,” “outlook,” “plan,” “possible,” “potential,” “predict,”

“project,” “should,” “target,” “will,” “would,” or similar words,

phrases or expressions. Examples of forward-looking statements

include, but are not limited to, the statements made by Messrs.

Simon, Robinson and Ohri , and our 2023 outlook. Factors that could

cause actual results to differ materially from those in the

forward-looking statements include, but are not limited to, the

ongoing conflict in Ukraine and related economic disruptions and

new governmental regulations on our business, including but not

limited to the potential impact on our sales, operations and supply

chain; adverse changes in the global or regional general business,

political and economic conditions, including the impact of

continuing uncertainty and instability in certain countries, that

could affect our global markets and the potential adverse economic

impact and related uncertainty caused by these items; the extent of

the continued impact of the COVID-19 pandemic, and any recurrence

of the COVID-19 pandemic, local, regional, national, and

international economic conditions that have deteriorated as a

result of the COVID-19 pandemic, including the risks of a global

recession or a recession in one or more of the Company’s key

markets, and the impact they may have on the Company and its

customers and management’s assessment of that impact; extensive and

evolving government regulations that impact the way the Company

operates; the impact of the COVID-19 pandemic on the Company’s

suppliers, including disruptions and inefficiencies in the supply

chain; and the Company’s ability to offset rising costs through

pricing and productivity effectively.

These forward-looking statements are subject to

risks, uncertainties and other factors, many of which are outside

of the Company’s control, which could cause actual results to

differ materially from the results contemplated by the

forward-looking statements. These statements are subject to the

risks and uncertainties indicated from time to time in the

documents the Company files (or furnishes) with the U.S. Securities

and Exchange Commission.

You are cautioned not to place undue reliance

upon any forward-looking statements, which are based only on

information currently available to the Company and speak only as of

the date made. The Company undertakes no commitment to publicly

update or revise the forward-looking statements, whether written or

oral that may be made from time to time, whether as a result of new

information, future events or otherwise, except as required by

law.

Contacts:

Investor Relations Contact:Whole Earth

Brands312-840-5001investor@wholeearthbrands.com

ICRJeff

Sonnek646-277-1263jeff.sonnek@icrinc.com

Whole Earth Brands, Inc.

Reconciliation of GAAP and Non-GAAP Financial

Measures (Unaudited)

The Company reports its financial results in

accordance with accounting principles generally accepted in the

United States (“GAAP”). However, management believes that also

presenting certain non-GAAP financial measures provides additional

information to facilitate the comparison of the Company’s

historical operating results and trends in its underlying operating

results, and provides additional transparency on how the Company

evaluates its business. Management uses these non-GAAP financial

measures in making financial, operating and planning decisions and

in evaluating the Company’s performance. The Company also believes

that presenting these measures allows investors to view its

performance using the same measures that the Company uses in

evaluating its financial and business performance and trends. The

Company considers quantitative and qualitative factors in assessing

whether to adjust for the impact of items that may be significant

or that could affect an understanding of its ongoing financial and

business performance and trends. The adjustments generally fall

within the following categories: constant currency adjustments,

intangible asset non-cash impairments, purchase accounting charges,

transaction-related costs, long-term incentive expense, non-cash

pension expenses, severance and related expenses associated with

productivity initiatives, public company readiness, M&A

transaction expenses, supply chain reinvention costs and other

one-time items affecting comparability of operating results. See

below for a description of adjustments to the Company’s U.S. GAAP

financial measures included herein. Non-GAAP information should be

considered as supplemental in nature and is not meant to be

considered in isolation or as a substitute for the related

financial information prepared in accordance with U.S. GAAP. In

addition, the Company’s non-GAAP financial measures may not be the

same as or comparable to similar non-GAAP measures presented by

other companies.

DEFINITIONS OF THE COMPANY’S NON-GAAP

FINANCIAL MEASURES

The Company’s non-GAAP financial measures and

corresponding metrics reflect how the Company evaluates its

operating results currently and provide improved comparability of

operating results. As new events or circumstances arise, these

definitions could change. When these definitions change, the

Company provides the updated definitions and presents the related

non-GAAP historical results on a comparable basis. When items no

longer impact the Company’s current or future presentation of

non-GAAP operating results, the Company removes these items from

its non-GAAP definitions.

The following is a list of non-GAAP financial

measures which the Company has discussed or expects to discuss in

the future:

- Constant

Currency Presentation: We evaluate our product revenue results on

both a reported and a constant currency basis. The constant

currency presentation, which is a non-GAAP measure, excludes the

impact of fluctuations in foreign currency exchange rates. We

believe providing constant currency information provides valuable

supplemental information regarding our product revenue results,

thereby facilitating period-to-period comparisons of our business

performance and is consistent with how management evaluates the

Company’s performance. We calculate constant currency percentages

by converting our current period local currency product revenue

results using the prior period exchange rates and comparing these

adjusted amounts to our prior period reported product

revenues.

- Adjusted EBITDA:

We define Adjusted EBITDA as net income or loss from our

consolidated statements of operations before interest income and

expense, income taxes, depreciation and amortization, as well as

certain other items that arise outside of the ordinary course of

our continuing operations specifically described below:

- Asset impairment

charges: We exclude the impact of charges related to the impairment

of goodwill and other long-lived intangible assets. We believe that

the exclusion of these impairments, which are non-cash, allows for

more meaningful comparisons of operating results to peer companies.

We believe that this increases period-to-period comparability and

is useful to evaluate the performance of the company.

- Purchase

accounting adjustments: We exclude the impact of purchase

accounting adjustments, including the revaluation of inventory at

the time of the business combination. These adjustments are

non-cash and we believe that the adjustments of these items allows

for more meaningful comparability of our operating results.

- Long-term

incentive plan: We exclude the impact of costs relating to the

long-term incentive plan. We believe that the adjustments of these

items allows for more meaningful comparability of our operating

results.

- Non-cash pension

expenses: We exclude non-cash pension expenses/credits related to

closed, defined pension programs of the Company. We believe that

the adjustments of these items allows for more meaningful

comparability of our operating results.

- Severance and

related expenses: We exclude employee severance and associated

expenses related to roles that have been eliminated or reduced in

scope as a productivity measure taken by the Company. We believe

that the adjustments of these items allows for more meaningful

comparability of our operating results.

- M&A

transaction expenses: We exclude expenses directly related to the

acquisition of businesses. We believe that the adjustments of these

items allows for more meaningful comparability of our operating

results.

- Supply chain

reinvention: To measure operating performance, we exclude certain

one-time and other costs associated with reorganizing our North

America Branded CPG operations and facilities in connection with

our supply chain reinvention program, which will drive long-term

productivity and cost savings. These costs include incremental

expenses such as hiring, training, start up and other temporary

costs. We believe that the adjustments of these items allows for

more meaningful comparability of our operating results.

- Other items: To

measure operating performance, we exclude certain expenses and

include certain gains that we believe are not operational in

nature. We believe the exclusion or inclusion of such amounts

allows management and the users of the financial statements to

better understand our financial results.

Adjusted EBITDA is not a presentation made in

accordance with GAAP, and our use of the term Adjusted EBITDA may

vary from the use of similarly-titled measures by others in our

industry due to the potential inconsistencies in the method of

calculation and differences due to items subject to interpretation.

Adjusted EBITDA margin is Adjusted EBITDA for a particular period

expressed as a percentage of product revenues for that period.

We use Adjusted EBITDA to measure our

performance from period to period both at the consolidated level as

well as within our operating segments, to evaluate and fund

incentive compensation programs and to compare our results to those

of our competitors. In addition to Adjusted EBITDA being a

significant measure of performance for management purposes, we also

believe that this presentation provides useful information to

investors regarding financial and business trends related to our

results of operations and that when non-GAAP financial information

is viewed with GAAP financial information, investors are provided

with a more meaningful understanding of our ongoing operating

performance.

Adjusted EBITDA should not be considered as an

alternative to net income or loss, operating income, cash flows

from operating activities or any other performance measures derived

in accordance with GAAP as measures of operating performance or

cash flows as measures of liquidity. Adjusted EBITDA has important

limitations as an analytical tool and should not be considered in

isolation or as a substitute for analysis of our results as

reported under GAAP.

The Company cannot reconcile its expected

Adjusted EBITDA to Net Income under “Outlook” without unreasonable

effort because certain items that impact net income and other

reconciling metrics are out of the Company’s control and/or cannot

be reasonably predicted. These items include, but are not limited

to, stock-based compensation expense and acquisition-related

charges. These items are uncertain, depend on various factors, and

could have a material impact on GAAP reported results for the

guidance period.

Adjusted Gross Profit Margin: We define Adjusted

Gross Profit Margin as Gross Profit excluding all cash and non-cash

adjustments impacting Cost of Goods Sold, included in the Adjusted

EBITDA reconciliation, as a percentage of Product Revenues, net.

Such adjustments include: depreciation, purchase accounting

adjustments, long-term incentives and other items adjusted by

management to better understand our financial results.

|

Whole Earth Brands, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(In thousands of dollars, except for share and per share

data) |

|

(Unaudited) |

| |

|

|

|

| |

June 30, 2023 |

|

December 31, 2022 |

| Assets |

|

|

|

| Current

Assets |

|

|

|

|

Cash and cash equivalents |

$ |

24,114 |

|

|

$ |

28,676 |

|

|

Accounts receivable (net of allowances of $1,845 and $1,614,

respectively) |

|

70,475 |

|

|

|

66,653 |

|

|

Inventories |

|

217,047 |

|

|

|

218,975 |

|

|

Prepaid expenses and other current assets |

|

7,716 |

|

|

|

10,530 |

|

|

Total current assets |

|

319,352 |

|

|

|

324,834 |

|

| |

|

|

|

| Property, Plant and

Equipment, net |

|

55,302 |

|

|

|

58,092 |

|

| |

|

|

|

| Other

Assets |

|

|

|

|

Operating lease right-of-use assets |

|

23,499 |

|

|

|

18,238 |

|

|

Goodwill |

|

194,595 |

|

|

|

193,139 |

|

|

Other intangible assets, net |

|

237,149 |

|

|

|

245,376 |

|

|

Deferred tax assets, net |

|

473 |

|

|

|

539 |

|

|

Other assets |

|

9,742 |

|

|

|

8,785 |

|

|

Total Assets |

$ |

840,112 |

|

|

$ |

849,003 |

|

| |

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current

Liabilities |

|

|

|

|

Accounts payable |

$ |

53,258 |

|

|

$ |

47,002 |

|

|

Accrued expenses and other current liabilities |

|

30,322 |

|

|

|

27,488 |

|

|

Current portion of operating lease liabilities |

|

8,737 |

|

|

|

8,804 |

|

|

Current portion of long-term debt |

|

3,750 |

|

|

|

3,750 |

|

|

Total current liabilities |

|

96,067 |

|

|

|

87,044 |

|

| Non-Current

Liabilities |

|

|

|

|

Long-term debt |

|

427,035 |

|

|

|

432,172 |

|

|

Deferred tax liabilities, net |

|

33,452 |

|

|

|

32,585 |

|

|

Operating lease liabilities, less current portion |

|

17,565 |

|

|

|

12,664 |

|

|

Other liabilities |

|

10,158 |

|

|

|

9,987 |

|

|

Total Liabilities |

|

584,277 |

|

|

|

574,452 |

|

| Commitments and

Contingencies |

|

— |

|

|

|

— |

|

| Stockholders’

Equity |

|

|

|

|

Preferred shares, $0.0001 par value; 1,000,000 shares authorized;

none issued and outstanding at June 30, 2023 and

December 31, 2022 |

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value; 220,000,000 shares authorized;

42,462,895 and 41,994,355 shares issued and outstanding at

June 30, 2023 and December 31, 2022, respectively |

|

4 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

364,698 |

|

|

|

360,777 |

|

|

Accumulated deficit |

|

(110,502 |

) |

|

|

(85,188 |

) |

|

Accumulated other comprehensive income (loss) |

|

1,635 |

|

|

|

(1,042 |

) |

|

Total stockholders’ equity |

|

255,835 |

|

|

|

274,551 |

|

|

Total Liabilities and Stockholders’ Equity |

$ |

840,112 |

|

|

$ |

849,003 |

|

|

|

|

Whole Earth Brands, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(In thousands of dollars, except for share and per share

data) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

|

Product revenues, net |

$ |

132,902 |

|

|

$ |

133,503 |

|

|

$ |

265,319 |

|

|

$ |

264,095 |

|

| Cost of goods sold |

|

99,522 |

|

|

|

96,189 |

|

|

|

199,598 |

|

|

|

187,223 |

|

| Gross profit |

|

33,380 |

|

|

|

37,314 |

|

|

|

65,721 |

|

|

|

76,872 |

|

| |

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

25,634 |

|

|

|

24,960 |

|

|

|

50,323 |

|

|

|

52,748 |

|

| Amortization of intangible

assets |

|

4,697 |

|

|

|

4,664 |

|

|

|

9,348 |

|

|

|

9,369 |

|

| |

|

|

|

|

|

|

|

| Operating income |

|

3,049 |

|

|

|

7,690 |

|

|

|

6,050 |

|

|

|

14,755 |

|

| |

|

|

|

|

|

|

|

| Interest expense, net |

|

(11,063 |

) |

|

|

(6,428 |

) |

|

|

(21,767 |

) |

|

|

(12,460 |

) |

| Other (expense) income,

net |

|

(256 |

) |

|

|

890 |

|

|

|

(885 |

) |

|

|

3,707 |

|

| (Loss) income before income

taxes |

|

(8,270 |

) |

|

|

2,152 |

|

|

|

(16,602 |

) |

|

|

6,002 |

|

| (Benefit) provision for income

taxes |

|

(2,753 |

) |

|

|

826 |

|

|

|

8,712 |

|

|

|

1,950 |

|

| Net (loss) income |

$ |

(5,517 |

) |

|

$ |

1,326 |

|

|

$ |

(25,314 |

) |

|

$ |

4,052 |

|

| |

|

|

|

|

|

|

|

| Net (loss) earnings per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.13 |

) |

|

$ |

0.03 |

|

|

$ |

(0.60 |

) |

|

$ |

0.10 |

|

|

Diluted |

$ |

(0.13 |

) |

|

$ |

0.03 |

|

|

$ |

(0.60 |

) |

|

$ |

0.10 |

|

|

|

|

Whole Earth Brands, Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(In thousands of dollars) |

|

(Unaudited) |

| |

|

|

|

| |

Six Months Ended |

| |

June 30, 2023 |

|

June 30, 2022 |

| Operating

activities |

|

|

|

|

Net (loss) income |

$ |

(25,314 |

) |

|

$ |

4,052 |

|

|

Adjustments to reconcile net (loss) income to net cash provided by

operating activities: |

|

|

|

|

Stock-based compensation |

|

4,877 |

|

|

|

3,214 |

|

|

Depreciation |

|

3,473 |

|

|

|

2,916 |

|

|

Amortization of intangible assets |

|

9,348 |

|

|

|

9,369 |

|

|

Deferred income taxes |

|

631 |

|

|

|

(1,857 |

) |

|

Amortization of inventory fair value adjustments |

|

— |

|

|

|

(2,537 |

) |

|

Amortization of debt issuance costs and original issue

discount |

|

1,082 |

|

|

|

929 |

|

|

Change in fair value of warrant liabilities |

|

(62 |

) |

|

|

(1,054 |

) |

|

Changes in current assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(3,351 |

) |

|

|

(4,785 |

) |

|

Inventories |

|

1,584 |

|

|

|

(16,800 |

) |

|

Prepaid expenses and other current assets |

|

(567 |

) |

|

|

(1,017 |

) |

|

Accounts payable, accrued liabilities and income taxes |

|

12,427 |

|

|

|

(1,741 |

) |

|

Other, net |

|

812 |

|

|

|

(2,712 |

) |

| Net cash provided by (used in)

operating activities |

|

4,940 |

|

|

|

(12,023 |

) |

| |

|

|

|

| Investing

activities |

|

|

|

| Capital expenditures |

|

(2,728 |

) |

|

|

(4,440 |

) |

| Proceeds from the sale of

fixed assets |

|

— |

|

|

|

50 |

|

| Net cash used in investing

activities |

|

(2,728 |

) |

|

|

(4,390 |

) |

| |

|

|

|

| Financing

activities |

|

|

|

| Proceeds from revolving credit

facility |

|

— |

|

|

|

50,000 |

|

| Repayments of revolving credit

facility |

|

(4,000 |

) |

|

|

— |

|

| Repayments of long-term

borrowings |

|

(1,875 |

) |

|

|

(1,875 |

) |

| Debt issuance costs |

|

(440 |

) |

|

|

(672 |

) |

| Payment of contingent

consideration |

|

— |

|

|

|

(29,108 |

) |

| Tax withholdings related to

net share settlements of stock awards |

|

(754 |

) |

|

|

(862 |

) |

| Net cash (used in) provided by

financing activities |

|

(7,069 |

) |

|

|

17,483 |

|

| |

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

295 |

|

|

|

(1,745 |

) |

| Net change in cash and

cash equivalents |

|

(4,562 |

) |

|

|

(675 |

) |

| Cash and cash equivalents,

beginning of period |

|

28,676 |

|

|

|

28,296 |

|

| Cash and cash equivalents, end

of period |

$ |

24,114 |

|

|

$ |

27,621 |

|

| |

|

|

|

| Supplemental

disclosure of cash flow information |

|

|

|

|

Interest paid |

$ |

20,851 |

|

|

$ |

11,511 |

|

|

Taxes paid, net of refunds |

$ |

2,383 |

|

|

$ |

5,757 |

|

|

|

|

Whole Earth Brands, Inc. |

|

Adjusted EBITDA Reconciliation |

|

(In thousands of dollars) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, 2023 |

|

Three Months Ended June 30, 2022 |

|

Six Months Ended June 30, 2023 |

|

Six Months Ended June 30, 2022 |

|

Product revenues, net |

$ |

132,902 |

|

|

$ |

133,503 |

|

|

$ |

265,319 |

|

|

$ |

264,095 |

|

| Net (loss) income |

$ |

(5,517 |

) |

|

$ |

1,326 |

|

|

$ |

(25,314 |

) |

|

$ |

4,052 |

|

| (Benefit) provision for income

taxes |

|

(2,753 |

) |

|

|

826 |

|

|

|

8,712 |

|

|

|

1,950 |

|

| Other expense (income),

net |

|

256 |

|

|

|

(890 |

) |

|

|

885 |

|

|

|

(3,707 |

) |

| Interest expense, net |

|

11,063 |

|

|

|

6,428 |

|

|

|

21,767 |

|

|

|

12,460 |

|

| Operating income |

|

3,049 |

|

|

|

7,690 |

|

|

|

6,050 |

|

|

|

14,755 |

|

| Depreciation |

|

1,783 |

|

|

|

1,456 |

|

|

|

3,473 |

|

|

|

2,916 |

|

| Amortization of intangible

assets |

|

4,697 |

|

|

|

4,664 |

|

|

|

9,348 |

|

|

|

9,369 |

|

| Purchase accounting

adjustments |

|

- |

|

|

|

(938 |

) |

|

|

- |

|

|

|

(2,537 |

) |

| Long term incentive plan |

|

783 |

|

|

|

1,564 |

|

|

|

2,062 |

|

|

|

3,214 |

|

| Severance and related

expenses |

|

1,219 |

|

|

|

33 |

|

|

|

1,189 |

|

|

|

264 |

|

| Non-cash pension expense |

|

- |

|

|

|

10 |

|

|

|

- |

|

|

|

20 |

|

| M&A transaction

expenses |

|

- |

|

|

|

43 |

|

|

|

- |

|

|

|

693 |

|

| Supply chain reinvention |

|

4,821 |

|

|

|

4,625 |

|

|

|

9,707 |

|

|

|

7,980 |

|

| Other items |

|

1,843 |

|

|

|

553 |

|

|

|

2,943 |

|

|

|

790 |

|

| Adjusted EBITDA |

$ |

18,195 |

|

|

$ |

19,701 |

|

|

$ |

34,772 |

|

|

$ |

37,464 |

|

|

|

|

Whole Earth Brands, Inc. |

|

Constant Currency Product Revenues, Net

Reconciliation |

|

(In thousands of dollars) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ change |

|

% change |

|

Product revenues, net |

|

2023 |

|

2022 |

Reported |

ConstantDollar |

Foreign Exchange(1) |

|

Reported |

Constant Dollar |

Foreign Exchange |

|

Branded CPG |

$ |

102,301 |

$ |

104,073 |

$ |

(1,772 |

) |

$ |

(1,282 |

) |

$ |

(490 |

) |

|

-1.7 |

% |

-1.2 |

% |

-0.5 |

% |

|

Flavors & Ingredients |

|

30,601 |

|

29,430 |

|

1,171 |

|

|

1,186 |

|

|

(15 |

) |

|

4.0 |

% |

4.0 |

% |

-0.1 |

% |

|

Combined |

$ |

132,902 |

$ |

133,503 |

$ |

(601 |

) |

$ |

(96 |

) |

$ |

(505 |

) |

|

-0.5 |

% |

-0.1 |

% |

-0.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ change |

|

% change |

|

Product revenues, net |

|

2023 |

|

2022 |

Reported |

ConstantDollar |

Foreign Exchange(1) |

|

Reported |

Constant Dollar |

Foreign Exchange |

|

Branded CPG |

$ |

204,311 |

$ |

207,834 |

$ |

(3,523 |

) |

$ |

(1,483 |

) |

$ |

(2,040 |

) |

|

-1.7 |

% |

-0.7 |

% |

-1.0 |

% |

|

Flavors & Ingredients |

|

61,008 |

|

56,261 |

|

4,747 |

|

|

5,076 |

|

|

(329 |

) |

|

8.4 |

% |

9.0 |

% |

-0.6 |

% |

|

Combined |

$ |

265,319 |

$ |

264,095 |

$ |

1,224 |

|

$ |

3,594 |

|

$ |

(2,370 |

) |

|

0.5 |

% |

1.4 |

% |

-0.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

| (1)The "foreign

exchange" amounts presented, reflect the estimated impact from

fluctuations in foreign currency exchange rates on product

revenues. |

|

|

|

Whole Earth Brands, Inc. |

|

GAAP to Adjusted EBITDA Reconciliation |

|

(In thousands of dollars) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, 2023 |

|

Three Months Ended June 30, 2022 |

|

|

|

| |

GAAP |

Non-cash adj. |

Cash adj. |

Adjusted EBITDA |

|

GAAP |

Non-cash adj. |

Cash adj. |

Adjusted EBITDA |

|

$Change |

%Change |

|

Product revenues, net |

$ |

132,902 |

|

$ |

- |

|

$ |

- |

|

$ |

132,902 |

|

|

$ |

133,503 |

|

$ |

- |

|

$ |

- |

|

$ |

133,503 |

|

|

$ |

(601 |

) |

(0.5 |

%) |

|

Cost of goods sold |

|

99,522 |

|

|

(3,365 |

) |

|

(3,686 |

) |

|

92,471 |

|

|

|

96,189 |

|

|

(1,561 |

) |

|

(3,765 |

) |

|

90,863 |

|

|

|

1,608 |

|

1.8 |

% |

|

Gross profit |

|

33,380 |

|

|

3,365 |

|

|

3,686 |

|

|

40,431 |

|

|

|

37,314 |

|

|

1,561 |

|

|

3,765 |

|

|

42,640 |

|

|

|

(2,209 |

) |

(5.2 |

%) |

|

Gross profit margin % |

|

25.1 |

% |

|

|

|

30.4 |

% |

|

|

27.9 |

% |

|

|

|

31.9 |

% |

|

|

(1.5 |

%) |

|

Selling, general and administrative expenses |

|

25,634 |

|

|

(2,131 |

) |

|

(1,267 |

) |

|

22,237 |

|

|

|

24,960 |

|

|

(1,818 |

) |

|

(203 |

) |

|

22,939 |

|

|

|

(703 |

) |

(3.1 |

%) |

|

Amortization of intangible assets |

|

4,697 |

|

|

(4,697 |

) |

|

- |

|

|

- |

|

|

|

4,664 |

|

|

(4,664 |

) |

|

- |

|

|

- |

|

|

|

- |

|

- |

|

|

Operating income |

$ |

3,049 |

|

$ |

10,193 |

|

$ |

4,953 |

|

$ |

18,195 |

|

|

$ |

7,690 |

|

$ |

8,043 |

|

$ |

3,968 |

|

$ |

19,701 |

|

|

$ |

(1,506 |

) |

(7.6 |

%) |

|

Operating margin % |

|

2.3 |

% |

|

|

|

13.7 |

% |

|

|

5.8 |

% |

|

|

|

14.8 |

% |

|

|

(1.1 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Six Months Ended June 30, 2023 |

|

Six Months Ended June 30, 2022 |

|

|

|

| |

GAAP |

Non-cash adj. |

Cash adj. |

Adjusted EBITDA |

|

GAAP |

Non-cash adj. |

Cash adj. |

Adjusted EBITDA |

|

$Change |

%Change |

|

Product revenues, net |

$ |

265,319 |

|

$ |

- |

|

$ |

- |

|

$ |

265,319 |

|

|

$ |

264,095 |

|

$ |

- |

|

$ |

- |

|

$ |

264,095 |

|

|

$ |

1,224 |

|

0.5 |

% |

|

Cost of goods sold |

|

199,598 |

|

|

(5,673 |

) |

|

(8,584 |

) |

|

185,342 |

|

|

|

187,223 |

|

|

(1,497 |

) |

|

(7,119 |

) |

|

178,606 |

|

|

|

6,736 |

|

3.8 |

% |

|

Gross profit |

|

65,721 |

|

|

5,673 |

|

|

8,584 |

|

|

79,977 |

|

|

|

76,872 |

|

|

1,497 |

|

|

7,119 |

|

|

85,489 |

|

|

|

(5,512 |

) |

(6.4 |

%) |

|

Gross profit margin % |

|

24.8 |

% |

|

|

|

30.1 |

% |

|

|

29.1 |

% |

|

|

|

32.4 |

% |

|

|

(2.2 |

%) |

|

Selling, general and administrative expenses |

|

50,323 |

|

|

(3,892 |

) |

|

(1,226 |

) |

|

45,205 |

|

|

|

52,748 |

|

|

(3,639 |

) |

|

(1,084 |

) |

|

48,025 |

|

|

|

(2,820 |

) |

(5.9 |

%) |

|

Amortization of intangible assets |

|

9,348 |

|

|

(9,348 |

) |

|

- |

|

|

- |

|

|

|

9,369 |

|

|

(9,369 |

) |

|

- |

|

|

- |

|

|

|

- |

|

- |

|

|

Operating income |

$ |

6,050 |

|

$ |

18,913 |

|

$ |

9,809 |

|

$ |

34,772 |

|

|

$ |

14,755 |

|

$ |

14,506 |

|

$ |

8,203 |

|

$ |

37,464 |

|

|

$ |

(2,691 |

) |

(7.2 |

%) |

|

Operating margin % |

|

2.3 |

% |

|

|

|

13.1 |

% |

|

|

5.6 |

% |

|

|

|

14.2 |

% |

|

|

(1.1 |

%) |

|

|

|

Whole Earth Brands, Inc. |

|

Adjustments to Operating Income by Income Statement Line

and Nature |

|

(In thousands of dollars) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, 2023 |

|

Three Months Ended June 30, 2022 |

| Non-Cash

adjustments |

Cost of Goods Sold |

SG&A |

Amort. Of Intangibles |

Operating Income |

|

Cost of Goods Sold |

SG&A |

Amort. Of Intangibles |

Operating Income |

|

Depreciation |

$ |

1,602 |

|

$ |

181 |

|

$ |

- |

$ |

1,783 |

|

$ |

1,295 |

|

$ |

161 |

$ |

- |

$ |

1,456 |

|

|

Amortization of intangible assets |

|

- |

|

|

- |

|

|

4,697 |

|

4,697 |

|

|

- |

|

|

- |

|

4,664 |

|

4,664 |

|

|

Non-cash pension expense |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

- |

|

|

10 |

|

- |

|

10 |

|

|

Long term incentive plan |

|

(59 |

) |

|

842 |

|

|

- |

|

783 |

|

|

153 |

|

|

1,411 |

|

- |

|

1,564 |

|

|

Purchase accounting costs |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

(938 |

) |

|

- |

|

- |

|

(938 |

) |

|

Supply chain reinvention |

|

1,189 |

|

|

- |

|

|

- |

|

1,189 |

|

|

772 |

|

|

- |

|

- |

|

772 |

|

|

Other items |

|

634 |

|

|

1,107 |

|

|

- |

|

1,741 |

|

|

279 |

|

|

236 |

|

- |

|

515 |

|

|

Total non-cash adjustments |

$ |

3,365 |

|

$ |

2,131 |

|

$ |

4,697 |

$ |

10,193 |

|

$ |

1,561 |

|

$ |

1,818 |

$ |

4,664 |

$ |

8,043 |

|

|

Cash adjustments |

|

|

|

|

|

|

|

|

|

|

Severance and related expenses |

|

54 |

|

|

1,165 |

|

|

- |

|

1,219 |

|

|

- |

|

|

33 |

|

- |

|

33 |

|

|

M&A transaction expenses |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

- |

|

|

43 |

|

- |

|

43 |

|

|

Supply chain reinvention |

|

3,632 |

|

|

- |

|

|

- |

|

3,632 |

|

|

3,765 |

|

|

88 |

|

- |

|

3,853 |

|

|

Other items |

|

- |

|

|

102 |

|

|

- |

|

102 |

|

|

- |

|

|

39 |

|

- |

|

39 |

|

|

Total cash adjustments |

$ |

3,686 |

|

$ |

1,267 |

|

$ |

- |

$ |

4,953 |

|

$ |

3,765 |

|

$ |

203 |

$ |

- |

$ |

3,968 |

|

|

Total adjustments |

$ |

7,051 |

|

$ |

3,397 |

|

$ |

4,697 |

$ |

15,146 |

|

$ |

5,326 |

|

$ |

2,021 |

$ |

4,664 |

$ |

12,011 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Six Months Ended June 30, 2023 |

|

Six Months Ended June 30, 2022 |

| Non-Cash

adjustments |

Cost of Goods Sold |

SG&A |

Amort. Of Intangibles |

Operating Income |

|

Cost of Goods Sold |

SG&A |

Amort. Of Intangibles |

Operating Income |

|

Depreciation |

$ |

3,086 |

|

$ |

387 |

|

$ |

- |

$ |

3,473 |

|

$ |

2,489 |

|

$ |

427 |

$ |

- |

$ |

2,916 |

|

|

Amortization of intangible assets |

|

- |

|

|

- |

|

|

9,348 |

|

9,348 |

|

|

- |

|

|

- |

|

9,369 |

|

9,369 |

|

|

Non-cash pension expense |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

- |

|

|

20 |

|

- |

|

20 |

|

|

Long term incentive plan |

|

178 |

|

|

1,884 |

|

|

- |

|

2,062 |

|

|

284 |

|

|

2,930 |

|

- |

|

3,214 |

|

|

Purchase accounting costs |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

(2,537 |

) |

|

- |

|

- |

|

(2,537 |

) |

|

Supply chain reinvention |

|

1,189 |

|

|

- |

|

|

- |

|

1,189 |

|

|

772 |

|

|

- |

|

- |

|

772 |

|

|

Other items |

|

1,220 |

|

|

1,621 |

|

|

- |

|

2,841 |

|

|

489 |

|

|

262 |

|

- |

|

751 |

|

|

Total non-cash adjustments |

$ |

5,673 |

|

$ |

3,892 |

|

$ |

9,348 |

$ |

18,913 |

|

$ |

1,497 |

|

$ |

3,639 |

$ |

9,369 |

$ |

14,505 |

|

|

Cash adjustments |

|

|

|

|

|

|

|

|

|

|

Severance and related expenses |

|

54 |

|

|

1,135 |

|

|

- |

|

1,189 |

|

|

- |

|

|

264 |

|

- |

|

264 |

|

|

M&A transaction expenses |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

- |

|

|

693 |

|

- |

|

693 |

|

|

Supply chain reinvention |

|

8,529 |

|

|

(11 |

) |

|

- |

|

8,518 |

|

|

7,119 |

|

|

88 |

|

- |

|

7,208 |

|

|

Other items |

|

- |

|

|

102 |

|

|

- |

|

102 |

|

|

- |

|

|

39 |

|

- |

|

39 |

|

|

Total cash adjustments |

$ |

8,584 |

|

$ |

1,226 |

|

$ |

- |

$ |

9,809 |

|

$ |

7,119 |

|

$ |

1,084 |

$ |

- |

$ |

8,203 |

|

|

Total adjustments |

$ |

14,256 |

|

$ |

5,118 |

|

$ |

9,348 |

$ |

28,722 |

|

$ |

8,617 |

|

$ |

4,723 |

$ |

9,369 |

$ |

22,709 |

|

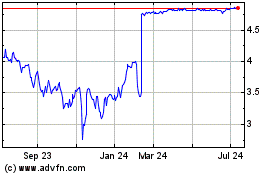

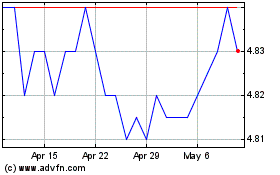

Whole Earth Brands (NASDAQ:FREE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Whole Earth Brands (NASDAQ:FREE)

Historical Stock Chart

From Apr 2023 to Apr 2024