0001068689

true

S-1/A

65308

66

32027696

241714

3491764

P3Y

60000

5229851

0.000

0001068689

2022-01-01

2022-06-30

0001068689

2022-06-30

0001068689

2021-12-31

0001068689

2020-12-31

0001068689

us-gaap:SeriesBPreferredStockMember

2022-06-30

0001068689

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

2022-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001068689

us-gaap:SeriesBPreferredStockMember

2020-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

2020-12-31

0001068689

2022-04-01

2022-06-30

0001068689

2021-04-01

2021-06-30

0001068689

2021-01-01

2021-06-30

0001068689

2021-01-01

2021-12-31

0001068689

2020-01-01

2020-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001068689

us-gaap:RetainedEarningsMember

2021-12-31

0001068689

us-gaap:CommonStockMember

2021-12-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-03-31

0001068689

us-gaap:RetainedEarningsMember

2022-03-31

0001068689

2022-03-31

0001068689

us-gaap:CommonStockMember

2022-03-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2020-12-31

0001068689

us-gaap:RetainedEarningsMember

2020-12-31

0001068689

us-gaap:CommonStockMember

2020-12-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-03-31

0001068689

us-gaap:RetainedEarningsMember

2021-03-31

0001068689

2021-03-31

0001068689

us-gaap:CommonStockMember

2021-03-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2019-12-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001068689

us-gaap:RetainedEarningsMember

2019-12-31

0001068689

2019-12-31

0001068689

us-gaap:CommonStockMember

2019-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-06-30

0001068689

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001068689

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-04-01

2022-06-30

0001068689

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001068689

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-06-30

0001068689

us-gaap:RetainedEarningsMember

2021-01-01

2021-06-30

0001068689

us-gaap:CommonStockMember

2021-01-01

2021-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-04-01

2021-06-30

0001068689

us-gaap:RetainedEarningsMember

2021-04-01

2021-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2021-04-01

2021-06-30

0001068689

us-gaap:CommonStockMember

2021-04-01

2021-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2020-01-01

2020-12-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001068689

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001068689

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001068689

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001068689

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-06-30

0001068689

us-gaap:RetainedEarningsMember

2022-06-30

0001068689

us-gaap:CommonStockMember

2022-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-06-30

0001068689

us-gaap:RetainedEarningsMember

2021-06-30

0001068689

2021-06-30

0001068689

us-gaap:CommonStockMember

2021-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:CenturionHoldingsILLCMember

2022-01-18

2022-01-19

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:CenturionHoldingsILLCMember

LDSRD:PromissoryNoteMember

2022-01-19

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:CenturionHoldingsILLCMember

2022-01-19

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:CenturionHoldingsILLCMember

2022-04-20

0001068689

us-gaap:RetainedEarningsMember

srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember

2022-01-01

2022-06-30

0001068689

srt:MinimumMember

2021-01-01

2021-12-31

0001068689

srt:MaximumMember

2021-01-01

2021-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-06-30

0001068689

LDSRD:StockOptionsMember

2022-01-01

2022-06-30

0001068689

LDSRD:StockOptionsMember

2021-01-01

2021-06-30

0001068689

us-gaap:WarrantMember

2022-01-01

2022-06-30

0001068689

us-gaap:WarrantMember

2021-01-01

2021-06-30

0001068689

LDSRD:ConvertibleNotesMember

2022-01-01

2022-06-30

0001068689

LDSRD:ConvertibleNotesMember

2021-01-01

2021-06-30

0001068689

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-06-30

0001068689

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

2020-01-01

2020-12-31

0001068689

LDSRD:StockOptionsMember

2021-01-01

2021-12-31

0001068689

LDSRD:StockOptionsMember

2020-01-01

2020-12-31

0001068689

LDSRD:WarrantsMember

2021-01-01

2021-12-31

0001068689

LDSRD:WarrantsMember

2020-01-01

2020-12-31

0001068689

LDSRD:ConvertibleNotesMember

2021-01-01

2021-12-31

0001068689

LDSRD:ConvertibleNotesMember

2020-01-01

2020-12-31

0001068689

LDSRD:PreferredBStockMember

2021-01-01

2021-12-31

0001068689

LDSRD:PreferredBStockMember

2020-01-01

2020-12-31

0001068689

us-gaap:FurnitureAndFixturesMember

2022-06-30

0001068689

us-gaap:FurnitureAndFixturesMember

2021-12-31

0001068689

us-gaap:ComputerEquipmentMember

2022-06-30

0001068689

us-gaap:ComputerEquipmentMember

2021-12-31

0001068689

us-gaap:FurnitureAndFixturesMember

2020-12-31

0001068689

us-gaap:ComputerEquipmentMember

2020-12-31

0001068689

LDSRD:WordpressGDPRRightsMember

2022-06-30

0001068689

LDSRD:WordpressGDPRRightsMember

2021-12-31

0001068689

LDSRD:ARALOCMember

2022-06-30

0001068689

LDSRD:ARALOCMember

2021-12-31

0001068689

LDSRD:ArcMailMember

2022-06-30

0001068689

LDSRD:ArcMailMember

2021-12-31

0001068689

LDSRD:DataExpressMember

2022-06-30

0001068689

LDSRD:DataExpressMember

2021-12-31

0001068689

LDSRD:FileFacetsMember

2022-06-30

0001068689

LDSRD:FileFacetsMember

2021-12-31

0001068689

LDSRD:IntellyWPMember

2022-06-30

0001068689

LDSRD:IntellyWPMember

2021-12-31

0001068689

LDSRD:ResilientNetworkSystemsMember

2022-06-30

0001068689

LDSRD:ResilientNetworkSystemsMember

2021-12-31

0001068689

LDSRD:WordpressGDPRRightsMember

2020-12-31

0001068689

LDSRD:ARALOCMember

2020-12-31

0001068689

LDSRD:ArcMailLicenseMember

2021-12-31

0001068689

LDSRD:ArcMailLicenseMember

2020-12-31

0001068689

LDSRD:DataExpressMember

2020-12-31

0001068689

LDSRD:FileFacetsMember

2020-12-31

0001068689

LDSRD:IntellyWPMember

2020-12-31

0001068689

LDSRD:ResilientNetworkSystemsMember

2020-12-31

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:FileFacetsMember

2020-08-12

2020-08-13

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:IntellyWPMember

2020-09-20

2020-09-21

0001068689

LDSRD:PaymentatClosingMember

LDSRD:AssetPurchaseAgreementMember

LDSRD:IntellyWPMember

2020-09-20

2020-09-21

0001068689

LDSRD:AssetPurchaseAgreementMember

2020-10-06

2020-10-08

0001068689

LDSRD:PaymentatClosingMember

LDSRD:AssetPurchaseAgreementMember

2020-10-06

2020-10-08

0001068689

us-gaap:CommonStockMember

LDSRD:AssetPurchaseAgreementMember

2020-10-06

2020-10-08

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:IntellyWPMember

2021-01-01

2021-12-31

0001068689

LDSRD:IssuedInFiscalYearTwoThousandAndTwentyMember

2022-06-30

0001068689

LDSRD:IssuedInFiscalYearTwoThousandAndTwentyMember

2021-12-31

0001068689

LDSRD:IssuedInFiscalYearTwoThousandAndTwentyOneMember

2022-06-30

0001068689

LDSRD:IssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-12-31

0001068689

LDSRD:IssuedInFiscalYearTwoThousandAndTwentyTwoMember

2022-06-30

0001068689

LDSRD:IssuedInFiscalYearTwoThousandAndTwentyTwoMember

2021-12-31

0001068689

LDSRD:IssuedInFiscalYearTwoThousandAndTwentyMember

2020-12-31

0001068689

LDSRD:IssuedInFiscalYearTwoThousandAndTwentyOneMember

2020-12-31

0001068689

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-06-30

0001068689

us-gaap:ConvertibleNotesPayableMember

2021-01-01

2021-12-31

0001068689

us-gaap:ConvertibleNotesPayableMember

2022-06-30

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2020-12-31

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-12-31

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-01-01

2021-12-31

0001068689

srt:MinimumMember

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-01-01

2021-12-31

0001068689

srt:MaximumMember

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-01-01

2021-12-31

0001068689

srt:MinimumMember

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-12-31

0001068689

srt:MaximumMember

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-12-31

0001068689

LDSRD:TwoThousandTwentyOneConvertibleNotesMember

2021-01-01

2021-12-31

0001068689

LDSRD:TwoThousandTwentyOneConvertibleNotesMember

2021-12-31

0001068689

LDSRD:TwoThousandTwentyOneConvertibleNotesMember

srt:MinimumMember

2021-12-31

0001068689

LDSRD:TwoThousandTwentyOneConvertibleNotesMember

srt:MaximumMember

2021-12-31

0001068689

LDSRD:TwoThousandTwentyOneConvertibleNotesMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

2022-06-30

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MinimumMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MaximumMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MinimumMember

2022-06-30

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MaximumMember

2022-06-30

0001068689

srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember

us-gaap:AccountingStandardsUpdate202006Member

2022-01-01

0001068689

LDSRD:ConvertibleNoteMember

LDSRD:LenderMember

2020-12-31

0001068689

srt:ChiefExecutiveOfficerMember

2020-01-01

2020-12-31

0001068689

srt:ChiefExecutiveOfficerMember

2020-12-31

0001068689

LDSRD:GraniteNoteMember

2020-03-20

0001068689

LDSRD:GraniteWarrantMember

2020-03-17

2020-03-18

0001068689

LDSRD:ExchangeNoteMember

2021-12-31

0001068689

LDSRD:ExchangeNoteMember

2021-01-01

2021-12-31

0001068689

srt:MinimumMember

LDSRD:ExchangeNoteMember

2021-12-31

0001068689

LDSRD:AgreementWithSmea2zLLCMember

2020-10-23

0001068689

LDSRD:AgreementWithSmea2zLLCTwoMember

2020-10-23

0001068689

LDSRD:AgreementWithSmea2zLLCMember

2020-11-17

0001068689

LDSRD:ExchangeNoteTwoMember

2021-01-01

2021-12-31

0001068689

LDSRD:ExchangeNoteTwoMember

2021-12-31

0001068689

2020-11-18

0001068689

us-gaap:ConvertibleDebtMember

2020-07-01

0001068689

us-gaap:ConvertibleDebtMember

2020-06-29

2020-07-01

0001068689

LDSRD:ConvertibleNoteMember

2021-01-01

2021-12-31

0001068689

LDSRD:ConvertibleNoteMember

2021-12-31

0001068689

LDSRD:ConvertibleNoteMember

2020-01-01

2020-12-31

0001068689

LDSRD:ConvertibleNoteMember

2020-12-31

0001068689

srt:MinimumMember

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2020-01-01

2020-12-31

0001068689

srt:MaximumMember

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2020-01-01

2020-12-31

0001068689

srt:MinimumMember

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2020-12-31

0001068689

srt:MaximumMember

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2020-12-31

0001068689

srt:MinimumMember

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2021-12-31

0001068689

us-gaap:MeasurementInputExpectedTermMember

2022-01-01

2022-06-30

0001068689

us-gaap:MeasurementInputExpectedTermMember

srt:MinimumMember

2021-01-01

2021-12-31

0001068689

us-gaap:MeasurementInputExpectedTermMember

srt:MaximumMember

2021-01-01

2021-12-31

0001068689

us-gaap:MeasurementInputPriceVolatilityMember

2022-06-30

0001068689

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2021-12-31

0001068689

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2021-12-31

0001068689

us-gaap:MeasurementInputExpectedDividendRateMember

2022-06-30

0001068689

us-gaap:MeasurementInputExpectedDividendRateMember

2021-12-31

0001068689

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-06-30

0001068689

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2021-12-31

0001068689

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2021-12-31

0001068689

us-gaap:MeasurementInputExpectedTermMember

srt:MinimumMember

2020-01-01

2020-12-31

0001068689

us-gaap:MeasurementInputExpectedTermMember

srt:MaximumMember

2020-01-01

2020-12-31

0001068689

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2020-12-31

0001068689

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2020-12-31

0001068689

us-gaap:MeasurementInputExpectedDividendRateMember

2020-12-31

0001068689

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2020-12-31

0001068689

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2020-12-31

0001068689

LDSRD:EconomicInjuryDisasterLoanOriginatedInMay2020Member

2022-06-30

0001068689

LDSRD:EconomicInjuryDisasterLoanOriginatedInMay2020Member

2021-12-31

0001068689

LDSRD:EconomicInjuryDisasterLoanOriginatedInMay2020Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInSeptember2020Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInSeptember2020Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInSeptember2020Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2020Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2020Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2020Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJanuary2021Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInJanuary2021Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJanuary2021Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInFebruary2021Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInFebruary2021Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInFebruary2021Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2021Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInApril2021Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2021Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJuly2021Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInJuly2021Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJuly2021Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInSeptember2021Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInSeptember2021Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInSeptember2021Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021OneMember

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021OneMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021OneMember

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021TwoMember

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021TwoMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021TwoMember

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInMarch2022Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInMarch2022Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInMarch2022Member

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInMarch2022OneMember

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInMarch2022OneMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInMarch2022OneMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022OneMember

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022OneMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022OneMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022TwoMember

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022TwoMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022TwoMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022ThreeMember

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022ThreeMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022ThreeMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022FourMember

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022FourMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2022FourMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInJune2022Member

2022-06-30

0001068689

LDSRD:PromissoryNoteOriginatedInJune2022Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJune2022Member

2022-01-01

2022-06-30

0001068689

LDSRD:TenPercentPromissoryNoteOriginatedInOctober2019Member

2021-12-31

0001068689

LDSRD:TenPercentPromissoryNoteOriginatedInOctober2019Member

2020-12-31

0001068689

LDSRD:TenPercentPromissoryNoteOriginatedInOctober2019Member

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInOctober2019OneMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInOctober2019OneMember

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInOctober2019OneMember

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2020Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2020Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2020Member

2020-01-01

2020-12-31

0001068689

LDSRD:PaycheckProtectionProgramPromissoryNoteOriginatedInApril2020OneMember

2021-12-31

0001068689

LDSRD:PaycheckProtectionProgramPromissoryNoteOriginatedInApril2020OneMember

2020-12-31

0001068689

LDSRD:PaycheckProtectionProgramPromissoryNoteOriginatedInApril2020OneMember

2020-01-01

2020-12-31

0001068689

LDSRD:EconomicInjuryDisasterLoanOriginatedInMay2020Member

2020-12-31

0001068689

LDSRD:EconomicInjuryDisasterLoanOriginatedInMay2020Member

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJune2020Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJune2020Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJune2020Member

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInSeptember2020Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInSeptember2020Member

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInOctober2020Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInOctober2020Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInOctober2020Member

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInNovember2020Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInNovember2020Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInNovember2020Member

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInNovember2020OneMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInNovember2020OneMember

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInNovember2020OneMember

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2020Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2020Member

2020-01-01

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJanuary2021Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInFebruary2021Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2021Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2021OneMember

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2021OneMember

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInApril2021OneMember

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInJuly2021Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInAugust2021Member

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInAugust2021Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInAugust2021Member

2021-01-01

2021-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInSeptember2021Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021Member

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021OneMember

2020-12-31

0001068689

LDSRD:PromissoryNoteOriginatedInDecember2021TwoMember

2020-12-31

0001068689

LDSRD:NotesPayableMember

2021-02-11

2021-02-12

0001068689

LDSRD:NotesPayableMember

2021-02-12

0001068689

LDSRD:NotesPayableMember

2021-01-01

2021-12-31

0001068689

us-gaap:NotesPayableOtherPayablesMember

2022-01-01

2022-06-30

0001068689

us-gaap:NotesPayableOtherPayablesMember

2021-01-01

2021-06-30

0001068689

us-gaap:NotesPayableOtherPayablesMember

2022-06-30

0001068689

us-gaap:NotesPayableOtherPayablesMember

2021-06-30

0001068689

us-gaap:NotesPayableOtherPayablesMember

2021-01-01

2021-12-31

0001068689

us-gaap:NotesPayableOtherPayablesMember

2020-01-01

2020-12-31

0001068689

us-gaap:NotesPayableOtherPayablesMember

2021-12-31

0001068689

us-gaap:NotesPayableOtherPayablesMember

2020-12-31

0001068689

2022-03-06

2022-03-07

0001068689

2022-03-07

0001068689

us-gaap:CommonStockMember

us-gaap:ConvertibleDebtMember

2022-01-01

2022-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001068689

LDSRD:PromissoryNoteMember

2022-01-01

2022-06-30

0001068689

2020-03-05

0001068689

2020-04-15

0001068689

2020-08-17

0001068689

us-gaap:SeriesBPreferredStockMember

2020-11-25

0001068689

2020-12-15

0001068689

2021-06-25

2021-07-01

0001068689

us-gaap:SeriesAPreferredStockMember

srt:ChiefExecutiveOfficerMember

2020-01-01

2020-12-31

0001068689

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-12-31

0001068689

us-gaap:SeriesBPreferredStockMember

LDSRD:IssuanceOfSharesMember

2021-01-01

2021-12-31

0001068689

us-gaap:SeriesBPreferredStockMember

LDSRD:IssuanceOfSharesMember

2021-12-31

0001068689

us-gaap:SeriesBPreferredStockMember

2020-01-01

2020-12-31

0001068689

2022-01-06

0001068689

us-gaap:CommonStockMember

us-gaap:ConvertibleDebtMember

2021-01-01

2021-12-31

0001068689

us-gaap:CommonStockMember

LDSRD:SharesIssuanceOfCashMember

2021-01-01

2021-12-31

0001068689

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001068689

us-gaap:CommercialPaperMember

2021-01-01

2021-12-31

0001068689

LDSRD:SharesIssuedForConversionOfDebtMember

2020-01-01

2020-12-31

0001068689

us-gaap:CommonStockMember

LDSRD:MrRemillardMember

2020-01-01

2020-12-31

0001068689

us-gaap:CommonStockMember

srt:ChiefFinancialOfficerMember

2020-01-01

2020-12-31

0001068689

us-gaap:WarrantMember

2020-12-31

0001068689

us-gaap:WarrantMember

2020-01-01

2020-12-31

0001068689

LDSRD:HoldersMember

2020-12-31

0001068689

LDSRD:HoldersMember

2020-01-01

2020-12-31

0001068689

LDSRD:TritonFundsLPMember

LDSRD:CoomonStockPurchaseAgreementMember

2020-12-11

0001068689

LDSRD:TritonFundsLPMember

LDSRD:CoomonStockPurchaseAgreementMember

2020-12-10

2020-12-11

0001068689

LDSRD:WarrantOneMember

2021-01-01

2021-12-31

0001068689

LDSRD:WarrantOneMember

2021-12-31

0001068689

us-gaap:WarrantMember

2021-04-22

2021-04-23

0001068689

us-gaap:WarrantMember

2021-04-23

0001068689

LDSRD:SecuredPromissoryNoteMember

us-gaap:WarrantMember

2021-04-23

0001068689

us-gaap:WarrantMember

2021-07-25

2021-07-28

0001068689

us-gaap:WarrantMember

2021-07-27

0001068689

LDSRD:SecuredPromissoryNoteMember

us-gaap:WarrantMember

2021-07-27

0001068689

us-gaap:WarrantMember

2021-09-27

2021-09-28

0001068689

us-gaap:WarrantMember

2021-09-28

0001068689

LDSRD:SecuredPromissoryNoteMember

us-gaap:WarrantMember

2021-09-28

0001068689

us-gaap:WarrantMember

2021-10-15

2021-10-19

0001068689

us-gaap:WarrantMember

2021-10-19

0001068689

LDSRD:ConvertiblePromissoryNoteMember

us-gaap:WarrantMember

2021-10-19

0001068689

us-gaap:WarrantMember

2021-01-01

2021-12-31

0001068689

us-gaap:WarrantMember

2021-12-31

0001068689

LDSRD:ConvertiblePromissoryNoteMember

us-gaap:WarrantMember

2021-12-31

0001068689

LDSRD:WarrantOneMember

2022-06-30

0001068689

LDSRD:WarrantOneMember

2022-01-01

2022-06-30

0001068689

LDSRD:WarrantTwoMember

2022-06-30

0001068689

LDSRD:WarrantTwoMember

2022-01-01

2022-06-30

0001068689

LDSRD:WarrantThreeMember

2022-06-30

0001068689

LDSRD:WarrantThreeMember

2022-01-01

2022-06-30

0001068689

LDSRD:WarrantFourMember

2022-06-30

0001068689

LDSRD:WarrantFourMember

2022-01-01

2022-06-30

0001068689

LDSRD:WarrantFiveMember

2022-06-30

0001068689

LDSRD:WarrantFiveMember

2022-01-01

2022-06-30

0001068689

LDSRD:WarrantSixMember

2022-06-30

0001068689

LDSRD:WarrantSixMember

2022-01-01

2022-06-30

0001068689

LDSRD:WarrantSevenMember

2022-06-30

0001068689

LDSRD:WarrantSevenMember

2022-01-01

2022-06-30

0001068689

LDSRD:WarrantOneMember

2021-12-31

0001068689

LDSRD:WarrantOneMember

2021-01-01

2021-12-31

0001068689

LDSRD:WarrantTwoMember

2021-12-31

0001068689

LDSRD:WarrantTwoMember

2021-01-01

2021-12-31

0001068689

LDSRD:WarrantThreeMember

2021-12-31

0001068689

LDSRD:WarrantThreeMember

2021-01-01

2021-12-31

0001068689

LDSRD:WarrantFourMember

2021-12-31

0001068689

LDSRD:WarrantFourMember

2021-01-01

2021-12-31

0001068689

LDSRD:WarrantFiveMember

2021-12-31

0001068689

LDSRD:WarrantFiveMember

2021-01-01

2021-12-31

0001068689

LDSRD:WarrantSixMember

2021-12-31

0001068689

LDSRD:WarrantSixMember

2021-01-01

2021-12-31

0001068689

LDSRD:WarrantSevenMember

2021-12-31

0001068689

LDSRD:WarrantSevenMember

2021-01-01

2021-12-31

0001068689

LDSRD:StockOptionsMember

2022-01-01

2022-06-30

0001068689

LDSRD:StockOptionsMember

srt:MaximumMember

2022-01-01

2022-06-30

0001068689

LDSRD:StockOptionsMember

2022-06-30

0001068689

LDSRD:StockOptionsMember

2021-12-31

0001068689

LDSRD:StockOptionsMember

2021-01-01

2021-12-31

0001068689

LDSRD:StockOptionsMember

srt:MaximumMember

2021-01-01

2021-12-31

0001068689

LDSRD:StockOptionsMember

2020-01-01

2020-12-31

0001068689

LDSRD:StockOptionsMember

2020-12-31

0001068689

us-gaap:RestrictedStockMember

2021-01-01

2021-12-31

0001068689

us-gaap:RestrictedStockMember

srt:MaximumMember

2021-01-01

2021-12-31

0001068689

us-gaap:RestrictedStockMember

2021-12-31

0001068689

us-gaap:RestrictedStockMember

2020-12-31

0001068689

LDSRD:EmployeesConsultantsAndAdvisorsMember

2021-12-31

0001068689

LDSRD:EmployeesConsultantsAndAdvisorsMember

2022-01-01

2022-06-30

0001068689

LDSRD:EmployeesConsultantsAndAdvisorsMember

2022-06-30

0001068689

LDSRD:EmployeesConsultantsAndAdvisorsMember

2019-12-31

0001068689

LDSRD:EmployeesConsultantsAndAdvisorsMember

2020-01-01

2020-12-31

0001068689

LDSRD:EmployeesConsultantsAndAdvisorsMember

2020-12-31

0001068689

LDSRD:EmployeesConsultantsAndAdvisorsMember

2021-01-01

2021-12-31

0001068689

us-gaap:RestrictedStockMember

2022-01-01

2022-06-30

0001068689

us-gaap:RestrictedStockMember

2022-06-30

0001068689

us-gaap:RestrictedStockMember

2019-12-31

0001068689

us-gaap:RestrictedStockMember

2020-01-01

2020-12-31

0001068689

LDSRD:RestrictedStockAwardsMember

2022-01-01

2022-06-30

0001068689

LDSRD:RestrictedStockAwardsMember

2021-01-01

2021-12-31

0001068689

LDSRD:RestrictedStockAwardsMember

2020-01-01

2020-12-31

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:DMBGroupLLCMember

2019-09-16

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:DMBGroupLLCMember

2022-04-01

2022-06-30

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:DMBGroupLLCMember

2022-06-30

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:DMBGroupLLCMember

2021-12-31

0001068689

srt:ChiefExecutiveOfficerMember

2022-06-30

0001068689

srt:ChiefExecutiveOfficerMember

2022-01-01

2022-06-30

0001068689

LDSRD:MyriadSoftwareProductionsLLCMember

LDSRD:MrRemillardMember

2018-01-31

0001068689

LDSRD:MyriadSoftwareProductionsLLCMember

LDSRD:MrRemillardMember

2018-01-01

2018-01-31

0001068689

LDSRD:MrRemillardMember

2018-01-01

2018-01-31

0001068689

us-gaap:SeriesAPreferredStockMember

LDSRD:ShareSettlementAgreementMember

2020-08-12

2020-08-14

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:DMBGroupLLCMember

2021-01-01

2021-12-31

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:DMBGroupLLCMember

2020-01-01

2020-12-31

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:DMBGroupLLCMember

2020-12-31

0001068689

srt:ChiefExecutiveOfficerMember

2021-01-01

2021-12-31

0001068689

srt:ChiefExecutiveOfficerMember

LDSRD:ConvertibleNoteMember

2020-01-01

2020-12-31

0001068689

us-gaap:SeriesBPreferredStockMember

us-gaap:SubsequentEventMember

2021-12-25

2022-01-02

0001068689

us-gaap:SeriesBPreferredStockMember

us-gaap:SubsequentEventMember

2022-01-02

0001068689

us-gaap:ConvertibleNotesPayableMember

us-gaap:SubsequentEventMember

2022-01-02

0001068689

us-gaap:ConvertibleNotesPayableMember

us-gaap:SubsequentEventMember

2021-12-25

2022-01-02

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:CenturionHoldingsILLCMember

us-gaap:SubsequentEventMember

2022-01-18

2022-01-19

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:CenturionHoldingsILLCMember

LDSRD:PromissoryNoteMember

2022-01-01

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:CenturionHoldingsILLCMember

LDSRD:PromissoryNoteMember

us-gaap:SubsequentEventMember

2022-01-18

2022-01-19

0001068689

LDSRD:AssetPurchaseAgreementMember

LDSRD:CenturionHoldingsILLCMember

LDSRD:PromissoryNoteMember

us-gaap:SubsequentEventMember

2022-01-19

0001068689

us-gaap:FairValueInputsLevel3Member

2019-12-31

0001068689

us-gaap:FairValueInputsLevel3Member

2020-01-01

2020-12-31

0001068689

us-gaap:FairValueInputsLevel3Member

2020-12-31

0001068689

us-gaap:FairValueInputsLevel3Member

2021-01-01

2021-12-31

0001068689

us-gaap:FairValueInputsLevel3Member

2021-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

LDSRD:Number

LDSRD:Segment

As Filed With the Securities

and Exchange Commission on November 7, 2022

Registration Number 333-256785

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT

NO. 2

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

DATA443 RISK MITIGATION, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

7372 |

|

86-0914051 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

No.) |

4000 Park Drive, Suite 400

Research Triangle Park,

NC 27709

(919)

526-1070

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive office)

Jason

Remillard

President

and Chief Executive Officer

4000 Park Drive, Suite 400

Research Triangle Park,

NC 27709

(919)

443-0654

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

With

Copies to:

| M.

Ali Panjwani |

Pamela

G. Maher |

Ralph

V. De Martino |

| Pryor

Cashman LLP |

Chief

Legal Officer |

ArentFox

Schiff LLP |

| 7

Times Square |

Data443

Risk Mitigation, Inc. |

1717

K Street |

| New

York, New York 10036 |

4000

Park Drive, Suite 400 |

Washington,

DC 20006 |

| (212)

326-0820 |

Research

Triangle Park, NC 27709 |

202-724-6848 |

| |

919-526-1070

x136 |

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer |

[ ] |

|

| |

Accelerated

filer |

[ ] |

|

| |

Non-accelerated

filer |

[X] |

|

| |

Smaller

reporting company |

[X] |

|

| |

Emerging

growth company |

[X] |

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

NOVEMBER 7, 2022 |

The

information in this preliminary Prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these

securities until the registration statement filed with the Securities and Exchange Commission is effective. This

preliminary Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or

other jurisdiction where the offer or sale is not permitted.

Units

Each

Unit Consisting of

One

Share of Common Stock and

One

Warrant to Purchase One Share of Common Stock

DATA443

RISK MITIGATION, INC.

ALL

THINGS DATA SECURITY™

This

is a firm commitment for an underwritten public offering of units (the “Units”), based on an assumed initial

offering price of $ per Unit, of DATA443 RISK MITIGATION, INC., a Nevada corporation (alternatively, the “Company”;

“we”; “us”; “our”). We anticipate a public offering price of $

per Unit. Each Unit consists of one share of common stock, $0.001 par value per share, and one warrant (each, a “Warrant”

and collectively, the “Warrants”) to purchase one share of common stock at an exercise price of $

per share, constituting 100% of the price of each Unit sold in this offering based on an assumed initial offering price of $

per Unit. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of common

stock and the Warrants comprising the Units are immediately separable and will be issued separately in this offering. Each Warrant offered

hereby is immediately exercisable on the date of issuance and will expire five years from the date of issuance. This offering also

includes the shares of common stock issuable from time to time upon exercise of the Warrants.

We

have also registered for public sale 931,000 shares of common stock held by 37 selling stockholders (the selling stockholders

referred to herein as the “Selling Stockholders”). We will not receive any of the proceeds from the sale of Common Stock

by the Selling Stockholders. The shares to be sold by the Selling Stockholders (the “Selling Stockholder Shares”) will not

be purchased by the underwriters or otherwise included in the underwritten offering of our Units in this

public offering. The Selling Stockholders may sell or otherwise dispose of their shares in a number of different ways and at varying

prices, but will not sell any Selling Stockholder Shares until after the closing of this offering. See “Selling Stockholders—Plan

of Distribution.” We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses, if any)

relating to the registration of the Selling Stockholders’ shares of Common Stock with the U.S. Securities and Exchange Commission.

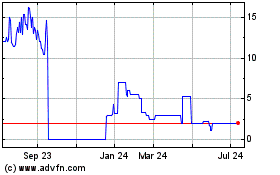

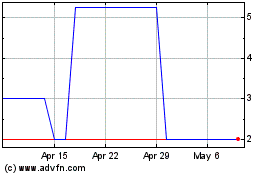

Our common stock is quoted on

the OTC Link LLC quotation system operated by OTC Markets, Group, Inc., under the symbol “ATDS” on the OTC Pink tier.

On November 4, 2022, the reported closing price of our Common Stock was $2.24 per share. We have applied to list our

common stock and Warrants on The Nasdaq Capital Market under the symbols “ATDS” and “ATDSW”, respectively.

No assurance can be given that our application will be approved or that the trading prices of our common stock on the OTC Pink

tier will be indicative of the prices of our common stock if our common stock were traded on The Nasdaq Capital Market. The approval

of our listing on The Nasdaq Capital Market is a condition of closing this offering.

The

offering price of the Units has been determined between the underwriter and us, considering our historical performance and capital

structure, prevailing market conditions, and overall assessment of our business, and may be at a discount to the current market price.

Investing

in our common stock involves a high degree of risk. This offering is highly speculative and these securities involve a high degree

of risk and should be considered only by persons who can afford the loss of their entire investment. You should carefully review

the risks and uncertainties described under the heading “Risk Factors” beginning on page 8

of this Prospectus, and under similar headings in any amendments or supplements to this Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Unit | | |

Total | |

| Offering price | |

$ | | | |

$ | | |

| Underwriting discount and commissions (1) | |

$ | | | |

$ | | |

| Proceeds to us before offering expenses (2) | |

$ | | | |

$ | | |

| (1) |

We

have also agreed to issue warrants to purchase shares of our common stock to the underwriter and to reimburse the underwriter

for certain expenses. See “Underwriting” for additional information regarding total underwriter compensation. |

| |

|

| (2) |

The

amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) over-allotment option

(if any) we have granted to the underwriter as described below; and (ii) warrants being issued to the underwriter in

this offering. We will receive no proceeds from the sale of any Selling Stockholder Shares. |

We

have granted a 45-day option to the underwriter, exercisable one or more times in whole or in part, to purchase up to an additional

shares of common stock and/or additional Warrants at the public offering price of $

per share, less, in each case, the underwriting discounts payable by us, in any combination solely to cover over-allotments, if any.

If the underwriter exercises the option in full, the total underwriting discounts and commissions payable will be $ ,

and the total proceeds to us, before expenses, will be $ .

The

underwriter expects to deliver the securities against payment to the investors in this offering on or about , 2022.

Sole

Book-Running Manager

DAWSON

JAMES SECURITIES, INC.

The

date of this Prospectus is , 2022

DATA443

RISK MITIGATION, INC.

ALL

THINGS DATA SECURITY™

TABLE

OF CONTENTS

In

this Prospectus, “we”; “us”; “our”; the “Company”; and “ATDS”

refer to DATA443 RISK MITIGATION, INC., a Nevada corporation, and where appropriate, its subsidiaries, unless expressly indicated or

the content requires otherwise.

ABOUT

THIS PROSPECTUS

You

should rely only on information contained in this Prospectus. We have not, and the underwriter has not, authorized anyone to provide

you with additional information or information different from that contained in this Prospectus. Neither the delivery of this Prospectus

nor the sale of our securities means that the information contained in this Prospectus is correct after the date of this Prospectus.

This Prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer

or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

For

investors outside the United States: Neither we nor the underwriter have taken any action that would permit this offering or possession

or distribution of this Prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons

outside the United States who come into possession of this Prospectus must inform themselves about, and observe any restrictions relating

to, the offering of the securities covered hereby and the distribution of this Prospectus outside of the United States.

The

information in this Prospectus is accurate only as of the date on the front cover of this Prospectus. Our business, financial condition,

results of operations and prospects may have changed since those dates.

We

are responsible for the information contained in this Prospectus and in any free-writing prospectus we prepare or authorize. We have

not, the Selling Stockholders have not, and the underwriters have not, authorized anyone to provide you with different information, and

we take no, the Selling Stockholders take no, and the underwriters take no, responsibility for any other information others may give

you. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, the Selling Stockholders

are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of

this Prospectus.

This

Prospectus includes market and industry data that has been obtained from third-party sources, including industry publications,

as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate

(including our management’s estimates and assumptions relating to such industries based on that knowledge). Management’s

knowledge of such industries has been developed through its experience and participation in these industries. While our management believes

the third-party sources referred to in this Prospectus are reliable, neither we nor our management have independently verified any of

the data from such sources referred to in this Prospectus or ascertained the underlying economic assumptions relied upon by such sources.

Internally prepared and third-party market forecasts in particular are estimates only and may be inaccurate, especially over long periods

of time. In addition, the underwriter has not independently verified any of the industry data prepared by management or ascertained

the underlying estimates and assumptions relied upon by management. Furthermore, references in this Prospectus to any publications, reports,

surveys, or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication,

report, survey, or article. The information in any such publication, report, survey, or article is not incorporated by reference in this

Prospectus.

PROSPECTUS

SUMMARY

This

summary highlights selected information about this offering included elsewhere in this Prospectus. This summary does not

contain all the information that you should evaluate and consider before investing in our securities. You should carefully read,

consider, and evaluate this entire Prospectus, especially the sections titled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements included herein,

including the notes thereto, before making an investment decision.

Business

Overview

We

provide data security and privacy management solutions

across the enterprise and in the cloud. Trusted by over 10,000 customers, we provide the visibility and control needed to protect

data at scale, regardless of format, location, or consumer, and to facilitate compliance with fast-changing global data

privacy requirements. Our customers include established leaders and up-and-coming businesses spanning the private and public/government

sectors across diverse industries and fields, including financial services, healthcare, manufacturing, retail, technology,

and telecommunications.

The

mounting ransomware landscape as well as other threats to data have accelerated the rate at which businesses are adopting

data security solutions and we believe that our portfolio of data security and privacy products provides an encompassing

solution set such that we are well positioned to capitalize on that increased adoption rate and establish our products as new data

privacy and security standards. Our offerings are anchored in reliable and comprehensive privacy management

and equip organizations with a seamless approach to safeguard data, protect against attacks, and otherwise mitigate the

most critical risks.

Sector-specific

US laws, state-level legislation, and outside-the-United States (OUS) regulations are confounding enterprises of all sizes for whom safeguarding

and stewarding data is key, but for whom becoming specialists in privacy and security is not an element of their strategic roadmap. For

many of these enterprises, we can bridge the gap between their need to protect data and their need to use their resources to grow their

core business by offering turnkey solutions and related counseling and technical support to offset risks from data breaches

and security incidents of various types. We provide products and services for the marketplace that are designed to protect

data that is stored in the cloud, on-premises, and in hybrid cloud/on-premises environments, and data that is transmitted throughout

the enterprise, including but not limited to by remote employees. Our suite of security products focuses on protecting

sensitive files and email, confidential customer, patient and employee data, financial records, strategic and product

plans, intellectual property and other proprietary information, allowing our customers to create, share, and protect

their sensitive data wherever it is stored and however it is used.

We

deliver solutions and capabilities that businesses can use in conjunction with their use of established cloud vendors such as Microsoft®

Azure, Google® Cloud Platform (GCP), and Amazon® Web Services (AWS), as well as with on-premises databases and database applications

and with virtualization platforms, such as those hosted or configured using VMWare®, Citrix®, and Oracle® products.

We

sell or plan to sell substantially all our products and services through a sales model that combines the leverage of a

channel sales model or direct account management, thereby providing us with opportunities to grow our current customer

base and deliver our value proposition for data privacy and security. We endeavor to use subscription models to license products and

services, commonly for a paid-in-advance, multiyear term that is auto-renewing. We also make use of channel partners, distributors,

and resellers which sell to end-users of the products and services. This approach allows us to maintain close relationships with

our customers and benefit from the global reach of our partners. Additionally, we are enhancing our product offerings and go-to-market

strategy by establishing technology alliances within the IT infrastructure and security vendor ecosystem. Our sales and marketing

focus for new organic growth is on organizations with 500 or more users who are adopting cloud services and can

make larger purchases with us over time and have a greater potential lifetime value.

We

continue to onboard to cloud-native technology adoption portals such as the Microsoft® Azure Marketplace and the Amazon® AWS

Marketplace. Vendors may offer incentives to us as a software and services provider to onboard and market via their marketplace portals.

We

strive to create new and innovative products and to improve existing products, proactively identifying and solving the data security

needs of our customers.

As

cloud adoption continues to accelerate, data privacy requirements get more complex, and data security becomes more challenging, we believe

that Data443 is well positioned to capture more market share, continue to lead in strategic data security technology development, and

prepare organizations for the next epoch in IT data privacy services.

Our

Products

Each

of our major product lines provides features and functionality which we believe enable our customers to optimally secure their data.

The products are modular, giving our customers the flexibility to select what they require for their business needs and the flexibility

to expand their usage simply by adding a license. We currently offer the following products and services:

| |

● |

Data443®

Ransomware Recovery Manager (also known as “SmartShield™”), a unique offering designed to recover a workstation

immediately upon infection to the last known business-operable state, without requiring any end user or IT administrator intervention. |

| |

● |

Data443®

Data Identification Manager (also known as ClassiDocs® and FileFacets®), our data classification and governance technology,

which supports GDPR, CCPA, and LGPD compliance in a Software-as-a-Service (SaaS) platform that performs sophisticated data discovery

and content searching of structured and unstructured data within corporate networks, servers, content management systems, email,

desktops, and laptops. |

| |

● |

Data443®

Data Archive Manager (also known as ArcMail®), a simple, secure, and cost-effective solution for enterprise data retention

management and archiving. |

| |

● |

Data443®

Sensitive Content Manager (also known as ARALOC®), a secure, cloud-based platform for managing, protecting and distributing

digital content to desktop and mobile devices, which protects an organization’s confidential content and intellectual property

assets from accidental leakage or intentional misappropriation—without impeding all authorized users of the content and other

stakeholders from collaborating. |

| |

● |

Data443®

Data Placement Manager (also known as DATAEXPRESS®), a data transport, transformation, and delivery product being used by

leading financial organizations worldwide. |

| |

● |

Data443®

Access Control Manager (also known as “Resilient Access”), enables fine-grained access controls across a wide variety

of platforms at scale for internal customer systems and commercial public cloud platforms like Salesforce®, Box.Net, Google®

G Suite, Microsoft® OneDrive, and others. |

| |

● |

Data443®

Blockchain Protection Manager (also known as ClassiDocs® for Blockchain), provides an active implementation for the Ripple

XRP that protects blockchain transactions from inadvertent disclosure and data leaks. |

| |

● |

Data443®

Global Privacy Manager, a privacy compliance and consumer loss mitigation platform which is integrated with the Data443®

Data Identification Manager to do the delivery portions of GDPR and CCPA as well as process privacy-related requests under such laws,

and therefore enables customers to manage the full range of privacy-law driven requirements, such as responding to permitted consumer

demands for access or removal, as well as to remediate issues and monitor and report on status and compliance. |

| |

● |

Data443®

IntellyWP, products for enhancing the user experience for the world’s largest content management platform, WordPress. |

| |

● |

Data443®

Chat History Scanner, which scans chat messages for compliance, security, personally identifiable information (PII), personal

information (PI), payment card information (PCI) as well as any custom keywords selected by the customer, and which can be used with

third party platforms such as the Zoom Video Communications, Inc. video conferencing platform. |

| |

● |

Data443®

GDPR Framework, CCPA Framework, and LGPD Framework WordPress Plugins, which help organizations of all sizes comply with Europe,

California and Brazil privacy rules and regulations and are currently used by over 30,000 active site owners. We offer the plugins

with a freemium business model, i.e., basic features at no cost and additional or more advanced features at a premium. |

Our

Growth Strategy

Key

elements of our growth strategy include:

Acquisitions.

We intend to aggressively pursue acquisitions of other cybersecurity software and service providers focused on the data security sector.

We target companies with a developed and/or steady client base, as well as companies with offerings that complement our existing suite

of products.

Research

& Development; Innovation. We intend to increase our spending on research and development to create new and innovative products

and to improve existing products, proactively identifying and solving the data security needs of our clients.

Grow

Our Customer Base. We believe the continued challenges businesses face in managing their enterprise data and the ever-evolving landscape

of cybersecurity threats will keep the demand high for the type of products and services we offer. We intend to capitalize on this demand

by continually developing and curating a collection of products and services that are attractive and relevant to both our established

revenue base and to new customers.

Expand

Our Sales Capacity. We believe that continuing to expand our sales force will be essential to achieving our expansion and growth.

We intend to expand our sales capacity by adding sales and marketing employees, with heavy focus on customer success and leveraging our

existing customer relationships.

Our

Customers

Our

current customer base is comprised primarily of two segments – commercial enterprises and open-source consumers. Our commercial

enterprise customers are generally focused within the U.S., range from 500 employees to over 150,000 employees, and use our data security

products. We have over 10,000 commercial enterprise customers. We have approximately 20 customers in the financial technology industry

that contract with us directly for products with subscriptions with terms of more than three years. We have more than 2,500 customers

comprising mid-market-sized organizations that also contract with us directly for products with subscriptions with terms of one to three

years. Our open-source consumers are more widely distributed geographically, include organizations of all sizes in terms of both number

of employees and revenues, and typically use our online GDPR/CCPA/GLPD Privacy plugins, our Privacy Badge solution, or our user experience

enhancement products. We have over 200,000 open-source consumers with active installations of our plugins, and we have 9,000 open-source

consumers that pay a premium for additional or advanced features. We expect that some of our open-source consumers will become commercial

customers over time.

Corporate Information

Our

principal offices are located at 4000 Park Drive, Research Triangle Park, North Carolina 27709, and our telephone number

is (919) 526-1070.

Implications

of Being an Emerging Growth Company

We

qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the “JOBS

Act.” An emerging growth company may take advantage of certain reduced disclosure and other requirements that are otherwise applicable

to public companies that are not emerging growth companies. As a result, the information that we provide to stockholders may be

different than the information you may receive from other public companies in which you hold equity. For example, as long as we are an

emerging growth company:

| |

● |

we

are not required to engage an auditor to report on our internal control over financial reporting pursuant to Section 404(b) of the

Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

| |

|

|

| |

● |

we

are not required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”)

regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about

the audit and the financial statements (i.e., an auditor discussion and analysis); |

| |

|

|

| |

● |

we

are not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,”

“say-on-frequency” and “say-on-golden parachutes”; and |

| |

|

|

| |

● |

we

are not required to comply with certain disclosure requirements related to executive compensation, such as the requirement to disclose

the correlation between executive compensation and performance and the requirement to present a comparison of our Chief Executive

Officer’s compensation to our median employee compensation. |

We

may take advantage of these reduced disclosure and other requirements until we are no longer an emerging growth company. We will remain

an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.07 billion

in annual revenue; the last day of the fiscal year in which we qualify as a “large accelerated filer”; the date on which

we have, during the previous three-year period, issued more than $1.0 billion of non-convertible debt securities; and the last

day of the fiscal year in which the fifth anniversary of this offering occurs.

As

mentioned above, the JOBS Act permits us, as an emerging growth company, to take advantage of an extended transition period to comply

with new or revised accounting standards applicable to public companies. We have elected not to opt out of the extended transition period

which means that when an accounting standard is issued or revised and it has different application dates for public or private companies,

as an emerging growth company, we can adopt the new or revised standard at the time private companies adopt the new or revised standard.

As a result, our financial statements may not be comparable to the financial statements of issuers who are required

to comply with the effective dates for new or revised accounting standards that are applicable to public companies that are

not emerging growth companies, which may make comparison of our financials to those of such other public companies more

difficult.

We are also a “smaller reporting company,” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned

subsidiary of a parent company that is not a smaller reporting company. The market value of our stock held by non-affiliates plus the

proposed aggregate amount of gross proceeds to us as a result of this offering is less than $700 million and our annual revenue was less

than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company after this offering

if either (i) the market value of our stock held by non-affiliates (public float) is less than $250 million as of the last business day

of the second fiscal quarter or (ii) our annual revenue is less than $100 Million during the most recently completed fiscal year and the

market value of our stock held by non-affiliates is less than $700 million as of the last business day of the second fiscal quarter. If

we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain

disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may choose

to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar to emerging

growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation. In the event that

we are still considered a “smaller reporting company” at such time as we cease being an “emerging growth company,”

the disclosure we will be required to provide in our SEC filings will increase, but it will still be less than it would be if we were

considered neither an “emerging growth company” nor a “smaller reporting company.” Specifically, similar to “emerging

growth companies,” “smaller reporting companies” are able to provide simplified executive compensation disclosures in

their filings; are exempt from the provisions of the Sarbanes-Oxley Act requiring that independent registered public accounting firms

provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased

disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial

statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or

“smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

OFFERING

SUMMARY

| Issuer: |

|

Data443

Risk Mitigation, Inc., a Nevada corporation |

| |

|

|

| Securities

offered by us: |

|

Units (or Units if the over-allotment option is exercised in full), with each Unit consisting of one share of

our common stock and one Warrant to purchase one share of our common stock. Each Warrant will have an exercise price of $

per share (100% of the assumed public offering price of one Unit), exercisable immediately and expiring five (5) years from the

date of issuance. The Units will not be certificated or issued in stand-alone form. The shares of our common stock and the Warrants

comprising the Units are immediately separable upon issuance and will be issued separately in this offering. |

| |

|

|

| Number

of shares of common stock offered by us: |

|

shares |

| |

|

|

| Number

of Warrants offered by us: |

|

|

| |

|

|

| Number of shares of common stock offered by the Selling

Stockholders |

|

Up

to a maximum of 931,000 shares. See “Selling Stockholders” for a description

of how we calculated the number of shares offered by the Selling Stockholders. |

| |

|

|

| Public

offering price: |

|

$

per Unit(1). |

| |

|

|

| Shares

of common stock outstanding prior to the offering (1): |

|

shares. |

| |

|

|

| Shares

of common stock outstanding after the offering(2): |

|

shares ( shares if the over-allotment option is exercised in full) (assuming none of the Warrants issued in the offering

are exercised). |

| |

|

|

| Over-allotment

option: |

|

We

have granted a 45-day option to the underwriter to purchase up to additional shares of common stock and/or

Warrants at the public offering price per share of common stock and per Warrant, respectively, less, in each case, the underwriting

discounts payable by us, in any combination solely to cover over-allotments, if any. The underwriter may exercise this option in

full or in part at any time and from time to time until 45 days after the date of this Prospectus. |

| |

|

|

| Use

of proceeds: |

|

We

estimate that we will receive net proceeds of approximately $ from our sale of Units, after deducting underwriting

discounts and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to provide funding for

the following purposes: general corporate purposes and operations; acquisitions; debt repayment; expanding our sales force and inbound

and outbound marketing capabilities; technology and research and development; IT development operations and hosting facility expansion;

and working capital. We will not receive any proceeds from the sale of the Selling Stockholder

Shares by the Selling Stockholders, if any. See “Use of Proceeds”. |