Current Report Filing (8-k)

June 09 2022 - 6:06AM

Edgar (US Regulatory)

0001668370falseCA

0001668370

2022-06-08

2022-06-08

0001668370

us-gaap:CommonStockMember

2022-06-08

2022-06-08

0001668370

tblt:SeriesAWarrantsMember

2022-06-08

2022-06-08

SECURITIES AND EXCHANGE COMMISSION

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

TOUGHBUILT INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

(State or other jurisdiction |

|

|

|

|

|

|

|

|

|

|

25371 Commercentre Drive, Suite 200 |

|

|

|

|

(Address of principal executive offices) |

|

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Name of each exchange on which registered |

Common Stock, par value $0.0001 per share |

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Agreement.

On June

8

, 2022, ToughBuilt Industries, Inc., a Nevada corporation (the “

Company

”), and an accredited institutional investor (the “

Investor

”) entered into a Warrant Repurchase Agreement (the “

Agreement

”). Pursuant to the Agreement, the Investor agreed to sell to the Company

a

common stock purchase warrant issued by the Company to the Investor on November 20, 2020 (the “

”), as amended

. The Repurchase Warrant is

exercisable for 11,500,001 shares of common stock

adjusted to 76,667 shares of common stock for the Company’s reverse stock split on April 25, 2022)

for $0.05 per

Warrant Share

Warrant Share

for the 1-for-150 reverse stock split) until April 24, 2024.

As previously reported by the Company on a Form 8-K filed with the U.S. Securities and Exchange Commission on November 23, 2020,

on November 20, 2020,

the

Repurchase

Warrant was issued in exchange for a common stock purchase warrant

urchased by the Investor pursuant to a Securities Purchase Agreement, dated August 19, 2019 (the “

Purchase Agreement

”)

.

In consideration for the

Repurchase

Warrant, the Company agreed to pay the Investor an aggregate of $2.5 million in two installments: (i) $1.0 million from the

proceeds of the

Company’s currently contemplated public offering (“

Offering

”) payable at closing; and (ii) $1.5 million no less than one business day after the closing of the Offering from the cash of the Company

(the “

Closing

”). Upon the Closing, the Repurchase Warrant will be deemed cancelled and of no further force and effect.

Until the Closing, the Investor has the right to exercise the Repurchase Warrant, subject to the exercise limitations contained in the Repurchase Warrant. The Repurchase Warrant provides for a cashless exercise at the Investor’s option based on the average VWAP (as defined below) of the common stock for the twenty (20) trading days immediately prior to the time of exercise. In addition, the Investor may, in its sole discretion, elect to receive upon a cashless exercise a number of shares of common stock equal to the “

Alternate Net Number

,” that is defined in the Repurchase Warrant as being equal to 200% of the difference of (i) the quotient of (A) the product of (I) such aggregate number of Warrant Shares to be exercised hereunder pursuant to such exercise notice and (II) $150.00 (reflecting the adjustment for the 1-for-150 reverse stock split as described above), divided by (B) the Market Price, less (ii) such aggregate number of Warrant Shares to be exercised pursuant to the Investor’s exercise notice. The term “

Market Price

” is defined in the Repurchase Warrant as the higher of (i) $0.264 and (ii) the lower of (1) the closing bid price of the common stock on the trading day immediately prior to such date and (2) the volume-weighted average price (the “

VWAP

”) of the common stock on the trading day immediately prior to such date.

As of the date of this Form 8-K, the Investor holds 62,700 Repurchase Warrants.

The Agreement also extends the Investor’s right to participate in future offerings under the Purchase Agreement to until December

and provides that the Company will redeem the nine shares of Series E Non-Convertible Preferred Stock held by the Investor for $1.00 per share at Closing.

The Agreement states that it shall automatically terminate and be of no further force and effect if the Offering is not consummated by June 24,

2022.

The Agreement contain

s

customary representations and warranties.

The foregoing purports to be a summary of the Agreement only. The Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are being filed herewith:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TOUGHBUILT INDUSTRIES, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

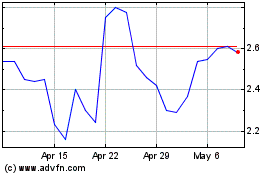

ToughBuilt Industries (NASDAQ:TBLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

ToughBuilt Industries (NASDAQ:TBLT)

Historical Stock Chart

From Apr 2023 to Apr 2024