UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of May 2022

Commission File Number: 001-39374

Inventiva S.A.

(Translation of registrant’s name into

English)

50 rue de Dijon

21121 Daix France

+33 3 80 44 75 00

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

x Form 20-F ¨ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or

other Commission filing on EDGAR.

Entry into a Material Definitive Agreement

On May 16, 2022, Inventiva S.A. (the “Registrant”)

entered into a finance contract with the European Investment Bank (“EIB”), for up to €50 million (the “Finance

Contract”) to support the Registrant’s preclinical and clinical pipeline, including to fund a portion of its Phase III clinical

trial of lanifibranor in patients with non-alcoholic steatohepatitis.

The Finance Contract provides for funding in two equal tranches of

€25 million. The disbursement of the first tranche is subject to, among other conditions, (i) the Registrant entering into a

subscription agreement to issue warrants to EIB, in a form and substance satisfactory to EIB, and (ii) the receipt by the Registrant

from the date of the Finance Contract of an aggregate amount of at least €18 million, paid either in exchange for the Registrant’s

shares, or through upfront or milestone payments. The disbursement of the second tranche is further subject to, among other conditions,

(i) the full drawdown of the first tranche, (ii) the receipt by the Registrant from the date of the Finance Contract of an aggregate

amount of at least €70 million (inclusive of the €18 million set forth above), paid either in exchange for the Registrant’s

shares, or through upfront or milestone payments, (iii) (a) an out-licensing, partnership or royalty transaction with an upfront

payment of at least €10 million, or (b) the initiation of a Phase III clinical trial of cedirogant by AbbVie Inc; and (iv) evidence

of at least (a) 850 patients enrolled, or (b) 650 patients enrolled and 300 sites activated, globally in the Registrant’s

Phase III clinical trial of lanifibranor. Any funds not disbursed within 36 months following the execution of the Finance Contract shall

be cancelled.

Borrowings under the Finance Contract shall bear an interest rate equal

to 8% per annum for the first tranche and 7% per annum for the second tranche. The interest shall be capitalised annually, starting on

the first anniversary of the disbursement of the relevant tranche. Each tranche shall be repayable in a single instalment on the maturity

date of the relevant tranche, which shall be no later than four years after the disbursement of the first tranche and no later than three

years after the disbursement of the second tranche. The Finance Contract may be prepaid, in whole or in part, for a prepayment fee, either

at the election of the Registrant or as a result of EIB’s demand following certain prepayment events, including a change of control

or change in senior management of the Registrant. The prepayment fee shall be equal to 6% of the prepayment amount in the first year after

disbursement, 4% of the prepayment amount in the second year after disbursement, 3% of the prepayment amount in the third year after disbursement

and 2% of the prepayment amount after the third year after disbursement. Subject to certain terms and conditions, upon the occurrence

of an event of default, EIB may demand immediate repayment by the Registrant of all or part of the outstanding funds, together with accrued

interest, any prepayment fee, and all other accrued or outstanding amounts under the Finance Contract, and/or cancel the undisbursed tranches.

Such events of default include: (i) any amount payable to EIB not being paid by the due date, (ii) any information, document,

representation, warranty or statement given to the EIB proving to be incorrect, incomplete or misleading (iii) any default in relation

to any loan, or any obligation arising out of any financial transaction, (iv) if the Registrant enters a state of suspension of payments

(cessation des paiements) or is unable to pay its debts as they fall due, and (iv) any corporate action, legal proceedings

or other procedure or step is taken in relation to the suspension of payments, a moratorium of any indebtedness, dissolution, administration

or reorganisation, or if the Registrant takes steps towards a substantial reduction in its capital, is declared insolvent or ceases or

resolves to cease to carry on the whole or any substantial part of its business or activities.

The Finance Contract contains certain representations and warranties

provided by the Registrant, and the Registrant shall pay all taxes, duties, fees and other impositions applied in connection with the

Finance Contract. The Finance Contract shall be governed by French law, and any dispute arising under the Finance Contract shall be subject

to the jurisdiction of the Courts of Paris.

In connection with the Finance Contract, the Registrant has also agreed

to issue warrants to EIB as a condition to the funding of each tranche. The warrants shall be issued under a subscription agreement, to

be negotiated and entered into by the parties in a form and substance satisfactory to EIB, which shall be entered into as a condition

precedent for the disbursement of the first tranche under the Finance Contract. The number of warrants to be issued to EIB will be determined

based on (i) the aggregate amount paid either in exchange for the Registrant’s shares, or through upfront or milestone payments,

from the date of the Finance Contract to the time of the disbursement of the relevant tranche, and (ii)(a) the average price per

share paid for the Registrant’s shares in its most recent qualifying equity offering, or (b) for the first tranche only, in

case of no qualifying equity offering, the average price per share of the Registrant’s shares over the last 90 trading days. The

subscription price shall be €0.01 per warrant, which shall be offset by an arrangement fee of €0.01 per warrant to be paid by

the Registrant to EIB.

The warrants shall be exercisable for a period of twelve years following

the earliest to occur of (i) a change of control event, (ii) the maturity date of the first tranche, (iii) an event of

default under the Finance Contract, or (iv) a repayment demand by the EIB under the Finance Contract. The warrants shall automatically

be deemed null and void if they are not exercised after twelve years. Subject to certain terms and conditions, each warrant will entitle

EIB to one of the Registrant’s shares in exchange for the exercise price. The exercise price will be equal to 95% of the volume

weighted average of the trading price of the Registrant’s shares over an agreed upon period. EIB shall be entitled to a put option

to require the Registrant to buy back all or part of the warrants then exercisable but not yet exercised, subject to certain terms and

conditions. Furthermore, the Registrant shall be entitled to a call option to require EIB to sell to the Registrant all shares and other

securities, including the warrants, and a right of first refusal to buy back any warrants that are offered for sale to a third party,

subject to certain terms and conditions.

A copy of the press release issued on May 16, 2022 in connection

with the Finance Contract is attached hereto as Exhibit 99.1. The description of the Finance Contract is qualified in its entirety

by the Finance Contract, a copy of which is attached hereto as Exhibit 99.2, and is incorporated herein by reference.

Forward-Looking Statements

This report on Form 6-K contains “forward-looking statements”

within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements

of historical facts, included in this Form 6-K are forward-looking statements. These statements include, but are not limited to,

the Registrant’s ability to enter into the subscription agreement for the warrants and to satisfy the conditions precedent to receive

the funds under the Finance Contract; potential future financings and strategic transactions, milestone payments, royalties and product

sales, future activities, expectations, plans, growth and prospects of the Registrant. Certain of these statements, forecasts and estimates

can be recognized by the use of words such as, without limitation, “believes”, “anticipates”, “expects”,

“intends”, “plans”, “seeks”, “estimates”, “may”, “will”, “would”,

“could”, “might”, “should”, and “continue” and similar expressions. Such statements are

not historical facts but rather are statements of future expectations and other forward-looking statements that are based on management’s

beliefs. These statements reflect such views and assumptions prevailing as of the date of the statements and involve known and unknown

risks and uncertainties that could cause future results, performance or future events to differ materially from those expressed or implied

in such statements. Actual events are difficult to predict and may depend upon factors that are beyond the Registrant’s control.

There can be no guarantees with respect to pipeline product candidates that the clinical trial results will be available on their anticipated

timeline, that future clinical trials, including the Phase III clinical trial of cedirogant by AbbVie Inc, will be initiated as anticipated,

that product candidates will receive the necessary regulatory approvals, that any of the anticipated milestones by the Registrant or its

partners will be reached or that conditions precedent to receive funds under the Finance Contract will be met on their expected timeline,

or at all. Actual results may turn out to be materially different from the anticipated future results, performance or achievements expressed

or implied by such statements, forecasts and estimates, due to a number of factors, including that the Registrant is a clinical-stage

company with no approved products and no historical product revenues, it has incurred significant losses since inception, has a limited

operating history and has never generated any revenue from product sales, the Registrant will require additional capital to finance its

operations, the Registrant’s future success is dependent on the successful clinical development, regulatory approval and subsequent

commercialization of current and any future product candidates, preclinical studies or earlier clinical trials are not necessarily predictive

of future results and the results of the Registrant’s or AbbVie Inc.’s clinical trials may not support their product candidate

claims, the Registrant or AbbVie Inc. may encounter substantial delays in their clinical trials or may fail to demonstrate safety and

efficacy to the satisfaction of applicable regulatory authorities, enrollment and retention of patients in clinical trials is an expensive

and time-consuming process and could be made more difficult or rendered impossible by multiple factors outside the Registrant’s

control, the Registrant’s financial condition and results of operations could be materially and adversely affected by the current

COVID-19 pandemic and geopolitical events, such as the conflict between Russia and Ukraine, which could delay the initiation, enrolment

and completion of the Registrant’s clinical trials on anticipated timelines or at all. Given these risks and uncertainties, no representations

are made as to the accuracy or fairness of such forward-looking statements, forecasts and estimates. Furthermore, forward-looking statements,

forecasts and estimates only speak as of the date of this report. Readers are cautioned not to place undue reliance on any of these forward-looking

statements.

Please refer to the Universal Registration Document for the year ended

December 31, 2021 filed with the Autorité des marchés financiers on March 11, 2022 under no. D.22-0090 and the

Annual Report on Form 20-F for the year ended December 31, 2021 filed with the Securities and Exchange Commission on March 11,

2022 for additional information in relation to such factors, risks and uncertainties.

All information in this report on Form 6-K is as of the date of

the report. Except as required by law, the Registrant has no intention and is under no obligation to update or review the forward-looking

statements referred to above.

EXHIBIT INDEX

Exhibit 99.1. Press Release dated May 16, 2022

Exhibit 99.2. Finance Contract between the European Investment Bank and Inventiva S.A. dated May 16, 2022

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Inventiva S.A. |

| |

|

|

| Date: May 16, 2022 |

By: |

/s/ Frédéric Cren |

| |

|

Name |

Frédéric Cren |

| |

|

Title: |

Chief Executive Officer |

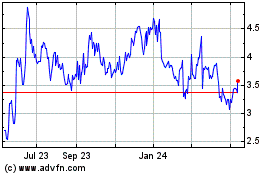

Inventiva (NASDAQ:IVA)

Historical Stock Chart

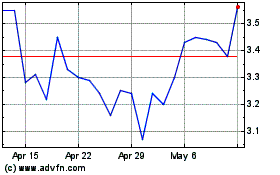

From Mar 2024 to Apr 2024

Inventiva (NASDAQ:IVA)

Historical Stock Chart

From Apr 2023 to Apr 2024