UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2022

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

[Free English Translation]

BANCO SANTANDER (BRASIL) S.A.

Public Company with Authorized Capital

Taxpayer Registry Number (CNPJ/ME) 90.400.888/0001-42

Company Registry Number (NIRE) 35.300.332.067

MINUTE OF THE ORDINARY GENERAL MEETING HELD

ON APRIL 29th, 2022

DATE, TIME, AND PLACE: April 29th,

2022, at 3 p.m., at the headquarters of Banco Santander (Brasil) S.A. (“Santander Brasil” or “Company”)

located in the city of São Paulo, State of São Paulo, at Avenida Presidente Juscelino Kubitschek, No. 2041 – CJ 281,

Bloco A, Cond. Wtorre JK - Vila Nova Conceição - CEP 04543-011

INSTALLATION QUORUM: Shareholders representing

94.61% of the voting capital of the Company, as verified by the signatures in the Shareholders' Attendance Book and considering the remote

voting forms, as per the summarized voting map disclosed by the Company.

LEGAL ATTENDANCE: (i) the Company’s

Officers Messrs. Reginaldo Antonio Ribeiro and Amancio Acurcio Gouveia; (ii) Mr. Diego Santos Almeida, Company´s accountant; (iii)

Mr. José Roberto Machado Filho, Member of the Company’s Fiscal Council; and (iv) Mr. Caio Arantes, representing PricewaterhouseCoopers

Auditores Independentes, external auditor of the Company.

BOARD: Mr. Daniel Pareto, as President;

and Mrs. Carolina Trindade, as Secretary.

CALL AND LEGAL PUBLICATIONS: (1) Call

notice published in the newspaper “Valor Econômico”, editions of March 28, 29 and 30, 2022; and (2) Financial

Statements of the Company related to the fiscal year ended on December 31st, 2021, jointly with the Management Report, the

balance sheet, other documents part of the financial statements, external auditors’ opinion, Audit Committee Report and the Fiscal

Council’s opinion, published in the DOESP and in the newspaper Valor Econômico, on February 3rd, 2022.

AGENDA: (a) To TAKE the management accounts,

examining, discussing and voting the Company’s Financial Statements related to the fiscal year ended on December 31, 2021, jointly

with the Management Report, the balance sheet, other parts of the financial statements, external auditors’ opinion and the Audit

Committee Report; (b) To DECIDE on the destination of the net profit of the fiscal year of 2021 and the distribution of dividends;

and (c) To FIX the annual overall compensation of the Company´s management and members of Audit Committee.

READING OF DOCUMENTS, VOTING, AND DRAFTING

OF THE MINUTES: (1) The reading of the documents related to the Agenda was dismissed, considering that they are entirely knew by

the shareholders and were disclosed on the Brazilian Securities and Exchange Commission website (Comissão de Valores Mobiliários

- “CVM” - www.cvm.gov.br) on March

25th, 2022, as per Instruction CVM No. 481/2009, as amended; (2) The declarations of votes, objections and divergences

submitted shall be numbered, received and certified by the Board and shall be kept filed at the Company’s headquarters, pursuant

to Article 130, first paragraph, of Law No. 6,404/76, as amended, and will be sent to the CVM by means of an electronic system available

on the CVM's website in the world computer network, pursuant to Article 21, X, of CVM Instruction 480/2009, as amended; and (3)

Authorized the drafting of these minutes as summary, and its publishing without the signatures of all the attending shareholders, pursuant

to Article 130, paragraphs 1st and 2nd, of the Brazilian Corporations Law.

REMOTE VOTING: The attending shareholders

resolved to dismiss the reading of the Consolidate Voting Map disclosed to market on April 28th, 2022, pursuant to the §

4 of Article 21-W of CVM Instruction No. 481/2009, introduced by CVM Instruction No. 561/2015, which was made available for shareholders'

appreciation. With regard to the provisions of Subsection II of § 5 of the aforementioned Article 21-W, it is recorded that the participating

shareholders had no interest in altering the vote casted through the remote voting ballots.

RESOLUTIONS: Following the discussions

related to the Agenda’s matters, the attending shareholders of the Company resolved to, with abstention of the prevent shareholders:

(a) TO APPROVE by majority, with 3,607,970,756

favorable votes, 48,089 against votes and 4,691,394 abstentions, the management accounts, and the Company’s Financial Statements

related to the fiscal year ended December 31st, 2021, jointly with the Management Report, the balance sheet, other parts of

the financial statements, external auditors’ opinion, Audit Committee Report and the Fiscal Council’s opinion, everything

as proposed by the Board of Executive Officers, as per the meeting held on February 1st , 2022, and favorable opinion of the

Board of Directors and Fiscal Council, according to the meetings held on February 1st, 2022;

(b) TO APPROVE by majority, with 3,612,517,498

favorable votes, 110,416 against votes and 82,325 abstentions, the destination of the net profit of the fiscal year ended on December

31st, 2020, in the amount of R$ 14,995,509,351.03, as follows: a) five per cent (5%), corresponding to R$

749,775,467.55 to the Legal Reserve; b) R$ 10,749,000,000.00 were distributed to shareholders as Dividends and Interest on

Equity, as follows: Dividends: b.1) R$ 7,100,000.00 according to the resolution took in the Board of Directors’ meetings

held on April 27, 2021, October 26, 2021 and February 1, 2022 and paid from June 2, 2021, December 3, 2021 and March 4, 2022 respectively; and Interest on Equity:

b.2) R$ 3,649,000,000.00

as approved at the Company’s Board of Directors’ meetings held on July 27, 2021 and December 28, 2021 and paid from September

3, 2021 and February 3, 2022 respectively; and c) R$ 4,796,733,883.48 to the Dividend Equalization Reserve, pursuant to Article

36, item III-a of the Company's Bylaws;

(c) TO FIX by majority, with 3,569,854,433

favorable votes, 42,728,651 against votes and 127,152 abstentions, the annual overall compensation of the Company´s management,

in the total amount of up to R$ 504,550,000.00 for the fiscal year of 2022 and the compensation of the Audit Committee in the amount of

up to R$ 4,000,000.00, for a twelve-month (12) period beginning on January 1st, 2022, as proposed in the Management Proposal

disclosed March 25th, 2022. The Board of Directors will deliberate on the individual compensation of the members of the management;

[and

(d)

Shareholders representing 1.00 % of preferred shares, pursuant to CVM Resolution 77/22, requested the installation of the Fiscal Council

for the fiscal year 2021, in accordance to the Articles 161 and 162 of the Brazilian Corporations Law, and the following were elected:

(i) in a separate vote, by the majority of shareholders holding preferred shares without voting rights, registering the abstention

of the shareholders BANCO SANTANDER, S.A.; GRUPO EMPRESARIAL SANTANDER, S.L.; STERREBEECK, B.V; ABERDEEN STANDARD SICAV I - DIVERSIFIED

INCOME FUND, ALQUITY SICAV - ALQUITY FUTURE WORLD FUND; ALQUITY SICAV - ALQUITY FUTURE WORLD GLOBAL IMPACT FUND; SEB STIFTELSEF UTLAND;

SEB VARLDENFOND; IT NOW IBOVESPA FUNDO DE ÍNDICE; IT NOW IDIV FUNDO DE INDICE; IT NOW IFNC FUNDO DE ÍNDICE; IT NOW ISE FUNDO

DE INDICE; ITAU CAIXA ACOES FI; ITAU FTSE RAFI BRAZIL 50 CAPPED INDEX FIA; ITAU HEDGE PLUS MULTIMERCADO FI; ITAU IBOVESPA ATIVO MASTER

FIA; ITAU INDEX ACOES IBRX FI; ITAÚ AÇÕES DIVIDENDOS FI; ITAÚ EXCELÊNCIA SOCIAL AÇÕES

FUNDO DE INVESTIMENTO; ITAÚ HEDGE MULTIMERCADO FUNDO DE INVESTIMENTO; ITAÚ IBRX ATIVO MASTER FIA; ITAÚ INDEX AÇÕES

IBOVESPA FI; ITAÚ LONG AND SHORT PLUS MULTIMERCADO FI; ITAÚ MASTER GLOBAL DIN MICO MULTIMERCADO FUNDO DE INVESTIMENTO;

ITAÚ MASTER GLOBAL DIN MICO ULTRA MULTIMERCADO FUNDO DE INVESTIMENTO; ITAÚ MASTER HU MULTIMERCADO FUNDO DE INVESTIMENTO;

ITAÚ MULTIMERCADO GLOBAL EQUITY HEDGE FI; ITAÚ MULTIMERCADO LONG AND SHORT FI; ITAÚ PREVIDÊNCIA IBRX FIA; ITAÚ

S&P B3 LOW VOLATILITY FUNDO DE INVESTIMENTO EM AÇÕES; LONG BIAS MULTIMERCADO FI; QUANTAMENTAL HEDGE MASTER FUNDO DE

INVESTIMENTO MULTIMERCADO; CANDRIAM GLOBAL EMERGING MARKETS

EQUITIES FUND LP; ALLIANZ EQUITY EMERGING MARKETS 1;

AMUNDI ESG GLOBAL LOW CARBON FUND; AMUNDI INDEX SOLUTIONS; CANDRIAM EQUITIES L; CANDRIAM SUSTAINABLE; GLOBAL MULTI-FACTOR EQUITY FUND;

ITAÚ MASTER MULTI QUANT MM FI; and THE BANK OF

NEW YORK MELLON attending the Meeting, Mrs. Louise Barsi, Brazilian, economist, bearer of the Identity Card RG No. 35.288.007-7,

enrolled with CPF/ME under No. 343.307.008-32,

resident and domiciled in São Paulo, State of São Paulo, at Nagib Izar, n° 248, apartment 261, CEP 03337-070; and as

her alternate, Mr. Valmir Pedro Rossi, Brazilian, married, banker, bearer of the Identity Card RG No. 55080446-8, enrolled with

CPF/ME under No. 276.266.790-91, resident and domiciled in São Paulo, State of São Paulo, with office at street Carlos Steinen,

n° 335, apartment 31, CEP 04004-012; (ii) by other shareholders attending the Meeting, registering the abstention of the shareholders

ABERDEEN STANDARD SICAV I - DIVERSIFIED INCOME FUND, ALQUITY

SICAV - ALQUITY FUTURE WORLD FUND; ALQUITY SICAV - ALQUITY FUTURE WORLD GLOBAL IMPACT FUND; SEB STIFTELSEF UTLAND; SEB VARLDENFOND; IT

NOW IBOVESPA FUNDO DE ÍNDICE; IT NOW IDIV FUNDO DE INDICE; IT NOW IFNC FUNDO DE ÍNDICE; IT NOW ISE FUNDO DE INDICE; ITAU

CAIXA ACOES FI; ITAU FTSE RAFI BRAZIL 50 CAPPED INDEX FIA; ITAU HEDGE PLUS MULTIMERCADO FI; ITAU IBOVESPA ATIVO MASTER FIA; ITAU INDEX

ACOES IBRX FI; ITAÚ AÇÕES DIVIDENDOS FI; ITAÚ EXCELÊNCIA SOCIAL AÇÕES FUNDO DE INVESTIMENTO;

ITAÚ HEDGE MULTIMERCADO FUNDO DE INVESTIMENTO; ITAÚ IBRX ATIVO MASTER FIA; ITAÚ INDEX AÇÕES IBOVESPA

FI; ITAÚ LONG AND SHORT PLUS MULTIMERCADO FI; ITAÚ MASTER GLOBAL DIN MICO MULTIMERCADO FUNDO DE INVESTIMENTO; ITAÚ

MASTER GLOBAL DIN MICO ULTRA MULTIMERCADO FUNDO DE INVESTIMENTO; ITAÚ MASTER HU MULTIMERCADO FUNDO DE INVESTIMENTO; ITAÚ

MULTIMERCADO GLOBAL EQUITY HEDGE FI; ITAÚ MULTIMERCADO LONG AND SHORT FI; ITAÚ PREVIDÊNCIA IBRX FIA; ITAÚ S&P

B3 LOW VOLATILITY FUNDO DE INVESTIMENTO EM AÇÕES; LONG BIAS MULTIMERCADO FI; QUANTAMENTAL HEDGE MASTER FUNDO DE INVESTIMENTO

MULTIMERCADO; CANDRIAM GLOBAL EMERGING MARKETS EQUITIES

FUND LP; ALLIANZ EQUITY EMERGING MARKETS 1; AMUNDI ESG

GLOBAL LOW CARBON FUND; AMUNDI INDEX SOLUTIONS; CANDRIAM EQUITIES L; CANDRIAM SUSTAINABLE; GLOBAL MULTI-FACTOR EQUITY FUND; ITAÚ

MASTER MULTI QUANT MM FI; PRISMA FIA; LUIZ BARSI FILHO e THE

BANK OF NEW YORK MELLON, Mr. José Roberto Machado Filho, Brazilian, married, engineer, bearer of the Identity Card RG No.

17.421.547-2 SSP/SP, enrolled with CPF/ME under No. 116.001.028-59, domiciled in São Paulo, State of São Paulo, resident

and domiciled at Avenida Presidente Juscelino Kubitschek nº 2041, CJ 281, Bloco A, Cond. Wtorre JK - Vila Nova Conceição,

CEP 04543-011; and, as his alternate, Mr. Manoel Marcos Madureira, Brazilian, married, engineer, bearer of the Identity

Card RG No. 5.948.737 SSP-SP, enrolled with CPF/ME under No. 885.024.068-68, domiciled in São Paulo, State of São Paulo,

at Avenida Presidente Juscelino Kubitschek nº 2041, CJ 281, Bloco A, Cond. Wtorre JK - Vila Nova Conceição, CEP 04543-011;

Mrs. Cassia Maria Matsuno Chibante, Brazilian, married, banker, bearer of the Identity Card RG No. 23.824.955 SSP/SP, enrolled

with CPF/ME under No. 289.400.948-83, domiciled in São Paulo, State of São Paulo, at Avenida Presidente Juscelino Kubitschek

nº 2041, CJ 281, Bloco A, Cond. Wtorre JK - Vila Nova Conceição, CEP 04543-011;;

and, as his alternate, Mr. Luciano Faleiros Paolucci, Brazilian, single, lawyer, bearer of the Identity Card No. 233.188

(OAB/SP), enrolled with CPF/ME under No. 181.017.248-93, domiciled in São Paulo, State of São

Paulo, at Avenida

Presidente Juscelino Kubitschek nº 2041, CJ 281, Bloco A, Cond. Wtorre JK - Vila Nova Conceição, CEP 04543-011;.

The members of the Fiscal Council will have a mandate that shall be enforce until the next Ordinary General Meeting of the Company, in

the terms of the second paragraph of the Article 162 of the Brazilian Corporate Law. The effectives and alternates elected members of

the Fiscal Council must declare to the Company that they have no legal impediment that prevents their election and investiture of the

position of fiscal councilor and that they meet the legal requirements for the exercise of the function, and shall only take office to

the positions to which they have been elected after authorization of their appointment by the Brazilian Central Bank. The elected members

of the Fiscal Council shall be invested in their positions by signing a term of office in the proper book, which shall remain filed at

the Company's headquarters. It was also approved, by majority, with 3,438,133,849 favorable votes and 174,576,390 abstentions, the monthly

compensation of the Fiscal Council members until the next Company's Ordinary General Meeting, in the amount of R$ R$11,985.00 (eleven

thousand, nine hundred and eighty-five reais) to the effective members of the Fiscal Council, being that alternate members should only

be remunerated when replacing the effective members in case of vacancy, absence or temporary impediment.]

CLOSING: There being no further matters

to be resolved, the Meeting was finalized, and these minutes have been prepared, which were read, approved, and signed by the Board members

and the attending shareholders.

SIGNATURES: Daniel Pareto –

President; Carolina Trindade – Secretary. Shareholders: BANCO SANTANDER, S.A. – Bruno Garcia Rosa Carneiro, attorney-in-fact;

GRUPO EMPRESARIAL SANTANDER, S.L. – Bruno Garcia Rosa Carneiro, attorney-in-fact; and STERREBEECK, B.V. – Bruno Garcia Rosa

Carneiro, attorney-in-fact; ABU DHABI RETIREMENT PENSIONS AND BENEFITS FUND; ALLIANZ GL INVESTORS GMBH ON BEHALF OF ALLIANZGI-FONDS DSPT;

AMONIS NV; ARTEMIS FUNDS (LUX) - GLOBAL EMERGING MARKETS; ARTEMIS GLOBAL EMERGING MARKETS FUND; AUSTRALIANSUPER PTY LTD AS TRUSTEE FOR;

AVIVA I INVESTMENT FUNDS ICVC - AVIVA I INTERNATIONAL I T F; AVIVA INVESTORS; AVIVA LIFE PENSIONS UK LIMITED; BLACKROCK ASSET MANAG IR

LT I ITS CAP A M F T BKR I S FD; BLACKROCK BALANCED CAPITAL PORTFOLIO OF BLACKROCK SERIES FUN; BLACKROCK CDN MSCI EMERGING MARKETS INDEX

FUND; BUREAU OF LABOR FUNDS - LABOR RETIREMENT FUND; BUREAU OF LABOR FUNDS-LABOR PENSION FUND; CANDRIAM GLOBAL SUSTAINABLE EMERGING MKTS

EQUITIES FUND LP; CONNECTICUT GENERAL LIFE INSURANCE COMPANY; CONSTRUCTION BUILDING UNIONS SUPER FUND; EMERGING MARKETS ALPHA TILTS-ENHANCED

FUND; EMERGING MARKETS EQUITY INDEX ESG SCREENED FUND B; EMERGING MARKETS EQUITY INDEX MASTER FUND; EMERGING MARKETS EX CHINA ALPHA TILTS

- ENHANCED FUND; EMERGING MARKETS INDEX NON-LENDABLE FUND; EMERGING MARKETS INDEX NON-LENDABLE FUND B; EQ/EMERGING MARKETS EQUITY PLUS

PORTFOLIO; FIDEICOMISO FAE; FIDELITY INVESTMENT FUNDS FIDELITY INDEX EMERG MARKETS FUND; FLEXSHARES EMERGING MARKETS LOW VOLATILITY CLIMATE;

FORSTA AP-FONDEN; GLOBAL ALL CAP ALPHA TILTS FUND; H.E.S.T.

AUSTRALIA LIMITED; INVESTERINGSFORENINGEN

NORDEA INVEST EMERGING MKTS E. KL; ISHARES EMERGING MARKETS IMI EQUITY INDEX FUND –

by means of remote voting procedure; ABERDEEN STANDARD SICAV I - DIVERSIFIED INCOME FUND, ALQUITY SICAV - ALQUITY FUTURE WORLD FUND;

ALQUITY SICAV - ALQUITY FUTURE WORLD GLOBAL IMPACT FUND; SEB STIFTELSEF UTLAND; SEB VARLDENFOND; IT NOW IBOVESPA FUNDO DE ÍNDICE;

IT NOW IDIV FUNDO DE INDICE; IT NOW IFNC FUNDO DE ÍNDICE; IT NOW ISE FUNDO DE INDICE; ITAU CAIXA ACOES FI; ITAU FTSE RAFI BRAZIL

50 CAPPED INDEX FIA; ITAU HEDGE PLUS MULTIMERCADO FI; ITAU IBOVESPA ATIVO MASTER FIA; ITAU INDEX ACOES IBRX FI; ITAÚ AÇÕES

DIVIDENDOS FI; ITAÚ EXCELÊNCIA SOCIAL AÇÕES FUNDO DE INVESTIMENTO; ITAÚ HEDGE MULTIMERCADO FUNDO DE

INVESTIMENTO; ITAÚ IBRX ATIVO MASTER FIA; ITAÚ INDEX AÇÕES IBOVESPA FI; ITAÚ LONG AND SHORT PLUS MULTIMERCADO

FI; ITAÚ MASTER GLOBAL DIN MICO MULTIMERCADO FUNDO DE INVESTIMENTO; ITAÚ MASTER GLOBAL DIN MICO ULTRA MULTIMERCADO

FUNDO DE INVESTIMENTO; ITAÚ MASTER HU MULTIMERCADO FUNDO DE INVESTIMENTO; ITAÚ MULTIMERCADO GLOBAL EQUITY HEDGE FI; ITAÚ

MULTIMERCADO LONG AND SHORT FI; ITAÚ PREVIDÊNCIA IBRX FIA; ITAÚ S&P B3 LOW VOLATILITY FUNDO DE INVESTIMENTO EM

AÇÕES; LONG BIAS MULTIMERCADO FI; QUANTAMENTAL HEDGE MASTER FUNDO DE INVESTIMENTO MULTIMERCADO; CANDRIAM

GLOBAL EMERGING MARKETS EQUITIES FUND LP; ALLIANZ

EQUITY EMERGING MARKETS 1; AMUNDI ESG GLOBAL LOW CARBON FUND; AMUNDI INDEX SOLUTIONS; CANDRIAM EQUITIES L; CANDRIAM SUSTAINABLE; GLOBAL

MULTI-FACTOR EQUITY FUND; ITAÚ MASTER MULTI QUANT MM F–

Joyce Costacurta Pacheco, attorney in fact; PRISMA FIA, Caio Cezar Monteiro Ramalho, attorney in fact; Luiz Barsi Filho, João Vicente

Silva Machado, attorney in fact; and THE BANK OF NEW YORK MELLON – Bruno Garcia Rosa Carneiro, attorney-in-fact.

We certify that this is a true transcript of

the minutes recorded in the Minutes of the General Meeting Book of the Company.

|

Daniel Pareto

President |

Carolina Trindade

Secretary |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: April 29, 2022

|

Banco Santander (Brasil) S.A. |

|

|

|

|

By: |

/S/ Amancio Acurcio Gouveia

|

|

| |

Amancio Acurcio Gouveia

Officer Without Specific Designation

|

|

|

|

|

|

|

|

|

|

|

By: |

/S/ Angel Santodomingo Martell

|

|

| |

Angel Santodomingo Martell

Vice - President Executive Officer

|

|

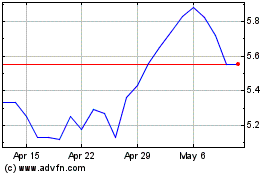

Banco Santander Brasil (NYSE:BSBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

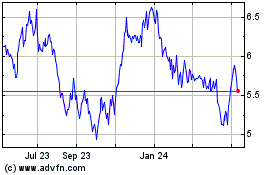

Banco Santander Brasil (NYSE:BSBR)

Historical Stock Chart

From Apr 2023 to Apr 2024