UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

|

Filed by the Registrant

|

☐

|

|

Filed by a Party other than the Registrant

|

☑

|

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, For Use of the Commission Only (as

permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☑

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

GENWORTH FINANCIAL, INC.

(Name of Registrant as Specified in Its Charter)

SCOTT KLARQUIST

(Name of Person(s) Filing Proxy Statement, if Other Than the

Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

No fee required.

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth

the amount on which the filing fee is calculated and

state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials:

|

|

☐

|

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing

for which the offsetting fee was paid previously.

Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its

filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

Scott Klarquist has filed a definitive proxy statement, dated April 19,

2022, and accompanying BLUE proxy card with the Securities and Exchange

Commission ("SEC") to be used to solicit votes against certain director

nominees at the 2022 annual meeting of shareholders of Genworth

Financial, Inc., a Delaware corporation (the "Company").

On April 29, 2022, Mr Klarquist issued the attached letter to

shareholders:

Dear Fellow Genworth Financial, Inc. Shareholder:

The undersigned, Scott Klarquist ("Mr Klarquist", "I" or "me"), currently

owns 50,100 shares of Genworth Financial, Inc., a Delaware corporation

("Genworth", "GNW" or the "Company"), which is more shares than all of our

Company's so-called "independent" directors have purchased during the past

five years combined.

Mr Klarquist has decided to initiate a "Vote No" proxy solicitation

with respect to Genworth's 2022 annual meeting (scheduled for May 19 th) and is urging shareholders to vote to (A) WITHHOLD their

votes with respect to the election of each of Karen E. Dyson, Jill R.

Goodman, Melina E. Higgins and Robert P. Restrepo Jr. (collectively,

the "Compensation Committee Directors") to our Board at the Annual

Meeting [Proposal 1] and (B) vote AGAINST approval of the advisory vote

on Genworth's executive compensation [Proposal 2].

If you have received a WHITE proxy card from Genworth, you can vote in

accordance with the foregoing recommendations-but please make sure to do so

ASAP, as the annual meeting is just a couple weeks away.

Why a "Vote No" campaign against Genworth's Compensation Committee

Directors? Incentives determine outcomes. As Charlie Munger has said,

"Never, ever, think about something else when you should be thinking about

the power of incentives." By far the most important incentives for any

corporate executive are the terms of such executive's short and long-term

compensation.

Unfortunately, Genworth's senior executive compensation appears deeply

flawed and does not, in Mr Klarquist's opinion, properly align the

financial incentives of Genworth's senior executives with those of the

true owners of the company, its shareholders.

Consider the following data points:

1. Per our Company's SEC filings,

Genworth's CEO James McInerney has been awarded $70 million in total

compensation by our Board since he took office on January 1, 2013

through December 31, 2021 (including $30 million in total cash

compensation), while during that period shareholders have suffered a

total loss of approximately 50% on their investment in Genworth stock

(including receiving zero dividends)

. All during a raging bull market, with the S&P 500 up over 200% (plus

dividends)!

2.

In 2011, the top five Genworth executives received a total of $11.5

million in compensation, while last year Genworth's five most senior

executives received $30 million in total, or 2.6X 2011's total

compensation

. This represents an annual increase of over 10% during the 2011-2021

period, despite (A) the consumer price index (or CPI) increasing under 2%

per year during the same time frame and (B) GNW's total shareholder return

(TSR) trailing the S&P 500's TSR during the decade by approximately

300%.

3. During the past five years, despite Genworth's stock price remaining

basically stagnant and the company paying zero dividends,

GNW's 5 most-highly compensated NEOs received in excess of 120% of

their targeted annual cash bonus amounts in

25 out of 25 instances (i.e., 100% "above target" awards)

.

4.

Over the past 5 years, none of the short-term compensation for GNW's

NEOs has been tied to any TSR metric or hurdle

and, prior to 2021, none of GNW's long-term NEO compensation was tied to

GNW's TSR.

5. In 2021, GNW belatedly instituted a TSR component for long-term NEO

incentive compensation, but this applies to just 20% of such compensation

(80% of the 2021-2023 LTI compensation remains untethered to GNW's TSR

versus any relevant benchmark).

6. In demonstrating the Compensation Committee Directors' apparently

uncanny ability to devise new ways to distribute shareholder money to

Genworth's senior executives, the Company's Proxy on Pages 65-66 discloses

that

Genworth (meaning us, the shareholders) not only paid a so-called "Cash

Retention Bonus" of $3,000,000 to Enact's CEO Gupta in 2021 (aren't his

Base Salary plus various cash and stock bonuses retention payments

enough?), but it also paid a so-called "Cash Separation Payment" of

$1,875,000 to Genworth's former COO Schneider, who quit in January 2021

(in return for quitting, Mr Schneider also received a pro-rated annual

incentive payment of $468,750, payments related to health benefits of

$51,374 and accelerated RSU vesting with an aggregate value of $753,719).

7. The Company's Proxy (Page 52) claims that the 2021 short-term incentive

compensation for CEO McInerney was determined "based on the achievement of

the financial and strategic measures indicated below", yet no such

financial or strategic measures, nor any percentage weightings for such

measures for bonus purposes, are listed therein. (In last year's proxy

statement, such measures appeared, but only 34% of the CEO's annual

incentive pay that year was tied to specific financial metrics, while

two-thirds was based on undefined and unmeasured objectives like "Right

Size Organization" and "Close China Oceanwide Transaction OR Implement

Strategic Alternatives" (truly a Pass/Fail test if I've ever seen one!))

Our Compensation Committee Directors also lauded him for "developing

and executing a new strategy after the China Oceanwide transaction" and

decided to grant him a bonus for 2021 equal to 150% of his targeted

amount (why 150%?),

when I believe he should have been reprimanded (not rewarded) by the

Board for allowing the China Oceanwide debacle to drag on so long in

the first place

.

This largesse to company insiders appears all the more insulting to

Genworth shareholders in light of the Company's board backing no less than

17 extensions of the doomed China Oceanwide merger without any ticking

or termination fee (note that Directors Higgins and Restrepo were both

on our Board throughout the entirety of this fiasco)

, resulting in the waste, in Mr Klarquist's estimation, of untold millions

of shareholder funds and thousands of Genworth employee man-hours. While

CEO McInerney and his C-suite friends likely enjoy receiving millions in

cash compensation per year courtesy of the shareholders regardless of

whether the shareholders win or lose (what insider wouldn't?), they

apparently are not willing to bet on their own stewardship of our Company

via our stock.

CEO McInerney, for example, has been dumping GNW shares in recent

months at a staggering pace. Per his SEC Form 4 filings, he sold

150,000 shares on the open market last November 15th and jettisoned

another 150,000 shares on the open market on February 22nd, in addition

to selling an additional 1,005,609 shares on March 1st as part of a PSU

vesting, in each case at a small fraction of Genworth's reported book

value

. In fact, the only insider (including C-suite and board members) who has

bought Genworth stock on the open market in recent years did so precisely

two days after I initiated the process to conduct a proxy campaign against

Genworth's incumbent leadership. Clearly something seems amiss here.

Since I began this campaign, I have received nearly universal positive

feedback from sentient Genworth shareholders. I am referring mainly to

individual shareholders and some smaller funds who (as one told me) watch

GNW stock "like a hawk" because it constitutes a meaningful percentage of

their respective portfolios. Here are some comments I have received:

A. Multiple shareholders have agreed that

Genworth's C-suite compensation is exorbitant and out of line with the

Company's true peers

, rather than the cherry-picked peer group in the Company's proxy statement

that on average is many multiples of Genworth's market cap.

B.

Corporate overhead costs are bloated and could be cut substantially.

One commenter cited a figure of $100 million per year in potential

savings if we simplified Genworth's corporate structure.

In addition, there does not seem to be any emphasis on expense control by

our Company's leadership. (Note that Genworth could have prevented this

entire "Vote No" campaign simply by sending me a few requested shareholder

lists, but instead have decided to spend tens of thousands of dollars of

shareholder money on proxy solicitors, legal teams and other assorted

"helpers" to fight my efforts. Pennywise and pound foolish!)

C.

CEO McInerney appears to be "drunk on his own Kool-Aid" with respect to

his proposed new LTC products.

There is no real market for these products, even if Genworth could get them

approved by regulators. Why squander our Company's precious capital on

speculative "new ventures" after all of the effort made to date to decrease

holdco debt, especially in light of Genworth's atrocious track record on

its legacy LTC book of business?

Sadly, I have yet to receive any substantive feedback from either of

our Company's largest holders, Blackrock and Vanguard (together owning

over 25% of GNW stock), who despite their supposed emphasis on ESG,

apparently don't care too much about the "G" in "ESG" (although they do

seem to care quite a bit about virtue signaling with respect to the "E"

and the "S").

Proper governance, though, is arguably the most important of the three,

because without it the other two are unlikely to reflect our society's

values at any company. Nor have I heard much from the proxy advisors, who

(unlike the sentient Genworth shareholders referenced above) lack

skin-in-the-game and thus are incentivized to either rubber-stamp the

incumbent directors and/or simply pass on a case like Genworth as "too

hard".

Incredibly, when I requested a meeting to discuss my "Vote No"

campaign, a key employee of one of the proxy advisors-who shall remain

nameless-actually thought I was a Genworth employee!

Thank you for your support in my "Vote No" campaign.

I believe that if shareholders band together and oppose the incumbent

Compensation Committee Directors, as well as the advisory vote on

executive compensation, it will send a loud and clear message to our

CEO and Board of Directors that the status quo at Genworth is no longer

acceptable

. VOTE "NO" TODAY!

Sincerely,

Scott Klarquist

CIO, Seven Corners Capital Management, LLC

This regulatory filing also includes additional resources:

gnwletter4292022.pdf

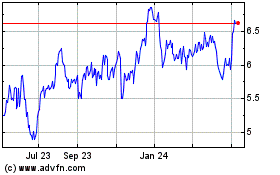

Genworth Financial (NYSE:GNW)

Historical Stock Chart

From Mar 2024 to Apr 2024

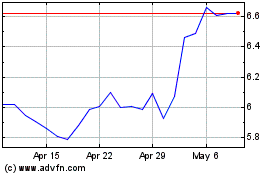

Genworth Financial (NYSE:GNW)

Historical Stock Chart

From Apr 2023 to Apr 2024