Castor Maritime Inc. (NASDAQ: CTRM), (“Castor” or the “Company”), a

diversified global shipping company, today announced its results

for the three months and year ended December 31, 2021.

Highlights of the Fourth Quarter Ended

December 31, 2021:

- Revenues, net: $60.0 million for the three months ended

December 31, 2021, as compared to $4.4 million for the three months

ended December 31, 2020;

- Net income/loss: Net income of $29.2 million for the

three months ended December 31, 2021, as compared to net loss of

$0.8 million for the three months ended December 31,

2020;

- Earnings/Loss per common

share(1): $0.18 earnings per

share for the three months ended December 31, 2021, as compared to

loss per share of $0.06 for the three months ended December 31,

2020;

- EBITDA(2): $36.1

million for the three months ended December 31, 2021, as compared

to $0.3 million for the three months ended December 31,

2020;

- Cash and restricted cash of $43.4 million as of

December 31, 2021, as compared to $9.4 million as of December 31,

2020;

- On December 8, 2021, we redeemed all of the Series A

preferred shares at a cash redemption price of $30 per preferred

share as per the Company’s amended and restated statement of

designations; and

- During the fourth quarter of 2021 and as of the date of

this press release, we have taken successful delivery of three

vessels consisting of two Panamax dry bulk carriers and one Aframax

/LR2 tanker. As a result, Castor currently owns a diversified fleet

of 29 vessels with an aggregate capacity of 2.5 million dwt, having

more than quadrupled the number of the vessels it owns since

December 31, 2020.

Earnings Highlights of the Year Ended

December 31, 2021:

- Revenues, net: $132.0 million for the year ended

December 31, 2021, as compared to $12.5 million for the year ended

December 31, 2020;

- Net income/loss: Net income of $52.3 million for the

year ended December 31, 2021, as compared to net loss of $1.8

million for the year ended December 31, 2020;

- Earnings/Loss per common share

(1): $0.48 earnings per share for the year

ended December 31, 2021, as compared to loss per share of $0.26 for

the year ended December 31, 2020; and

- EBITDA(2): $69.9

million for the year ended December 31, 2021, as compared to $2.3

million for the year ended December 31, 2020.

(1) All share and per share amounts

disclosed throughout this press release and in the financial

information presented in Appendix B have been retroactively updated

to reflect the one-for-ten (1-for-10) reverse stock split effected

on May 28, 2021, unless otherwise indicated.

(2) EBITDA is not a recognized measure

under United States generally accepted accounting principles (“U.S.

GAAP”). Please refer to Appendix B for the definition and

reconciliation of this measure to the most directly comparable

financial measure calculated and presented in accordance with U.S.

GAAP.

Management Commentary:

Mr. Petros Panagiotidis, Chief Executive Officer

of Castor commented:

"2021 was a transformational year for Castor. We

have grown exponentially ending the year with 29 vessels, on a

fully delivered basis, and we have enjoyed strong operating cash

flow especially in the second half of the year. We benefit from a

healthy liquidity position and low leverage and in January 2022 we

signed and drew down a new credit facility. We did not sell any

common shares under the ATM Program during the fourth quarter and

up to the date of this release. We will continue to seek attractive

acquisition opportunities to further pursue Castor’s growth

trajectory.”

Earnings Commentary:

Fourth Quarter ended December 31, 2021,

and 2020 Results

Vessel revenues, net of charterers’ commissions,

for the three months ended December 31, 2021, increased to $60.0

million from $4.4 million in the same period of 2020. This increase

was largely driven by the increase in our Available Days (defined

below) from 449 in the three months ended December 31, 2020, to

2,433 in the three months ended December 31, 2021, following the

acquisition and delivery to our fleet of 22 vessels since December

31, 2020. The increase in vessel revenues during the three months

ended December 31, 2021, as compared with the same period of 2020

was further underpinned by the healthy dry bulk shipping market

resulting in a Daily TCE Rate (1) (as defined below) for the

vessels of our fleet of more than double as compared to the same

period a year ago.

The increase in voyage expenses, from $0.1

million in the three months ended December 31, 2020, to $5.8

million in the same period of 2021, is mainly associated with (i)

increased port expenses and bunkers consumption expenses as a

result of having certain of our tanker vessels operating under

voyage charters in the fourth quarter of 2021, and (ii) increased

brokerage commission expenses, commensurate with the increase in

vessel revenues discussed above.

The increase in vessel operating expenses by

$11.7 million, from $3.1 million in the three months ended December

31, 2020 to $14.8 million in the same period of 2021, as well as

the increase in vessels’ depreciation and amortization costs by

$4.7 million, from $0.8 million in the three months ended December

31, 2020 to 5.5 million in the same period of 2021, mainly reflect

the increase in our Ownership Days following the expansion of our

fleet.

General and administrative expenses in the three

months ended December 31, 2021, amounted to $1.2 million, whereas,

in the same period of 2020 general and administrative expenses

totalled $0.6 million. This increase stemmed from higher corporate

fees primarily due to the growth of our company and our shareholder

base.

Management fees in the three months ended

December 31, 2021, amounted to $2.2 million, whereas, in the same

period of 2020 management fees totalled $0.5 million. This increase

in management fees is due to the substantial increase in our

Ownership Days for which our managers charge us with a daily

management fee, following the acquisitions discussed above.

During the three months ended December 31, 2021,

we incurred net interest costs and finance costs amounting to $1.1

million compared to $0.3 million during the same period in 2020.

The increase is mainly due to our higher level of weighted average

indebtedness during the three months ended December 31, 2021, as

compared with the same period of 2020.

(1) Daily TCE Rate is not a recognized measure

under U.S. GAAP. Please refer to Appendix B of this press release

for the definition and reconciliation of this measure to the most

directly comparable financial measure calculated and presented in

accordance with U.S. GAAP.

Recent Financial and

Business Developments Commentary:

Vessel acquisitions update

During the fourth quarter of 2021 and as of the

date of this earnings press release, we have taken delivery of

three vessels, aggregating to 23 completed vessel acquisitions

since the beginning of 2021.

Details and delivery information of our

completed acquisitions within the fourth quarter of 2021 and as of

the date of this press release are as follows:

|

|

|

Vessel Name |

Vessel Type |

DWT |

Year Built |

Country of Construction |

Purchase Price (in million) |

Delivery Date |

|

Dry Bulk Carriers |

|

|

|

|

|

|

|

Magic Phoenix |

Panamax |

76,636 |

2008 |

Japan |

$18.75 |

26 October 2021 |

|

Magic Callisto |

Panamax |

74,930 |

2012 |

Japan |

$23.55 |

4 January 2022 |

|

Tankers |

|

|

|

|

|

|

|

Wonder Bellatrix |

Aframax/ LR2 |

115,341 |

2006 |

S. Korea |

$18.15 |

23 December 2021 |

Equity update

In connection with our ongoing at-the-market

common stock offering program (“ATM Program”), from June 15, 2021,

and as of December 31, 2021, we had raised net proceeds of $12.4

million by issuing and selling 4,654,240 common shares, after sales

commissions and other offering expenses paid of $0.5 million, at an

average price per share of $2.76.

From October 1, 2021 to date, no sales of common

shares have taken place under the ATM Program, and there have been

no subsequent warrant exercises under our currently effective

warrant schemes.

As of February 4, 2022, we had issued and

outstanding 94,610,088 common shares.

On December 8, 2021, pursuant to a decision

approved by our Board of Directors on November 8, 2021, we redeemed

all of the issued and outstanding Series A preferred shares. Based

on the amended and restated statement of designations of Castor

dated October 10, 2019, the holders of the Series A preferred

shares received a cash redemption of $30.00 per Series A Preferred

Share.

New Financings update

On November 24, 2021, we drew down, in two

tranches, our previously announced $23.15 million term loan

facility, through and secured by two of the Company’s dry bulk

vessel ship-owning subsidiaries, those owning the Magic Rainbow and

Magic Phoenix, and guaranteed by the Company. This facility has a

tenor of five years and bears interest at a margin over LIBOR per

annum.

Further, on January 12, 2022, we entered into a

$55.0 million senior secured term loan facility with a major

European bank, through and secured by five of the Company’s dry

bulk vessel ship-owning subsidiaries, those owning the Magic

Starlight, Magic Mars, Magic Pluto, Magic Perseus and the Magic

Vela, and guaranteed by the Company. This facility has a tenor of

five years from the drawdown date and bears interest at a margin

over adjusted SOFR per annum. The loan was drawn down in full on

January 13, 2022.

The Company has used and intends to use the net

proceeds from these facilities for general corporate purposes,

including supporting the Company’s growth plans.

Cash Flow update

Our consolidated cash position as of December

31, 2021, increased by $34.0 million, to $43.4 million, as compared

with our cash position on December 31, 2020. During the year ended

December 31, 2021, our cash position improved mainly as a result

of: (i) $60.8 million of net operating cash flows generated during

the year ended December 31, 2021, (ii) $156.9 million of net cash

proceeds pursuant to the three registered direct offerings of an

aggregate 42,405,770 common shares and the concurrent private

placement of an equivalent aggregate number of warrants on January

5, January 12 and April 7, 2021, (iii) net cash proceeds of

approximately $83.4 million resulting from subsequent exercises of

approximately 34.4 million warrants pursuant to the June 2020, July

2020 and the January 2021 equity offerings, that resulted in the

issuance of an equal number of common shares, (iv) net cash inflows

of approximately $95.3 million following our entry into four

secured loan facilities in January, April, July and November of

2021, and (v) $12.5 million of net cash proceeds pursuant to common

stock sales under our ATM Program. From these amounts, during the

year ended December 31, 2021, we used $348.6 million to fund the

growth and related capital expenditures of our fleet, whereas,

$14.4 million were used for the redemption of our Series A

Preferred Shares and $11.9 million were used for scheduled

principal repayments of our debt.

As of December 31, 2021, our total debt, gross

of unamortized deferred loan fees, was $103.8 million of which

$16.7 million is repayable within one year, as compared to $18.5

million of gross total debt as of December 31, 2020.

New employment agreements

On January 16, 2022, the Magic Twilight

commenced a time charter contract at a gross daily charter rate of

$16,500. The charter has a duration of about 60 days.

On January 26, 2022, the Magic Argo commenced a

time charter contract at a gross daily charter rate of $16,600. The

charter has a duration of about 60 days.

On January 28, 2022, the Magic Sun was fixed on

a time charter contract at a gross daily charter rate of $17,500

plus a one-time gross ballast bonus of $750,000. The charter is

expected to commence on or around February 27, 2022 and will have a

duration of about 60 days.

On February 1, 2022, the Magic Venus was fixed

on a time charter contract at a gross daily charter rate of $16,300

plus a one-time gross ballast bonus of $630,000. The charter is

expected to commence on or around February 15, 2022 and will have a

duration of about 40 days.

On February 3, 2022, the Magic Rainbow was fixed

on a time charter contract at a gross daily charter rate of

$16,000. The charter is expected to commence upon expiration of the

vessel’s current contract, on or around February 13, 2022 and will

have a duration of about 60 days.

On February 3, 2022, the Magic Vela was fixed on

a time charter contract at a gross daily charter rate of $16,000

plus a one-time gross ballast bonus of $550,000. The charter is

expected to commence on or around February 17, 2022 and will have a

duration of about 70 days.

On February 3, 2022, the Magic Nebula was fixed

on a time charter contract at a gross daily charter rate of

$23,500. The charter is expected to commence on or around February

28, 2022 and will have a duration of about 7 to about 9 months

(about means +/- 15 days) at the option of the Charterer.

Fleet Employment Status (as of February

4, 2022)

During the three months ended December 31, 2021,

we operated on average 26.8 vessels earning a Daily TCE Rate of

$22,299 as compared to an average 5.8 vessels earning a Daily TCE

Rate of $9,915 during the same period in 2020.

Our current employment profile is presented

below.

|

Vessel Name |

Type/ Country of Construction |

DWT |

Year Built |

Type of Employment |

Daily Gross Charter Rate |

Estimated Redelivery Date |

|

Earliest |

Latest |

|

Magic Orion |

Capesize dry bulk carrier / Japan |

180,200 |

2006 |

TC (1) period |

101% of BCI5TC (2) |

Oct-22 |

Jan-23 |

|

Magic Venus |

Kamsarmax dry bulk carrier / Japan |

83,416 |

2010 |

TC trip (3) |

$16,300 plus $630,000 Ballast Bonus |

Mar-23 |

Mar-23 |

|

Magic Thunder |

Kamsarmax dry bulk carrier / Japan |

83,375 |

2011 |

TC period |

100% of BPI5TC (4) |

Oct-22 |

Jan-23 |

|

Magic Argo |

Kamsarmax dry bulk carrier / Japan |

82,338 |

2009 |

TC trip |

$16,600 |

Mar-22 |

Mar-22 |

|

Magic Perseus |

Kamsarmax dry bulk carrier / Japan |

82,158 |

2013 |

TC period |

100% of BPI5TC |

Oct-22 |

Jan-23 |

|

Magic Starlight |

Kamsarmax dry bulk carrier / China |

81,048 |

2015 |

TC period |

$32,000 (5) |

Sep-22 |

Mar-23 |

|

Magic Twilight |

Kamsarmax dry bulk carrier / Korea |

80,283 |

2010 |

TC trip |

$16,500 |

Μar-22 |

Μar-22 |

|

Magic Nebula |

Kamsarmax dry bulk carrier / Korea |

80,281 |

2010 |

TC period |

$31,750 |

Feb-22 |

Μar -22 |

|

Magic Nova |

Panamax dry bulk carrier / Japan |

78,833 |

2010 |

TC period |

92% of BPI5TC |

Oct-22 |

Feb-23 |

|

Magic Mars |

Panamax dry bulk carrier / Korea |

76,822 |

2014 |

TC period |

$21,500 (6) |

Νοv-22 |

Feb-23 |

|

Magic Phoenix |

Panamax dry bulk carrier / Japan |

76,636 |

2008 |

TC period |

102% of BPI4TC (7) |

Sep-22 |

Dec-22 |

|

Magic Horizon |

Panamax dry bulk carrier / Japan |

76,619 |

2010 |

TC trip |

$20,100 |

Mar-22 |

Mar-22 |

|

Magic Moon |

Panamax dry bulk carrier / Japan |

76,602 |

2005 |

TC trip |

$17,500 |

Feb-22 |

Feb-22 |

|

Magic P |

Panamax dry bulk carrier / Japan |

76,453 |

2004 |

TC period |

$27,500 |

Apr-22 |

Jul-22 |

|

Magic Sun |

Panamax dry bulk carrier / Korea |

75,311 |

2001 |

TC trip (8) |

$17,500 plus $750,000 Ballast Bonus |

Apr-22 |

Apr-22 |

|

Magic Vela |

Panamax dry bulk carrier / China |

75,003 |

2011 |

TC trip (9) |

$16,000 plus $550,000 Ballast Bonus |

Apr-22 |

Apr-22 |

|

Magic Eclipse |

Panamax dry bulk carrier / Japan |

74,940 |

2011 |

TC period |

$28,500 |

Αpr-22 |

Jul-22 |

|

Magic Pluto |

Panamax dry bulk carrier / Japan |

74,940 |

2013 |

TC period |

91% of BPI5TC |

Nov-22 |

Feb-23 |

|

Magic Callisto |

Panamax dry bulk carrier / Japan |

74,930 |

2012 |

TC period |

101% of BPI4TC |

Oct-22 |

Jan-23 |

|

Magic Rainbow |

Panamax dry bulk carrier / China |

73,593 |

2007 |

TC period |

$25,000 |

Feb-22 |

Feb-22 |

|

Wonder Polaris |

Aframax / LR2 tanker / Korea |

115,351 |

2005 |

TC period |

$15,000 plus profit sharing |

Feb-22 |

Feb-22 |

|

Wonder Sirius |

Aframax / LR2 tanker / Korea |

115,341 |

2005 |

TC period |

$15,000 plus profit sharing |

Feb-22 |

May-22 |

|

Wonder Bellatrix |

Aframax / LR2 tanker / Korea |

115,341 |

2006 |

TC period |

$15,000 plus profit sharing |

Feb-22 |

Feb-22 |

|

Wonder Musica |

Aframax / LR2 tanker / Korea |

106,290 |

2004 |

Voyage |

$4,200 (10) |

3-Feb-22(11) |

N/A |

|

Wonder Avior |

Aframax / LR2 tanker / Korea |

106,162 |

2004 |

Unfixed |

N/A |

N/A |

N/A |

|

Wonder Arcturus |

Aframax / LR2 tanker / Korea |

106,149 |

2002 |

Voyage |

$14,000 (10) |

16-Feb-22(11) |

N/A |

|

Wonder Vega |

Aframax tanker / Korea |

106,062 |

2005 |

Tanker Pool (12) |

N/A |

N/A |

N/A |

|

Wonder Mimosa |

Handysize tanker / Korea |

36,718 |

2006 |

Tanker Pool (13) |

N/A |

N/A |

N/A |

|

Wonder Formosa |

Handysize tanker / Korea |

36,660 |

2006 |

Tanker Pool (13) |

N/A |

N/A |

N/A |

(1) TC stands for time charter.

(2) The benchmark vessel used in the calculation of the average

of the Baltic Capesize Index 5TC routes is a non-scrubber fitted

180,000mt dwt vessel (Capesize) with specific age, speed -

consumption, and design characteristics.

(3) The charter is expected to commence on around

15/02/2022.

(4) The benchmark vessel used in the calculation of the average

of the Baltic Panamax Index 5TC routes is a non-scrubber fitted

82,500mt dwt vessel (Kamsarmax) with specific age, speed -

consumption, and design characteristics.

(5) The vessels’ daily gross charter rate is equal to 114% of

BPI4TC. In accordance with the prevailing charter party, on

19/10/2021 owners converted the index-linked rate to fixed from

01/01/2022 until 30/09/2022, at a rate of $32,000 per day. Upon

completion of said period, the rate will be converted back to index

linked.

(6) The vessels’ daily gross charter rate is equal to 91% of

BPI5TC. In accordance with the prevailing charter party, on

20/01/2022 owners converted the index-linked rate to fixed from

01/02/2022 until 30/09/2022, at a rate of $21,500 per day. Upon

completion of said period, the rate will be converted back to index

linked.

(7) The benchmark vessel used in the calculation of the average

of the Baltic Panamax Index 4TC routes is a non-scrubber fitted

74,000mt dwt vessel (Panamax) with specific age, speed -

consumption, and design characteristics.

(8) The charter is expected to commence on around

27/02/2022.

(9) The charter is expected to commence on around

17/02/2022.

(10) For vessels that are employed on the voyage/spot market,

the gross daily charter rate is considered as the Daily TCE Rate on

the basis of the expected completion date.

(11) Estimated completion date of the voyage.

(12) The vessel is currently participating in an

unaffiliated tanker pool specializing in the employment of Aframax

tanker vessels.

(13) The vessel is currently participating in an

unaffiliated tanker pool specializing in the employment of

Handysize tanker vessels.

Financial Results Overview:

|

|

Three Months Ended |

|

Year Ended |

|

(Expressed in U.S. dollars) |

|

December 31, 2021 (unaudited) |

|

December 31, 2020 (unaudited) |

|

|

December 31, 2021 (unaudited) |

|

December 31, 2020 (unaudited) |

|

Vessel revenues, net |

$ |

60,010,788 |

$ |

4,385,498 |

|

|

$ |

132,049,710 |

$ |

12,487,692 |

|

|

Operating income/ (loss) |

$ |

30,546,613 |

$ |

(475,406 |

) |

|

$ |

55,519,085 |

|

452,029 |

|

|

Net income/ (loss) |

$ |

29,210,843 |

$ |

(768,912 |

) |

|

$ |

52,270,487 |

$ |

(1,753,533 |

) |

|

EBITDA (1) |

$ |

36,127,417 |

$ |

276,579 |

|

|

$ |

69,910,529 |

$ |

2,327,671 |

|

|

Earnings/(Loss) per common share |

$ |

0.18 |

$ |

(0.06 |

) |

|

$ |

0.48 |

$ |

(0.26 |

) |

(1) EBITDA is not a recognized measure

under U.S. GAAP. Please refer to Appendix B of this press release

for the definition and reconciliation of this measure to the most

directly comparable financial measure calculated and presented in

accordance with U.S. GAAP.

Fleet selected financial and operational

data:

Set forth below are selected financial and

operational data of our fleet for each of the three months and year

ended December 31, 2021, and 2020, respectively, that we believe

are useful in analysing trends in our results of operations:

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(Expressed in U.S. dollars except for operational

data) |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Ownership Days (1) (7) |

|

2,467 |

|

|

529 |

|

|

6,807 |

|

|

1,405 |

|

| Available

Days (2)(7) |

|

2,433 |

|

|

449 |

|

|

6,657 |

|

|

1,267 |

|

| Operating

Days (3) (7) |

|

2,419 |

|

|

442 |

|

|

6,562 |

|

|

1,259 |

|

| Daily TCE

rate(4) |

$ |

22,299 |

|

$ |

9,915 |

|

$ |

17,891 |

|

$ |

9,395 |

|

| Fleet

Utilization (5) |

|

99 |

% |

|

98 |

% |

|

99 |

% |

|

99 |

% |

| Daily vessel

operating expenses (6) |

$ |

6,004 |

|

$ |

5,818 |

|

$ |

5,759 |

|

$ |

5,301 |

|

(1) Ownership Days are the total number of calendar days in a

period during which we owned a vessel.

(2) Available Days are the Ownership Days in a period less the

aggregate number of days our vessels are off-hire due to scheduled

repairs, dry-dockings or special or intermediate surveys.

(3) Operating Days are the Available Days in a period after

subtracting off-hire and idle days.

(4) Daily TCE rate is not a recognized measure under U.S. GAAP.

Please refer to Appendix B of this press release for the definition

and reconciliation of this measure to the most directly comparable

financial measure calculated and presented in accordance with U.S.

GAAP.

(5) Fleet Utilization is calculated by dividing the Operating

Days during a period by the number of Available Days during that

period.

(6) Daily vessel operating expenses are calculated by dividing

vessel operating expenses for the relevant period by the Ownership

Days for such period.

(7) Our definitions of days (i.e., Ownership Days, Available

Days, Operating Days) may not be comparable to those reported by

other companies.

|

|

|

APPENDIX A CASTOR MARITIME INC.

Unaudited Condensed Consolidated Statements of

Comprehensive Income/ (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In U.S. dollars except for number of share data) |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

REVENUES |

|

|

|

|

|

|

|

|

|

Vessel revenues, net |

$ |

60,010,788 |

|

$ |

4,385,498 |

|

$ |

132,049,710 |

|

$ |

12,487,692 |

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

Voyage expenses -including commissions to related party |

|

(5,756,397 |

) |

|

66,178 |

|

|

(12,950,783 |

) |

|

(584,705 |

) |

|

Vessel operating expenses |

|

(14,811,629 |

) |

|

(3,077,944 |

) |

|

(39,203,471 |

) |

|

(7,447,439 |

) |

|

General and administrative expenses (including related party

fees) |

|

(1,193,519 |

) |

|

(599,393 |

) |

|

(3,266,310 |

) |

|

(1,130,953 |

) |

|

Management fees -related parties |

|

(2,154,750 |

) |

|

(450,500 |

) |

|

(6,744,750 |

) |

|

(930,500 |

) |

|

Provision for doubtful accounts |

|

(2,483 |

) |

|

(37,103 |

) |

|

(2,483 |

) |

|

(37,103 |

) |

|

Depreciation and amortization |

|

(5,545,397 |

) |

|

(762,142 |

) |

|

(14,362,828 |

) |

|

(1,904,963 |

) |

|

Operating income/ (loss) |

$ |

30,546,613 |

|

$ |

(475,406 |

) |

$ |

55,519,085 |

|

$ |

452,029 |

|

|

Interest and finance costs, net (including related party interest

costs) (1) |

|

(1,062,469 |

) |

|

(261,709 |

) |

|

(2,779,875 |

) |

|

(2,154,601 |

) |

|

Other income, (expenses), net |

|

35,407 |

|

|

(10,157 |

) |

|

28,616 |

|

|

(29,321 |

) |

|

US source income taxes |

|

(308,708 |

) |

|

(21,640 |

) |

|

(497,339 |

) |

|

(21,640 |

) |

|

Net income/(loss) |

$ |

29,210,843 |

|

$ |

(768,912 |

) |

$ |

52,270,487 |

|

$ |

(1,753,533 |

) |

|

Less: Deemed dividend on Series A preferred shares

(2) |

|

(11,772,157 |

) |

|

— |

|

|

(11,772,157 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss) to common shareholders |

|

17,438,686 |

|

|

(768,912 |

) |

|

40,498,330 |

|

|

(1,753,533 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings/(loss) per common share (basic) (3) |

$ |

0.18 |

|

$ |

(0.06 |

) |

$ |

0.48 |

|

$ |

(0.26 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings/(loss) per common share (diluted)

(3) |

$ |

0.18 |

|

$ |

(0.06 |

) |

$ |

0.47 |

|

$ |

(0.26 |

) |

|

Weighted average number of common shares outstanding, basic

(3): |

|

94,610,088 |

|

|

13,121,238 |

|

|

83,923,435 |

|

|

6,773,519 |

|

|

Weighted average number of common shares outstanding, diluted

(3): |

|

94,610,088 |

|

|

13,121,238 |

|

|

85,332,728 |

|

|

6,773,519 |

|

(1) Includes interest and finance costs and interest income, if

any.

(2) Represents the difference between the redemption value and

the carrying value of the Series A preferred shares.

| |

| CASTOR

MARITIME INC. Unaudited Condensed

Consolidated Balance Sheets

(Expressed in U.S. Dollars—except for number of share

data) |

|

|

|

|

|

|

|

|

|

December 31,

2021 |

|

December 31,

2020 |

|

ASSETS |

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

Cash and cash equivalents |

$ |

37,173,736 |

$ |

8,926,903 |

|

Restricted cash |

|

2,382,732 |

|

— |

|

Due from related party |

|

— |

|

1,559,132 |

|

Other current assets |

|

15,443,620 |

|

3,078,119 |

|

Total current assets |

|

55,000,088 |

|

13,564,154 |

|

|

|

|

|

|

|

NON-CURRENT ASSETS: |

|

|

|

|

|

Vessels, net |

|

393,965,929 |

|

58,045,628 |

|

Advances for vessel acquisition |

|

2,368,165 |

|

— |

|

Restricted cash |

|

3,830,000 |

|

500,000 |

|

Due from related party |

|

810,437 |

|

— |

|

Other non-currents assets |

|

6,938,823 |

|

2,261,573 |

|

Total non-current assets, net |

|

407,913,354 |

|

60,807,201 |

|

Total assets |

|

462,913,442 |

|

74,371,355 |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

Current portion of long-term debt, net – including related

party |

|

16,091,723 |

|

7,102,037 |

|

Due to related parties |

|

4,507,569 |

|

1,941 |

|

Other current liabilities |

|

13,430,104 |

|

3,799,929 |

|

Total current liabilities |

|

34,029,396 |

|

10,903,907 |

|

NON-CURRENT LIABILITIES: |

|

|

|

|

|

Long-term debt, net |

|

85,949,676 |

|

11,083,829 |

|

Total non-current liabilities |

|

85,949,676 |

|

11,083,829 |

|

Total liabilities |

|

119,979,072 |

|

21,987,736 |

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

Common shares, $0.001 par value; 1,950,000,000 shares authorized;

94,610,088 and 13,121,238 shares, issued and outstanding as at

December 31, 2021 and 2020, respectively (3) |

|

94,610 |

|

13,121 |

|

Series A Preferred Shares- 0 shares issued and outstanding as at

December 31, 2021 and 480,000 shares issued and outstanding as at

December 31, 2020 |

|

— |

|

480 |

|

Series B Preferred Shares- 12,000 shares issued and outstanding as

at December 31, 2021 and 2020 |

|

12 |

|

12 |

|

Additional paid-in capital |

|

303,658,153 |

|

53,686,741 |

|

Retained Earnings/ (Accumulated Deficit) |

|

39,181,595 |

|

(1,316,735) |

|

Total shareholders’ equity |

|

342,934,370 |

|

52,383,619 |

|

Total liabilities and shareholders’ equity |

$ |

462,913,442 |

$ |

74,371,355 |

|

CASTOR MARITIME INC. Unaudited

Consolidated Statements of Cash Flows |

|

|

|

(Expressed in U.S. Dollars—except for number of share

data) |

|

Year Ended December 31, |

|

|

|

2021 |

|

|

2020 |

|

| Cash

flows provided by/(used in) Operating Activities: |

|

|

|

|

| Net

income/(loss) |

$ |

52,270,487 |

|

$ |

(1,753,533 |

) |

|

Adjustments to reconcile net income/(loss) to net cash

provided by/(used in) Operating activities: |

|

|

|

|

| Depreciation

and amortization |

|

14,362,828 |

|

|

1,904,963 |

|

| Amortization

and write-off of deferred finance charges |

|

414,629 |

|

|

599,087 |

|

| Amortization

of other deferred charges |

|

— |

|

|

112,508 |

|

| Deferred

revenue amortization |

|

— |

|

|

(430,994 |

) |

| Amortization

of fair value of acquired time charter |

|

(1,940,000 |

) |

|

— |

|

| Interest

settled in common stock |

|

— |

|

|

57,773 |

|

| Amortization

and write-off of convertible notes beneficial conversion

feature |

|

— |

|

|

532,437 |

|

| Provision

for doubtful accounts |

|

2,483 |

|

|

37,103 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

| Accounts

receivable trade |

|

(6,924,622 |

) |

|

(1,122,836 |

) |

|

Inventories |

|

(3,722,061 |

) |

|

(571,284 |

) |

| Due from/to

related parties |

|

5,254,323 |

|

|

(797,805 |

) |

| Prepaid

expenses and other assets |

|

(3,406,066 |

) |

|

(885,828 |

) |

| Dry-dock

costs paid |

|

(3,730,467 |

) |

|

(1,308,419 |

) |

| Other

deferred charges |

|

(191,234 |

) |

|

26,494 |

|

| Accounts

payable |

|

3,070,287 |

|

|

584,527 |

|

| Accrued

liabilities |

|

1,495,032 |

|

|

625,894 |

|

| Deferred

revenue |

|

3,819,708 |

|

|

46,104 |

|

| Net

cash provided by/ (used in) Operating Activities |

|

60,775,327 |

|

|

(2,343,809 |

) |

| |

|

|

|

|

| Cash

flows used in Investing Activities: |

|

|

|

|

| Vessel

acquisitions and other vessel improvements |

|

(346,273,252 |

) |

|

(35,472,173 |

) |

| Advances for

vessel acquisition |

|

(2,367,455 |

) |

|

— |

|

| Net

cash used in Investing Activities |

|

(348,640,707 |

) |

|

(35,472,173 |

) |

| |

|

|

|

|

| Cash

flows provided by Financing Activities: |

|

|

|

|

| Gross

proceeds from issuance of common stock and warrants |

|

265,307,807 |

|

|

39,053,325 |

|

| Common stock

issuance expenses |

|

(12,527,747 |

) |

|

(3,710,394 |

) |

| Redemption

of series A preferred shares |

|

(14,400,000 |

) |

|

— |

|

| Proceeds

from long-term debt |

|

97,190,000 |

|

|

9,500,000 |

|

| Repayment of

related party debt |

|

(5,000,000 |

) |

|

— |

|

| Repayment of

long-term debt |

|

(6,878,500 |

) |

|

(2,050,000 |

) |

| Payment of

deferred financing costs |

|

(1,866,615 |

) |

|

(608,985 |

) |

| Net

cash provided by Financing Activities |

|

321,824,945 |

|

|

42,183,946 |

|

| |

|

|

|

|

| Net

increase in cash, cash equivalents, and restricted

cash |

|

33,959,565 |

|

|

4,367,964 |

|

|

Cash, cash equivalents and restricted cash at the beginning

of the period |

|

9,426,903 |

|

|

5,058,939 |

|

|

Cash, cash equivalents and restricted cash at the end of

the period |

$ |

43,386,468 |

|

$ |

9,426,903 |

|

(3) All numbers of share and earnings per

share amounts in these unaudited condensed financial statements

have been retroactively adjusted to reflect the reverse stock split

effected on May 28, 2021.

APPENDIX B

Non-GAAP Financial

Information

Daily TCE Rate. The Daily Time

Charter Equivalent Rate (“Daily TCE Rate”), is a measure of the

average daily revenue performance of a vessel. The Daily TCE Rate

is calculated by dividing total revenues (time charter and/or

voyage charter revenues, and/or pool revenues, net of charterers’

commissions), less voyage expenses, by the number of Available Days

during that period. Under a time charter, the charterer pays

substantially all the vessel voyage related expenses. However, we

may incur voyage related expenses when positioning or repositioning

vessels before or after the period of a time charter, during

periods of commercial waiting time or while off-hire during dry

docking or due to other unforeseen circumstances. The Daily TCE

Rate is not a measure of financial performance under U.S. GAAP

(non-GAAP measure) and should not be considered as an alternative

to Time charter revenues, net, the most directly comparable GAAP

measure, or any other measure of financial performance presented in

accordance with U.S. GAAP. However, the Daily TCE Rate is a

standard shipping industry performance measure used primarily to

compare period-to-period changes in a company's performance and,

management believes that the Daily TCE Rate provides meaningful

information to our investors since it compares daily net earnings

generated by our vessels irrespective of the mix of charter types

(i.e., time charter trips, time charter periods and voyage

charters) under which our vessels are employed between the periods

while it further assists our management in making decisions

regarding the deployment and use of our vessels and in evaluating

our financial performance. Our calculation of the Daily TCE Rates

may not be comparable to that reported by other companies. The

following table reflects the calculation of our Daily TCE Rates for

the periods presented (amounts in U.S. dollars, except for

Available Days):

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(In U.S. dollars, except for Available Days) |

|

2021 |

|

|

2020 |

|

2021 |

|

|

2020 |

|

|

Vessel revenues, net |

$ |

60,010,788 |

|

$ |

4,385,498 |

$ |

132,049,710 |

|

$ |

12,487,692 |

|

|

Voyage expenses -including commissions from related party |

|

(5,756,397 |

) |

|

66,178 |

|

(12,950,783 |

) |

|

(584,705 |

) |

|

TCE revenues |

$ |

54,254,391 |

|

$ |

4,451,676 |

$ |

119,098,927 |

|

$ |

11,902,987 |

|

|

Available Days |

|

2,433 |

|

|

449 |

|

6,657 |

|

|

1,267 |

|

|

Daily TCE Rate |

$ |

22,299 |

|

$ |

9,915 |

$ |

17,891 |

|

$ |

9,395 |

|

EBITDA. We define EBITDA as

earnings before interest and finance costs (if any), net of

interest income, taxes (when incurred), depreciation and

amortization of deferred dry-docking costs. EBITDA is used as a

supplemental financial measure by management and external users of

financial statements to assess our operating performance. We

believe that EBITDA assists our management by providing useful

information that increases the comparability of our performance

operating from period to period and against the operating

performance of other companies in our industry that provide EBITDA

information. This increased comparability is achieved by excluding

the potentially disparate effects between periods or companies of

interest, other financial items, depreciation and amortization and

taxes, which items are affected by various and possibly changing

financing methods, capital structure and historical cost basis and

which items may significantly affect net income between periods. We

believe that including EBITDA as a measure of operating performance

benefits investors in (a) selecting between investing in us and

other investment alternatives and (b) monitoring our ongoing

financial and operational strength. EBITDA is not a measure of

financial performance under U.S. GAAP, does not represent and

should not be considered as an alternative to net income, operating

income, cash flow from operating activities or any other measure of

financial performance presented in accordance with U.S. GAAP.

EBITDA as presented below may not be comparable to similarly titled

measures of other companies. The following table reconciles EBITDA

to net (loss)/income, the most directly comparable U.S. GAAP

financial measure, for the periods presented:

Reconciliation of Net Income/(Loss) to

EBITDA

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(In U.S. dollars) |

|

2021 |

|

2020 |

|

|

2021 |

|

2020 |

|

| |

|

|

|

|

|

|

|

|

| Net

Income/(Loss) |

$ |

29,210,843 |

$ |

(768,912 |

) |

$ |

52,270,487 |

$ |

(1,753,533 |

) |

| Depreciation

and amortization |

|

5,545,397 |

|

762,142 |

|

|

14,362,828 |

|

1,904,963 |

|

| Interest and

finance costs, net (including related party interest costs)

(1) |

|

1,062,469 |

|

261,709 |

|

|

2,779,875 |

|

2,154,601 |

|

| US source

income taxes |

|

308,708 |

|

21,640 |

|

|

497,339 |

|

21,640 |

|

|

EBITDA |

$ |

36,127,417 |

$ |

276,579 |

|

$ |

69,910,529 |

$ |

2,327,671 |

|

(1) Includes interest and finance costs and

interest income, if any.

Cautionary Statement Regarding

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”)

and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events or

performance, and underlying assumptions and other statements, which

are other than statements of historical facts. We are including

this cautionary statement in connection with this safe harbor

legislation. The words “believe”, “anticipate”, “intend”,

“estimate”, “forecast”, “project”, “plan”, “potential”, “will”,

“may”, “should”, “expect”, “pending” and similar expressions

identify forward-looking statements. The forward-looking statements

in this press release are based upon various assumptions, many of

which are based, in turn, upon further assumptions, including

without limitation, our management’s examination of historical

operating trends, data contained in our records and other data

available from third parties. Although we believe that these

assumptions were reasonable when made, because these assumptions

are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond our control, we cannot assure you that we will achieve or

accomplish these forward-looking statements, including these

expectations, beliefs or projections. We undertake no obligation to

update any forward-looking statement, whether as a result of new

information, future events or otherwise. In addition to these

important factors, other important factors that, in our view, could

cause actual results to differ materially from those discussed in

the forward‐looking statements include general dry bulk and tanker

shipping market conditions, including fluctuations in charter hire

rates and vessel values, the strength of world economies, our

future financial condition or results of operations and our future

revenues and expenses, our continued ability to enter into time or

voyage charters with existing and new customers, and to re-charter

our vessels upon the expiry of the existing charters, the stability

of Europe and the Euro, fluctuations in interest rates and foreign

exchange rates, changes in demand in the dry bulk and tanker

shipping industries, including the market for our vessels, changes

in our operating expenses, including bunker prices, dry docking and

insurance costs, our ability to fund future capital expenditures

and investments in the acquisition and refurbishment of our

vessels, our expectations regarding the availability of vessel

acquisitions and our ability to complete acquisition transactions

as planned, our ability to realize the expected benefits from our

vessel acquisitions, potential liability from pending or future

litigation and potential costs due to environmental damage and

vessel collisions, potential exposure or loss from investment in

derivative instruments (if any), changes in supply and demand in

the dry bulk and tanker shipping industry, including the market for

our vessels and the number of newbuildings under construction,

changes in seaborne and other transportation, changes in

governmental rules and regulations or actions taken by regulatory

authorities, potential liability from pending or future litigation,

general domestic and international political conditions, potential

disruption of shipping routes due to accidents or political events,

our business strategy and other plans and objectives for future

operations, future sales of our securities in the public market,

the impact of adverse weather and natural disasters, impacts of

climate change and greenhouse gas restrictions, the length and

severity of the COVID-19 outbreak, the impact of public health

threats and outbreaks of other highly communicable diseases, the

impact of the expected discontinuance of LIBOR after 2021 on

interest rates of our debt that reference LIBOR, the availability

of financing and refinancing and grow our business, vessel

breakdowns and instances of off‐hire, potential exposure or loss

from investment in derivative instruments, potential conflicts of

interest involving our Chief Executive Officer, his family and

other members of our senior management, and our ability to complete

acquisition transactions as planned. Please see our filings with

the Securities and Exchange Commission for a more complete

discussion of these and other risks and uncertainties. The

information set forth herein speaks only as of the date hereof, and

we disclaim any intention or obligation to update any

forward‐looking statements as a result of developments occurring

after the date of this communication.

CONTACT DETAILS For further

information please contact:

Petros Panagiotidis Chief Executive Officer

& Chief Financial Officer Castor Maritime Inc. Email:

ir@castormaritime.com

Media Contact: Kevin Karlis Capital Link Email:

castormaritime@capitallink.com

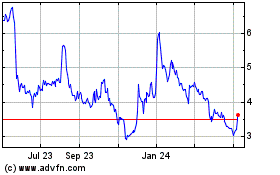

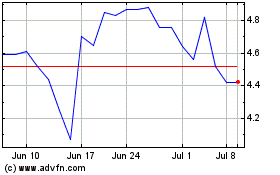

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Apr 2023 to Apr 2024