Telenor Continues Myanmar Exit With $53 Million Sale of Wave Money Stake

January 17 2022 - 3:05AM

Dow Jones News

By Dominic Chopping

Telenor ASA said Monday it has agreed to sell its 51% stake in a

Myanmar mobile financial-services provider in a further step toward

exiting operations in the country following last year's military

coup.

The Norwegian telecom provider said it will sell the stake in

Digital Money Myanmar Ltd., known as Wave Money, to a consortium of

investors led by Myanmar-focused conglomerate Yoma Strategic

Holdings Ltd. for $53 million.

When the transaction is concluded, Yoma Strategic will become

the largest and controlling shareholder of Wave Money, ensuring

that the company continues operations and further extends its role

in Myanmar's fintech sector, Telenor said.

Telenor last year agreed to sell its mobile operations in

Myanmar to Lebanese investment firm M1 Group for $105 million, with

the country facing a worsening economic and business environment

outlook and a deteriorating security and human-rights

situation.

Wave Money was launched in November 2016 as a joint venture

between Yoma Bank and Telenor. Monday's agreement completes a

divestment process announced in June 2020, when Telenor sold a

34.2% stake in Wave Money for $76.5 million.

The transaction is subject to various conditions, including

regulatory approval from the Myanmar Central Bank.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

January 17, 2022 02:50 ET (07:50 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

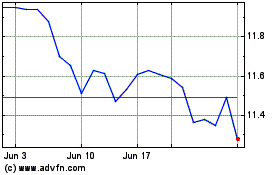

Telenor ASA (QX) (USOTC:TELNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

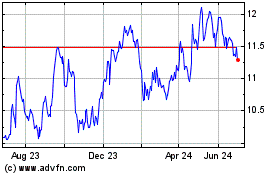

Telenor ASA (QX) (USOTC:TELNY)

Historical Stock Chart

From Apr 2023 to Apr 2024