Filed pursuant

to Rule 424(b)(3)

Registration

Statement No. 333-235891

AUDDIA

INC.

This prospectus relates

to the issuance of up to (i) 3,991,818 shares of common stock upon the exercise of Series A Warrants that were issued as part of our initial

public offering, exercisable immediately at an exercise price of $4.5375 per share, and which expire on February 19, 2026, or the Base

Warrants, (ii) 598,772 shares of common stock upon the exercise of Series A Warrants that were issued as part of our initial public offering,

exercisable immediately at an exercise price of $4.5375 per share and expire on February 19, 2026, or the Option Warrants, and (iii) 319,346

shares of common stock upon the exercise of underwriter representative warrants that were issued as part of an initial public offering,

exercisable on and after August 19, 2021 at an exercise price of $5.15625 per share, and expire on February 19, 2026, or the Representative

Warrants. The Base Warrants, Option Warrants and Representative Warrants are collectively referred to herein as the Warrants.

Our shares of common

stock trade on the Nasdaq Capital Market under the symbol “AUUD”. On July 13, 2021, the last reported sale price of our

ordinary shares on Nasdaq was $5.39 per share.

Our Series A Warrants

stock trade on the Nasdaq Capital Market under the symbol “AUUDW”. On July 13, 2021, the last reported sale price of our

Series A Warrants on Nasdaq was $1.53 per share.

We are an emerging growth

company as that term is used in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act and, as such, we have elected to take

advantage of certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common

stock involves a high degree of risk. Please carefully consider the risks discussed in this prospectus under “Risk Factors”

beginning on page 5 and in Item 1A – “Risk Factors” of our most recent Annual Report on Form 10-K incorporated by

reference in this prospectus for a discussion of the factors you should consider carefully before deciding to purchase any of our common

stock.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy

or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus

is July 14, 2021

TABLE OF CONTENTS

No action is being

taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this

prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required

to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus applicable

to that jurisdiction.

OUR BUSINESS

This prospectus summary

highlights certain information appearing elsewhere in this prospectus. As this is a summary, it does not contain all of the information

that you should consider in making an investment decision. This prospectus includes forward-looking statements that involve risks and

uncertainties. See “Information Regarding Forward-Looking Statements.”

In this prospectus,

unless the context otherwise requires, the terms “Auddia,” “the Company,” “we,” “us” and

“our” refer to Auddia Inc.

Overview

Auddia is a technology

company headquartered in Boulder, CO that is reinventing how consumers engage with audio through the development of a proprietary AI platform

for audio and innovative technologies for podcasts. Auddia is leveraging these technologies to bring to market two industry first apps,

Auddia and Vodacast.

Auddia gives consumers

the opportunity to listen to any AM/FM radio station with no commercials while personalizing the listening experience through skips, the

insertion of on-demand content and the programming of audio routines to customize listening sessions such as a daily commute. The Auddia

app represents the first time consumers can access the local content uniquely provided by radio in the commercial free and personalized

manner many consumers have come to demand for media consumption.

Vodacast is a podcasting

app that provides an interactive digital feed to supplement podcast audio with additional content to tell deeper stories and give podcasters

access to digital revenue for the first time. Vodacast is also introducing a new payments platform that allows consumers to make on-demand

micropayments to enjoy any podcast episode commercial free, without needing to be a subscriber.

The Company is currently

finalizing development and testing of the minimally viable product (“MVP”) version of the Auddia App and initiated the first

consumer pilots in the second quarter of 2021 with a full commercial launch to follow later in 2021.

The Company has also

developed a new podcasting platform called Vodacast. The platform is unique in that it is designed to add new monetization channels for

podcasters while delivering a superior content experience for listeners. Vodacast leverages technologies and proven product concepts from

the Company’s previously developed and deployed platform to deliver on these objectives for the radio industry.

Vodacast mobile apps

are available today through the iOS and Android app stores.

Our corporate information

We were originally formed

as Clip Interactive, LLC in January 2012, as a limited liability company under the laws of the State of Colorado. In connection with our

February 2021 IPO, we converted into a Delaware corporation pursuant to a statutory conversion and were renamed Auddia Inc.

Our principal executive

offices are located at 2100 Central Ave., Suite 200, Boulder, CO 80301. Our main telephone number is (303) 219-9771. Our internet website

is www.auddia.com. The information contained in, or that can be accessed through, our website is not incorporated by reference and is

not a part of this prospectus.

THE OFFERING

|

Securities offered by us

|

Up to 4,909,936 shares of common stock upon the exercise of the Warrants.

|

|

|

|

|

Description of the Warrants

|

The Base Warrants and Option Warrants have a per share exercise price

of $4.5375, were exercisable immediately upon issuance and expire on February 19, 2026.

The Representative Warrants have a per share exercise price of $5.15625,

are exercisable on and after August 19, 2021, and expire on February 19, 2026.

|

|

|

|

Common stock to be outstanding

after this offering

|

16,201,765 shares of common stock if the Warrants are exercised in full.

|

|

|

|

|

Nasdaq symbols

|

Our shares of common stock are listed on the Nasdaq

Capital Market under the symbol “AUUD.”

Our Series A Warrants are listed on the Nasdaq

Capital Market under the symbol “AUUDW.”

|

|

|

|

|

Risk Factors

|

You should carefully read the section titled “Risk Factors” and other information included in this prospectus for a discussion of factors that you should consider before deciding to invest in our securities.

|

The number of shares outstanding after this offering is based on 11,291,829 shares of our common stock outstanding as of June 30, 2021, and excludes:

|

|

·

|

300,353 shares of our common stock reserved for issuance under outstanding stock options,

|

|

|

·

|

358,334 shares of common stock reserved for issuance upon the exercise of outstanding common share warrants,

|

|

|

·

|

1,500,000 shares of our common stock reserved for issuance under our 2021 Equity Incentive Plan,

|

|

|

·

|

4,590,590 shares of common stock reserved for issuance upon the exercise of our publicly traded outstanding Series A Warrants, and

|

|

|

·

|

319,346 shares of common stock reserved for issuance upon the exercise of the outstanding Representative Warrants.

|

INFORMATION REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus and the

documents incorporated by reference in this prospectus include forward-looking statements, which involve risks and uncertainties. These

forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believe,” “estimate,”

“project,” “anticipate,” “expect,” “seek,” “predict,” “continue,”

“possible,” “intend,” “may,” “might,” “will,” “could,” would”

or “should” or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements

include all matters that are not historical facts. They appear in a number of places throughout this prospectus and the documents incorporated

by reference in this prospectus, and include statements regarding our intentions, beliefs or current expectations concerning, among other

things, our product candidates, research and development, commercialization objectives, prospects, strategies, the industry in which we

operate and potential collaborations. We derive many of our forward-looking statements from our operating budgets and forecasts, which

are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to

predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results.

Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when

such performance or results will be achieved. In light of these risks and uncertainties, the forward-looking events and circumstances

discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking

statements.

Forward-looking statements

speak only as of the date of this prospectus. You should not put undue reliance on any forward-looking statements. We assume no obligation

to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking

information, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should

be drawn that we will make additional updates with respect to those or other forward-looking statements.

You should read this

prospectus, the documents incorporated by reference in this prospectus, and the documents that we reference in this prospectus and have

filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual

future results, levels of activity, performance and events and circumstances may be materially different from what we expect. All forward-looking

statements are based upon information available to us on the date of this prospectus. Important factors that could cause our results to

vary from expectations include, but are not limited to:

|

|

☐

|

our expenses, ongoing losses, future revenue, capital requirements and need for and ability to obtain additional financing;

|

|

|

|

|

|

|

☐

|

changes in senior management, loss of one or more key personnel or our inability to attract, hire, integrate and retain highly skilled personnel;

|

|

|

|

|

|

|

☐

|

our ability to avoid and defend against intellectual property infringement, misappropriation and other claims including breaches of security of confidential consumer information;

|

|

|

|

|

|

|

☐

|

difficulties with certain vendors and suppliers we rely on or will rely on;

|

|

|

|

|

|

|

☐

|

our competition and market development; and

|

|

|

|

|

|

|

☐

|

the impact of laws and regulations on our operations.

|

By their nature, forward-looking

statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the

future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations,

financial condition, business and prospects may differ materially from those made in or suggested by the forward-looking statements contained

in this prospectus. In addition, even if our results of operations, financial condition, business and prospects are consistent with the

forward-looking statements contained (or incorporated by reference) in this prospectus, those results may not be indicative of results

in subsequent periods.

The foregoing does not

represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we

are faced with. Forward-looking statements necessarily involve risks and uncertainties, and our actual results could differ materially

from those anticipated in the forward-looking statements due to a number of factors, including those set forth below under “Risk

Factors” and elsewhere in this prospectus. The factors set forth below under “Risk Factors” and other cautionary statements

made in this prospectus should be read and understood as being applicable to all related forward-looking statements wherever they appear

in this prospectus. The forward-looking statements contained in this prospectus represent our judgment as of the date of this prospectus.

We caution readers not to place undue reliance on such statements. Except as required by law, we undertake no obligation to update publicly

any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. All subsequent

written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety

by the cautionary statements contained above and throughout this prospectus.

You should read this

prospectus, the documents incorporated by reference in this prospectus, and the documents that we reference in this prospectus and have

filed as exhibits to the registration statement of which this prospectus is a part completely and with the understanding that our actual

future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

RISK FACTORS

Investing in our common

stock involves a high degree of risk. Please carefully consider the risks described in Item 1A – “Risk Factors” of our

most recent Annual Report on Form 10-K incorporated by reference in this prospectus for a discussion of the factors you should consider

carefully before deciding to purchase any of our common stock. If any of these risks are realized, our business, financial condition,

results of operations and prospects would likely be materially and adversely affected. In that event, the trading price of our common

stock could decline, and you could lose part or all of your investment.

USE OF PROCEEDS

In the event of full

exercise for cash of all of the Warrants that remain outstanding, we will receive gross proceeds of approximately $22.5 million.

We intend to use the

net proceeds from this offering, together with our existing cash, to build out and complete the Auddia and Vodacast platforms, expand

our sales and marketing efforts, and for general and administration expenses.

The amounts and timing

of our actual expenditures will depend on numerous factors, including the progress of our product development team, the scale achieved

by our sales and marketing team, as well as the amount of cash used in our operations. We therefore cannot estimate with certainty the

amount of net proceeds to be used for the purposes described above. We may find it necessary or advisable to use the net proceeds for

other purposes, and we will have broad discretion in the application of the net proceeds. Pending the uses described above, we plan to

invest the net proceeds from this offering in short- and intermediate-term, interest-bearing obligations, investment-grade instruments,

certificates of deposit or direct or guaranteed obligations of the U.S. government.

DIVIDEND POLICY

We have not declared

or paid any cash dividends on our capital stock since our inception. We intend to retain future earnings, if any, to finance the operation

and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

CAPITALIZATION

The following table describes

our cash and capitalization as of March 31, 2021 (unaudited):

You should read this

information together with our financial statements and related notes incorporated by reference in this prospectus and the information

set forth under the headings “Use of Proceeds” in this prospectus and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q incorporated

by reference in this prospectus.

|

|

|

As of

March 31, 2021

|

|

|

Cash

|

|

$

|

6,162,647

|

|

|

Restricted cash

|

|

|

2,000,000

|

|

|

Shareholders' equity (deficit):

|

|

|

|

|

|

Preferred stock - $0.001 par value, 10,000,0000 authorized, actual, and 0 shares issued and outstanding, actual

|

|

|

–

|

|

|

Common stock - $0.001 par value, 100,000,000 authorized, actual; 11,291,829 shares issued and outstanding, actual

|

|

|

11,292

|

|

|

Additional paid-in capital

|

|

|

67,939,382

|

|

|

Accumulated deficit

|

|

|

(60,656,818

|

)

|

|

Total shareholders’ equity (deficit)

|

|

|

7,293,856

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity (deficit)

|

|

$

|

10,446,853

|

|

The number of shares

of common stock issued and outstanding in the table above is based on 11,291,829 shares of our common stock outstanding as of March 31,

2021, and excludes:

|

|

·

|

300,353 shares of our common stock reserved for issuance under outstanding stock options,

|

|

|

·

|

358,334 shares of common stock reserved for issuance upon the exercise of outstanding common share warrants,

|

|

|

·

|

1,500,000 shares of our common stock reserved for issuance under our 2021 Equity Incentive Plan,

|

|

|

·

|

4,590,590 shares of common stock reserved for issuance upon the exercise of our publicly traded outstanding Series A Warrants, and

|

|

|

·

|

319,346 shares of common stock reserved for issuance upon the exercise of the outstanding Representative Warrants.

|

DESCRIPTION OF CAPITAL

STOCK

The following description

is intended as a summary of our certificate of incorporation (which we refer to as our “charter”) and our bylaws, each of

which is filed as an exhibit to the registration statement of which this prospectus forms a part, and to the applicable provisions of

the Delaware General Corporation Law. Because the following is only a summary, it does not contain all of the information that may be

important to you. For a complete description, you should refer to our charter and bylaws.

We have two classes of

securities registered under Section 12 of the Exchange Act. Our shares of common stock are listed on The Nasdaq Stock Market under the

trading symbol “AUUD.” Our Series A Warrants are listed on the Nasdaq Stock Market under the trading symbol “AUUDW.”

Authorized Capital

Stock

Our authorized capital

stock consists of 100,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value

$0.001 per share.

Common Stock

The holders of our common

stock are entitled to one vote for each share held on all matters submitted to a vote of the stockholders. The holders of our common stock

do not have any cumulative voting rights. Holders of our common stock are entitled to receive ratably any dividends declared by our board

of directors out of funds legally available for that purpose, subject to any preferential dividend rights of any outstanding preferred

stock. Our common stock has no preemptive rights, conversion rights or other subscription rights or redemption or sinking fund provisions.

In the event of our liquidation,

dissolution or winding up, holders of our common stock will be entitled to share ratably in all assets remaining after payment of all

debts and other liabilities and any liquidation preference of any outstanding preferred stock. Each outstanding share of common stock

is duly and validly issued, fully paid and non-assessable.

Preferred stock

Our board will have the

authority, without further action by our stockholders, to issue up to 10,000,000 shares of preferred stock in one or more series and to

fix the rights, preferences, privileges and restrictions thereof. These rights, preferences and privileges could include dividend rights,

conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting,

or the designation of, such series, any or all of which may be greater than the rights of common stock. The issuance of our preferred

stock could adversely affect the voting power of holders of common stock and the likelihood that such holders will receive dividend payments

and payments upon our liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing

a change in control of our company or other corporate action.

No shares of preferred

stock are currently outstanding.

Anti-Takeover Effects

of Delaware Law and Provisions of our Charter and our Bylaws

Certain provisions of

the DGCL and of our charter and our bylaws could have the effect of delaying, deferring or preventing another party from acquiring control

of us and encouraging persons considering unsolicited tender offers or other unilateral takeover proposals to negotiate with our board

of directors rather than pursue non-negotiated takeover attempts. These provisions include the items described below.

Delaware Anti-Takeover

Statute

We are subject to the

provisions of Section 203 of the DGCL. In general, Section 203 prohibits a publicly held Delaware corporation from engaging in a “business

combination” with an “interested stockholder” for a three-year period following the time that this stockholder becomes

an interested stockholder, unless the business combination is approved in a prescribed manner. Under Section 203, a business combination

between a corporation and an interested stockholder is prohibited unless it satisfies one of the following conditions:

|

|

·

|

before the stockholder became interested, our Board approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

|

|

|

·

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding, shares owned by persons who are directors and also officers, and employee stock plans, in some instances, but not the outstanding voting stock owned by the interested stockholder; or

|

|

|

·

|

at or after the time the stockholder became interested, the business combination was approved by our Board and authorized at an annual or special meeting of the stockholders by the affirmative vote of at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder.

|

Section 203 defines a

business combination to include:

|

|

·

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

·

|

any sale, transfer, lease, pledge, exchange, mortgage or other disposition involving the interested stockholder of 10% or more of the assets of the corporation;

|

|

|

·

|

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; or

|

|

|

·

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

In general, Section 203

defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation

and any entity or person affiliated with or controlling or controlled by the entity or person.

Board Composition

and Filling Vacancies

Our charter provides

that stockholders may remove directors only for cause and only by the affirmative vote of the holders of at least two-thirds of our outstanding

common stock. Our charter and bylaws authorize only our board of directors to fill vacant directorships, including newly created seats.

In addition, the number of directors constituting our board of directors may only be set by a resolution adopted by a majority vote of

our entire board of directors. These provisions would prevent a stockholder from increasing the size of our board of directors and then

gaining control of our board of directors by filling the resulting vacancies with its own nominees. This makes it more difficult to change

the composition of our board of directors but promotes continuity of management.

No Written Consent

of Stockholders

Our charter and bylaws

provides that all stockholder actions are required to be taken by a vote of the stockholders at an annual or special meeting, and that

stockholders may not take any action by written consent in lieu of a meeting. This limit may lengthen the amount of time required to take

stockholder actions and would prevent the amendment of our bylaws or removal of directors by our stockholders without holding a meeting

of stockholders.

Meetings of Stockholders

Our charter and bylaws

provide that only a majority of the members of our Board then in office, our Executive Chairman or our Chief Executive Officer may call

special meetings of stockholders and only those matters set forth in the notice of the special meeting may be considered or acted upon

at a special meeting of stockholders.

Advance Notice Requirements

Our bylaws provide advance

notice procedures for stockholders seeking to bring matters before our annual meeting of stockholders or to nominate candidates for election

as directors at our annual meeting of stockholders. Our bylaws also specify certain requirements regarding the form and content of a stockholder’s

notice. These provisions might preclude our stockholders from bringing matters before our annual meeting of stockholders or from making

nominations for directors at our annual meeting of stockholders if the proper procedures are not followed. We expect that these provisions

might also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate

of directors or otherwise attempting to obtain control of our company.

Amendment to our Charter

and Bylaws

The DGCL, provides, generally,

that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend a corporation’s certificate

of incorporation or bylaws, unless a corporation’s certificate of incorporation or bylaws, as the case may be, requires a greater

percentage. Our bylaws may be amended or repealed by a majority vote of our board of directors or the affirmative vote of the holders

of at least two-thirds of the votes that all our stockholders would be entitled to cast in an annual election of directors. In addition,

the affirmative vote of the holders of at least two-thirds of the votes that all our stockholders would be entitled to cast in an election

of directors is required to amend or repeal or to adopt certain provisions of our charter.

Undesignated preferred

stock

Our charter provides

for 10,000,000 authorized shares of preferred stock. The existence of authorized but unissued shares of preferred stock may enable our

board to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise. For example, if

in the due exercise of its fiduciary obligations, our board of directors were to determine that a takeover proposal is not in the best

interests of our stockholders, our board could cause shares of convertible preferred stock to be issued without stockholder approval in

one or more private offerings or other transactions that might dilute the voting or other rights of the proposed acquirer or insurgent

stockholder or stockholder group. In this regard, our charter grants our board broad power to establish the rights and preferences of

authorized and unissued shares of preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings and

assets available for distribution to holders of shares of common stock. The issuance may also adversely affect the rights and powers,

including voting rights, of these holders and may have the effect of delaying, deterring or preventing a change in control of us.

Choice of Forum

Our charter provides

that the Court of Chancery of the State of Delaware is the exclusive forum for the following types of actions or proceedings: any derivative

action or proceeding brought on behalf of the Company, any action asserting a claim of breach of a fiduciary duty owed by any director,

officer or other employee of the Company to the Company or the Company’s stockholders, any action asserting a claim against the

Company arising pursuant to any provision of the DGCL or the Company’s certificate of incorporation or bylaws, or any action asserting

a claim against the Company governed by the internal affairs doctrine. Our charter also provides that unless the Company consents in writing

to the selection of an alternative forum, the federal district courts of the United States of America shall be the exclusive forum for

the resolution of any complaint asserting a cause of action arising under the Securities Act. Despite the fact that the certificate of

incorporation provides for this exclusive forum provision to be applicable to the fullest extent permitted by applicable law, Section

27 of the Exchange Act, creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the

Exchange Act or the rules and regulations thereunder and Section 22 of the Securities Act, creates concurrent jurisdiction for federal

and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder.

As a result, this provision of the Company’s certificate of incorporation would not apply to claims brought to enforce a duty or

liability created by the Exchange Act, or any other claim for which the federal courts have exclusive jurisdiction. However, there is

uncertainty as to whether a Delaware court would enforce the exclusive federal forum provisions for Securities Act claims and that investors

cannot waive compliance with the federal securities laws and rules and regulations thereunder.

Unless the Company consents

in writing to the selection of an alternative forum, the federal district courts of the United States of America shall be the exclusive

forum for the resolution of any complaint asserting a cause of action arising under the Securities Act.

Series A Warrants

Each Series A Warrant

represents the right to purchase one share of common stock at an exercise price of $ 4.54. The Series A Warrants are exercisable beginning

February 19, 2021 will terminate on the 5th anniversary date the warrants are first exercisable. The exercise price and number of shares

for which each Series A Warrant may be exercised is subject to adjustment in the event of stock dividends, stock splits, reorganizations

or similar events affecting our common stock.

Holders of the Series

A Warrants may exercise their Series A Warrants to purchase shares of our common stock on or before the termination date by delivering

an exercise notice, appropriately completed and duly signed. Payment of the exercise price for the number of shares for which the Series

A Warrants is being exercised must be made within two trading days following such exercise. In the event that the registration statement

relating to the Series A Warrants shares (the “Warrant Shares”) is not effective, a holder of Series A Warrants may only exercise

its Series A Warrants for a net number of Warrant Shares pursuant to the cashless exercise procedures specified in the Series A Warrants.

Series A Warrants may be exercised in whole or in part, and any portion of a Series A Warrant not exercised prior to the termination date

shall be and become void and of no value. The absence of an effective registration statement or applicable exemption from registration

does not alleviate our obligation to deliver common stock issuable upon exercise of a Series A Warrant.

Upon the holder’s

exercise of a Series A Warrant, we will issue the shares of common stock issuable upon exercise of the Series A Warrant within three trading

days of our receipt of notice of exercise, subject to timely payment of the aggregate exercise price therefor.

The shares of common

stock issuable on exercise of the Series A Warrants will be, when issued in accordance with the Series A Warrants, duly and validly authorized,

issued and fully paid and non-assessable. We will authorize and reserve at least that number of shares of common stock equal to the number

of shares of common stock issuable upon exercise of all outstanding warrants.

If, at any time a Series

A Warrant is outstanding, we consummate any fundamental transaction, as described in the Series A Warrants and generally including any

consolidation or merger into another corporation, the consummation of a transaction whereby another entity acquires more than 50% of our

outstanding common stock, or the sale of all or substantially all of our assets, or other transaction in which our common stock is converted

into or exchanged for other securities or other consideration, the holder of any Series A Warrants will thereafter receive upon exercise

of the Series A Warrants, the securities or other consideration to which a holder of the number of shares of common stock then deliverable

upon the exercise or conversion of such Series A Warrants would have been entitled upon such consolidation or merger or other transaction.

The Series A Warrants

are not exercisable by their holder to the extent (but only to the extent) that such holder or any of its affiliates would beneficially

own in excess of 4.99% of our common stock.

Amendments and waivers

of the terms of the Series A Warrants require the written consent of the holder of such Series A Warrants and us. The Series A Warrants

will be issued in book-entry form under a warrant agent agreement between V-Stock Transfer Company, Inc. as warrant agent, and us, and

shall initially be represented by one or more book-entry certificates deposited with The Depository Trust Company, or DTC, and registered

in the name of Cede & Co., a nominee of DTC, or as otherwise directed by DTC.

You should review a copy

of the warrant agent agreement and the form of the Series A Warrants, each of which are included as exhibits to the registration statement

of which this prospectus is a part.

Transfer Agent, Registrar,

Warrant Agent

The transfer agent and

registrar for our common stock and the warrant agent for our Series A Warrants is VStock Transfer LLC, 18 Lafayette Place, Woodmere, NY

11598.

Representative Warrant

In connection with our

IPO, we issued the representative of our IPO underwriters a warrant to purchase up to 319,346 shares of common stock at an exercise price

of $5.15625. The Representative warrant contains a cashless exercise feature. The Representative Warrant may be exercised beginning six

months from the date of effectiveness of our IPO registration statement, and shall expire five years from such effective date. The Representative

Warrant contains limitations on exercise that prevent the holder from acquiring shares upon exercise that would result in the number of

shares beneficially owned by the representative and its affiliates, including the shares issuable upon exercise, exceeding 9.99% of the

total number of shares of our common stock then issued and outstanding. The Representative Warrant has provisions for piggyback registration

rights for a period of five years after our IPO.

Pre-IPO Warrants

At June 30, 2021 we had

358,334 outstanding common stock warrants which were issued to investors prior to our IPO. These warrants have a weighted-average exercise

price of $7.02, and will expire in October 2023.

These warrants have a

net exercise provision under which its holder may, in lieu of payment of the exercise price in cash, surrender the warrant and receive

a net amount of shares based on the fair market value of the underlying shares at the time of exercise of the warrant after deduction

of a number of shares equal in value to the aggregate exercise price. The warrants contain provisions for the adjustment of the exercise

price and the number of shares issuable upon the exercise of the warrant in the event of certain stock dividends, stock splits, reorganizations,

reclassifications and consolidations.

Pre-IPO Stock Options

At June 30, 2021 we had 300,353 outstanding common stock options which

have a weighted-average exercise price of $3.65. These options were granted under the Clip Interactive, LLC 2013 Equity Incentive Plan.

We ceased granting awards under the 2013 Plan upon the implementation of the 2021 Plan described below.

2021 Equity Incentive

Plan

The Company’s 2021

Equity Incentive Plan, which became effective upon the completion of the IPO in February 2021, serves as the successor equity incentive

plan to the 2013 Plan. The 2021 Plan and has 1,500,000 shares of common stock available for issuance.

The 2021 Equity Incentive

Plan contains an “evergreen” provision, pursuant to which the number of shares of common stock reserved for issuance pursuant

to awards under such plan shall be increased on the first day of each year beginning in 2022 and ending in 2030 equal to the lesser of

(a) five percent (5%) of the shares of stock outstanding (on an as converted basis) on the last day of the immediately preceding fiscal

year and (b) such smaller number of shares of stock as determined by our board of directors.

At June 30, 2021, there

were no grants outstanding under the 2021 Plan.

Piggyback registration

rights

If we register any of

our equity securities either for our own account or for the account of other security holders, certain of our pre-IPO stockholders are

entitled to piggyback registration rights and may include their shares in the registration. The underwriters may advise us to limit the

number of shares included in any underwritten offering to the number of shares which we and the underwriters determine in our sole discretion

will not jeopardize the success of the offering. If this occurs, the aggregate number of securities held by such stockholders that may

be included in the underwriting shall be allocated among all requesting stockholders in proportion to the amount of securities sought

to be sold by each such stockholder.

The piggyback registration

rights granted to certain of our pre-IPO stockholders will terminate, with respect to each such holder, as of the date when all registrable

securities held by and issued to such holder may be sold under Rule 144 under the Securities Act, provided such holder owns less than

1% of the outstanding common stock of the Company.

DESCRIPTION OF SECURITIES

WE ARE OFFERING

This prospectus relates

to the shares of common stock issuable upon exercise of the Base Warrants, Option Warrants and Representative Warrants.

The material terms and

provisions of our common stock and each other class of our securities are described under the caption “Description of Capital Stock”

in this prospectus.

PLAN

OF DISTRIBUTION

The ongoing offer and

sale by us of the shares of common stock issuable upon exercise of the Warrants is being made pursuant to this prospectus.

We will deliver shares

of common stock upon exercise of the Warrants, in whole or in part. Each Warrant contains instructions for the exercise. In order to exercise

a Warrant, the holder must deliver the information required by the applicable warrant agreement, along with payment of the exercise price,

if the exercise price is being paid in cash, for the shares to be purchased. We will then deliver our shares in the manner described in

the applicable warrant agreement.

LEGAL MATTERS

Bingham & Associates

Law Group, APC of Encinitas, CA has passed upon the validity of the shares of common stock offered hereby.

EXPERTS

Daszkal Bolton LLP (“Daszkal”),

independent registered public accounting firm, has audited our financial statements included in our Annual Report on Form 10-K for the

year ended December 31, 2020, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the

registration statement. Our financial statements are incorporated by reference in reliance on Daskal’s report, given on their authority

as experts in accounting and auditing.

WHERE YOU CAN FIND

MORE INFORMATION

We have filed with the

SEC a registration statement on Form S-1 under the Securities Act with respect to the shares of our common stock being offered by this

prospectus. This prospectus, which constitutes part of that registration statement, does not contain all of the information set forth

in the registration statement or the exhibits and schedules that are part of the registration statement. Some items included in the registration

statement are omitted from the prospectus in accordance with the rules and regulations of the SEC. For further information with respect

to us and the common stock offered in this prospectus, we refer you to the registration statement and the accompanying exhibits and schedules

filed therewith. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as

an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference

to the full text of such contract or other document filed as an exhibit to the registration statement.

The SEC maintains a website

that contains reports, proxy and information statements and other information regarding registrants that file electronically with the

SEC. The address is www.sec.gov.

We also maintain a website

at www.auddia.com. The reference to our website address does not constitute incorporation by reference of the information contained on

our website, and you should not consider information on our website to be part of this prospectus.

You may also request

a copy of these filings, at no cost to you, by writing or telephoning us at the following address:

Auddia Inc.

Attn: Investor Relations

2100 Central Avenue, Suite

200

Boulder, CO 80301

Telephone: (303) 219-9771

INCORPORATION OF CERTAIN

INFORMATION BY REFERENCE

The SEC allows us to

incorporate by reference the information and reports we file with it, which means that we can disclose important information to you by

referring you to these documents. The information incorporated by reference is an important part of this prospectus, and information that

we file later with the SEC will automatically update and supersede the information already incorporated by reference. We are incorporating

by reference the documents listed below, which we have already filed with the SEC (SEC File No. 001-40071), and any future filings we

make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including all filings made after the date of the filing

of this registration statement, except as to any portion of any future report or document that is not deemed filed under such provisions

until we sell all of the securities:

|

|

·

|

our Annual Report on

Form 10-K for the year ended December 31, 2020, filed with the SEC on March 31, 2021;

|

|

|

|

|

|

|

·

|

our Quarterly Report

on Form 10-Q for the three months ended March 31, 2021, filed with the SEC on May 14, 2021;

|

|

|

|

|

|

|

·

|

our Current Reports

on Form 8-K, filed with the SEC, on February 22, March 18, April 15, and July 8, 2021; and

|

|

|

|

|

|

|

·

|

the description of our

securities registered pursuant to Section 12 of the Exchange Act our Registration Statement on Form 8-A (File No. 001-40071), filed with

the SEC under Section 12(b) of the Exchange Act, on February 16, 2021, including any amendment or report filed for the purpose of updating

such description.

|

We will furnish without

charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference in this prospectus, including

exhibits to these documents. You should direct any requests for documents to Auddia Inc., Attn: Investor Relations, 2100 Central Avenue,

Suite 200, Boulder, CO 80301; Telephone: (303) 219-9771; E-mail: bhoff@auddia.com.

You also may access these

filings, free of charge, on the SEC’s website at www.sec.gov or on our website at www.auddia.com. We do not incorporate the information

on our website into this prospectus or any supplement to this prospectus and you should not consider any information on, or that can be

accessed through, our website as part of this prospectus or any supplement to this prospectus (other than those filings with the SEC that

we specifically incorporate by reference into this prospectus or any supplement to this prospectus).

Any statement contained

in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed modified, superseded or replaced

for purposes of this prospectus to the extent that a statement contained in this prospectus modifies, supersedes or replaces such statement.

AUDDIA, INC.

PROSPECTUS

July 14, 2021

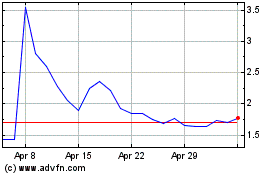

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Apr 2023 to Apr 2024