Current Report Filing (8-k)

July 07 2021 - 6:01AM

Edgar (US Regulatory)

false

0001563880

0001563880

2021-07-06

2021-07-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 6, 2021

Trevi Therapeutics, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-38886

|

|

45-0834299

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

195 Church Street, 14th Floor

New Haven, Connecticut

|

|

06510

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (203) 304-2499

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock, $0.001 par value per share

|

|

TRVI

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into a Material Definitive Agreement

On July 6, 2021, Trevi Therapeutics, Inc., a Delaware corporation (the “Company”), and Silicon Valley Bank (“SVB”) entered into a First Amendment (the “Amendment”) to the Loan and Security Agreement, dated as of August 13, 2020, by and between the Company and SVB (the “Loan and Security Agreement”). The Amendment principally modifies the conditions under which the Company is required to cash collateralize all outstanding amounts owed to SVB under the Loan and Security Agreement. Prior to entering into the Amendment, the Company was required under the Loan and Security Agreement to deposit unrestricted and unencumbered cash equal to 100% of all outstanding amounts owed to SVB in a cash collateral account controlled by SVB if it failed to meet certain equity raise requirements, including raising (1) by June 30, 2021, at least $12 million in net proceeds from the sale of equity securities from the inception of the loan, (2) by December 31, 2021, at least $16.0 million in net proceeds from the sale of equity securities from the inception of the loan (inclusive of amounts raised under clause (1)) and (3) by March 31, 2022, sufficient additional net proceeds from the sale of equity securities to finance the Company’s planned second Phase 3 clinical trial of Haduvio for prurigo nodularis (the “Planned Phase 3 Trial”) and the Company’s ongoing operations. As a result of the Amendment, the cash collateralization requirement under the Loan and Security Agreement will now be triggered if the Company does not (i) raise during the period from June 1, 2021 through October 31, 2021 at least $15.0 million in net proceeds from the sale of equity securities, (ii) receive positive data from its ongoing Phase 2b/3 PRISM trial of Haduvio for prurigo nodularis, and (iii) raise by June 30, 2022 sufficient additional net proceeds from the sale of equity securities to finance the Planned Phase 3 Trial and the Company’s ongoing operations (collectively, the “Milestone Conditions”). In addition, the Amendment provides that if the Company fails to maintain at least $20.0 million in unrestricted and unencumbered cash in its accounts with SVB at any time prior to the satisfaction of all the Milestone Conditions, the Company will be required to cash collateralize all outstanding amounts owed to SVB under the Loan and Security Agreement.

The foregoing description of the Amendment is qualified in its entirety by reference to the full text of the Amendment, which is filed as Exhibit 99.1 hereto and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

TREVI THERAPEUTICS, INC.

|

|

|

|

|

|

Date: July 6, 2021

|

|

By:

|

/s/ Jennifer Good

|

|

|

|

|

Name: Jennifer Good

|

|

|

|

|

Title: President and Chief Executive Officer

|

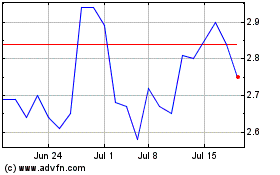

Trevi Therapeutics (NASDAQ:TRVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trevi Therapeutics (NASDAQ:TRVI)

Historical Stock Chart

From Apr 2023 to Apr 2024