Information Statement - All Other (definitive) (def 14c)

May 11 2021 - 12:04PM

Edgar (US Regulatory)

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

|

☐

|

Preliminary

Information Statement

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2))

|

|

|

|

|

|

|

☒

|

Definitive

Information Statement

|

|

|

CYBER

APPS WORLD INC.

(Name

of Registrant As Specified In Charter)

Payment

of Filing Fee (Check the appropriate box):

|

☒

|

No

fee required.

|

|

|

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

|

1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total

fee paid:

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

2)

|

Form,

Schedule or Registration Statement No:

|

|

|

|

|

|

|

3)

|

Filing

Party:

|

|

|

|

|

|

|

4)

|

Date

Filed:

|

THIS

INFORMATION STATEMENT IS BEING PROVIDED TO

YOU

BY THE BOARD OF DIRECTORS OF THE COMPANY

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED

NOT TO SEND US A PROXY

INFORMATION

STATEMENT

CYBER

APPS WORLD INC.

9436

W. Lake Mead Blvd., Ste. 5-53

Las

Vegas NV 89134-8340

Telephone:

702-805-0632

Email:

info@cyberappsworld.com

May

11, 2021

GENERAL

INFORMATION

This

Information Statement has been filed with the Securities and Exchange Commission and is being furnished, pursuant to Section 14C

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to the holders (the “Stockholders”)

of the common stock, par value $.00075 per share (the “Common Stock”), of Cyber Apps World Inc., a Nevada Corporation

(the “Company”), to notify such Stockholders of the following:

|

|

1.

|

On

April 21, 2021, the Company received written consents in lieu of a meeting of Stockholders

from holders of 128,240,000 shares of common stock representing approximately 74.9% of

the 171,162,128 shares of the total issued and outstanding shares of voting stock of

the Company (the "Majority Stockholders") authorizing the Company to increase

the number of authorized shares of common stock from 250,000,000 shares of common stock,

par value $.00075 per share, to 1,000,000,000 shares of common stock, par value $.00075

per share (the “Authorized Share Increase”). The Company currently has no

commitments for the issuance of any shares of common stock or preferred stock, other

than as provided for in existing agreements and instruments to which it is a party. There

will be no change to the number of authorized shares of preferred stock.

|

|

|

2.

|

On

April 21, 2021, the Board of Directors of the Company approved the Authorized Share Increase.

|

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

The

entire cost of furnishing this Information Statement will be borne by the Company. The Company will request brokerage houses,

nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the

Common Stock held of record by them. The Board of Directors has fixed the close of business on April 21, 2021, as the record date

(the “Record Date”) for the determination of Stockholders who are entitled to receive this Information Statement.

Each

share of our common stock entitles its holder to one vote on each matter submitted to the stockholders. However, because the stockholders

holding at least a majority of the voting rights of all outstanding shares of capital stock as of the Record Date have voted in

favor of the foregoing actions by resolution; and having sufficient voting power to approve such proposals through their ownership

of the capital stock, no other consents will be solicited in connection with this Information Statement.

You

are being provided with this Information Statement pursuant to Section 14C of the Exchange Act and Regulation 14C and Schedule

14C thereunder, and, in accordance therewith, the forgoing action will not become effective until at least 20 calendar days after

the mailing of this Information Statement.

ADDITIONAL

INFORMATION

The

Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and in accordance therewith files reports, proxy statements and other information including annual and quarterly reports on Form

10-K and 10-Q (the “1934 Act Filings”) with the Securities and Exchange Commission (the “Commission”).

Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained at

the Commission at 100 F Street, N.E., Washington, DC 20549. Copies of such material can be obtained upon written request addressed

to the Commission, Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. The Commission maintains

a web site on the Internet (http://www.sec.gov) that contains reports, proxy and information statements and other information

regarding issuers that file electronically with the Commission through the Electronic Data Gathering, Analysis and Retrieval System

(“EDGAR”).

OUTSTANDING

VOTING SECURITIES

As

of the date of the Consent by the Majority Stockholders, April 21, 2021, the Company had 171,162,128 shares of common stock issued

and outstanding. Each share of outstanding common stock is entitled to one vote on matters submitted for Stockholder approval.

On

April 21, 2021, the holders of 128,240,000 shares (or approximately 74.9% of the 171,162,128 shares of Common Stock then outstanding)

executed and delivered to the Company a written consent approving the actions set forth herein. Since the action has been approved

by the Majority Stockholders, no proxies are being solicited with this Information Statement.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following information table sets forth certain information regarding the Company’s common stock owned on April 21, 2021,

by (i) each who is known by the Company to own beneficially more than 5% of its outstanding Common Stock, (ii) each director and

officer, and (iii) all officers and directors as a group:

|

Name

of Beneficial Owner

|

|

Number of

Common

Shares Owned

|

|

|

Percent

of Class (1)

|

|

|

Kateryna Malenko (Director)

|

|

|

82,240,000

|

|

|

|

48.05

|

%

|

|

Real-Time Save Online Inc.

|

|

|

46,000,000

|

|

|

|

26.88

|

%

|

|

Mohammed Irfan Rafimiya Kazi (President)

|

|

|

0

|

|

|

|

0.00

|

%

|

|

All officers and directors

|

|

|

|

|

|

|

48.05

|

%

|

|

(1)

|

Applicable

percentage of ownership is based on 171,162,128 shares of common stock outstanding as of April 21, 2021.

|

DISSENTER’S

RIGHTS OF APPRAISAL

Section

78.3793 of Nevada Revised Statue (“NRS”) which provides dissenting shareholders with rights to obtain payment of the

fair value of his/her shares in the case of a control share acquisition is not applicable to the matters disclosed in this Information

Statement. Accordingly, dissenting shareholders will not have rights to appraisal in connection with the amendment to the

Articles of Incorporation discussed in this Information Statement.

AMENDMENT

OF ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED CAPITAL OF THE COMPANY’S COMMON STOCK AND AMEND ITS ARTICLES OF

INCORPORATION ACCORDINGLY

On

April 21, 2021, the Majority Stockholders took action by written consent to increase the number of authorized shares of common

stock from 250,000,000 shares of common stock, par value $.00075 per share, to 1,000,000,000 shares of common stock, par value

$.00075 per share (the “Authorized Share Increase”). Our Board of Directors has authorized the increase in authorized

capital in order to allow it to comply with terms of various convertible notes with at arm’s length creditors of the Company

that have the right to convert their outstanding debt into the Company’s shares of common stock at a discount to the current

trading price of the Company’s shares.

We

intend to file the Amendment to the Articles of Incorporation with the Secretary of the State of Nevada promptly after the twentieth

day after the date this Information Statement has been sent to stockholders. With the approval of our Majority Stockholders, the

amended Articles will become effective upon the filing with the Secretary of State of Nevada.

This

Information Statement is provided to the holders of common stock of the Company only for information purposes in connection with

the forward stock split described herein pursuant to and in accordance with Rule 14c-2 of the Exchange Act.

|

By

Order of the Board of Directors

|

|

|

|

|

|

/s/

Mohammed Irfan Rafimiya Kazi

|

|

|

Mohammed

Irfan Rafimiya Kazi

|

|

|

President

& CEO

|

|

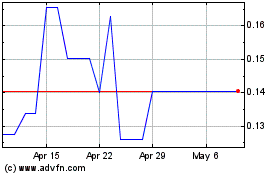

Cyber Apps World (PK) (USOTC:CYAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cyber Apps World (PK) (USOTC:CYAP)

Historical Stock Chart

From Apr 2023 to Apr 2024