Golden Minerals Reports First Quarter 2021 Results

May 06 2021 - 6:50AM

Golden Minerals Company (“Golden Minerals”, “Golden” or the

“Company”) (NYSE American and TSX: AUMN) today provided financial

results and a business summary for the quarter ending March 31,

2021.

First Quarter Summary Financial

Results (All currency expressed in approximate USD)

- Revenue

$1.8 million, cost of metals sold $1.5 million and net operating

margin $0.2 million in the first quarter 2021, all related to

mining at the Company’s Rodeo gold-silver operations (the “Rodeo

Property”). In the first quarter 2020, the Company recorded revenue

of $1.2 million and a net operating margin of $0.6 million related

to a lease of the Company’s oxide mill to Hecla Mining. That lease

concluded on November 30, 2020.

- Cash and

cash equivalents balance of $8.0 million as of March 31, 2021,

compared to $9.7 million at year-end 2020 and $2.2 million as of

March 31, 2020.

-

Exploration expenses of $0.8 million compared to $1.6 million in

the year ago period.

- Net loss

of $3.2 million or $0.02 per share in the first quarter 2021,

compared to a net loss of $3.3 million or $0.03 per share in the

first quarter 2020.

First Quarter Business

Summary

- Began

processing material from the Rodeo mine at our Velardeña oxide

plant in January 2021.

- Produced

1,559 gold equivalent ounces (“AuEq oz”) in doré and sold 1,054

AuEq oz. in doré, with the differential representing doré inventory

at March 31, 2021 that will be recognized as sales in the second

quarter 2021.

- Reported

as-planned average start-up grades processed of 3.0 grams per tonne

(“g/t”) gold and 14.3 g/t silver. Initiated a 2000-meter

exploration drill program at Rodeo aimed at expanding the

resource.

-

Successfully commissioned the second ball mill and achieved full

operational throughput at our Velardeña oxide plant in April

2021.

- Announced

promising results from an initial drill program conducted at the

district-scale Yoquivo gold-silver project (Chihuahua State,

Mexico) and announced plans for a Phase II program which could

begin in the second quarter 2021.

Warren Rehn, President and Chief Executive

Officer of the Company, commented, “The first quarter of 2021 has

been transformational for Golden Minerals, as we report results as

a gold-silver producer for the first time since 2015. We are

exceptionally pleased to have begun processing gold and silver from

our Rodeo Property in January 2021. At the end of April, we

surpassed our daily throughput goal at our oxide plant of 450 tpd

with the successful commissioning of the second ball mill installed

at the plant. We remain on track to achieve 2021 production

guidance of 12,000-14,000 oz gold and 25,000-30,000 oz silver. We

anticipate announcing further success as we anticipate reporting

net income at the corporate level during the second quarter of

2021.”

First Quarter 2021 Financial

Results

The Company reported revenue of $1.8 million in

the first quarter 2021, all from the sale of gold and silver

bearing doré bars from Rodeo operations in Mexico. Costs of metals

sold, which include direct and indirect costs incurred to mine and

process the products, were $1.5 million. Rodeo operations generated

a positive net operating margin of over $0.2 million. Also during

the first quarter, Golden received $1.8 million net of fees from

equity sales under its existing At the Market Program (“ATM

Program”) and $1.0 million from the exercise of warrants issued in

past common stock offerings. Exploration expenses were $0.8 million

in the first quarter, primarily reflecting exploration work at

Yoquivo and the commencement of a drill program targeting resource

expansion at Rodeo. The Company incurred $0.5 million in capital

expenditures during the first quarter, primarily related to

construction of a new regrind mill circuit related to the Rodeo

Property. El Quevar project expense was $0.1 million in the quarter

which includes costs of exploration and evaluation activities, care

and maintenance and property holding costs, net of reimbursements

from Barrick Gold under the terms of an Earn-In Agreement.

Administrative expenses totaled $1.5 million in the first quarter

2021, including costs associated with being a public company that

are incurred primarily by the Company’s corporate activities in

support of the Rodeo Property, the Velardeña Properties, the

Yoquivo project and the balance of the Company’s exploration

portfolio. Golden reported a net loss of $3.2 million or $0.02 per

share in the first quarter 2021 compared to a net loss of $3.3

million or $0.03 per share in the year ago period.

Twelve Month Financial

Outlook

The Company ended the first quarter 2021 with a

cash balance of $8.0 million and currently anticipates receiving

approximately $13.0 to $15.0 million in net operating margin

(defined as revenue from the sale of metals less costs of metals

sold) from the Rodeo operation during the 12 months ending March

31, 2022. The Company’s currently forecasted expenditures during

the 12 months ending March 31, 2022, apart from Rodeo costs of

metals sold which are included in the net operating margin

forecast, total $8.5 million and are as follows:

- $3.2 million on exploration

activities and property holding costs associated with the Company’s

portfolio of exploration properties located in Mexico, Argentina

and Nevada, including project assessment and evaluation costs

relating to additional exploration at Rodeo, Yoquivo and other

properties;

- $0.5 million on capital

expenditures related to the Rodeo Property;

- $0.6 million at the Velardeña

Properties for care and maintenance;

- $0.5 million at the El Quevar

project to fund care and maintenance and property holding costs,

net of reimbursement from Barrick;

- $3.5 million on general and

administrative costs; and

- $0.2 million related to an increase

in working capital primarily related to increased inventories and

receivables at the Rodeo operation.

Forecasted cash inflows do not include an

anticipated second installment of $1.5 million due to Golden

Minerals from Fabled Silver Gold Corp. in December 2021 under the

terms of an agreement for the sale of the Company’s Santa Maria

project. Rodeo estimates assume average realized metals prices of

$1,800/oz gold and $25/oz silver.

Covid-19 Uncertainties

Activities at the Rodeo operation and the

Velardeña Properties, including mining and processing, were not

interrupted as a result of the pandemic during the first quarter

2021. The Company undertook several initiatives and installed

multiple safety practices in 2020 in response to the pandemic and

continues to carry out these initiatives and practices. The Company

will continue to follow World Health Organization protocols at all

its projects and offices. Business and financial projections are

current as of the date of this news release but could be negatively

impacted if business interruptions related to COVID-19 occur.

Additional information regarding first quarter

2021 financial results may be found in the Company’s 10-Q Quarterly

Report which is available on the Golden Minerals website at

www.goldenminerals.com.

About Golden Minerals

Golden Minerals is a Delaware corporation based

in Golden, Colorado. The Company is primarily focused on producing

gold and silver from its Rodeo Mine and advancing its Velardeña

Properties in Mexico and, through partner funded exploration, its

El Quevar silver property in Argentina, as well as acquiring and

advancing selected mining properties in Mexico, Nevada and

Argentina.

Financial Statements

CONDENSED CONSOLIDATED BALANCE

SHEETS(US Dollars, unaudited)

|

|

|

|

|

|

|

| |

|

March 31, |

|

|

December 31, |

| |

|

2021 |

|

|

2020 |

| |

|

(in thousands, except share data) |

| Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

7,975 |

|

$ |

9,704 |

|

Short-term investments |

|

131 |

|

|

79 |

|

Lease receivables |

|

- |

|

|

72 |

|

Inventories, net |

|

1,840 |

|

|

284 |

|

Value added tax receivable, net |

|

805 |

|

|

45 |

|

Prepaid expenses and other assets |

|

990 |

|

|

1,130 |

|

Total current assets |

|

11,741 |

|

|

11,314 |

| Property, plant and equipment,

net |

|

6,106 |

|

|

5,520 |

| Other long term

assets |

|

978 |

|

|

1,472 |

|

Total assets |

$ |

18,825 |

|

$ |

18,306 |

|

|

|

|

|

|

|

| Liabilities and

Equity |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable and other accrued liabilities |

$ |

2,290 |

|

$ |

1,318 |

|

Deferred revenue, current |

|

396 |

|

|

535 |

|

Other current liabilities |

|

544 |

|

|

667 |

|

Total current liabilities |

|

3,230 |

|

|

2,520 |

| Asset retirement and

reclamation liabilities |

|

3,145 |

|

|

3,166 |

| Other long term

liabilities |

|

512 |

|

|

648 |

|

Total liabilities |

|

6,887 |

|

|

6,334 |

| |

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

| |

|

|

|

|

|

| Equity |

|

|

|

|

|

|

Common stock, $.01 par value, 200,000,000 shares authorized;

162,469,612 and 157,512,652 shares issued and outstanding

respectively |

|

1,625 |

|

|

1,575 |

|

Additional paid in capital |

|

539,357 |

|

|

536,263 |

|

Accumulated deficit |

|

(529,044) |

|

|

(525,866) |

|

Shareholders' equity |

|

11,938 |

|

|

11,972 |

|

Total liabilities and equity |

$ |

18,825 |

|

$ |

18,306 |

| |

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(US dollars, unaudited)

| |

|

|

|

|

| |

Quarter Ended March 31, |

|

|

|

2021 |

|

|

|

2021 |

|

| |

|

(in thousands, except per share data) |

| Revenue: |

|

|

|

|

|

|

|

|

Sale of metals |

$ |

1,778 |

|

|

$ |

- |

|

|

Oxide plant lease |

|

- |

|

|

|

1,196 |

|

|

Total revenue |

|

1,778 |

|

|

|

1,196 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

Cost of metals sold (exclusive of depreciation shown

below) |

|

(1,536 |

) |

|

|

- |

|

|

Oxide plant lease costs |

|

- |

|

|

|

(564 |

) |

|

Exploration expense |

|

(781 |

) |

|

|

(1,631 |

) |

|

El Quevar project expense |

|

(106 |

) |

|

|

(248 |

) |

|

Velardeña care and maintenance costs |

|

(199 |

) |

|

|

(463 |

) |

|

Administrative expense |

|

(1,548 |

) |

|

|

(1,163 |

) |

|

Stock based compensation |

|

(429 |

) |

|

|

(52 |

) |

|

Reclamation expense |

|

(66 |

) |

|

|

(59 |

) |

|

Other operating income, net |

|

199 |

|

|

|

4 |

|

|

Depreciation and amortization |

|

(155 |

) |

|

|

(279 |

) |

|

Total costs and expenses |

|

(4,621 |

) |

|

|

(4,455 |

) |

|

Loss from operations |

|

(2,843 |

) |

|

|

(3,259 |

) |

| Other income

(expense): |

|

|

|

|

|

|

|

|

Interest and other expense, net |

|

(360 |

) |

|

|

(27 |

) |

|

Other income |

|

52 |

|

|

|

- |

|

|

Loss on foreign currency translations |

|

(79 |

) |

|

|

(50 |

) |

|

Total other loss |

|

(387 |

) |

|

|

(77 |

) |

|

Loss from operations before income taxes |

|

(3,230 |

) |

|

|

(3,336 |

) |

|

Income taxes |

|

52 |

|

|

|

- |

|

|

Net loss |

$ |

(3,178 |

) |

|

$ |

(3,336 |

) |

| Net loss per common

share - basic |

|

|

|

|

|

|

|

|

Loss |

$ |

(0.02 |

) |

|

$ |

(0.03 |

) |

| Weighted average

Common Stock outstanding - basic (1) |

|

160,442,137 |

|

|

|

107,247,298 |

|

| |

|

|

|

|

|

|

|

(1) Potentially dilutive shares have not been

included because to do so would be anti-dilutive.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended, and applicable Canadian securities

legislation, including statements regarding the expected

achievement of corporate profitability in the second quarter of

2021; financial projects related to net operating margin at the

Rodeo operation; anticipated Phase II drilling program at Yoquivo;

projected cash balances and anticipated spending during the 12

months ended March 31, 2022; and potential business

restrictions and other matters related to the COVID-19 pandemic.

These statements are subject to risks and uncertainties, including

the overall impact of the COVID-19 pandemic, including the

potential future re-suspension of non-essential activities in

Mexico, including mining; lower than anticipated revenue or higher

than anticipated costs at the Rodeo mine; declines in general

economic conditions; changes in political conditions, in tax,

royalty, environmental and other laws in the United States, Mexico

or Argentina and other market conditions; and fluctuations in

silver and gold prices. Golden Minerals assumes no obligation to

update this information. Additional risks relating to Golden

Minerals may be found in the periodic and current reports filed

with the SEC by Golden Minerals, including the Company’s Annual

Report on Form 10-K for the year ended December 31, 2020.

For additional information please visit

http://www.goldenminerals.com/ or contact:

Golden Minerals CompanyKaren Winkler, Director

of Investor Relations(303) 839-5060SOURCE: Golden Minerals

Company

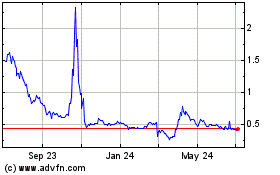

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

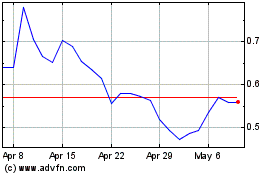

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Apr 2023 to Apr 2024