Current Report Filing (8-k)

January 27 2021 - 5:13PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 27, 2021 (January 21, 2021)

MJ

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55900

|

|

20-8235905

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

7320

S. Rainbow Blvd., Suite 102-210, Las Vegas, NV 89139

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code:

(702) 879-4440

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.001 par value per share

|

|

MJNE

|

|

OTC

Markets “PINK”

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Forward-looking

Statements

This

Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements can generally be identified by our use

of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,”

“estimate,” “believe,” “continue,” or other similar words. Readers of this report should be

aware that there are various factors that could cause actual results to differ materially from any forward-looking statements

made in this report. Factors that could cause or contribute to such differences include, but are not limited to, changes in general

economic, regulatory and business conditions in Colorado, and or changes in U.S. Federal law. Accordingly, readers are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Item

1.02. TERMINATION OF A MATERIAL DEFINITIVE AGREEMENT.

On

January 21, 2021, the Company received a Notice of Termination (the “Notice”), effective immediately, from Acres Cultivation,

LLC (“Acres”) on the following three (3) agreements (collectively, herein the “Cooperation Agreement”):

|

|

1)

|

The

Cultivation and Sales Agreement entered into by and between MJNE and Acres, dated as

of January 1, 2019 (the “Cultivation and Sales Agreement” or “CSA”),

pursuant to Sections 5.3, and 16.20 (cross-default);

|

|

|

|

|

|

|

2)

|

The

Consulting Agreement, by and between Acres and MJNE, made as of January 1, 2019 (the

“Consulting Agreement”), pursuant to Sections 10 and 11.10 (cross-default);

and

|

|

|

|

|

|

|

3)

|

The

Equipment Lease Agreement between Acres and MJNE, dated as of January 1, 2019 (the “Equipment

Lease Agreement”), pursuant to Sections 8(ii), 8(iv), and 29 (cross-default).

|

Within

the Notice, Acres makes claims that the Company and its subsidiaries failed to perform in accordance with the terms and conditions

of the Cooperation Agreement in a number of ways, as follows, and among others:

|

|

1.

|

The

Company’s failure to comply with applicable law;

|

|

|

2.

|

The

Company’s ongoing compliance violations and failures or inability to cure;

|

|

|

3.

|

The

Company’s failures under CSA sections 5.3(c) and 6.1(b);

|

|

|

4.

|

The

Company’s breaches related to sales;

|

|

|

5.

|

The

Company’s breach by failure to discharge Mechanic’s lien; and

|

|

|

6.

|

The

Company’s breach by failure to obtain required insurance.

|

The

Company and Acres (the “Parties”) are in active discussions in an effort to remedy the alleged breaches noted within

the Notice. There is no guarantee that the Parties will reach a resolution satisfactory to the Company.

Item

9.01. FINANCIAL STATEMENTS AND EXHIBITS.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

MJ

HOLDINGS, INC.

|

|

|

|

|

Date:

January 27, 2021

|

By:

|

/s/

Roger Bloss

|

|

|

|

Roger

Bloss

|

|

|

|

Interim

Chief Executive Officer

|

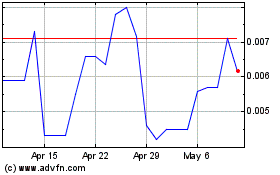

MJ (PK) (USOTC:MJNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

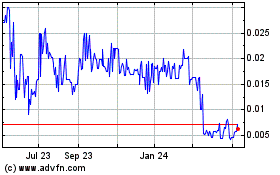

MJ (PK) (USOTC:MJNE)

Historical Stock Chart

From Apr 2023 to Apr 2024