UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

☒

Preliminary Information Statement

☐

Confidential, for Use of the Commission only (as permitted by Rule 14c-5(d)(2))

☐

Definitive Information Statement

|

ARVANA

INC

|

|

(Name

of Registrant as Specified In Its Charter)

|

Payment

of Filing Fee (Check the Appropriate Box):

|

|

Fee

computed on table below per Exchange Act Rules 14(c)-5(g) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing is calculated and state how it was determined.):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously

with preliminary materials.

|

|

☐

|

Check box if any

part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

|

|

(1)

|

Amount Previously

Paid:

|

|

|

(2)

|

Form, Schedule or

Registration Statement No.:

|

ARVANA

INC.

299

Main Street, 13th Floor

Salt

Lake City, Utah 84111

NOTICE

OF STOCKHOLDER ACTION TAKEN WITHOUT A STOCKHOLDERS MEETING

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

________________________________

Dear

Stockholders:

Arvana

Inc., is providing this Notice and the following Information Statement to notify you that

stockholders holding a simple majority of our outstanding common stock, acted by written consent in lieu of a special meeting

of stockholders, to authorize the board of directors to repeal, amend, restate and replace the Articles of Incorporation

of Arvana Inc., first filed with the Nevada Secretary of State on June 16, 1977, amended on October 16, 1998, and further amended

on August 3, 2006.

No

action is required of you to effectuate the actions taken. The repeal and replacement of our articles of incorporation by

stockholders holding a simple majority of voting shares is sufficient to make the approved changes. No other stockholder action

is necessary. Neither Arvana, nor the individual members of its board of directors

intend to solicit your consent or proxy in connection with the actions taken. The repeal and replacement of our articles

of incorporation will not be submitted to stockholders for a vote.

We

expect to mail this Notice and Information Statement on or about January 30, 2021, to all Arvana stockholders as of the close

of business on January 15, 2021. Formal adoption

of the action taken will require us to file amended and restated articles of incorporation with the Nevada Secretary of State

within the time frame prescribed in Rule 14(c)-2 promulgated under the Securities and Exchange Act of 1934, as amended, that limits

the effectiveness of actions taken by written consent until the expiration of twenty (20) calendar days subsequent to the mailing

date of the Notice and Information Statement to affected stockholders. Given the mandated time frame, we expect to file the amended

and restated articles of incorporation with the Nevada Secretary of State on or after March 1, 2021.

A

copy of the Stockholder Action Without A Meeting resolution, and a copy of the Amended

and Restated Articles of Incorporation of Arvana Inc., are attached to the Information Statement as Exhibit A and

Exhibit B respectively.

THIS

IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS, AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY

MATTER DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS

OF THE MATTERS DESCRIBED HEREIN.

IMPORTANT

NOTICE REGARDING ONLINE AVAILABILITY OF INFORMATION STATEMENT

You

can ALSO review our Information Statement online on the Commission’s website www.sec.gov OR at www.iproxydirect.com/AVNIMaterials

Thank

you for your continued interest in and support of Arvana.

By

Order of the Board of Directors

By:

__________________________

Ruairidh

Campbell

Title:

Chief Executive Officer

Date:

January __, 2021

INFORMATION

STATEMENT

NO

VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

________________________________

This

information statement (“Information Statement”) is provided to you pursuant to Rule 14(c)-2 promulgated under the

Securities Exchange Act of 1934, as amended (“Exchange Act”), to inform stockholders of Arvana Inc. (“Company”)

entitled to vote or consent to actions determined by written consent in lieu of a special meeting of stockholders (“Written

Consent”) of actions considered and approved on January 15, 2021.

The

following description is qualified in its entirety by reference to the full text of the Written Consent and the Amended and Restated

Articles of Incorporation of Arvana Inc. (“Amended Articles”) each of which is attached hereto as Exhibit A

and Exhibit B respectively.

Distribution

This

Information Statement is being distributed on or about January 30, 2021, to inform Company stockholders of actions taken by those

that hold a simple majority voting interest equal

to 57% of the Company’s outstanding common stock (“Consenting Stockholders”) to

repeal, amend, restate and replace in their entirety the Articles of Incorporation, first filed with the Nevada Secretary

of State on June 16, 1977, amended on October 16, 1998, and further amended on August 3, 2006 (“Articles”), and to

adopt the Amended Articles.

Action

by Written Consent

Nevada

Revised Statutes (“NRS”) §78.320 provides that any action that may be taken at a meeting of the stockholders

may also be taken without a meeting, without prior notice and without a vote, if a consent in writing, setting forth the action

or actions so taken, is signed by the holders of outstanding shares of capital stock holding at least a majority of the voting

power needed to approve the action, except if a different percentage of voting power is required for such action at a meeting,

then that proportion of voting power is required.

The

Board recommended to the Consenting Stockholders on January 8, 2021, that stockholder action be taken to

repeal, amend, restate and replace the Articles in their entirety with the Amended Articles. On due consideration, Consenting

Stockholders determined to implement the Board’s recommendations by Written Consent given the cost and time efficiencies

of that process when compared to drafting, delivering and tabulating proxies within an elongated time frame.

Record

Date

The

Board fixed January 15, 2021, as the record date (“Record Date”) for determining stockholders entitled to receive

notice of the action taken by Consenting Stockholders. Only stockholders of record at the close of business on the Record Date

will receive this Information Statement.

Date,

Time and Place Information

The

Written Consent executed by Consenting Stockholders was delivered to the Company’s principal executive offices at 299 South

Main Street, 13th Floor, Salt Lake City, Utah 84111 on January 15, 2021.

Notice

When

mailed to stockholders, this Information Statement will fulfill the notice requirement of Rule 14(c)-2 promulgated under the Exchange

Act and NRS Title 7, Chapter 78 §390.

Effectiveness

of the Written Consent

Pursuant

to Rule 14(c)-2 promulgated under the Exchange Act, actions taken by Written Consent to repeal the Articles and adopt the Amended

Articles cannot be made effective until at least twenty (20) calendar days have passed subsequent to the mailing of the Information

Statement to affected stockholders to describe the actions taken by the Consenting Stockholders.

Given

the mandated time frame, we expect to file the Amended Articles with the Nevada Secretary of State on or after March 1, 2021.

Quorum

NRS

§78.320.8 and Article III §8 of the Company’s Bylaws mandate that the holder or holders of not less than thirty-three

and one-third percent (33 1/3%) of the outstanding shares of stock entitled to vote shall constitute a quorum for the transaction

of business. The Consenting Stockholders established quorum on the Record Date by virtue of holding a simple majority of the Company’s

common stock par value $0.001(“Common Stock”).

Voting

Securities

NRS

§78.350.1 mandates that, unless otherwise provided in an entity’s articles of incorporation or bylaws, that each share

of common stock entitles its holder to one vote on each matter submitted to stockholders. On the Record Date, there were 4,610,670

shares of Common Stock outstanding of which 2,625,690 were held by Consenting Stockholders equal to 57% of the outstanding shares

of Common Stock entitled to vote on the matters considered.

Votes

Required

NRS

§78.320.2 and Article III, §13 of the Company’s Bylaws mandate that actions herein described require the approval

of those stockholders entitled to vote as a single class on any given action who hold a simple majority of the Company’s

Common Stock. On the Record Date, Consenting Stockholders holding a simple majority of the voting power of the Common Stock acted

to repeal the Articles and adopt the Amended Articles.

Information

on Consenting Stockholders

One

stockholder acting with two related business entities, holding in the aggregate a simple majority voting interest equal to 57%

of the Company’s Common Stock on the Record Date, are referred to hereto as the Consenting Stockholders, that were responsible

for the actions taken by Written Consent.

Action Taken

to Repeal and Replace the Company’s Articles of Incorporation

On

January 8, 2021, the Board recommended to the Consenting Stockholders that they act to repeal, amend, restate and replace in their

entirety the Articles with the Amended Articles to include the following changes to “Article First”, without change

or amendment, as article one (I) to preserve the name; amend “Article Second” as article two (II) to move the term

of its existence to a new article seven (VII); to amend “Article Third” as article three (III) to update the registered

office and resident agent addresses; to include “Article Fourth”, without change or amendment, as article four (IV)

in respect to directors; to include “Article Fifth”, without change or amendment, as article five (V); to preserve

the names of the original members of the Board; to amend “Article Six”, as article six (VI) to increase the Company’s

authorized capital stock from 5,000,000 to 500,000,000 shares of Common Stock; to add a new article seven (VII) to provide for

perpetual existence; to include “Article Nine”, without change or amendment, as a new article eight (VIII) to address

potential conflicts of interest; to include “Article Ten”, without change or amendment, as article nine (IX) in respect

to indemnification rights; and to include “Article Fourteen”, without change or amendment, as article ten (X) to continue

the election not to be governed pursuant to specific sections of the NRS that affect dissenters, rights, controlling interests,

and combinations with interested stockholders.

[TABLE

ON THE FOLLOWING PAGE]

|

Existing

Article

|

Amended

Article

|

New

Article

|

Changes

|

Title

|

|

Article

First

|

Article

I

|

N/A

|

None

|

Name

|

|

Article

Second

|

Article

II

|

N/A

|

Term

of Existence to Article VII

|

Nature

of Business

|

|

Article

Third

|

Article

III

|

N/A

|

Registered

Office

|

Addresses

|

|

Article

Fourth

|

Article

IV

|

N/A

|

None

|

Directors

|

|

Article

Fifth

|

Article

V

|

N/A

|

None

|

Names

of First Directors

|

|

Article

Six

|

Article

VI

|

N/A

|

Increase

Authorized

|

Authorized

Capital Stock

|

|

Article

Seven

|

-

|

Article

VII

|

None

|

Term

of Existence

|

|

Article

Eight

|

-

|

Article

VIII

|

Article

Nine to Article VIII

|

Common

Directors

|

|

Article

Nine

|

-

|

Article

IX

|

Article

Ten to Article IX

|

Liability of

Directors/Officers

|

|

Article

Ten

|

-

|

Article

X

|

Article

Fourteen to Article X

|

NRS

Election

|

|

Article

Eleven

|

-

|

-

|

-

|

-

|

|

Article

Twelve

|

-

|

-

|

-

|

-

|

|

Article

Thirteen

|

-

|

-

|

-

|

-

|

|

Article

Fourteen*

|

-

|

Article

X**

|

Article

Fourteen to Article X

|

NRS

Election

|

*

The existing Articles do not an provision for Articles enumerated as Seven, Eight, Eleven, Twelve or Thirteen.

**

Article Fourteen (new Article 10), requires a supermajority to effect any change. The Articles presented for stockholder approval

by Written Consent did not include any amendment to Article Fourteen (new Article Ten) given this threshold requirement.

Substantive

Changes to the Articles – Increase in Authorized Capital Stock

Most

differences between the Articles and the Amended Articles are non-substantive in nature. The non-substantive changes include the

consolidation of governing provisions into chronological order, the provision of current corporate information, and the preservation

of the identity of the incorporators. However, there is one substantive change in connection with an increase in authorized capital

stock. The Board’s recommendation that capital stock be increased was made in response to perceived limitations placed on

the Company’s ability to secure a business development opportunity stymied by its present capitalization.

The

Company is authorized to issue 5,000,000 shares of Common Stock of which 4,610,670 shares of Common Stock outstanding as of January

15, 2021. When the Amended Articles are made effective, the number of authorized shares of Common Stock will increase to 500,000,000.

The Company expects that an increase in authorized but unissued shares of Common Stock will enable prompt action on corporate

opportunities without the delay and expense associated with convening a special meeting of stockholders. Other opportunities attendant

to the increase in share capital could also include using equity for private placements or other forms of secondary financings.

The Company continues to struggle to survive the financial burdens associated with fulfilling its public disclosure requirements

while it urgently seeks a suitable corporate opportunity. The increase in authorized capital will also enable the Company to continue

its ongoing strategy to settle outstanding debts with equity as part of a vigorous restructure of its balance sheet intended to

make the Company more attractive to corporate suitors. In the event that we do acquire or develop an existing business, the increase

in authorized capital might also facilitate the authorized capital necessary to establishment employee benefit plans as a means

to retain credible individuals in management.

The

positive possibilities associated with the increase in authorized capital is cautioned by the potentially adverse effects of increasing

the number of shares of Common Stock then available for issuance without realizing any corresponding tangible increase in value.

When equity securities are issued, existing stockholders are generally diluted and the value of individual shares of corporate

stock most often decrease even if the stock issuances are in exchange for businesses or assets. Notwithstanding the foregoing,

the Company has no present obligation to issue additional shares, other than to satisfy convertible debt obligations, and has

no plans, proposals or arrangements otherwise to issue additional shares of Common Stock at this time.

Potential

Anti-Takeover Effects of the Increase in Authorized Shares

While

the increased proportion of unissued authorized shares to issued shares could under certain circumstances have an anti-takeover

effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the

composition of the Board or contemplating a tender offer or other transaction for the combination of the Company with another

company), the increase in authorized capital was not approved by the Consenting Stockholders in response to any such effort, nor

is it part of a plan by management to recommend similar actions that could have an anti-takeover effect on the Board or the Company’s

stockholders in the future.

Dissenters’

Rights

The

NRS do not entitle stockholders to dissenter rights of appraisal with respect to the stockholder action taken by the Consenting

Stockholders to repeal the Company’s Articles and adopt the Amended Articles.

Distribution

to Stockholders Sharing an Address

The

Securities and Exchange Commission (“SEC’) has adopted rules that permit companies to deliver a single copy of an

Information Statement to multiple stockholders sharing an address unless a company has received contrary instructions from one

or more of the stockholders at that address. This means that only one copy of the Information Statement may have been sent to

multiple stockholders in your household.

If

you would prefer to receive separate copies of the Information Statement, either now or in the future, please contact our Chief

Executive Officer by mailing a request to Arvana

Inc., 299 South Main Street, 13th Floor, Salt Lake City, Utah 84105 or by calling our main telephone number at 1-(801) 232-7395.

Upon written or oral request to the our Chief Executive Officer, the Company will promptly provide a separate copy of the Information

Statement. Further, stockholders at a shared address who receive multiple copies of the Information Statement may request to receive

a single copy of the Information Statement and similar documents in the future in the same manner as described above.

Interest

of Certain Persons in or in Opposition to Matters to be Acted Upon

The

Company is not aware of any substantial direct interests by security holdings or otherwise, of any director or officer in the

approval of the Amended Articles, that are different

from or greater than those of other stockholders.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth certain information regarding beneficial ownership of the Company’s Common Stock as of January

15, 2021, by (i) each person known by the Company to be the beneficial owner of more than 5% of the outstanding common stock,

(ii) each director and each named executive officers and (iii) all executive officers and directors as a group. The number of

shares of Common Stock beneficially owned by each person is determined under the rules of the SEC and the information is not necessarily

indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which

such person has sole or shared voting power or investment power and also any shares which the individual has the right to acquire

within 60 days after the date hereof, through the exercise of any stock option, warrant or other right. Unless otherwise indicated,

each person has sole investment and voting power (or shares such power with his or her spouse) with respect to the shares set

forth in the following table. The inclusion herein of any shares deemed beneficially owned does not constitute an admission of

beneficial ownership of those shares.

The

Company had 4,610,670 issued and outstanding shares of Common Stock as of the Record Date.

[TABLE

ON THE FOLLOWING PAGE]

|

Title

of Class

|

Name

and Address

of Beneficial Owner

|

Number

of Common

Shares

|

Percentage

of

Common Shares

|

|

Directors

and Officers

|

|

|

|

|

Common

Stock

|

Ruairidh

Campbell, CEO, CFO, and Director

299 S. Main Street, 13th Floor,

Salt

Lake City, Utah 84111

|

-

|

-

|

|

Common

Stock

|

Shawn

Teigen, Director

299 S. Main Street, 13th Floor,

Salt

Lake City, Utah 84111

|

-

|

-

|

|

Common

Stock

|

Sir

John Baring, Director

299 S. Main Street, 13th Floor,

Salt

Lake City, Utah 84111

|

14,625

|

< 0.01 %

|

|

|

All

Directors and Executive Officers as a Group (3 persons)

|

14,625

|

<

0.01%

|

|

Common

Stock

|

Valor

Invest Ltd.

60

Rue du Rhone, Fifth Floor

Geneva

3, Switzerland CH1211

|

380,090

|

8.2%

|

|

Common

Stock

|

Altaf

Nazerali

3001-788

Richards Street, the Hermitage

Vancouver,

British Columbia Canada V6B 0C7

|

1,112,910

|

24.1%

|

|

Common

Stock

|

International

Portfolio Management

3001-788

Richards Street, the Hermitage

Vancouver,

British Columbia Canada V6B 0C7

|

1,132,690

|

24.6%

|

|

|

Valor

Invest Ltd., International Portfolio Management are under the common control of Altaf Nazerali

|

2,625,690

|

57.0%

|

Where

You Can Find More Information

The

Company files its annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K, and

other documents electronically with the SEC under the Exchange Act. You may obtain such reports from the SEC’s website at

www.sec.gov. The Company will also make available, free of charge, our annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K, and

amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable

after such material is electronically filed with, or furnished to, the SEC.

Delivery

to Stockholders Holding Securities in Brokerage Houses

The

Company will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement

to the beneficial owners of Common Stock held of record.

Effective

Date

The

Amended Articles, approved by the Board and the Consenting Stockholders, in accordance with. Rule 14(c)-2 promulgated under the

Exchange Act, will be made effective no earlier than twenty (20) days after this Information Statement is mailed to Company stockholders.

We anticipate the effective date to be on or about March 1, 2021.

By

Order of the Board of Directors

___________________________________

Ruairidh

Campbell

Chief

Executive Officer

January

__, 2021

Exhibit

A

STOCKHOLDER

ACTION WITHOUT A MEETING

January

15, 2021

ARVANA

INC.

(A

Nevada Corporation)

This

Stockholder Action is permitted in accordance with the provisions set forth in the State of Nevada Revised Statutes (“NRS”)

§78.320.2 and Article III, §13 of the amended bylaws of Arvana Inc., hereinafter referred to as the “Corporation”,

which provide that any action required or permitted to be taken at an annual or special meeting of the stockholders may be taken

without a meeting, without prior notice, and without a vote, if the action is taken by the holders of the majority of the outstanding

shares of each voting group entitled to vote thereon having not less than the minimum number of votes required to take such action

at a meeting at which the whole voting group was present and able to vote.

NRS

§78.390, Article III, §13 of the Corporation’s amended bylaws (“Bylaws”) and Schedule 14C promulgated

under the Securities Act of 1934, as amended, mandate that if a written consent for stockholder action without a meeting is signed

by less than the unanimous consent of all stockholders, that the Corporation must give notice of the action taken to all stockholders

who were entitled to vote upon the action but who have not consented to the action.

RECORD

DATE

The

record date for the stockholders of the Corporation’s common stock on the action presented is January 15, 2021 (“Record

Date”), as determined by the Corporation’s board of directors, hereinafter referred to as the “Board”,

there being four million six hundred and ten thousand six hundred and seventy (4,610,670) shares of common stock outstanding as

of the Record Date.

EFFECTIVE

DATE

The

effective date of the consent actions shall be the later date upon which the Corporation receives the signatures necessary to

effect the actions.

BOARD

RECOMMENDATION

The

Board has recommended, pursuant to a unanimous consent resolution dated January 8, 2021, that stockholder action be taken to repeal,

amend, restate and replace in their entirety the Corporation’s articles of incorporation, hereinafter referred to as “Articles”,

filed with the Nevada Secretary of State on June 16, 1977, as amended on October 16, 1998, as further amended on August 3, 2006.

VOTE

REQUIRED

NRS

§78.320.2 and Article III, §13 of the Corporation’s Bylaws, mandate that the action herein contemplated requires

the approval of those stockholders of common stock entitled to vote as a single class on any given action who hold a simple majority

of the issued and outstanding common shares of the Corporation.

QUORUM

REQUIRED

NRS

§78.320.8 and Article III §8 of the Corporation’s Bylaws mandate that the holder or holders of not less than thirty-three

and one-third percent (33 1/3%) of the outstanding shares of stock entitled to vote shall constitute a quorum for the transaction

of business.

PROPOSED

ACTION

The

Board recommends to the stockholders that action be taken to repeal, amend, restate and replace in their entirety the Corporation’s

Articles as filed with the Nevada Secretary of State on June 16, 1977, as amended on October 16, 1998, as further amended on August

3, 2006, as follows:

|

Existing

Article

|

Amended

Article

|

New

Article

|

Changes

|

Title

|

|

Article

First

|

Article

I

|

N/A

|

None

|

Name

|

|

Article

Second

|

Article

II

|

N/A

|

Term

of Existence Moved to Article VII

|

Nature

of Business

|

|

Article

Third

|

Article

III

|

N/A

|

Registered

Office

|

Addresses

|

|

Article

Fourth

|

Article

IV

|

N/A

|

None

|

Directors

|

|

Article

Fifth

|

Article

V

|

N/A

|

None

|

Names

of First Directors

|

|

Article

Six

|

Article

VI

|

N/A

|

Increase

Authorized

|

Authorized

Capital Stock

|

|

Article

Seven

|

-

|

Article

VII

|

None

|

Term

of Existence

|

|

Article

Eight

|

-

|

Article

VIII

|

Article

Nine to Article VIII

|

Common

Directors

|

|

Article

Nine

|

-

|

Article

IX

|

Article

Ten to Article IX

|

Liability of

Directors and Officers

|

|

Article

Ten

|

-

|

Article

X

|

Article

Fourteen to Article X

|

NRS

Election

|

|

Article

Eleven

|

-

|

-

|

-

|

-

|

|

Article

Twelve

|

-

|

-

|

-

|

-

|

|

Article

Thirteen

|

-

|

-

|

-

|

-

|

|

Article

Fourteen*

|

-

|

Article

X**

|

Article

Fourteen to Article X

|

NRS

Election Regarding Dissenters Rights, Controlling Interests and Combinations with Interested Stockholders

|

*

The existing Articles do not include Articles Seven, Eight, Eleven, Twelve or Thirteen.

**

Article Fourteen (new Article 10), requires a supermajority of stockholders to effect any change. The Articles presented for stockholder

approval do not include any amendment to Article Fourteen (new Article Ten) given this threshold requirement

Recommendation

of the Corporaton’s Board

The

Board recommends to the Corporation’s stockholders that they act to repeal, amend, restate and replace in their entirety

the Articles to include “Article First”, without change or amendment, as article one (I) to preserve the name of the

Corporation; amend “Article Second” as article two (II) to move the term of its existence to a new article seven (VII);

amend “Article Third” as article three (III) to update the address of the Corporation’s registered office and

resident agent; to include “Article Fourth”, without change or amendment, as article four (IV) in respect to its directors;

to include “Article Fifth”, without change or amendment, as article five (V); to preserve the names of the original

members of the Board; to amend “Article Six”, as article six (VI) to increase the Corporation’s capital stock;

to add a new article seven (VII) to provide for the Corporation’s perpetual existence; to include “Article Nine”,

without change or amendment, as a new article eight (VIII) to address potential conflicts of interest; to include “Article

Ten”, without change or amendment, as article nine (IX) in respect to indemnification rights; and to include “Article

Fourteen”, without change or amendment, as article ten (X) to continue the Corporation’s election not to be governed

pursuant to specific sections of the NRS as same affect the rights of dissenters, controlling interests, and combinations with

interested stockholders.

CONSENT

ACTION

The

stockholders holding a simple majority of the Corporation’s outstanding common stock entitled to vote on the Record Date,

voting as a single class, constituting a quorum for the purposes of the action taken, do hereby vote to adopt the Amended and

Restated Articles of Incorporation of Arvana Inc. (attached hereto), and to authorize the Corporation’s officers to

file same as soon as is practicable with the Nevada Secretary of State in compliance with the notification requirements of FINRA,

the SEC and the State of Nevada.

SIGNATURES

The

consent actions set forth above were approved by those stockholders holding a majority of the voting shares of the Corporation’s

common stock, voting as a single group on the Record Date, each of which has signed and dated this Stockholder Action as evidenced

in the table below.

|

|

Stockholders

|

|

Registered

Common Stock

|

|

Votes

|

|

Signature

|

|

Date

|

|

1

|

Altaf

Nazerali

|

|

1,112,910

|

|

1,112,910

|

|

/s/

Altaf Nazerali

|

|

January

15, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

International

Portfolio Management, Inc.

|

|

1,132,690

|

|

1,132,690

|

|

By:

/s/ Altaf Nazerali

Altaf

Nazerali

Its:

President

|

|

January

15, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

3

|

Valor

Invest Ltd.

|

|

380,090

|

|

380,090

|

|

By:

/s/ Altaf Nazerali

Altaf

Nazerali

Its:

Authorized Signatory

|

|

January

15, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Votes Entitled to Act in Favor of the Proposal Recommended by the Board

|

|

2,625,690

|

CERTIFICATE

OF THE CORPORATE SECRETARY TO RECORD THE MINUTES OF THE STOCKHOLDER ACTION TAKEN BY WRITTEN CONSENT

I,

Ruairidh Campbelli, do hereby certify, acting as the duly appointed corporate secretary of Arvana Inc., that the proposal described

in the written consent action detailed above, to repeal, amend, restate and replace the Articles in their entirety, was approved

by those stockholders entitled to act on the Record Date who hold a simple majority of the issued and outstanding shares of the

Corporation’s common stock there being 4,610,670 shares of common stock entitled to vote on the Record Date of which 2,625,690

shares or 57% of those shares outstanding acted to approve the Amended and Restated Articles of Incorporation of Arvana Inc. (appended

hereto) effective the date on which same are accepted for filing with the Nevada Secretary of State.

IN

WITNESS WHEREOF, I have signed this certificate as of this 15th day of January 2021.

/s/

Ruairidh Campbell

Name:

Ruairidh Campbell

Title:

Corporate Secretary

Exhibit

B

AMENDED

AND RESTATED ARTICLES OF INCORPORATION

OF

ARVANA

INC.

ARTICLE

I

Name

The

name of the Corporation is Arvana Inc.

ARTICLE

II

Nature

of Business

The

purpose for which the Corporation is formed are:

(a)

To engage in any lawful business activity from time to time authorized or approved by the Board of Directors of this Corporation;

(b)

To act a principal, agent, partner or joint venture or in any other legal capacity in any transaction;

(c)

To do business anywhere in the world; and

(d)

To have and exercise all rights and powers from time to time granted to a corporation by law.

The

above purpose clauses shall not be limited by reference to or inference from one another, but each purpose clause shall be construed

as a separate statement conferring independent purposes and powers upon the Corporation.

ARTICLE

III

Addresses

The

name of the Corporation’s resident agent and registered address in the State of Nevada is AA Registered Agents located at

4869 Nightwood Court, Las Vegas, Nevada 89149.

The

principal place of business of the Corporation is 299 South Main Street, 13th Floor, Salt Lake City, Utah 84111.

ARTICLE

IV

Directors

The

Directors are hereby granted the authority to do any act on behalf of the Corporation as may be allowed by law. Any action taken

in good faith, shall be deemed appropriate and in each instances where the Articles of Incorporation so authorized, such action

by the Directors, shall be deemed to exist in these Articles and the authority granted by said act shall be imputed hereto without

the same specifically having been enumerated herein. The Board of Directors may consist of from one (1) to nine (9) directors,

as determined from time to time, by the then existing Board of Directors.

ARTICLE

V

Names

of First Directors and Incorporators

The

names and addresses of the persons who were first appointed to act as Directors of the Corporation, who were also the incorporators

of the Corporation, are:

-

Joseph

R. Laird, Jr. 3890 South Swenson, Suite 100 Las Vegas, Nevada 89109

-

Kenneth

J. Fisher 3890 South Swenson, Suite 100 Las Vegas, Nevada 89109

-

Patricia

J. Laird 3890 South Swenson, Suite 100 Las Vegas, Nevada 89109

ARTICLE

VI

Authorized

Capital Stock

The

total authorized capital stock of the Corporation is five hundred million (500,000,000) shares of common stock, with a par value

of $0.001 (“Common Stock”). All Common Stock when issued shall be deemed fully paid and non-assessable. No cumulative

voting of Common Stock shall be allowed for any purpose. The capital stock of the Corporation may be issued at such time, upon

such terms and conditions and for such consideration as the Board of Directors shall, from time to time determine. Stockholders

shall not have any preemptive right to acquire unissued shares of the capital stock of the Corporation.

ARTICLE

VII

Term

of Existence

The

Corporation shall have a perpetual existence.

ARTICLE

VIII

Common

Directors

As

provided by Nevada Revised Statutes(“NRS”) §78.140, without repeating the section in full here, the same is adopted

and no contact or other transaction between this Corporation and any of its officers, agents or Directors shall be deemed void

or voidable solely for that reason. The balance of the provision of this code section cited as it now exists, allowing such transactions,

is hereby interpreted to provide the greatest latitude in its application.

ARTICLE

IX

Liability

of Directors and Officers

No

Director Officer or Agent, to include counsel, shall be personally liable to the Corporation or its Stockholders for monetary

damage for any breach or alleged breach of fiduciary or professional duty by such person acting in such capacity, It shall be

presumed that in accepting the position as an Officer, Director, Agent or Counsel, said individual relied upon and acted in reliance

upon the terms and protections provided for by this Article. Notwithstanding the foregoing sentences, a person specially covered

by this Article, shall be liable to the extent provided by applicable law, for acts or omission which involve intentional misconduct,

fraud or a knowing violation of law, or for the payment of dividends in violation of NRS §78.300.

ARTICLE

X

ELECTION

REGARDING NRS §78.378 - §78.3793 AND §78.411 - §78.444

The

Corporation shall NOT be governed by nor shall the provisions of NRS §78.378 through and including §78.3793 and NRS

§78.411 through and including §78.444 in any way whatsoever affect the management, operation or be applied in this Corporation.

This Article may only be amended by a majority vote of not less than 90% of the then issued and outstanding shares of the Corporation.

A quorum of outstanding shares for voting on an amendment to this article shall not be met unless 95% or more of the issued and

outstanding shares are present at a properly called and noticed meeting of the stockholders. The super-majority set-forth in this

Article only applies to any attempted amendment to this Article.

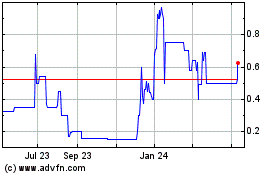

Arvana (PK) (USOTC:AVNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

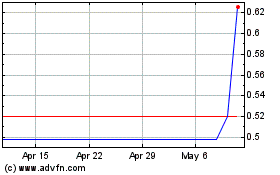

Arvana (PK) (USOTC:AVNI)

Historical Stock Chart

From Apr 2023 to Apr 2024