Current Report Filing (8-k)

November 25 2020 - 4:33PM

Edgar (US Regulatory)

false

0001177394

0001177394

2020-11-24

2020-11-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 24, 2020

SYNNEX CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-31892

|

94-2703333

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

44201 Nobel Drive, Fremont, California

|

|

94538

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(510) 656-3333

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

SNX

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 24, 2020, Concentrix Corporation (“Concentrix”), a wholly owned subsidiary of SYNNEX Corporation (the “Company”), entered into an offer letter with Chris Caldwell (the “Offer Letter”) with respect to Mr. Caldwell’s continued service as Chief Executive Officer of Concentrix following the previously announced separation of Concentrix from the Company through a spin-off (the “Spin-off”).

Pursuant to the terms of the Offer Letter, Mr. Caldwell will receive a starting base salary at the rate of $775,000 per year and will be eligible to receive an annual cash incentive award with a target equal to 2.5 times his base salary for fiscal year 2021, with the actual amount of the award based on the achievement of performance goals established by the Compensation Committee of the Concentrix Board of Directors (the “Concentrix Compensation Committee”). Thereafter, Mr. Caldwell will be eligible to receive an annual cash incentive award as determined by the Concentrix Compensation Committee. With respect to his annual cash incentive award for the fiscal year ending November 30, 2020 previously determined by the Company Compensation Committee, the bonus opportunity will remain the same except it will be paid by Concentrix and, in the event less than one hundred percent of the SYNNEX target goal is achieved, the bonus will be increased by twenty-five percent up to an aggregate maximum of $1,150,000.

The Offer Letter also provides for the grant of three equity awards (the “Equity Awards”) to Mr. Caldwell to occur on the effective date of the Spin-off or, if Concentrix’ trading window is not open at such time, during Concentrix’ next open trading window: (i) a non-qualified stock option to acquire common stock of Concentrix with a fair market value of approximately $1,000,000, (ii) restricted stock of Concentrix with a fair market value of approximately $550,000, and (iii) restricted stock of Concentrix with a fair market value of $10,000,000. The stock option will vest 20% on the first anniversary of October 7, 2020, with the remainder to vest ratably on a monthly basis over the subsequent 48 months, subject to Mr. Caldwell’s continued employment with Concentrix. The first grant of restricted stock will vest in equal installments on each of the first five anniversaries of October 7, 2020, and the second grant of restricted stock will vest in equal installments on each of the first five anniversaries of the effective date of the Spin-off, in each case subject to Mr. Caldwell’s continued employment with Concentrix. The Offer Letter also provides for certain payments to Mr. Caldwell in the event of a termination without “cause” (as such term is defined in the Offer Letter).

The foregoing summary of the Offer Letter is qualified in its entirety by reference to the Offer Letter, which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Date: November 25, 2020

|

SYNNEX CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Simon Y. Leung

|

|

|

|

Simon Y. Leung

Senior Vice President, General Counsel and Corporate Secretary

|

3

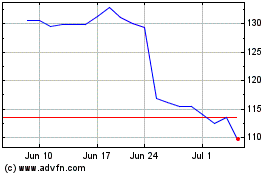

TD SYNNEX (NYSE:SNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

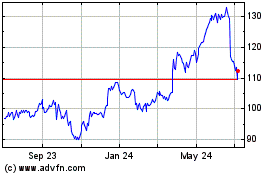

TD SYNNEX (NYSE:SNX)

Historical Stock Chart

From Apr 2023 to Apr 2024