Joint-Venture & Earn-In Agreement with Rio Tinto Mining and Exploration Ltd for up to US$20 million at Enonkoski Project Finl...

November 10 2020 - 8:00AM

InvestorsHub NewsWire

Bluejay Mining

plc

(‘Bluejay’ or the

‘Company’)

Joint-Venture & Earn-In Agreement with

Rio Tinto Mining and Exploration Ltd for up to US$20 million at

Enonkoski Project Finland

November 10, 2020 -- InvestorsHub NewsWire -- Bluejay Mining

plc, the AIM, OTCQB and FSE listed exploration and development

company with projects in Greenland and Finland, is pleased to

announce that it has entered into an Option to Joint Venture

Agreement (the “Agreement”) with Rio Tinto Mining and Exploration

Limited (“Rio Tinto”) on its Enonkoski nickel project (“Enonkoski”)

where Rio Tinto may acquire up to a 75% interest in Enonkoski by

completing US$20.0 million worth of expenditure.

Overview of transaction

Terms of the Agreement - Rio Tinto may acquire

up to a 75% interest, in stages, in the Enonkoski Project by sole

funding US$20.0 million in project expenditures or cash equivalent

payments over three stages:

- Stage One – Rio Tinto can move to 51% ownership by spending

US$5.0 million by November 2023. Of this $5.0 million, $0.4 million

is expected to be spent by 30 March 2021

- Stage Two – 65% ownership for further expenditure of US$5.0

million by November 2025

- Stage Three – 75% ownership for further expenditure of US$10.0

million by November 2029

- Beyond Stage Three, each party shall fund its respective

75%:25% share of project expenditure or be diluted

Shareholders should note that there is no guarantee that Rio

Tinto will exercise its option to enter into a joint venture with

the Company or that any project expenditure will be provided for

Enonkoski or any cash payments made to Bluejay. Further

announcements concerning the status of the Agreement will be made

by the Company in due course.

Rod McIllree, CEO of Bluejay Mining said:

“We are delighted to have signed this Agreement with Rio Tinto

and look forward to a successful partnership as we jointly assess

the Enonkoski nickel belt. This belt has demonstrable nickel

occurrences and past production and it’s a testament to the project

that we have attracted a blue-chip miner at

Enonkoski.

"At Bluejay and FinnAust, our wholly owned Finnish

subsidiary, we have a strategy of discover, develop, deliver, and

we have always maintained that our portfolio is of exceptional

quality and value, derived through our exploration expertise. We

have been transparent in communicating the need for partners to aid

us in moving through and beyond the development phase with our

larger projects, and this is something that is continuing across

our portfolio. Today is therefore particularly pleasing as this

Agreement demonstrates our ability to deliver on our strategy,

partner with major mining companies, and add significant value for

shareholders.

“We have worked hard to maintain the integrity of our

projects over the last few years and now are set to reap the

benefits of this strategy as the market outlook brightens

significantly for both industrial and battery metals. In Finland,

the Company has significant licence areas on two additional

high-quality ex-state-owned historical mine belts, and we will

update the market on those projects in due course. Additionally, we

are continuing to progress our partnerships and work programmes

across our broader base metal portfolio in

Greenland.

“We look forward to being in a position to follow-up this

transaction with others across both our Finnish and Greenlandic

portfolio in due course.”

Overview of Bluejay in Finland

Bluejay’s wholly owned subsidiary FinnAust Mining Finland Oy

(‘FinnAust’) is currently one of the largest licence holders in

East Finland. It is the current 100% owner of a range of brownfield

exploration licences that generally surround historical mines

including the Hammaslahti copper mine, the Outokumpu copper mines

and the Enonkoski nickel belt which hosts the Enonkoski

Project.

The Enonkoski Project

Enonkoski covers more than 2,300 hectares over mafic -

ultramafic rocks between and along more than 15km of strike from

the historical Enonkoski and Hälvälä mines operated by Finnish

state-owned mining company Outokumpu Oy. The area is prospective

for nickel, copper, cobalt and Platinum Group Elements. ("PGE").

The Enonkoski mine previously produced 6.7 million tonnes at an

average grade of 0.8% nickel between 1984 and 1994 with historic

intercepts of the massive ore in the mine including 32.90m @ 4.09%

Nickel, 0.56% Copper, 0.17% Cobalt and 19.70m @ 6.12% Nickel, 1.94%

Copper, 0.29% Cobalt.

Market Abuse Regulation (MAR)

Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

For

further information please visit http://www.bluejaymining.com

or

contact:

|

Roderick McIllree

|

Bluejay Mining plc

|

+44 (0) 20 7907 9326

|

|

Kevin Sheil

|

Bluejay Mining plc

|

+44 (0) 20 7907 9326

|

|

Ewan Leggat

|

SP Angel Corporate Finance LLP

(Nominated Adviser)

|

+44 (0) 20 3470 0470

|

|

Adam Cowl

|

SP Angel Corporate Finance LLP

(Nominated Adviser)

|

+44 (0) 20 3470 0470

|

|

Andrew Chubb

|

Hannam & Partners (Advisory) LLP

|

+44 (0) 20 7907 8500

|

|

Tim Blythe

|

Blytheweigh

|

+44 (0) 20 7138 3205

|

|

Megan Ray

|

Blytheweigh

|

+44 (0) 20 7138 3205

|

Notes

Bluejay is listed

on the London AIM market and Frankfurt Stock Exchange and its

shares also trade on the OTCQB Market in the US. With projects in

Greenland and Finland, its most advanced project is the Dundas

Ilmenite Project in Greenland, which is being developed towards

production in the near term. The Dundas Ilmenite Project has

been proven to be the highest-grade mineral sand ilmenite project

globally, with a Mineral Resource reported in accordance with the

JORC Code of 117 million tonnes at 6.1% ilmenite and a maiden

offshore Exploration Target of between 300Mt and 530Mt of ilmenite

at an average expected grade range of 0.4 - 4.8% ilmenite

in-situ.

The Company's strategy is focused on securing an

offtake partner and commencing commercial production at Dundas in

the near term in order to create a company capable of self-funding

exploration on its current projects and future

acquisitions.

Bluejay holds

three additional projects in Greenland - the 2,897sq km

Disko-Nuussuaq ('Disko') Magmatic Massive Sulphide

nickel-copper-cobalt-platinum group element-gold project

('Ni-Cu-Co-PGE-Au'), which has shown its potential to host

mineralisation similar to the world's largest nickel-copper mining

district at Noril’sk-Talnakh, northern Russia; the 692sq km

Kangerluarsuk zinc-lead- silver project ('Kangerluarsuk'), where

historical work has recovered grades of 41% zinc, 9.3% lead and 596

g/t silver and identified four large-scale drill ready targets; and

the 2,025 sq km Thunderstone project which has the potential to

host large-scale base metal and gold

deposits.

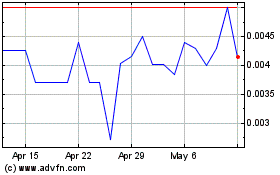

Bluejay Mining (PK) (USOTC:BLLYF)

Historical Stock Chart

From Mar 2024 to Apr 2024

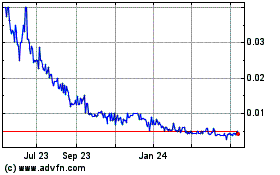

Bluejay Mining (PK) (USOTC:BLLYF)

Historical Stock Chart

From Apr 2023 to Apr 2024