Robex Vigorously Opposes the Unfounded Demand of Some of Its Minority Shareholders

October 09 2020 - 1:07PM

Robex Resources Inc. (“Robex” or the “Company”) (TSXV: RBX/FWB:

RB4) has been informed of the filing of an application for relief

orders in the Quebec Superior Court by a very small group of

minority shareholders. The allegations contained therein against

the Company, its directors, officers and the Cohen family are

unfounded and untrue. Robex intends to vigorously challenge the

claim and set the record straight under the applicable procedure.

The Company follows the applicable rules of good

governance and has made sure to maintain within its board of

directors and its various committees a sufficient number and the

active participation of experienced independent directors.

The Company, through its board of directors,

independent directors and officers, has always acted in the best

interests of the Company and all of its shareholders. At the last

shareholders’ meeting held on June 26, 2020, the directors were

re-elected with over 97.6% of the votes cast.

All financing completed by the Company since the

arrival in its administration of the Cohen family in 2013 has been

made in accordance with securities regulations and in a way that is

respectful of minority shareholders. Among other things, any

material element that needed to be brought to the attention of

shareholders has been disclosed in a timely and complete manner

without any objection from the shareholders at the time.

The Company considers the compensation of the

Company’s management team to be comparable to that of companies of

similar size and scope. Moreover, during the 2019 financial year,

in addition to the analyses performed by its independent directors,

the Company called on an independent specialist company to carry

out an analysis of the Company’s compensation practices. It

concluded that the compensation was in line with industry

standards.

Robex points out that it has been able to count

on funding from the Cohen family at critical times to keep it

going, even when the price of gold has been at historic lows over

the past decade and the stock markets were unfavourable to the

mining sector in general.

It should also be remembered that, at the start,

the Nampala mine in Mali, which constitutes the Company’s main

asset, was considered to be a deposit of insufficient quality and

quantity of very low grade, endowed with basic facilities, with

high financing needs, and that Mali was a country at war, weakened

by political tensions and then by the emergence of Ebola.

Since then, the Nampala mine has moved from

exploration to production – it is now operating profitably and its

operating costs are among the most competitive in the world.

The Company’s work and efforts have resulted in

creating value for all shareholders. Moreover, since the beginning

of 2020, the Company has declared payment of dividends of $0.06 per

share, which represents a dividend yield of 12% on the share price

as of September 24, 2020, valued at $0.50, while the share value

was $0.15 as of January 3, 2020.

After investing more than $70 million in the

development and commissioning of the Nampala mine under favourable

conditions for the Company, the Company has since proceeded to

almost fully repay its debts and it is now today one of the

healthiest operations in the industry.

The Company does not intend to comment further

on the ongoing legal proceedings.

About ROBEX

Robex Resources Inc. is a Canadian mining

company operating in gold production and exploration in West

Africa. The Company operates the Nampala mine in Mali, which

reached the commercial production stage on January 1, 2017.

For information:

Robex Resources Inc.

Benjamin Cohen, CEOAugustin Rousselet, CFO/COOHead office:

(581) 741-7421info@robexgold.com

This news release contains statements that may

be considered “forecast information” or “forecast statements” in

terms of security rights. These forecasts are subject to

uncertainties and risks, some of which are beyond the control of

Robex. Achievements and final results may differ significantly from

forecasts made implicitly or explicitly. These differences can be

attributed to many factors, including market volatility, the impact

of the exchange rate and interest rate fluctuations, mispricing,

the environment (hardening of regulations), unforeseen geological

situations, unfavourable operating conditions, political risks

inherent in mining in developing countries, changes in government

policies or regulations (laws and policies), an inability to obtain

necessary permits and approvals from government agencies, or any

other risk associated with mining and development. There can be no

assurance that the circumstances set out in these forecasts will

occur, or even benefit Robex, if any. The forecasts are based on

the estimates and opinions of the Robex management team at the time

of publication. Robex makes no commitment to make any updates or

changes to these publicly available forecasts based on new

information or events, or for any other reason, except as required

by applicable security laws. The TSX Venture Exchange or the

Regulation Services Provider (as defined in the policies of the TSX

Venture Exchange) assumes no responsibility for the authenticity or

accuracy of this news release.

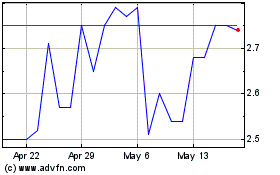

Robex Resources (TSXV:RBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

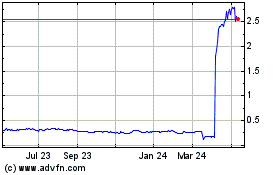

Robex Resources (TSXV:RBX)

Historical Stock Chart

From Apr 2023 to Apr 2024