Report of Foreign Issuer (6-k)

October 21 2019 - 5:09PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2019

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425- 070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

GAFISA S.A.

CNPJ/MF 01.545.826/0001-07

NIRE 35.300.147.952

Publicly-held Company

MATERIAL FACT

GAFISA S.A. (B3: GFSA3; OTC: GFASY) (“Gafisa” or “Company”), in compliance with CVM Instruction No. 358/2002, as amended, informs its shareholders and the market in general that, on this date, entered into with Alphaville Urbanismo S.A. (“Alphaville”), Private Equity AE Investimentos e Participações S.A. (“PEAE”) and affiliates of PEAE, a Purchase and Sale, Stock Redemption, Corporate Restructuring Agreement and Other Covenants (“Agreement”) aiming at setting forth the terms and conditions to put into effect Gafisa’s divestment in Alphaville.

Currently, Gafisa holds twenty-one point twenty percent (21.20%) of Alphaville’s shares. This transaction totals the amount of one hundred million Reais (R$100,000,000.00), to be paid by means of credit offset and delivery of assets.

The close of the deal depends upon compliance with usual condition precedents, including a corporate restructuring of certain assets of Alphaville, the obtainment of third parties’ consent and corporate approvals.

The referred transaction is in line with portfolio optimization and improvement of the Company’s capital allocation, aiming at creating value for our shareholders.

The Company will keep its investors and the market in general informed, pursuant to the laws and CVM’s rules.

São Paulo, October 21, 2019.

GAFISA S.A.

André Luis Ackermann

Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 21, 2019

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: André Luis Ackermann

Title: Chief Executive Officer

|

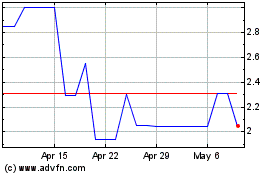

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

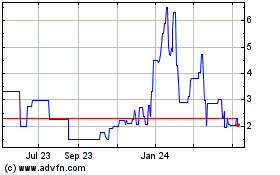

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024