Current Report Filing (8-k)

October 21 2019 - 4:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 21, 2019

BERKSHIRE HILLS BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-15781

|

|

04-3510455

|

|

(State or Other Jurisdiction)

of Incorporation)

|

|

(Commission File No.)

|

|

(I.R.S. Employer

Identification No.)

|

|

60 State Street, Boston, Massachusetts

|

|

02109

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (800) 773-5601 ext.

133773

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

BHLB

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 7.01 Regulation FD Disclosure.

In a report filed with the SEC on Form 8-K on September 20, 2019, Berkshire Hills Bancorp Inc. (the “Company”) disclosed that its

subsidiary, Berkshire Bank (the “Bank”), owned an interest with an approximate balance of $16 million in a loan relationship which was determined to be in default due to potentially fraudulent activity by the borrower and related interests. The

Company disclosed that it expected that the Company’s third quarter 2019 net income and net income per share would be adversely affected. The Company has determined to charge-off the full balance of this loan as of September 30, 2019. On an

after-tax basis, this resulted in a charge to third quarter net income of approximately $12 million, or approximately $0.23 per share. The Company has no other lending or deposit exposures to this borrower. The Company is scheduled to release its complete results for the third quarter after the close of business on October 28, 2019 and to host a conference call discussing its

results at 10:00 a.m. on Tuesday, October 29, 2019.

The information contained in this Form 8-K provided under Item 7.01 is being furnished and shall not be deemed to be “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall it be deemed incorporated by reference in any filing of the Company under the Securities Act of 1933 (the

“Securities Act”) or the Exchange Act, unless expressly incorporated by specific reference in such filing.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, and the Private Securities Litigation Reform Act of 1995. The Company

intends its forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in this document. All statements regarding the Company’s expected financial position and operating results are forward-looking

statements. These statements can sometimes be identified by the Company’s use of forward-looking words such as “may,” “will,” “anticipate,” “estimate,” “expect,” or “intend.” The Company cannot promise that its expectations in such

forward-looking statements will turn out to be correct. The Company’s actual results could be materially different from expectations because of various factors. Information concerning these and other factors can be found in the Company’s periodic

filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K for the Year Ended December 31, 2018, and subsequent filings on Form 10-Q. These filings are available publicly on the SEC’s website at

http://www.sec.gov, on the Company’s website at http://www.berkshirebank.com or upon request from the Corporate Secretary. Except as otherwise required by law, the Company undertakes no obligation to publicly update or revise its forward-looking

statements, whether as a result of new information, future events, or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

|

BERKSHIRE HILLS BANCORP, INC.

|

|

DATE: October 21, 2019

|

By:

|

/s/ Richard M. Marotta

|

|

|

|

Richard M. Marotta

|

|

|

|

President and Chief Executive Officer

|

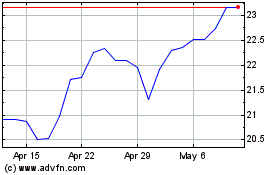

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

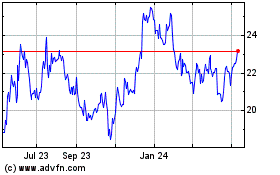

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Apr 2023 to Apr 2024