Current Report Filing (8-k)

September 30 2019 - 4:53PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): September 26, 2019

vTv Therapeutics Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

(State or other jurisdiction

of incorporation)

|

001-37524

(Commission File No.)

|

47-3916571

(IRS Employer

Identification No.)

|

|

|

|

4170 Mendenhall Oaks Pkwy

High Point, NC 27265

(Address of principal executive offices)

|

(336) 841-0300

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a‑12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A common stock, par value $0.01 per share

|

VTVT

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into a Material Definitive Agreement

On September 26, 2019, vTv Therapeutics Inc. (the “Company”), entered into a letter agreement (the “September 2019 Letter Agreement”), with MacAndrews & Forbes Group LLC (the “Investor”), for the Investor’s commitment to purchase, at the Company’s option, exercisable on demand during a one-year period after the date of the Letter Agreement (the “Investment Period”), the Company’s Class A common stock, par value $0.01 per share (“Common Stock”) at a per share price of $1.46, which is equal to the closing price of the Common Stock for the trading day prior to the date of the September 2019 Letter Agreement. The September 2019 Letter Agreement also permits the Investor to exercise an option to purchase Common Stock at the same price up to three times during the Investment Period. The aggregate amount of Common Stock that may be purchased by the Investor (whether at its or the Company’s option) pursuant to the September 2019 Letter Agreement is limited to $10.0 million.

In consideration for the commitment of the Investor under the September 2019 Letter Agreement, the Investor will receive warrants (the “Warrants”) to purchase 400,990 shares of the Company’s Common Stock, exercisable at a price of $1.68, which is 115% of the option price under the September 2019 Letter Agreement. The Warrants will be exercisable until September 26, 2026.

The obligation of the Investor to fund and the obligation of the Company to issue shares under the September 2019 Letter Agreement is subject to the execution of mutually acceptable definitive documentation at the time of a request for funding.

As of September 26, 2019, subsidiaries and affiliates of the Investor held 23,084,267 shares of the Company’s Class B Common Stock and 23,506,897 shares of the Company’s Class A Common Stock. As a result, the Investor’s holdings represent approximately 81.5% of the combined voting power of the Company’s outstanding common stock. One of the Company’s directors, Paul G. Savas, is also an employee of the Investor. The transactions described above were approved in accordance with the Company’s Related Person Transactions Policy.

The descriptions of the September 2019 Letter Agreement and the Warrants contained herein do not purport to be complete and are qualified in their entirety by reference to the September 2019 Letter Agreement and the Warrants, copies of which will be filed as exhibits to the Company’s Quarterly Report on Form 10-Q for the quarter ending September 30, 2019.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth above and referenced under Item 1.01 that relates to the creation of an off-balance sheet financial obligation of the Company is hereby incorporated by reference into this Item 2.03 of this report.

Item 3.02 Unregistered Sales of Equity Securities

See Item 1.01 which is incorporated herein by reference. The Common Stock and Warrants to be issued to the Investor pursuant to the September 2019 Letter Agreement will be issued in reliance upon an exemption provided by Regulation D under the Securities Act of 1933.

On September 27, 2019, vTv Therapeutics Inc. (the “Company”) exercised its right to cause MacAndrews & Forbes Group LLC (the “Investor”) to purchase 1,369,863 shares of the Company’s Class A common stock at a per share price of $1.46 pursuant to the terms of the September 2019 Letter Agreement. The Investor funded $2,000,000 million to the Company in exchange for 1,369,863 shares of Class A common stock following the execution of definitive documentation by and between the Company and the Investor.

The foregoing disclosure regarding the September 2019 Letter Agreement is qualified in its entirety by reference to the September 2019 Letter Agreement, copies of which will be filed as exhibits to the Company’s Quarterly Report on Form 10-Q for the quarter ending September 30, 2019.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

VTV THERAPEUTICS INC.

|

|

|

|

By:

|

/s/ Rudy C. Howard

|

|

Name:

|

Rudy C. Howard

|

|

Title:

|

Chief Financial Officer

|

Dated: September 30, 2019

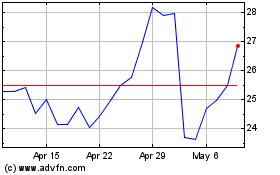

vTv Therapeutics (NASDAQ:VTVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

vTv Therapeutics (NASDAQ:VTVT)

Historical Stock Chart

From Apr 2023 to Apr 2024