Current Report Filing (8-k)

May 14 2019 - 2:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 10, 2019

Hibbett Sports, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

000-20969

|

20-8159608

|

|

(State of Incorporation)

|

(Commission

|

(IRS the Company

|

|

|

File Number)

|

Identification No.)

|

2700 Milan Court

Birmingham, Alabama 35211

(Address of principal executive offices)

(205) 942-4292

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

□

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□

Pre commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 Par Value Per Share

|

HIBB

|

NASDAQ Global Select Market

|

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain

Officers.

As previously reported in a Form 8-K filed on March 22, 2019, Hibbett Sports, Inc. (the “Company”) announced the planned

retirement of Jeffry O. Rosenthal as President and Chief Executive Officer of the Company. The retirement of Mr. Rosenthal is planned to take effect at the time the Company’s Board of Directors (“Board of Directors”) appoints a replacement chief

executive officer or such earlier date as the Board of Directors may request (the “Retirement Date”). The Board of Directors has initiated a search for a permanent replacement for Mr. Rosenthal.

Subsequently, on May 10, 2019, Hibbett Sporting Goods, Inc., the wholly-owned operating subsidiary of the Company

(“Hibbett Sporting Goods”), and Mr. Rosenthal entered into a Retirement Agreement (the “Agreement”), subject to a seven day revocation period at Mr. Rosenthal’s election. The Agreement provides, among other things, the following terms and

conditions with respect to Mr. Rosenthal’s retirement from the Company:

|

(a)

|

Until the Retirement Date, Mr. Rosenthal agrees to continue in his current employment as President and Chief Executive Officer of

the Company and to effectively perform the traditional duties of the Chief Executive Officer. Mr. Rosenthal acknowledges in the Agreement that his employment with the Company has been and remains “at-will” and may be terminated by the

Company at any time.

|

|

(b)

|

If the Compensation Committee of the Board of Directors determines that a bonus is payable for fiscal year 2020 to executive

officers generally, then Mr. Rosenthal will receive a full bonus for fiscal year 2020 based on the same performance goals that are used to determine the bonuses for other executive officers.

|

|

(c)

|

Mr. Rosenthal will continue to serve as a director on the Board of Directors (and may be eligible for re-election) through the

remaining portion of his current term expiring at the 2021 annual meeting of stockholders, unless he resigns at an earlier date. Subsequent to the Retirement Date, Mr. Rosenthal will be entitled to Board compensation applicable to

non-employee directors in effect at such time.

|

|

(d)

|

Mr. Rosenthal will be eligible to receive a salary continuation benefit of $575,000 to be paid over twelve months in twenty-six

equal installments of $22,115.40, subject to all applicable tax withholdings, beginning on the Retirement Date.

|

|

(e)

|

All outstanding equity awards granted to Mr. Rosenthal were terminated effective May 10, 2019. Pursuant to the Agreement, Mr.

Rosenthal is entitled to receive a lump sum cash payment equal to the greater of (x) the value of the terminated equity awards based on the closing price of the Company's common stock on the Retirement Date or (y) $957,022, less

applicable withholding taxes.

|

|

(f)

|

Mr. Rosenthal is entitled to receive an additional one-time, lump sum payment of $21,362.04, subject to all applicable tax

withholdings, to partially offset his estimated expense for medical coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended.

|

|

(g)

|

Mr. Rosenthal will execute a General Release Agreement, the form of which is attached to the Agreement as Exhibit A, releasing

Hibbett Sporting Goods and its subsidiaries, affiliates and related entities, including the Company, and all of their past and present owners, officers, directors, agents and employees, from all claims, known or unknown, of any kind that

Mr. Rosenthal may have relating to such parties as of the Retirement Date. The General Release Agreement also provides for a release of Mr. Rosenthal and his heirs, successors and assigns from all claims of any kind of which Hibbett

Sporting Goods and its subsidiaries, affiliates and related entities is aware, or should be aware, as of the Retirement Date.

|

|

(h)

|

Mr. Rosenthal will remain subject to certain restrictive covenants relating to nondisclosure, noncompetition and treatment of

confidential information that are contained in certain agreements with Hibbett Sporting Goods until the twelve-month anniversary of the Retirement Date.

|

The foregoing summary of the Agreement is not intended to be complete and is qualified in its entirety by reference to the

copy of the Agreement attached to this Form 8-K as Exhibit 10.1 and incorporated herein by reference.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits.

Exhibit No.

Description

|

10.1

|

Retirement Agreement between Hibbett Sporting Goods, Inc. and Jeffry O. Rosenthal dated May 10, 2019.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be

signed on its behalf by the undersigned hereunto duly authorized.

|

|

HIBBETT SPORTS, INC.

|

|

|

|

|

May 14, 2019

|

By:

|

/s/ David M. Benck

|

|

|

|

David M. Benck

|

|

|

|

Vice President and General Counsel

|

Exhibit Index

Exhibit No.

Description

|

10.1

|

Retirement Agreement between Hibbett Sporting Goods, Inc. and Jeffry O. Rosenthal dated May 10, 2019.

|

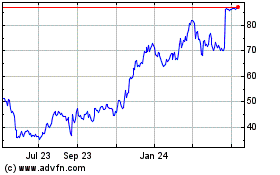

Hibbett (NASDAQ:HIBB)

Historical Stock Chart

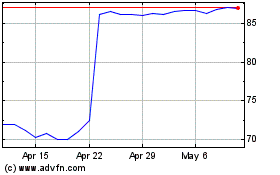

From Mar 2024 to Apr 2024

Hibbett (NASDAQ:HIBB)

Historical Stock Chart

From Apr 2023 to Apr 2024