UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant

þ

Filed by a Party other than the Registrant

o

Check the appropriate box:

|

|

|

|

o

|

Preliminary Proxy Statement

|

|

|

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

þ

|

Definitive Proxy Statement

|

|

|

|

|

o

|

Definitive Additional Materials

|

|

|

|

|

o

|

Soliciting Material Pursuant to §240.14a-12

|

Kaiser Aluminum Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

o

|

Fee paid previously with preliminary materials:

|

|

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount previously paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

LETTER TO OUR STOCKHOLDERS

FROM OUR CHAIRMAN OF THE BOARD AND OUR LEAD INDEPENDENT DIRECTOR

April 30, 2019

Dear Stockholder:

On behalf of our Board of Directors and management team, thank you for your continued support of Kaiser Aluminum and your participation in this year’s Annual Meeting of Stockholders. It is our pleasure to invite you to attend the Annual Meeting of Kaiser Aluminum Corporation to be held at the Company’s corporate office, located at 27422 Portola Parkway, Suite 200, Foothill Ranch, California 92610, on Thursday, June 6, 2019, at 9:00 a.m., local time. While the company does not expect to make a separate presentation, our directors and officers will be present at the Annual Meeting and will be available to respond to any questions you may have.

Your vote is very important to us. Whether or not you plan to attend the Annual Meeting in person, we urge you to vote your shares as promptly as possible. Details of the business to be conducted at the Annual Meeting are included in this proxy statement, which we encourage you to read carefully. You may submit your voting instructions over the Internet or by telephone as indicated on the enclosed proxy card or by completing, signing and dating the enclosed proxy card and returning it by mail in the accompanying envelope. If you plan to attend in person, please review the information on attendance provided on page 2 of the proxy statement.

We would like to share with you several areas of particular significance in advance of our Annual Meeting and in connection with our distribution of this proxy statement:

BUSINESS STRATEGY AND PERFORMANCE HIGHLIGHTS

Our success over the years has been driven by our people and a highly focused and consistent strategy, overseen by our Board, to drive steady continuous improvement. We pursue six key strategic initiatives that align our actions with our corporate values to ensure that our long-term success is driven by practices that are economically, environmentally and socially responsible.

|

|

|

|

|

|

|

|

Ÿ

|

Advance our position as the supplier of choice

|

Ÿ

|

Enhance quality and depth of technical and managerial talent

|

|

Ÿ

|

Achieve and sustain a position as a low cost producer

|

Ÿ

|

Sustain financial strength and flexibility

|

|

Ÿ

|

Pursue profitable sales growth

|

Ÿ

|

Enhance our standing as a valued corporate citizen

|

This strategy has been successful in uniquely positioning our Company to benefit all of our stakeholders, and we are confident that this strategy will continue to drive improvement in the future. With consistent execution of these strategic priorities we have achieved a strong, industry-leading business, evidenced again in 2018 by excellent results and a number of important milestones, despite formidable headwinds. We achieved record shipments, record value-added revenue, near-record adjusted EBITDA and record adjusted net income and adjusted earnings per share. In addition, we continued to invest in our platform for further growth and efficiency, and we returned approximately $100 million to stockholders through share repurchases and dividends consistent with our capital allocation priorities.

While 2019 will present some challenges given uncertainty in aerospace and automotive demand, we remain focused on executing on our strategic initiatives to capture the full efficiency and capacity benefits from our recent Trentwood investments and to position the Company for expected strong automotive shipments growth in 2020 and 2021. We are well positioned in attractive, growing served markets, and, through a combination of capital investment and ongoing process enhancements, we expect to continue steady improvement in underlying manufacturing cost efficiency to further drive value for all of our stakeholders. Our strong balance sheet and cash flow generation will support our growth and capital deployment priorities and provide sustainability through industry cycles.

BOARD OVERSIGHT OF STRATEGY

Our Board of Directors remains actively focused on overseeing the Company’s business strategies, risk management, talent development, and succession planning and our Company’s long-term strategy development and execution. In addition to ongoing programs embedded within our enterprise risk management programs, additional areas of focus including environmental, social and governance matters, are reviewed by management with our Board of Directors annually.

By focusing on our long-term outlook, we are best able to support our common goal of creating enduring value in our company and for our stockholders. We contribute to management’s strategic plan by engaging the company's senior management in robust discussions about the company’s overall strategy, priorities for its businesses, capital allocation, risk assessment and opportunities for continued long-term growth through our regularly scheduled meetings, including a dedicated annual strategic planning session, and throughout the year.

CORPORATE GOVERNANCE AND STOCKHOLDER ENGAGEMENT

We believe effective governance means ongoing and thoughtful evaluation of our governance structure, including our Board and board committees, and constructive stockholder engagement on evolving environmental, social and governance issues. We conduct an annual corporate governance survey of management and non-management employees in order to monitor the internal perception around a broad range of topics including the company's control environment, risk mitigation and management, the use of technology, company values and the overall “tone at the top.”

Our Board of Directors values the feedback and insights gained from frequent engagement with our stockholders. In 2018, in addition to interactions regarding our financial performance, management engaged with stockholders representing approximately 55% of our outstanding shares on matters relating to our long-term business strategy and performance, corporate governance, executive compensation and corporate responsibility. We are committed to including our stockholders’ perspectives in boardroom discussions, and we believe that regular engagement with our stockholders is necessary in order to ensure thoughtful and informed consideration of those matters. We look forward to continuing to engage in productive dialogue with our stockholders in 2019 and beyond.

BOARD COMPOSITION AND SUCCESSION PLANNING

Our Board is highly independent, engaged and diverse in perspective and background as reflected by the composition of our board which is currently 90% independent and 40% gender or ethnically diverse. This structure underscores the Board’s belief that the Company is best served when it can draw upon members with a variety of perspectives to exercise strong and experienced oversight. We have a policy of encouraging diversity of gender, ethnicity, age and background, as well as a range of tenures on the board to ensure both continuity and fresh perspectives among our director nominees.

In addition,

we recognize the importance of and remain committed to board refreshment and succession planning that ensures our directors possess a composite set of skills, experience and qualifications necessary to successfully review, challenge and help shape the Company’s strategic direction. We have a robust, multi-tiered self-evaluation process, which consists of annual reviews at the Board, committee and individual director levels.

In 2018, we added a new highly qualified independent director, Emily Liggett, to our board of directors. Ms. Liggett was president and chief executive officer of Nova Torque, Inc. and has management and board experience in a variety of manufacturing companies.

In 2019, as part of our board of director’s continued commitment to board refreshment, Teresa Sebastian and Donald J. Stebbins, two new highly qualified individuals, have been nominated to join the board this year, reflecting a total of four new highly qualified individuals nominated to join the board in the last five years. Ms. Sebastian is President and Chief Executive Officer of The Dominion Asset Group, was previously the Senior Vice President, General Counsel, Corporate Secretary and Internal Audit executive leader, of Darden Restaurants, Inc., and is experienced in finance, mergers and acquisitions, global transactions, internal audit, governance, enterprise risk, and compliance. Mr. Stebbins is the former President and Chief Executive Officer of Superior Industries International, Inc. and has extensive automotive industry experience, as well as experience in international business, manufacturing, sales, product innovation and development, accounting and finance, and mergers and acquisitions. Upon election of the Class I directors, our board of directors would be 91% independent and 45% gender or ethnically diverse.

CORPORATE SUSTAINABILITY MATTERS

Creating sustainable value for our stakeholders is an integral part of our corporate values, the end markets we serve, how we manage our business, and what we view as just good business practices. We conduct our operations in a sound environmental manner, and, within a culture of continuous improvement, we continually seek to improve our product quality and manufacturing efficiency through process improvement and capital investments that reduce our environmental impact and, in turn, reduce the environmental impact of our customers.

We recognize that long-term excellence requires sustainable practices, and we manage our business for long-term success in a manner that is economically, environmentally and socially responsible. In furtherance of our commitment to these matters, this past year we sought to articulate our story through our inaugural 2018 Sustainability Report that captures highlights of our sustainability culture and initiatives.

|

|

|

|

•

|

We maintain a strong focus on financial strength and flexibility and manage our liquidity and conservative capital structure to remain strong through the business and economic cycles.

|

|

|

|

|

•

|

Our core values drive our strategic initiatives, which are translated into annual key process indicators focused on results, and our incentive compensation structure includes performance metrics to ensure we are aligned with our common goal of creating enduring value in our company for all of our stakeholders.

|

|

|

|

|

•

|

We strive to be an employer of choice by providing equal opportunity employment and a non-discriminating workplace, protecting the health and safety of our employees, maintaining a positive and constructive relationship with our employees and their designated representatives, developing and empowering our employees and being responsible and active members of our communities.

|

|

|

|

|

•

|

We believe it is important to the success of our business that we be good stewards of our environment and resources. To that end, we focus on both compliance and ensuring that we are taking the steps now to facilitate compliance in the future. Our focus on lean manufacturing processes helps us proactively mitigate our environmental footprint.

|

To all of our stakeholders - customers, suppliers, investors, employees and the communities in which we operate - thank you for your ongoing contribution and support. Your efforts have made Kaiser Aluminum what it is today - a highly differentiated, well-respected leader in our industry - and a company well positioned for continued growth and success in the future.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jack A. Hockema

|

|

Alfred E. Osborne, Jr.

|

|

Chief Executive Officer and Chairman of the Board

|

|

Lead Independent Director

|

Kaiser Aluminum Corporation

27422 Portola Parkway, Suite 200

Foothill Ranch, CA 92610-2831

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

JUNE 6, 2019

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Kaiser Aluminum Corporation will be held at the company's corporate office, located at 27422 Portola Parkway, Suite 200, Foothill Ranch, California 92610, on

Thursday

,

June 6, 2019

, at 9:00 a.m., local time, for the following purposes:

|

|

|

|

(1)

|

To elect

four

members to our board of directors for three-year terms to expire at our

2022

annual meeting of stockholders;

|

|

|

|

|

(2)

|

To approve, on a non-binding, advisory basis, the compensation of our named executives officers as disclosed in the accompanying Proxy Statement;

|

|

|

|

|

(3)

|

To ratify the selection of

Deloitte & Touche LLP

as our independent registered public accounting firm for

2019

; and

|

|

|

|

|

(4)

|

To consider such other business as may properly come before the Annual Meeting or any adjournments thereof.

|

Information concerning the matters to be acted upon at the Annual Meeting is set forth in the accompanying Proxy Statement.

The close of business on

April 12, 2019

has been fixed as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournments thereof.

We urge stockholders to vote by proxy by submitting voting instructions

over the Internet or by telephone as indicated on the enclosed proxy card or by

completing, signing and dating the enclosed proxy card and returning it by mail

in the accompanying envelope, which does not require postage if mailed in the

United States.

|

|

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

John M. Donnan

|

|

|

Executive Vice President - Legal,

|

|

|

Compliance and Human Resources

|

|

|

|

|

April 30, 2019

|

|

|

Foothill Ranch, California

|

|

PROPOSALS AND BOARD RECOMMENDATIONS

Proposal 1 - Election of Directors

The board of directors recommends a vote "FOR ALL" of the persons

nominated by the board of directors.

Additional information about each director and his or her qualifications may be found beginning on page 4.

|

|

|

|

|

|

|

|

|

|

|

Name

|

Age

|

Director Since

|

Primary Occupation

|

Independent

|

Committee Membership

|

|

Alfred E. Osborne, Jr.

|

74

|

2006

|

Interim Dean, UCLA Anderson School of Management

|

ü

|

Ÿ

|

Audit

|

|

Ÿ

|

Executive

|

|

Ÿ

|

Nominating and Corporate Governance (Chair)

|

|

Teresa Sebastian

(New)

|

61

|

N/A

|

President and Chief Executive Officer of The Dominion Asset Group

|

ü

|

|

|

|

Donald J. Stebbins

(New)

|

61

|

N/A

|

Former President and Chief Executive Officer of Superior Industries International, Inc.

|

ü

|

|

|

|

Thomas M. Van Leeuwen

|

62

|

2006

|

Retired Director - Senior Equity Research Analyst, Deutsche Bank Securities, Inc.

|

ü

|

Ÿ

|

Audit

|

|

Ÿ

|

Executive

|

|

Ÿ

|

Compensation (Chair)

|

|

Ÿ

|

Nominating and Corporate Governance

|

Proposal 2 - Advisory Vote on Executive Compensation

The board of directors recommends a vote "FOR" the approval of the compensation of our named executive officers as disclosed in this Proxy Statement.

Additional information about executive compensation may be found beginning on page 13.

Proposal 3 - Ratification of Appointment of Independent Registered Public Accounting Firm

The board of directors recommends a vote "FOR" the ratification of the audit committee's selection of

Deloitte & Touche LLP

as our independent registered public accounting firm for

2019

.

Additional information about the independent registered public accounting firm may be found beginning on page 16.

PROXY STATEMENT SUMMARY

With consistent execution of our strategic priorities we have achieved a strong, industry-leading business, evidenced again in 2018 by excellent results and a number of important milestones, despite formidable headwinds. This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider. We encourage you to read the entire Proxy Statement for more information about these topics prior to voting.

|

|

|

|

|

|

|

COMPANY OVERVIEW

|

Ÿ

|

Leading North American producer of highly engineered aluminum mill products

|

|

Ÿ

|

Focus on demanding applications for aerospace, automotive and general industrial end-markets

|

|

Ÿ

|

Fundamental part of business model is mitigating impact of aluminum price volatility

|

|

Ÿ

|

Long-standing customer relationships - original equipment manufacturers, tier 1 suppliers and metal service centers

|

|

Ÿ

|

Differentiate through broad product offering and “Best in Class” customer satisfaction

|

|

Ÿ

|

Significant investment in talent development throughout company

|

|

|

|

|

|

PERFORMANCE HIGHLIGHTS

|

Ÿ

|

Achieved key cost position with plant & equipment investments at 2x rate of depreciation

|

|

Ÿ

|

Maintained financial strength through business cycle, steadily increasing quarterly dividends

|

|

Ÿ

|

Invested over $750 million in organic investments and over $140 million in bolt-on acquisitions since 2007

|

|

Ÿ

|

Returned over $700 million to shareholders since 2007

|

|

Ÿ

|

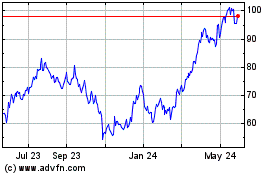

Solid total stockholder return ("TSR") over extended period (outperformed direct peers and S&P 600 Materials Index) with less volatility than many other industry participants

|

|

Ÿ

|

Excellent results despite significant headwinds from aerospace supply chain destocking, high contained metal and freight costs and newly authorized tariffs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECORD

|

|

|

|

|

|

RECORD

|

|

RECORD

|

|

NEAR RECORD

|

|

|

|

RECORD

|

|

Shipments

|

|

Net Sales

|

|

Net Income

|

|

Adjusted Net Income*

|

|

Value Added Revenue*

|

|

Adjusted EBITDA*

|

|

Earnings Per Share

|

|

Adjusted Earnings Per Share*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

652

|

|

$1,586

|

|

$92

|

|

$109

|

|

$828

|

|

$205

|

|

$5.43

|

|

$6.48

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Million lbs

|

|

Million

|

|

Million

|

|

Million

|

|

Million

|

|

Million

|

|

|

|

|

______________

*See Appendix A to this Proxy Statement for reconciliations of measures from generally accepted accounting principles (“GAAP”) to non-GAAP. While our use of terms such as earnings before interest, tax, depreciation and amortization (“EBITDA”) or “adjusted” are not intended to be (and should not be relied on) in lieu of the comparable caption under GAAP to which it is reconciled, those terms are intended to provide greater clarity of the impact of certain material items on the GAAP measure and are not intended to imply those terms should be excluded.

|

|

|

|

|

|

|

BOARD OF DIRECTORS

|

Ÿ

|

Diverse and independent Board

|

|

Ÿ

|

Robust and multi-tiered Board and Committee annual assessment process

|

|

Ÿ

|

Utilize internal resource and/or third party to facilitate Board and Committee evaluations

|

|

Ÿ

|

Continuing focus on identifying critical skills needed to support company strategy and succession planning

|

|

Ÿ

|

United Steelworkers ("USW") has right to nominate 40% of our Board members

|

|

Ÿ

|

Elected new independent director, Emily Liggett, in 2018 with significant CEO, board and manufacturing experience

|

|

Ÿ

|

Two new highly qualified individuals have been nominated to join the board this year

|

|

Ÿ

|

Strong support for continued proactive and effective stockholder engagement (> 50% annually)

|

|

|

|

|

|

|

|

|

2018 CAPITAL ALLOCATION

|

Ÿ

|

Consistent capital allocation strategy focused on organic growth, external growth and returning cash to shareholders through dividends and share repurchases

|

|

|

Ÿ

|

Continued investment to further manufacturing efficiency, quality and capacity

|

|

Ÿ

|

Acquired Imperial Machine & Tool Co. ("IMT"), a leader in multi-material additive manufacturing and machining technologies for aerospace and defense, automotive, high-tech, and general industrial applications, to further advance capability to deliver highly engineered solutions for customers

|

|

Ÿ

|

Increased quarterly dividend for the 8th consecutive year

|

|

Ÿ

|

Returned approximately $100 million to shareholders through share repurchases and dividends

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSISTENT CAPITAL ALLOCATION STRATEGY

|

|

|

|

|

|

Cash deployment track record

|

|

|

|

|

Ÿ

|

Invested ~$750M in the business since 2007 (~2x depreciation)

|

|

|

|

|

Ÿ

|

Distributed >700M to stockholders since 2007

|

|

|

|

|

|

Ÿ

|

Dividends increased each year since 2011

|

|

|

|

|

|

Ÿ

|

~6.2 million shares repurchased at an average price of $67.42

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENVIRONMENT & SUSTAINABILITY

|

Ÿ

|

Sustainability is an integral part of our corporate values

|

|

Ÿ

|

Our business is managed for long-term success in a manner that is economically, environmentally and socially responsible

|

|

Ÿ

|

Our products are part of the carbon solution, facilitating light weighting and increased fuel efficiency

|

|

Ÿ

|

Aluminum is infinitely recyclable and we have continued to increase our use of recycled scrap

|

|

Ÿ

|

Our investments increasing our manufacturing efficiency reduce our environmental impact and the impact of our customers

|

|

Ÿ

|

Published inaugural Corporate Sustainability Report in response to feedback from stockholders in connection with our proactive engagement efforts

|

|

Ÿ

|

Launched new website with enhanced environmental, social and governance disclosures

|

|

Ÿ

|

Continued proactive engagement with BlueGreen Alliance, environmental groups and others

|

|

|

|

|

|

|

|

Executive Compensation

|

Ÿ

|

Approximately 75% of CEO and COO target compensation is “at-risk”, with >50% subject to stringent performance metrics

|

|

Ÿ

|

Approximately 65% of other NEO target compensation is “at-risk”, with >50% subject to stringent performance metrics

|

|

Ÿ

|

Compensation programs supported by best practices and aligned with our strategic objectives and stockholder interests

|

|

Ÿ

|

Stockholder approval of compensation consistently exceeds 90%; 93% approval in 2018

|

|

Ÿ

|

Incentive plans' financial and performance metrics continue to demand increasing levels of performance as more fully described below in our Executive Compensation Highlights

|

EXECUTIVE COMPENSATION HIGHLIGHTS

As noted in the letter from our Chairman and Lead Independent Director, our success over the years has been driven by our people, a highly focused and consistent strategy to drive steady continuous improvement and our pursuit of six key strategic initiatives that align our actions with our corporate values to ensure that our long-term success is driven by practices that are economically, environmentally and socially responsible.

|

|

|

|

|

|

|

|

Ÿ

|

Advance our position as the supplier of choice

|

Ÿ

|

Enhance quality and depth of technical and managerial talent

|

|

Ÿ

|

Achieve and sustain a position as a low cost producer

|

Ÿ

|

Sustain financial strength and flexibility

|

|

Ÿ

|

Pursue profitable sales growth

|

Ÿ

|

Enhance our standing as a valued corporate citizen

|

Each of those initiatives have been, and continue to be, reflected in our compensation structure. As described in further detail in the “Executive Compensation - Compensation Discussion and Analysis” section of this Proxy Statement, or CD&A, our 2018 compensation structure was developed and designed to:

|

|

|

|

•

|

align the interest of our named executive officers and stockholders by tying a significant portion of compensation to enhancing stockholder return;

|

|

|

|

|

•

|

attract, motivate and retain highly experienced executives with significant industry experience vital to our short-term and long-term success, profitability and growth;

|

|

|

|

|

•

|

deliver a mix of fixed and at-risk compensation with the portion of compensation at risk increasing with seniority; and

|

|

|

|

|

•

|

tie our executive compensation to our ability to pay and safety, quality, delivery, cost and individual performance directly linked to our strategic initiatives.

|

In 2018 the compensation of our named executive officers consisted primarily of the following components:

|

|

|

|

•

|

a base salary targeted at the 50

th

percentile of our compensation peer group (1) compensating each named executive officer based on the level and scope of responsibility, individual expertise and prior experience and (2) providing a fixed amount of cash compensation upon which our named executive officers can rely;

|

|

|

|

|

•

|

a short-term annual cash incentive targeted at the 50

th

percentile of our compensation peer group (1) payable only if our company achieved a certain adjusted earnings before interest, taxes, depreciation and amortization, or Adjusted EBITDA, performance level which has continued to increase, resulting in increasingly demanding performance required to realize the same or similar payouts year-over-year, (2) adjusted based on our (a) safety performance, (b) quality performance, (c) delivery performance, (d) cost performance, and, (e) in exceptional and rare instances approved by our compensation committee, individual and group performance, and (3) capped at three times target; and

|

|

|

|

|

•

|

an equity-based, long-term incentive targeted at between the 50

th

and 65

th

percentile of our compensation peer group and designed to align compensation with the interests of our stockholders and to enhance retention of our named executive officers consisting of (1) restricted stock units with three-year cliff vesting and (2) performance shares, which vest, if at all, based on our performance against demanding underlying metrics over the applicable three-year performance period.

|

Because grants under our long-term incentive program are outstanding for three years, at any time we have three over-lapping long-term incentive programs outstanding and the underlying metrics applicable to the performance shares can vary as our compensation committee assesses the effectiveness of our outstanding programs, metrics critical to our long-term success and compensation trends. The following table describes the performance share metrics (described more fully below) we used for our 2016-2018, 2017-2019 and 2018-2020 long-term incentive programs:

|

|

|

|

|

|

|

|

Performance Share Metrics

|

2016-2018

|

2017-2019

|

2018-2020

|

|

Relative TSR

|

60%

|

40%

|

30%

|

|

Total Controllable Cost

|

40%

|

40%

|

40%

|

|

Economic Value Added

|

|

20%

|

30%

|

We benchmark our long-term incentives at between the 50th and the 65th percentiles to (1) provide more flexibility for our compensation program where necessary and appropriate, (2) facilitate our ability to address substantive differences in the roles, scope of responsibility and experience of our named executive officers when compared to the positions reflected in our compensation peer group and (3) more heavily weight the compensation of our named executive officers to appropriately emphasize the long-term equity based pay, ensure that our named executive officers maintain a stockholder perspective, directly promote retention of key executives, ensure that a substantial portion of compensation is at risk and subject to forfeiture and link awards to our overall performance and the creation of long-term stockholder value. In addition, we compete for talent with companies much larger than us and those included in our compensation peer group and these larger companies aggressively recruit the most highly qualified talent in critical functions.

Our compensation committee, working with the compensation committee’s compensation consultant, Meridian Partners, LLC (referred to herein as Meridian), reviews, evaluates and updates our compensation peer group, which includes companies in both similar and different industries, at least annually. For 2018, our compensation committee approved the 34-company peer group more fully described in our CD&A section with (1) market caps ranging from $622 million to approximately $9.8 billion and a median market cap of approximately $1.8 billion and (2) revenues ranging from $638 million to approximately $3.1 billion and median revenue of approximately $1.6 billion. Due to the differences in size among the companies in our peer group, Meridian uses a regression analysis to adjust survey data results based on our revenue as compared to the revenue of other companies in our peer group.

Pay for Performance

The table below summarizes the performance metrics under our 2018 short-term incentive and 2018-2020 long-term incentive plans:

|

|

|

|

|

|

|

|

|

Incentive Program

|

Performance Metric

|

Weighting

|

Modifier

|

Impact on Multiplier

|

|

Short-Term Incentive Plan

|

Adjusted EBITDA

|

100%

|

Safety (TCIR & LCIR)

|

+/- 10%

|

|

|

|

|

Quality

|

+/- 10%

|

|

|

|

|

Delivery

|

+/- 10%

|

|

|

|

|

Cost

|

+/- 20%

|

|

|

|

|

Individual*

|

+/- 100%

|

|

Long-Term Incentive Plan

|

Total Controllable Cost

|

40%

|

|

|

|

|

EVA

|

30%

|

|

|

|

|

TSR

|

30%

|

|

|

_______________

* As noted, individual awards are capped at three times target and the individual modifier is only used in exceptional and rare instances approved by the compensation committee.

The following summarizes our performance against the metrics under our 2018 short-term incentive and 2016-2018 long-term incentive plans:

2018 Short-Term Incentive

_______________

* The targets are based on the Adjusted EBITDA required to achieve the designated return on net assets (excluding cash) plus depreciation. As noted, increasing net assets and depreciation raise the year-over-year Adjusted EBITDA targets. While we achieved strong quality performance in 2018, our safety, on-time delivery and cost performance lagged and did not meet our expectations or demanding requirements, resulting in +7%, -10%, -10% and -4% modifiers, respectively, and an overall reduction of Adjusted EBITDA multiplier of 1.4 to a final multiplier of 1.2.

|

|

|

|

|

|

|

FEATURES

|

|

Ÿ

|

Pay for performance

|

|

Ÿ

|

Adjusted EBITDA target determined based on return on net assets (excluding cash) plus depreciation

|

|

Ÿ

|

Modifiers for safety, quality, delivery and cost performance establishing a strong linkage to strategic non-financial results

|

|

Ÿ

|

In exceptional and rare instances approved by our compensation committee, individual adjustment up to plus or minus 100% based on actual performance, including individual, facility, and/or functional area performance

|

|

Ÿ

|

No payout unless we:

|

|

|

(1)

|

achieve the threshold Adjusted EBITDA goal

|

|

|

(2)

|

generate positive adjusted net income

|

|

Ÿ

|

Maximum payout capped at three times the target

|

|

Ÿ

|

Rigorous financial performance goals - target increases with investments and increasingly higher net assets and depreciation

|

Annual Performance Award Payouts under Short-Term Incentive Plans for our Named Executive Officers

|

|

|

|

|

|

|

The Adjusted EBITDA targets under our short- term incentive plan reflect the Adjusted EBITDA required to achieve 7.5%, 15% and 35% returns on our net assets (excluding cash) at the threshold, target and maximum payout levels and also recover our depreciation. As we have continued to invest in our business our net assets and depreciation have continued to grow, and, as a result, the Adjusted EBITDA targets have continued to increase each year. To that end, our Adjusted EBITDA performance at the target level increased 10% from 2017 to 2018 and 21% from 2016 to 2018.

|

|

|

|

|

|

|

The table on the right illustrates our annual Adjusted EBITDA performance multiplier for the last three years under our short-term incentive plans before the application of modifiers. See Appendix A to this Proxy Statement for reconciliations of GAAP to non-GAAP measures.

|

|

The Adjusted EBITDA Multiplier under our 2018 Short-Term Incentive Plan is the lowest in the last three years despite our near-record Adjusted EBITDA performance due to our annually increased Adjusted EBITDA targets. After the application of modifiers, the the final multipliers under our short-term incentive plan for 2016 ranged from 2.2 to 2.6 and the final multipliers under our short-term incentive plans for 2017 and 2018 were approximately and 1.5 and 1.2 respectively, each reflecting the impact of our performance against demanding modifiers.

2016-2018 Long-Term Incentive

|

|

|

|

|

|

|

Relative TSR*

|

|

|

|

Controllable Cost**

|

|

_____________

* Relative TSR is against companies comprising the S&P 600 SmallCap Materials Sector Index. Payout capped at target if TSR is negative.

** Payout at target only if we offset underlying inflation. Payout at maximum only if we achieve 3% or more annualized cost reduction after offsetting underlying inflation.

|

|

|

|

|

|

|

FEATURES

|

|

Ÿ

|

Three-year performance period (2016-2018)

|

|

Ÿ

|

Include retention features by utilizing time-vested restricted stock units

|

|

Ÿ

|

Pay for performance by utilizing performance shares subject to demanding metrics

|

|

Ÿ

|

Performance metrics:

|

|

|

(1)

|

40% based on controllable cost

|

|

|

(2)

|

60% based on relative TSR

|

|

Ÿ

|

Payout for relative TSR performance is capped at target if TSR is negative

|

|

Ÿ

|

Payout at target for controllable cost performance only if we offset inflation

|

|

Ÿ

|

No windfall upon a change in control for performance shares - only shares earned based on performance through the date of the change in control will vest

|

Annual Performance Award Payouts under Long-Term Incentive Plans

The table below reflects our annual performance award payouts for the last three years under our long-term incentive plans. The payout under our 2016-2018 Long-Term Incentive Plan was lower primarily as result of our lower relative TSR performance against the other companies in the S&P 600 SmallCap Materials Sector Index.

|

|

|

|

|

|

|

|

|

|

|

|

Performance Period

|

Payout Year

|

Performance Metric

|

Weighting

|

Company Performance

|

Actual Payout as Percentage of Target

|

|

2016-2018

|

2019

|

Relative TSR

|

60

|

%

|

45th Percentile

|

90

|

%

|

|

|

|

Controllable Cost

|

40

|

%

|

1% Cost Reduction*

|

118

|

%

|

|

|

|

Weighted Average

|

|

|

101

|

%

|

|

2015-2017

|

2018

|

Relative TSR

|

100

|

%

|

81st Percentile

|

170

|

%

|

|

2014-2016

|

2017

|

Relative TSR

|

100

|

%

|

63rd Percentile

|

126

|

%

|

_______________

* After offsetting underlying inflation.

Performance Share Award Payouts Based on Relative TSR

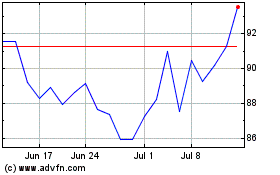

The chart below illustrates the performance share award payouts based on our relative TSR performance for the 2014-2016, 2015-2017 and 2016-2018 long-term incentive programs:

|

|

|

|

|

|

|

|

|

|

Performance shares earned, if any, are based on our TSR over the underlying three year performance period compared to the other companies comprising the S&P 600 SmallCap Materials Sector Index. In considering constituents for the S&P SmallCap 600, S&P Dow Jones Indices looks for companies (1) with market capitalizations of between $450 million and $2.1 billion, (2) meeting certain float requirements, (3) with a U.S. domicile, (4) required to file SEC annual reports, and (5) listed on a major U.S. exchange, among other factors.

|

|

|

|

|

|

|

The beginning and ending stock prices used to determine our TSR are calculated using the 20-trading day average preceding the beginning and end of the performance period.

|

|

|

|

|

|

|

The performance share multiplier is determined by using straight line interpolation based on our TSR percentile ranking within our comparison group based on the table to the right:

|

Percentile Ranking

|

|

Multiplier

|

|

< 25th

|

|

0.0x

|

|

25th

|

|

0.5x

|

|

50th

|

|

1.0x

|

|

75th

|

|

1.5x

|

|

> 90th

|

|

2.0x

|

_______________

* Reflects percentage of target. The final payout multipliers for the 2014-2016, 2015-2017 and 2016-2018 programs as a percentage of the total opportunity or maximum payout were 63%, 85% and 45%, respectively.

Performance Share Award Payout Based on Controllable Cost

Achieving and sustaining a position as a low cost producer is one of our six key strategic initiatives. For our 2016-2018 long-term incentive compensation program, 40% of the performance shares issued to our named executive officers were subject to a controllable cost performance metric that required our company to reduce controllable costs to offset underlying inflation over the three year performance period to achieve the target payout of performance shares subject to the controllable cost metric. A 9% reduction of controllable costs after offsetting underlying inflation over the same three-year period would result in payout of performance shares equal to two times target and an increase of controllable costs of 9% or more would result in no payout of performance shares subject to the controllable cost metric.

Controllable costs are generally defined as our variable conversion costs which adjust with our product volume and mix plus corporate and plant overhead. Controllable costs also (1) include benefits because we believe that management is required to take actions to influence benefit costs over the performance period and (2) exclude, among other things, major maintenance, research and development and enterprise resource planning costs to ensure that we continue to invest in the future of our company.

2018 Total CEO Compensation

As previously noted, the mix of our CEO’s total target compensation is heavily weighted toward performance-based compensation with more than 75% of the total target compensation being at-risk (short- and long-term compensation), 57% of the total target compensation being long-term, and 64% of the long-term target being allocated to performance shares.

For 2018, the benchmarking performed by Meridian reflected that the total target compensation of our CEO was 5% below the median of our compensation peer group and that our CEO’s (1) base salary was approximately 8% above the median base salary, (2) short-term incentive target was approximately 28% below the median and (3) long-term incentive target was approximately 6% above the median and 15% below the 65

th

percentile. Regressed Equilar Executive Compensation Survey data received by our compensation committee reflected similar comparisons. Using that information, the compensation committee did not increase our CEO’s 2018 base salary and, instead allocated a total increase in his 2018 total target compensation of 3% to his short- and long-term incentive compensation targets to bring his short- and long-term incentive targets closer to the median levels of our compensation peer group and continue to increase his at risk-compensation and drive the alignment reflected in our compensation philosophy.

As reflected in more detail in the Summary Compensation Table in the CD&A section of this Proxy Statement, in 2018, despite excellent performance and record shipments, record value added revenue, record adjusted earnings per share, record adjusted net income and near record Adjusted EBITDA, the total compensation of our CEO decreased by 5.5% from his 2017 total compensation and decreased by 9.7% from his 2016 total compensation. The year-over-year decreases in total compensation resulted from the increasingly demanding performance metrics in both our short-term and long-term incentive compensation plans as we continue to invest in our business, grow our net assets, increase our depreciation, increase the financial returns required to achieve target performance levels for our financial metrics and increase the level of performance required by our performance metrics and modifiers.

In summary, our incentive compensation programs are designed to demand continuous improvement in our year-over-year results for our CEO and other named executive officers to realize the same year-over-year financial benefit under our incentive compensation plans. We believe that design emphasizing the importance of successful execution of each of our six key strategic initiatives is important to our long-term success and aligns the interests of our CEO and other named executive officers with our success and our stockholders.

Kaiser Aluminum Corporation

27422 Portola Parkway, Suite 200

Foothill Ranch, CA 92610-2831

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held On

June 6, 2019

_________________________________________________

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Page

|

|

GENERAL QUESTIONS AND ANSWERS

|

|

|

PROPOSALS REQUIRING YOUR VOTE

|

|

|

|

Proposal 1 - Election of Directors

|

|

|

|

Proposal 2 - Advisory Vote on Executive Compensation

|

|

|

|

Proposal 3 - Ratification of the Selection of our Independent Registered Public Accounting Firm

|

|

|

CORPORATE GOVERNANCE

|

|

|

|

Board Leadership Structure

|

|

|

|

Risk Oversight

|

|

|

|

Director Independence

|

|

|

|

Director Designation Agreement

|

|

|

|

Board Committees

|

|

|

|

Board and Committee Meetings and Consents in 2018

|

|

|

|

Annual Meetings of Stockholders

|

|

|

|

Annual Performance Reviews

|

|

|

|

Stockholder Engagement

|

|

|

|

Sustainable Value Creation

|

|

|

|

Stock Ownership Guidelines and Securities Trading Policy

|

|

|

|

Risks Arising from Compensation Policies and Practices

|

|

|

|

Stockholder Communications with the Board of Directors

|

|

|

EXECUTIVE OFFICERS

|

|

|

EXECUTIVE COMPENSATION

|

|

|

|

Compensation Committee Report

|

|

|

|

Compensation Discussion and Analysis

|

|

|

|

Summary Compensation Table

|

|

|

|

All Other Compensation

|

|

|

|

Grants of Plan-Based Awards in 2018

|

|

|

|

Employment-Related Agreements and Certain Employee Benefit Plans

|

|

|

|

Outstanding Equity Awards at December 31, 2018

|

|

|

|

Stock Vested in 2018

|

|

|

|

Pension Benefits as of December 31, 2018

|

|

|

|

Nonqualified Deferred Compensation for 2018

|

|

|

|

Pay Ratio

|

|

|

|

Potential Payments and Benefits Upon Termination of Employment

|

|

|

DIRECTOR COMPENSATION

|

|

|

|

Director Compensation for 2018

|

|

|

|

Director Compensation Arrangements

|

|

|

EQUITY COMPENSATION PLAN INFORMATION

|

|

|

PRINCIPAL STOCKHOLDERS AND MANAGEMENT OWNERSHIP

|

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

|

|

AUDIT COMMITTEE REPORT

|

|

|

INDEPENDENT PUBLIC ACCOUNTANTS

|

|

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

|

|

|

OTHER MATTERS

|

|

|

STOCKHOLDER PROPOSALS

|

|

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on

June 6, 2019

: The Proxy Statement

and our Annual Report to Stockholders are available at www.envisionreports.com/kalu.

GENERAL QUESTIONS AND ANSWERS

|

|

|

|

Q:

|

When is the Proxy Statement being sent to stockholders and what is its

purpose?

|

|

|

|

|

A:

|

This Proxy Statement is first being sent to our stockholders on or about

May 6, 2019

at the direction of our board of directors in order to solicit proxies for our use at the Annual Meeting.

|

|

|

|

|

Q:

|

When is the Annual Meeting and where will it be held?

|

|

|

|

|

A:

|

The Annual Meeting will be held on

Thursday

,

June 6, 2019

, at 9:00 a.m., local time, at our corporate office, located at 27422 Portola Parkway, Suite 200, Foothill Ranch, California 92610.

|

|

|

|

|

Q:

|

Who may attend the Annual Meeting?

|

|

|

|

|

A:

|

All of our stockholders may attend the Annual Meeting.

|

|

|

|

|

Q:

|

Who is entitled to vote?

|

|

|

|

|

A:

|

Stockholders as of the close of business on

April 12, 2019

are entitled to vote at the Annual Meeting. Each share of our common stock is entitled to one vote.

|

|

|

|

|

A:

|

You will be voting on:

|

|

|

|

|

•

|

The election of

four

members to our board of directors to serve until our

2022

annual meeting of stockholders;

|

|

|

|

|

•

|

The approval, on a non-binding, advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement;

|

|

|

|

|

•

|

The ratification of the selection of

Deloitte & Touche LLP

as our independent registered public accounting firm for

2019

; and

|

|

|

|

|

•

|

Such other business as may properly come before the Annual Meeting or any adjournments.

|

|

|

|

|

Q:

|

How does the board of directors recommend that I vote?

|

|

|

|

|

A:

|

The board of directors recommends that you vote your shares:

|

|

|

|

|

•

|

"FOR ALL"

the director nominees identified in "Proposals Requiring Your Vote - Proposal 1 - Election of Directors" below;

|

|

|

|

|

•

|

"FOR"

the approval , on a non-binding, advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement; and

|

|

|

|

|

•

|

"FOR"

the ratification of the selection of

Deloitte & Touche LLP

as our independent registered public accounting firm for

2019

.

|

|

|

|

|

A:

|

You can vote in person at the Annual Meeting or you can vote prior to the Annual Meeting by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy without delay.

|

|

|

|

|

Q:

|

How do I vote by proxy?

|

|

|

|

|

A:

|

If you choose to vote your shares by proxy, you have the following options:

|

|

|

|

|

•

|

Over the Internet:

You can vote over the Internet at the website shown on your proxy card. Internet voting will be available 24 hours a day, seven days a week, until 11:59 p.m., Eastern Time, on

Wednesday

,

June 5, 2019

.

|

|

|

|

|

•

|

By telephone:

You can vote by telephone by calling the toll-free number shown on your proxy card. Telephone voting will be available 24 hours a day, seven days a week, until 11:59 p.m., Eastern Time, on

Wednesday

,

June 5, 2019

.

|

|

|

|

|

•

|

By mail:

You can vote by mail by completing, signing and dating your proxy card and returning it in the enclosed prepaid envelope.

|

|

|

|

|

Q:

|

I want to attend the Annual Meeting and vote in person. How do I

obtain directions to the Annual Meeting?

|

|

|

|

|

A:

|

You may obtain directions to the Annual Meeting by calling us at (949) 614-1740.

|

|

|

|

|

Q:

|

What constitutes a quorum?

|

|

|

|

|

A:

|

As of

April 12, 2019

, the record date, 16,128,768 shares of our common stock were issued and outstanding. A majority of these shares present or represented by proxy will constitute a quorum for the transaction of business at the Annual Meeting. If you properly vote by proxy by submitting your voting instructions over the Internet, by telephone or by mail, then your shares will be counted as part of the quorum. Abstentions or votes that are withheld on any matter will be counted towards a quorum but will be excluded from the vote relating to the particular matter under consideration. Broker non-votes are counted towards a quorum but are excluded from the vote with respect to the matters for which they are applicable. A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner. Among our proposals, brokers will have discretionary voting power only with respect to the proposal to ratify the selection of

Deloitte & Touche LLP

as our independent registered public accounting firm for

2019

.

|

|

|

|

|

Q:

|

What are the voting requirements for the proposals?

|

|

|

|

|

A:

|

There are different voting requirements for the proposals.

|

|

|

|

|

•

|

Each director will be elected by an affirmative vote of the majority of the votes cast with respect to the director in an uncontested election. If an incumbent director nominee receives a greater number of votes cast against his or her election than in favor of his or her election (excluding abstentions) in an uncontested election, the nominee must promptly tender his or her resignation, and the board of directors will decide, through a process managed by the nominating and corporate governance committee, whether to accept the resignation, taking into account its fiduciary duties to our company and our stockholders. The board of director's explanation of its decision will be promptly disclosed in a Form 8-K furnished to the Securities and Exchange Commission. An election of directors is considered to be contested if there are more nominees for election than positions on the board of directors to be filled by election at the meeting of stockholders. In the event of a contested election, each director will be elected by a plurality vote of the votes cast at such meeting. The election of directors at the Annual Meeting is uncontested.

|

|

|

|

|

•

|

The approval of the holders of a majority of the total number of outstanding shares of our common stock present in person or represented by proxy at the Annual Meeting and actually voted on the proposal is necessary (1) to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement, and (2) to ratify the selection of

Deloitte & Touche LLP

as our independent registered public accounting firm for

2019

. If you abstain from voting on the proposal to approve the compensation of our named executive officers as disclosed in this Proxy Statement and/or the proposal to ratify the selection of

Deloitte & Touche LLP

as our independent registered public accounting firm for

2019

, your shares will not be counted in the vote for such proposal(s) and will have no effect on the outcome of the vote.

|

|

|

|

|

Q:

|

If my shares are held in "street name" by my broker, will my broker

vote my shares for me?

|

|

|

|

|

A:

|

As discussed above, among our proposals, brokers will have discretionary voting power only with respect to the proposal to ratify the selection of

Deloitte & Touche LLP

as our independent registered public accounting firm for

2019

. To be sure your shares are voted, you should instruct your broker to vote your shares using the instructions provided by your broker.

|

|

|

|

|

Q:

|

What will happen if the compensation of the company's named executive officers is not approved by

the stockholders?

|

|

|

|

|

A:

|

Because this is an advisory vote, our board of directors and compensation committee will not be bound by the approval of, or the failure to approve, the executive compensation of our named executive officers as disclosed in this Proxy Statement. The board of directors and the compensation committee, however, value the opinions that our stockholders express in their votes and will consider the outcome of the vote when determining future executive compensation programs.

|

|

|

|

|

Q:

|

What will happen if the selection of

Deloitte & Touche LLP

as our

independent registered public accounting firm for

2019

is not ratified

by the stockholders?

|

|

|

|

|

A:

|

Pursuant to the audit committee charter, the audit committee of our board of directors has sole authority to appoint our independent registered public accounting firm, and the audit committee will not be bound by the ratification of, or failure to ratify, the selection of

Deloitte & Touche LLP

. The audit committee will, however, consider any failure to ratify the selection of

Deloitte & Touche LLP

in connection with the appointment of our independent registered public accounting firm the following year.

|

|

|

|

|

Q:

|

Can I change my vote after I give my proxy?

|

|

|

|

|

A:

|

Yes. If you vote by proxy, you can revoke that proxy at any time before voting takes place at the Annual Meeting. You may revoke your proxy by:

|

•

voting again over the Internet or by telephone no later than 11:59 p.m., Eastern Time, on

Wednesday

,

June 5, 2019

;

•

submitting a properly signed proxy card with a later date;

|

|

|

|

•

|

delivering, no later than 5:00 p.m., Eastern Time, on

Wednesday

,

June 5, 2019

, written notice of revocation to our Secretary, c/o Computershare, P.O. Box 43126, Providence, Rhode Island 02940-5138; or

|

|

|

|

|

•

|

attending the Annual Meeting and voting in person.

|

Your attendance alone will not revoke your proxy. To change your vote, you must also vote in person at the Annual Meeting. If you instruct a broker to vote your shares, you must follow your broker's directions for changing those instructions.

|

|

|

|

Q:

|

What does it mean if I receive more than one proxy card?

|

|

|

|

|

A:

|

If you receive more than one proxy card, it is because your shares are held in more than one account. You must vote each proxy card to ensure that all of your shares are voted at the Annual Meeting.

|

|

|

|

|

Q:

|

Who will count the votes?

|

|

|

|

|

A:

|

Representatives of Computershare, our transfer agent, will tabulate the votes and act as inspectors of election.

|

|

|

|

|

Q:

|

How much will this proxy solicitation cost?

|

|

|

|

|

A:

|

We have hired MacKenzie Partners, Inc. to assist us in the distribution of proxy materials and solicitation of votes at a cost not to exceed $10,000, plus out-of-pocket expenses. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to the owners of our common stock. Our officers and regular employees may also solicit proxies, but they will not be specifically compensated for these services. In addition to the use of the mail, proxies may be solicited personally or by telephone by our employees or by MacKenzie Partners.

|

PROPOSALS REQUIRING YOUR VOTE

Proposal 1 - Election of Directors

General

We have a diverse and independent board of directors. Our board of directors currently has 10 members, consisting of our CEO and nine independent directors. Our current directors are:

|

|

|

|

|

|

Carolyn Bartholomew

|

Lauralee E. Martin

|

|

|

|

|

David Foster

|

Alfred E. Osborne, Jr., Ph.D.

|

|

|

|

|

L. Patrick Hassey

|

Jack Quinn

|

|

|

|

|

Jack A. Hockema

|

Thomas M. Van Leeuwen

|

|

|

|

|

Emily Liggett

|

Brett E. Wilcox

|

Mr. Hockema, our CEO, serves as our Chairman of the Board, and Dr. Osborne serves as our Lead Independent Director. If each of our Class I director nominees is elected, because Mr. Quinn is not standing for re-election at the Annual Meeting and because the new nominees, Teresa Sebastian and Donald J. Stebbins, are standing for election, our board of directors will expand from 10 to 11 members.

Our board of directors represents a breadth of experience and diversity in perspective and background, as reflected in the summary of their collective qualifications below. Additionally, our current directors have a broad range of tenures, from less than one year to almost 18 years of service, with an average tenure of approximately 12 years. We believe this balances institutional knowledge and experience with new perspectives and ideas.

Strategic Board Skills, Experience and Attributes

|

|

|

|

|

|

|

|

|

|

|

Public Board of Directors Experience

|

|

Industry-Specific

|

|

Economic, Regulatory and/or Policy

|

|

Diversity

|

|

|

|

|

|

|

|

|

|

Leadership /Management

|

|

Labor / Talent Management and Development

|

|

Financial / Investment

|

|

International Industrial

|

Our amended and restated certificate of incorporation and bylaws provide for a classified board of directors consisting of three classes. The term of our Class I directors expires at the Annual Meeting; the term of our Class II directors will expire at the 2020 annual meeting of stockholders; and the term of our Class III directors will expire at the 2021 annual meeting of stockholders.

Mr. Quinn, who was designated by the United Steel, Paper and Foresting, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, AFL-CIO, CLC (referred to herein as the USW) as a director candidate pursuant to the terms of our Director Designation Agreement with the USW (described under “Corporate Governance - Director Designation Agreement”), has not been nominated to stand for re-election when his term ends at the Annual Meeting. Our board of directors, based on the designation by the USW and recommendation of the Nominating and Corporate Governance Committee, has nominated Ms. Sebastian to serve on our board of directors pursuant to the Director Designation Agreement. For information on Ms. Sebastian, see "— Nominees for Election as Class I Directors" below.

Board Refreshment and Director Succession Planning

During 2017, we increased the retirement age in our corporate governance guidelines from age 72 to 75. The policy now provides that unless otherwise approved by the board, no individual may be nominated for election or re-election as a director if he or she would be age 75 or older at the time the term would begin. We believe the increase in retirement age will facilitate

retaining strategic board skills and experience as the board continues to plan for director succession and develop transition plans for the longer term.

We plan thoughtfully for director succession and board refreshment. By developing and following a long-term succession plan, the board has an ongoing opportunity to:

•

evaluate the depth and diversity of experience of our board;

•

constructively engage with the USW;

•

expand and replace key skills and experience that support our strategies;

•

build on our record of board diversity; and

•

maintain a balanced mix of tenures.

The Nominating and Corporate Governance Committee also plans for the orderly succession of our independent lead director and of the chairs of our board's five committees, providing for the identification, development and transition of responsibilities.

Board Composition and Diversity

Bringing together informed directors with different perspectives, in a well-managed and constructive environment, fosters thoughtful and innovative decision-making. We have a policy of encouraging diversity of gender, ethnicity, age and background, as well as a range of tenures on the board to ensure both continuity and fresh perspectives among our directors. Our directors exhibit a balanced mix of tenures and age, and independent and diverse leadership.

|

|

|

|

|

|

|

Diversity (Gender or Ethnicity)

|

|

Independence

|

|

40%

|

|

90%

|

Nominees for Class I Directors

The nominating and corporate governance committee of our board of directors has recommended, and our board of directors has approved, the nomination of the

four

nominees listed below. The nominees have indicated their willingness to serve as members of the board of directors if elected; however, in case any nominee becomes unavailable for election to the board of directors for any reason not presently known or contemplated, the proxy holders have discretionary authority to vote proxies for a substitute nominee. Proxies cannot be voted for more than

four

nominees.

The board of directors recommends a vote "FOR ALL" of the persons

nominated by the board of directors.

Set forth below is information about the Class I director nominees, including their ages, present principal occupations, other business experiences, directorships in other public companies, membership on committees of our board of directors, and reasons why each individual nominee's specific experience, qualifications, attributes or skills led the nominating and corporate governance committee to recommend, and our board of directors to conclude, that the nominee should serve as a director of the company.

|

|

|

|

|

Alfred E. Osborne, Jr.

|

|

|

|

Lead Independent Director

|

|

|

|

Director since: July 2006

|

|

|

|

Committees: Audit; Executive; and Nominating and Corporate Governance (Chair)

|

|

|

|

Age: 74

|

|

|

|

Other Current Public Board Memberships:

|

–

First Pacific Advisor family of seven funds (Capital, Crescent, International Value, New Income, Paramount, Perennial and Source Capital) (1999 - Present)

|

–

Nuverra Environmental Solutions, Inc. (formerly Heckmann Corporation) (2007 - Present)

|

|

|

|

|

|

|

|

Other Affiliations:

|

–

Member of board of directors of Wedbush, Inc. (1998 - Present)

|

|

|

|

DESCRIPTION OF BUSINESS EXPERIENCE:

|

|

|

|

Dr. Osborne has been the Interim Dean at the UCLA Anderson School of Management since July 2018 and a Professor of Global Economics and Management since July 2008. Dr. Osborne was previously the Senior Associate Dean at the UCLA Anderson School of Management from July 2003 to June 2018 and an Associate Professor of Global Economics and Management and served as the Director of the Harold and Pauline Price Center for Entrepreneurial Studies at the UCLA Anderson School of Management.

|

|

|

|

PREVIOUS DIRECTORSHIPS:

|

|

|

–

AFH Acquisition VII, Inc.

|

|

|

|

|

|

|

|

QUALIFICATIONS:

|

|

|

|

Dr. Osborne has served on many boards and board committees of public companies and investment funds over a more than 30-year period. During that time, Dr. Osborne worked extensively on the development of board and director best practices, as well as director training and governance programs sponsored by the UCLA Anderson School of Management. Dr. Osborne was one of the original directors selected by a search committee (referred to herein as the search committee) to serve as a director of our company upon our emergence from chapter 11 bankruptcy in 2006 and was selected because of his public company experience and governance background. During his service on our board of directors, Dr. Osborne has gained an understanding of our company and the environment in which we operate. Dr. Osborne's experience as a director of public companies, as a member of various board committees of public companies, and as an educator in the fields of business management and corporate governance allow him to draw on his experience and offer guidance to our board of directors and management on issues that affect our company, including governance and board best practices.

|

|

|

|

|

|

Teresa Sebastian

(New)

|

|

|

|

Age: 61

|

|

|

|

Other Affiliations:

|

–

Member Board of Directors, Assemble Sound, a private company

|

–

Member Board of Directors and Chair of Audit Committee, The United Negro College Fund

|

–

Member Dean’s Advisory Council, University of Michigan School of Literature Sciences and Arts

|

|

|

|

DESCRIPTION OF BUSINESS EXPERIENCE:

|

|

|

|

Ms. Sebastian has been the President and Chief Executive Officer of The Dominion Asset Group, an angel investment and venture capital firm, since June 2015, an adjunct professor for accounting and enterprise risk management at Vanderbilt Law School since August 2017, and an adjunct professor for governance and compliance at the University of Michigan Law School since August 2016. Ms. Sebastian was previously the Senior Vice President, General Counsel, Corporate Secretary and Internal Audit executive leader, of Darden Restaurants, Inc, a publicly held multi-brand restaurant operator, from October 2010 to March 2015.

|

|

|

|

Before joining Darden Restaurants, Ms. Sebastian served as Vice President at Veyance Technologies, Inc., a m

anufacturer and marketer of engineered rubber products