United States Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the

Registrant ☒

|

Filed by a Party

other than the Registrant ☐

|

Check

the appropriate box:

☐

Preliminary Proxy

Statement

☐

Confidential, for

Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

☒

Definitive Proxy

Statement

☐

Definitive

Additional Materials

☐

Soliciting Material

Pursuant to §240.14a-12

Global Digital Solutions, Inc.

(Name of Registrant As Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the

Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee

required.

☐

Fee computed on

table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

(1)

Title

of each class of securities to which transaction

applies:

(2)

Aggregate number of

securities to which transaction applies:

(3)

Per

unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was

determined):

(4)

Proposed maximum

aggregate value of transaction:

(5)

Total

fee paid:

☐

Fee paid previously

with preliminary materials.

☐

Check box if any

part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its

filing.

(1)

Amount

Previously Paid:

(2)

Form,

Schedule or Registration Statement No.:

(3)

Filing

Party:

(4)

Date

Filed:

GLOBAL DIGITAL SOLUTIONS, INC.

777 SOUTH FLAGLER DRIVE, SUITE 800, WEST TOWER

WEST PALM BEACH, FL 33401

December

7, 2018

Dear

Stockholder:

I

invite you to attend the 2019 Annual Meeting of Stockholders of

Global Digital Solutions, Inc. (“Annual Meeting”). The

Annual Meeting will be held at 9:00 EST on January 31, 2019, at the

offices of First Capital Real Estate Investment, 2355 Gold Meadow

Way, Suite 160, Gold River, California 95670.

Under

the Securities and Exchange Commission rules that allow companies

to furnish proxy materials to shareholders over the Internet, we

have elected to deliver our proxy materials to the majority of our

shareholders over the Internet. This delivery process allows us to

provide shareholders with the information they need, while at the

same time conserving natural resources and lowering the cost of

delivery. On or about December 18th, 2018, we expect to mail to our

shareholders a Notice and Access to Internet Availability of Proxy

Materials (the “Notice”) containing instructions on how

to access our 2018 Proxy Statement and 2017 Annual Report to

shareholders. The Notice also provides instructions on how to vote

online and includes instructions on how to receive a paper copy of

the proxy materials by mail. On or about December 18, 2018, we

expect to mail to our Shareholders a Notice and Access card of

internet availability.

On the

following pages, you will find the Notice of our 2019 Annual

Meeting of Stockholders and the Proxy Statement that describes the

matters to be considered at the Annual Meeting. We also have

enclosed your Proxy Card and our Annual Report for the year ended

December 31, 2017. You will find voting instructions on the Notice

and Access card you received, as well as your voting codes. If your

shares are held in “street name” (that is, held for

your account by a broker or other nominee) and you have elected not

to be solicited, your materials will be forwarded to you

as an

Objecting Beneficial Owner

by your

broker.

The

Annual Meeting is an excellent opportunity to learn more about the

business and operations of Global Digital Solutions, Inc. We hope

you will be able to attend.

Thank

you for your ongoing support and continued interest in Global

Digital Solutions, Inc.

|

|

|

|

|

Sincerely

yours,

|

|

|

/s/

William Delgado

|

|

|

William

Delgado

|

|

|

Chief

Executive Officer

|

YOUR VOTE IS IMPORTANT. PLEASE VOTE PROMPTLY IN THE MANNER EASIEST

FOR YOU PURSUANT TO THE INSTRUCTIONS IN THE NOTICE AND ACCESS TO

INTERNET AVAILABILITY OF PROXY MATERIALS IN ORDER TO ENSURE YOUR

REPRESENTATION AT THE ANNUAL MEETING. IF YOU REQUEST A PAPER COPY

OF THE PROXY MATERIALS, A RETURN ENVELOPE WILL BE ENCLOSED FOR THAT

PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN

PERSON IF YOU ATTEND THE ANNUAL MEETING.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE 2019 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JANUARY 31,

2019.

Internet Availability of Proxy Materials

Under

rules recently approved by the Securities Exchange Commission

(“SEC”), the Company is now furnishing proxy materials

on the Internet in addition to mailing paper copies of the

materials to each stockholder of record. Instructions on how to

access and review the proxy materials on the Internet can be found

on the proxy card sent to shareholders of record and on the Notice

and Access to Internet Availability of Proxy Materials (the

“Notice”) sent to shareholders who hold their shares in

“street name” (i.e., in the name of a broker, bank or

other record holder). The Notice will also include instructions for

shareholders who hold their shares in street name on how to access

the proxy card to vote over the Internet. Voting over the Internet

will not affect your right to vote in person if you decide to

attend the Annual Meeting; however, if you wish to revoke your

proxy, you must first notify the Corporate Secretary of your intent

to vote in person, and vote your shares at the Annual Meeting. The

Notice is not a form for voting and presents only an overview of

the more complete proxy materials, which contain important

information and are available on the Internet or by mail. Please

access and review the proxy materials before voting.

The

Proxy Statement and our 2017 Annual Report to Stockholders will be

available at:

https://www.iproxydirect.com/

GDSI.

GLOBAL DIGITAL SOLUTIONS, INC.

777 SOUTH FLAGLER DRIVE, SUITE 800, WEST TOWER

WEST PALM BEACH, FL 33401

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

DATE AND TIME:

January

31, 2019, at 9:00 a.m. PST

PLACE:

Offices

of First Capital Real Estate Investment, 2355 Gold Meadow Way,

Suite 160, Gold River, California 95670

.

ITEMS OF BUSINESS:

●

A proposal to elect

one (1) member of the Board to a one-year term;

●

A proposal to

ratify the appointment of Turner, Stone & Company, LLP, as our

independent registered public accounting firm for the fiscal year

ending December 31, 2019;

●

A proposal to

approve an amendment to our Articles of Incorporation to increase

our authorized common shares to Two Billion (2,000,000,000) shares

from the current Six Hundred Fifty Million (650,000,000) shares.

The par value of the common shares will not be

changed;

●

A proposal to

approve a Special Litigation Committee, consisting of William

Delgado, to investigate the claims and allegations in litigations

deriving from the conduct of the Board of Directors and the

Officers leading to the Securities and Exchange Commission

complaint (the “Litigations”), to evaluate whether the

Company should pursue any of the claims asserted in the

Litigations, and to prepare such reports, arrive at such decisions,

and take such other actions in connection with the Litigations as

the Special Litigation Committee in its discretion deems

appropriate and in the best interests of the Company and its

stockholders, in accordance with New Jersey law, and:

●

To transact such

other business as may properly come before the Annual

Meeting.

RECORD DATE:

You are

entitled to vote if you were a stockholder of record at the close

of business on December 13th, 2019.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Shareholders to be held on January 31,

2019.

Our Proxy Statement is attached. Financial and other

information concerning Global Digital Solutions, Inc., is contained

in our Annual Report to shareholders for the fiscal year ended

December 31, 2017. The Proxy Statement and our fiscal 2017 Annual

Report to shareholders will be available on the Internet at

https://www.iproxydirect.com/GDSI.

YOUR VOTE IS VERY IMPORTANT.

Whether or not you plan to

attend the Annual Meeting of Stockholders, we urge you to vote and

submit your proxy in order to ensure the presence of a

quorum.

Registered holders may vote

by internet, mail, fax or

telephone. Please follow the instructions on the Notice and Access

to Internet Availability of Proxy Materials.

Beneficial Stockholders may vote

if your shares are held in

the name of a broker, bank or other holder of record, following the

voting instructions you receive from the holder of record to vote

your shares.

Any

Proxy may be revoked at any time prior to its exercise at the

Annual Meeting. Shareholders are not entitled to assert dissenter

rights under NJ Rev Stat § 14A:11-1 (2013).

|

|

|

|

|

|

|

|

|

By

Order of the Board of Directors,

|

|

|

|

|

/s/

William Delgado

|

|

December

4, 2018

|

|

|

William

Delgado

|

|

New

York, NY

|

|

|

Chief

Executive Officer

|

GLOBAL DIGITAL SOLUTIONS, INC.

777 SOUTH FLAGLER DRIVE, SUITE 800, WEST TOWER

WEST PALM BEACH, FL 33401

PROXY STATEMENT

FOR 2019 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 31, 2019

This

Proxy Statement is being provided to you by Global Digital

Solutions, Inc.’s Board of Directors (the

“Board”) in connection with our 2019 Annual Meeting of

Stockholders. The Annual Meeting will be held at 9:00 a.m. PST on

January 31, 2019, at the offices of First Capital Real Estate

Investment, 2355 Gold Meadow Way, Suite 160, Gold River, CA 95670,

for the purposes set forth in the accompanying Notice of 2019

Annual Meeting of Stockholders and this Proxy Statement. We expect

to mail this information to stockholders entitled to vote at the

Annual Meeting on or about December 18th, 2018.

PURPOSE OF MEETING

At the

Annual Meeting, stockholders will be asked to consider and act

upon:

(1)

A proposal to

elect one (1) member of the Board to a one-year term;

(2)

A proposal to

ratify the appointment of Turner, Stone & Company, LLP, as our

independent registered public accounting firm for the fiscal year

ending December 31, 2019;

(3)

A proposal to

approve an amendment to our Articles of Incorporation to increase

our authorized common shares to Two Billion (2,000,000,000) shares

from the current Six Hundred Fifty Million (650,000,000) shares.

The par value of the common shares will not be

changed;

(4)

A proposal to

approve a Special Litigation Committee, consisting of William

Delgado, to investigate the claims and allegations in litigations

deriving from the conduct of the Board of Directors and the

Officers leading to the Securities and Exchange Commission

complaint (the “Litigations”), to evaluate whether the

Company should pursue any of the claims asserted in the

Litigations, and to prepare such reports, arrive at such decisions,

and take such other actions in connection with the Litigations as

the Special Litigation Committee in its discretion deems

appropriate and in the best interests of the Company and its

stockholders, in accordance with New Jersey law; and

(5)

Such other

business as may properly come before the Annual

Meeting.

The

Board knows of no other business to be presented for consideration

at the Annual Meeting. Each proposal is described in more detail in

this Proxy Statement.

INFORMATION ABOUT THE ANNUAL MEETING, PROXIES, PROPOSALS AND

VOTING

What is the purpose of the Annual Meeting?

At the

Annual Meeting, stockholders, whom we also refer to as shareholders

in this Proxy Statement, will consider and vote on the following

matters:

(1)

The election of

the nominees named in this Proxy Statement to our Board, each for a

term of one year; and

(2)

The ratification

of the appointment of Turner, Stone & Company, LLP, as our

independent registered public accounting firm for the fiscal year

ending December 31, 2019.

(3)

The approval of an

amendment to our Articles of Incorporation to increase our

authorized common shares to Two Billion (2,000,000,000) shares from

the current Six Hundred Fifty Million (650,000,000) shares. The par

value of the common shares will not be changed;

(4)

The approval of a

Special Litigation Committee to investigate the claims and

allegations in the Litigations, to evaluate whether the Company

should pursue any of the claims asserted in the Litigations, and to

prepare such reports, arrive at such decisions, and take such other

actions in connection with the Litigations as the Special

Litigation Committee in its discretion deems appropriate and in the

best interests of the Company and its stockholders, in accordance

with New Jersey law;

The

shareholders will also act on any other business that may properly

come before the meeting.

Who can vote?

To be

able to vote, you must have been a Global Digital Solutions, Inc.,

shareholder of record at the close of business on December 13,

2018. This date is the Record Date for the Annual Meeting.

Shareholders of record who own our voting securities at the close

of business on December 13, 2018, are entitled to vote on each

proposal at the Annual Meeting.

How many votes do I have?

Each

share of our common stock that you own on the Record Date entitles

you to one vote on each matter that is voted on.

Is my vote important?

Your

vote is important no matter how many shares you own. Please take

the time to vote. Take a moment to read the options for voting

below. Choose the way to vote that is easiest and most convenient

for you and cast your vote as soon as possible.

How do I vote?

If you

are the “record holder” of your shares, meaning that

you own your shares in your own name and not through a bank or

brokerage firm, you may vote in one of five ways as

follows:

(1)

You may vote over the Internet

. If you

have Internet access, you may vote your shares by following the

Internet instructions on the Notice and Access to Internet

Availability of Proxy Materials (the “Notice”) that was

mailed to you.

(2)

You may vote by mail

. If you wish to

vote by mail, you should follow the instructions on the proxy card.

Shares represented by written proxy that are properly dated,

executed and returned will be voted at the Annual Meeting in

accordance with the instructions on such written proxy. The shares

you own will be voted according to your instructions on the Proxy

Card you mail. If you return the Proxy Card, but do not give any

instructions on a particular matter described in this Proxy

Statement, the shares you own will be voted in accordance with the

recommendations of our Board. If no specific instructions are

given, shares will be voted: (1) FOR the election of the director

nominees described in the proxy statement; and (2) FOR the

ratification of the selection of Turner, Stone & Company, LLP

as our independent registered public accounting firm for the fiscal

year ending December 31, 2019. Such shares may also be voted by the

named proxies for such other business as may properly come before

the annual meeting or any adjournment or postponement

thereof.

(3)

You may vote by telephone

. Stockholders

who wish to vote by telephone should follow the instructions on the

proxy card. Shares voted by telephone or represented by written

proxies that are properly dated, executed and returned will be

voted at the annual meeting in accordance with the instructions

given by telephone. If no specific instructions are given, shares

will be voted: (1) FOR the election of the director nominees

described in the proxy statement; and (2) FOR the ratification of

the selection of Turner, Stone & Company, LLP as our

independent registered public accounting firm for the fiscal year

ending December 31, 2019. Such shares may also be voted by the

named proxies for such other business as may properly come before

the annual meeting or any adjournment or postponement

thereof.

(4)

You may vote by fax

: If you wish to vote

by fax, you should follow the instructions on the proxy card.

Shares represented by written proxy that are properly dated,

executed and faxed will be voted at the Annual Meeting in

accordance with the instructions on such written proxy. The shares

you own will be voted according to your instructions on the Proxy

Card you mail. If you fax the Proxy Card, but do not give any

instructions on a particular matter described in this Proxy

Statement, the shares you own will be voted in accordance with the

recommendations of our Board. If no specific instructions are

given, shares will be voted: (1) FOR the election of the director

nominees described in the proxy statement; and (2) FOR the

ratification of the selection of Turner, Stone & Company, LLP

as our independent registered public accounting firm for the fiscal

year ending December 31, 2019. Such shares may also be voted by the

named proxies for such other business as may properly come before

the annual meeting or any adjournment or postponement

thereof.

(5)

You may vote in person

. If you attend

the meeting, you may vote by delivering your completed Proxy Card

in person or you may vote by completing a ballot. Ballots will be

available at the meeting.

Why did I receive a notice in the mail regarding the Internet

availability of proxy materials instead of a full set of printed

proxy materials?

Under

rules recently approved by the Securities Exchange Commission

(“SEC”), the Company is now furnishing proxy materials

on the Internet instead of mailing paper copies of the materials to

each shareholder of record. We elected to make this proxy statement

and our Annual Report available to our stockholders on the Internet

to reduce printing and shipping costs and diminish the effect of

our Annual Meeting on the environment. Instructions on how to

access and review the proxy materials on the Internet can be found

on the Proxy Card sent to shareholders of record and on the Notice

and Access to Internet Availability of Proxy Materials (the

“Notice”) sent to shareholders who hold their shares in

“street name” (i.e. in the name of a broker, bank or

other record holder). The Notice will also include instructions for

shareholders who hold their shares in street name on how to access

the Proxy Card to vote over the Internet. Voting over the Internet

will not affect your right to vote in person if you decide to

attend the Annual Meeting; however, if you wish to revoke your

proxy, you must first notify the Corporate Secretary of your intent

to vote in person, and vote your shares at the Annual

Meeting.

On or

about December 18, 2018, we will send all stockholders of record as

of December 13, 2018, a Notice instructing them as to how to

receive their proxy materials via the Internet this year. The proxy

materials will be available on the Internet as of December 18,

2018.

Where and when will the meeting be held?

The

2019 Annual Meeting will be held at 9:00 a.m. PST on January 31,

2019, at the offices of First Capital Real Estate Investment, 2355

Gold Meadow Way, Suite 160, Gold River, California

95670.

How can I obtain directions to the meeting?

For

directions to the location of our 2019 Annual Meeting, please visit

our proxy voting website at

https://www.iproxydirect.com/GDSI

and refer to the address in the proxy statement.

Who is soliciting my proxy?

Our

Board is soliciting your proxy to vote at our 2019 Annual Meeting.

By completing and returning a proxy card, you are authorizing the

proxy holder to vote your shares at our Annual Meeting as you have

instructed.

What is the difference between holding shares as a stockholder of

record and as a beneficial owner?

If your

shares are registered directly in your name with our transfer

agent, Direct Transfer LLC, you are considered, with respect to

those shares, the “stockholder of record” and the

Notice has been directly sent to you by us. If your shares are held

in a stock brokerage account or by a bank or other nominee, you are

considered the “beneficial owner” of shares held in

“street name” and, accordingly, the Notice may be

forwarded to you by your broker, bank, or company appointed

designee.

Can I change my vote after I have mailed my Proxy Card or after I

have voted my shares?

Yes.

You can change your vote and revoke your proxy at any time before

the polls close at the meeting by doing any one of the following

things:

●

signing another

proxy with a later date;

●

giving our

Corporate Secretary a written notice before or at the meeting that

you want to revoke your proxy; or

●

voting in person at

the meeting.

Your

attendance at the meeting alone will not revoke your

proxy.

Can I vote in person at the meeting if my shares are held in

“street name”?

Yes, if

your shares are held in street name, you must bring an account

statement or letter from your bank or brokerage firm showing that

you are the beneficial owner of the shares as of the record date

(December 13, 2018) in order to be admitted to the meeting on

January 31, 2019. To be able to vote your shares held in street

name at the meeting, you will need to obtain a Proxy Card from the

holder of record.

What if I do not mark the boxes on my Proxy Card?

Any

Proxy Card returned without directions given will be voted

“

FOR

” all

proposals presented.

Who pays for the solicitation of Proxies?

The

solicitation of proxies is made on behalf of the Board. We pay all

costs to solicit these proxies. Our officers, directors and

employees may solicit proxies but will not be additionally

compensated for such activities. We are also working with brokerage

houses and other custodians, nominees and fiduciaries to forward

solicitation materials to the beneficial owners of shares held of

record by such institutions and persons. We will reimburse their

reasonable expenses.

Who is entitled to vote at the 2019 Annual Meeting?

Stockholders

of record at the close of business on December 13, 2018, which we

refer to herein as the Record Date, will be entitled to notice of

the Annual Meeting and to vote at the Annual Meeting. Our voting

stock is comprised of our common stock, of which five hundred

sixty-six million five hundred eighty-four thousand nine hundred

five (566,584,905) shares were issued and outstanding as of the

Record Date and our Preferred Shares of one million (1,000,000)

shares constituting a voting block of 33.2 to 1 or the common share

equivalent of 332,012,222.

What happens if additional matters or amendments to matters are

presented at the Meeting?

Other

than the proposals described in this Proxy Statement, we are not

aware of any other business to be acted upon at the Meeting. If you

grant a proxy, the persons named as proxy holders will have the

discretion to vote your shares on any additional matters properly

presented for a vote at the Meeting or with respect to any

amendments or variations to the proposals described in this Proxy

Statement.

With

respect to any matter that is properly brought before the meeting,

the election inspectors will treat abstentions as

unvoted.

Establishing a Quorum and Votes Required

What constitutes a quorum?

In

order for business to be conducted at the meeting, a quorum must be

present in person or represented by valid proxies. If you sign and

return your proxy card, your shares will be counted to determine

whether we have a quorum, even if you abstain or fail to vote on

any of the proposals listed on the proxy card. A quorum consists of

the holders of a majority of the shares of stock issued and

outstanding on December 13, 2018, the Record Date. In the event of

any abstentions or broker non-votes with respect to any proposal

coming before the Annual Meeting, the proxy will be counted as

present for purposes of determining the existence of a quorum. If a

quorum is not present, the meeting will be adjourned until a quorum

is obtained.

If I don’t vote, how will the shares I own in my brokerage

account be voted?

Abstentions

and broker non-votes typically will not be counted for purposes of

approving any of the matters to be acted upon at the Annual

Meeting. A broker non-vote generally occurs when a broker or

nominee who holds shares in street name for a customer does not

have authority to vote on certain non-routine matters because its

customer has not provided any voting instructions on the matter.

Non-routine matters would be those matters more likely to affect

the structure and operations of the Company, which would have a

greater impact on the value of the underlying security. Examples of

non-routine matters include, among other things, decisions as to

corporate restructuring, poison pill provisions, and changes in

capitalization. In general, routine matters are those matters that

do not propose to change the structure, bylaws or operations of the

Company. An example of such matters is approval of the auditors.

Therefore, abstentions and broker non-votes generally have no

effect under Nevada law with respect to routine matters, which

require the approval of only a majority of the shares of common

stock present and voting at the meeting. However, with respect to

non-routine matters, abstentions and broker non-votes generally

have the effect of a vote “against” a non-routine

proposal since a majority of the shares of common stock outstanding

must be voted in present or by proxy at the meeting. If your shares

are held in the name of a brokerage firm, and you do not tell your

broker how to vote your shares (a "broker non-vote"), the broker

can vote them as it sees fit only on matters that are determined to

be routine, and not on any other proposal.

What vote is required for each item?

Election of Directors.

A nominee will be elected to the

Board if the votes cast “for” the nominee’s

election exceed the votes cast “against” the

nominee’s election, with abstentions and “broker

non-votes” counting as votes “against” the

nominee. If the shares you own are held in “street

name” by a brokerage firm, your brokerage firm, as the record

holder of your shares, is required to vote your shares according to

your instructions.

If you

do not instruct your broker how to vote with respect to the

election of directors, your broker may not vote with respect to

this proposal. If an uncontested incumbent director nominee

receives a majority of votes “against” his election,

the director must tender a resignation from the Board. The Board

will then decide whether to accept the resignation within 90 days

following certification of the shareholder vote. We will publicly

disclose the Board’s decision and its reasoning with regard

to the offered resignation.

Ratification of Independent Registered Public Accounting

Firm.

The affirmative vote of a majority of the total number

of votes cast at the meeting is needed to ratify the selection of

Turner, Stone & Company, LLP, as our independent registered

public accounting firm.

Who will count the votes?

The

votes will be counted, tabulated and certified by Issuer Direct,

our proxy agent.

Will my vote be kept confidential?

Yes,

your vote will be kept confidential and we will not disclose your

vote, unless (1) we are required to do so by law (including in

connection with the pursuit or defense of a legal or administrative

action or proceeding) or (2) there is a contested election for the

Board. The Inspector of Elections will forward any written comments

that you make on the Proxy Card to management without providing

your name, unless you expressly request disclosure on your Proxy

Card.

How does the Board recommend that I vote on the

proposals?

The

Board recommends that you vote

FOR

all of the proposals.

Where can I find the voting results?

We will

report the voting results on Form 8-K within four business days

after the end of our Annual Meeting.

Could other matters be considered and voted upon at the

meeting?

Our

Board does not expect to bring any other matter before the Annual

Meeting and is not aware of any other matter that may be considered

at the meeting. In addition, pursuant to our bylaws, the time has

elapsed for any stockholder to properly bring a matter before the

meeting. However, if any other matter does properly come before the

meeting, the proxy holders will vote the proxies as the Board may

recommend.

What happens if the meeting is postponed or adjourned?

Your

proxy will still be good and may be voted at the postponed or

adjourned meeting. You will still be able to change or revoke your

proxy at any time until the meeting is held and votes are

accordingly tabulated.

How can I obtain a paper copy of the proxy materials?

You can

request a paper copy of the proxy materials at no charge by

following the instructions included in the Notice and Access to

Internet Availability of Proxy Materials. If you do not make a

request for a paper copy of the proxy materials, you will not

otherwise receive a paper copy.

How can I obtain an Annual Report on Form 10-K?

Our

Annual Report on Form 10-K for the fiscal year ended December 31,

2017 is available on the Securities & Exchange Commission

website at

http://www.sec.gov

.

If you would like a copy of our Annual Report on Form 10-K or any

of its exhibits, we will send you one without charge. Please follow

the instructions on the Notice.

Whom should I contact if I have any questions?

If you

have any questions about the Annual Meeting of Stockholders or your

ownership of our common stock, please contact William Delgado,

Chief Executive Officer, at:

Global

Digital Solutions, Inc.

Attn:

William Delgado, Chief Executive Officer

777

South Flagler Drive, Suite 800, West Tower

West

Palm Beach, FL 33401

Phone:

(561) 515-6198

Email:

info@gdsi.co

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN

ADDRESS

We will

only deliver one Notice and Access to Internet Availability of

Proxy Materials (“Notice”) to multiple stockholders

sharing an address, unless we have received contrary instructions

from one or more of the stockholders. Also, we will promptly

deliver a separate copy of the Notice and future stockholder

communication documents to any stockholder at a shared address to

which a single copy of these materials were delivered, or deliver a

single copy of these materials and future stockholder communication

documents to any stockholder or stockholders sharing an address to

which multiple copies are now delivered, upon written request to us

at our address noted above. Stockholders may also address future

requests regarding delivery of proxy materials and/or annual

reports by contacting us at the address noted above.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

The

following table shows ownership of our common stock on December 18,

2018, based on five hundred sixty-six million five hundred

eighty-four thousand nine hundred five (566,584,905) shares of

common stock outstanding on that date, by (i) each director, (ii)

our named executive officers, (iii) all of our directors and

executive officers as a group and (iv) each person or entity known

to us to own beneficially more than five percent (5%) of our

capital stock. Except to the extent indicated in the footnotes to

the following table, the person or entity listed has sole voting

and dispositive power with respect to the shares that are deemed

beneficially owned by such person or entity, subject to community

property laws where applicable

.

|

|

|

|

|

|

|

|

|

|

Total

Shares

|

|

|

|

|

|

Beneficially

|

|

|

Name

|

|

|

Owned

|

|

|

|

|

|

|

|

|

Directors

and Named Executive Officers

|

|

|

|

|

|

William

Delgado

|

-

|

1,000,0001

|

3,322,032

Direct

|

0.556

%

|

|

Jerome

Gomolski

|

-

|

-

|

-

|

-

|

1

The issued and outstanding Preferred Shares of one million

(1,000,000) shares constituting a voting block of 33.2 to 1 or the

common share equivalent of 332,012,222

Change in Control

We are

not aware of any arrangement that might result in a change in

control of our Company in the future.

Purchases of Equity Securities by the Issuer and Affiliated

Purchasers

None

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The

Board has nominated the sole director of our Board to be re-elected

at the Annual Meeting to serve a one-year term until the 2020

Annual Meeting of stockholders and until his respective successors

are elected and qualified. The nominee has agreed to serve if

elected.

Set

forth below is information regarding the nominee, as of December

18, 2018, including his age, position with Global Digital

Solutions, Inc., recent employment and other

directorships.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE

ELECTION TO THE BOARD OF DIRECTORS FOR EACH NOMINEE.

The

person who has been nominated for election at the Annual Meeting to

serve on our Board are named in the table below. Proxies cannot be

voted for a greater number of persons than the number of nominees

named. All directors of our Company hold office until the next

Annual Meeting of our shareholders and until such director’s

successor is elected and has been qualified, or until such

director’s earlier death, resignation or removal. The

following table sets forth the name, position and age of our

executive officer and director. Our board of directors elects

officers and their terms of office are at the discretion of our

board of directors.

|

|

|

Position Held

|

|

|

|

Appointed or

|

|

Name

|

|

with the Company

|

|

Age

|

|

Elected

|

|

William

Delgado

|

|

Chairman

and CEO

|

|

59

|

|

May

13, 2016

|

Business Experience

The

following is a brief account of the education and business

experience during at least the past five years of our director and

executive officer, indicating his

principal

occupations during that period, and the name and principal business

of the organizations in which such occupation and employment were

carried out.

Board of Directors

William Delgado, Chairman and CEO

Mr.

Delgado served as our President, Chief Executive Officer and Chief

Financial Officer from August 2004 to August 2013. Effective August

12, 2013, Mr. Delgado assumed the position of Executive Vice

President, and was responsible, along with Mr. Sullivan, for

business development. Mr. Delgado has over 33 years of management

experience including strategic planning, feasibility studies,

economic analysis, design engineering, network planning,

construction and maintenance. He began his career with Pacific

Telephone in Outside Plant Construction. He moved to the network

engineering group and concluded his career at Pacific Bell as the

Chief Budget Analyst for the Northern California region. Mr.

Delgado founded All Star Telecom in late 1991, specializing in OSP

construction and engineering and systems cabling. All Star Telecom

was sold to International FiberCom in April of 1999. After leaving

International FiberCom in 2002, Mr. Delgado became President/CEO of

Pacific Comtel in San Diego, California. After the Company acquired

Pacific Comtel in 2004, Mr. Delgado became Director, President, CEO

and CFO of the Company. Management believes that Mr.

Delgado’s many years of business experience uniquely qualify

him for his positions with the Company.

On

May 13, 2016, Mr. Delgado assumed the role of Chief Executive

Officer and Chariman of the Board of Directors and currently serves

in that position.

CORPORATE GOVERNANCE

We

currently act with one (1) director: William Delgado.

We do

not have a standing audit and compensation committee.

All

proceedings of our Board were conducted by resolutions consented to

in writing by all the directors and filed with the minutes of the

proceedings of the directors. Such resolutions consented to in

writing by the directors entitled to vote on those resolutions at a

meeting of the directors are, according to the corporate laws of

the State of New Jersey and the bylaws of our Company, as valid and

effective as if they had been passed at a meeting of the directors

duly called and held.

Nomination Process

As of

December 13, 2018, we had not implemented any material changes to

the procedures by which our shareholders may recommend nominees to

our Board. Our Board does not have a policy with regards to the

consideration of any director candidates recommended by our

shareholders. Our Board has determined that it is in the best

position to evaluate our Company’s requirements as well as

the qualifications of each candidate when the Board considers a

nominee for a position on our Board. The Board believes that, given

the early stage of our development, a specific nominating policy

would be premature and of little assistance until our business

operations develop to a more advanced level. Our Company does not

currently have any specific or minimum criteria for the election of

nominees to the Board, and we do not have any specific process or

procedure for evaluating such nominees. The Board assesses all

candidates, whether submitted by management or shareholders, and

makes recommendations for election or appointment.

Our

Company does not have any defined policy or procedure requirements

for shareholders to submit recommendations or nominations for

directors. A shareholder who wishes to communicate with our Board

may do so by directing a written request to the following

address:

Global

Digital Solutions, Inc.

Attn:

William Delgado, Chief Executive Officer

777

South Flagler Drive, Suite 800, West Tower

West

Palm Beach, FL 33401

Phone:

(561) 515-6198

Email:

info@gdsi.co

The

Board has nominated the one (1) member of our current Board to be

re-elected at the Annual Meeting to serve a one-year term until the

2020 Annual Meeting of stockholders and until his respective

successors are elected and qualified. The nominee has agreed to

serve if elected.

Audit Committee Financial Expert

Our

Board has determined that we do not have a board member that

qualifies as an “audit committee financial expert” as

defined in Item 407(d)(5)(ii) of Regulation S-K. We believe that

our Board is capable of analyzing and evaluating our financial

statements and understanding internal controls and procedures for

financial reporting.

COMPENSATION OF NAMED EXECUTIVE OFFICERS

The

following table summarizes the compensation of each named executive

for the fiscal years ended December 31, 2017 and 2016 awarded to or

earned by (i) each individual serving as our principal executive

officer and principal financial officer of the Company and (ii)

each individual that served as an executive officer of the Company

at the ends of such fiscal years who received compensation in

excess of $100,000.

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and

Principal Position

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Executive

Officer

|

|

|

|

|

|

|

|

William

Delgado

|

2017

|

$

240,000

|

$

—

|

$

—

|

$

—

|

$

240,000

|

|

|

2016

|

$

70,000

|

$

—

|

$

20,740

|

$

—

|

$

90,740

|

Compensation of Directors

We

currently have no formal plan for compensating our directors for

their services in their capacity as directors, although we may

elect to issue stock options to such persons from time to time.

Directors are entitled to reimbursement for reasonable travel and

other out-of-pocket expenses incurred in connection with attendance

at meetings of our board of directors. Our board of directors may

award special remuneration to any director undertaking any special

services on our behalf other than services ordinarily required of a

director.

Pension, Retirement or Similar Benefit Plans

There

are no arrangements or plans in which we provide pension,

retirement or similar benefits for directors or executive officers.

We have no material bonus or profit sharing plans pursuant to which

cash or non-cash compensation is or may be paid to our directors or

executive officers, except that stock options may be granted at the

discretion of the board of directors or a committee

thereof.

Equity Compensation Plan Information and Stock Options

There

are no arrangements or plans in which we provide equity

compensation for directors or executive officers.

Stock Option Awards

There

are no arrangements or plans in which we provide stock options

compensation for directors or executive officers.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The

Board has, subject to the ratification of the stockholders,

appointed Turner, Stone & Company, LLP, as our independent

registered public accounting firm for the fiscal year ending

December 31, 2018.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE

RATIFICATION OF THE SELECTION OF TURNER, STONE & COMPANY, LLP,

AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL

YEAR ENDING DECEMBER 31, 2019.

Turner,

Stone & Company, LLP, will not have a representative at the

Annual Meeting.

FEES

PAID TO TURNER, STONE & COMPANY, LLP

|

|

Quarter

Ending

September

30,

2018

|

|

Audit Fees

(1)

|

$

127,500.00

|

|

Audit-Related Fees

(2)

|

$

10,500.00

|

|

Tax

Fees

|

$

-

|

|

Subtotal

|

$

-

|

|

All Other

Fees

|

$

-

|

|

Total

Fees

|

$

138,000.00

|

(1)

Audit Fees. These

are fees for professional services for the audit of our

third-quarter financial statements dated September 31, 2018,

included in our Quarterly Report on Form 10-Q. The fees were billed

and paid during the fourth quarter of 2018.

(2)

Audit-Related Fees.

These are fees for assurance and related services that are

reasonably related to the performance of the audit or review of our

financial statements, including financial disclosures made in our

equity finance documentation and registration statements filed with

the SEC that incorporate financial statements and the

auditors’ report thereon, and reviewed with our Audit

Committee on financial accounting/reporting standards.

PROPOSAL NO. 3

INCREASE IN THE NUMBER OF AUTHORIZED COMMON SHARES

The current Articles of Incorporation state that the number of

authorized shares of Common Stock is limited to 650,000,000 shares.

As of December 5, 2018, a total of 579,525,814 shares of Common

Stock were issued and outstanding. The purpose of the increase in

the authorized Common Stock is to provide our Company’s

management with certain abilities including, but not limited to,

issuance of Common Stock to be used for public or private

offerings, conversions of convertible securities, issuance of

options pursuant to employee stock option plans, acquisition

transactions, and other general corporate purposes.

Our Board of Directors and majority shareholders approved

the Amendment to increase the number of authorized shares of Common

Stock to 2,000,000,000 shares.

The Amendment for the increase in authorized shares will become

effective upon filing of the Amendment promptly following the

annual meeting.

Distribution and Costs

We will pay the cost of preparing, printing and distributing this

proxy statement.

Absence of Dissenters’ Rights of Appraisal

Neither the adoption by the board of directors nor the approval by

the Majority Stockholder of the amendment to our articles of

incorporation provides shareholders any right to dissent and obtain

appraisal of or payment for such shareholder's shares under the New

Jersey corporate law, the articles of incorporation or the

bylaws.

Potential Anti-Takeover Effects of Amendment

Release No. 34-15230 of the staff of the SEC requires disclosure

and discussion of the effects of any stockholder proposal that may

be used as an anti-takeover device. The increase in authorized

Common Stock may make it more difficult or prevent or deter a third

party from acquiring control of our Company or changing our Board

and management, as well as inhibit fluctuations in the market price

of our Company’s shares that could result from actual or

rumored takeover attempts. The proposed increased in our authorized

Common Stock is not the result of any such specific effort, rather,

as indicated below, the purpose of the increase in the authorized

Common Stock is to provide our Company’s management with

certain abilities, and not to construct or enable any anti-takeover

defense or mechanism on behalf of our Company. While it is possible

that management could use the additional shares to resist or

frustrate a third-party transaction providing an above-market

premium that is favored by a majority of the independent

Shareholders, our Company presently has no intent or plan to employ

any additional authorized shares as an anti-takeover

device.

Other than this proposal, our Board of Directors does not currently

contemplate the adoption of any other amendments to our Articles of

Incorporation that could be construed to affect the ability of

third parties to take over or change the control of the

Company.

Our Articles of Incorporation and Bylaws contain certain provisions

that may have anti-takeover effects, making it more difficult for

or preventing a third party from acquiring control of the Company

or changing its board of directors and management. According to our

Bylaws and Articles of Incorporation, the holders of the

Company’s common stock do not have cumulative voting rights

in the election of our directors. The combination of the present

ownership by a few stockholders of a significant portion of the

Company’s issued and outstanding common stock and lack of

cumulative voting makes it more difficult for other stockholders to

replace the Company’s board of directors or for a third party

to obtain control of the Company by replacing its board of

directors.

Potential Dilution Effects of Amendment

The increase in our authorized shares could result in dilution to

our current shareholders, if the Company issues additional shares

of common stock. Any dilution to our current shareholders would

result in less voting power than was held by our current

shareholders prior to any issuance of additional common

shares.

PROPOSAL NO. 4

AUTHORIZATION OF A SPECIAL LITIGATION COMMITTEE

Certain

current and former directors and officers of the Company are

parties to certain derivative litigations (referred to

collectively, along with any related derivative actions

subsequently filed, as the “Litigations”). The claims

asserted in the Litigations are assets of the Company. The Board of

Directors of the Company (the “Board”) has determined

that it is in the best interests of the Company and its

shareholders to form a Special Litigation Committee of the Board

(“Special Litigation Committee”) to investigate and

evaluate the claims and allegations asserted in the Litigations and

to make a determination as to how the Company should proceed with

respect to the Litigations and the asserted claims and

allegations.

The

Board has determined that it is advisable and in the best interests

of the Company and its shareholders that a Special Litigation

Committee shall investigate the claims and allegations in the

Litigations and evaluate whether the Company should pursue any of

the claims asserted in the Litigations, as well as prepare such

reports, arrive at such decisions, and take such other actions in

connection with the Litigations, as the Special Litigation

Committee in its discretion deems appropriate and in the best

interests of the Company and its stockholders, in accordance with

New Jersey law.

Upon

approval, the Board of Directors will appoint independent and

disinterested directors to serve on the Special Litigation

Committee, or, in the alternative, appoint a special counsel to

report to the board on his investigation.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

No

director, executive officer, principal shareholder holding at least

5% of our common shares, or any family member thereof, had any

material interest, direct or indirect, in any transaction, or

proposed transaction, during the year ended December 31, 2018, in

which the amount involved in the transaction exceeded or exceeds

the lesser of $120,000 or one percent of the average of our total

assets at the year end for the last three completed fiscal

years.

OTHER BUSINESS

Management

knows of no other matters that may be properly presented at the

Annual Meeting.

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Section

16(a) of the Exchange Act requires our officers and directors, and

persons who beneficially own more than ten percent of our common

stock, to file reports of ownership and changes of ownership of

such securities with the SEC. All reports were filed as of November

30, 2018.

STOCKHOLDER PROPOSALS FOR 2019 ANNUAL MEETING

Under

SEC rules, if a stockholder wants us to include a proposal in our

Proxy Statement and form of proxy for presentation at our 2019

Annual Meeting of stockholders, the proposal must be received by

us, attention: William Delgado, Chief Executive Officer, at our

principal executive offices by December 18, 2018. Also in

accordance with SEC guidelines, if a stockholder notifies us of

that stockholder’s intent to present a proposal at our 2019

Annual Meeting of stockholders after December 18, 2018, we may,

acting through the persons named as proxies in the proxy materials

for that meeting, exercise discretionary voting authority with

respect to the proposal without including information about the

proposal in our proxy materials. However, in either case, if the

date of the 2019 Annual Meeting is changed by more than 30 days

from the date of the 2019 Annual Meeting, then the deadline would

be a reasonable time before we begin to print and mail our proxy

materials.

DELIVERY OF VOTING MATERIALS

To

reduce the expenses of delivering duplicate voting materials to our

stockholders who may have more than one Global Digital Solutions,

Inc., stock account, we are taking advantage of

“house-holding” rules that permit us to deliver only

one Notice and Access to Internet Availability of Proxy Materials

to stockholders who share an address unless otherwise requested. If

you hold your shares through a broker, you may have consented to

reducing the number of copies of materials delivered to your

address. If you wish to revoke a consent previously provided to

your broker, you must contact the broker to do so. In any event, if

you share an address with another stockholder and have received

only one set of voting materials, you may write or call us to

request a separate copy of these materials at no cost to you. For

future Annual Meetings, you may request separate voting materials,

or request that we send only one set of voting materials to you if

you are receiving multiple copies, by either: (i) telephoning us at

(866) 752-8683; (ii) sending a letter to us at Issuer Direct, 500

Perimeter Park Drive, Suite D, Morrisville, North Carolina 27560,

Attention: Global Digital Solutions, Inc.; or (iii) sending an

e-mail to us at proxy@iproxydirect.com. If you hold your shares

through a broker, you can request a single copy of materials for

future meetings by contacting the broker.

|

|

|

By

Order of the Board of Directors,

|

|

|

|

/s/

William Delgado

|

|

December

7, 2018

|

|

William

Delgado

|

|

New

York, NY

|

|

Chief

Executive Officer

|

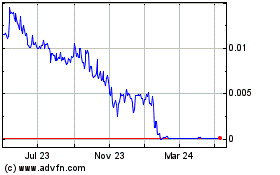

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

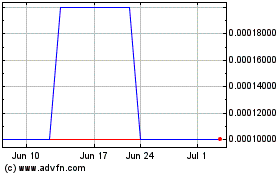

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Apr 2023 to Apr 2024