Report of Foreign Issuer (6-k)

December 14 2018 - 6:05AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or

15d-16 of the Securities Exchange Act of 1934

For the month of December 2018

Commission File Number: 1-15256

_____________________

OI S.A. – In Judicial Reorganization

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant’s name into English)

Rua Humberto de Campos, No. 425, 8th floor – Leblon

22430-190 Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F:

ý

Form 40-F:

o

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)):

Yes

:

o

No

:

ý

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)):

Yes

:

o

No

:

ý

(Indicate by check mark whether the registrant by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

:

o

No

:

ý

If “Yes” is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

Oi S.A. – In Judicial Reorganization

Corporate Taxpayers’ Registry (CNPJ/MF) No. 76.535.764/0001-43

Board of Trade (NIRE) No. 33.30029520-8

Publicly-Held Company

NOTICE TO THE MARKET

Oi S.A. – In Judicial Reorganization

, in accordance with the provisions set forth in article 12 of CVM Instruction No. 358/02, hereby informs that it has received, yesterday, a letter from

JPMorgan Chase &Co.

with the information below:

“New York, December 12, 2018

To

OI S.A. (“Company”)

Investor Relations Office

Lelio Gama Street, 104 – 38th floor

Zip Code: 20031-080

City: Rio de Janeiro/RJ

Att.:

Investor Relations Officer

Ref.:

Acquisition of a significant equity interest in the Company

Dear Sirs,

JPMorgan Chase & Co. (“JP Morgan”), in its capacity as manager of investment funds, investment vehicles and investment accounts, hereby informs, in accordance with article 12 of CVM Instruction No. 358/2002 (“ICVM 358”), the following:

1.

Certain funds, vehicles and investment accounts managed by JPMorgan purchased a total amount of 25,400,000 common shares and 4,936,295 American Depositary Receipts backed by shares issued by the Company. This participation in the Company was achieved through operations carried out until December 7, 2018.

2.

Accordingly, based on the Company’s share capital represented by 2,294,931,874 common shares, the funds’, vehicles’ and investment accounts’ equity interest in question increased from 4.32% to 5.64% of the total common shares issued by the Company.

3.

In addition, we must report, in accordance with the provisions set forth in article 12 of ICVM 358, the following positions currently held by such funds, vehicles and investment accounts:

Position purchased on physical settlement instruments

|

Type of Instrument

|

Type

|

Class

|

Total Shares

|

%

|

|

Shares

|

Common Shares

|

N/A

|

68,683,848

|

2.99%

|

|

American Depositary Receipts

|

ADRs

|

N/A

|

58,454,645

|

2.55%

|

|

Borrowed position of American Depositary Receipts

|

ADRs

|

N/A

|

2,298,500

|

0.10%

|

|

Total Purchased Position

|

|

|

129,436,993

|

5.64%

|

Position sold on physical settlement instruments

|

Type of Instrument

|

Type

|

Class

|

Total Shares

|

%

|

|

Shares (put and call options)

|

Common Shares

|

N/A

|

(15,978,580)

|

(0.69%)

|

|

American Depositary Receipts

|

Put and Call Options

|

N/A

|

(34,942,880)

|

(1.52%)

|

|

Total Sold Position

|

|

|

(50,921,460)

|

(2.21%)

|

Position purchased on physical settlement instruments

|

Type of Instrument

|

Type

|

Class

|

Total Shares

|

%

|

|

Derivative

|

Equity Swap

|

N/A

|

21,218,200

|

0.92%

|

|

Total Purchased Position

|

|

|

21,218,200

|

0.92%

|

Position sold on physical settlement instruments

|

Type of Instrument

|

Type

|

Class

|

Total Shares

|

%

|

|

Derivative

|

Equity Swap

|

N/A

|

(1,574,590)

|

(0.06%)

|

|

Total Purchased Position

|

N/A

|

N/A

|

(1,574,590)

|

(0.06%)

|

4.

The above-mentioned operations had the sole purpose of investing, or of hedging financial risks arising from entering into derivative transactions with clients, and not to change the composition of the control or the administrative structure of the Company, without prejudice to the regular exercise of possible voting rights by such investors.

Regards,

JPMorgan Chase &Co.”

Rio de Janeiro, December 13, 2018.

Oi S.A. – In Judicial Reorganization

Carlos Augusto Machado Pereira de Almeida Brandão

Chief Financial Officer and Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 13, 2018

OI S.A. – In Judicial Reorganization

By:

/s/ Carlos Augusto Machado Pereira de Almeida Brandão

Name: Carlos Augusto Machado Pereira de Almeida Brandão

Title: Chief Financial Officer and Investor Relations Officer

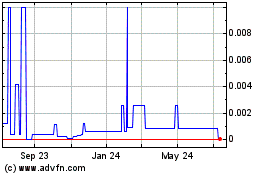

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From Apr 2024 to May 2024

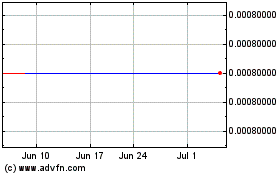

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From May 2023 to May 2024