The Buckle, Inc. (NYSE: BKE) announced today that net income for

the fiscal quarter ended November 3, 2018 was $20.5 million,

or $0.42 per share ($0.42 per share on a diluted basis).

Net sales for the 13-week fiscal quarter ended November 3,

2018 decreased 4.1 percent to $215.1 million from net sales of

$224.3 million for the prior year 13-week fiscal quarter ended

October 28, 2017. Comparable store net sales for the 13-week

period ended November 3, 2018 decreased 1.4 percent from

comparable store net sales for the prior year 13-week period ended

November 4, 2017. Online sales increased 8.8 percent to $25.5

million for the 13-week period ended November 3, 2018,

compared to net sales of $23.4 million for the 13-week period ended

October 28, 2017.

Net sales for the 39-week fiscal period ended November 3,

2018 decreased 1.8 percent to $621.1 million from net sales of

$632.2 million for the prior year 39-week fiscal period ended

October 28, 2017. Comparable store net sales for the 39-week

period ended November 3, 2018 decreased 1.1 percent from

comparable store net sales for the prior year 39-week period ended

November 4, 2017. Online sales increased 7.8 percent to $69.8

million for the 39-week period ended November 3, 2018,

compared to net sales of $64.7 million for the 39-week period ended

October 28, 2017.

Due to the 53rd week in fiscal 2017, comparable store net sales

for the quarter and year-to-date periods are compared to the

13-week and 39-week periods ended November 4, 2017.

Net income for the third quarter of fiscal 2018 was $20.5

million, or $0.42 per share ($0.42 per share on a diluted basis),

compared with $19.9 million, or $0.41 per share ($0.41 per share on

a diluted basis) for the third quarter of fiscal 2017.

Net income for the 39-week fiscal period ended November 3,

2018 was $54.5 million, or $1.13 per share ($1.12 per share on a

diluted basis), compared with $47.7 million, or $0.99 per share

($0.99 per share on a diluted basis) for the 39-week period ended

October 28, 2017.

Management will hold a conference call at 5:00 p.m. EST today to

discuss results for the quarter. To participate in the call, please

call (800) 398-9402 for domestic calls or (612) 234-9960 for

international calls and reference the conference code 456802. A

replay of the call will be available for a two-week period

beginning today at 7:00 p.m. EST by calling (800) 475-6701 for

domestic calls or (320) 365-3844 for international calls and

entering the conference code 456802.

About Buckle

Offering a unique mix of high-quality, on-trend apparel,

accessories, and footwear, Buckle caters to fashion-conscious young

men and women. Known as a denim destination, each store carries a

wide selection of fits, styles, and finishes from leading denim

brands, including the Company’s exclusive brand, BKE. Headquartered

in Kearney, Nebraska, Buckle currently operates 453 retail stores

in 43 states. As of the end of the fiscal quarter, it operated 453

stores in 43 states compared with 461 stores in 44 states at the

end of the third quarter of fiscal 2017.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995: All forward-looking statements made by the

Company involve material risks and uncertainties and are subject to

change based on factors which may be beyond the Company’s control.

Accordingly, the Company’s future performance and financial results

may differ materially from those expressed or implied in any such

forward-looking statements. Such factors include, but are not

limited to, those described in the Company’s filings with the

Securities and Exchange Commission. The Company does not undertake

to publicly update or revise any forward-looking statements even if

experience or future changes make it clear that any projected

results expressed or implied therein will not be realized.

Note: News releases and other information on

The Buckle, Inc. can be accessed at www.buckle.com on the

Internet.

THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF

INCOME (Amounts in Thousands Except Per Share Amounts)

(Unaudited)

Thirteen Weeks Ended Thirty-Nine Weeks Ended

November 3, 2018

October 28, 2017

November 3, 2018 October 28,

2017 SALES, Net of returns and allowances $ 215,107 $

224,307 $ 621,084 $ 632,208 COST OF SALES (Including buying,

distribution, and occupancy costs) 128,950 133,379

376,305 385,424 Gross profit 86,157

90,928 244,779 246,784 OPERATING

EXPENSES: Selling 50,612 50,684 144,361 144,281 General and

administrative 9,244 9,307 30,696

29,113 59,856 59,991 175,057 173,394

INCOME FROM OPERATIONS 26,301 30,937 69,722 73,390

OTHER INCOME, Net 1,332 808 3,791 2,642

INCOME BEFORE INCOME TAXES 27,633 31,745 73,513 76,032

PROVISION FOR INCOME TAXES 7,157 11,841

19,040 28,360 NET INCOME $ 20,476 $ 19,904 $ 54,473 $

47,672 EARNINGS PER SHARE: Basic $ 0.42 $ 0.41 $ 1.13

$ 0.99 Diluted $ 0.42 $ 0.41 $ 1.12 $ 0.99 Basic

weighted average shares 48,379 48,218 48,379 48,218 Diluted

weighted average shares 48,611 48,339 48,584 48,331

THE BUCKLE, INC. CONSOLIDATED BALANCE SHEETS

(Amounts in Thousands Except Share and Per Share Amounts)

(Unaudited)

ASSETS November 3, 2018

February 3, 2018 (1) October 28, 2017

CURRENT ASSETS: Cash and cash equivalents $ 177,918 $

165,086 $ 205,247 Short-term investments 45,605 50,833 52,202

Receivables 8,266 8,588 11,247 Inventory 145,473 118,007 128,821

Prepaid expenses and other assets 19,862

18,070 8,317 Total current assets

397,124 360,584 405,834

PROPERTY AND EQUIPMENT 460,523 459,043 462,798 Less accumulated

depreciation and amortization (324,044 ) (309,497 )

(306,655 ) 136,479 149,546

156,143 LONG-TERM INVESTMENTS 18,322 21,453

18,386 OTHER ASSETS 7,170 6,533

7,760 Total assets $ 559,095 $ 538,116

$ 588,123

LIABILITIES AND STOCKHOLDERS’ EQUITY

CURRENT LIABILITIES: Accounts payable $ 48,400 $ 29,387 $

41,294 Accrued employee compensation 17,996 22,307 14,899 Accrued

store operating expenses 21,851 15,646 17,044 Gift certificates

redeemable 13,907 18,202 14,853 Income taxes payable —

12,364 4,087 Total current

liabilities 102,154 97,906

92,177 DEFERRED COMPENSATION 13,804 15,154 14,581

DEFERRED RENT LIABILITY 30,287 33,808

35,452 Total liabilities 146,245

146,868 142,210 COMMITMENTS

STOCKHOLDERS’ EQUITY: Common stock, authorized 100,000,000 shares

of $.01 par value; issued and outstanding; 49,017,975 shares at

November 3, 2018, 48,816,170 shares at February 3, 2018, and

48,841,280 shares at October 28, 2017 490 488 488 Additional

paid-in capital 147,584 144,279 143,670 Retained earnings 264,776

246,570 301,834 Accumulated other comprehensive loss —

(89 ) (79 ) Total stockholders’ equity

412,850 391,248 445,913

Total liabilities and stockholders’ equity $ 559,095 $

538,116 $ 588,123 (1) Derived from audited

financial statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181126005701/en/

Thomas B. Heacock, Chief Financial OfficerThe Buckle, Inc.(308)

236-8491

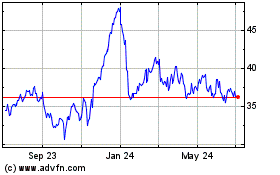

Buckle (NYSE:BKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

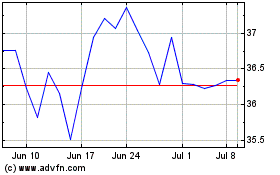

Buckle (NYSE:BKE)

Historical Stock Chart

From Apr 2023 to Apr 2024