Current Report Filing (8-k)

November 15 2018 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2018

PennyMac Mortgage Investment Trust

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Maryland

|

001-34416

|

27-0186273

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

3043 Townsgate Road, Westlake Village, California

|

91361

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(818) 224‑7442

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

Mortgage Loan Participation Purchase and Sale Agreement with Bank of America, N.A.

On November 9, 2018, PennyMac Mortgage Investment Trust (the “Company”), through its wholly-owned subsidiary, PennyMac Corp. (“PMC”), executed a Temporary Increase Letter (the “BANA Temporary Increase”) in connection with that certain Mortgage Loan Participation Purchase and Sale Agreement, dated December 23, 2011, by and among Bank of America, N.A. (“BANA”), on the one hand, and PMC, as seller, the Company and PennyMac Operating Partnership, L.P. (the “Operating Partnership”), as guarantors, on the other hand (the “BANA Participation Agreement”), pursuant to which PMC may sell to BANA up to $100 million in participation certificates, each of which represents an undivided beneficial ownership interest in a pool of mortgage loans that have been pooled with Fannie Mae or Freddie Mac and are pending securitization. In connection with its sale of any participation certificate, PMC will also assign to BANA a take-out commitment, which evidences PMC’s right to sell to a third party investor the security backed by the mortgage loans underlying the related participation certificate.

The BANA Participation Agreement is set to expire on July 1, 2019, unless terminated earlier in accordance with its terms. The obligations of PMC under the BANA Participation Agreement are fully guaranteed by the Company and the Operating Partnership, and the mortgage loans are serviced by PennyMac Loan Services, LLC, a controlled subsidiary of PennyMac Financial Services, Inc. (NYSE: PFSI), pursuant to the terms of the BANA Participation Agreement.

Pursuant to the terms of the BANA Temporary Increase, the aggregate transaction limit of purchase prices for participation certificates owned by BANA provided for thereunder was temporarily increased to $400 million. The period for the BANA Temporary Increase commenced on November 9, 2018 and will expire on January 10, 2019. Upon the expiration of the BANA Temporary Increase, the aggregate transaction limit of purchase prices will revert back to $100 million. All other terms and conditions of the BANA Participation Agreement remain the same in all material respects. The Company, through PMC, is required to pay BANA certain administrative costs and expenses in connection with the structuring of the BANA Temporary Increase.

The foregoing descriptions of the BANA Participation Agreement and the related guaranty by the Company and the Operating Partnership do not purport to be complete and are qualified in their entirety by reference to (i) the descriptions of the BANA Participation Agreement and the related guaranty in the Company’s Current Report on Form 8-K as filed on February 6, 2014; (ii) the full text of the BANA Participation Agreement and the related guaranty attached thereto as Exhibits 10.2 and 10.10, respectively; and (iii) the full text of any amendments to the BANA Participation Agreement filed therewith and thereafter with the SEC.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

PENNYMAC MORTGAGE INVESTMENT TRUST

|

|

|

|

|

|

|

|

|

|

|

Dated: November 15, 2018

|

/s/ Andrew S. Chang

|

|

|

Andrew S. Chang

Senior Managing Director and Chief Financial Officer

|

|

|

|

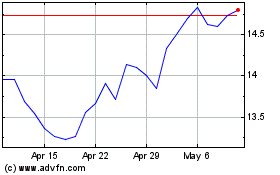

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

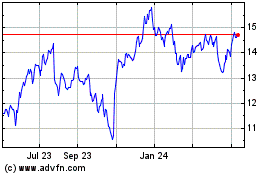

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Apr 2023 to Apr 2024