|

PROSPECTUS SUPPLEMENT

|

Filed pursuant to Rule 424(b)(5)

|

|

(To Prospectus dated June 16, 2017)

|

Registration Statement No. 333-218517

|

Ekso

Bionics Holdings, Inc.

Up to $25,000,000

Common Stock

Ekso Bionics Holdings, Inc. (“Ekso Bionics”) has

entered into a Controlled Equity Offering

SM

sales agreement with Cantor Fitzgerald & Co. (“Cantor Fitzgerald”)

relating to the sale of the shares of our common stock, par value $0.001 (the “sales agreement”), offered by this prospectus

supplement. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate

offering price of up to $25,000,000 under this prospectus supplement from time to time through Cantor Fitzgerald, acting as agent.

Sales of our common stock, if any, under this prospectus supplement

may be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities

Act of 1933, as amended (the “Securities Act”). Cantor Fitzgerald will act as sales agent on a best efforts basis and

use commercially reasonable efforts consistent with its normal trading and sales practices to sell on our behalf all of the shares

of common stock requested to be sold by us, on mutually agreed terms between Cantor Fitzgerald and us. There is no arrangement

for funds to be received in any escrow, trust or similar arrangement.

Cantor Fitzgerald will be entitled to compensation at a fixed

commission rate of 3.0% of the gross sales price per share sold. In connection with the sale of our common stock on our behalf,

Cantor Fitzgerald will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation

of Cantor Fitzgerald will be deemed to be underwriting commissions or discounts.

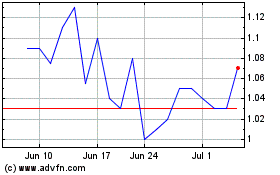

Our common stock trades on Nasdaq Capital Market (“Nasdaq”) under the symbol “EKSO.”

On August 17, 2018, the last reported sale price of the common stock on Nasdaq was $2.72 per share.

Investing in our securities involves

a high degree of risk. You should carefully read and consider the risk factors described in this prospectus supplement, the accompanying

base prospectus and in the documents incorporated by reference into this prospectus supplement and the base prospectus. See “Risk

Factors” beginning on page S-4.

Neither the Securities and Exchange Commission nor

any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is

truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement

is August 21, 2018

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying base prospectus

are part of a registration statement that we have filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf”

registration process. Under this prospectus supplement, we may offer shares of our common stock having an aggregate offering price

of up to $25,000,000 from time to time at prices and on terms to be determined by market conditions at the time of offering.

We provide information to you about this offering of shares

of our common stock in two separate documents that are bound together: (1) this prospectus supplement, which describes the specific

details regarding this offering; and (2) the accompanying base prospectus, which provides general information, some of which may

not apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined.

If information in this prospectus supplement is inconsistent with the accompanying base prospectus, you should rely on this prospectus

supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later

date—for example, a document incorporated by reference in this prospectus—the statement in the document having the

later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects

may have changed since the earlier dates.

We further note that the representations, warranties and covenants

made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were

made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among

the parties to such agreement, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations and warranties should not

be relied on as accurately representing the current state of our affairs or obligations.

You should rely only on the information contained in, or incorporated

by reference into, this prospectus and in any free writing prospectus that we may authorize for use in connection with this offering.

We have not, and Cantor Fitzgerald has not, authorized any other person to provide you with different information. If anyone provides

you with different or inconsistent information, you should not rely on it. We are not, and Cantor Fitzgerald is not, making an

offer to sell or soliciting an offer to buy our securities in any jurisdiction in which an offer or solicitation is not authorized

or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make

an offer or solicitation. You should assume that the information appearing in this prospectus, the documents incorporated by reference

into this prospectus, and in any free writing prospectus that we may authorize for use in connection with this offering, is accurate

only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have

changed since those dates.

You should read this prospectus, the documents incorporated by reference into this prospectus, and

any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an

investment decision. You should also read and consider the information in the documents to which we have referred you in the sections

of this prospectus entitled “Where You Can Find More Information” and “Incorporation of Certain Documents By

Reference.”

We are offering to sell, and seeking offers to buy, shares of

common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of

the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and

the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection

with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction

in which it is unlawful for such person to make such an offer or solicitation.

For purposes of this prospectus, references to the terms “Ekso

Bionics,” “the Company,” “we,” “us” and “our” refer to Ekso Bionics Holdings,

Inc., unless the context otherwise requires.

This prospectus and the information incorporated by reference

herein and therein include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks

and trade names included or incorporated by reference into this prospectus are the property of their respective owners.

PROSPECTUS SUMMARY

The following summary highlights certain information contained

elsewhere in this prospectus supplement, the accompanying base prospectus, any free writing prospectus that we have been authorized

to use and the documents incorporated by reference herein and in the accompanying base prospectus. This summary does not contain

all the information you will need in making your investment decision. You should carefully read this entire prospectus supplement

the accompanying base prospectus, any free writing prospectus that we have been authorized to use and the documents incorporated

by reference herein and in the accompanying base prospectus. You should pay special attention to the “Risk Factors”

section of this prospectus and the financial statements and other information incorporated by reference in this prospectus.

Company Overview

Ekso Bionics designs, develops and sells

exoskeletons that augment human strength, endurance, and mobility. Our exoskeleton technology serves multiple markets and can be

used both by able-bodied users as well as by persons with physical disabilities. We have sold, rented or leased devices that (a)

enable individuals with neurological conditions affecting gait (stroke and spinal cord injury) to rehabilitate and to walk again

and (b) allow industrial workers to perform heavy duty work for extended periods.

We believe the commercial opportunity for

exoskeleton technology adoption is accelerating as a result of recent advancements in material technologies, electronic and electrical

engineering, control technologies, and sensor and software development. Taken individually, many of these advancements have become

ubiquitous in peoples’ everyday lives. We believe we have learned how to integrate these existing technologies and wrap the

result around a human being efficiently, elegantly and safely, supported by an industry leading intellectual property portfolio.

We further believe we can do so across a broad spectrum of applications, from persons with lower limb paralysis to able-bodied

users.

Additional details of these programs and related strategic agreements

are contained in our annual report on Form 10-K for the year ended December 31, 2017.

Company Information

Our corporate headquarters are located in Richmond, California

94804. Our telephone number is (510) 984-1761, and our website address is www.eksobionics.com. Our official Twitter account is

@EksoBionics. The information on or accessible through our website or our Twitter account does not constitute part of this prospectus

supplement or the accompanying prospectus and should not be relied upon in connection with making any investment in our securities.

The common stock of Ekso Bionics is listed on the Nasdaq Capital

Market (“Nasdaq”) under the symbol “EKSO.”

THE OFFERING

|

|

|

|

|

Common stock to be offered by us

|

|

Shares of our common stock having an aggregate offering price of up to $25,000,000

|

|

|

|

|

Common shares to be outstanding after this offering

|

|

Up to 70,023,522 shares of common stock, assuming sales of 9,191,176 shares of our common stock

in this offering at an assumed offering price of $2.72 per share, which was the last reported sale price of our common stock

on Nasdaq on August 17, 2018. The actual number of shares issued will vary depending on the sales prices under this

offering.

|

|

|

|

|

Plan of Distribution

|

|

An “at the market offering” of shares of common stock that may be made from time to time

through our sales agent, Cantor Fitzgerald. See “Plan of Distribution” on page S-26.

|

|

|

|

|

Use of Proceeds

|

|

We intend to use the net proceeds primarily for general corporate purposes, which may include acquisitions,

research and development activities, capital expenditures, selling, general and administrative costs, facilities expansion and

to meet working capital needs. See “Use of Proceeds” on page S-24.

|

|

|

|

|

Risk Factors

|

|

Before investing in our common stock, you should carefully read and consider the “Risk Factors”

beginning on page S-4 of this prospectus, and any documents incorporated by reference, for certain considerations relevant to an

investment in our common stock.

|

|

|

|

|

Nasdaq Capital Market symbol

|

|

“EKSO.”

|

The number of shares of common stock to be outstanding after this offering is based on 60,832,346 shares

of common stock outstanding as of June 30, 2018 and a total offering of an aggregate of

9,191,176

shares of our common stock at a public offering price of $2.72 per share, which was the last reported sale price of our common

stock on Nasdaq on August 17, 2018, and excludes as of June 30, 2018:

|

|

·

|

2,916,453 shares of common stock issuable upon the exercise of stock

options outstanding at a weighted average exercise price of $4.60 per share, 78,514 restricted stock units which will, after vesting,

be settled in shares of our common stock, and 5,093,211 shares of our common stock reserved for issuance under our Amended and

Restated 2014 Equity Incentive Plan (“2014 Incentive Plan”);

|

|

|

·

|

500,000 shares of our common stock reserved for issuance under our

Employee Stock Purchase Plan (“ESPP”); and

|

|

|

·

|

3,395,532 shares of common stock issuable upon the exercise of warrants

outstanding at a weighed exercise price of $7.43 per share.

|

RISK FACTORS

Investing in our securities involves a high degree of risk.

You should carefully consider the specific risks described below, as well as the other information contained in this prospectus

and the other documents incorporated by reference, before making an investment decision. See the sections of this prospectus entitled

“Where You Can Find More Information” and “Incorporation of Certain Information By Reference.” Any of the

risks we describe below or in the information incorporated herein by reference in this prospectus could cause our business, financial

condition or operating results to suffer. The market price of our common stock could decline if one or more of these risks and

uncertainties develop into actual events. You could lose all or part of your investment.

Risks Related to our Business and the

Industry in Which We Operate

We have a limited operating history

upon which investors can evaluate our future prospects.

Although we were incorporated in 2005,

we did not sell our first Ekso medical device until 2012 and did not sell our first industrial unit until 2016. Therefore, we have

limited operating history upon which an evaluation of our business plan or performance and prospects can be made. Our business

and prospects must be considered in light of the potential problems, delays, uncertainties and complications encountered in connection

with a newly established business and creating a new industry. The risks include, but are not limited to, the possibility that

we will not be able to develop functional and scalable products and services, or that although functional and scalable, our products

and services will not be economical to market; that our competitors hold proprietary rights that preclude us from marketing such

products; that our competitors market a superior or equivalent product; that we are not able to upgrade and enhance our technologies

and products to accommodate new features and expanded service offerings; or that we fail to receive necessary regulatory clearances

for our products. To successfully introduce and market our products at a profit, we must establish brand name recognition and competitive

advantages for our products. There are no assurances that we can successfully address these challenges. If we are unsuccessful,

we and our business, financial condition and operating results could be materially and adversely affected.

Given the limited operating history, management

has little basis on which to forecast future demand for our products from our existing customer base, much less new customers.

Our current and future expense levels are based largely on estimates of planned operations and future revenues rather than experience.

It is difficult to accurately forecast future revenues because our business is new and our market has not been developed. If our

forecasts prove incorrect, our business, operating results and financial condition will be materially and adversely affected. Moreover,

we may be unable to adjust our spending in a timely manner to compensate for any unanticipated reduction in revenue. As a result,

any significant reduction in revenues would immediately and adversely affect our business, financial condition and operating results.

The industries in which we operate

are highly competitive and subject to rapid technological change. If our competitors are better able to develop and market products

that are safer, more effective, less costly, easier to use, or are otherwise more attractive, we may be unable to compete effectively

with other companies.

The medical technology and industrial robotics

industries are characterized by intense competition and rapid technological change, and we will face competition on the basis of

product features, clinical outcomes, price, services and other factors. Competitors may include large medical device and other

companies, some of which have significantly greater financial and marketing resources than we do, and firms that are more specialized

than we are with respect to particular markets. Our competition may respond more quickly to new or emerging technologies, undertake

more extensive marketing campaigns, have greater financial, marketing and other resources than we do or may be more successful

in attracting potential customers, employees and strategic partners.

Our competitive position will depend on

multiple, complex factors, including our ability to achieve market acceptance for our products, develop new products, implement

production and marketing plans, secure regulatory approvals for products under development and protect our intellectual property.

Competitors may offer, or may attempt to develop, more efficacious, safer, cheaper, or more convenient alternatives to our products,

including alternatives that could make the need for robotic exoskeletons obsolete. The development of new or improved products,

processes or technologies by other companies may render our products or proposed products obsolete or less competitive. The entry

into the market of manufacturers located in low-cost manufacturing locations may also create pricing pressure, particularly in

developing markets. Our future success depends, among other things, upon our ability to compete effectively against current technology,

as well as to respond effectively to technological advances, and upon our ability to successfully implement our marketing strategies

and execute our research and development plan.

Our products or exoskeletons generally

may not be accepted in the market.

We cannot be certain that our current products

or any other products we may develop or market will achieve or maintain market acceptance. Market acceptance of our products depends

on many factors, including our ability to convince key opinion leaders to provide recommendations regarding our products, convince

distributors and customers that our technology is an attractive alternative to other technologies, convince health insurers and

other third party payers to cover and provide adequate payments for any products that are used for medical or therapeutic purposes,

demonstrate that our products are reliable and supported by us in the field, supply and service sufficient quantities of products

directly or through marketing alliances, and price products competitively in light of the current macroeconomic environment, which,

particularly in the case of the medical device industry, is becoming increasingly price sensitive.

In addition, the market for medical and

industrial exoskeletons is new and unproven. We cannot be certain that the market for robotic exoskeletons will continue to develop,

or that robotic exoskeletons for medical or industrial use will achieve market acceptance. If the exoskeleton market fails to develop,

or develops more slowly than we anticipate, we and our business, financial condition and operating results could be materially

and adversely affected.

Protecting our patent and other proprietary

rights can be costly, and we may not be able to attain, defend or maintain such rights, which could harm our business.

Our long-term success largely depends on

our ability to market technologically competitive products. Failure to protect or to obtain, maintain or extend adequate patent

and other intellectual property rights could materially adversely impact our competitive advantage and impair our business. Our

issued patents may not be sufficient to protect our intellectual property and our patent applications may not result in issued

patents. Even if our patent applications issue as patents, they may not issue in a form that will provide us with any meaningful

protection, prevent competitors from competing with us or otherwise provide us with any competitive advantage. Our competitors

may be able to circumvent our patents by developing similar or alternative technologies or products in a non-infringing manner

or may challenge the validity of our patents. Our attempts to prevent third parties from circumventing our intellectual property

and other rights ultimately may be unsuccessful. We may also fail to take the required actions or pay the necessary fees to maintain

any of our patents that issue.

Furthermore, we have not filed applications

for all of our patents internationally and may not be able to prevent third parties from using our proprietary technologies or

may lose access to technologies critical to our products in other countries. These include, in some cases, countries in which we

are currently selling products and countries in which we intend to sell products in the future.

Intellectual property litigation

and infringement claims could cause us to incur significant expenses or prevent us from selling certain of our products.

The industries in which we operate, including,

in particular, the medical device industry, are characterized by extensive intellectual property litigation and, from time to time,

we might be the subject of claims by third parties of potential infringement or misappropriation. Regardless of outcome, such claims

are expensive to defend and divert the time and effort of our management and operating personnel from other business issues. A

successful claim or claims of patent or other intellectual property infringement against us could result in our payment of significant

monetary damages and/or royalty payments or negatively impact our ability to sell current or future products in the affected category

and could have a material adverse effect on our business, cash flows, financial condition or results of operations.

Because competition in our industry is

intense, competitors may infringe or otherwise violate our issued patents, patents of our licensors or other intellectual property.

To counter infringement or unauthorized use, we may be required to file infringement claims, which can be expensive and time-consuming.

Any claims we assert against perceived infringers could provoke these parties to assert counterclaims against us alleging that

we infringe their patents. In addition, in a patent infringement proceeding, a court may decide that a patent of ours is invalid

or unenforceable, in whole or in part, construe the patent’s claims narrowly, or refuse to stop the other party from using

the technology at issue on the grounds that our patents do not cover the technology in question. An adverse result in any litigation

proceeding could put one or more of our patents at risk of being invalidated or interpreted narrowly. We may also elect to enter

into license agreements in order to settle patent infringement claims or to resolve disputes prior to litigation, and any such

license agreements may require us to pay royalties and other fees that could be significant. Furthermore, because of the substantial

amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential

information could be compromised by disclosure.

Some of the patents and patent applications

in the intellectual property portfolio are not within our complete control, which could reduce the value of such patents.

Some of our U.S. patents (which have associated

international patents and applications) are co-owned by the Regents of the University of California Berkeley (“UC Berkeley”).

UC Berkeley has licensed its rights under many of these patents to us, but we do not have a license to UC Berkeley’s rights

under three of these patents.

UC Berkeley has licensed their U.S. rights

in two of these three co-owned patents to an unrelated third party.

The third patent is a continuation-in-part

of a patent that UC Berkeley did license to us. Under the terms of the relevant license agreement between us and UC Berkeley, we

have exclusive rights to any claims that are fully supported by the specification in the parent application. But, any claims that

are not based on the specification in the parent application are co-owned by UC Berkeley and us, and UC Berkeley’s rights

in respect of such claims are not exclusively licensed to us. There is no assurance that we will be able to obtain a license to

UC Berkeley’s rights in any such claims on commercially reasonable terms or at all, and UC Berkeley may choose to license

its rights to third parties instead of us.

In addition, in connection with our acquisition

of certain assets from Equipois, we assumed the rights and obligations of Equipois with respect to certain patents and patent applications

under an in-license of intellectual property from a third party and subject to an out-license of that intellectual property to

an unrelated third party for use in a particular field. We do not have complete control over the prosecution of these patent applications.

As well, the license of intellectual property rights under these patents to third parties could reduce the value of our patent

portfolio and limit any income or license fees that we might receive if we were to attempt to transfer or license our rights under

any of our co-owned or licensed patents.

If we fail to comply with our obligations

in the agreements under which we license intellectual property rights from third parties or otherwise experience disruptions to

our business relationships with our licensors, we could lose intellectual property rights that are important to our business.

We

are a party to two exclusive license agreements and one amendment with UC Berkeley, covering ten patents exclusively licensed to

us. In addition, in connection with our acquisition of certain assets from Equipois, we assumed the rights and obligations of Equipois

with respect to certain patents and patent applications under an in-license of intellectual property from a third party and subject

to an out-license of that intellectual property to an unrelated third party for use in a particular field.. We may also need to

obtain additional licenses from others to advance our research and development activities or allow the commercialization of our

devices or any other devices we may identify and pursue. Our license agreements with UC Berkeley and the rights and obligations

that we assumed in connection with the Equipois acquisition impose various development, diligence, commercialization, and other

obligations on us, and we any future license agreements may impose similar or other obligations on us. For example, under our license

agreements with UC Berkeley we are required to submit a commercialization plan with performance milestones and progress report

to UC Berkeley, and must satisfy specified minimum annual royalty payment obligations. In spite of our efforts, our licensors might

conclude that we have materially breached our obligations under such license agreements and might therefore terminate the license

agreements, thereby removing or limiting our ability to develop and commercialize products and technology covered by these license

agreements. If our license agreements with UC Berkeley is terminated, or if our agreements granting us intellectual property rights

in connection with the Equipois acquisition or any future agreements granting us material intellectual property rights are terminated

or impeded in a material way, competitors or other third parties would have the freedom to seek regulatory approval of, and to

market, products that may be identical or functionally similar to our devices and we may be required to cease our development and

commercialization of such devices. Any of the foregoing could have a material adverse effect on our competitive position, business,

financial conditions, results of operations and prospects.

Moreover,

disputes may arise between us and our counterparties regarding intellectual property subject to a licensing agreement, including:

|

|

·

|

the

scope of rights granted under the license agreement and other interpretation-related issues;

|

|

|

·

|

the

extent to which our devices, technology and processes infringe on intellectual property of the licensor that is not subject to

the licensing agreement;

|

|

|

·

|

the

sublicensing of patent and other rights under our collaborative research and development relationships;

|

|

|

·

|

our

diligence obligations under the license agreement and what activities satisfy those diligence obligations;

|

|

|

·

|

the

ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our licensors and us

and our partners; and

|

|

|

·

|

the

priority of invention of patented or patentable technology.

|

In

addition, certain provisions in our license agreement with UC Berkeley may be susceptible to multiple interpretations. The resolution

of any contract interpretation disagreement that may arise could narrow what we believe to be the scope of our rights to the relevant

intellectual property or technology, or increase what we believe to be our financial or other obligations under the agreement,

either of which could have a material adverse effect on our business, financial condition, results of operations and prospects.

Moreover, if disputes over intellectual property that we have licensed prevent or impair our ability to maintain our current licensing

arrangements on commercially acceptable terms, we may be unable to successfully develop and commercialize the affected devices,

which could have a material adverse effect on our business, financial conditions, results of operations and prospects.

Patent terms may be inadequate to

protect our competitive position on our devices for an adequate amount of time.

Patents have a

limited lifespan. In the United States, if all maintenance fees are timely paid, the natural expiration of a patent is generally

20 years from its earliest U.S. non-provisional filing date. Various extensions may be available, but the life of a patent, and

the protection it affords, is limited. Even if patents covering our devices are obtained, once the patent life has expired, we

may be open to competition from competitive products. Given the amount of time required for the development, testing and regulatory

review of new devices, patents protecting such devices might expire before or shortly after such devices are commercialized. As

a result, our owned and licensed patent portfolio may not provide us with sufficient rights to exclude others from commercializing

products similar or identical to ours.

If we fail to obtain or maintain

necessary regulatory clearances or approvals for our medical device products, or if clearances or approvals for future products

or modifications to existing products are delayed or not issued, our commercial operations would be harmed.

Our EksoGT product is a medical device

that is subject to extensive regulation by the Food and Drug Administration (“FDA”), the European Union and other governmental

authorities both inside and outside of the United States. These agencies enforce laws and regulations that govern the development,

testing, manufacturing, labeling, advertising, marketing and distribution, and market surveillance of our medical products. Our

failure to comply with these complex laws and regulations could have a material adverse effect on our business, results of operations,

financial condition and cash flows.

In the United States, before we can market

a new medical device, or a new use of, new claim for or significant modification to an existing product, we must first receive

either clearance under Section 510(k) of the FDCA or approval of a premarket approval (“PMA”) application from the

FDA, unless an exemption applies. Both the PMA and the 510(k) clearance process can be expensive, lengthy and uncertain. The FDA’s

510(k) clearance process may take anywhere from several months to over a year. The process of obtaining a PMA is much more costly

and uncertain than the 510(k) clearance process and generally takes from one to three years, or even longer, from the time the

application is filed with the FDA. In addition, PMA generally requires the performance of one or more clinical trials.

The FDA also has substantial discretion

in the medical device review process. Despite the time, effort and cost, we cannot assure you that any particular device will

be approved or cleared by the FDA. Any delay or failure to obtain necessary regulatory approvals could harm our business. Failure

can occur at any stage, and we could encounter problems that cause us to repeat or perform additional development, standardized

testing, pre-clinical studies and clinical trials. Any delay or failure to obtain necessary regulatory approvals could harm our

business.

The FDA or other non-U.S. regulatory authorities

can delay, limit or deny clearance or approval of a medical device candidate for many reasons, including:

|

|

·

|

a medical device candidate may not be deemed to be substantially equivalent to a device lawfully marketed either as a grandfathered device or one that was cleared through the 510(k) premarket notification process;

|

|

|

·

|

a medical device candidate may not be deemed to be in conformance with applicable standards and regulations;

|

|

|

·

|

FDA or other regulatory officials may not find the data from pre-clinical studies and clinical trials or other product testing date to be sufficient;

|

|

|

·

|

other non-U.S. regulatory authorities may not approve our processes or facilities or those of any of our third-party manufacturers, thereby restricting export; or

|

|

|

·

|

the FDA or other non-U.S. regulatory authorities may change clearance or approval policies or adopt new regulations.

|

Even after regulatory clearance or approval

has been granted, a cleared or approved product and its manufacturer are subject to extensive regulatory requirements relating

to manufacturing, labeling, packaging, adverse event reporting, storage, advertising and promotion for the product. If we fail

to comply with the regulatory requirements of the FDA or other non-U.S. regulatory authorities, or if previously unknown problems

with our products or manufacturing processes are discovered, we could be subject to administrative or judicially imposed sanctions,

including:

|

|

·

|

restrictions on the products, manufacturers or manufacturing process;

|

|

|

·

|

adverse inspectional observations (Form 483), warning letters, non-warning letters incorporating inspectional observations;

|

|

|

·

|

civil or criminal penalties or fines;

|

|

|

·

|

injunctions;

|

|

|

·

|

product seizures, detentions or import bans;

|

|

|

·

|

voluntary or mandatory product recalls and publicity requirements;

|

|

|

·

|

suspension or withdrawal of regulatory clearances or approvals;

|

|

|

·

|

total or partial suspension of production;

|

|

|

·

|

imposition of restrictions on operations, including costly new manufacturing requirements;

|

|

|

·

|

refusal to clear or approve pending applications or premarket notifications; and

|

|

|

·

|

import and export restrictions.

|

If imposed on us, any of these sanctions

could have a material adverse effect on our reputation, business, results of operations and financial condition.

Modifications to our EksoGT and our

future products may require new 510(k) clearances or premarket approvals, or may require us to cease marketing or recall the modified

products until clearances are obtained

On April 4, 2016, we received clearance

from the FDA to market our EksoGT robotic exoskeleton for use in the treatment of individuals with hemiplegia due to stroke, individuals

with spinal cord injuries at levels T4 to L5, and individuals with spinal cord injuries at levels of T3 to C7 (ASIA D), in accordance

with the device’s labeling. On July 19, 2016, we received clearance from the FDA to expand/clarify the indications and labeling

to expressly include individuals with hemiplegia due to stroke who have upper extremity function of at least 4/5 in only one arm.

Our prior cleared indications for use statement required that individuals with hemiplegia due to stroke have upper extremity function

of at least 4/5 in both arms.

An element of our strategy is to continue

to upgrade the EksoGT to incorporate new software and hardware enhancements. Any modification to a 510(k)-cleared device, including

our EksoGT, that could significantly affect its safety or effectiveness, or that would constitute a major change in its intended

use, design, or manufacture, requires a new 510(k) clearance or, possibly, a PMA. The FDA requires every manufacturer to make this

determination in the first instance based on the final guidance document issued by the FDA in October 2017 addressing when to submit

a new 510(k) application due to modifications to 510(k)-cleared devices and a separate guidance document on when to submit a new

510(k) application due to software changes to 510(k)-cleared devices. Although largely aligned with the FDA’s longstanding

guidance document issued in 1997, the 2017 guidance includes targeted changes intended to provide additional clarity on when a

new 510(k) application is needed. The FDA may review our determinations regarding whether new clearances or approvals are necessary,

and may not agree with our decisions. If the FDA disagrees with our determinations for any future changes, or prior changes to

previously marketed products, as the case may be, we may be required to cease marketing or to recall the modified products until

we obtain clearance or approval, and we may be subject to significant regulatory fines or penalties.

The manufacture of our products is

subject to extensive post-market regulation by the FDA. Our failure to meet strict regulatory requirements could require us to

pay fines, incur other costs or even close our facilities.

We are required to comply with the FDA’s

Quality System Regulation (“QSR”) which is a complex regulatory scheme that covers the procedures and documentation

of the design, testing, production, process controls, quality assurance, labeling, packaging, handling, storage, distribution,

installation, servicing and shipping of our marketed products. These regulatory requirements may significantly increase our production

costs and may even prevent us from making our products in amounts sufficient to meet market demand. If we change our approved manufacturing

process, the FDA may need to review the process before it may be used. The FDA enforces the QSR through periodic announced and

unannounced inspections of manufacturing facilities. Failure to comply with regulatory requirements such as QSR may result in changes

to labeling, restrictions on such products or manufacturing processes, withdrawal of the products from the market, voluntary or

mandatory recalls, a requirement to repair, replace or refund the cost of any medical device we manufacture or distribute, fines,

suspension of regulatory approvals, product seizures, injunctions or the imposition of civil or criminal penalties which would

adversely affect our business, operating results and prospects.

Federal, state and non-U.S. regulations

regarding the manufacture and sale of medical devices are subject to future changes. The complexity, timeframes and costs associated

with obtaining marketing clearances are unknown. Although we cannot predict the impact, if any, these changes might have on our

business, the impact could be material.

We may be subject to fines, penalties

or injunctions if we are determined to be promoting the use of our products for unapproved or “off-label” uses.

Any cleared or approved product may be

promoted only for its indicated uses and our promotional materials must comply with FDA and other applicable laws and regulations.

We believe that the specific use for which our products are marketed fall within the scope of the indications for use that have

been cleared by the FDA. However, if the FDA determines that our promotional materials or training constitutes promotion of an

unapproved use, it could request that we modify our promotional materials or subject us to regulatory or enforcement actions, including

the issuance of an untitled letter, a warning letter, injunction, seizure, civil fine and criminal penalties. It is also possible

that other federal, state or foreign enforcement authorities might take action if they consider our promotional or training materials

to constitute promotion of an unapproved use, which could result in significant fines or penalties under other statutory authorities,

such as laws prohibiting false claims for reimbursement. In that event, our reputation could be damaged and adoption of the products

would be impaired.

Failure to comply with anti-kickback

and fraud regulations could result in substantial penalties and changes in our business operations.

Although we do not provide healthcare services,

submit claims for third-party reimbursement, or receive payments directly from Medicare, Medicaid or other third-party payers for

our products, we are subject to healthcare fraud and abuse regulation and enforcement by federal, state and foreign governments,

which could significantly impact our business. These laws may constrain the business and financial arrangements and relationships

through which we conduct our operations, including how we research, market, sell and distribute any product for which we have obtained

regulatory approval, or for which we obtain regulatory approval in the future. The principal U.S. federal laws implicated include,

but are not limited to, those that prohibit, among other things, (i) filing, or causing to be filed, false or improper claims for

federal payment, known as the false claims laws, (ii) payment, solicitation or receipt of unlawful inducements, directly or indirectly,

for the referral of business reimbursable under federally-funded health care programs, known as the anti-kickback laws, and (iii)

health care service providers from seeking reimbursement for providing certain services to a patient who was referred by a physician

who has certain types of direct or indirect financial relationships with the service provider, known as the Stark law. Many states

have similar laws that apply to reimbursement by state Medicaid and other government funded programs as well as in some cases to

all payers. In addition, we may be subject to federal and state data privacy laws that govern the privacy and security of health

information in specified circumstances, many of which differ from each other in significant ways and may not have the same effect,

thus complicating compliance efforts.

Efforts to ensure that our business arrangements will comply with applicable healthcare laws and regulations

will involve substantial costs. We are subject to the risk that a person or government could allege we have engaged in fraud or

other misconduct, even if none occurred. It is possible that governmental and enforcement authorities will conclude that our business

practices do not comply with current or future statutes, regulations or case law interpreting applicable fraud and abuse or other

healthcare laws and regulations. If our operations are found to be in violation of any of the laws described above or any other

governmental regulations that apply to us now or in the future, we may be subject to penalties, including civil and criminal penalties,

damages, fines, disgorgement, exclusion from governmental health care programs, additional integrity oversight and reporting obligations,

contractual damages, reputational harm and the curtailment or restructuring of our operations, any of which could adversely affect

our ability to operate our business and our financial results.

Changes in law or regulation could

make it more difficult and costly for us to manufacture, market and distribute our products or obtain or maintain regulatory approval

of new or modified products.

From time to time, legislation is drafted and introduced in Congress that could significantly change the

statutory provisions governing the regulatory approval, manufacture and marketing of regulated devices. In addition, FDA regulations

and guidance are often revised or reinterpreted by the FDA in ways that may significantly affect our business and our products.

Any new regulations or revisions or reinterpretations of existing regulations may impose additional costs or lengthen review times

of future products. In addition, FDA regulations and guidance are often revised or reinterpreted by the agency in ways that may

significantly affect our business and our products. Elections could result in significant changes in, and uncertainty with respect

to, legislation, regulation and government policy that could significantly impact our business and the health care industry. It

is impossible to predict whether legislative changes will be enacted or FDA regulations, guidance or interpretations changed, and

what the impact of such changes, if any, may be.

Any change in the laws or regulations that

govern the clearance and approval processes relating to our current and future products could make it more difficult and costly

to obtain clearance or approval for new products, or to produce, market, and distribute existing products. Significant delays in

receiving clearance or approval, or the failure to receive clearance or approval, for any new products would have an adverse effect

on our ability to expand our business.

Healthcare changes in the U.S. and

other countries, including recently enacted legislation reforming the U.S. healthcare system, could have a negative impact on our

future operating results.

In the United States and some foreign

jurisdictions, there have been a number of legislative and regulatory proposals to change the health care system in ways that

could affect our ability to sell our products profitably. For example, in 2010, the Patient Protection and Affordable Care Act

(“ACA”) was enacted into law. The legislation seeks to reform the United States healthcare system. It is far-reaching

and is intended to expand access to health insurance coverage, improve quality and reduce costs over time. We expect the law will

have a significant impact upon various aspects of our business operations. The ACA reduces Medicare and Medicaid payments to hospitals,

clinical laboratories and pharmaceutical companies, and could otherwise reduce the volume of medical procedures. These factors,

in turn, could result in reduced demand for our products and increased downward pricing pressure. It is also possible that the

ACA will result in lower reimbursements. While the ACA is intended to expand health insurance coverage to uninsured persons in

the United States, the impact of any overall increase in access to healthcare on sales of our products remains uncertain. The

new U.S. Presidential administration and the majority party in both Houses of the U.S. Congress have indicated their desire to

repeal the Affordable Care Act. It is unclear whether, when and how that repeal will be effectuated and what the effect on the

healthcare sector will be. However, in December 2017, the Tax Cuts and Jobs Act was enacted and signed into law, one part of which

repeals the “individual mandate” introduced by the ACA starting in 2019. The repeal of the “individual mandate”

may have an adverse effect on ACA insurance markets and lead to further legislative changes. In addition, the new law imposes

a 2.3 percent excise tax on medical devices that will apply to United States sales of our medical device product. Although a moratorium

was placed on the medical device excise tax in 2016, 2017 and 2018, absent further legislative action, the medical device excise

tax will apply to sales of our medical device product beginning on January 1, 2020. There have been other changes to the ACA since

the enactment of the Tax Cuts and Jobs Act, and Congress could still consider additional legislation to repeal or replace all

or certain elements of the ACA. In addition, other reform legislation has been passed subsequent to the enactment of the ACA,

including measures that reduced reimbursement for certain providers and entities under federal health care programs. The outlook

for the healthcare sector is unclear, and we are unable to predict the future course of federal or state healthcare legislation

and regulations. Changes in the law or regulatory framework that reduce our revenues or increase our costs could also harm our

business, financial condition and results of operations and cash flows.

If our medical products, or malfunction

of our medical products, cause or contribute to a death or a serious injury, we will be subject to medical device reporting regulations,

which can result in voluntary corrective actions or agency enforcement actions.

Under the FDA’s medical device reporting

(“MDR”) regulations, we are required to report to the FDA any incident in which our product may have caused or contributed

to a death or serious injury or in which our product malfunctioned and, if the malfunction were to recur, would likely cause or

contribute to death or serious injury. For example, we have been informed of a limited number of events with respect to our EksoGT

devices that have been determined to be reportable pursuant to the MDR regulations. In each case, the required MDR report was

filed with the FDA.

In addition, all manufacturers bringing

medical devices to market in the European Economic Area are legally bound to report any incident that led or might have led to

the death or serious deterioration in the state of health of a patient, user or other person, and which the manufacturer’s

device is suspected to have caused, to the competent authority in whose jurisdiction the incident occurred. In such case, the manufacturer

must file an initial report with the relevant competent authority, which would be followed by further evaluation or investigation

of the incident and a final report indicating whether further action is required. The events described above that were reported

to the FDA were also reported to the relevant EU regulatory authorities.

We are also required to follow detailed

recordkeeping requirements for all Company-initiated medical device corrections and removals, and to report such corrective and

removal actions to the FDA if they are carried out in response to a risk to health and have not otherwise been reported under the

MDR regulations. Any adverse event involving our products could result in future voluntary corrective actions, such as recalls

or customer notifications, or agency action, such as inspection or enforcement action. Recalls of our products, or agency actions

relating to our failure to comply with our reporting or recordkeeping obligations, could harm our reputation and financial results.

Discovery of serious safety issues

with our products, or a recall of our products either voluntarily or at the direction of the FDA or another governmental authority,

could have a negative impact on us.

The FDA and similar foreign governmental

authorities have the authority to require the recall of commercialized products in the event of material deficiencies or defects

in design or manufacture or in the event that a product poses an unacceptable risk to health. In addition, manufacturers may, under

their own initiative, recall a product if any material deficiency in a device is found. A government-mandated or voluntary recall

by us could occur as a result of an unacceptable risk to health, component failures, manufacturing errors, design or labeling defects

or other deficiencies and issues. To date, we have initiated only one field action in which we voluntarily accelerated our maintenance

schedule based on field usage.

When a medical human exoskeleton is used

by a paralyzed individual to walk, the individual relies completely on the exoskeleton to hold them upright. There are many exoskeleton

components that, if they were to fail catastrophically, could cause a fall resulting in severe injury or death of the patient.

Certain of our competitors have reported injuries caused by the malfunction of human exoskeleton devices (in at least one case

to the FDA). Injuries caused by the malfunction or misuse of human exoskeleton devices, even where such malfunction or misuse occurs

with respect to one of our competitor’s products, could cause regulatory agencies to implement more conservative regulations

on the medical human exoskeleton industry, which could significantly increase our operating costs.

Similarly, when an industrial exoskeleton

is used by a healthy individual — for example to operate heavy machinery overhead — malfunction

of the device at an inopportune moment could result in severe injury or death of the person using the device. Such occurrences

could result in regulatory action on the part of OSHA or its foreign counterparts.

Any future recalls of any of our products

could divert managerial and financial resources, impair our ability to manufacture our products in a cost-effective and timely

manner, and have an adverse effect on our reputation, results of operations and financial condition. In some circumstances, such

adverse events could also cause delays in new product approvals. We may also be required to bear other costs or take other actions

that may have a negative impact on our future sales and our ability to generate profits.

In addition, personal injuries relating

to the use of our products could also result in product liability claims being brought against us. Any product liability claim

brought against us, with or without merit, could result in substantial damages, be costly and time-consuming to defend and could

increase our insurance rates or prevent us from securing insurance coverage in the future.

We could be exposed to significant

liability claims if we are unable to obtain insurance at adequate levels or otherwise protect ourselves against potential product

liability claims.

The testing, manufacture, marketing and

sale of medical devices and industrial products entail the inherent risk of liability claims or product recalls. Although we maintain

product liability insurance, the coverage is subject to deductibles and limitations, and may not be adequate to cover future claims.

A successful product liability claim or product recall could inhibit or prevent the successful commercialization of our products,

cause a significant financial burden on us, or both, which in either case could have a material adverse effect on our business

and financial condition.

Warranty claims or any other service

and repairs provided by the Company at its expense could have a material adverse effect on our business.

Sales of our EksoGT generally include a

one-year warranty for parts and services in the U.S. and a two-year warranty in Europe, the Middle East and Africa. We also generally

provide customers with an option to purchase an extended warranty for up to an additional three years. The costs associated with

such warranties, including any warranty-related legal proceedings, could have a material adverse effect on our results of operations,

cash flows and liquidity. As we enhance our product and in an effort to build our brand and drive adoption, the Company has elected

to incur increased service expenses related to an accelerated maintenance program, field corrections and the implementation of

technological improvements developed subsequent to many of our units being placed into service, sometimes outside of its warranty

and contractual obligations. Continuation of these activities could have a material adverse effect on our results of operations,

cash flows and liquidity.

If we are not able to both obtain

and maintain adequate levels of third-party reimbursement for our products, it would have a material adverse effect on our business.

Healthcare providers and related facilities

are generally reimbursed for their services through payment systems managed by various third-party payers, including governmental

agencies worldwide, private insurance companies, and managed care organizations. The manner and level of reimbursement in any

given case may depend on the site of care, the procedure(s) performed, the final patient diagnosis, the device(s) utilized, available

budget, or a combination of these factors, and coverage and payment levels are determined at each payer’s discretion. The

adoption of our product by our customers will depend on their ability to obtain adequate reimbursement for treatments provided

using our product from third-party payers. The coverage policies and reimbursement levels of these third-party payers may impact

the decisions of healthcare providers and facilities regarding which medical products they purchase and the prices they are willing

to pay for those products. Reimbursement rates can also affect the acceptance rates of new technologies.

We have no direct control over payer decision-making

with respect to coverage and payment levels for our medical device products. Additionally, we expect many payers to continue to

explore cost-containment strategies (e.g., comparative and cost-effectiveness analyses, so-called “pay-for-performance”

programs implemented by various public and private payers, and expansion of payment bundling schemes such as Accountable Care Organizations,

and other such methods that shift medical cost risk to providers) that may potentially impact coverage and/or payment levels for

our current products or products we develop.

In addition to the ACA, which is intended

to reduce the cost of healthcare over time, initiatives sponsored by government agencies, legislative bodies and the private sector

to limit the growth of healthcare costs, including price regulation and competitive pricing, are ongoing in markets where we do

business. Pricing pressure has also increased in these markets due to continued consolidation among health care providers, trends

toward managed care, the shift towards governments becoming the primary payers of health care expenses and laws and regulations

relating to reimbursement and pricing generally. Reductions in reimbursement levels or coverage or other cost-containment measures

could adversely affect customer demand or the price customers may be willing to pay for our products and could result in decreased

revenue.

Clinical studies regarding our products

may not provide sufficient data to either cause third-party payers to approve reimbursement or to make human exoskeletons a standard

of care.

Our business plan relies on broad adoption

of human exoskeletons to provide neuro-rehabilitation in the form of gait training to individuals who have suffered a neurological

injury or disorder. Although use of human exoskeletons in neuro-rehabilitation is new, use of robotic devices to provide gait training

has been going on for over a decade and the clinical studies relating to such devices have had both positive and negative outcomes.

Much of the rehabilitation community has rejected the use of such devices based on the data from some of these studies. Although

we believe that human exoskeletons will outperform such robotic equipment, this has not been proven. Furthermore, it may prove

impossible to prove an advantage in a timely manner, or at all, which could prevent broad adoption of our products.

Part of our business plan relies on broad

adoption of our robotic exoskeleton to provide “early mobilization” of individuals who have been immobilized by an

injury, disease, or other condition. Although the health benefits of other methods of “early mobilization” have been

demonstrated in clinical studies in fields such as stroke, those studies did not test early mobilization with human exoskeletons

directly. To date, our device has been the subject of several clinical trials, some of which have been partially sponsored by

us, but most of which are non-Ekso-sponsored independent studies conducted by rehabilitation institutions. Data from these studies

was provided to the FDA as part of our 510(k) application submissions. In addition, there are several ongoing independent studies

to investigate additional indications for use for our device, as well as to evaluate clinical and non-clinical outcomes of using

the Ekso device, and we are currently in the planning stage for several Company-led studies. Further, a Company-sponsored clinical

trial, entitled WISE (Walking Improvement for SCI with Exoskeletons), is being conducted to evaluate improvement in independent

gait speeds of SCI patients undergoing rehabilitation with the EksoGT and to compare it to both conventional therapy and a control

group.

If current and future clinical trials do

not provide sufficient data to support our belief that early mobilization through the use of exoskeletons improves health outcomes,

or such studies actually contradict that belief, market acceptance of the human exoskeletons could fail to increase or could decrease

and our business could be harmed.

Any studies that we initiate, whether

to drive market adoption and support commercialization, or to support additional product submissions or new claims, will be expensive

and time consuming, which could harm our financial results.

Initiating and completing clinical trials

necessary to drive market adoption and support commercialization, or to support additional product submissions or new claims, is

time consuming and expensive. Conducting successful clinical studies requires the enrollment of large numbers of patients, and

suitable patients may be difficult to identify and recruit. Delays in patient enrollment or failure of patients to continue to

participate in a clinical trial may cause an increase in costs and delays in future clearances or approvals of our products or

result in the failure of the clinical trial. Such increased costs and delays or failures could adversely affect our business, results

of operations and prospects.

In addition, all clinical trial activities

that we undertake are subject to extensive regulation and review by numerous governmental authorities both in the United States

and abroad. Clinical trials intended to support a 510(k) applications or PMA must be conducted in compliance with the FDA’s

Good Clinical Practice regulations and similar requirements in foreign jurisdictions. Sufficient and appropriate clinical protocols

to demonstrate safety and efficacy may be required and we may not adequately develop such protocols to support future clearances

and approvals. Compliance with these regulations is costly, and any failure to do so could delay or prevent us from using data

obtained from such activities to support our claims that a product is safe and effective.

The results of clinical trials may

not support new product submissions or claims or may result in the discovery of adverse side effects.

Despite considerable time and expense invested

in clinical trials, the FDA may not consider any data that we obtain adequate to demonstrate safety and efficacy for future submissions.

Even if our clinical trials are completed as planned, we cannot be certain that their results will support our intended claims

or demonstrate that our product candidates are safe and effective for the proposed indicated uses, which could cause us to abandon

a product candidate and may delay development of others. Moreover, the results of early clinical trials are not necessarily predictive

of future results, and any product we advance into clinical trials may not have favorable results in later clinical trials. Any

delay or termination of our clinical trials or studies could delay the filing of associated product submissions and, ultimately,

our ability to commercialize products requiring submission of clinical data or relying on clinical data for market acceptance.

It is also possible that patients enrolled

in a clinical trial will experience adverse side effects that are not currently part of the product candidate’s safety profile,

which could cause us to delay or abandon development of such product

Our business may suffer if we are

not able to attract and retain key employees.

Our success depends on our ability to identify,

hire, train and retain highly qualified managerial, technical and sales and marketing personnel. In addition, as we introduce new

products or services, we will need to hire additional personnel. Currently, competition for personnel with the required knowledge,

skill and experiences is intense, particularly in the San Francisco Bay area, where we are headquartered, and we may not be able

to attract, assimilate or retain such personnel. The inability to attract and retain the necessary managerial, technical and sales

and marketing personnel could have a material adverse effect on our business, results of operations and financial condition.

Changes in our management team may

adversely affect our operations.

Over the last several months, we have experienced

turnover in our senior management. Most recently, Maximilian Scheder-Bieschin, our Chief Financial Officer, ceased being an employee

of the Company as of August 1, 2018 and transitioned to being a consultant of the Company, where he will remain our Chief Financial

Officer and engaged in day-to-day operations until his replacement is hired and begins work with us. At that point, Mr. Scheder-Bieschin

will cease being our Chief Financial Officer, but will remain a consultant to us until December 31, 2018 to assist with the transition

of his role and responsibilities. As well, Gregory Davault, previously our Chief Marketing Officer, resigned effective as of May

15, 2018.

While we expect to engage in an orderly

transition process as we integrate newly appointed officers and managers, we face a variety of risks and uncertainties relating

to management transition, including diversion of management attention from business concerns, failure to retain other key personnel

or loss of institutional knowledge. These risks and uncertainties could result in operational and administrative inefficiencies

and added costs, which could adversely impact our results of operations, stock price and research and development of our products.

We will experience long and variable

sales cycles, which could have a negative impact on our results of operations for any given quarter and may result in volatility

in our stock price.

The EksoGT has a lengthy sale and purchase

order cycle because it is a major capital item and generally requires the approval of senior management at purchasing institutions,

which may contribute to substantial fluctuations in our quarterly operating results. Other factors that may cause our operating

results to fluctuate include:

|

|

·

|

general economic uncertainties and political concerns;

|

|

|

|

|

|

|

·

|

the introduction of new products or product lines;

|

|

|

|

|

|

|

·

|

product modifications;

|

|

|

|

|

|

|

·

|

the level of market acceptance of new products;

|

|

|

|

|

|

|

·

|

the availability of coverage and adequate reimbursement by third-party payers

of services provided using our products;

|

|

|

·

|

the timing and amount of research and development and other expenditures;

|

|

|

|

|

|

|

·

|

timing of the receipt of orders from, and product shipments to, distributors and customers;

|

|

|

|

|

|

|

·

|

changes in the distribution arrangements for our products;

|

|

|

|

|

|

|

·

|

manufacturing or supply delays;

|

|

|

|

|

|

|

·

|

the time needed to educate and train additional sales and manufacturing personnel; and

|

|

|

|

|

|

|

·

|

costs associated with defending our intellectual property.

|

In addition to these factors, expenditures

are based, in part, on expected future sales. If sales levels in a particular quarter do not meet expectations, we may be unable

to adjust operating expenses quickly enough to compensate for the shortfall of sales, and our results of operations may be adversely

affected.

International sales of our products

account for a portion of our revenues, which will expose us to certain operating risks. If we are unable to successfully manage

our international activities, our net sales, results of operations and financial condition could be adversely impacted.

Our business currently depends in part

on our activities in Europe and other foreign markets and we are actively looking to broaden our footprint in Asia. Our international

activities are subject to a number of risks inherent in selling and operating abroad. These include:

|

|

·

|

failure of local laws to provide the same degree of protection against infringement of our intellectual property rights;

|

|

|

|

|

|

|

·

|

protectionist laws and business practices that favor local competitors, which could slow our growth in international markets;

|

|

|

|

|

|

|

·

|

the expense of establishing facilities and operations in new foreign markets;

|

|

|

|

|

|

|

·

|

building an organization capable of supporting geographically dispersed operations;

|

|

|

|

|

|

|

·

|

challenges caused by distance, language and cultural differences;

|

|

|

|

|

|

|

·

|

challenges caused by differences in legal regulations, markets, and customer preferences, which may limit our ability to adapt our products or succeed in other regions;

|

|

|

·

|

multiple, conflicting, and changing laws and regulations, including complications due to unexpected changes in regulatory requirements, foreign laws, tax schemes, international import and export legislation, trading and investment policies, exchange controls and tariff and other trade barriers;

|

|

|

|

|

|

|

·

|

foreign tax consequences;

|

|

|

|

|

|

|

·

|

fluctuations in currency exchange rates and foreign currency translation adjustments;

|

|

|

|

|

|

|

·

|

foreign exchange controls that might prevent us from repatriating income earned outside the United States;

|

|

|

|

|

|

|

·

|

imposition of public sector controls;

|

|

|

|

|

|

|

·

|

differing payer reimbursement regimes, governmental payers or patient self-pay systems and

price controls;

|

|

|

|

|

|

|

·

|

political, economic and social instability; and

|

|

|

|

|

|

|

·

|

restrictions on the export or import of technology.

|

Some of the countries in which we operate

and seek to expand are in emerging markets where legal systems may be less developed or familiar to us. Other jurisdictions in

which we conduct business may establish legal and regulatory regimes that differ materially from United States laws and regulations.

Compliance with diverse legal requirements is costly and time-consuming and requires significant resources. Violations of one or

more of these regulations in the conduct of our business could result in significant fines or monetary damages, criminal sanctions

against us or our officers, prohibitions on doing business, unfavorable publicity and other reputational damage, restrictions on

our ability to process information and allegations by our clients that we have not performed our contractual obligations.

As we look to expand into China, we may

be exposed to the additional risks of doing business in China. Our success in the Chinese markets may be adversely affected by

China’s continuously evolving laws and regulations, including those relating to taxation, import and export tariffs, currency

controls, anti-corruption, environmental regulations, indigenous innovation, and intellectual property rights and enforcement of

those rights. Enforcement of existing laws or agreements may be inconsistent. In addition, changes in the political environment,

governmental policies or United States-China relations could result in revisions to laws or regulations or their interpretation

and enforcement, exposure of our proprietary intellectual property, increased taxation, restrictions on imports, import duties

or currency revaluations, which could have an adverse effect on our business plans and operating results.

If we are unable to meet and overcome these

challenges, then our international operations may not be successful, which could adversely affect our net sales, results of operations

and financial condition and limit our growth.

The disruption or loss of relationships

with vendors and suppliers for the components of our products could materially adversely affect our business.

Our ability to manufacture and market our

products successfully is dependent on relationships with both third party vendors and suppliers. Although most of the raw materials